Transcript: Weekly Wrap 6 October

TGIF is the thought many investors globally will be thinking after the turbulence on global markets over the last week. With the prospect of a potential US government shutdown earlier in the week causing a sell-off on Wall St, and subsequently, global markets, the last-minute stopgap bill passing by Congress slightly eased investor sentiment. This is a tale of merry-go-round in the US, and it happens every three or so months. The last time fear spread through investors was when the US was allegedly going to default on debt, which never happened, and now, the government ‘was’ going to shutdown, which was again saved by the bell. The arguments in the US house stemmed over the supposed out-of-control spending by the Biden government, where a vast amount of both Republicans and Democrats believe the government is spending too much and placing the US further into a debt crisis.

The argument in congress erupted when a group of Republicans refused to support the funding legislation until the House could make dramatic cost cuts across all government agencies and impose stricter border provisions. Adding fuel to the fire was the way House Speaker Kevin McCarthy agreed spending limits with Joe Biden, that members of the GOP’s far-right ‘Freedom Caucus’ say are too generous.

The US may have narrowly avoided a shutdown this time, but the stopgap funding bill that passed at the 11th hour simply buys time to keep government doors open through to November. The Stopgap bill includes natural disaster aid but no additional funding for Ukraine or border security. The cutting of funding for Ukraine, where it is believed a further $24bn is needed, has both Democrats and Republicans protesting the stopgap funding bill and speculations have now arisen that Biden and McCarthy have a separate Ukraine funding bill in the works.

Another factor impacting markets this week was the consensus of ‘Higher for Longer’, the term used in almost every major economy right now as central banks continue the fight against sticky inflation in a bid to return the rate to their respective ranges.

The RBA held the nation’s cash rate at 4.1% for a fourth straight month in the October meeting this week. As with the last few months of holds though, the central bank warned further tightening may be required if inflation remains high. Australia’s wage price index, consumer price index, housing and rent, energy and producer price index all continue to respectively rise which are the key factors of inflation in Australia while unemployment also remains at 3.7%. CBA, Westpac and ANZ each believe the nation’s cash rate has peaked at 4.1% with cuts to follow next year, while NAB is the outlier, believing the RBA has one more rate hike in store in November or December.

Over in the US, private payrolls data came in almost half of the forecast figure in a positive sign the tight US labour market is easing, while non-farm payrolls out on Friday US time will either support or contradict this idea.

The risk of inflation remaining sticky globally prompted investors to flee the riskier equities markets this week in favour of government bonds. The 10-year Treasury Yield in the US rose to a 16 year high this week, while in the UK, 30-year bond yields rose to the highest level since 1988 on Wednesday. Oil prices also jumping to almost US$100/barrel in recent months is another key driver of global inflation.

So what does all of this mean for your investment journey? The market sliding to 2023 lows over the last week can be taken as an opportunity to consider buying into stocks on your watchlist or that are defensive in nature. Stocks that are not impacted by rising energy prices or that can pass on inflationary costs to customers without impacting demand are the key to resilience in the current macro environment.

