Transcript: Weekly Wrap 22 November

Global economic indicators painted a mixed picture this week.

In the US, we saw strong economic performance, with flash PMI data revealing robust growth in business activity, driven by rising demand and increased business confidence. Encouragingly, price pressures continued to ease, suggesting potential for further interest rate cuts. Also, this week, key economic data, including GDP figures and PCE price index, provided further insights into the US economy’s trajectory. Amid robust consumer spending, US GDP increased at an unrevised 2.8% annualised rate. Consumer spending, government spending, and exports were expected to be lower than previously thought. However, this was balanced out by increases in business investment, government spending at the state and local level, and businesses building up their stockpiles.

The Thanksgiving holiday brings a shortened trading week for US markets, which are closed Thursday and shutting early on Friday.

Across the globe, the economic landscape was less optimistic. Eurozone and UK PMIs indicated renewed downturns in business activity, with weakness spreading from manufacturing to the services sector. While price pressures remained relatively modest, concerns over structural issues and political uncertainty weighed on sentiment. Investors eagerly await fresh business confidence and inflation data, out tonight, to assess the potential for further monetary easing.

Asia, India and Singapore released their GDP figures, while South Korea and New Zealand announced their respective monetary policy decisions.

As for the markets performance this week so far,

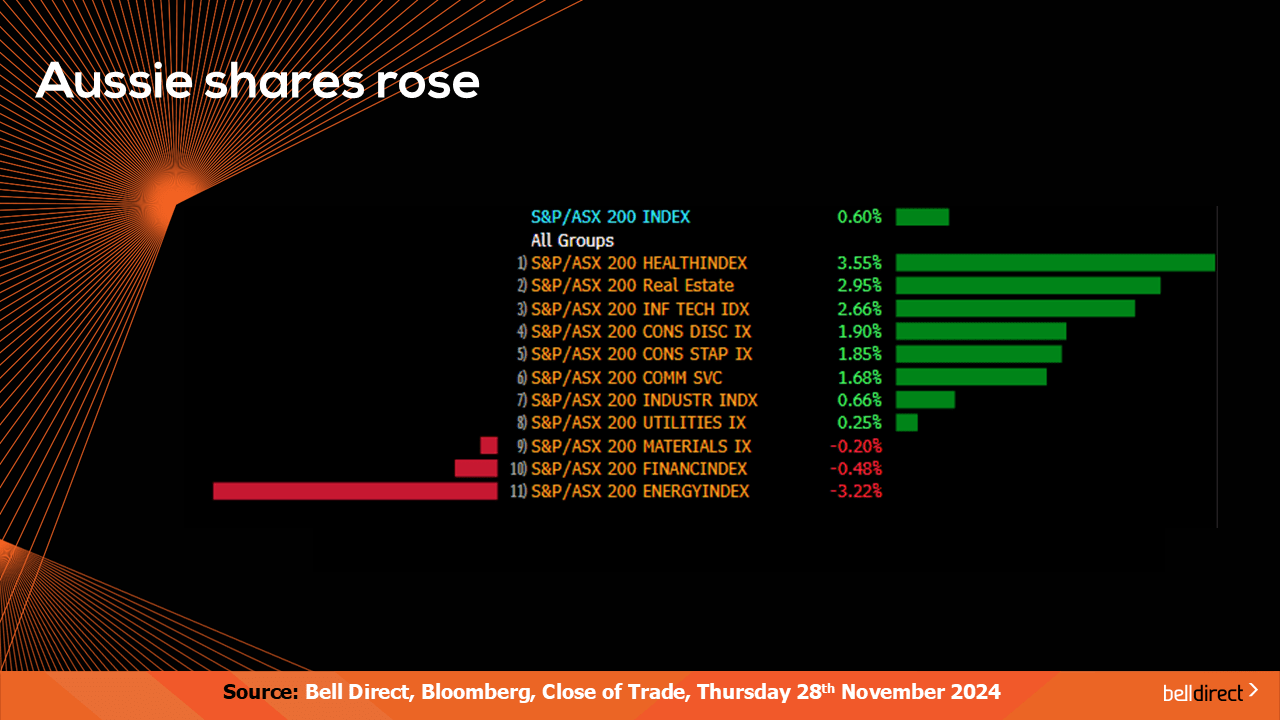

The ASX200 has advanced 0.6% this week so far (Monday to Thursday), with the healthcare sector in the lead, up 3.55%, followed by real estate and technology, while the energy sector declined the most.

