Transcript: Weekly Wrap 31 May

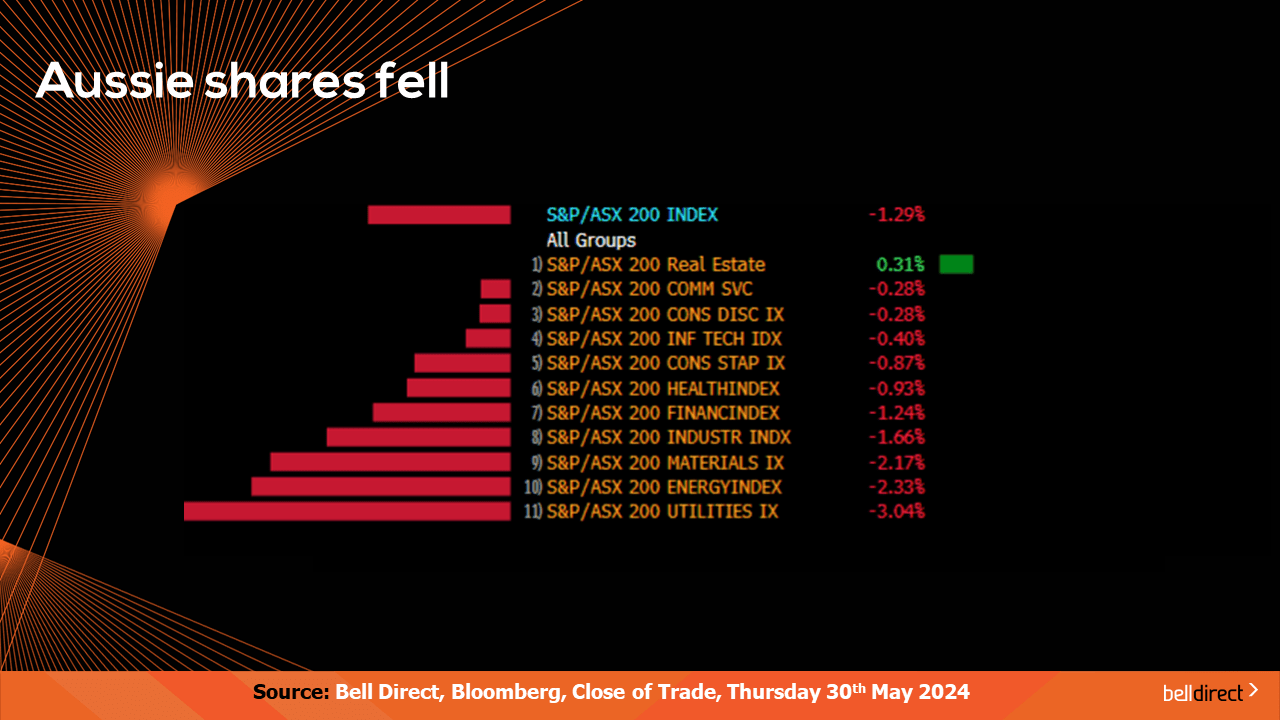

Locally from Monday to Thursday, the ASX200 fell 1.3% as every sector closed lower aside from tech stocks which was boosted by the tech-heavy Nasdaq on Wall Street climbing to record highs throughout the week.

The local inflation print for April ticked up to an annual rate of 3.6% from 3.5% in March and exceeded analysts’ expectations of a moderation to 3.4%. Despite retail sales falling earlier in the week providing support for inflationary contraction, the latest CPI print rising above expectations gives the RBA strong support to maintain the nation’s cash rate higher for longer until the reading hits the target 2-3%.

