Transcript: Weekly Wrap 28 February

This reporting season, we’ve seen 244 companies release results with 86 beating expectations, 83 meeting expectations and 75 missing expectations. 37 companies have been upgraded by brokers, while 42 have been downgraded.

In the final days of reporting season, we saw investors react to results from supermarket giants Woolworths (ASX:WOW) and Coles (ASX:COL), Light & Wonder (ASX:LNW), and Qantas (ASX:QAN).

Qantas shares took off on Thursday, following the release of impressive first half results including the declaration of the first dividend since the pandemic. As turbulence rocks other airlines in Australia, Qantas continues to soar, with profits up 6%, underlying EPS up 21% to 63cps, a 9% rise in revenue, a special dividend of 9.9cps and an interim dividend of 16.5cps fully franked.

In the gaming sector, the share price of Light & Wonder rose 7% to $169.21, following the release of the online gaming company’s results. Light & Wonder reported a 10% increase in revenue, reaching a record $3.2 billion, and a 110% surge in net income, which rose to $336 million. A combination of R&D investment, commercial strategy and a robust product roadmap led to increased gaming machine sales in North America and Australia in 2024 and the company is guiding to low double-digit income growth in the first quarter of FY25.

Supermarket giants released first half results this week, which sparked different investor reactions with Coles impressing investors, while Woolies’ strike action in the first half impacted investor sentiment and earnings. For the half, Woolworths posted profits slid 20.5% to $739 million, the interim dividend fell 17% to 39cps, a long way from the 57 cents per share final dividend that shareholders enjoyed in September last year. The company’s Big W brand also weighed on results, at the same time Wesfarmers’s Kmart brand continued to excel. The second half might not be as bad for Woolworths though, with management revealed that Australian Food sales were up 3.3% during the first seven weeks of the second half.

Overall, investors have been very focused on outlook this reporting season, looking for some clarity on H2.

