Transcript: Weekly Wrap 31 January

This week we saw the ASX rally to another fresh record intra-day high as inflation easing and corporate results boosted investor outlook and optimism for an RBA rate cut come February.

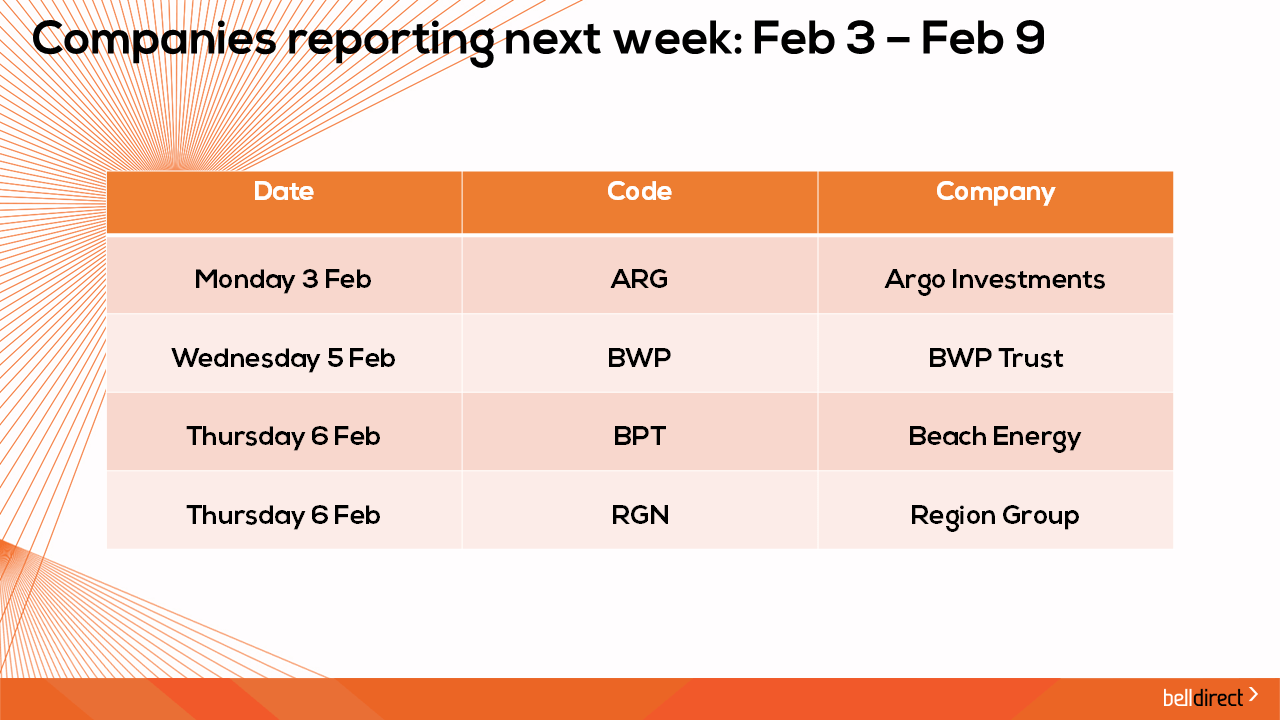

Now, it’s the last day of January and what better way to close out the month than with a reporting season outlook as we head into the all-important 1st half FY25 reporting season locally and FY24 reporting season in the US.

Firstly, from a broad perspective what are markets expecting from earnings this first half locally and what global and local factors are expected to have impacted earnings in the first half?

China may be showing signs of a post-pandemic recovery now (finally) but during the first half of FY25 activity in the region remained subdued thus extending the depreciated demand environment for any companies exposed to the region like our iron ore giants and even wine makers like Treasury Wine Estates.

The AUD has been weakening over the last few months, meaning higher input costs for those buying goods and services in USD terms. For those companies selling goods and services in USD though like Pro Medicus, Block Inc, and James Hardie Industries, the stronger USD over the last months is likely to boost earnings from operations in the US.

Gold soared to the moon in the first half of FY25, but this doesn’t mean all gold producers will soar this reporting season. What we will be looking for when analysing the results of a gold miner is the All-in-sustaining-cost per ounce against average sale price per ounce. Capex is also a key metric to decipher the leaders from the laggards in mining this reporting season. With Capricorn Metals and Gold Road Resources announcing record gold production in a time where they are selling to the spot market, there’s no wonder why Bell Potter’s analyst has a buy rating on both gold producers.

