I’M READY

I’M THINKING ABOUT IT

As brokers not bankers we know what experienced stock market investors and traders need. Better fees and analysts reports are just some of the benefits you can expect with Bell Direct.

Features for experienced investors.

Or rather, what makes Bell Direct the smarter choice?

Advanced charting

Our new fully interactive HTML5 charting technology helps you visualise complex pricing data and technical indicators in a simple way. Directly manuipulate the data displayed across all devices.

Multi Order Pad

With the Bell Direct multi order pad, you don’t need to enter and place one trade at a time. Now, you can action any number of trades in or out of a stock from one or all of your accounts with just one order pad.

Real Broker Research

Because we’re a branch of Bell Financial Group, we get access to all kinds of research and reporting from Bell Potter. So, when you trade with Bell Direct, we give you the latest high quality institutional research.

Easy Tax Reporting

The financial year summary report is innovative and easy-to-read. We make it free and available to all Bell Direct clients during the year, detailing the key aspects of your account.

The more you trade the more you save.

We reward frequent traders with better rates and services.

| Trade size | Bell Direct | CommSec | ANZ Share Investing | Westpac Online Investing | Nabtrade |

|---|---|---|---|---|---|

| $5,000 trade | $15 | $19.95 | $19.95 | $19.95 | $14.95 |

| $10,000 trade | $15 | $19.95 | $24.95 | $19.95 | $19.95 |

| $25,000 trade | $25 | $29.95 | $29.95 | $29.95 | $27.50 |

| Frequent Trader Discount | > 10 trades/mth $13 > 30 trades/mth $10 | None | > 1 trade/mth $19.95 or 0.11% | None | None |

Looking for something more?

Bell Direct Advantage is an exclusive program for active and sophisticated investors.

Premium services for experienced traders.

We have a suite of services for those that require an extra edge.

