When you are just starting out on your investment journey, the plethora of options available can seem overwhelming. Should you invest locally or globally? Buy shares on a Bell Direct trading account or through a managed fund? And what should you do to keep your investment plan on course?

If you have made the decision to transition from being a saver to an investor, it is important to be armed with the knowledge to make the right decisions for you. But life is complicated enough, so we have broken down the options to help you get started.

Types of investment

While there are a broad range of investment options to choose from, the two favoured by first-time investors are individual shares (companies such as BHP) and exchange-traded funds (ETFs).

Buying individual shares can give you a clear idea of what you own, provide control over what you invest in and can help you to keep investment costs down. There are no yearly management fees involved in holding a portfolio of Australian shares that you have selected yourself.

However, individual shares can have different levels of volatility or risk, which means some companies’ share prices fluctuate more than others. –For example, an established company with a successful business with a history of stable cash flows like CBA is less risky than a mining exploration company that may not find what they are looking for.

For this reason, if you are planning to buy individual shares, it’s important to build a diversified portfolio incorporating a number of companies across different market sectors (or industries) and geographies (or countries).

The second option favoured by first-time investors, ETFs, are managed funds that are bought and sold on a stock exchange, and which typically invest in a basket of shares that track an index such as the ASX200 which represents the 200 largest companies on the Australian Stock Exchange. A well-known index that tracks 500 of the largest companies listed on the New York Stock Exchange is the S&P500.

ETFs provide several layers of investment portfolio diversification, such as:

- Market and geographic diversification: For example, Vanguard (a fund manager based in the US) has an ETF that tracks the performance of 20 global developed markets including the US, Japan, UK, France and Canada. In one ASX trade investors can access over 1,500 companies. The largest companies include Apple, Microsoft, Facebook, VISA, Johnson & Johnson and Nestle. The ASX code is VGS.

- Sector diversification: The global technology sector, for instance, is one of the fastest growing sectors globally. There are only a handful of technology stocks available on the Australian market, meaning investors need to look globally to access this theme. BetaShares (an Australian fund manager) has an ETF that tracks the performance of 100 global technology stocks. Investors can buy this ETF on the ASX and the ASX code is NDQ. NDQ’s largest holdings include Apple, Amazon, Alphabet, Intel and Cisco Systems.

