Transcript: Weekly Wrap 7 March

Well, the US bellwether extended its drawdown from its mid- February high. The news flow around tariffs was one of the headwinds for stocks this week, however some segments of the market were relatively more insulated. The S&P500 US revenue exposure index, designed to measure the performance of S&P500 constituents that have a higher-than-average revenue exposure to the US, is up 2.2% YTD, outperforming its parent index by 3.7%.

Given the cautious market backdrop, it’s not too surprising that defensive sectors outperformed the market. Looking at the US sectors, consumer staples and real estate were up 5% and 4% respectively, in February. Within-sector dispersion decreased, signalling increase co-movement of stocks within sectors.

It’s been an uncertain time for anyone trying to decipher market signals from the constant barrage of news headlines. While traders navigate this volatile landscape, businesses attempting long-term planning face a difficult task. With trade policies shifting rapidly, strategic decision- making is severely hampered, which will inevitably have wider economic consequences. The uncertainty is palpable within the US corporate sector. Adding to the unease were specific aspects of US economic data, notably, the “Prices Paid” component of the ISM Services index increased, and subsequent commentary from the ISM indicated that companies were struggling to pass these increased costs onto consumers due to weak demand. Also the Fed’s Beige Book highlighted that many firms were finding it difficult to raise prices, which is a worrying sign for US corporate profit margins and likely contributed to the reluctance of investors to buy US dollars.

However, global currency markets have seen significant shifts beyond the US, with positive developments in other regions have provided alternatives, leading to a substantial decline in the US dollar. The dollar index experienced a sharp drop, marking one of its worst days of the year.

There’s been a surge of optimism surrounding the Euro, particularly following Germany’s announcement of a massive fiscal stimulus package, potentially reaching one trillion Euros. This news caused a significant rise in German bond yields compared to US Treasury yields, propelling the Euro against the dollar. The decline in oil and natural gas prices in Europe further bolstered European assets.

While the upcoming European Central Bank (ECB) meeting poses some risk, its ability to provide clear guidance is questionable given the ongoing trade uncertainties and the yet-to-be-approved fiscal measures. The ECB’s statement may be intentionally vague regarding long-term policy.

