Transcript: Weekly Wrap 7 June

Global markets painted a rosy picture in May, with most regions experiencing healthy gains. The US, in particular, saw impressive growth, with the S&P500 and the Nasdaq, jumping nearly 5% and 7% respectively.

Despite the strong market performance, some indicators suggest the US economy may pullback. Inflation, though a concern earlier, has begun to cool down. Additionally, the first quarter’s economic growth was revised downward to 1.3%. We also saw weaker consumer spending and softer durable goods purchases.

These are good signs for the US Federal Reserve, which has been battling high inflation. The encouraging signs on inflation, coupled with the economic slowdown, could prompt the Fed to cut interest rates sooner than anticipated. While September is currently priced in by the market, some economists believe a July rate cut is a strong possibility.

Over in Europe, the European Central Bank faces a different scenario. Despite a slight uptick in inflation in May, the ECB is still expected to announce its first interest rate cut in eight years this June. This decision reflects the overall downward trend in inflation, even though it remains elevated and subdued economic growth in the Eurozone.

Meanwhile China’s economic picture appears less bright. Manufacturing activity, a key driver of China’s growth, surprisingly contracted in May, indicating a decline in demand. This weakness extends to the non-manufacturing sector as well, which displayed sluggish growth compared to expectations.

The commodity market also witnessed some interesting trends. Oil prices continued their downward trajectory due to concerns about slowing global demand and rising oil inventories. Copper prices, on the other hand, remained relatively stable. While consolidation is expected in the near future, analysts predict a significant rise in copper prices over the next year and a half, fueled by potential easing in China and the US, alongside a global manufacturing recovery.

Looking ahead, the global economic outlook hinges heavily on the US performance. As we approach the halfway mark of 2024, the US economic exhibits surprising resilience, with stock markets defying predictions of a slowdown. However, the recent economic data hints at a potential shift. The Fed’s upcoming meeting in June will be closely watched, with a rate cut decision a potential turning point.

Investors navigating this landscape should consider a well-diversified portfolio across assets and regions. Remaining adaptable and prepared for surprises will be a key to navigating the evolving economic environment.

As for the market’s performance this week so far.

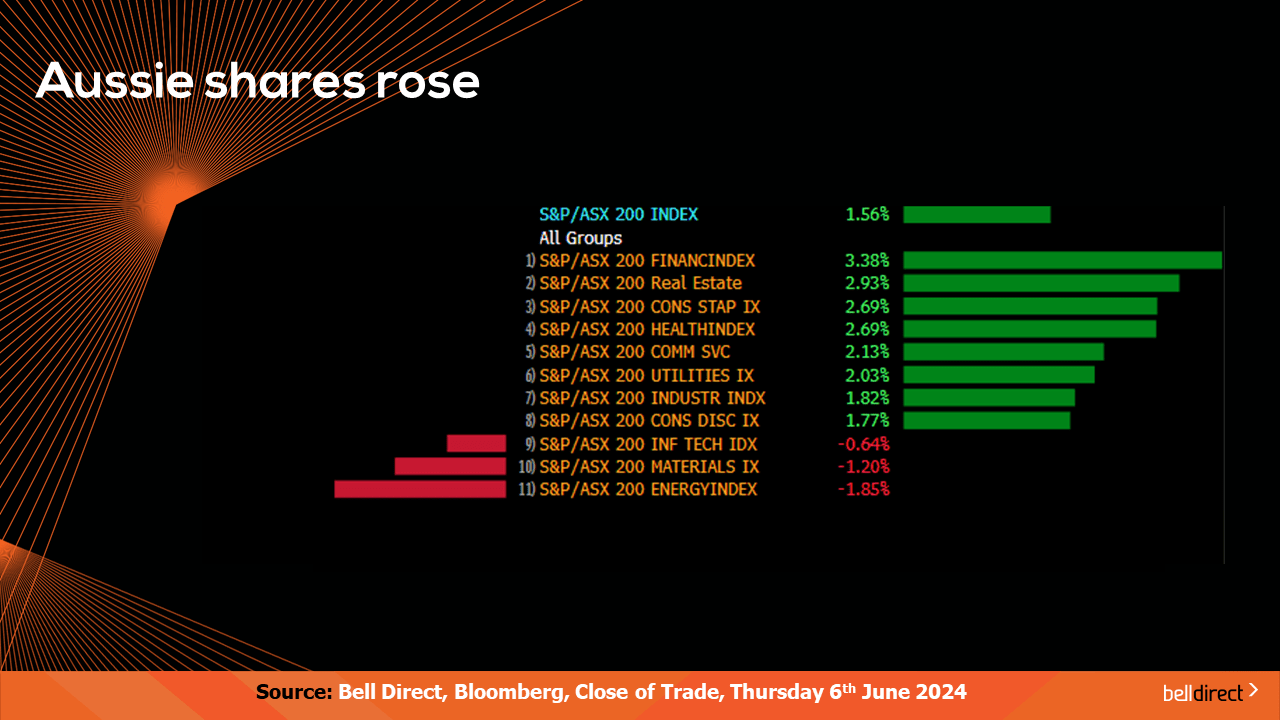

Locally from Monday to Thursday, the ASX200 rose 1.56% with the majority of sectors closing in the green. Gains were led by the financial and real estate sectors which rose 3.38% and 2.93% respectively.

