Transcript: Weekly Wrap 28 June

The recent AI-driven rally took a stark halt this week as investors reassessed their holdings ahead of the end of FY24 and on the back of the latest inflation print released in Australia. The RBA’s hawkish comments after the latest rate decision that saw the nation’s cash rate held at 4.35%, were justified as inflation in Australia rebounded back to an annual rate of 4% in May, from 3.6% in April and this topped economists’ expectations of a rise to 3.8%. Let’s delve into what is driving inflation to remain sticky, and what impact this uptick in inflation may have on the rate outlook down under.

The key contributors to the significant rise in inflation to 4% in May were increases in the price of housing which rose 5.2%, food and non-alcoholic beverages up 3.3%, transport jumped 4.9% and alcohol and tobacco spiked 6.7%. While some of the rises are declines on prior monthly growth for example food and non-alcoholic beverages rose 3.8% in April and 3.3% in May, others like clothing & footwear and transport are on an upward trajectory over the last few months.

A concern to keep in mind is the rising levels of immigration down under since the borders opened post-pandemic. Between 2022 and 2023 there was an increase of 35.8% in the government’s Migration Program, while total arrivals to Australia in April topped 1.6m, an increase of 19.3% on the PCP. The increase in migration down under places further pressure on our existing housing crisis, driving up the price of property to buy and rent and creates a sticky driver of housing inflation. Another rate hike may be considered given the latest inflation reading, which if the RBA does increase rates, will see a likely increase in the number of defaults on existing home loans as some Aussies with higher levels of debt become unable to service the loans acquired in the previously lower interest rate environment.

The falling unemployment rate in Australia is another contributing factor to the hawkish outlook from the RBA toward the inflation driven rate pathway. Australia’s unemployment rate fell by 0.1% to 4% in May with the number of employed Australians rising by around 40,000 people while the number of unemployed fell by 9000. A lower unemployment rate is a contributing factor to inflation as the more Australians that are working leads to higher spend and further increase in aggregate demand, thus presenting a case for businesses to raise the costs of goods and therefore adding to rising inflation.

In the same way, Australia’s wage price index rose again in the March to May quarter by 4.1% over the year which was the first slight ease in rise from the peak of 4.2% in the December quarter. Professional, education and training and construction wages growth were the highest contributors to the WPI rise in the latest quarter and post another factor for the RBA to consider in the nation’s inflation journey as higher wages means more disposable income for spending thus contributing to the currently sticky inflation rate.

So where does this leave us in the rate journey and what do investors need to consider heading into FY25?

After the latest inflation print was released, the RBA rate tracker run by the ASX soared from a 0% chance of a rate raise on 17th June to now a 37% chance of a rate hike to 4.6% as of the 26th June. We have seen investors acting more cautiously over recent weeks and repositioning into sectors that offer safer returns in a high-interest environment. Consumer staples stocks have risen 6.17% over the last month while financials stocks have jumped 4.01% as investors see the banks will benefit from the inflation drivers remaining sticky and the rate cut outlook being prolonged. A stronger gold price has also buoyed gold miners to the top of investors buying list over recent weeks as they provide a safer investment option to riskier growth stocks in the higher interest rate environment.