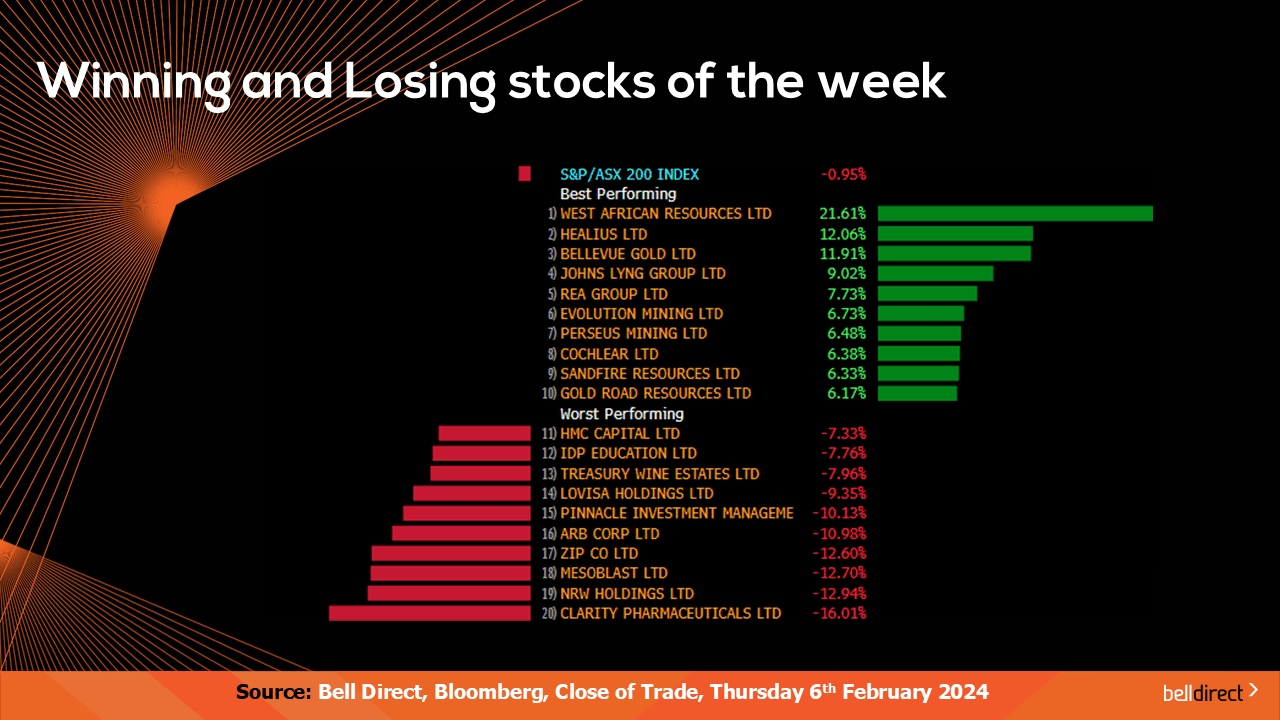

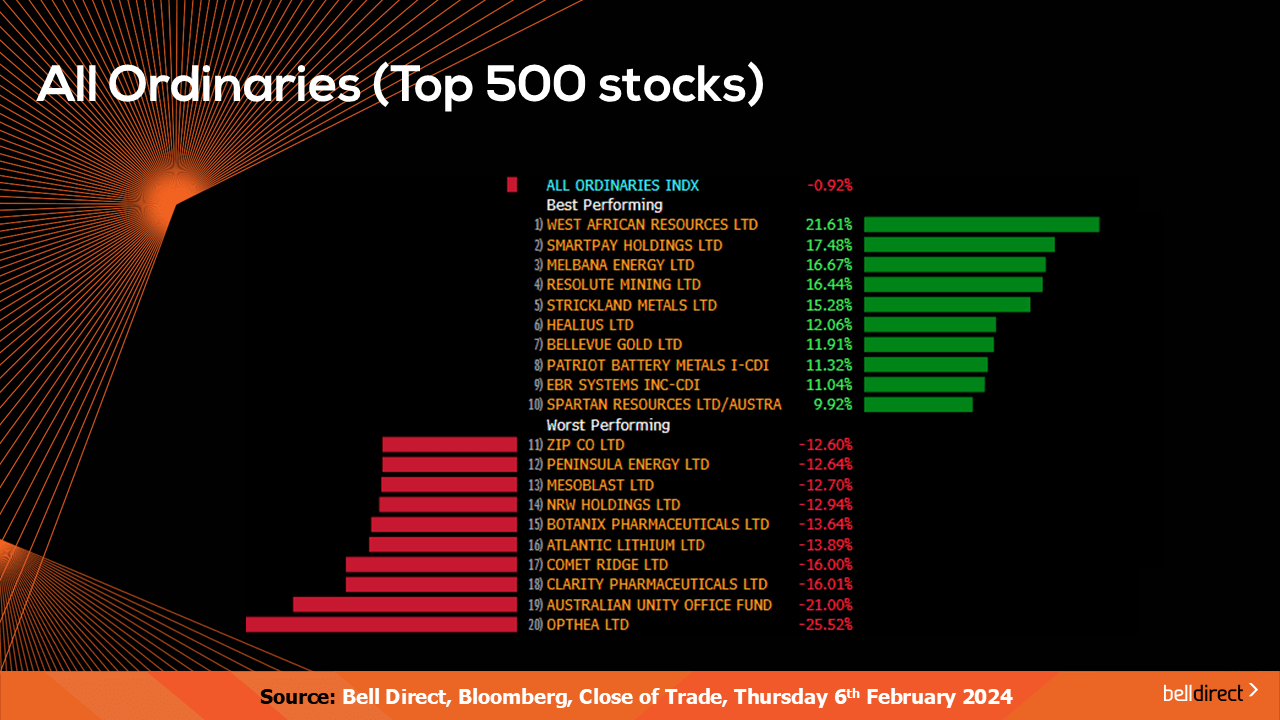

Looking now at our local market’s performance this week so far, the ASX200 has declined 0.95% Monday to Thursday with West African Resources (ASX:WAF) in the lead advancing 22%, while Clarity Pharmaceuticals (ASX:CU6) declined 16%.

