Transcript: Weekly Wrap 28 july

Thank you for joining me this Friday the 28th July, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update.

The release of economic data around the world was the key driver of market movements this week in addition to speculation around China’s support policy announcement and investors responding to earnings season results.

The big miners stole the show locally this week for two key reasons. Firstly, on speculation that China is set to announce new and further policy support to reignite growth and operational output in the region. China’s GDP data speaks volumes in terms of how lacklustre and underwhelming the world’s second largest economy’s post pandemic recovery has been. China’s GDP growth rate in Q2 was just 0.8%, slowing drastically from the 2.2% growth recorded in Q1, indicating the Chinese economy, despite still growing, remains uncertain due to the ongoing property and building crisis, the possibility of disinflation and record high unemployment in the region. The Chinese government has already moved to cut rates on certain loans in the region however are set to announce further stimulus to prompt sustainable growth again. This caused a lift in the price of iron ore this week, which subsequently sparked a rally for the big iron ore miners on the ASX earlier this week with BHP (ASX:BHP) adding 3.84%, Rio Tinto lifting 3.4% earlier in the week and Fortescue Metals Group rallying 4.55%.

Rio Tinto (ASX:RIO) shares took a hit later in the week following the release of the mining giant’s first half results that missed expectations. For the half, Rio reported revenue fell 10% to US$26.67bn, NPAT fell 43% to US$5.1bn and the company’s fully franked interim dividend fell 33% to US$1.77/share. Lower commodity prices and higher costs were the key drivers of the weaker-than-expected results.

Fortescue Metals Group (ASX:FMG) also released a June quarter trading update this week including Q4 iron ore shipments of 48.9 million tonnes, which contributed to record shipments of 192 million tonnes for FY23. The miner also reduced net debt to US$1bn at 30 June 2023, from US$2.1bn at 31 March 2023, and average revenue of US$96/dry metric tonne in Q4 FY23, which is significantly lower than the US$108/dry metric tonne in the PCP, due to weaker iron ore prices. FMG also revealed its progress in the green energy market through the operation of Fortescue Energy which will consist of FFI and WAE Technologies, in addition to the company’s acquisition of the Phoenix Hydrogen Hub in the US being approved in recent weeks.

Overseas, we saw the real impact of the AI movement through stellar results released by Microsoft and Alphabet, driving even more attention and hype around the capabilities of AI. Microsoft reported record quarterly sales of US$56.2bn driven by the company’s investments in AI, and record profit for the quarter of US$20.1bn.

And finally, the US, European and Japanese Central Banks all announced interest rate decisions this week. The US is leading the pack in terms of cooling inflation yet still announced a 25-basis point rate hike on Wednesday US time as Jerome Powell is wary of inflation remaining sticky in the region. The ECB also announced a 25-basis point rate hike on Thursday, also due to concerns of prolonged high inflation across the European region.

The Japanese Central Bank is set to announce the rate decision this afternoon with the expectation of the country’s cash rate to remain at -0.1% for the month ahead.

