Weekly Wrap transcript 3 May

This week has been a whirlwind in US earnings season. Major players across various industries have released their financial reports, keeping investors watching markets closely. Let’s recap the earnings reports of the biggest names that reported this week in the US and how the market reacted.

In Wall Street’s healthcare sector, Pfizer beat expectations for both revenue and earnings per share in the first quarter, despite a significant drop in sales of its COVID vaccine and pill. This decline was offset by strong performance in its non-COVID vaccine product lines, particularly their products for heart disease and blood clots. The company also benefited from its recent acquisition of Seagen, whose cancer treatments contributed substantially. Based on this positive start and cost-cutting initiatives, Pfizer raised its full-year profit forecast.

As for the tech sector: PayPal boosted its full-year profit forecast after a solid first quarter, but investors are watching closely to see if the company can reignite growth in its branded checkout products like Venmo. These products have faced pressure from big tech giants like Apple and Google. New leadership is focusing on cost cuts and improving the profitability of the core business, aiming to deliver “profitable growth.” While a turnaround might take time, analysts remain optimistic about PayPal’s long-term potential as a platform offering more than just a checkout button.

And Pinterest also reported this week. The stock soared after exceeding expectations for both earnings and revenue. They reported their fastest revenue growth in two years, with a 23% jumped compared to last year. Monthly active users grew 12% year-over-year, exceeding analyst expectations, with Gen Z being their biggest and most engaged demographic. The company credits its investments in AI for driving better returns for advertisers.

In the food and restaurant space, Yum Brands missed Wall Street’s expectations for both earnings and revenue this quarter. Same-store sales, a key metric of existing store performance, also fell 3% globally. This slump was driven by weakness at KFC and Pizza Hut, whose same-store sales dropped 2% and 7% respectively. Taco Bell, however, offered a bright spot with a 1% increase in same-store sales. And digital sales surpassed 50% of total sales for the first time.

Coca- Cola beat analyst expectations for both earnings and revenue thanks to strong sales in Fanta and Fairlife beverages. They also raised their full-year forecast for organic revenue growth to 8-9%, driven by price increases and higher demand for some products. Some key highlights included:

- Earnings per share increased to 72 cents,

- Revenue came in at US$11.30 billion, compared to the $11.01 billion expected,

- And global unit case volume increase by 1%

However, some weaker areas of the report included that:

- Overall prices rose 13%, partly due to inflation in certain markets,

- North America volume was flat overall

- And the water, sports, coffee and tea division saw volume declines due to weaker demand.