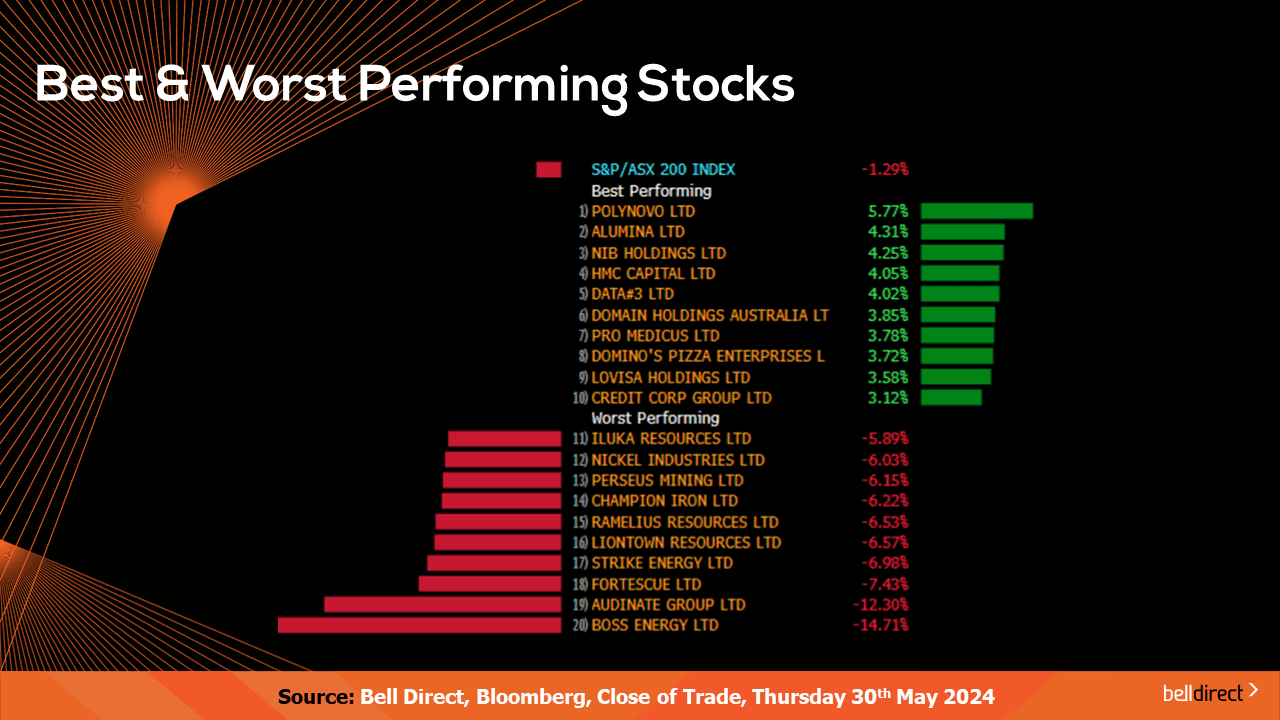

The winning stocks on the ASX200 were led by Polynovo (ASX:PNV) rising 5.77%, Alumina (ASX:AWC) adding 4.3% and NIB Holdings (ASX:NHF) rallying 4.25% this week.

On the losing end, Boss Energy (ASX:BOE) tumbled 14.71% over the 5-trading days while Audinate (ASX:AD8) fell 12.30% and Fortescue (ASX:FMG) dropped 7.43%.

