Transcript: Weekly Wrap 7 February

This week on the markets we saw Trump’s trade war discussions come to a sharp halt as tariffs between Mexico and the US, and Canada and the US were placed on pause as negotiations between the nations begin. Trump imposed tariffs on China though which came into effect on Tuesday and saw China retaliate with tariffs of 10%-15% on certain goods from the US. The full extent of the tariff implications in Australia are yet to be known and given tariff pauses are in effect; we will likely not know the impact of the tariffs until a months’ time.

Onto the reporting season front, we have seen some surprisingly strong results to kick off the earnings season for February 2025. Prior to reporting season, the expectation on an earnings front across the board was for single digit earnings growth amid tough operating conditions against a backdrop of inflationary pressures, labour shortages, economic instability and subdued demand, however, from some results we have seen so far, it looks like we might be surprised by the strength of the general results this season.

In the healthcare space, sleep apnoea device specialist ResMed (ASX:RMD) smashed expectations and quashed any speculations that a rise in weight loss injectables will deplete demand for sleep apnoea devices, with the CEO even going as far as saying the two complement one another to deliver the best sleep quality possible through a study currently underway. ResMed reported revenue rose 10% to US$1.3bn in Q2FY25, gross margin improved 300bps to 58.6%, that’s an incredible rise from the 50bps contraction reported in the PCP. ResMed also reported the company launched into India during the quarter, tariffs in the US will provide tailwinds on a competitive front as two key competitors operate out of China and Mexico, and new generative AI is being used through ResMed’s Dawn product, tapping into the personal health tracking service. Overall, investors welcomed the results with shares in ResMed rallying on the day of release.

In the real estate space, REA Group’s (ASX:REA) strong results this week were overshadowed by the retirement announcement of the company’s CEO Owen Wilson after 10 years with REA and 6 years in the role of CEO. For the first half though, REA reported revenue rose 20% to $873m, EBITDA rose 22% to $535m, net profit jumped 26% to $314m and the full franked interim dividend rose 26% to $1.10 per share, while operating expenses also rose 18% to $338m. The results were boosted by strong Australian and Indian markets. The results were surprisingly strong given the high-interest rate environment in Australia throughout the first half of FY25 and paints a strong growth outlook for H2 given the outlook for rate cuts from the RBA. Across the metrics REA Group beat consensus expectations across all but one where DPS rose 26.4% to 110cps but this was 4% short of expectations.

And another company that impressed investors with strong results and ties into REA Group through its 61% ownership in the company, is News Corp. The leading global mass media and publishing company released Q2 FY25 results later in the week including a 5% increase in revenues to $2.24bn driven by growth in the Digital Real Estate Services, Dow Jones and Book Publishing segments. News Corp also reported net income from continuing operations rose 58% in Q2 to $306m, announced the agreement to sell Foxtel to DAZN for AUD$3.4bn EV, and posted a Q2 Total Segment EBITDA of $478m, up 20% on the PCP. Being headquartered in the US and earning in USD drives tailwinds for the company to continue capitalising on the strong USD of late.

All in all, while we are still very early in reporting season for the first half of FY25, so far it looks surprisingly strong from those that have released results, suggesting across the board the outlook for single digit earnings growth was a conservative guide given the headwinds faced.

Next week on the reporting season calendar we will analyse results out of JB Hi-Fi (ASX:JBH), CSL (ASX:CSL), AGL (ASX:AGL), CBA (ASX:CBA), Suncorp (ASX:SUN), Treasury Wine Estates (ASX:TWE), Insurance Australia Group (ASX:IAG), QBE Insurance (ASX:QBE), Magellan Financial (ASX:MFG) and Mirvac Group (ASX:MGR) among others. Be sure to tune in to our reporting season video on Wednesday each week of reporting season to stay up to date with the latest results and investor reactions.