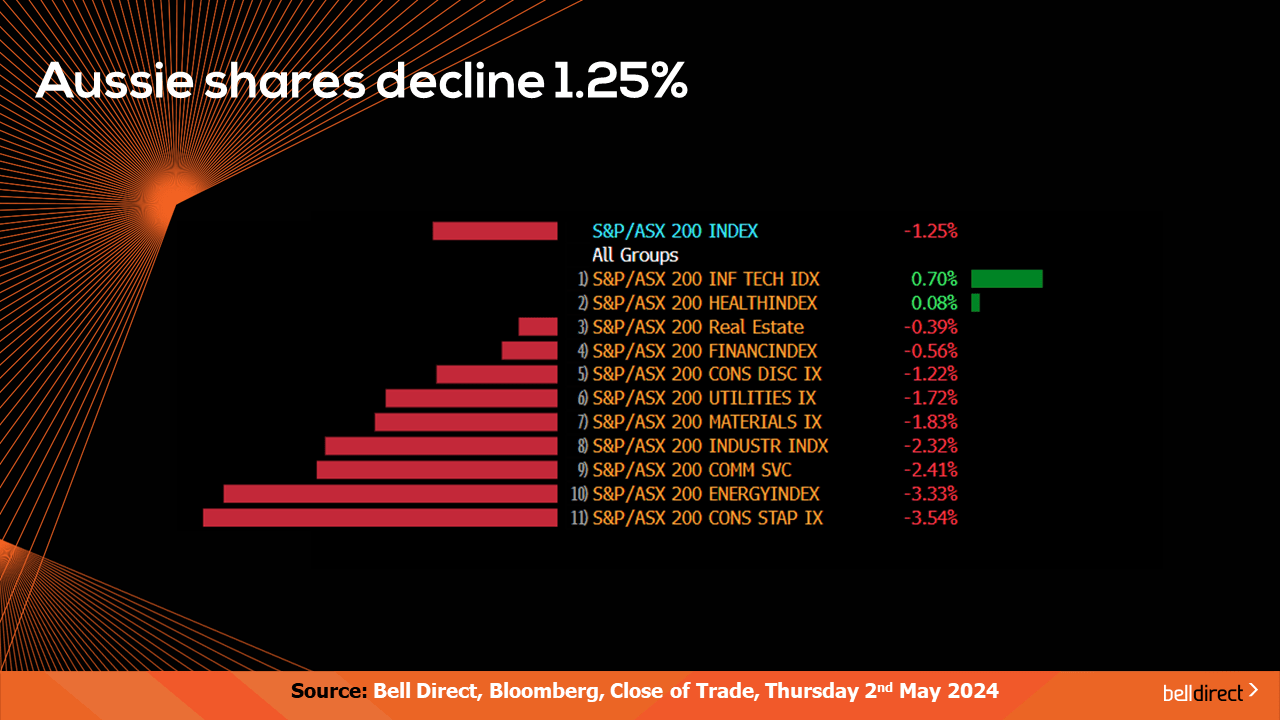

As for our local market’s performance this week so far,

The ASX200 was declined 1.25% this week, with consumer staples and energy sectors weighing down on the market the most.

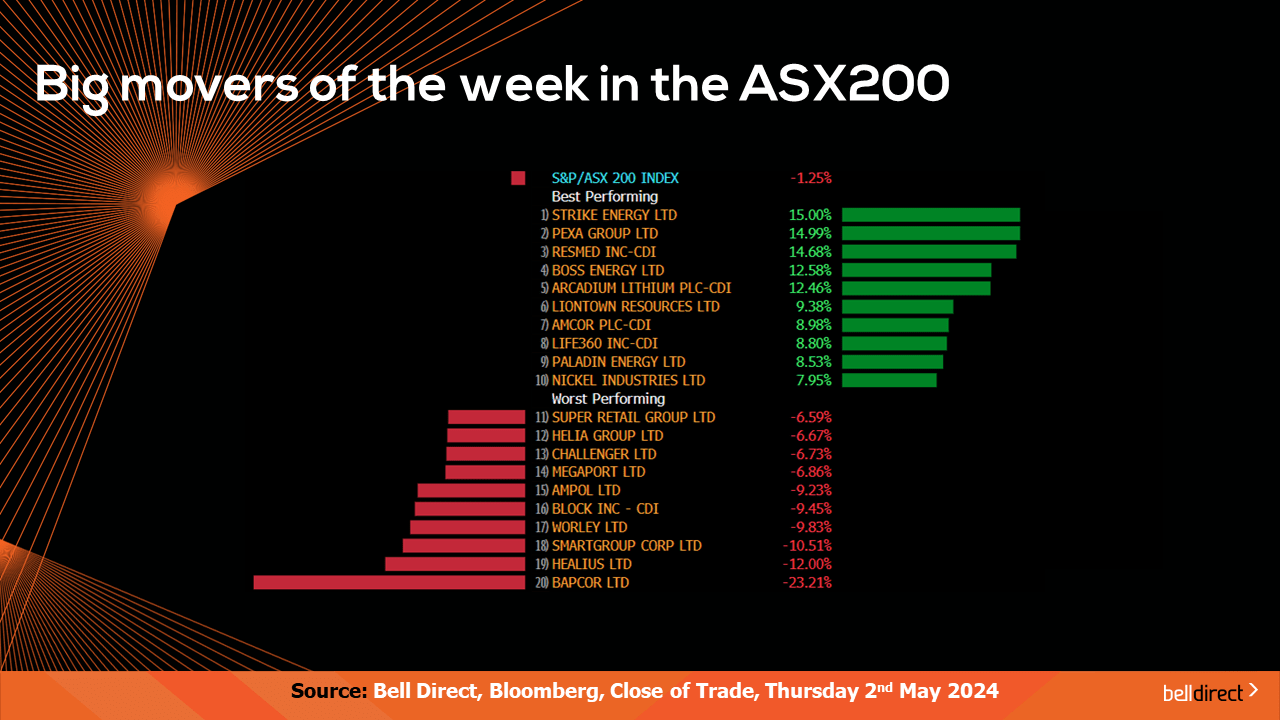

The best performer was Strike Energy (ASX:STX), advancing an impressive 15%, followed by Pexa Group (ASX:PXA) and ResMed (ASX:RMD). Meanwhile, Bapcor (ASX:BAP) was the worst performing stock on the ASX200, down 23% WTD. The auto parts retailer’s share price tumbled further after returning from a trading halt yesterday. The company’s CEO-elect decided against joining the company the day before he was due to start in the role. A recent trading update also advised Bapcor’s second half pro-forma net profit after tax to be lower than its first half results.

