Transcript: Weekly Wrap 6 September

We are now in Spring, meaning a wrap on reporting season for FY24 results. Over the last month, of the 350 companies featured that released results, 98 beat expectations, 126 met expectations and 126 missed expectations. This was broadly expected as the high interest rate, high cost of living environment hurt margins and earnings especially in the second half of FY24.

So, what are the key takeaways from reporting season and what can we expect from FY25?

The resources sector was hit hard this reporting season with higher input costs and weakening commodity prices creating the perfect storm for eased margins and earnings pressures. Gold miners were in luck though as the price of the precious commodity continues to soar which saw producers like Northern Star Resources post record results for FY24.

Companies across the board were hesitant to post optimistic outlook for the new financial year, even if tailwinds are fuelling increased demand, think Goodman Group (ASX:GMG). Overall, we saw outlook paint a very conservative picture for earnings and revenue across most industries in FY25, especially across the first half.

Higher debt levels were punished this reporting season – especially for companies like Mineral Resources (ASX:MIN), as the high interest rate environment means repayments of debt are sitting at elevated levels.

Dividends were on the chopping block this reporting season as companies either faced marginal pressures or chose to reinvest in R&D or capital growth to bolster operations ahead of the anticipated challenges of H1 FY25.

Some companies that were deemed fully priced prior to reporting season surprised to the upside and experienced further share price appreciation after results indicated growth continues to justify the higher valuations, think WiseTech Global (ASX:WTC) which soared 28% in the two sessions after results were released.

The consumer may have been resilient in FY24, but this is unlikely to last into the new financial year. Temple & Webster (ASX:TPW), JB Hi-Fi (ASX:JBH) and Baby Bunting (ASX:BBN) all posted strong results in FY24 and a strong start to FY25, but this is unlikely to remain for the entire new financial year.

On the outlook front we can expect earnings growth to ease to single digit growth across most industries in FY25. This is due to easing demand, higher capex and opex costs, inflationary pressures and easing economic growth.

Australia’s GDP growth rate data out this week showed growth of just 0.2% in Q2 ,explains why earnings eased especially in H2 of FY24, as economic growth succumbs to inflationary pressures. At the same time, consumer spend eased 0.2% QoQ which again indicates the easing outlook on a consumer front.

Retailers may have surprised to the upside in FY24 but FY25 is likely to see subdued consumer spend as savings run out and discretionary items are on the chopping block from weekly budgets. This is likely to hit retailer earnings in H1FY25 until interest rates are cut.

Equity valuations on the ASX and US markets are boosting the markets to record territory, but with easing earnings growth outlook, how long can such valuations remain sky high?

The green energy transition continues to underpin market movements; from copper, to the services and infrastructure required to operate green energy systems, the tailwinds for equities in this space continue to grow.

Dividends may be reduced again in FY25 amid eased earnings growth and subdued economic expansion, don’t expect too much on this front!

Analyse cost management practices by the companies in your watchlist or portfolio. CAPEX and OPEX continues to rise and inflation is driving these costs higher, so be sure to assess how companies manage the higher costs and if they increase product and service prices to pass the rising costs onto customers or not. Margin maintenance is key to manage the challenging environment expected in FY25.

And that’s a wrap on reporting season for August 2024, let’s dive into what happened on the local market this week.