The miners have faced a tough first half amid volatility in the commodities space and uncertainty around outlook for the second half. Operating in a depreciated commodity price environment is tough but for those controlling costs and delivering quality output, we have seen demand for shares rise. Pilbara Minerals delivered sales volume and average realised prices above expectations in Q2 despite a weak lithium price, and as a result shares rose on Wednesday.

On the tech, REIT and Consumer Discretionary front we are expecting a rebound in growth outlook from the first rate cut. Investors pre-emptively bought into these sectors this week amid rising optimism of a rate cut in the very near future. Tech stocks benefit from lower interest rates in the way the higher debt levels they take on to fund growth become cheaper to fund with every rate cut, while REIT stocks struggle to pass on elevated costs in a higher interest rate environment so any rate cut eases the cost pressures faced, and consumer discretionary demand and spend increases with rate cuts as consumers have greater disposable income in the lower cost of living environment.

We are expecting a tougher first half for these sectors but anticipate positive growth outlook into H2.

In summary what we are anticipating this reporting season is:

- Single digit earnings growth is expected as many of the companies that included first half guidance last year indicated tougher economic conditions were weighing on sales thus single digit earnings growth was conservatively guided to across the board.

- A rebound in demand outlook and growth across most sectors into the latter quarter of H2 as inflation eases and the RBA is expected to cut the nation’s cash rate.

- Those operating in USD terms will benefit from the weaker AUD throughout the first half.

- Higher promotional activity to reduce inventory levels will likely deplete earnings of our retailers.

- And of course, guidance for the second half, as always, will be the key to reassuring investors this reporting season.