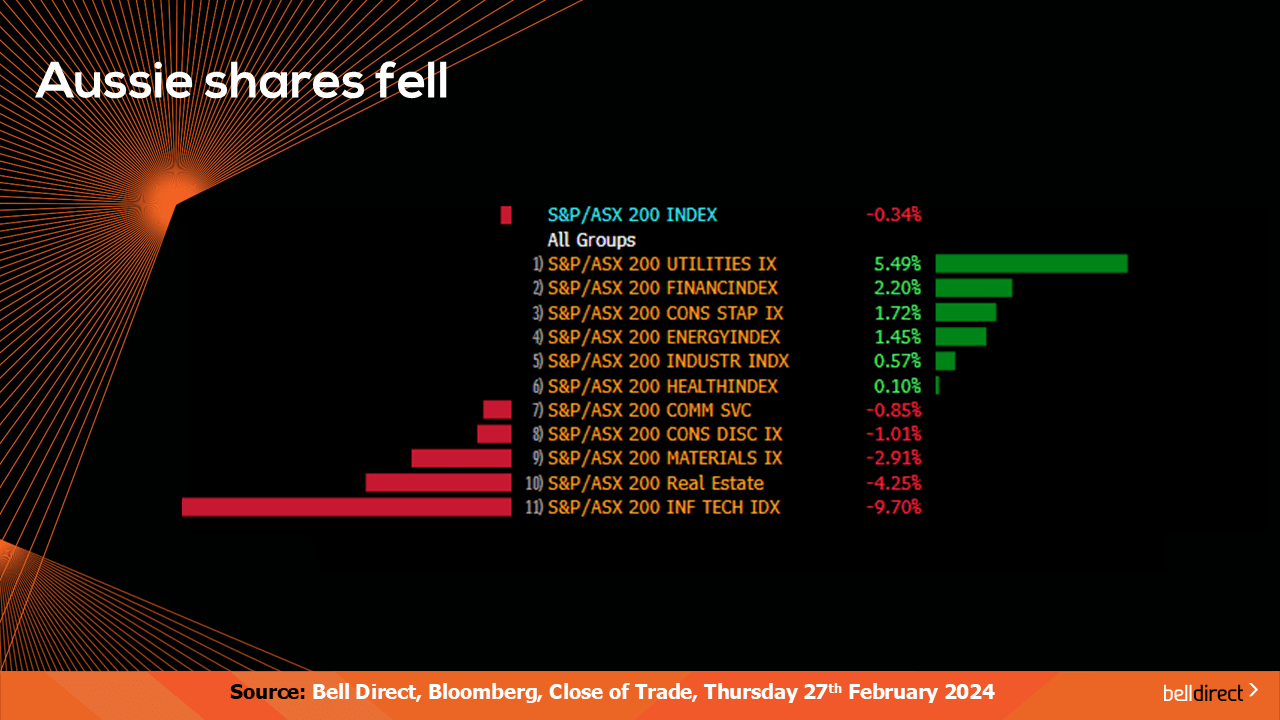

Locally from Monday to Thursday the ASX 200 fell 0.34% as an uncertain inflationary vs rate picture in the US weighed on investor sentiment, as economic growth eases while inflationary pressures remain sticky. Tech stocks fell 9.7% weighed down by Wisetech (ASX:WTC) tumbling amid board-level conflict, while utilities and financial stocks offset some of the local market gains this week.

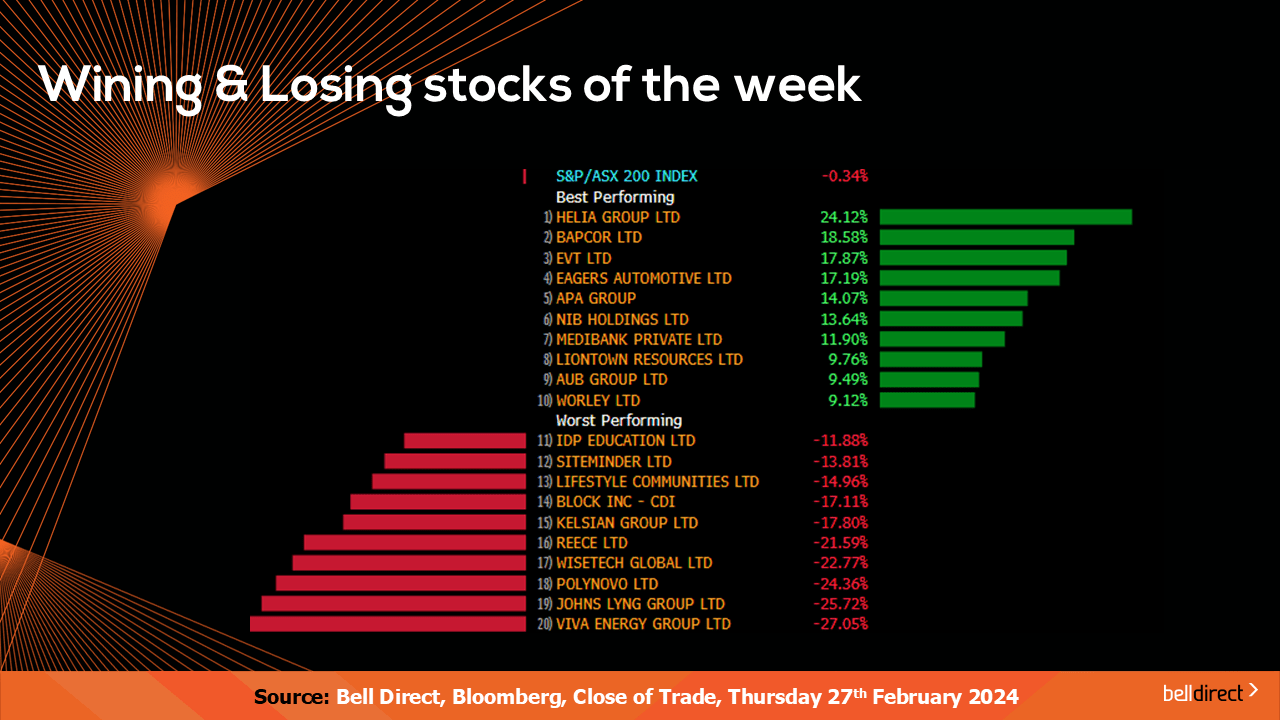

The winning stocks on the key index were led by Helia Group (ASX:HLI) rising 24%, while Bapcor (ASX:BAP) rallied 19% and EVT (ASX:EVT) rose 18%.

And on the losing end Viva Energy (ASX:VEA) and Johns Lyng Group (ASX:JLG) declined 27% and 26% respectively over the week amid outlook for an earnings downgrade, and Polynovo (ASX:PNV) ended the week down more than 24%.