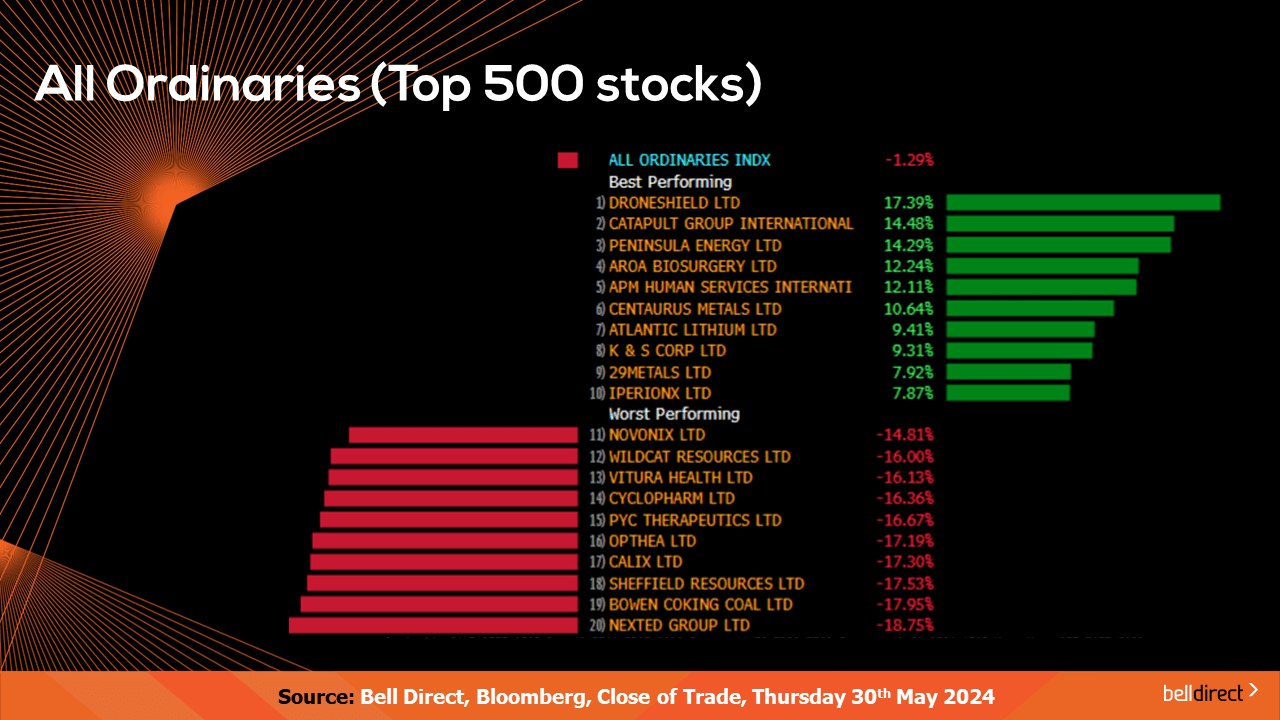

On the broader market index, the All Ords fell 1.29% this week as NextEd Group (ASX:NXD) tumbled 18.75% while Bowen Coking Coal (ASX:BCB) declined just shy of 18%.

