Weekly Wrap Transcript 5 April

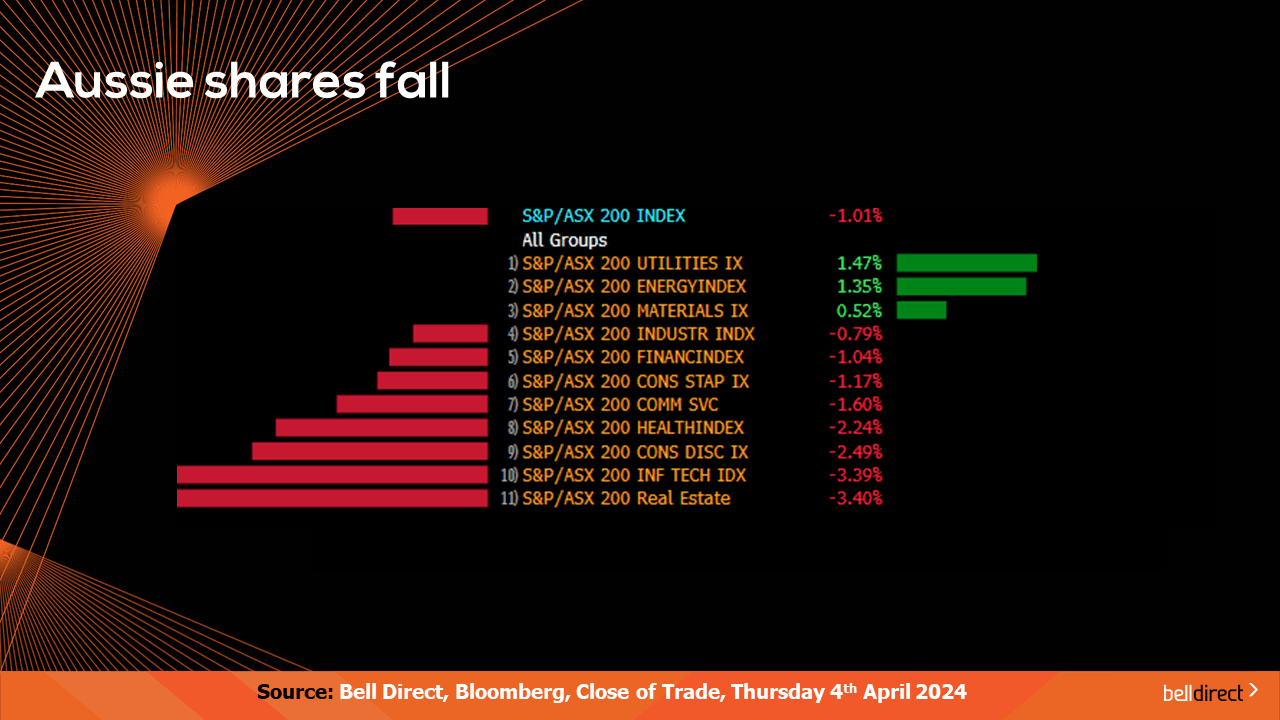

Locally from Monday to Thursday the ASX200 lost 1.01% with all but 3 sectors finishing in the red. Losses were led by the real estate and information technology sectors, which lost 3.4% and 3.39% respectively. This was offset by the utilities and energy sectors, which gained 1.47% and 1.35%.