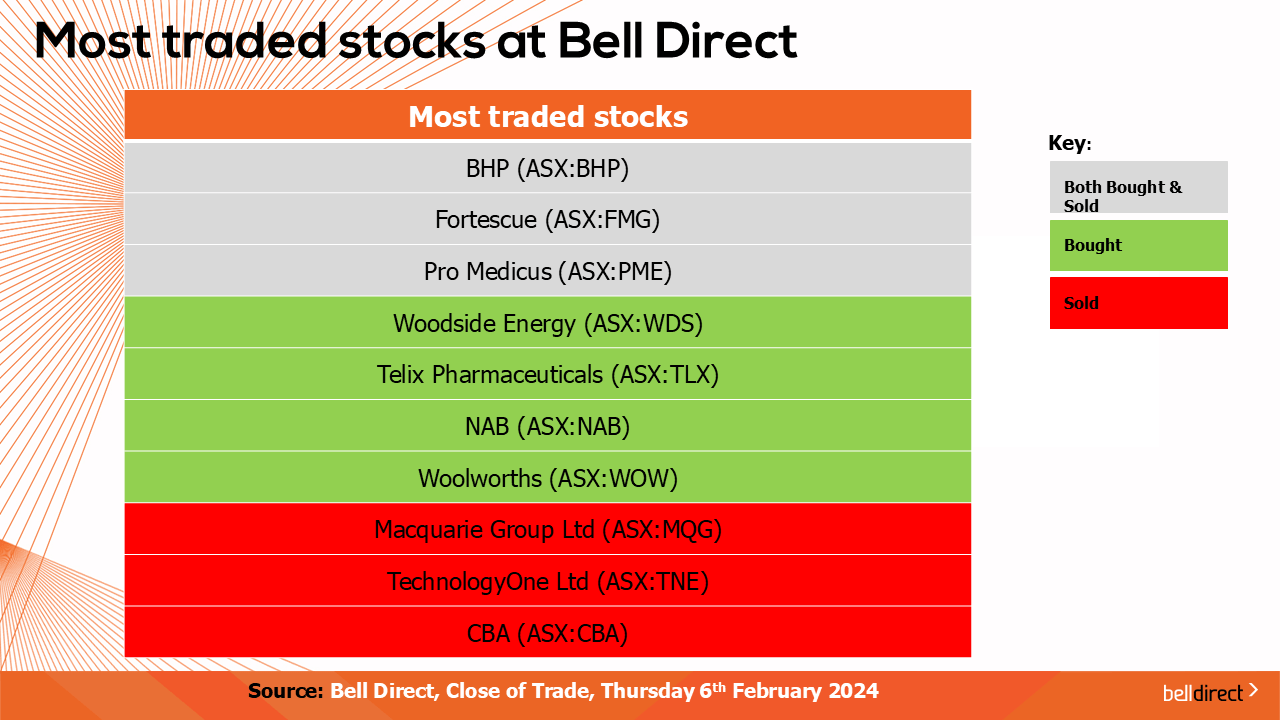

The most traded stocks by Bell Direct clients this week were BHP (ASX:BHP), Fortescue (ASX:FMG) and Pro Medicus (ASX:PME). Clients also bought into Woodside (ASX:WDS), Telix Pharmaceuticals (ASX:TLX), NAB (ASX:NAB) and Woolworths (ASX:WOW), while took profits from Macquarie (ASX:MQG), Technology One (ASX:TNE) and Commonwealth Bank (ASX:CBA).