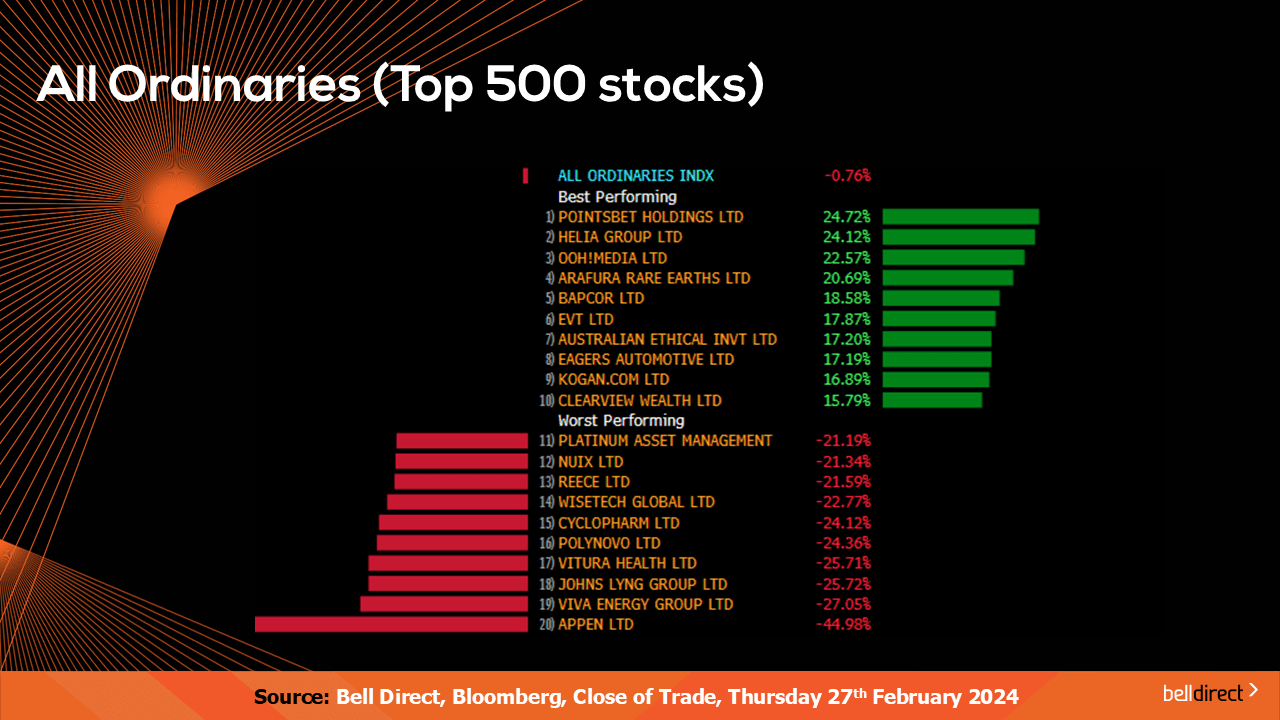

On the broader market index the All Ords fell 0.76% over the 4-trading days as Appen (ASX:APX) tanked 45% while PointsBet (ASX:PHB) gained over 24% each.