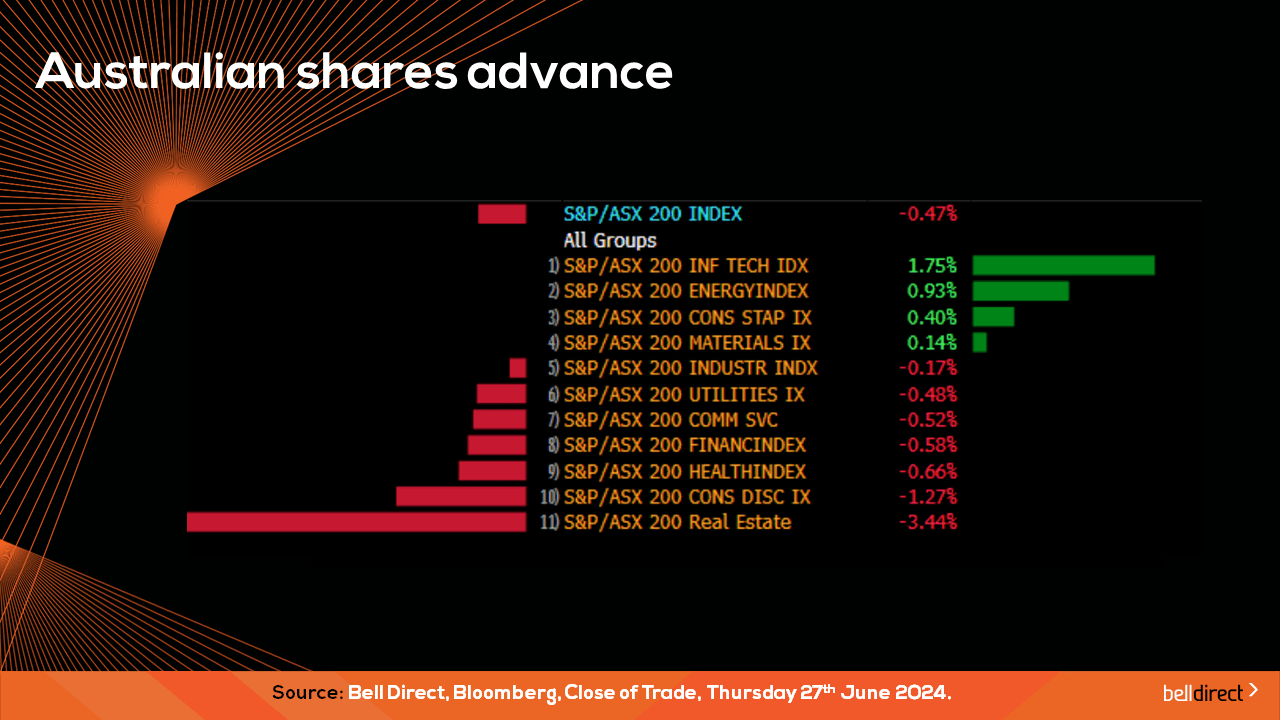

Locally from Monday to Thursday the ASX200 fell 0.47%, as a tumble in REIT stocks weighed on the key index and investors hit the sell-button later in the week following the release of hotter-than-expected inflation data.