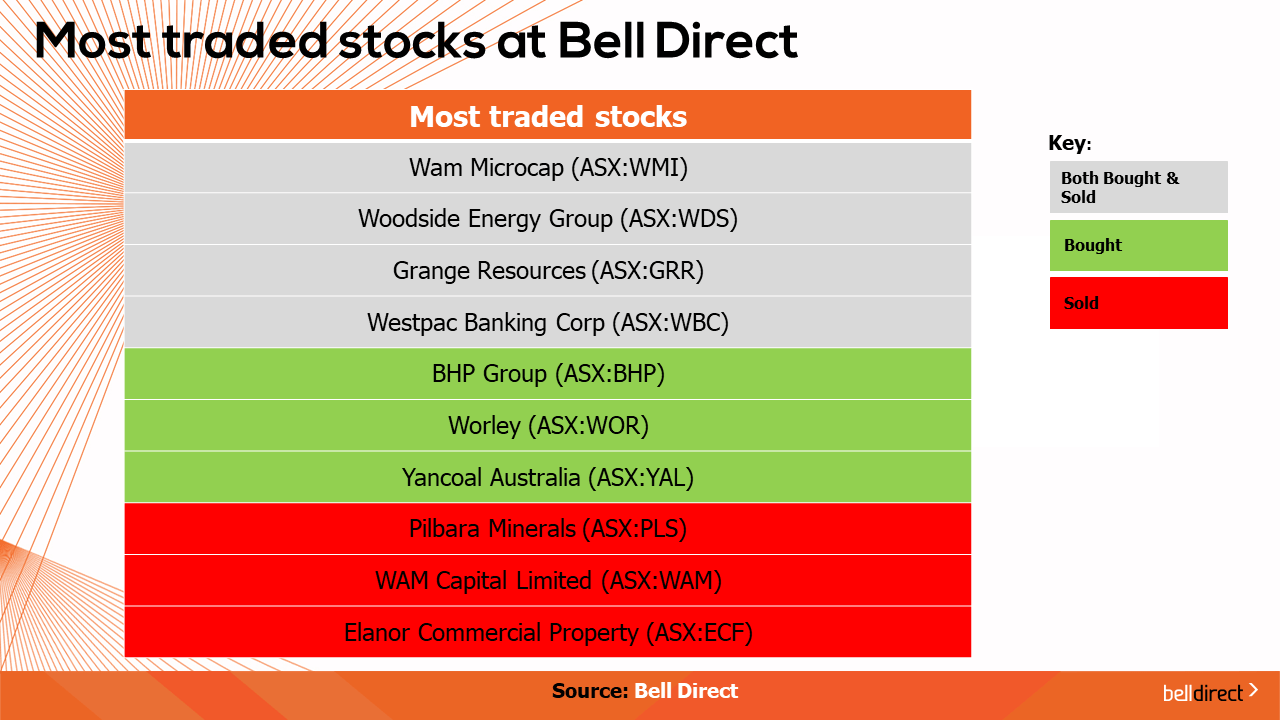

Looking now at the most traded stocks by Bell Direct clients this week. These included Wam Microcap (ASX:WMI), Woodside Energy (ASX:WDS), Grange Resources (ASX:GRR) and Westpac (ASX:WBC).

Clients also bought into BHP Group (ASX:BHP), Worley (ASX:WOR) and Yancoal (ASX:YAL). While took profits from Pilbara Minerals (ASX:PLS), WAM Capital Limited (ASX:WAM) and Elanor Commercial Property (ASX:ECF).