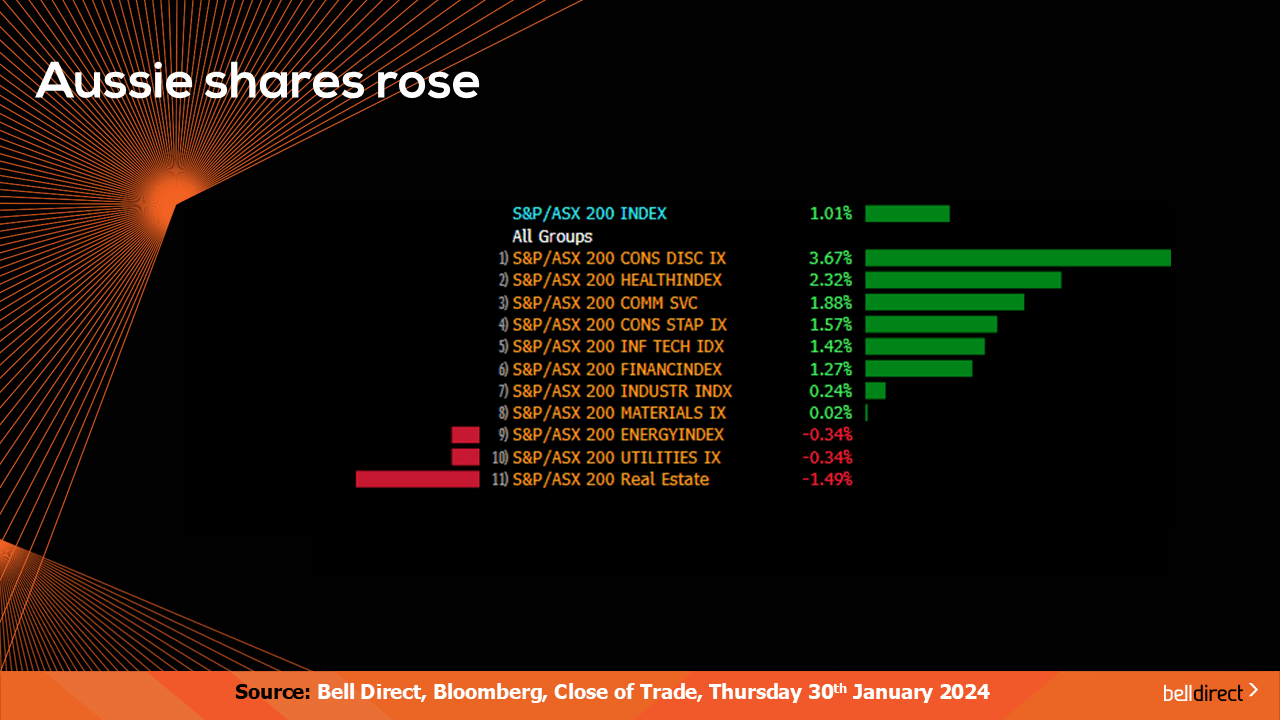

Locally from Monday to Thursday, the ASX200 rose 1.01% driven by the consumer discretionary sector gaining 3.7% mid increased demand outlook for discretionary spend when interest rate cuts come into effect in Australia.

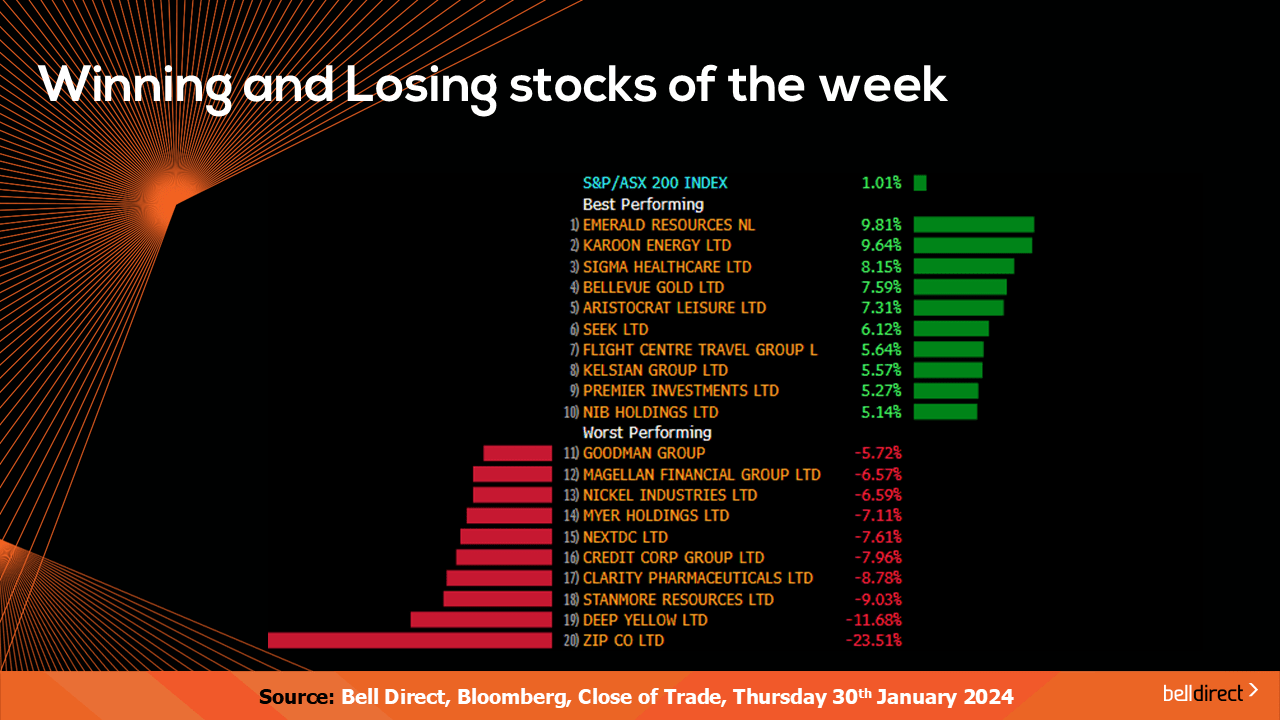

The winning stocks were led by Emerald Resources (ASX:EMR) rallying 9.81%, Karoon Energy (ASX:KAR) rising 9.64%, and Sigma Healthcare (ASX:SIG) added 8.15%.