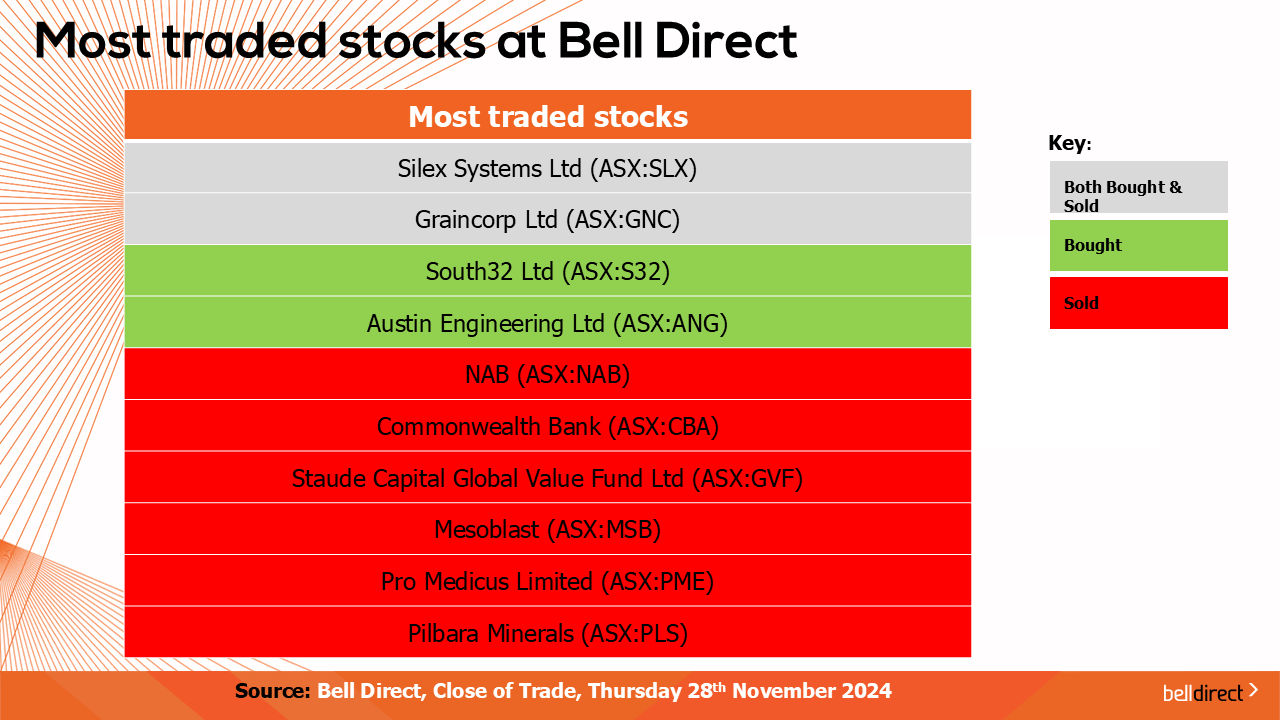

As for the most traded stocks by Bell Direct clients, this included Silex Systems (ASX:SLX) and Graincorp (ASX:GNC). Clients also bought into South32 (ASX:S32) and Austin Engineering (ASX:ANG), while took profits from NAB, CBA, Staude Capital Global Value Fund (ASX:GVF), Mesoblast (ASX:MSB), Pro Medicus (ASX:PME) and Westpac (ASX:WBC).