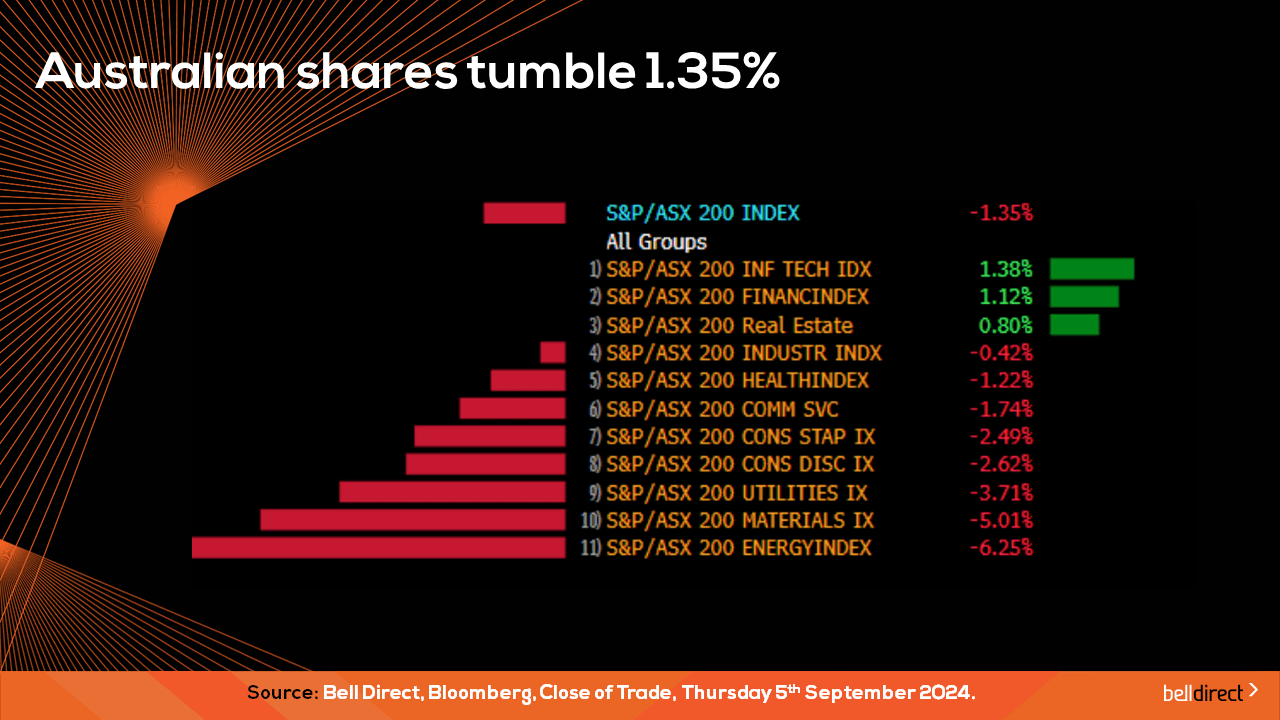

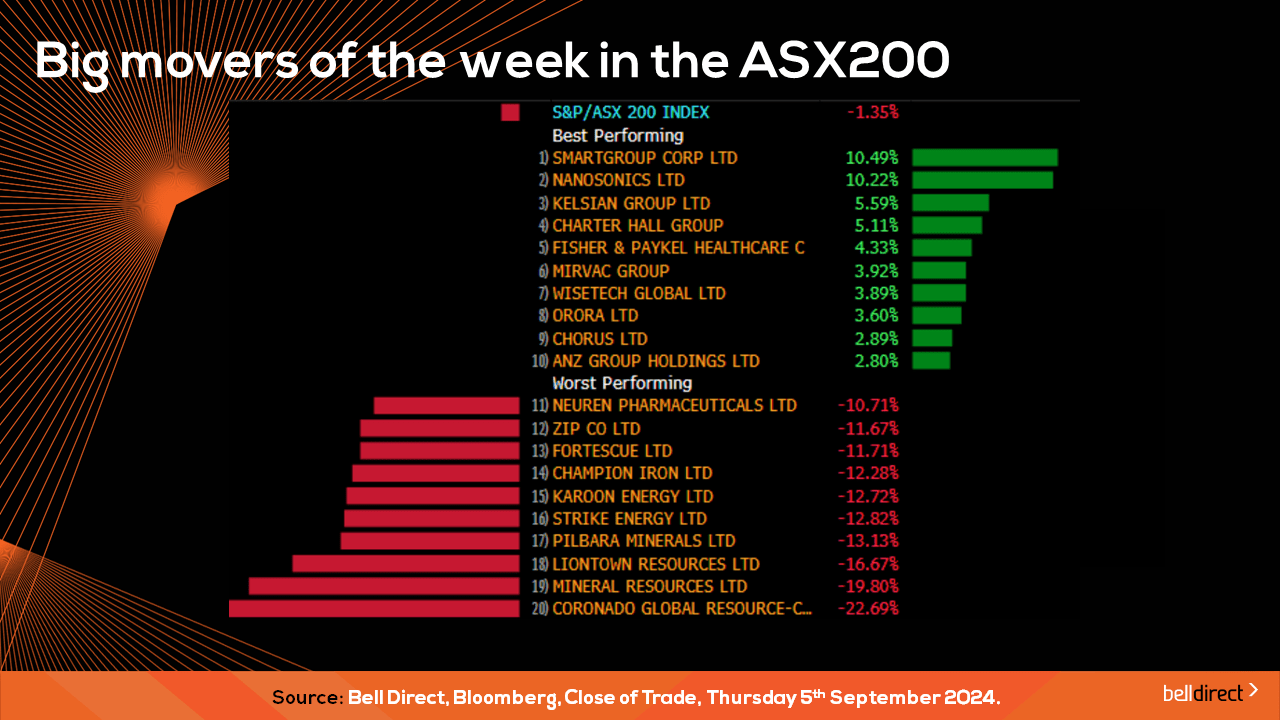

Locally from Monday to Thursday, the ASX200 tumbled 1.35% taking lead from Wall Street’s early September sell-off with the Nasdaq posting its worst session since the early August tech exodus. The energy sector took the biggest hit with a decline of 6.25% while materials stocks fell 5.01% and utilities lost 3.71%.