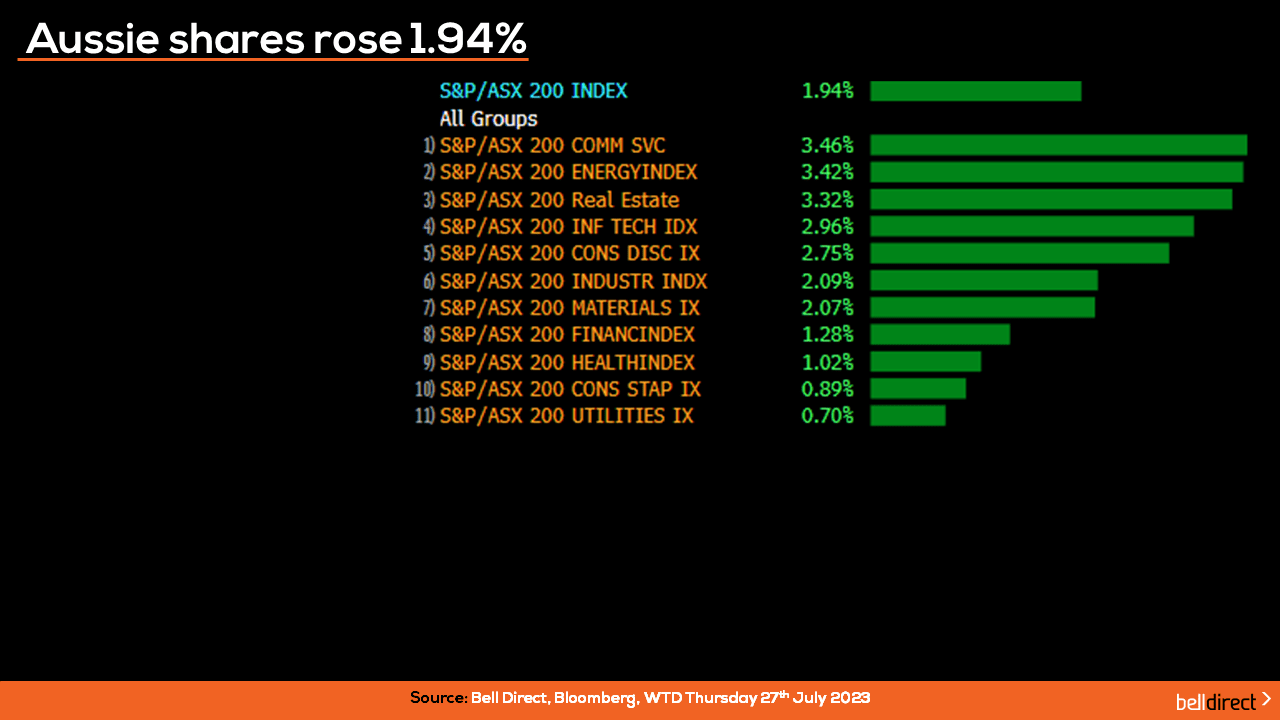

Locally from Monday to Thursday the ASX200 rose 1.94% with every sector posting a modest gain led by the Communication Services sector jumping 3.46%, while energy added 3.42% and REIT stocks felt some much-needed relief, lifting 3.32%. Local market sentiment was boosted by Australia’s inflation rate falling more than expected to an annual rate of 6% to June 2023.

