Transcript: Weekly Wrap 30 August

At the end of week 4 this reporting season we have seen a total of 275 companies release results this month so far, with 85 beating expectations, 89 meeting expectations and 101 missing expectations. This week was a key week in reporting season as ASX heavyweights released results that painted a very mixed picture about the outlook for FY25.

Australian conglomerate Wesfarmers (ASX:WES) shares fell 4% on Thursday despite the company reporting very strong results for FY24. For the year Wesfarmers reported revenue rose 1.5% to $44.189bn, EBIT rose 3.3% to $3.989bn, NPAT increased 3.7% to $2.557bn and Wesfarmers declared a fully franked full-year final dividend of 198cps. By division, Kmart was a strong driver of Wesfarmers’ results, experiencing a 4.4% increase in revenue to $11.1bn, while Bunnings Group rose just 2.3% to $18.968bn in revenue, still accounting for the greatest % of revenue though. Wesfarmers’ Catch online deals platform continued its downward spiral with a 36% decline in revenue, while Wesfarmers CEF which is the chemicals, fertiliser and energy division, experienced a 16.9% drop in revenue on weakness in the company’s lithium assets. The sell-off in shares on Thursday was likely due to the lithium weakness for Wesfarmers and stagnant sales growth on H2 FY24 across the retail divisions.

Qantas’ share price ran into turbulence on Thursday after the national carrier released FY24 results. For the last financial year, Qantas (ASX:QAN) reported Underlying profit before tax fell 16% to $2.08bn, Statutory profit after tax declined 28% to $1.25bn, net debt rose to $4.1bn on the delivery of new aircraft, operating margin declined to 10.4%, from 13.5% in FY23, and the airline announced a $400m on-market share buy-back. $198m in legal provisions were also reported for the last financial year, including $128m paid t settle a court case with the ACCC.

Mining giant Mineral Resources (ASX:MIN) tumbled over 7% after releasing FY24 results including the slashing of its final dividend in favour of paying down debt. For the year, MIN reported revenue rose 10% to $5.278bn, underlying NPAT dived 79% to $158m, statutory NPAT fell 53% to $114m, net debt rose significantly to $4.428bn up from $1.896bn in FY23, and the company’s achieved lithium price fell 76% amid the declining price of the commodity. The Chris Ellison-led miner and mining services giant had some key milestones in FY24 including the first iron ore shipment out of its Onslow iron ore project and increased underlying EBITDA for the company’s mining services division to a record $550m, but commodity price headwinds ultimately impacted the overall financial resilience of the company last financial year.

And dairy giant Bega Cheese (ASX:BGA) bucked the sell-off on Thursday to rise nearly 10% after posting a return to profitability in FY24. For the year Bega reported net revenue rose 4% YoY to $3.5bn, statutory EBITDA jumped 15% to $165.1m, statutory profit after tax of $30.5m which was a big turnaround from the loss of $229.5m reported in FY23, and the company declared 4cps final dividend. Investors also welcomed the 11% rise in international sales and expect continued growth into FY25.

On the reporting season calendar in the final days of this August reporting season we can expect results out of Ramsay Healthcare (ASX:RHC), Downer EDI (ASX:DOW), and Dicker Data (ASX:DDR).