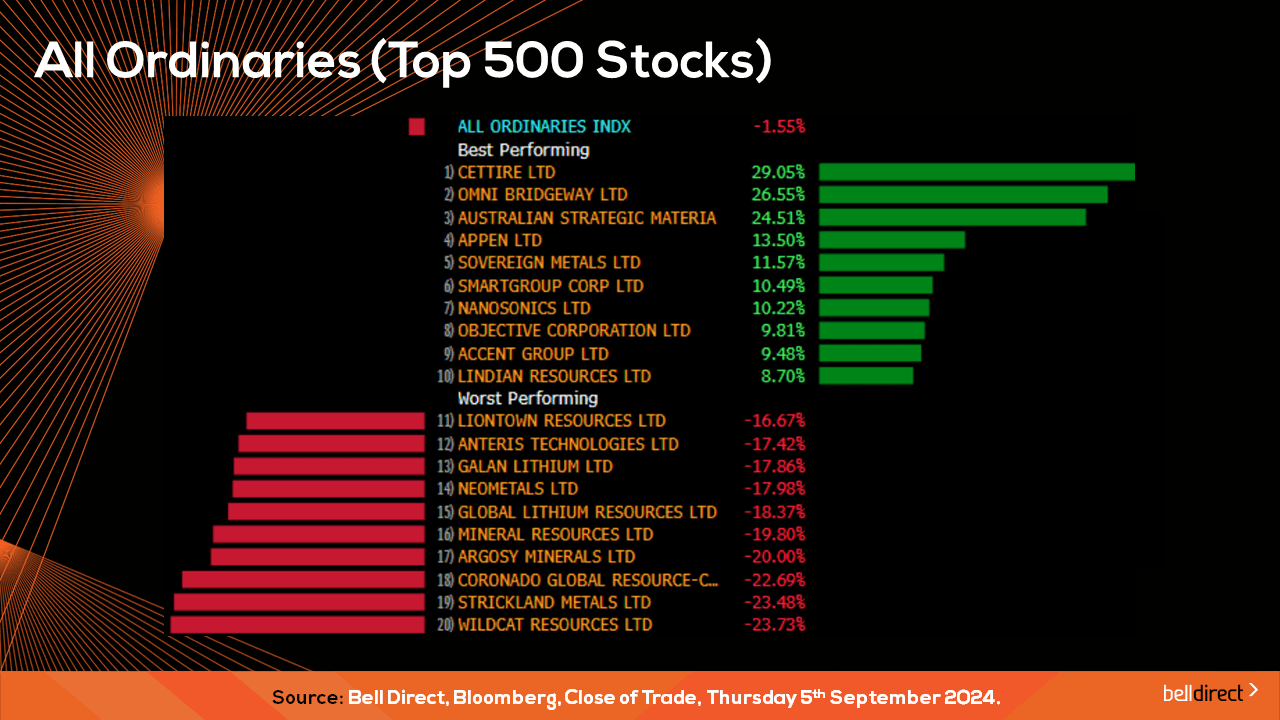

On the broader market front this week, the All Ords fell 1.55% as losses for Wildcat Resources (ASX:WC8) and Strickland Metals (ASX:STK) offset Cettire’s (ASX:CTT) near 30% rally.