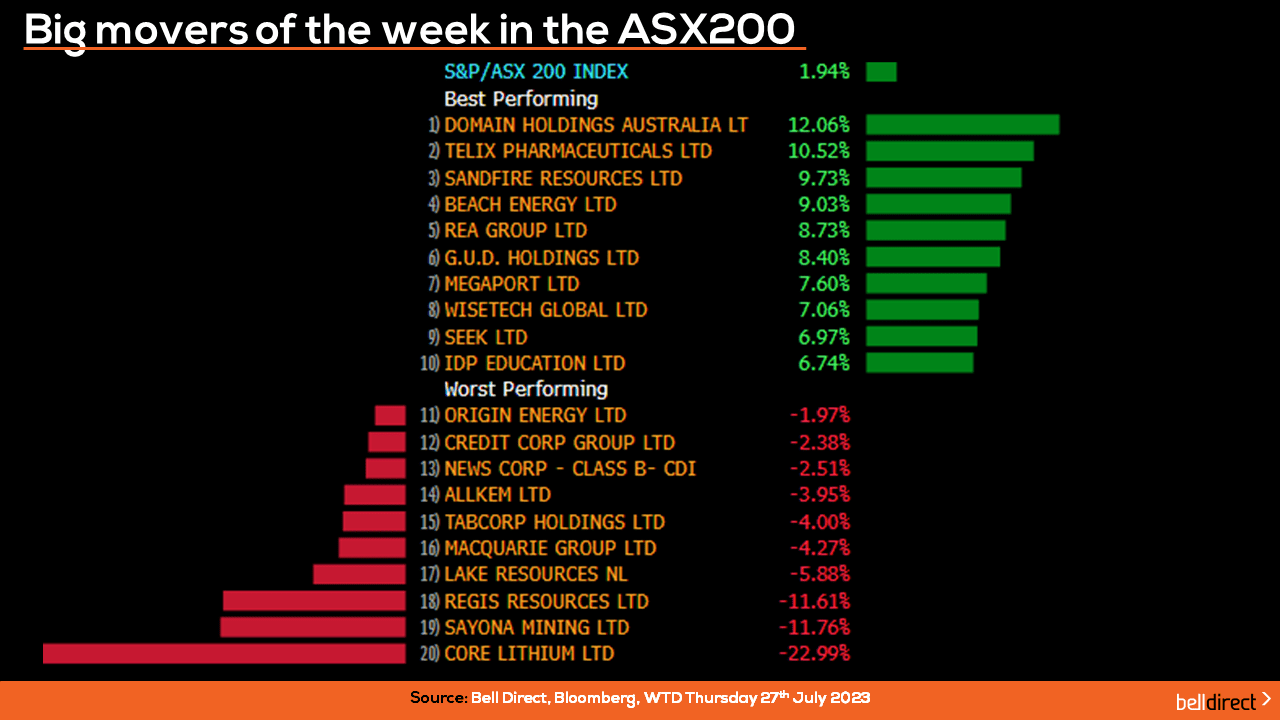

The winning stocks from Monday to Thursday were led by Domain Holdings (ASX:DHG) surging 12.06%, while Telix Pharmaceuticals (ASX:TLX) rose 10.52% and Sandfire Resources (ASX:SFR) rose 9.73% on the back of the copper miner releasing strong Q4 results including a 13% quarterly increase in production at its MATSA Copper Operations in Spain.

On the losing end of the ASX200, Core Lithium (ASX:CXO) tumbled 23% on the release of a disappointing trading update outlining it expects spodumene production to decline significantly in FY24. Sayona Mining (ASX:SYA) fell 11.76% over the four days this week and Regis Resources (ASX:RRL) lost 11.61%.