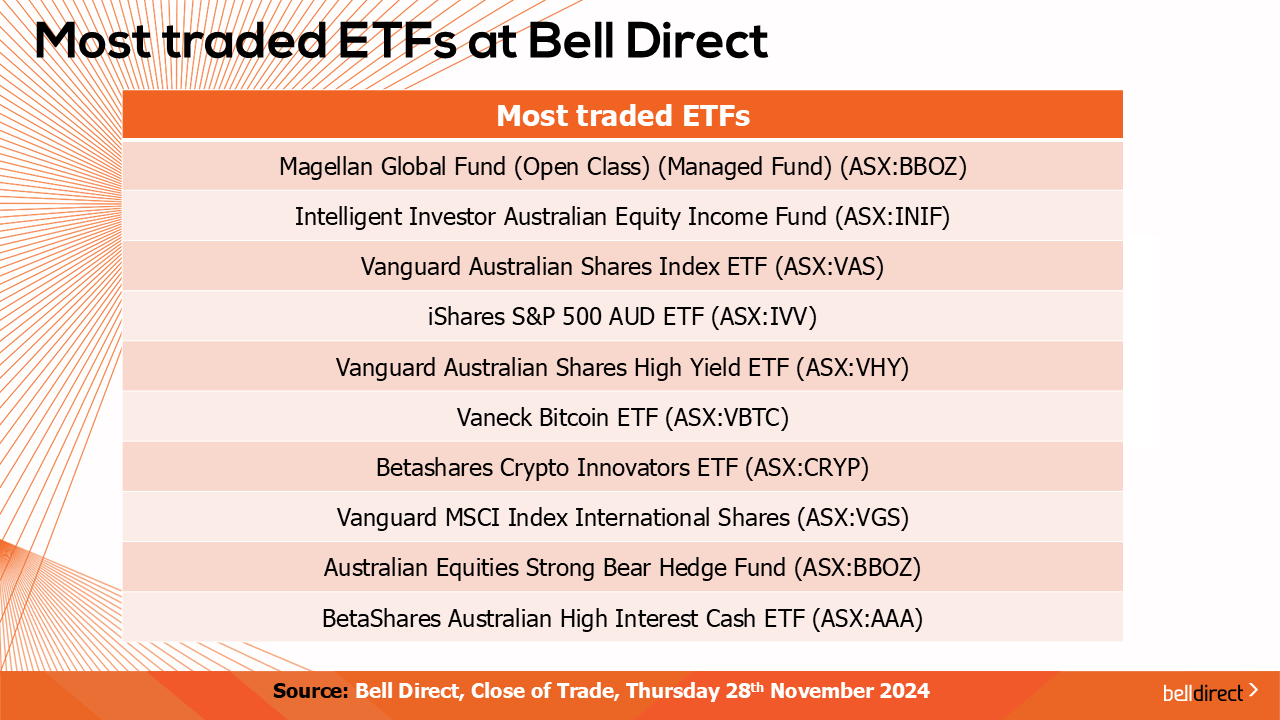

The most traded ETFs this week included Magellan Global Fund (ASX:MGOC), Intelligent Investor Australian Equity Income Fund (ASX:INIF) and the Vanguard Australian Shares Index ETF (ASX:VAS).

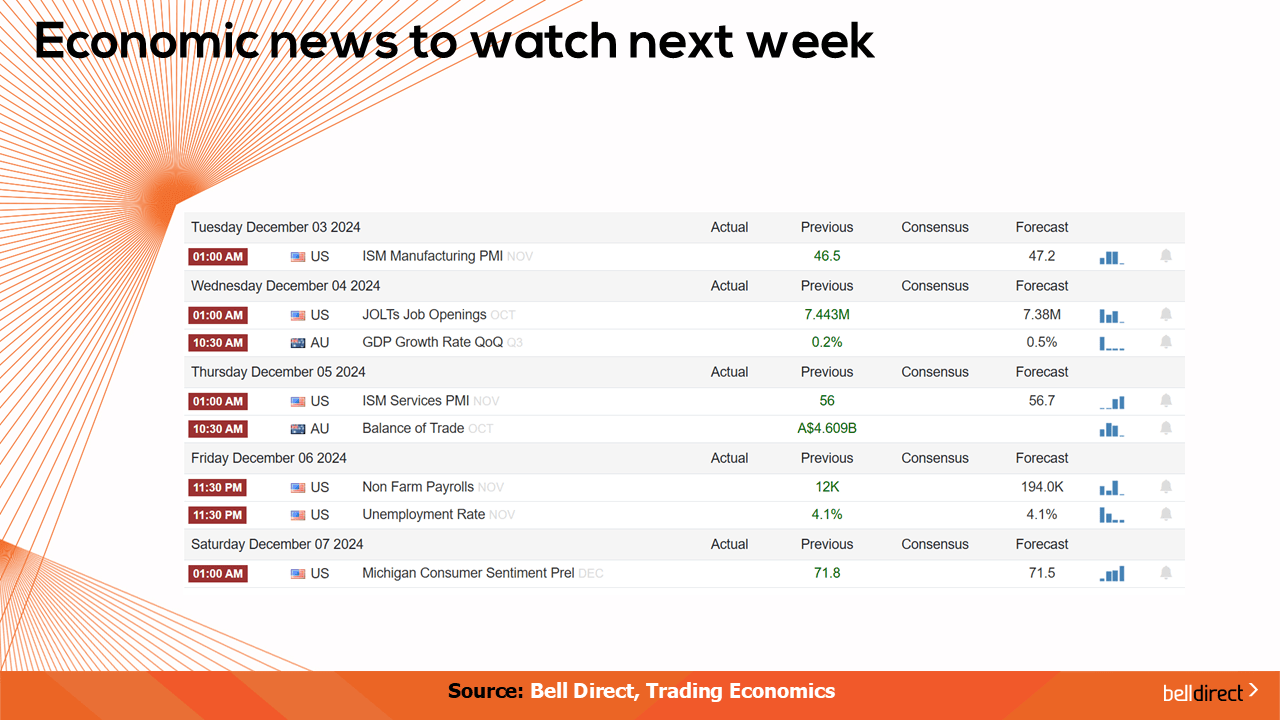

And to end, economic data to watch out for next week:

On Monday, the final manufacturing PMI will be released, an indicator of key economic trends in the sector. The PMI is expected to be 47.3 and remember a reading below 50 indicates a contraction from the month prior. Also on Monday, building permit data, retail sales data and YoY commodity prices will be released. On Wednesday, we’ll receive the final PMI for the services sector, as well the GDP Growth rate for Q3, forecast to rise from 0.2% to 0.5% for the quarter, or forecast to rise to 1.3% YoY. Lastly, on Thursday, balance of trade data for October will be released.

And that’s all for this week. I’m Sophia Mavridis with Bell Direct. Have a great Friday and weekend, and as always, happy investing.