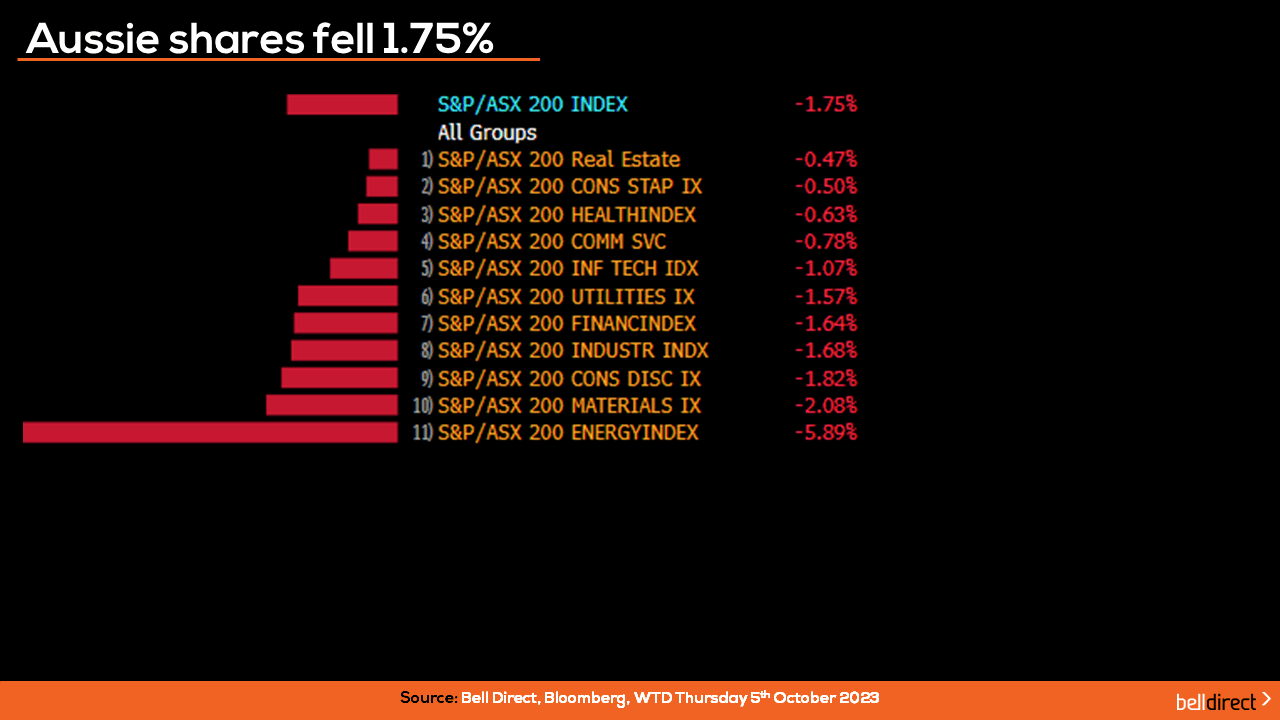

Locally from Monday to Thursday the ASX200 fell 1.75% taking strong lead from the US sell-off. Energy stocks were the worst performers over the four trading days on the declining price of oil, while every sector posted a loss over the course of the week.