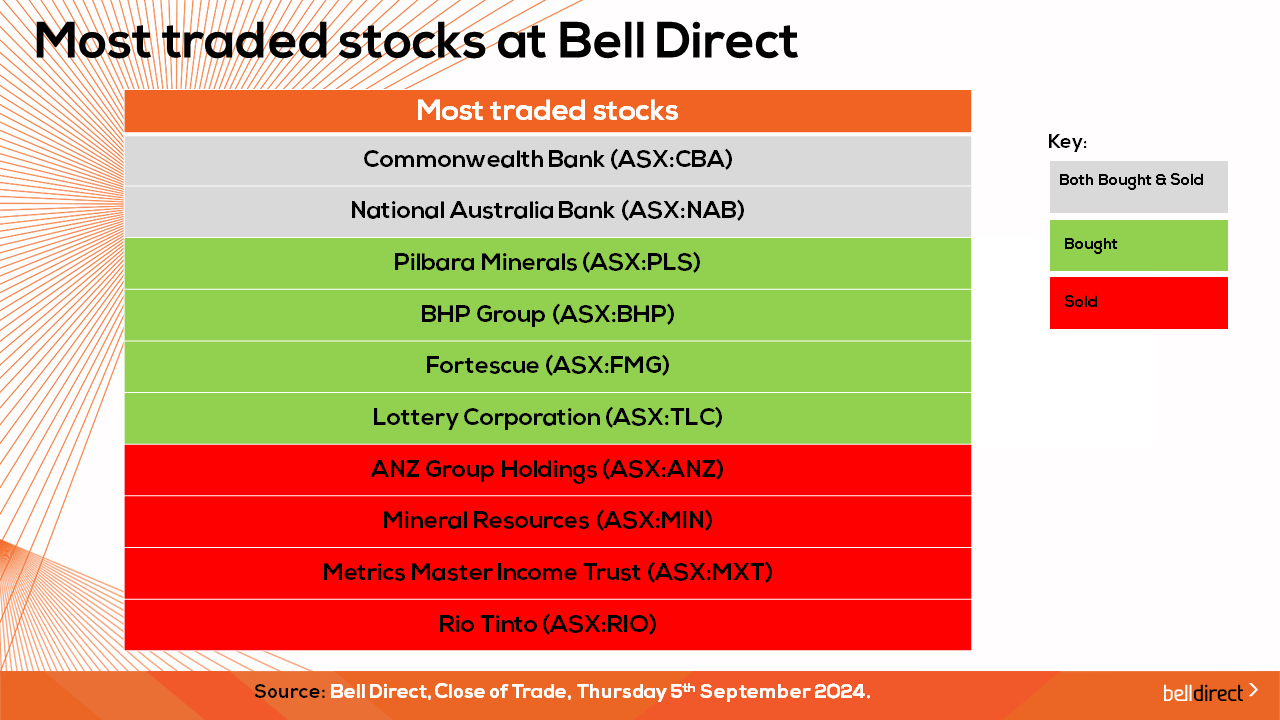

The most traded stocks by Bell Direct clients this week were CBA (ASX:CBA), Mineral Resources (ASX:MIN) and Metrics Master Income Trust (ASX:MXT).

Clients also bought into BHP (ASX:BHP), Fortescue (ASX:FMG), and Rio Tinto (ASX:RIO) while taking profits from NAB (ASX:NAB), Pilbara Minerals (ASX:PLS), The Lottery Corporation (ASX:TLC), and ANZ (ASX:ANZ).