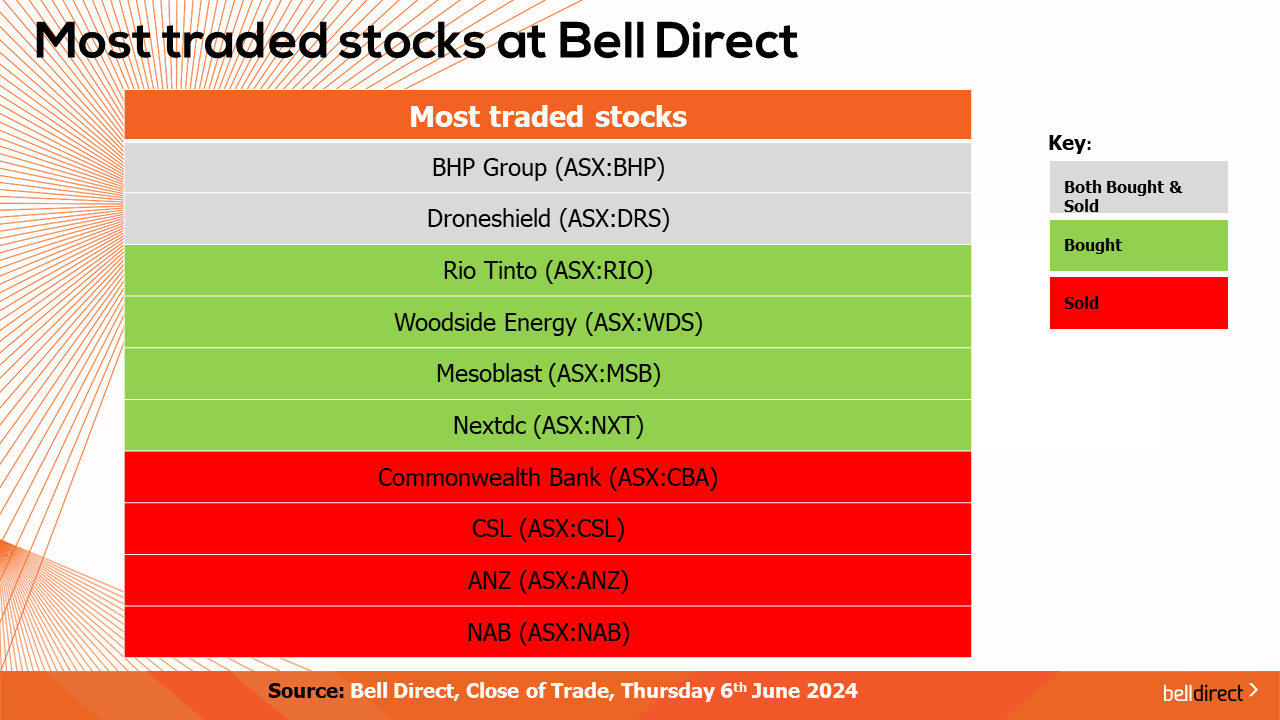

As for the most traded stocks by Bell Direct clients this week, these included BHP Group (ASX:BHP) and Droneshield (ASX:DRO). Clients also bought into Rio Tinto (ASX:RIO), Woodside Energy (ASX:WDS), Mesoblast (ASX:MSB) and Nextdc (ASX:NXT). Clients also took profits from Commonwealth Bank (ASX:CBA), CSL (ASX:CSL), ANZ (ASX:ANZ) and NAB (ASX:NAB).