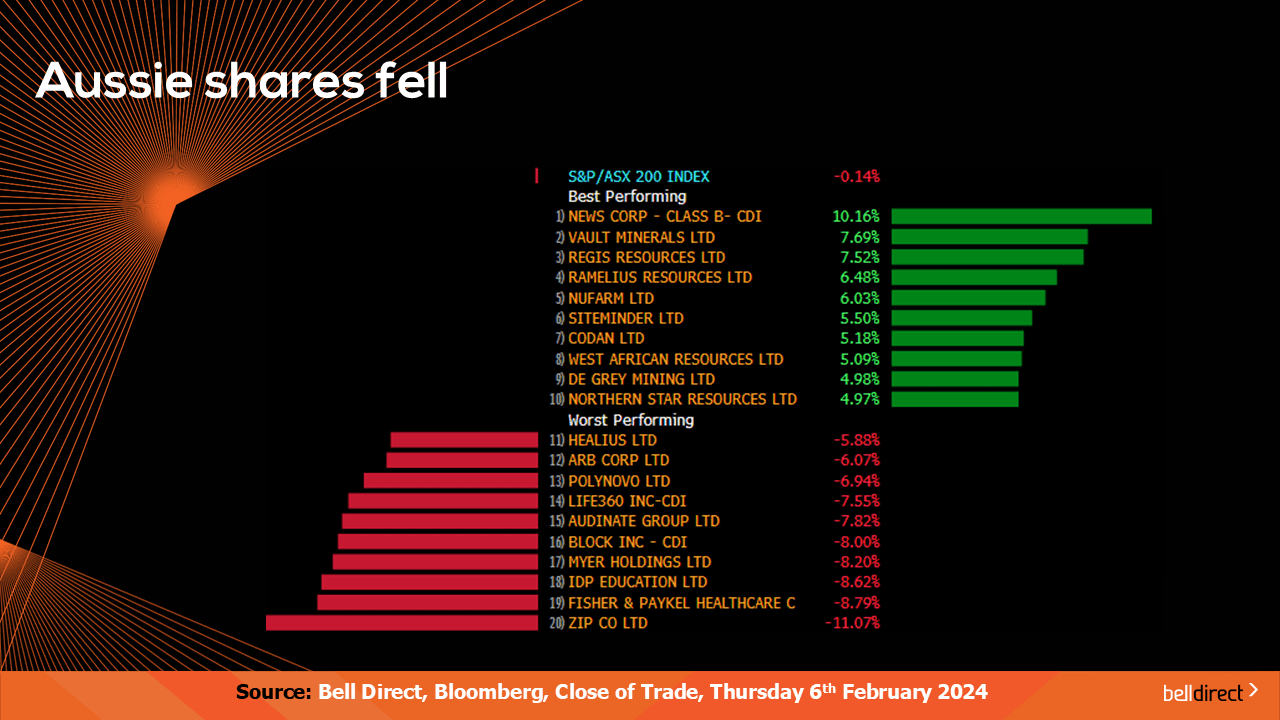

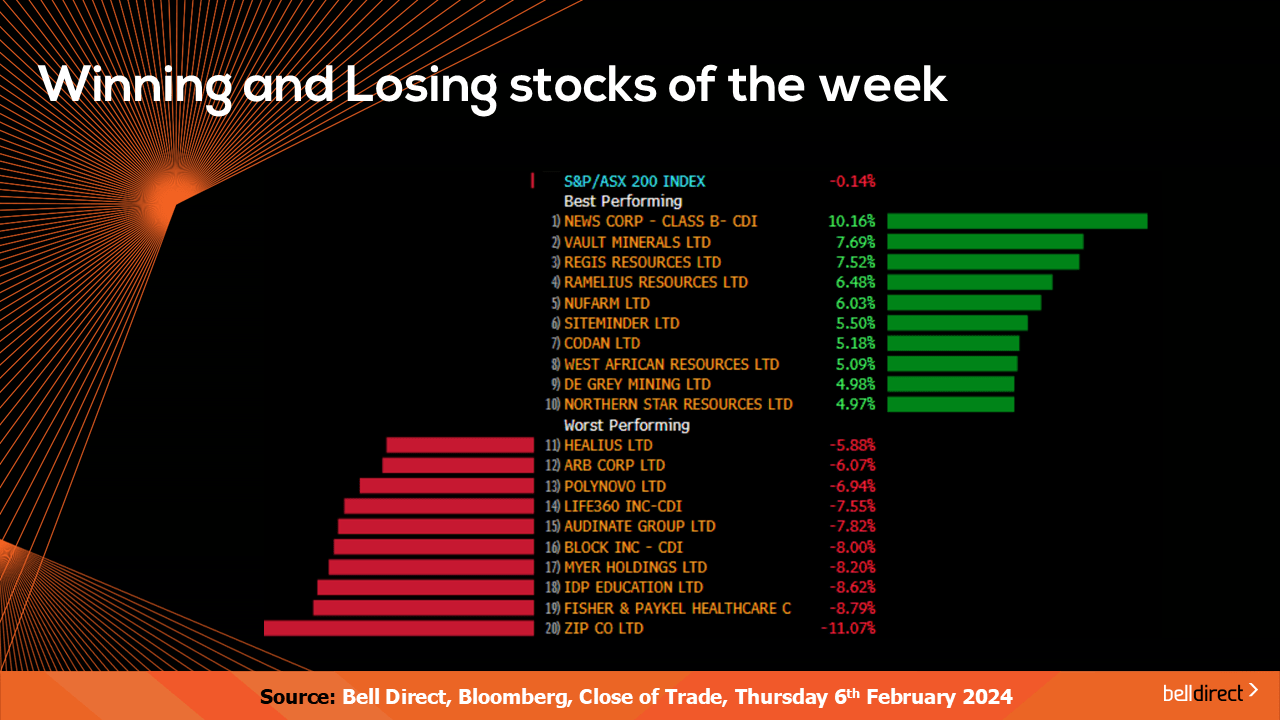

Locally from Monday to Thursday the ASX200 posted a loss of 0.14% as a sharp sell-off in healthcare and consumer staples stocks weighed on strong gains posted by the tech and materials sectors. The markets this week were sold off amid economic uncertainty surrounding Trump’s tariffs and concerns over a US-China trade war impacting local market stability.

The winning stocks on the ASX200 this week were led by News Corp (ASX:NWS) jumping 10.16%, Vault Minerals (ASX:VAU) adding 7.7% and Regis Resources (ASX:RRL) rallying 7.52%.

On the losing end, Zip Co (ASX:ZIP) fell 11.07%, Fisher and Paykel Healthcare (ASX:FPH) dropped 8.8% and IDP Education (ASX:IEL) ended the week down 8.62%.