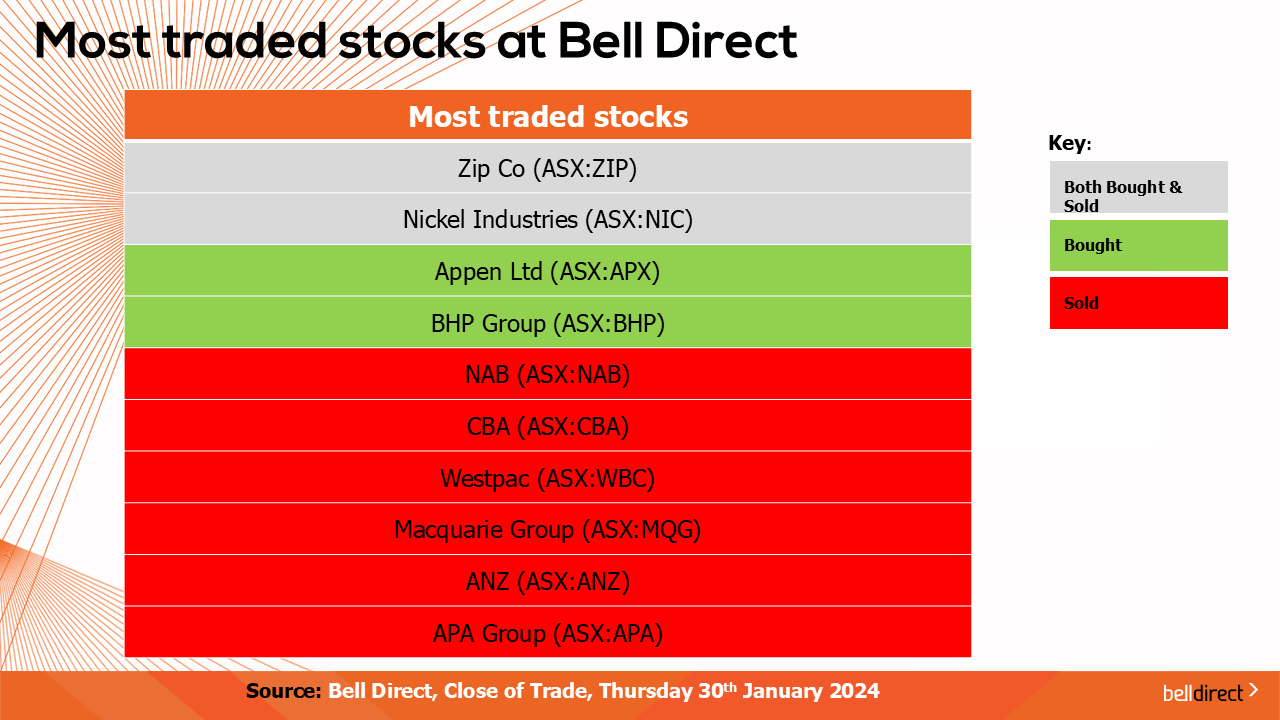

And on the losing end Zip Co (ASX:ZIP) tumbled 23% this week on a trading update, while Deep Yellow (ASX:DYL) fell 11.68% and Stanmore Resources (ASX:SMR) ended the week down 9.03%.