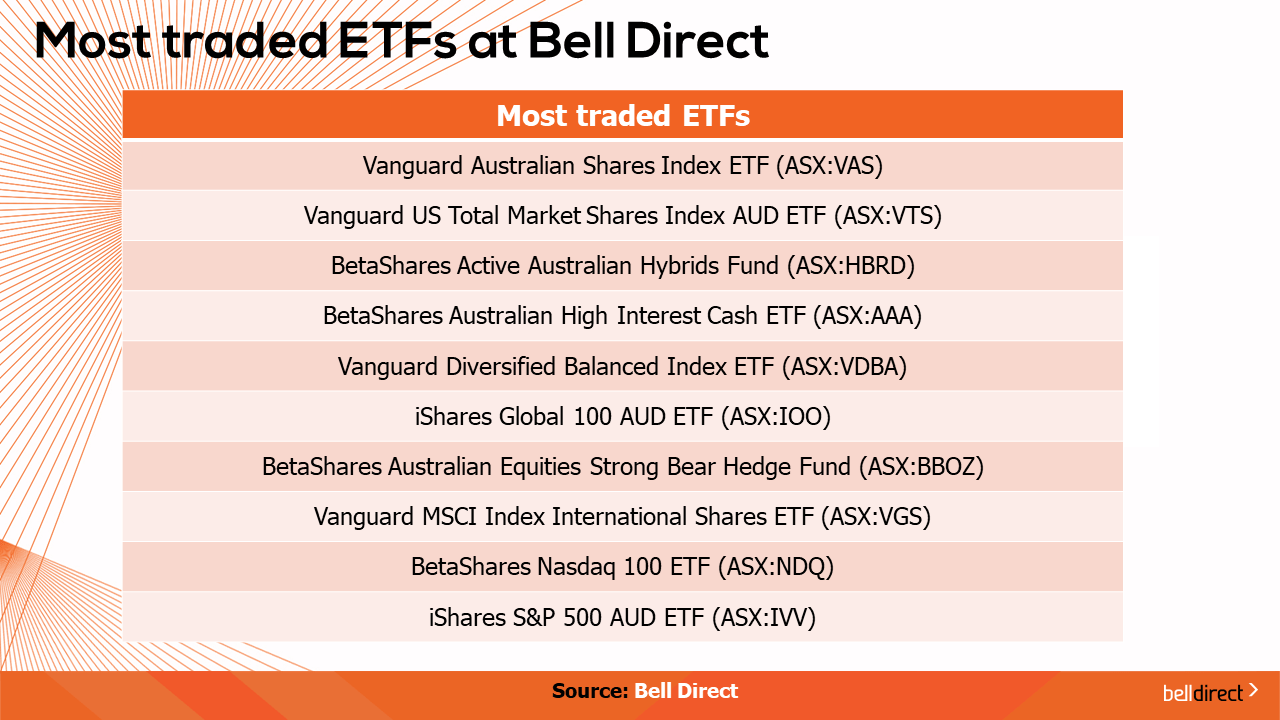

And the most traded ETFs by Bell Direct clients were Vanguard Australian Shares Index ETF (ASX:VAS), Vanguard US Total Market Shares Index ETF (ASX:VTS) and the BetaShares Active Australia Hybrids Fund (ASX:HBRD).

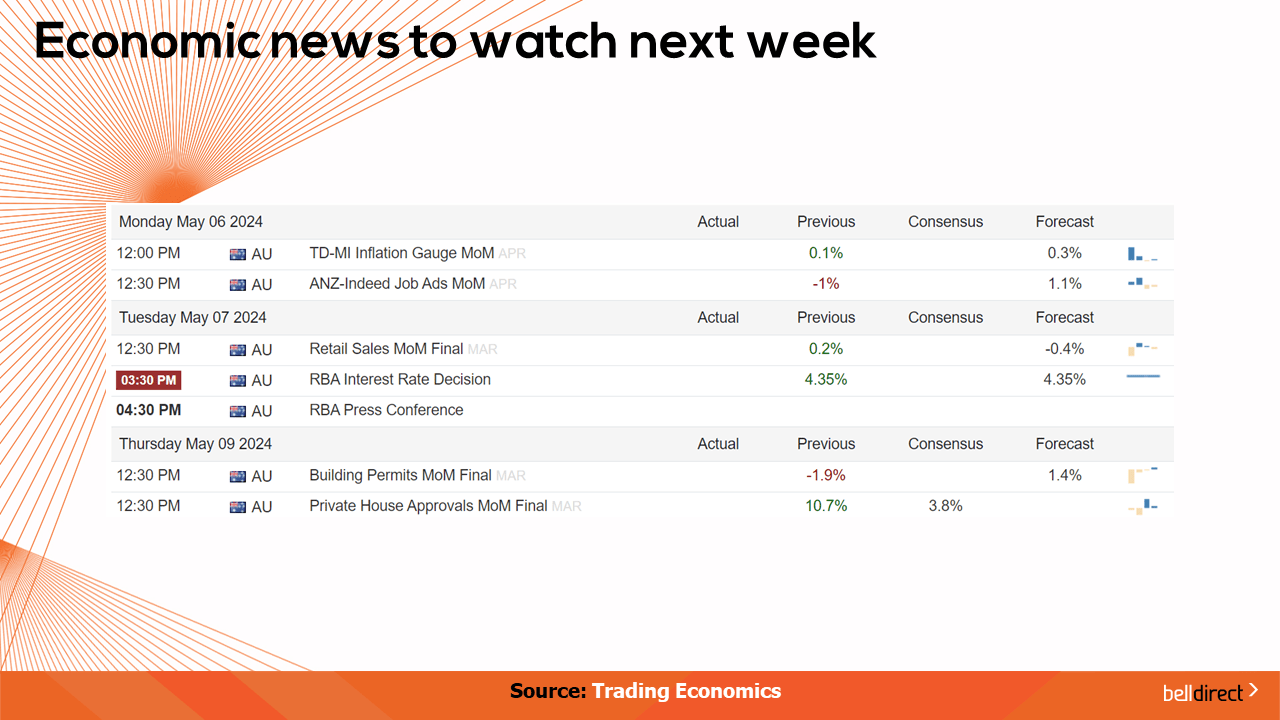

And to end, key economic data to watch out for next week is the RBA’s next interest rate decision released on Tuesday, expected to remain on hold at 4.35%.

And that’s all for this week. To receive more insights and research that is available exclusively to Bell Direct clients, open your Bell Direct account via the link in the description box below.

Have a great Friday and as always, happy investing.