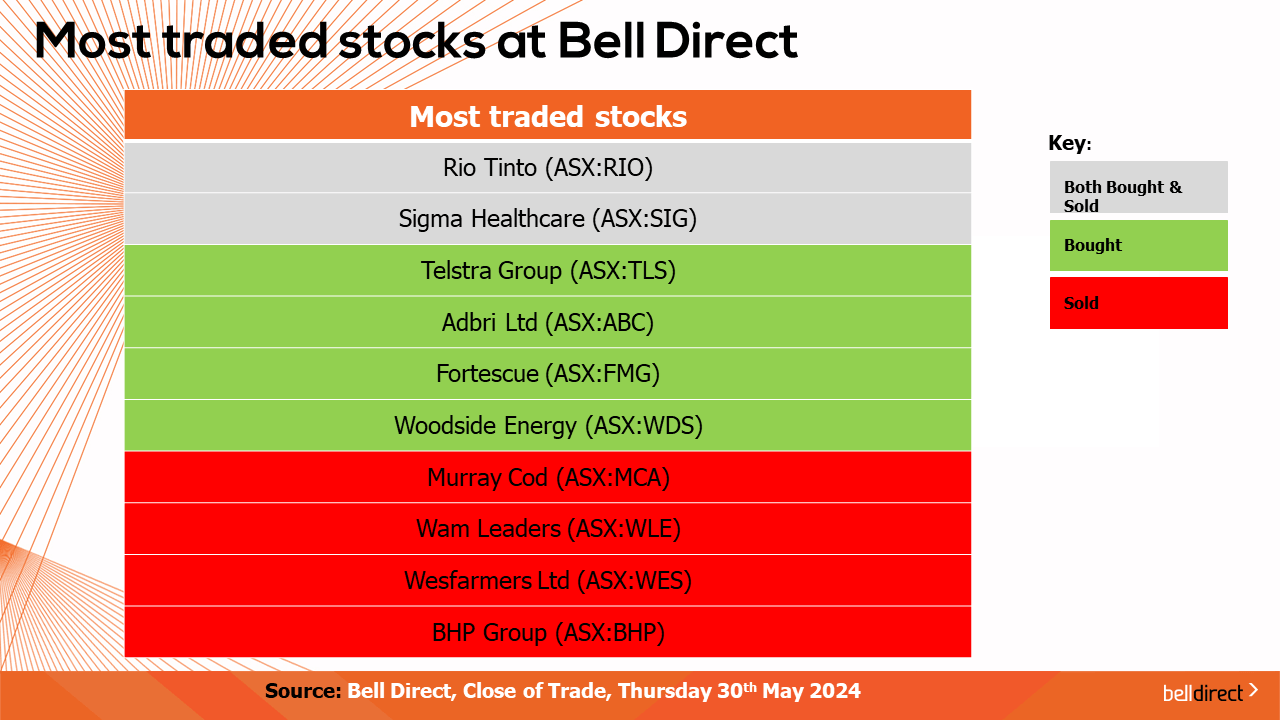

The most traded stocks by Bell Direct clients this week were Rio Tinto (ASX:RIO) and Sigma Healthcare (ASX:SIG). Clients also bought into Telstra Group (ASX:TLS), ADBRI (ASX:ABC), Fortescue (ASX:FMG) and Woodside Energy (ASX:WDS). Clients also took profits from Murray Cod Australia (ASX:MCA), Wam Leaders (ASX:WAM), Wesfarmers (ASX:WES), and BHP Group (ASX:BHP).

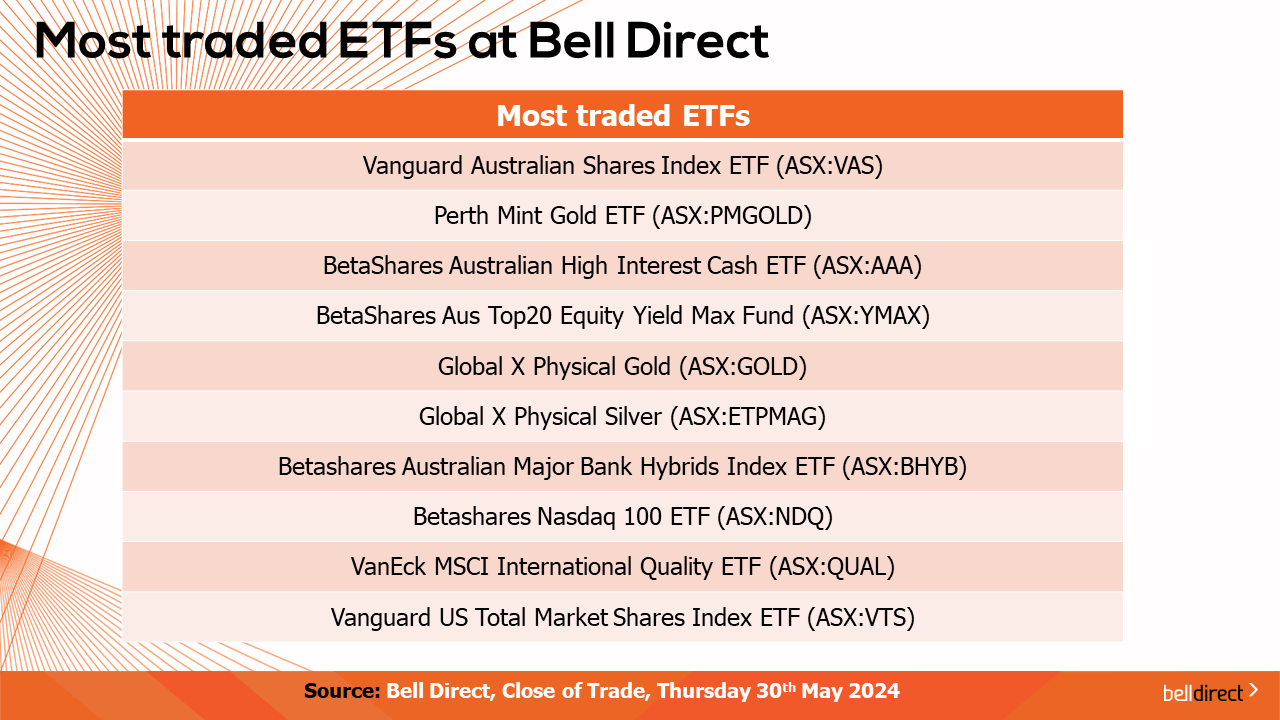

And the most traded ETFs by Bell Direct clients this week were led by Vanguard Australian Shares Index ETF, Perth Mint Gold ETF and Betashares Australian High Interest Cash ETF.