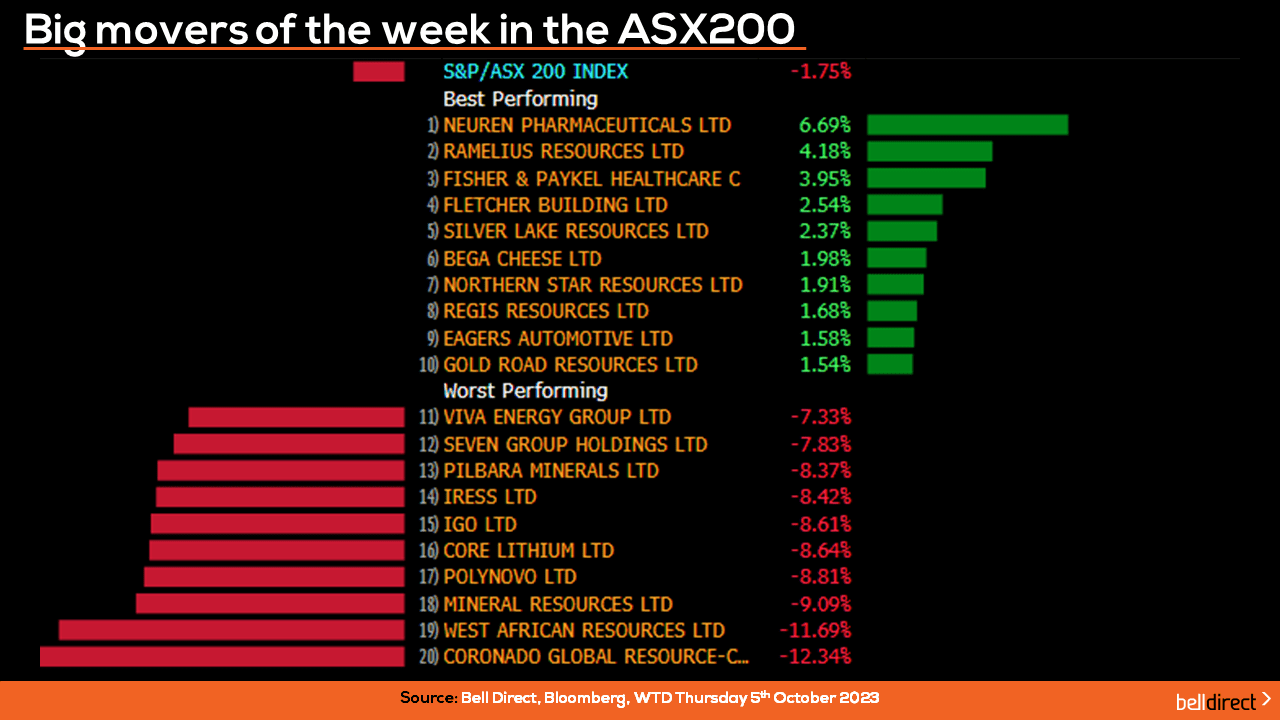

The winning stocks on the ASX200 this week were led by Neuren Pharmaceuticals (ASX:NEU) jumping 6.7%, Ramelius Resources (ASX:RMS) rallied 4.18% and Fisher and Paykel (ASX:FPH) rose just shy of 4% over the four days. At the losing end, Coronado Global Resources (ASX:CRN) fell 12.34% despite no price sensitive news out of the company, while West African Resources (ASX:WAF) fell 11.7% and Mineral Resources (ASX:MIN) lost 9.09%.