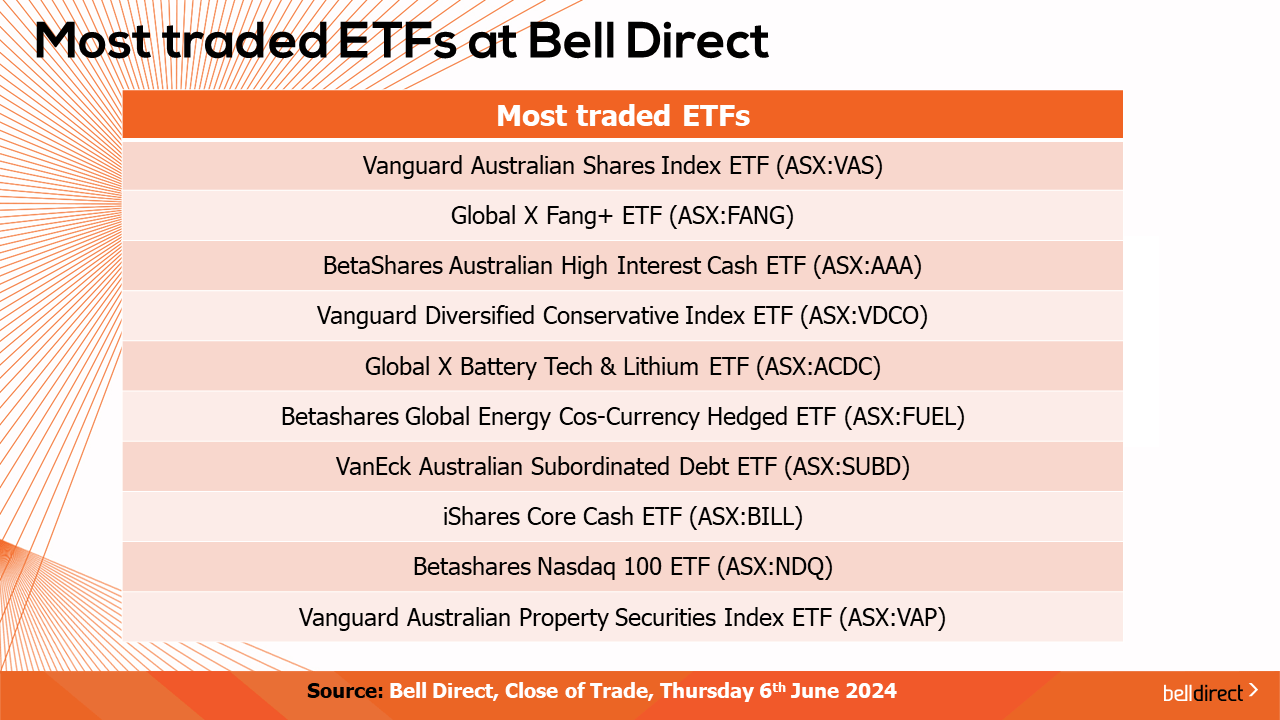

And the most traded ETFs by Bell Direct clients this week were led by Vanguard Australian Shares Index ETF, Global X Fang+ ETF and Betashares Australian High Interest Cash ETF.

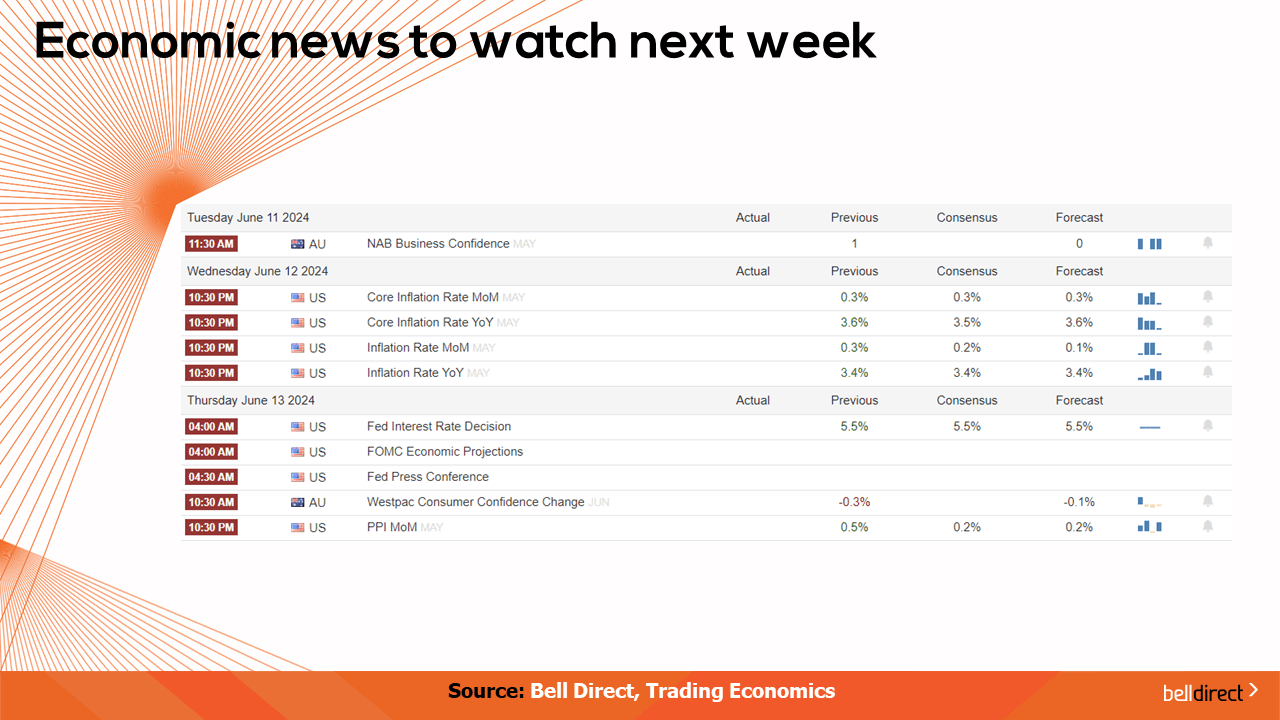

Taking a look at the week ahead on an economic data front, NAB business confidence results will come out on Tuesday and on Wednesday, key US inflation data will be released with core inflation month on month having a forecast of 0.3%. And on Thursday, the US Federal Reserve will release their interest rate decision with a consensus and forecast of 5.5%.

And that’s all for this week, I’m Sophia Mavridis with Bell Direct. Have a good long weekend and as always, happy investing.