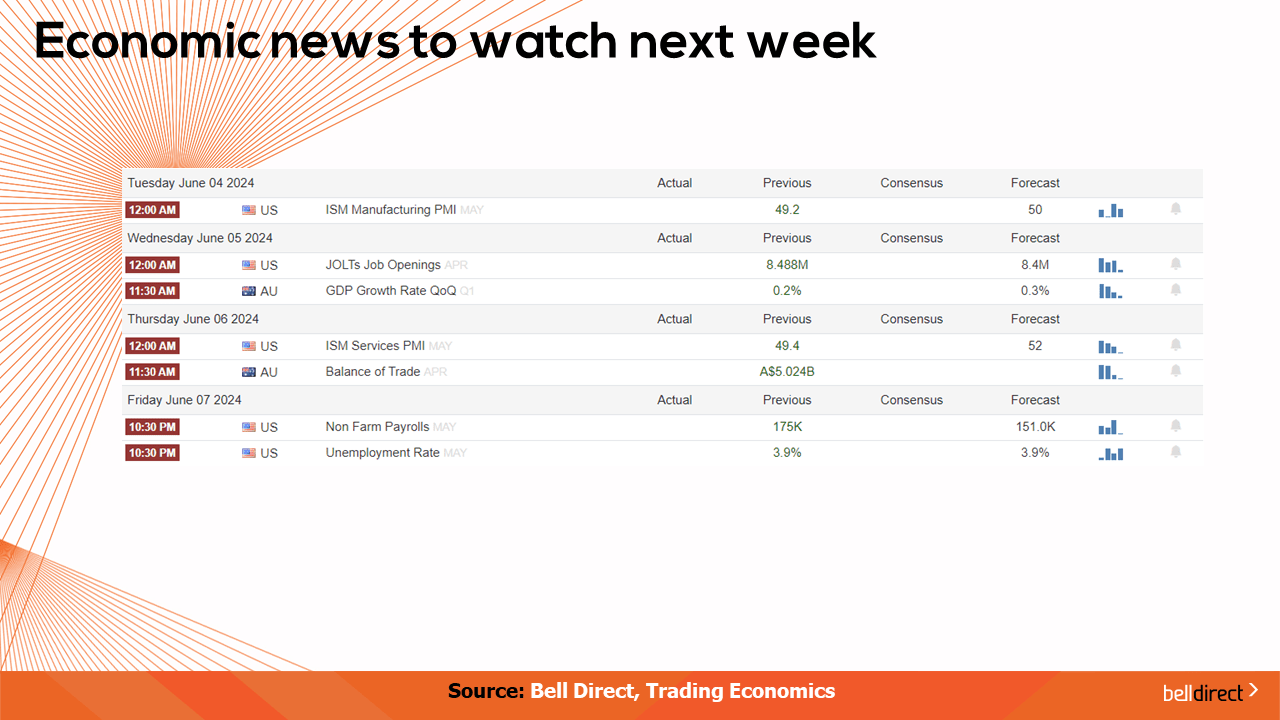

Taking a look at the week ahead on an economic data front, Australia’s GDP growth rate data is out on Wednesday with economists’ expecting a reading of 0.3% growth in Q1 from 0.2% growth in Q4 which will indicate modest economic growth in the current high interest rate environment. Australia’s trade balance data for April is also out later next week, where the trade surplus has been declining since November amid softer exports against imports.

Overseas, US JOLTs job openings data for April is out on Wednesday with the expectation of a slight decline to 8.4m from 8.488m in March.

In Europe, the ECB will hand down its latest interest rate decision on Thursday night local time where it is expected Europe’s central bank will cut interest rates to 4.25% from the current rate of 4.5%.

And that’s all for this Friday, have a wonderful weekend and happy investing.