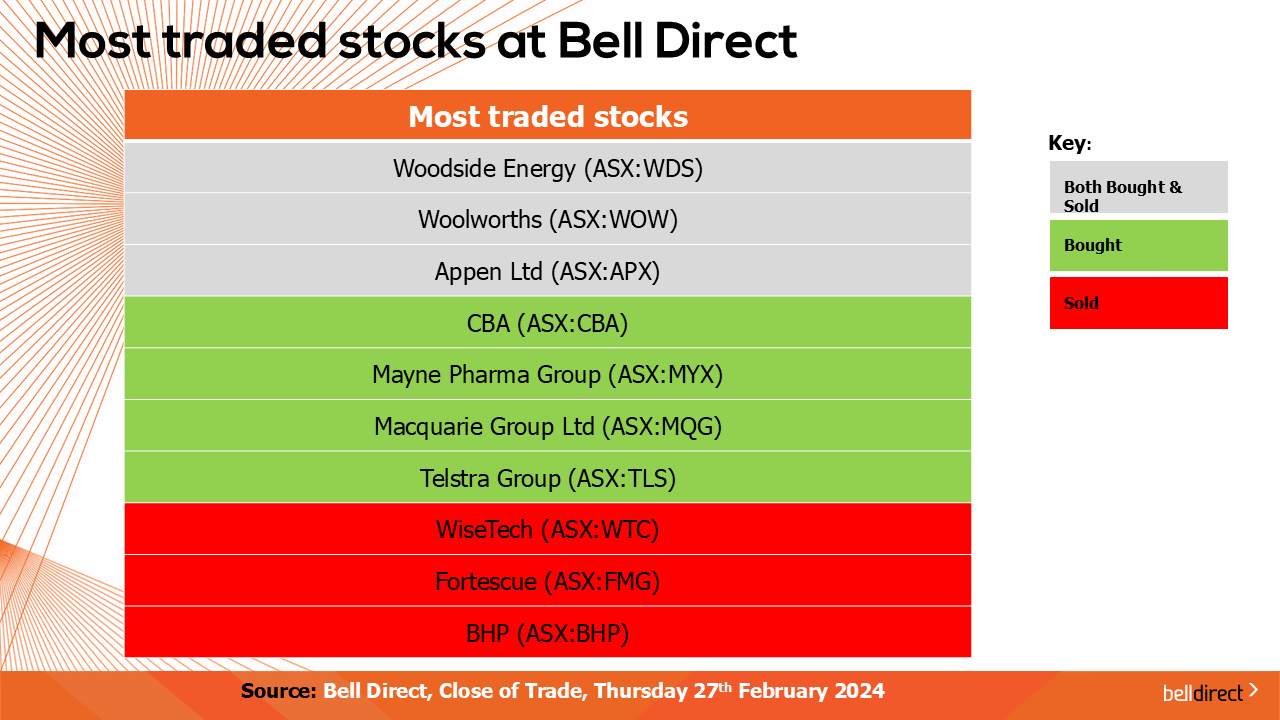

The most traded stocks by Bell Direct clients this week were Woodside (ASX:WDS), Woolworths (ASX:WOW) and Appen (ASX:APX). Clients bought into Wisetech (ASX:WTC), Fortescue (ASX:FMG), and BHP (ASX:BHP), while took profits from CBA (ASX:CBA), Mayne Pharma Group (ASX:MYX), Macquarie (ASX:MQG), and Telstra (ASX:TLS).