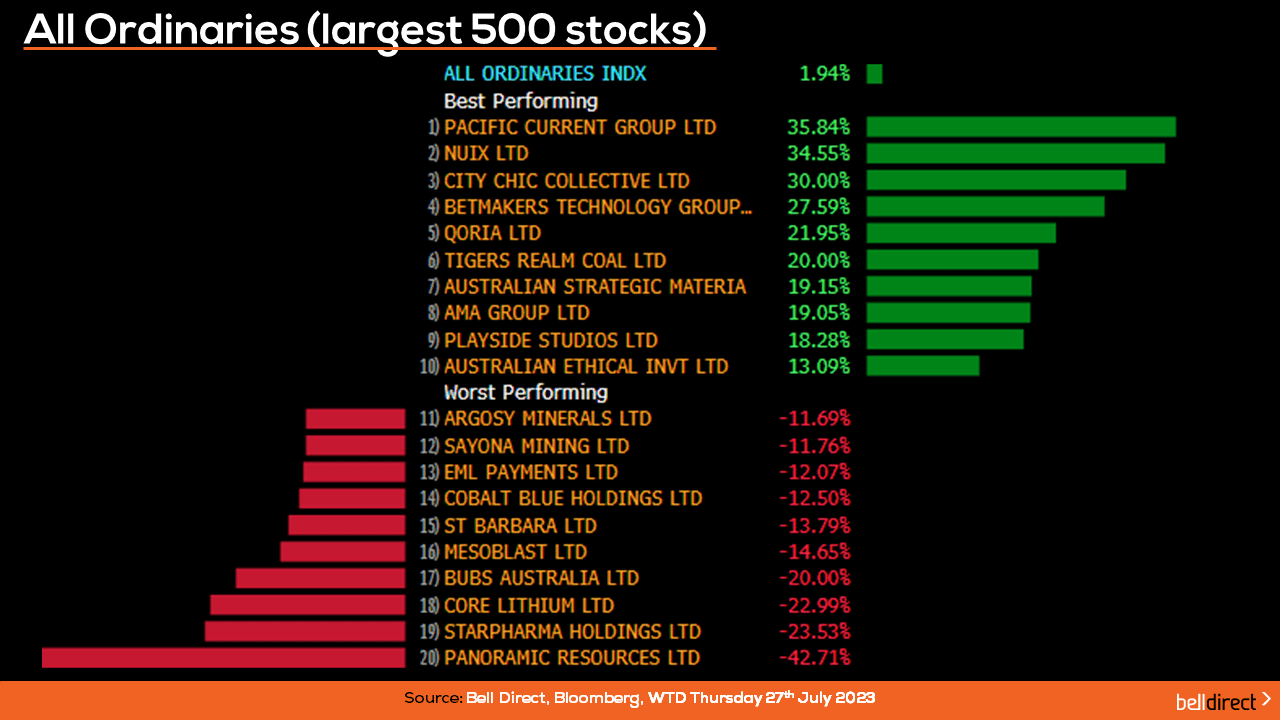

On the broader market, the All Ords rose 1.94% buoyed by Pacific Current Group (ASX:PAC) jumping almost 36%, while Nuix (ASX:NXL) added 34.55% and City Chic (ASX:CCX) lifted 30%.

Panoramic Resources (ASX:PAN) tumbled 42% and Starpharma (ASX:SPL) fell 23.53% at the losing end of the All Ords over this week.