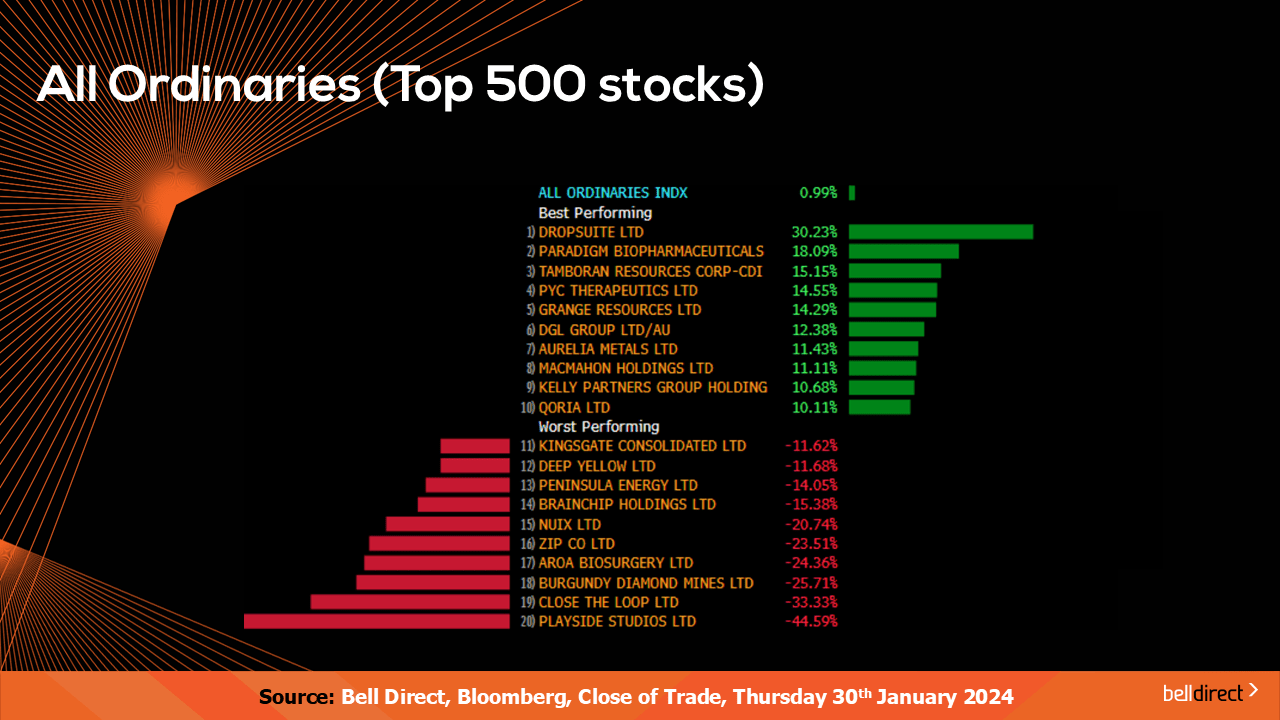

On the broader market index, the All Ords rose 0.99% as Dropsuite (ASX:DSE) rocketed 30.23% while Playside Studios (ASX:PLY) tanked 44.59%.