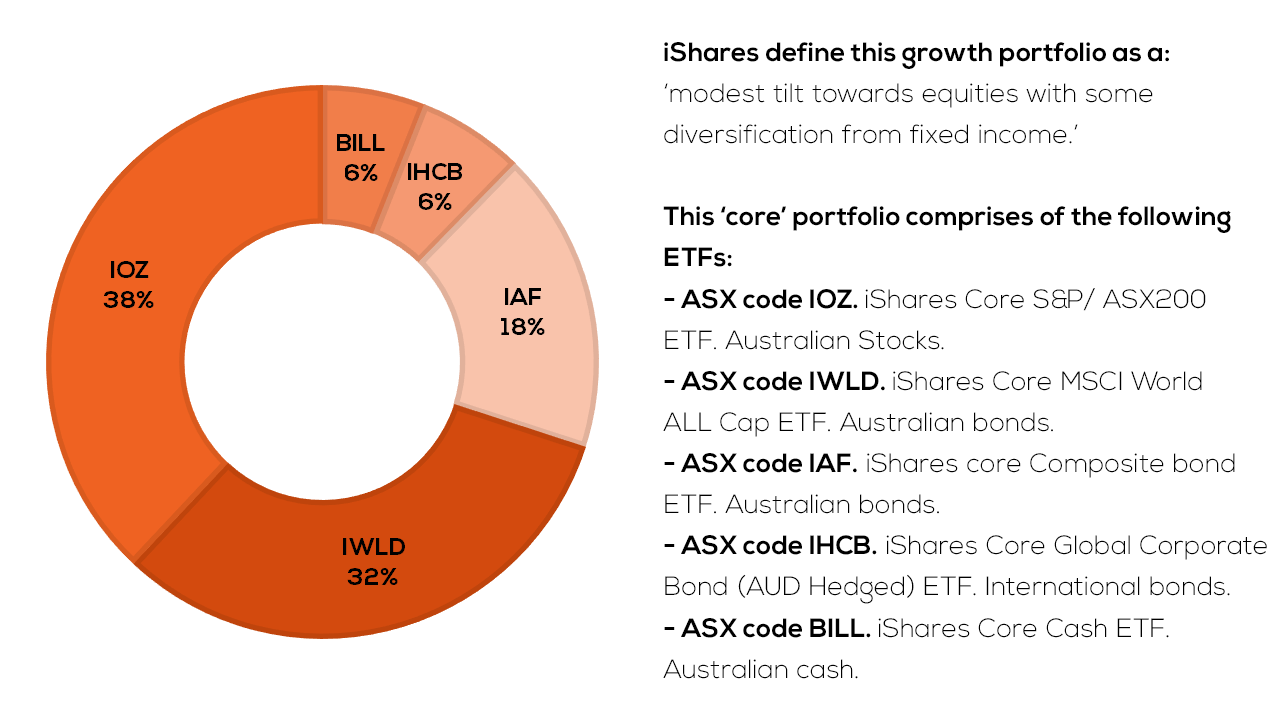

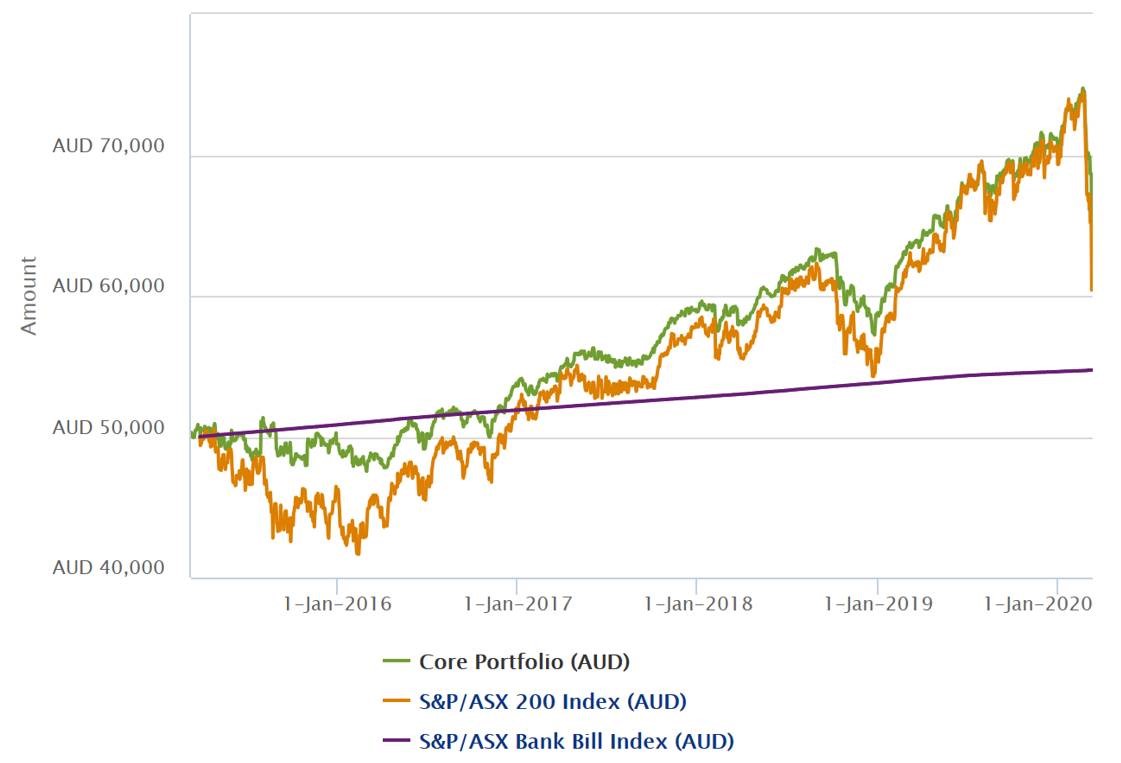

- Asset class diversification: ASX research has shown that three out of four share owners only hold domestic shares. Considering the Australian market represents less than 3% of the world’s investable assets, local investors are missing out on diversification opportunities globally. ETFs provide easy access to international shares, domestic and international bonds, property and cash markets. For example, we can build the core of a portfolio with five iShares ETFs.