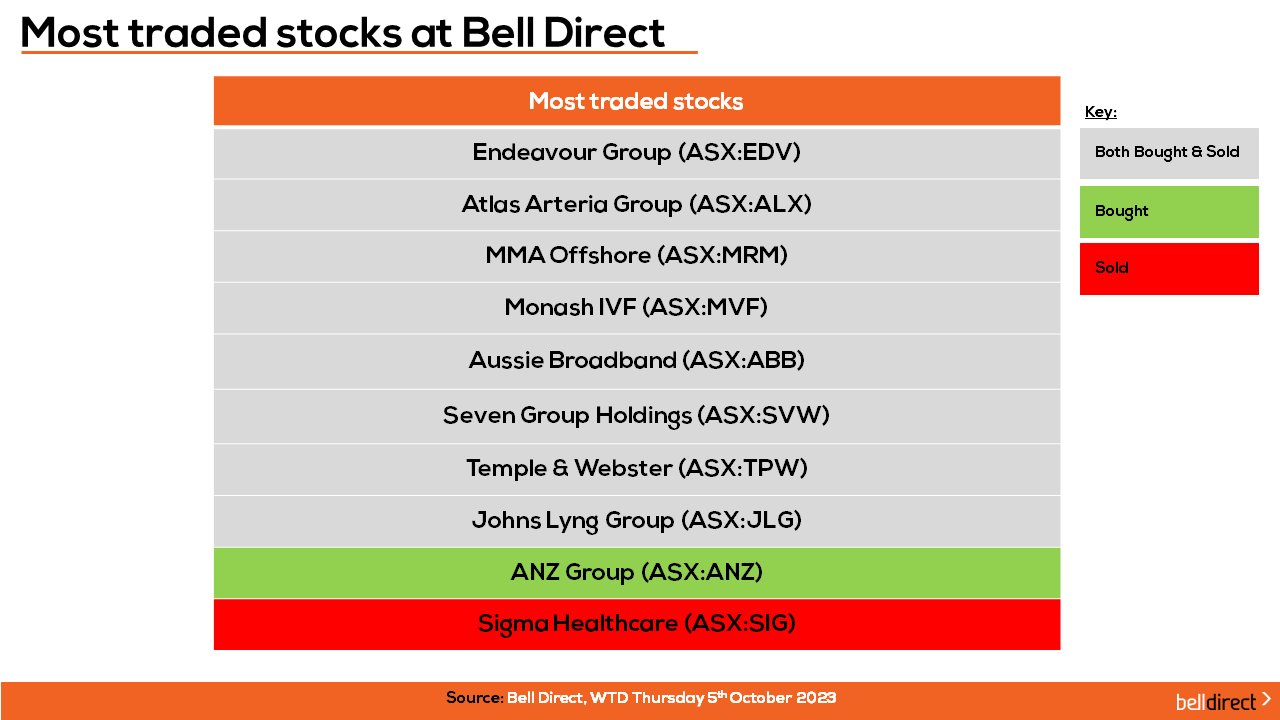

The most traded stocks by Bell Direct clients from Monday to Thursday were Endeavour Group (ASX:EDV), Atlas Ateria Group (ASX:ALX), MMA Offshore (ASX:MMA), Monash IVF (ASX:MVF), Aussie Broadband (ASX:ABB), Seven Group (ASX:SVW), Temple & Webster (ASX:TPW), and Johns Lyng Group (ASX:JLG).

Clients also bought into ANZ (ASX:ANZ) while taking profits from Sigma Healthcare (ASX:SIG).

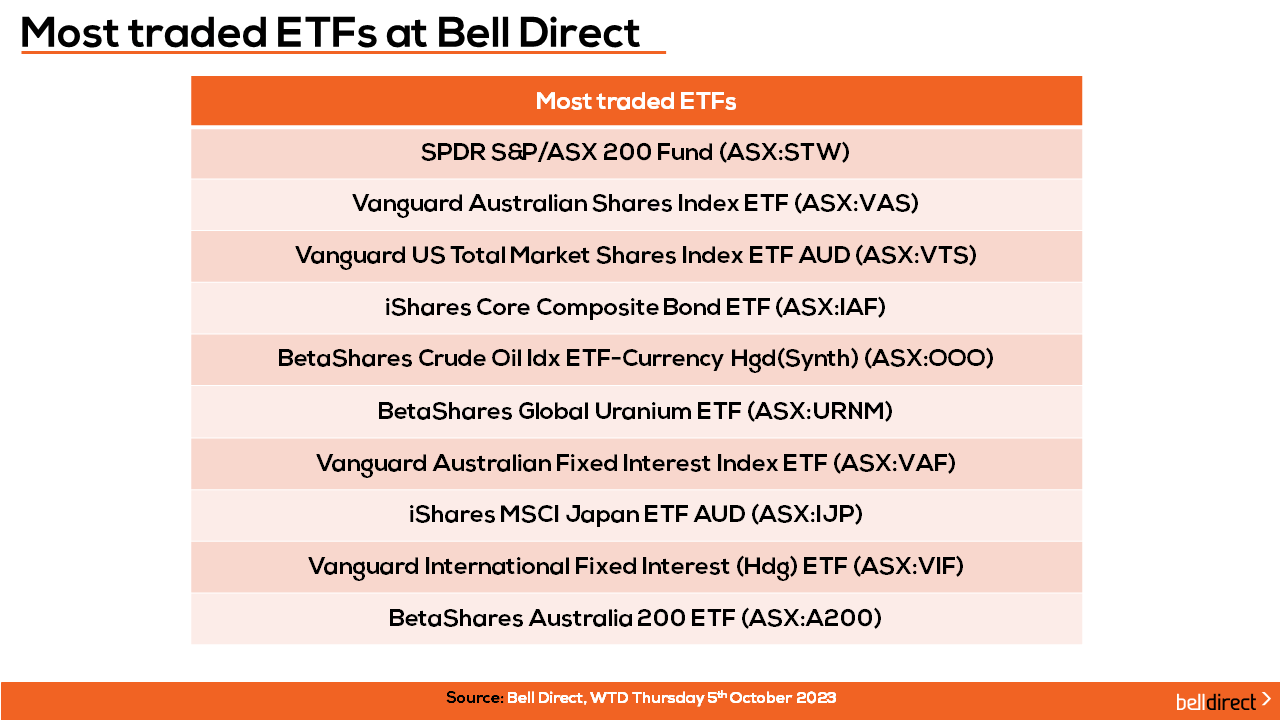

And the most traded ETFs were led by SPDR S&P/ASX 200 Fund, Vanguard Australian Shares Index ETF, and Vanguard US Total Market Shares Index ETF.