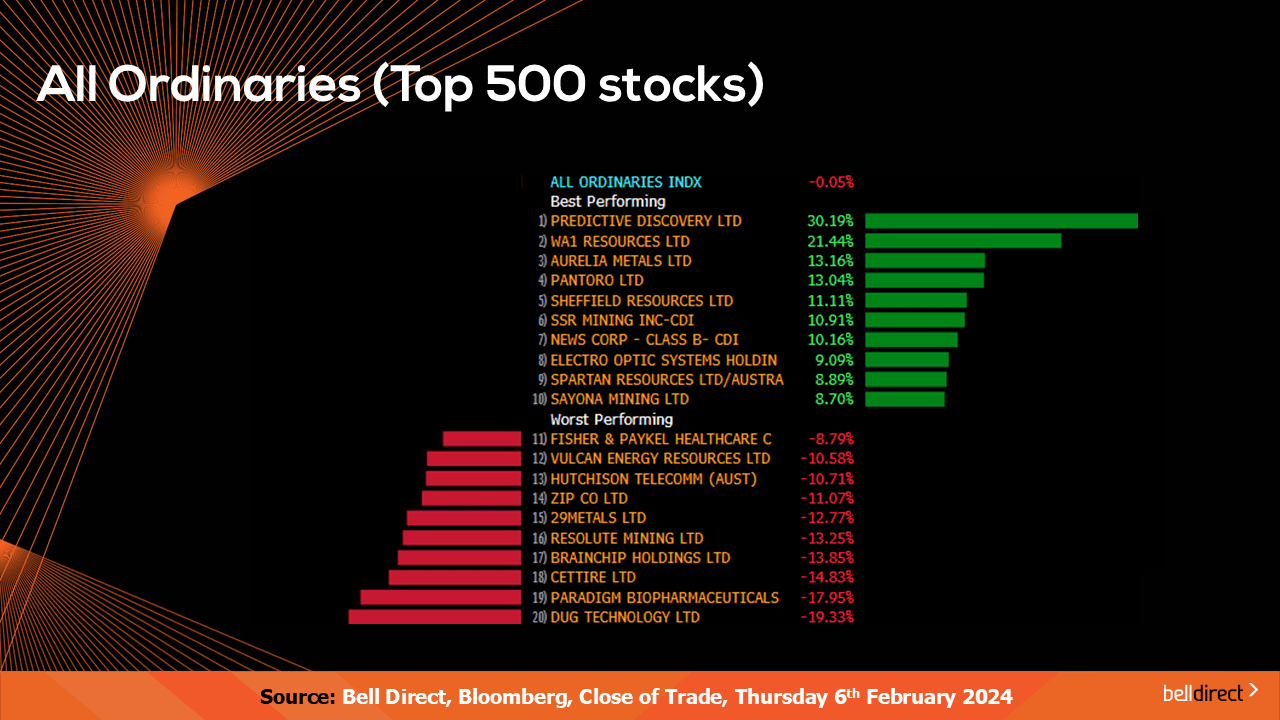

On the broader market index the All Ords fell just 0.05% this week as a 20% loss for Dug Technology (ASX:DUG) and a near 18% loss for Paradigm Biopharmaceuticals (ASX:PAR) offset Predictive Discovery’s (ASX:PDI) 30% rally.