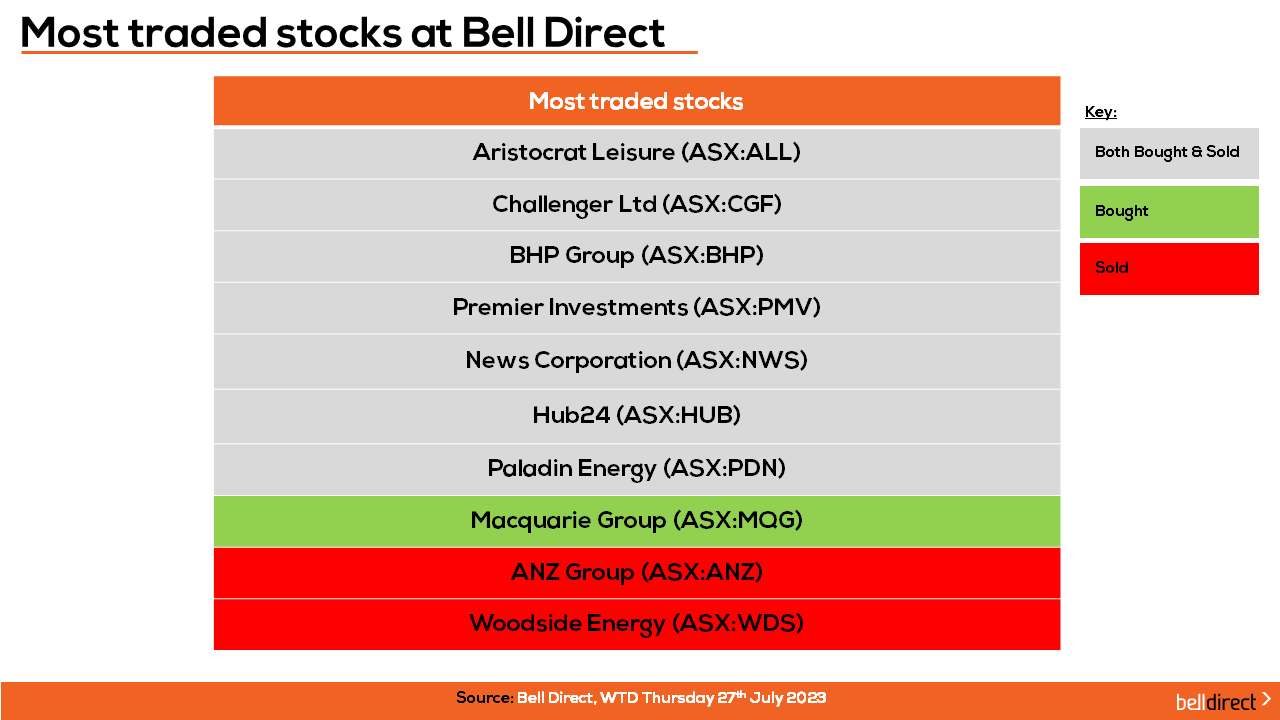

The most traded stocks by Bell Direct clients from Monday to Thursday were Allkem (ASX:AKE), Challenger (ASX:CGF), BHP (ASX:BHP), Premier Investments (ASX:PMV), News Corporation (ASX:NWS), HUB24 (ASX:HUB), and Paladin Energy (ASX:PDN).

Clients also bought into Macquarie Group (ASX:MQG) while taking profits from ANZ (AXS:ANZ) and Woodside Energy (ASX:WDS).

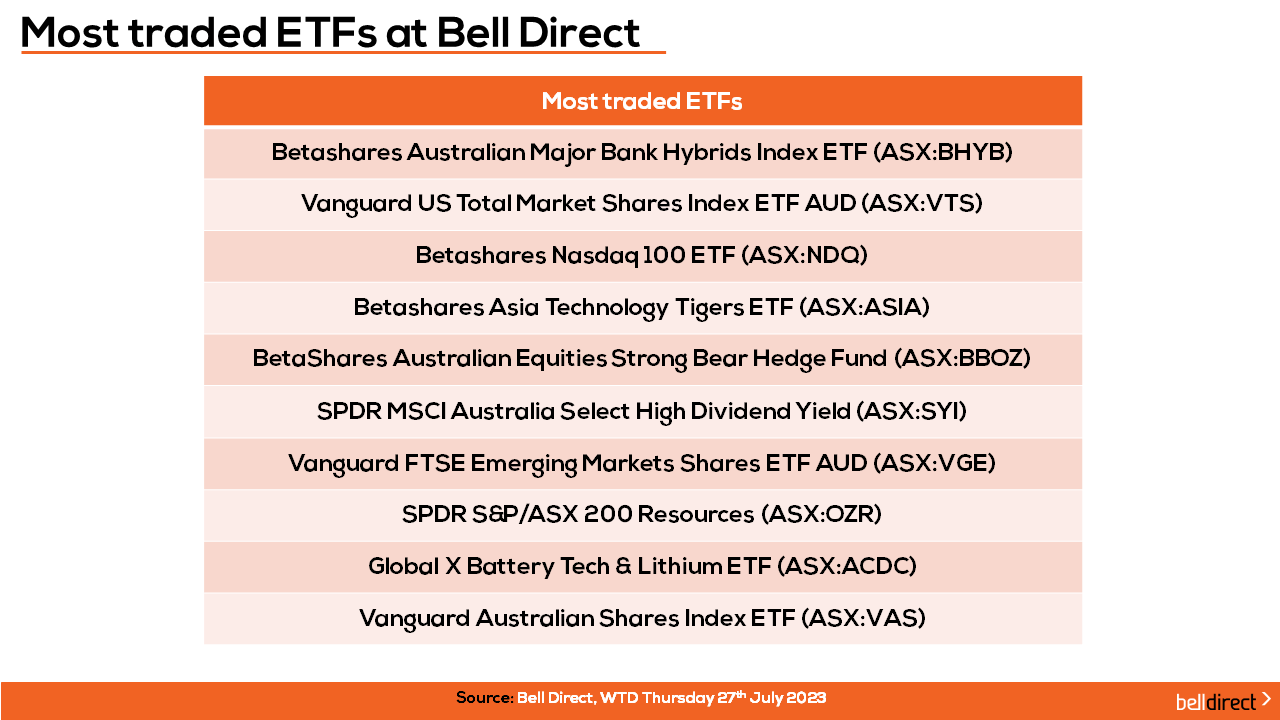

On the diversification front, the most traded ETFs by Bell Direct clients from Monday to Thursday were BetaShares Australian Major Bank Hybrids Index ETF, Vanguard US Total Market Shares Index ETF and BetaShares Nasdaq 100 ETF.