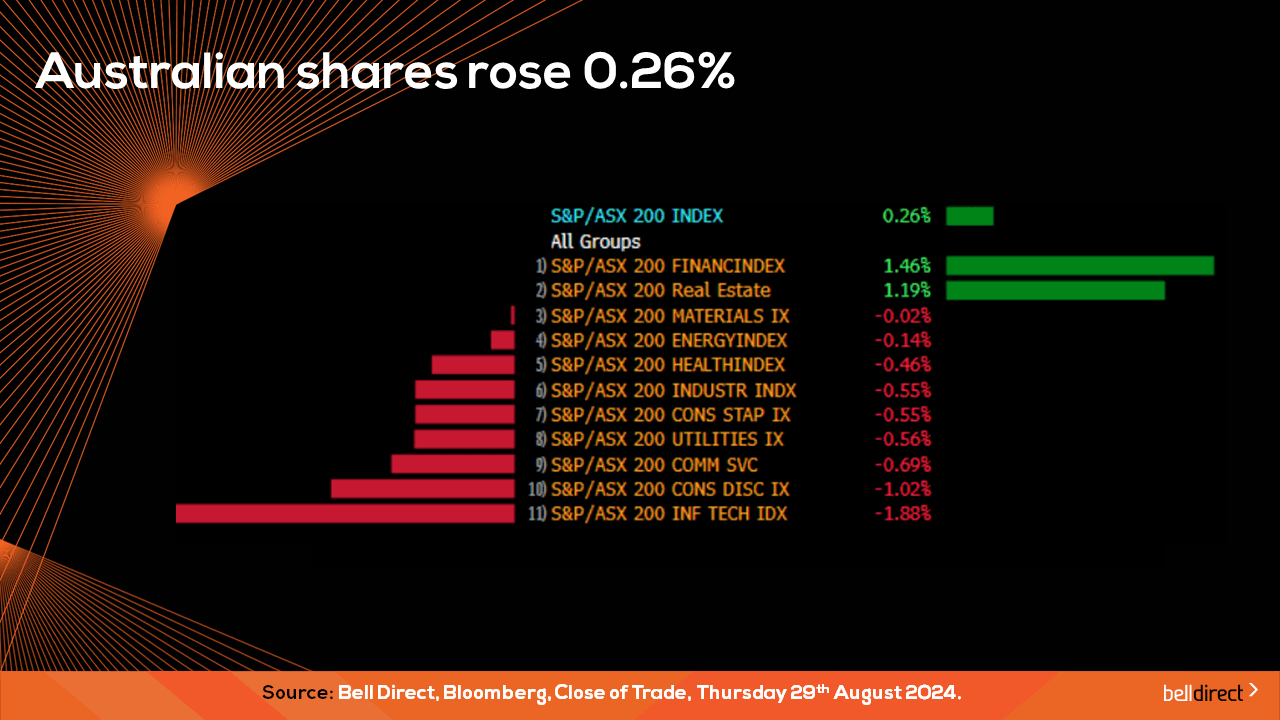

Locally from Monday to Thursday the ASX200 rose 0.26% as a rise in financial and real estate stocks offset the losses among tech and discretionary stocks.

