Ready to find your investing edge?

Prefer to test the water first?

Ready to take things to the next level?

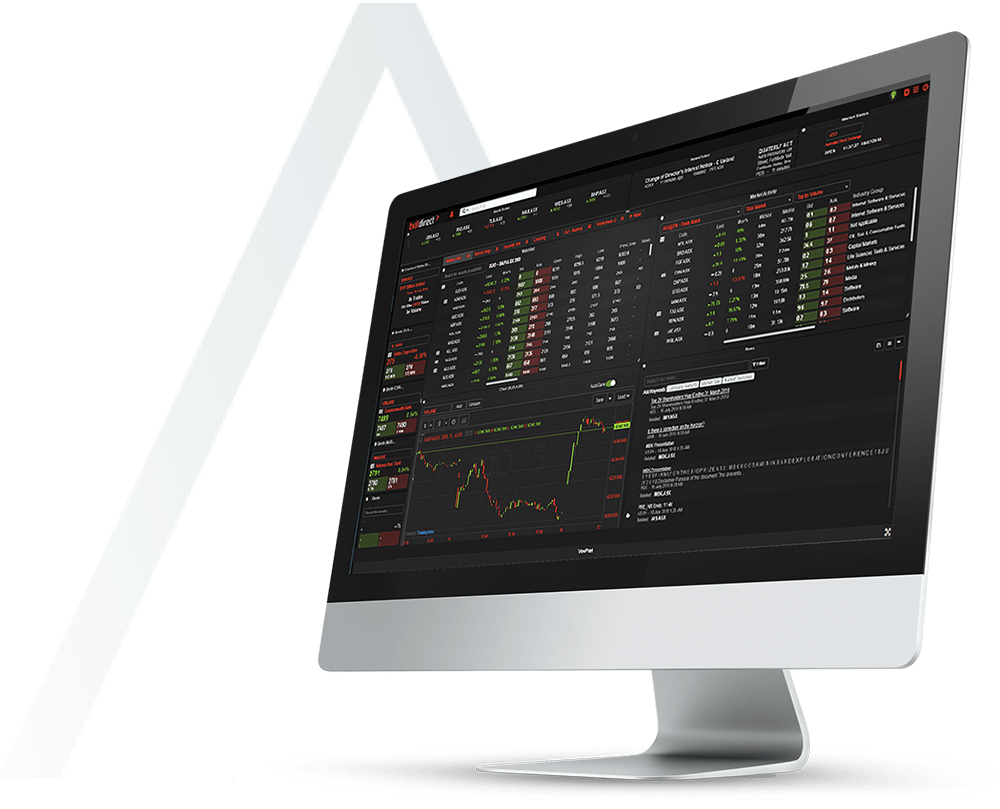

The ultimate share trading platform

CONFIDENCE

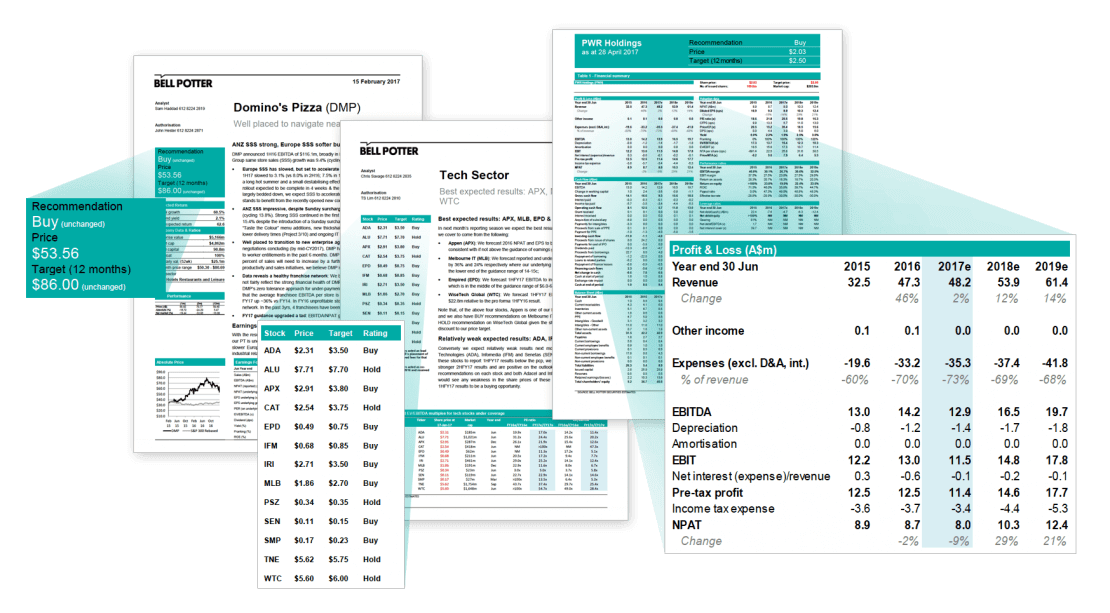

Build trade-winning confidence with our exclusive insights

Bell Potter research library

Game-changing insights into 150+ ASX-listed stocks, only available to investors trading with Bell Direct.

Daily trading ideas

Wake up to six fresh trading ideas in your inbox early each morning, based on charting analysis from global research specialists Trading Central.

Changes in substantial

holdings indicator

Stalk the big players to see what they’re up to via real-time data on major shareholder moves in any stock.

SMARTER TOOLS FOR CONTROL

Smart tools to put you in

complete control

Strategy builder

Blends fundamental, technical and earnings momentum analysis so you can find the stocks that tick all your boxes.

Advanced charting

You can quickly make sense of complex pricing data and technical indicators and make informed decisions with this interactive technology.

ETF and mFund filters

Screen the market for ETFs and mFunds and compare them instantly across multiple criteria to see if they suit your strategy. Available to Bell Direct clients only.

TIME-SAVING

Invest easier with our

time-saving technology

Mobile trading

Get a ton of research data on your phone and invest anywhere with our mobile app.

Technical insights

Use the power of technical analysis to get actionable stock intel even if you’re not a charting whizz or short-term trader.

Painless tax reporting

Put an end to end-of-year hassle with the tax report voted #1 by experienced investors in Investment Trends’ Online Investing survey 2023. Only available to Bell Direct clients.

We are apart of Bell Financial Group (ASX:BFG) a leader in the Australian stockbroking industry since 1970

More market insights

When you join Bell Direct you get access to daily market news and real broker research.

Market Insights

Grady Wulff

Imagine the difference if someone invested in you?

Our mission is to help Australians be better off.