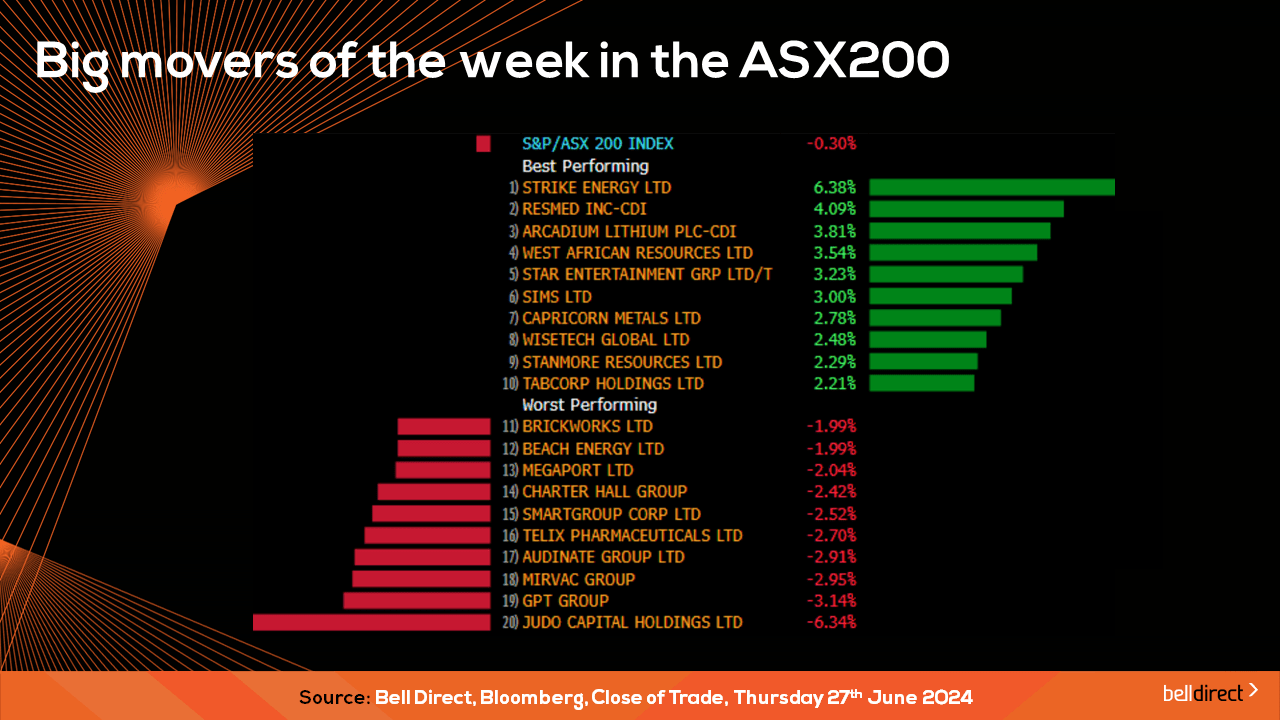

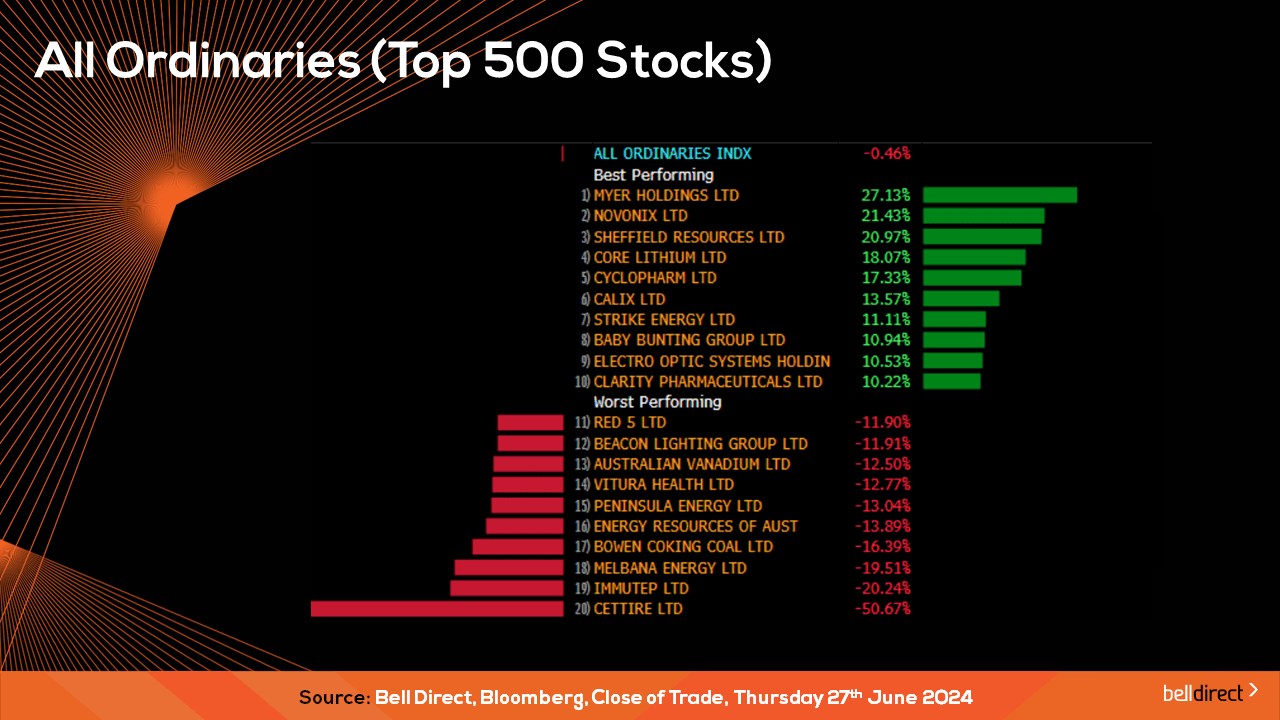

The winning stocks over the four trading days were led by Strike Energy (ASX:STX) jumping 11.11%, West African Resources (ASX:WAF) rising 6.98% and Premier Investments (ASX:PMV) rising 6.21%.

On the losing end Red 5 (ASX:RED) slipped 11.9%, ResMed (ASX:RMD) fell 9.95% and Deep Yellow (ASX:DYL) declined 9.6% over the four trading days.