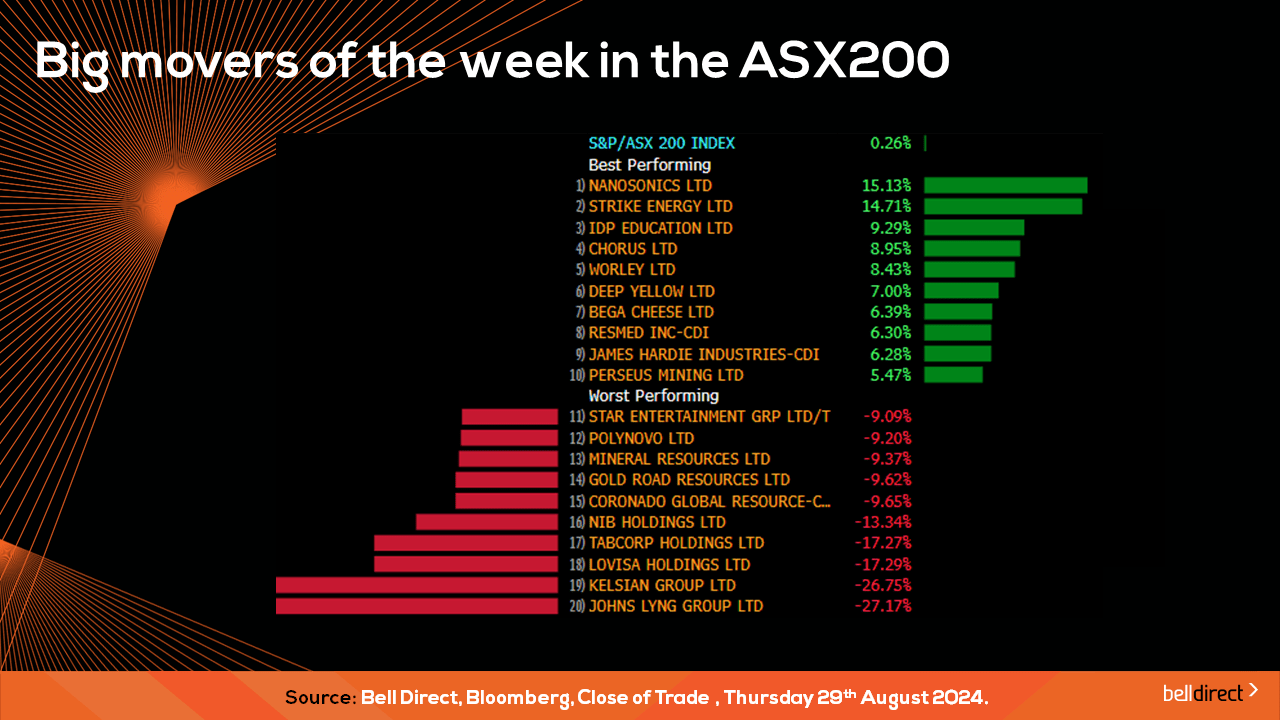

The winning stocks on the ASX200 this week were led by Nanosonics (ASX:NAN) jumping 15.13%, Strike Energy (ASX:STX) adding 14.71% and IDP Education (ASX:IEL) rallying 9.3%.

On the losing end, Johns Lyng Group (ASX:JLG) and Kelsian Group (ASX:KLS) weighed on the market gains with declines of 27.17% and 26.75% respectively.