Trade more, save more

We reward you for trading more frequently with better rates and services.

Your first 10 trades per month

$15 (up to $10,000)

$25 ($10,000+ to $25,000) | 0.1% ($25,000+)

Your 11th to 30th trades per month

$13 or 0.08%

Whichever is greater

Your 31st trade onwards per month

$10 or 0.08%

Whichever is greater

mFund trades

From $30

What you can trade

We specialise in all ASX listed securities with a 1 second placement guarantee.

- ASX listed equities

- ETFs

- Warrants

- Interest rate securities

- Options

- Managed funds via mFund

- IPOs

- Using your margin lending account

- US markets

Everything you need to give yourself an investing edge

Whether you’re new to investing or a markets veteran, our tools can give you the edge.

Already a seasoned investor?

We’ve got the innovative tools and serious support you need to reach your full trading potential, such as advanced charting, excusive Bell Potter research, integrating IRESS viewpoint and direct access to margin lending.

Running an SMSF?

You want low costs and high levels of control with an SMSF. As well as value-for-money trading and the latest research tools and insights, our administration service backs you up with the paperwork.

What they say about Bell Direct

Definitely recommend Bell Direct

Using Bell Direct has been a great experience and I’d recommend them highly. Their online platform has everything you need, their trading is competitively priced, and if you want to speak to someone it is easy to get in contact.

Trina – Melbourne, VIC

Always great service

Bell Direct always answer your their phones within a couple of minutes, no matter what time you call. Always pleasant and informative if you ask them questions. Excellent company to deal with.

Ben

The Best Online Broker I have tried

Prior to Bell Direct, I tried 4 other broker services. All the others were more expensive & sometimes much more complicated. Bell Direct is the best I have used with a very fast & easy to use platform, terrific support service & more than ample information about stocks on the site. I wouldn’t consider using anyone else.

