I’M READY

I’M THINKING ABOUT IT

Direct to your financial goals

Bell Direct’s Direct Investment Account is tailored for investors, companies, trusts and SMSFs, providing you with the security to confidently manage and grow your wealth. Your Direct Investment Account is an account purely for your trading settlement to allow ease of transparency and reporting.

Trade with confidence and control:

Seamless trade settlement

Streamlined trade execution, allowing you to seize investment opportunities as they emerge without the hassle of transferring funds between accounts.

Low brokerage

It’s value for money. Trade from $15 when settling to your Direct Investment Account.

Secure & easy

Trade from $15 when settling to your Direct Investment Account, allowing you to focus on your investment strategy without the hassle of complex processes.

Reporting & visibility

Enjoy the added benefit of comprehensive reporting, including the flexibility to share data with your accountant or financial adviser and easily organise and search your transactions.

With Bell Direct’s Direct Investment Account, you’ll have no fees, charges, or minimum balance:

| Direct Investment Account balance | Interest rate |

|---|---|

| $0 to $100,000 | 1.45% pa |

| >$100,000 | 1.60% pa |

Plus, the more you trade, the more you save:

| Trades | |

|---|---|

| Your first 10 trades per month | $15 (up to $10,000) $25 ($10,000+ to $25,000) 0.1% ($25,000+) |

| Your 11th to 30th trades per month | $13 or 0.08%, whichever is greater |

| Your 31st trade onwards per month | $10 or 0.08%, whichever is greater |

More settlement options

Macquarie Cash Management Account

A Macquarie Cash Management Account (CMA) provides you with easy access to funds for trading and complete visibility of transactions, via detailed online reporting.

To view the CMA Terms and Conditions including current interest rates and fees, please visit macquarie.com.au/cma.

Brokerage:

| Trades | |

|---|---|

| Any trade value | $19.95 or 0.12% of the value of the trade (whichever is greater). |

Interest rates:

| Product | Balance portion | Interest rate |

|---|---|---|

| CMA | All | 2.75% |

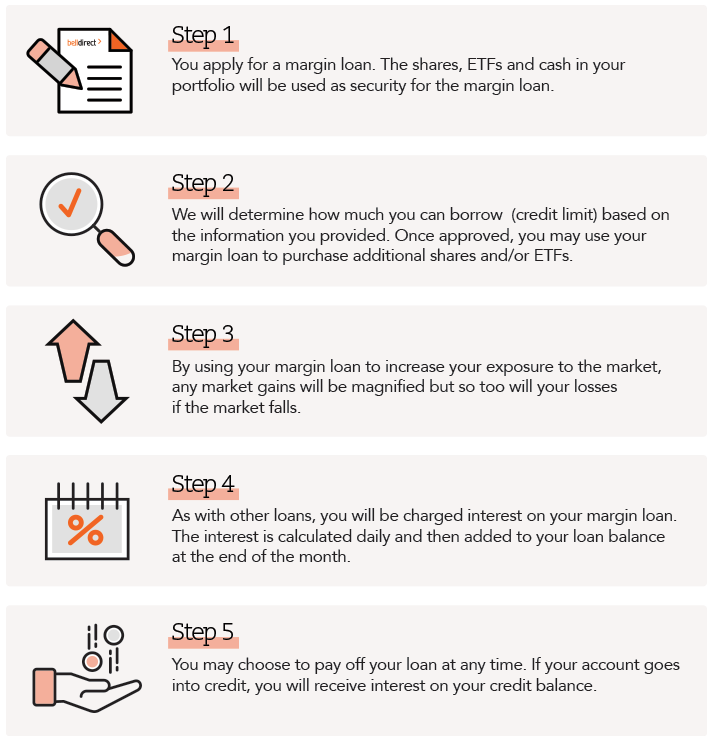

Bell Direct Margin Lending

Whether you’re boosting your potential returns with leverage or want to access more funds for investing, margin lending is a powerful investment strategy.

A margin loan enables you to borrow money by using your existing portfolio holdings as security. By accessing more funds, you can increase the amount you have invested. This means you can work on building the portfolio you thought was out of reach.

Brokerage fees

| Direct margin loan | Standard brokerage as listed above |

| Third party margin lenders | $15 + standard brokerage as listed above |

Direct margin loan interest rates

Variable loan rate of 9.90% p.a. (effective 08/11/2023)

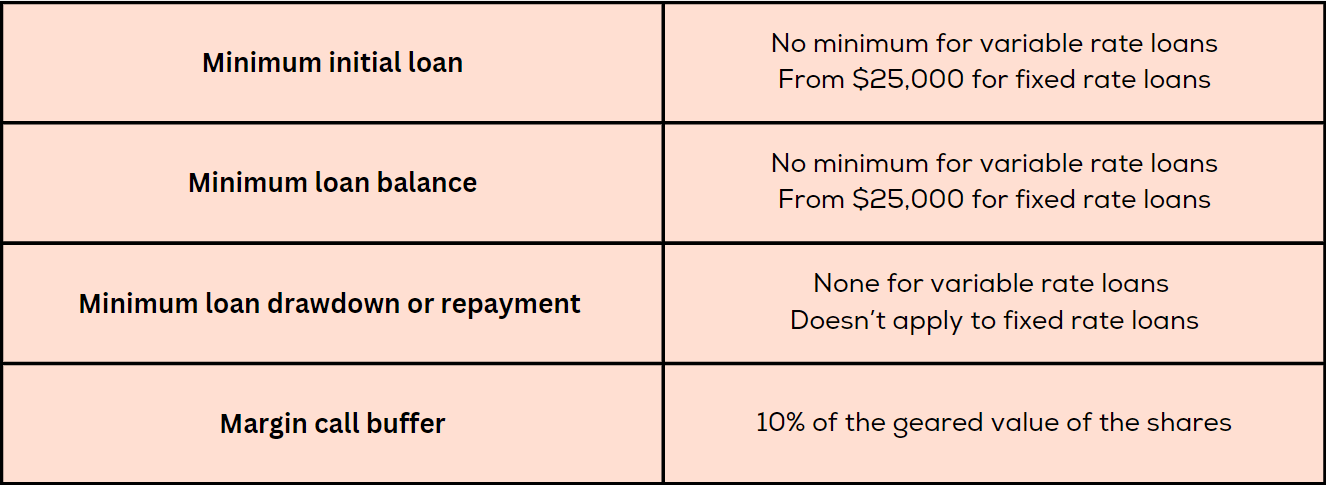

How does it work?

Key features of the Bell Direct Direct Margin Loan