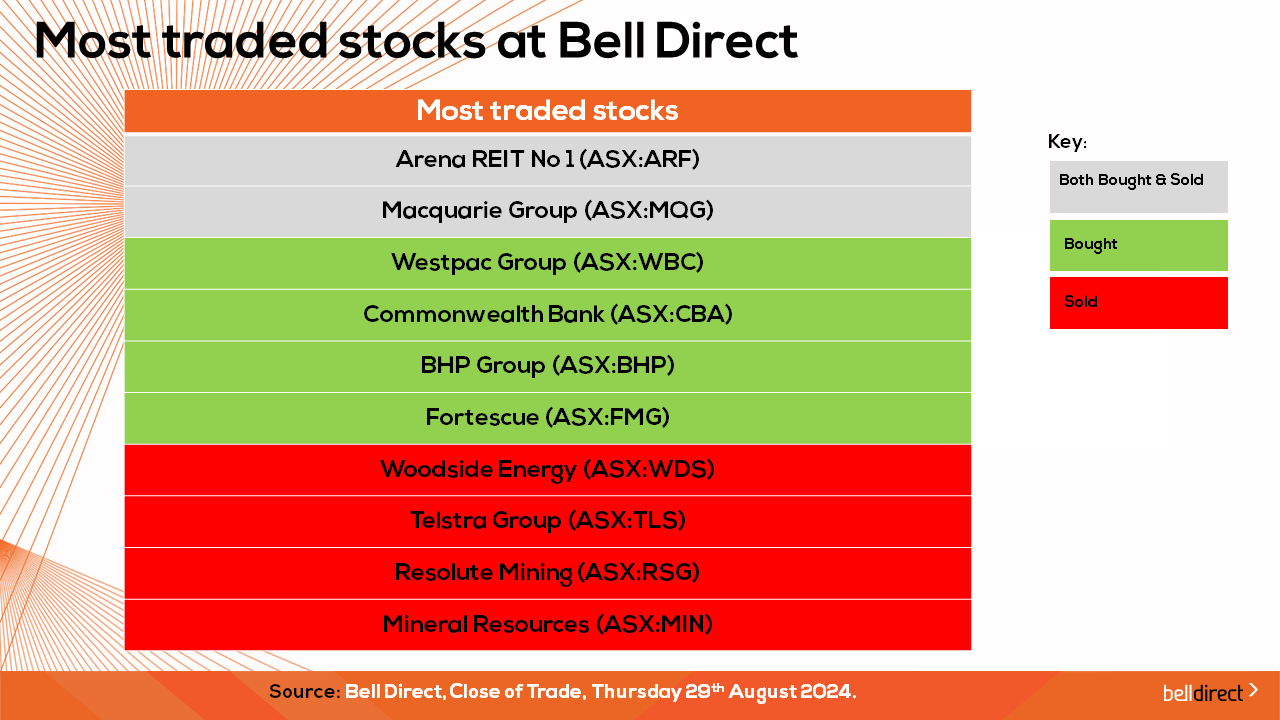

The most traded stocks by Bell Direct clients this week were Macquarie Group (ASX:MQG), clients also bought into BHP (ASX:BHP), FMG (ASX:FMG), Woodside (ASX:WDS), Telstra Group (ASX:TLS) and Mineral Resources (ASX:MIN), while taking profits from Westpac (ASX:WBC), CBA (ASX:CBA), Arena REIT No 1 (ASX:ARF), and Resolute Mining (ASX:RSG).

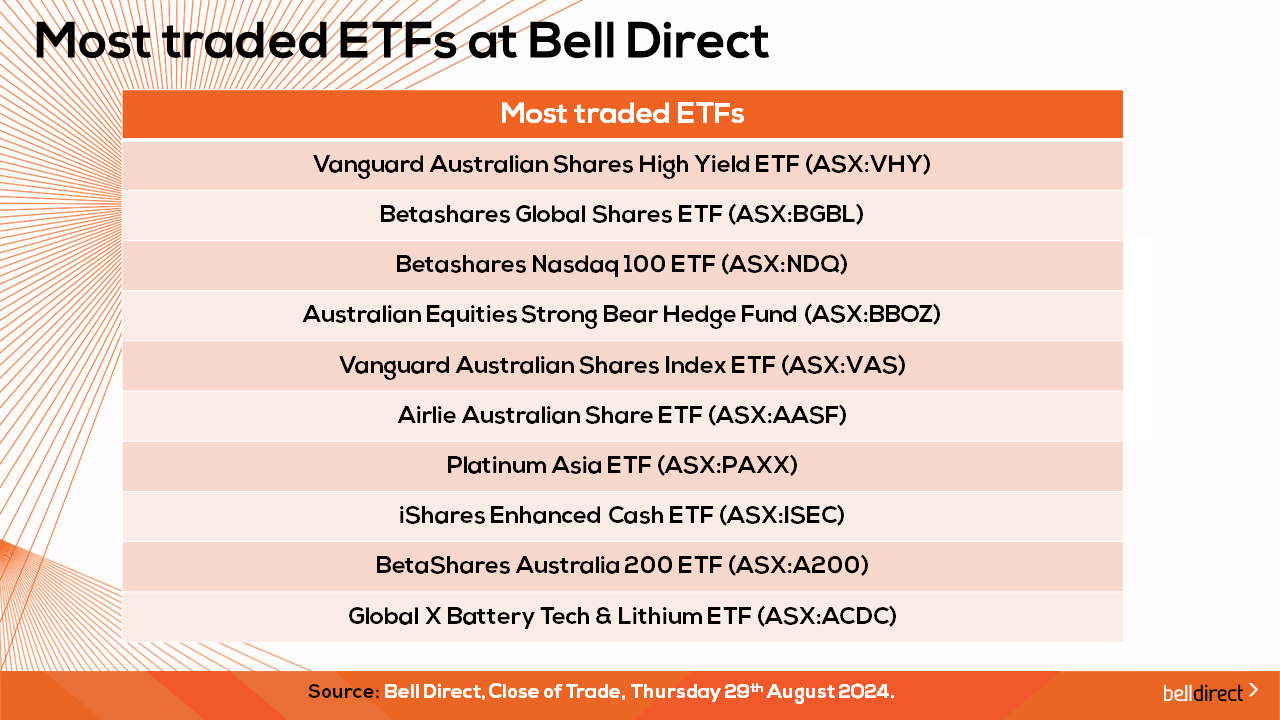

And the most traded ETFs were led by Vanguard Australian Shares High Yield ETF, Betashares Global Shares ETF, and Betashares Nasdaq 100 ETF.