Howard – South East Queensland, QLD

Excellent service provider for my investment

It provides me a fast, accurate market information, index and graphics, Furthermore they provide some free seminary and conferences, so that I can get more investment acknowledges and skills for my investment. It makes me rich my fortunate and wealth at my investment.

Desmond – Sydney, NSW

Great service & very reasonable fees

I recently needed to transfer money out of Bell Direct account to my nominated account after selling some shares. Once the shares were cleared (which took only 2 days) the funds were in my bank account.

Julie

Bell Direct is an efficient online broker with best value in the market

Bell Direct is a true online broker. Set-up and trading can all be done online. This is the best value stockbroking available taking into account reputation, quality and price at $15 per trade.

We use this as a preferred provider when setting up SMSF’s. If you consider setting up a SMSF, this is a great low cost option

Hein

Consistent Platform

Bell Direct trading platform has been a consistently performing online broking investment service for us. We consider ourselves old fashioned, yet we have been able to access and use the features of their platform without difficulty. Bell Direct’s conditional trading achieves a better instantaneous price whether buying or selling. Their brokerage fees are affordable for small trades. We are maintaining our account with Bell Direct, and will use their service again soon.

Ray – Darling Downs, QLD

Like to know more?

Check out some commonly asked questions

How soon can I start trading after opening an account?

You can generally start trading within:

– 3 working days if you have applied for a new holder identification number (HIN) for your trading account.

– 4 working days if you have requested for a HIN transfer across from your previous broker to your trading account.

We will contact you should we require any further information on your application.

Once the trading account has been activated, you can deposit funds into your Direct Investment Account. See how do this in the FAQ question below.

What I.D. do I need to set up an account?

– Your ID details so we can verify your identity online (i.e. Australian passport or driver’s licence)

– Your bank account details (from an Australian bank)

– Tax File Number (optional)

– Company or trust documents if you are opening an SMSF, company or trust account

– Your HIN if you’re switching from another broker

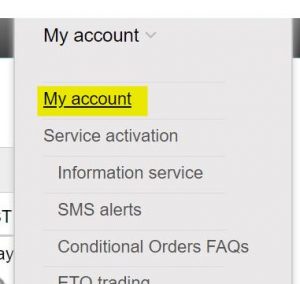

How do I deposit funds to start trading and withdraw funds from my account?

Watch the video: https://youtu.be/isjktWx_ra0

Or follow the steps:

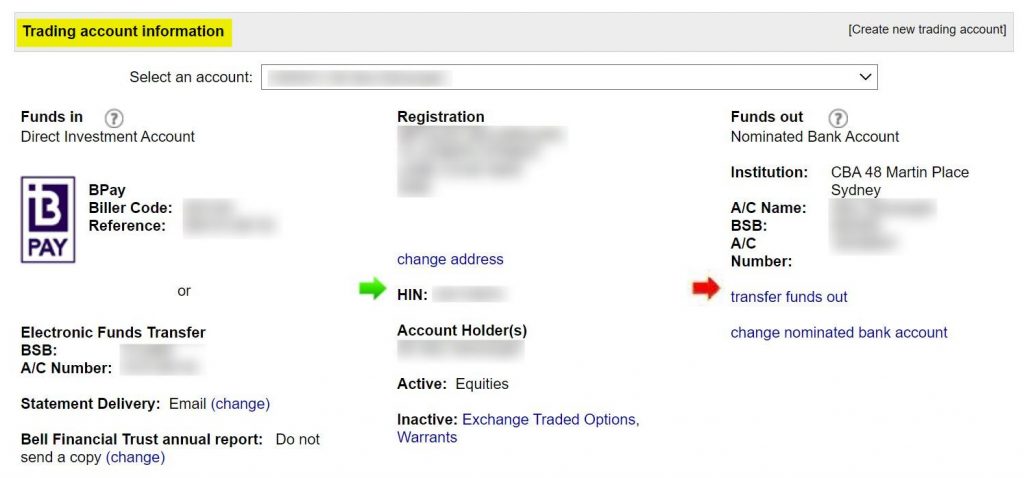

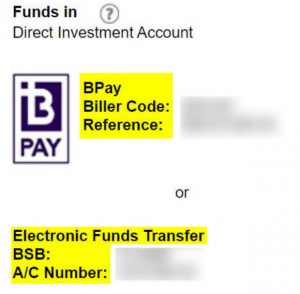

Deposit funds into your Direct Investment Account electronically by either:

-

- BPay: simply use the Biller Code and your BPay Reference

- Electronic transfer: use your BSB and Account Number

To find your deposit details:

- Click on the “My account” tab underneath the “My account” drop down button (this is in the top right of your page)

- Scroll to the bottom of the page and you will see your ‘Trading account Information’.