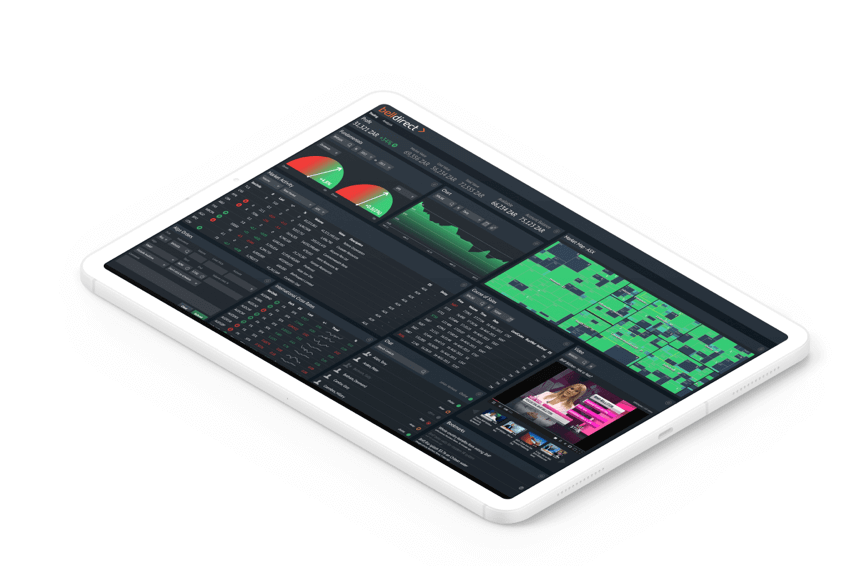

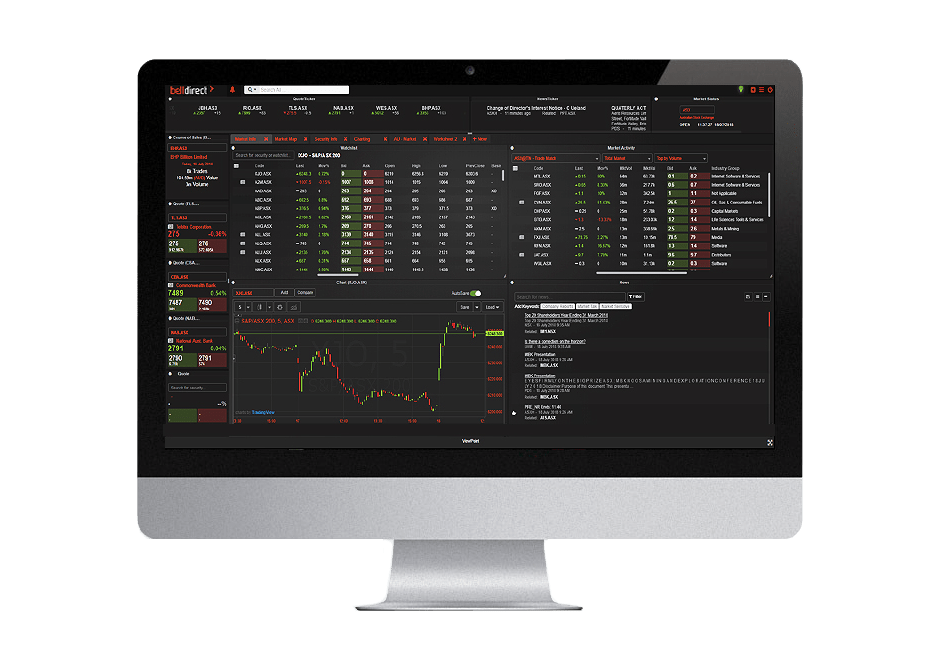

Integrated ViewPoint

$79.00 per month

- A constant stream of live market data

- Quotes, market depth and trades dynamically updated as they happen

- Stock data including dividends, historical corporate actions, company profiles and charting

- Real-time charting with advanced technical analysis tools

- A customisable interface, so stock market investors can personalise their system to suit their trading style

- Viewpoint has a highly customisable user interface with many widgets.

Platinum Live Streaming

$27.50 per month

With Bell Direct’s ‘in website’ Live Streaming service (Australia’s first) you get:

- Price changes when they happen in real time

- Your watchlist and portfolio updating in real time

- Streaming data in every page of your Bell Direct website and mobile app

- A range of display styles to choose from

- No need to launch an additional window or third party service

- Nothing to download or install

- No need to refresh pages and lose precious seconds getting the latest price update

Direct Margin Lending

Whether you’re boosting your potential returns with leverage or want to access more funds for investing, margin lending is a powerful investment strategy.

A margin loan enables you to borrow money by using your existing portfolio holdings as security.

By accessing more funds, you can increase the amount you have invested. This means you can work on building the portfolio you thought was out of reach.

Investor FAQs

How can I transfer my holdings to Bell Direct?

To transfer shares to your Bell Direct account, follow these steps:

1. Determine where the shares are held: at another broker or at a share registry.

2. Fill up the right transfer request form:

For shares from another broker: once logged in, go to Forms in the My Account tab and fill up the Broker to Broker Transfer Request form.

Your details at the other broker must exactly match the details you have with us to allow the transfer. If shares are currently held in a different name, you will need to complete an Off Market Transfer Request form (found in Forms in the My Account tab once logged in) (at a cost of $55 per holding).

For shares from a share registry: once logged in, go to Forms in the My Account tab and fill up the Issuer Sponsored Conversion Request form.

Your details at the share registry must exactly match the details you have with us to allow the transfer. If shares are currently held in a different name, you will need to contact the share registry to change the details before submitting the Issuer Sponsored Conversion Request form.

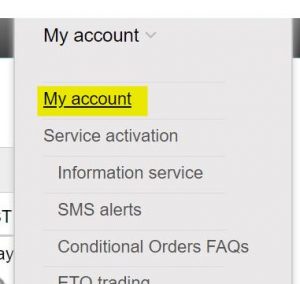

All the request forms can be found on My account tab once you have logged in.

If you are in the process of opening a new account with us, you will have the option to transfer a HIN across during the online account setup process.

3. Send us your signed request form by:

Email at support@belldirect.com.au

Mail to Bell Direct, GPO Box 1630, Sydney NSW 2001

Once we’ve received it we’ll transfer the shares into your Bell Direct account within 3 days.

You can also watch our tutorial video:

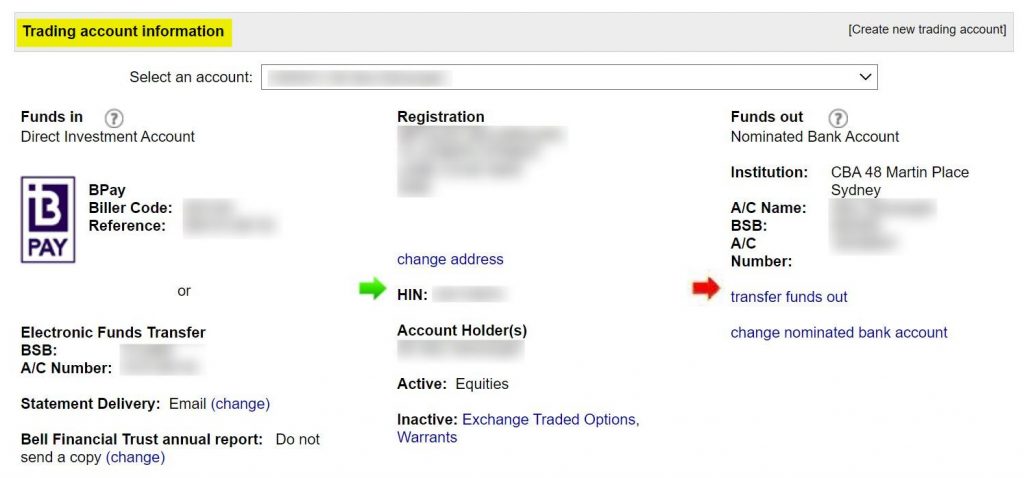

How do I deposit funds to start trading and withdraw funds from the account?

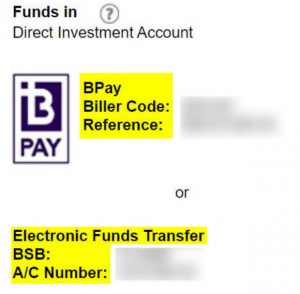

You can deposit funds into your Direct Investment Account electronically by either:

BPay: simply use the Biller Code and your BPay Reference

Electronic transfer: use your BSB and Account Number

To find your deposit details:

- Click on the “My account” tab underneath the “My account” drop down button (this will be in the top right of your page)

- Scroll down to the bottom of the page and you will see your ‘Trading account Information’.

- On the left hand side you can view the BPay Biller Code and Reference number as well as the BSB and Account Number for the Electronic Funds Transfer.

- Use either of these and you will be able to fund your Direct Investment Account.

Kindly note: You must first deposit funds into your trading account before you can start trading.

The timing of your funds deposit reaching your Direct Investment Account is dependent on your bank’s processing time.

If your deposit instruction was completed before your bank’s cut-off time, your funds will normally be in your Direct Investment Account the next business day. If your deposit instruction was completed after your bank’s cut-off time, your funds will normally be in your Direct Investment Account the following business day

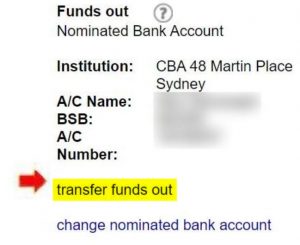

To withdraw funds you simply:

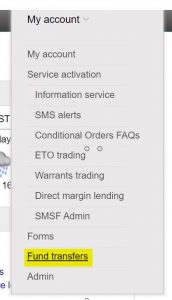

- Click on the “Fund transfers” tab underneath the “My account” drop down button (this will be in the top right of your page)

- Or, within your trading account information (under “My account” in step 1 of finding your deposit details), you can click on “transfer funds out”.

- Then, just follow the steps, and you will be able to submit a funds transfer request online at anytime from your Direct Investment Account to your nominated bank account.

- Please enter your trading PIN to complete the fund transfer request.

Your available transfer balance takes into account your cash balance and any buys pending settlement and open buy orders you have at the time of processing your transfer request. If you have sell orders that are due for settlement, you will only be able to transfer the funds out after the sell orders settle (T+2, between 12pm to 5pm AEST).

When you submit your transfer request before 2:30pm AEDT on business days, your funds transfer is processed on the same day and the funds should be in your nominated bank account the next working day.

After 2:30pm AEDT on a business day or on a non-business day, your instruction will be processed at 2:30pm the next business day.

Please note that the cut-off on non-settlement days and shortened ASX trading days such as Christmas Eve and New Year’s Eve is 12.30pm AEDT.

How do I update my instructions for dividends?

You can opt-in to have your dividends centralised to your Direct Investment Account via our Auto-Update function. We will automatically update the share registry with your bank account and TFN details whenever you buy new shares. Come tax time, your reporting will be even easier. You can opt in and find out more here.

Can I place stop loss orders with Bell Direct?

You can place conditional orders, which work similar to a stop loss. A conditional order allows you to pre-set a trade based on triggers you decide without having to consistently monitor the market. You can plan for future market conditions, capitalise on potential trading opportunities and manage downside risk by taking action in real time to manage your portfolio. Find out more on conditional orders here.

Experienced investors ranked Bell Direct #1 for customer service, help in identifying opportunities, stock comparison/selection tools, education materials/programmes & reporting and other reporting (P&L, transactions).

As voted by investors with 10+ years’ experience in the 1H 2024 Investment Trends Online Investing Survey.