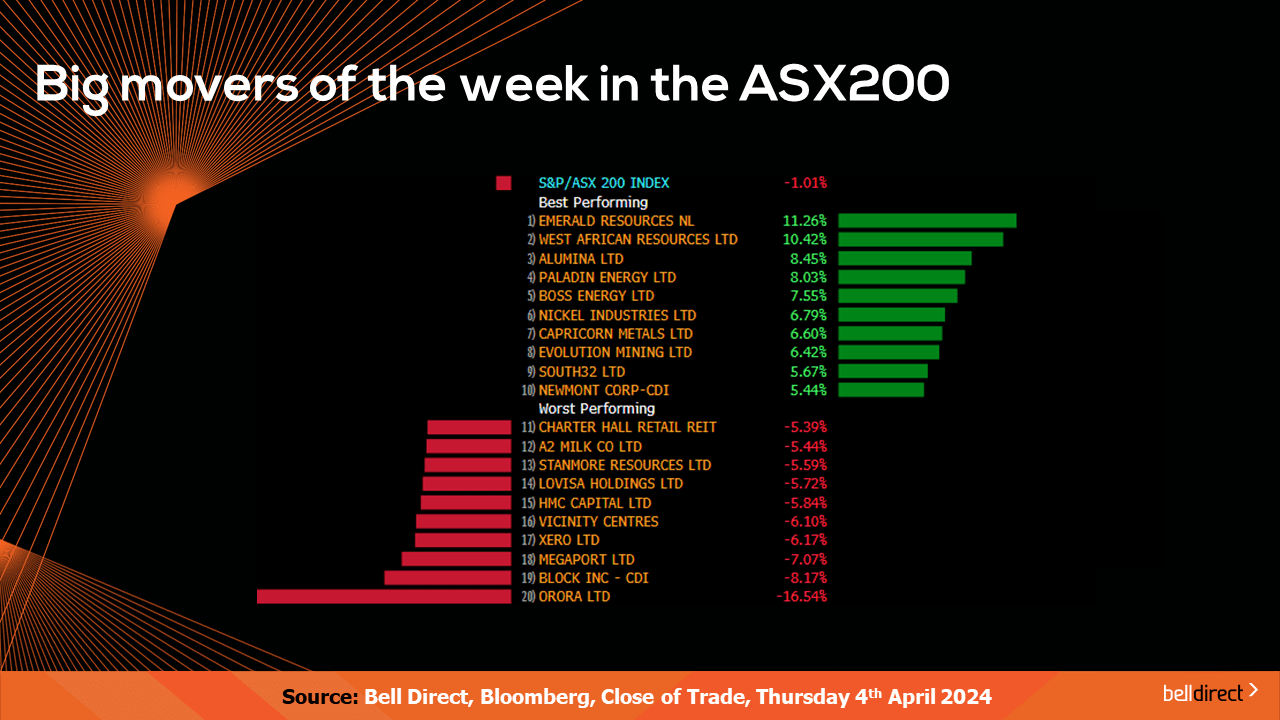

The winning stocks over the four trading sessions were led by Emerald Resources (ASX:EMR) rallying 11.26%. West African Resources (ASX:WAF) also rallied 10.42% this week and Alumina (ASX:AWC) closed Monday to Thursday 8.45% higher.

And on the losing end Orora (ASX:ORA) fell 16.54%, Block Inc (ASX:SQ2) lost 8.17% and Megaport (ASX:MP1) ended 7.07% in the red.