- On the left hand side you can view the BPay Biller Code and Reference number as well as the BSB and Account Number for the Electronic Funds Transfer.

- Use either of these to fund your Direct Investment Account.

Remember: You must deposit funds into your trading account first, then you can start trading.

The timing of your funds deposit reaching your Direct Investment Account depend on your bank’s processing time.

If your deposit instruction was completed before your bank’s cut-off time, your funds will usually be in your Direct Investment Account the next business day. If your deposit instruction was completed after your bank’s cut-off time, your funds will normally be in your Direct Investment Account the following business day

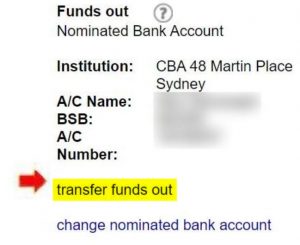

To withdraw funds simply:

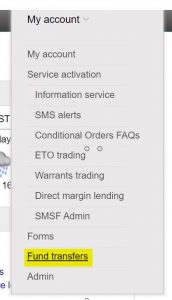

- Click on the “Fund transfers” tab underneath the “My account” drop down button (this is in the top right of your page)

- Or, within your trading account information (under “My account” in step 1 of finding your deposit details), click on “transfer funds out”.

- Then, just follow the steps, and submit a funds transfer request online anytime from your Direct Investment Account to your nominated bank account.

- Enter your trading PIN to complete the fund transfer request.

Your available transfer balance takes into account your cash balance and any buys pending settlement and open buy orders you have at the time of processing your transfer request. If you have sell orders that are due for settlement, you will only be able to transfer the funds out after the sell orders settle (T+2, between 12pm to 5pm AEST).

When you submit your transfer request before 2:30pm AEDT on business days, your funds transfer is processed on the same day and the funds should be in your nominated bank account the next working day.

After 2:30pm AEDT on a business day or on a non-business day, your instruction will be processed at 2:30pm the next business day.

The cut-off on non-settlement days and shortened ASX trading days such as Christmas Eve and New Year’s Eve is 12.30pm AEDT.

How do I transfer my holdings to Bell Direct?

To transfer shares to your Bell Direct account, follow these steps:

1. Determine where the shares are held: at another broker or at a share registry.

2. Complete the correct transfer request form:

For shares from another broker:

- Login and go to Forms in the My Account tab

- Complete the Broker to Broker Transfer Request form.

Remember, your details at the other broker must exactly match the details you have with us to allow the transfer. If shares are currently held in a different name, complete an Off Market Transfer Request form (found in Forms in the My Account tab once logged in) (at a cost of $55 per holding).

For shares from a share registry:

- Login go to Forms in the My Account tab

- Complete the Issuer Sponsored Conversion Request form.

Remember, your details at the share registry must exactly match the details you have with us to allow the transfer. If shares are currently held in a different name, contact the share registry to change the details before submitting the Issuer Sponsored Conversion Request form.

You can find all the request forms on your My account tab once you have logged in.

Good news – if you’re in the process of opening a new online share trading account with us, you will have the option to transfer a HIN across during the online account setup process.

3. Send us your signed request form by:

- Email at support@belldirect.com.au

- Mail to Bell Direct, GPO Box 1630, Sydney NSW 2001

Once we’ve received it, we’ll transfer the shares into your Bell Direct account within 3 days.

Watch the video for more:

Experienced investors ranked Bell Direct #1 for customer service, help in identifying opportunities, stock comparison/selection tools, education materials/programmes & reporting and other reporting (P&L, transactions).

As voted by investors with 10+ years’ experience in the 1H 2024 Investment Trends Online Investing Survey.