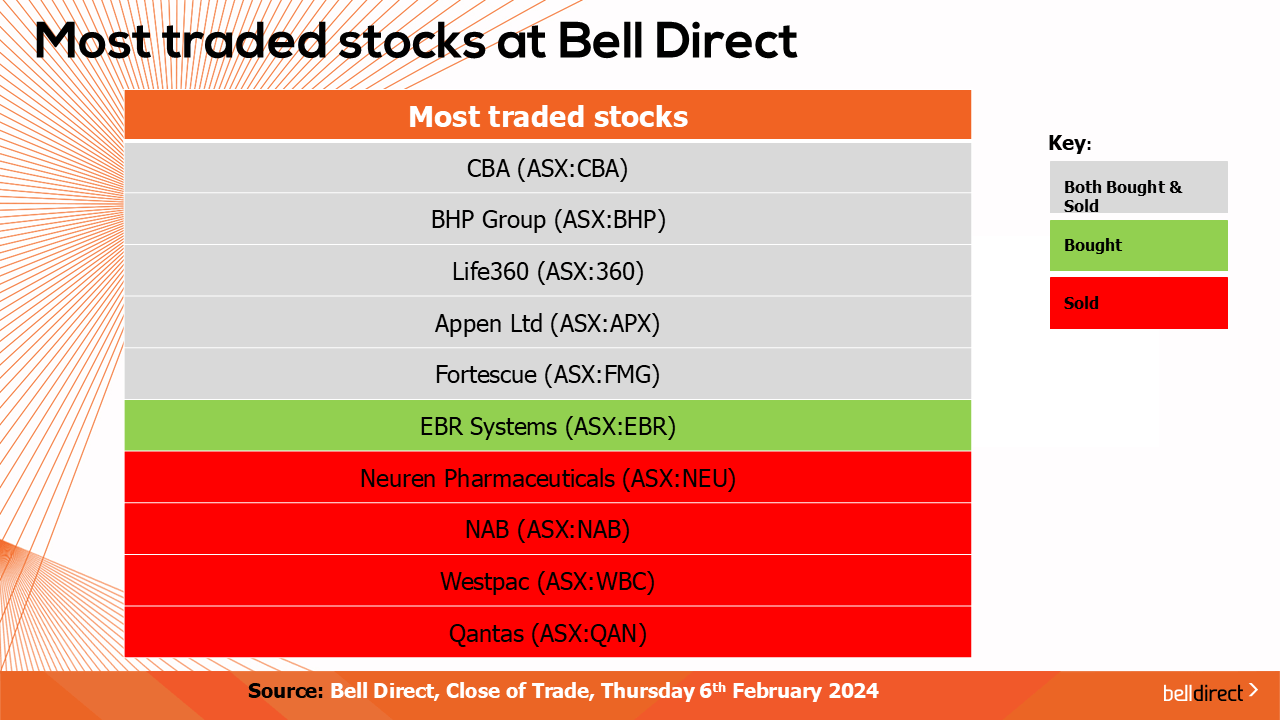

The most traded stocks by Bell Direct clients this week were CBA (ASX:CBA), BHP (ASX:BHP), Life 360 (ASX:360), Appen (ASX:APX), and Fortescue (ASX:FMG).

Clients also bought into EBR Systems (ASX:EBR), while taking profits from Neuren (ASX:NEU), NAB (ASX:NAB), Westpac (ASX:WBC), and Qantas (ASX:QAN).

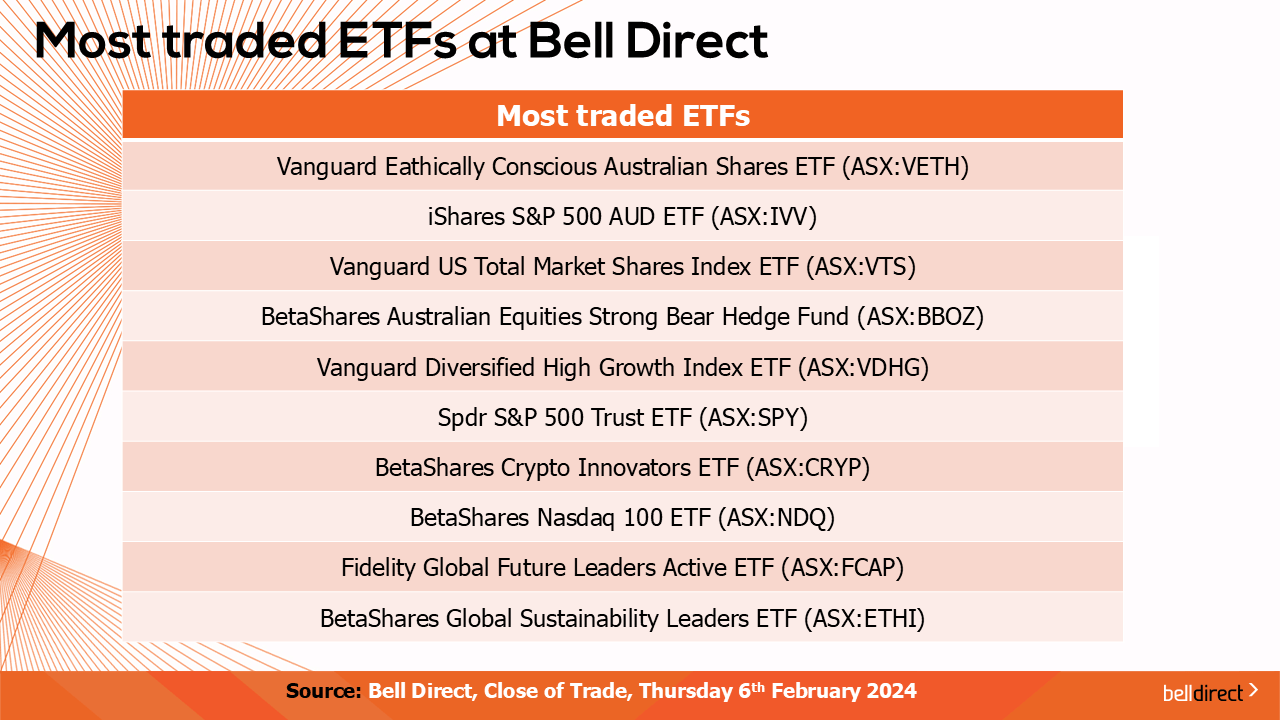

And the most traded ETFs were led by Vanguard Ethically Conscious Australian Shares ETF, iShares S&P 500 AUD ETF and Vanguard US Total Market Shares Index AUD ETF.