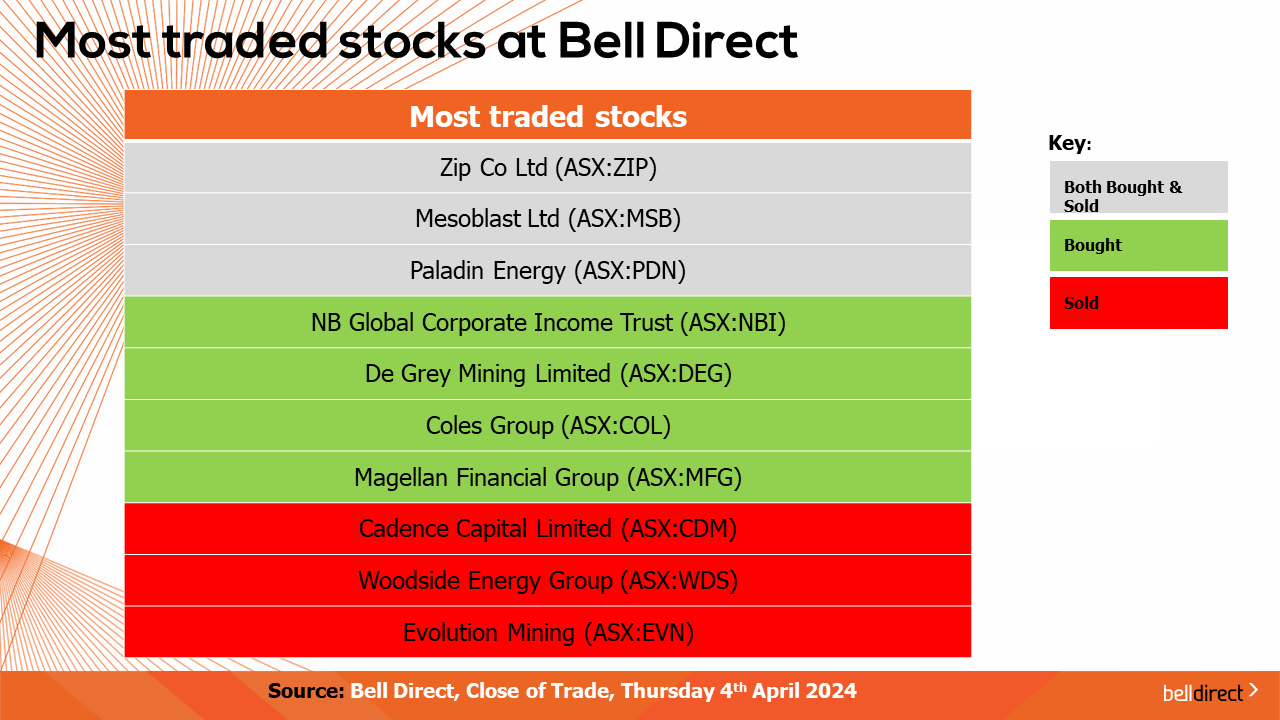

As for the most traded stocks by Bell Direct clients this week, clients bought and sold Zip Co (ASX:ZIP), Mesoblast (ASX:MSB) and Paladin Energy (ASX:PDN), while buying into NB Global Corporate Income Trust (ASX:NBI), De Grey Mining (ASX:DEG), Coles Group (ASX:COL) and Magellan Financial Group (ASX:MFG).

And this week, clients took profits from Cadence Capital Limited (ASX:CDM), Woodside Energy Group (ASX:WDS) and Evolution Mining (ASX:EVN).