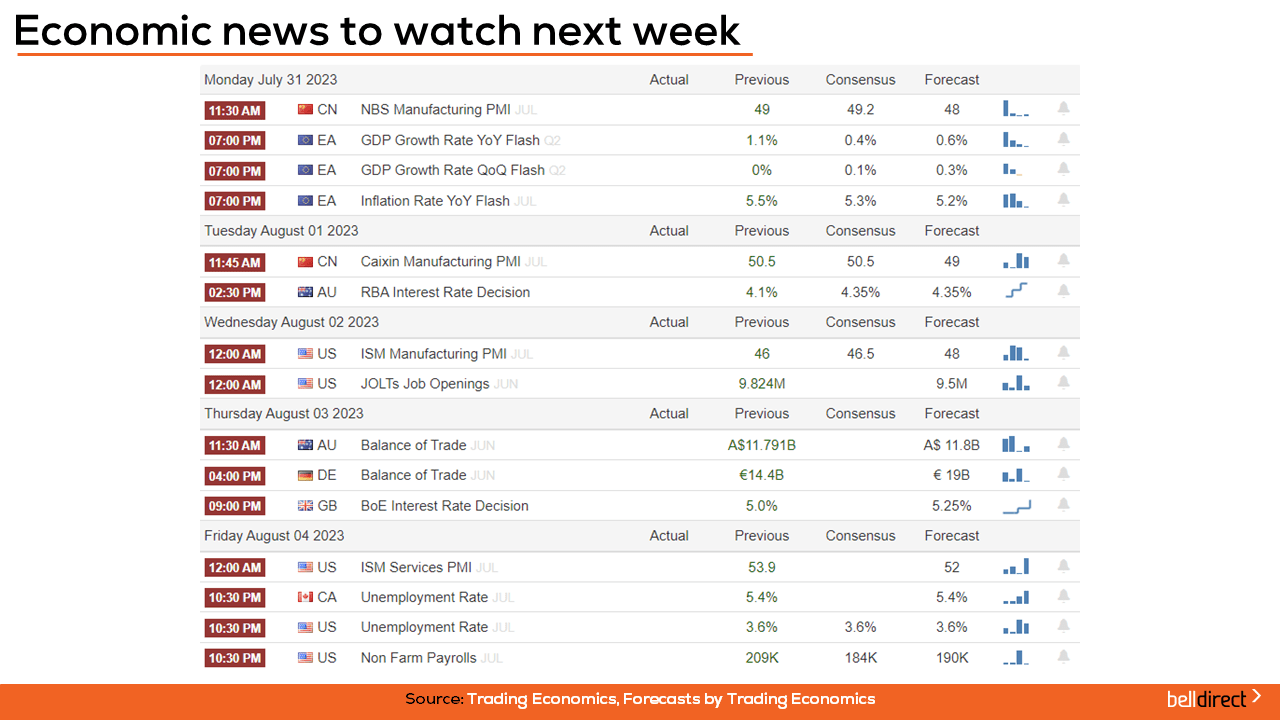

Taking a look at the week ahead, Australia’s interest rate decision is out on Tuesday with consensus expecting the RBA to announce a 25-basis point rate hike which will take the nation’s cash rate to 4.35% as the RBA continues its efforts to cool inflation in Australia to the target range of 2-3%.

Australia’s trade balance data for June is also out next Thursday with the forecast of an increase in trade surplus to $11.8bn.

Overseas, China’s manufacturing PMI for July is out on Tuesday with the forecast of a decline to 49 points from 50.5 points in June. The Bank of England will announce the latest rate decision for the UK on Thursday with the expectation of a 25-basis point rate hike to be announced.

And key US jobs data is out on Friday with the expectation of unemployment to remain at 3.6%, while Nonfarm Payrolls are expected to decline to 184,000 new jobs added in July from 209,000 new jobs added in June.

And that’s all for this week. I’m Grady Wulff with Bell Direct and I hope you have a wonderful weekend. Happy investing!