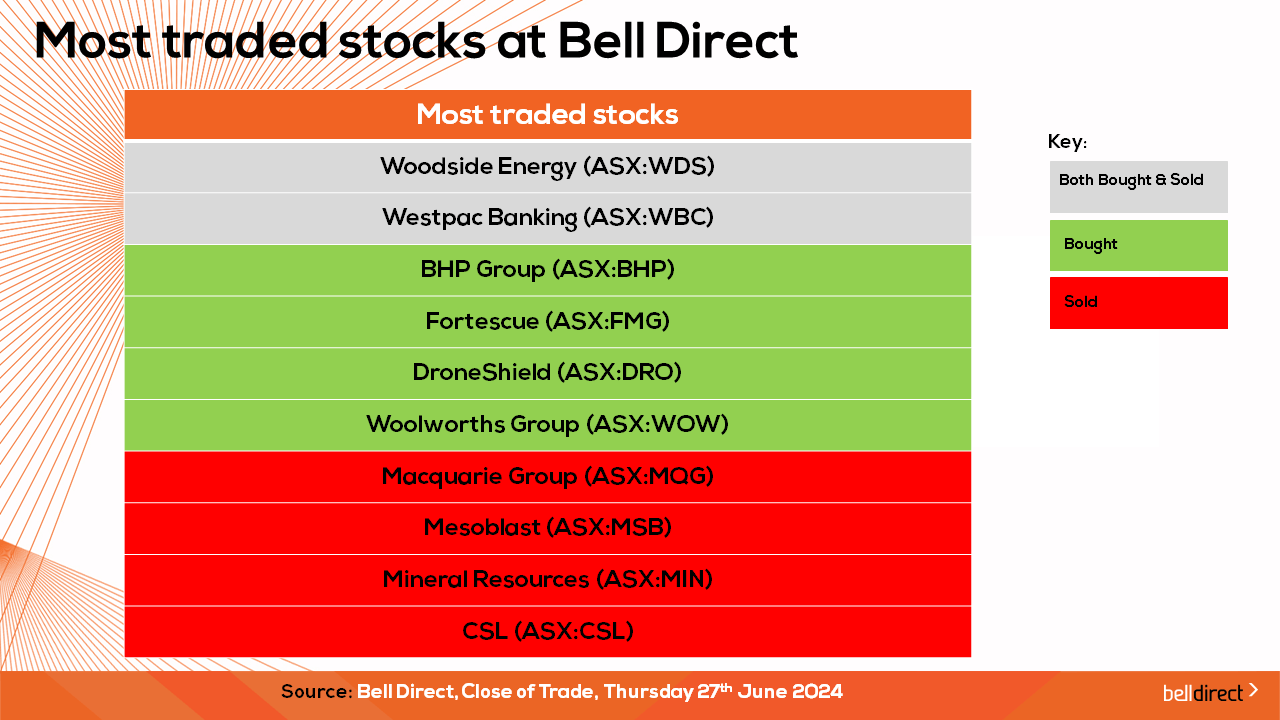

The most traded stocks by Bell Direct clients over the last trading week of June were Woodside (ASX:WDS), Westpac (ASX:WBC), and BHP Group (ASX:BHP). Clients also bought into Mesoblast (ASX:MSB) and Mineral Resources (ASX:MIN) while taking profits from Fortescue (ASX:FMG), DroneShield (ASX:DRO), Woolworths (ASX:WOW), Macquarie (ASX:MQG) and CSL (ASX:CSL).

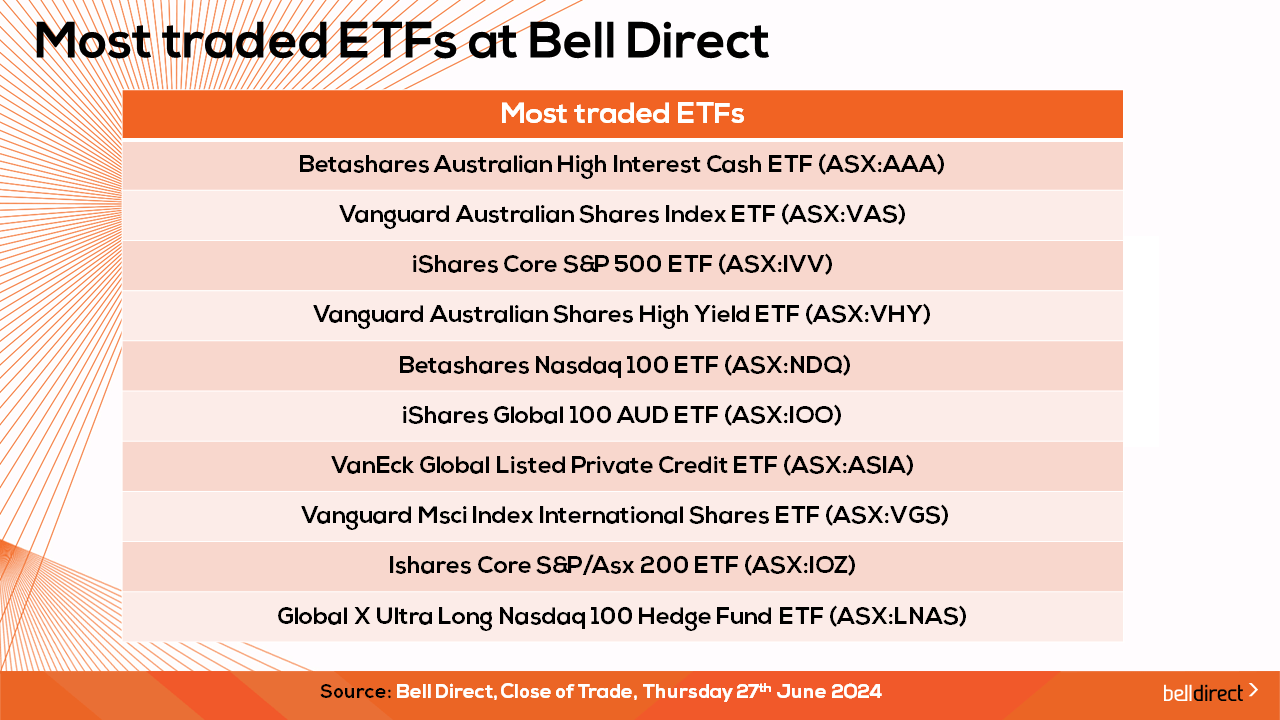

And the most traded ETFs by Bell Direct clients this week were led by Betashares Australian High Interest Cash ETF (ASX:AAA), Vanguard Australian Shares Index ETF (ASX:VAS) and iShares S&P 500 AUD ETF (ASX:IVV).