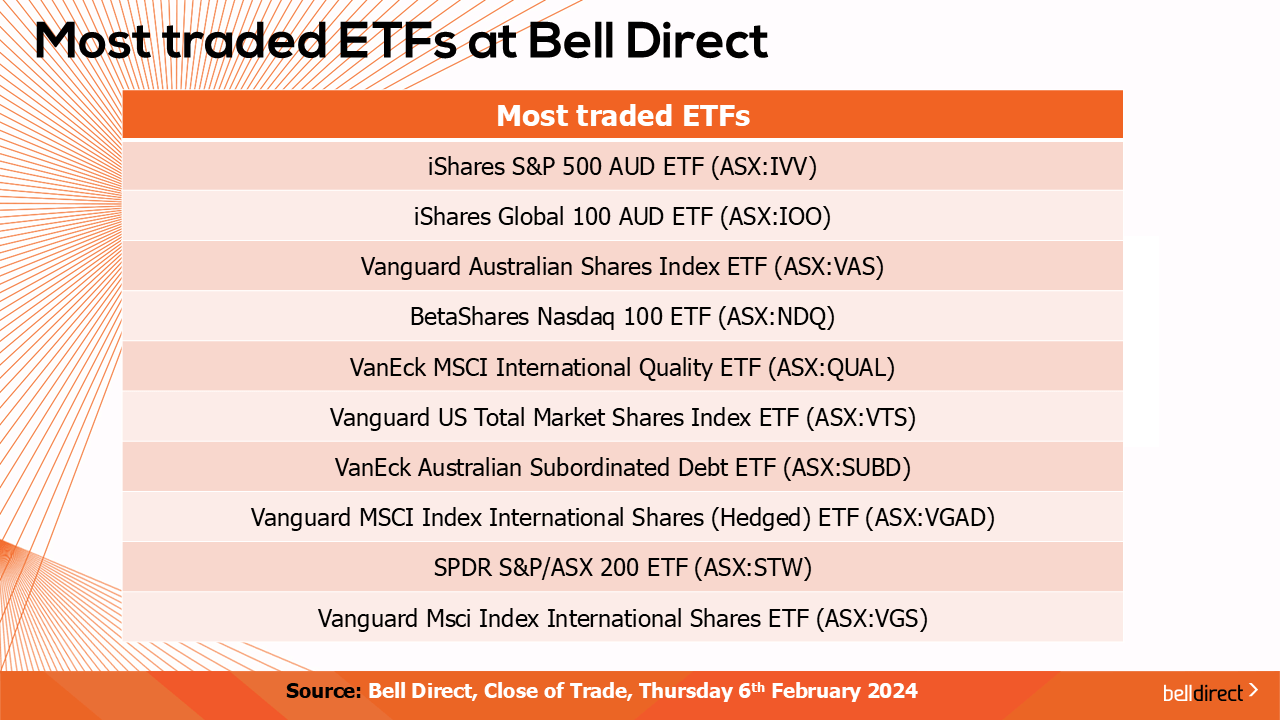

While the most traded ETFs were iShares S&P500 ETF, the iShares Global 100 ETF and the Vanguard Australian Shares ETF.

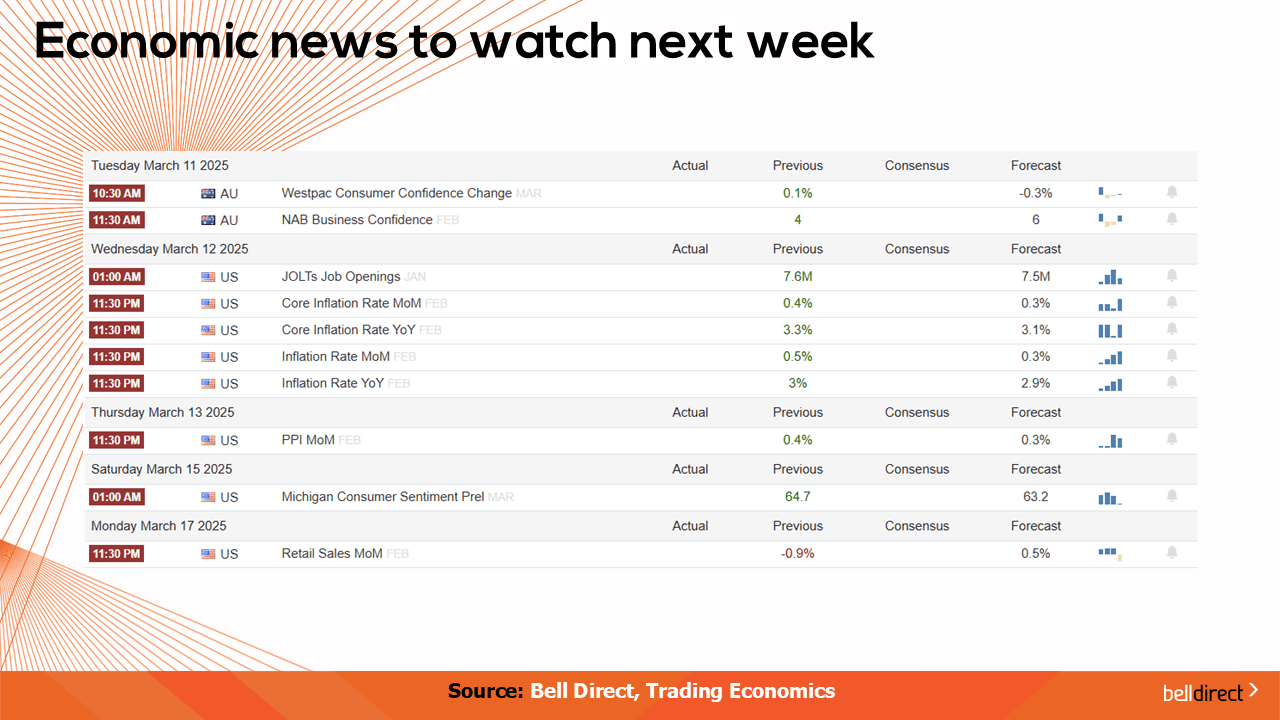

As for economic data to watch out for next week,

On Tuesday we’ll receive Westpac’s consumer confidence data for March and NAB’s consumer confidence data for February and on Thursday we’ll receive building permits data and RBA Assistant Governor Brad Jones will provide an update.

And that’s all for markets this week. I’m Sophia Mavridis with Bell Direct. I hope you have a great day and as always, happy trading!