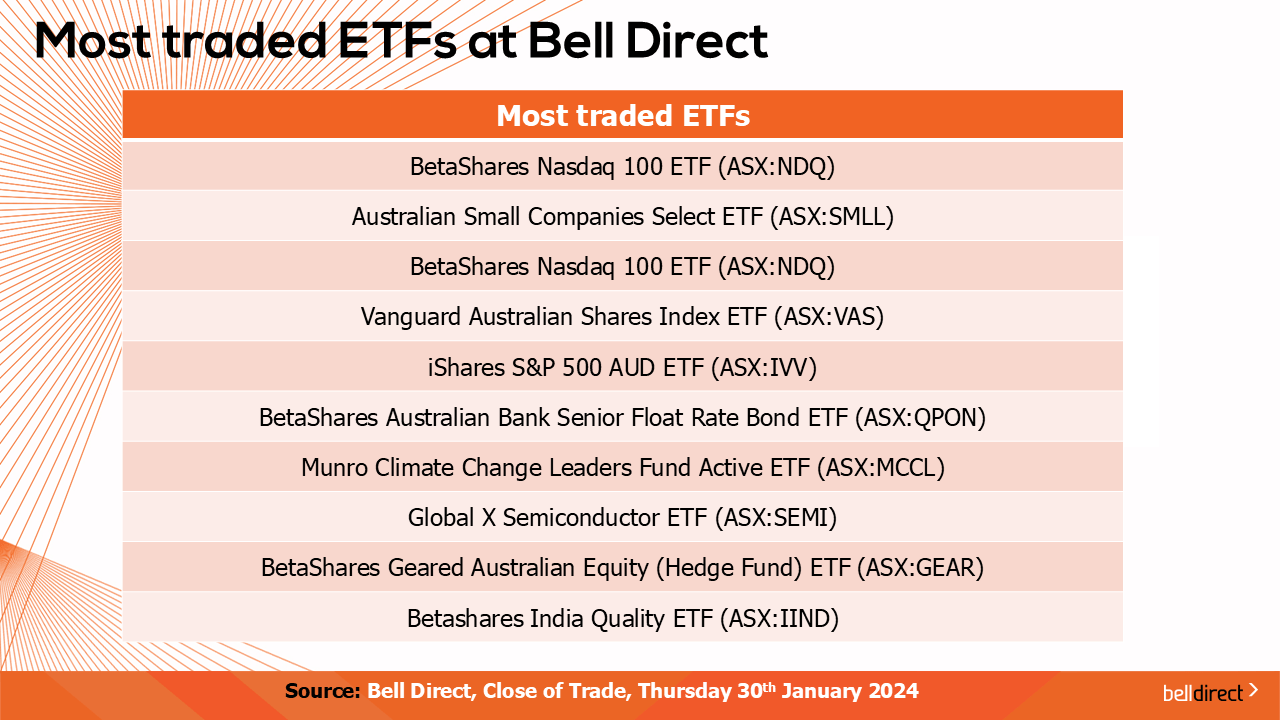

And the most traded ETFs were Vanguard Msci Index International Shares ETF, BetaShares Australian Small Companies Select ETF, and Betashares Nasdaq 100 ETF.

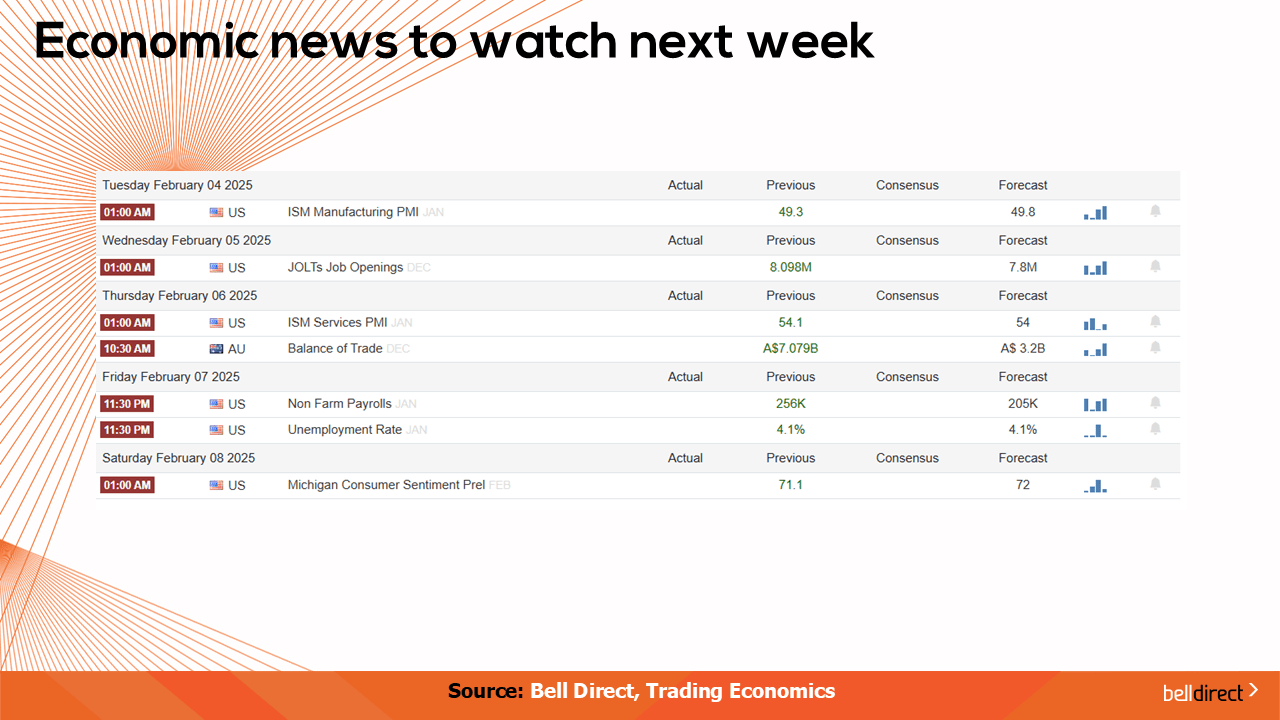

On the economic calendar next week, we may see investors react to Australia’s trade balance data out on Thursday with the forecast of a decline in trade surplus in December. Overseas, US Manufacturing PMI data for January is out on Tuesday while JOLTs Job Openings, Non-Farm Payrolls and unemployment rate data are out later in the week which will paint the outlook for the Fed’s rate journey after America’s central bank held rates at the meeting this week.