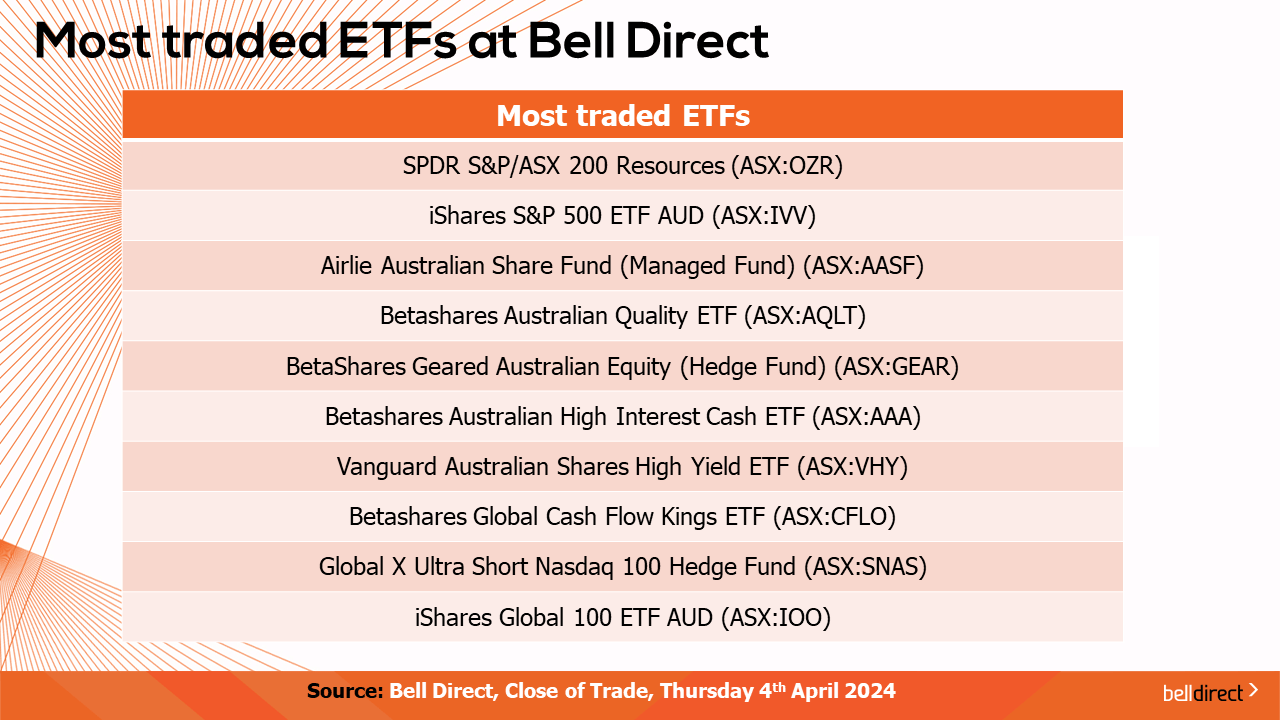

The most traded ETFs by Bell Direct clients were the SPDR S&P/ASX 200 Resources ETF (ASX:OZR), the iShares S&P 500 ETF AUD (ASX:IVV) and the Airlie Australian Share Fund ETF (ASX:AASF)

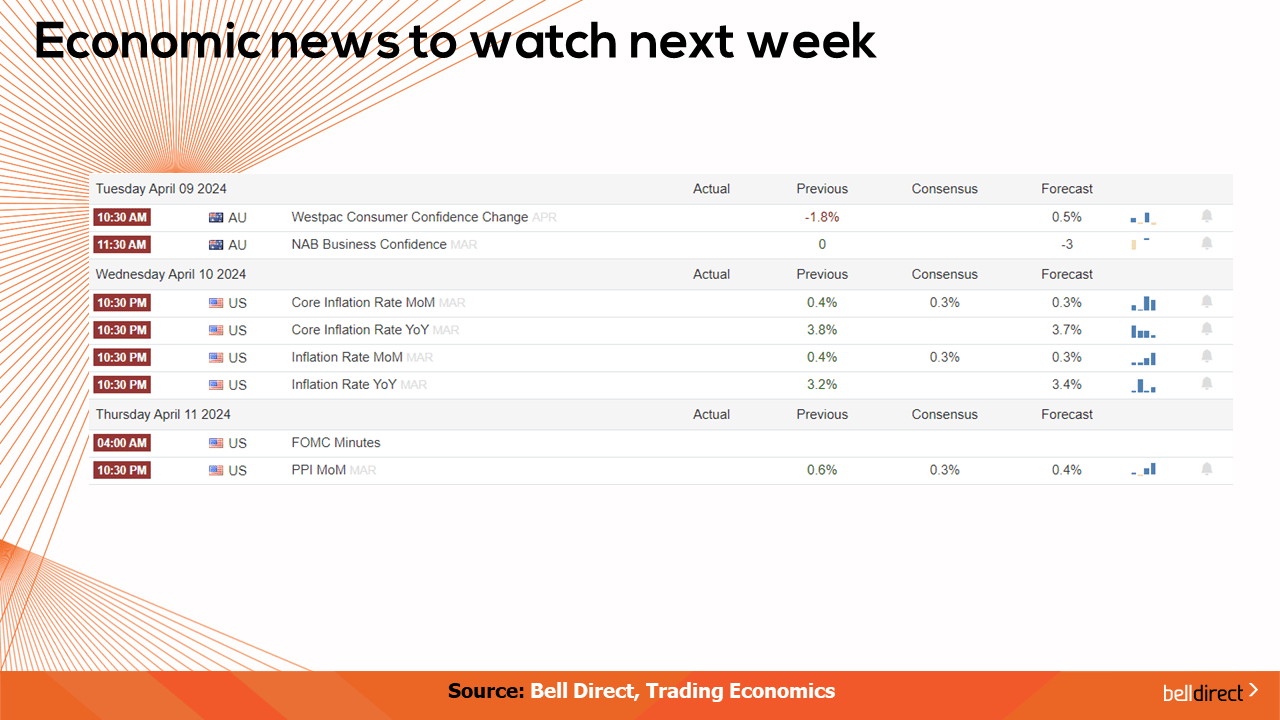

And to end, economic data to watch out for next week, on Tuesday, Westpac’s consumer confidence data will be out for April, with inflation data out on Wednesday and Thursday.

That’s our wrap up for this week, enjoy your weekend and as always, happy investing!