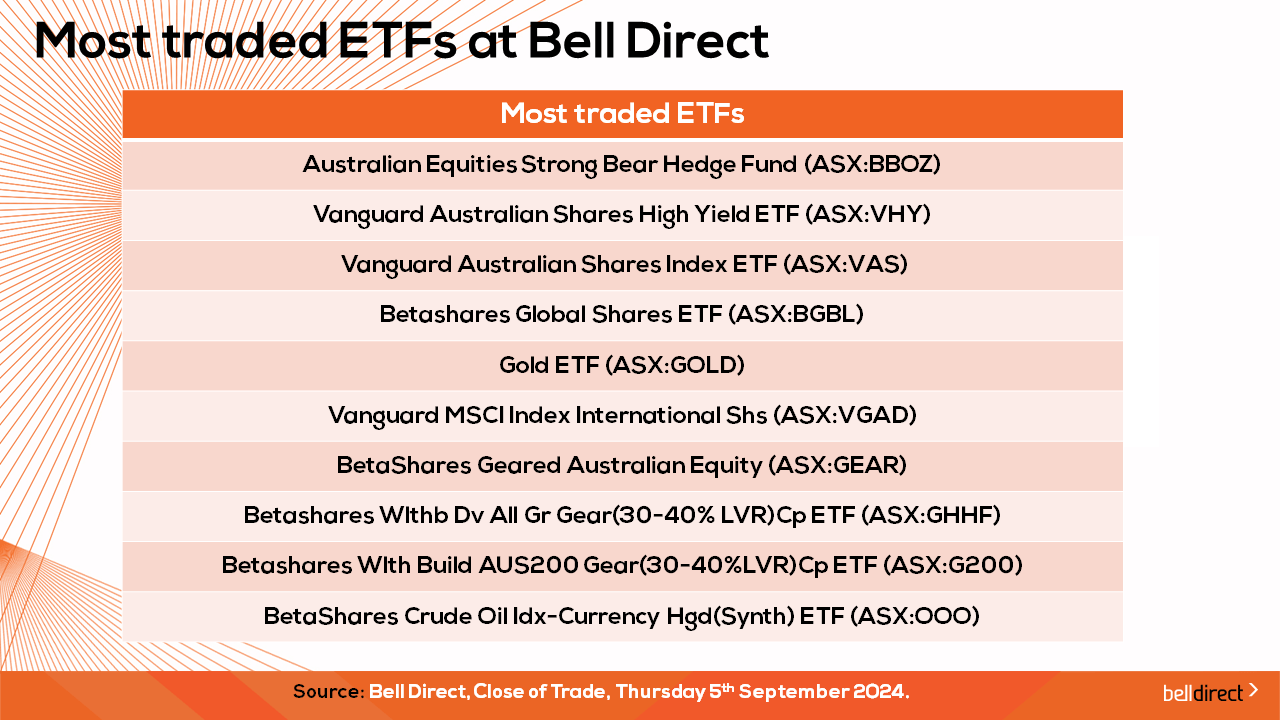

And the most traded ETFs this week were led by BetaShares Australian Equities Strong Bear Hedge Fund, Vanguard Australian Shares High Yield ETF and Vanguard Australian Shares Index ETF

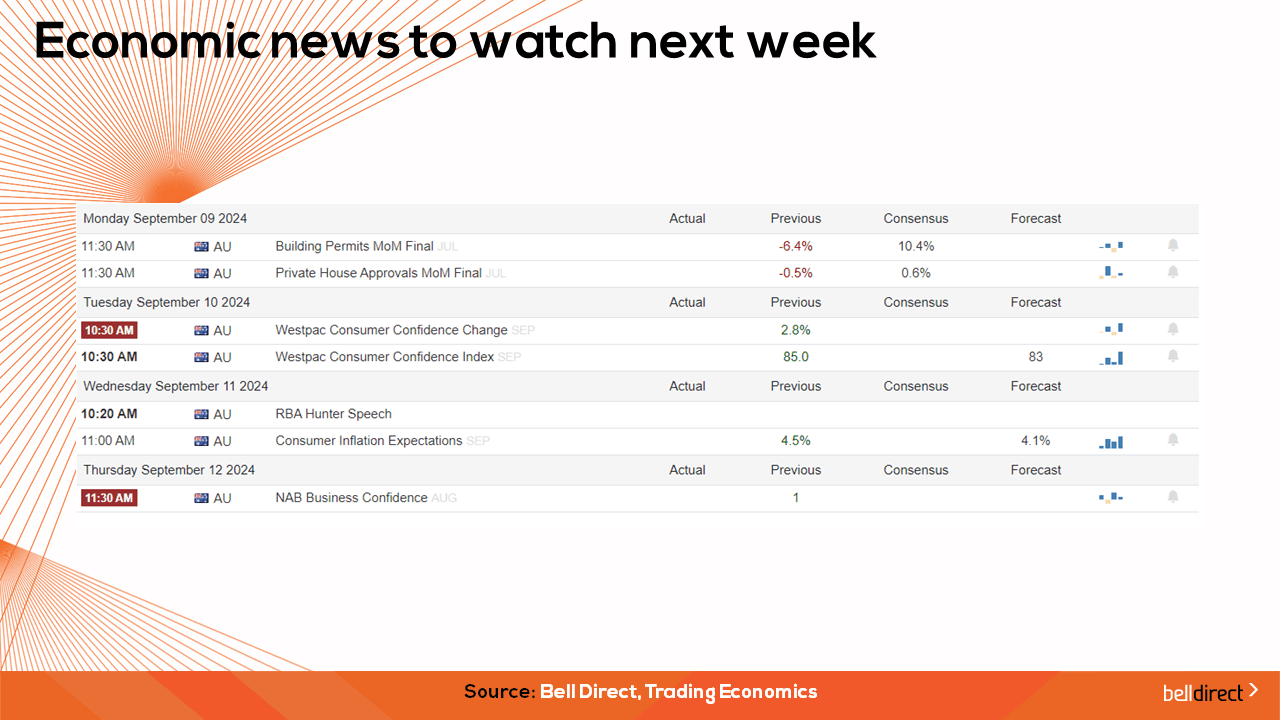

On the economic calendar front next week, we will likely see investors react to Westpac Consumer Confidence Data out on Tuesday as this will give an indication into the consumer sentiment toward market conditions for September.

Overseas, China’s inflation rate data is out on Monday with the market forecasting a flat reading of 0.5% for August from July.

US key inflation data is out midweek with the expectation that core inflation will remain at 3.2% YoY in August while the inflation rate is expected to fall to 2.6% from 2.9% YoY in August.