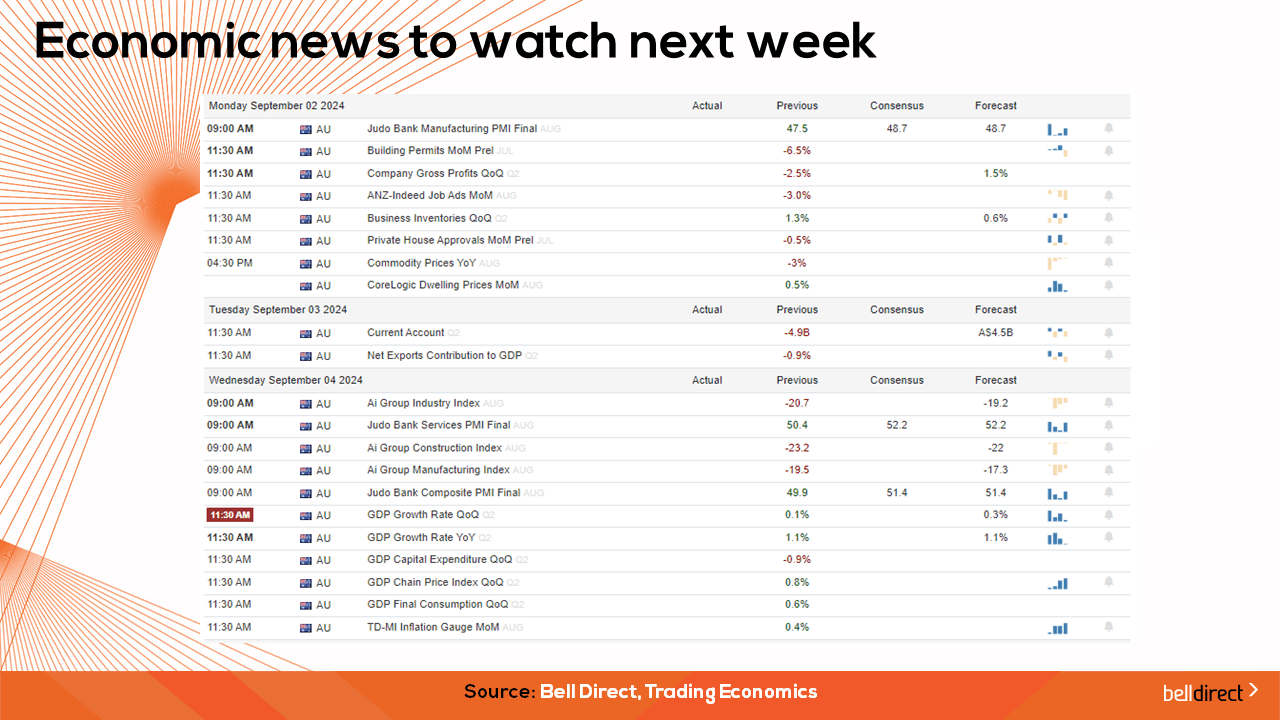

On the economic calendar front next week we can expect investor reactions to Australia’s GDP growth rate data for Q2 out on Wednesday with the forecast of a 0.3% growth compared to 0.1% growth in Q1. Australia’s trade balance data is also out next Thursday.

Key US jobs data will likely spark investor reaction overseas next week with Nonfarm payrolls, JOLTs job openings and the unemployment rate out later next week.

And that’s all for this week, have a wonderful weekend and happy investing!