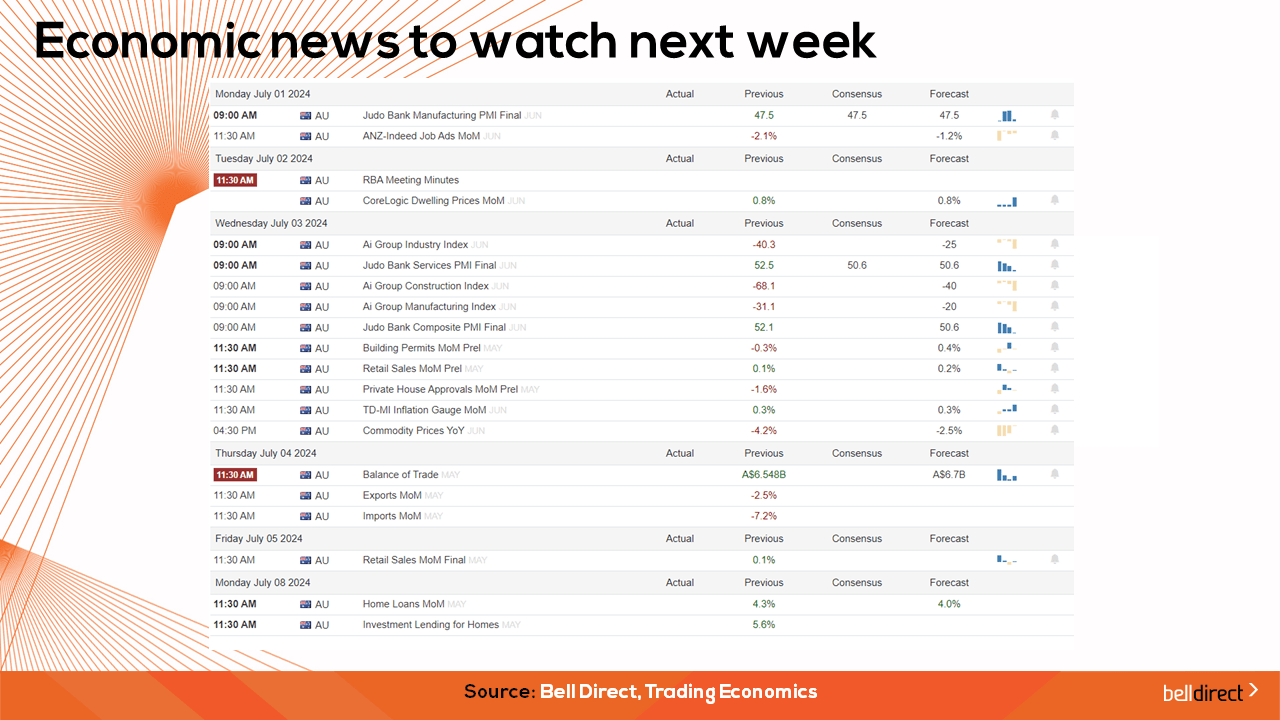

Taking a look at the first trading week of July and the new financial year from an economic standpoint, the RBA meeting minutes are out on Tuesday which will give investors further insight into the RBA’s rate outlook from the latest meeting, which will likely change at the next meeting given the latest inflation reading.

We also have Australia’s trade balance for May out next week with the expectation of continued recovery in the country’s trade surplus to $6.7bn from the $6.54bn reported in April.

Overseas next week we will gauge further insight into China’s economic recovery through the Caixin (SY-SHIN) Manufacturing PMI for June out on Monday with the market forecasting a continued decline to 51.2 points from 51.7 points in May. Key US jobs data is also out next week with JOLTs job openings data for May out on Wednesday, Non-Farm payrolls out on Friday and the unemployment rate for the US also out next Friday.

And that’s all for this Friday and this financial year. Have a wonderful weekend and happy investing.