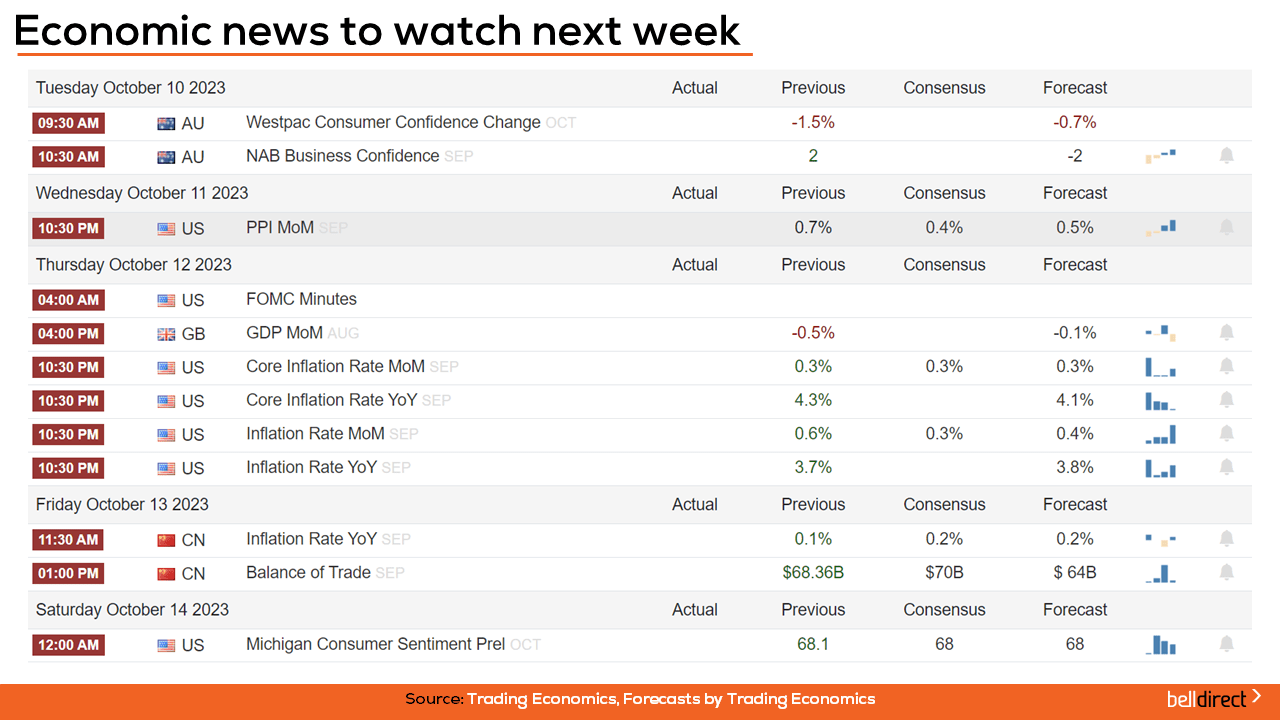

Looking to the week ahead, Westpac Consumer Confidence data for October and NAB Business Confidence Data for September are both out on Tuesday with the forecast of a decline in both consumer and business confidence in the respective readings.

Over in the US, PPI data for September is released on Wednesday with consensus expecting a decline to 0.4% growth which would be a favourable sign of inflation easing in the US. The latest FOMC minutes are also out next week and the all-important inflation and core inflation rates for September are out on Thursday with the market expecting the inflation rate to rise just 0.3% from a 0.6% rise in August.

And that’s all we have time for today, have a wonderful Friday, a great weekend and as always, happy investing.