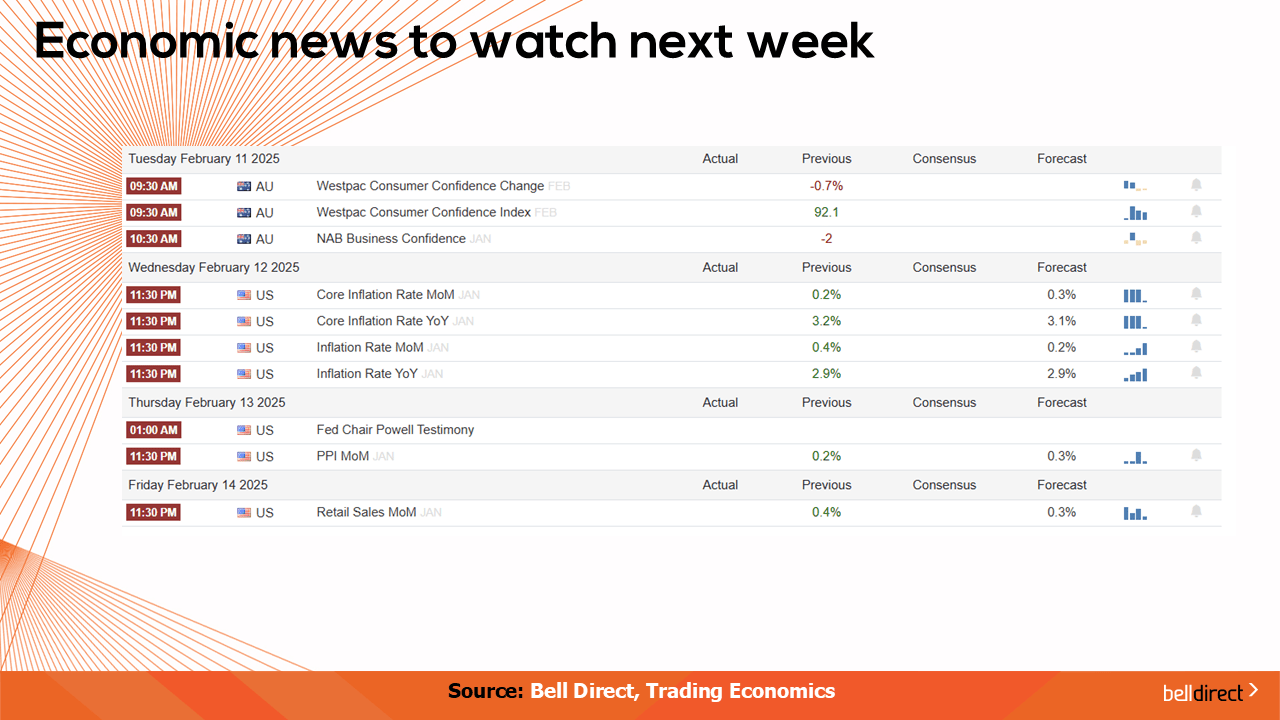

On the economic calendar next week, we may see investors react to Westpac Consumer Confidence Data for February out on Tuesday and NAB Business Confidence Data also out on Tuesday.

Overseas, key inflation data will be released in the US from Wednesday to Friday including core inflation rate, inflation rate, PPI data and retail sales figures for January, which will all play a vital role in the Fed’s rate pathway and outlook for a future rate cut.

And that’s all for this week, have a wonderful weekend and happy investing!