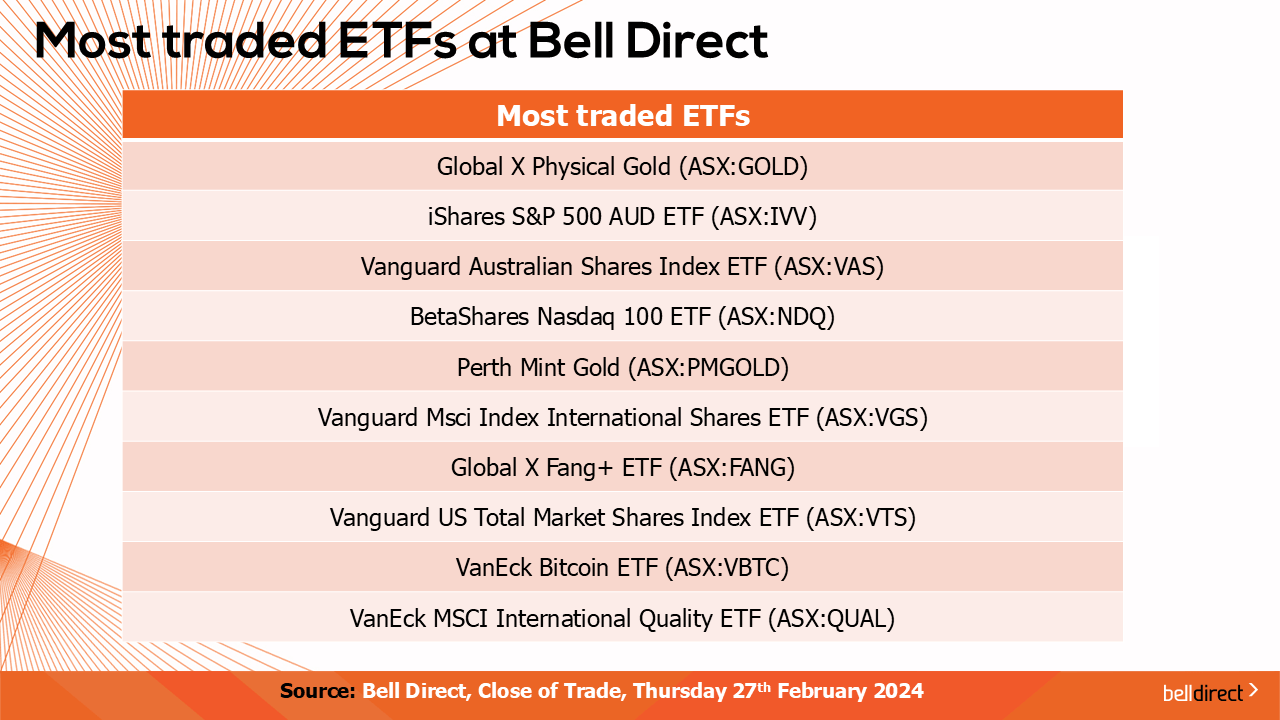

And the most traded ETFs were the Global X Physical Gold ETF, iShares S&P 500 ETF and the Vanguard Australian Shares Index ETF.

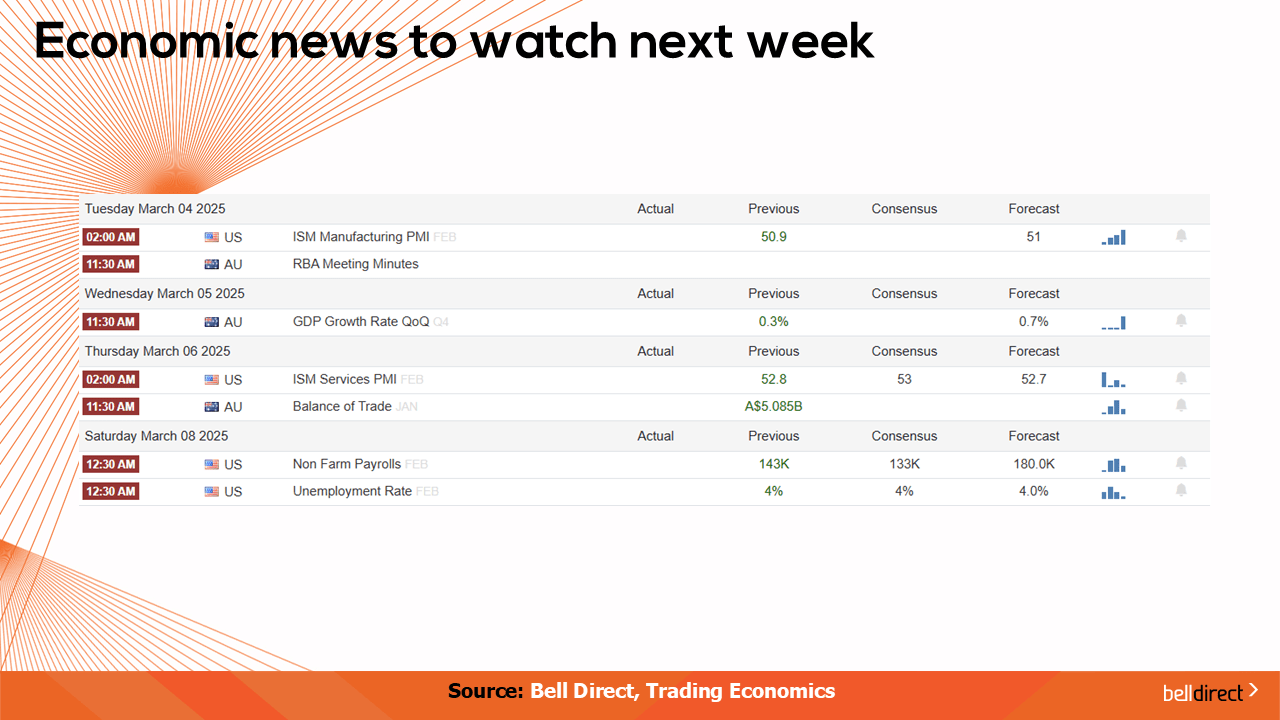

On the economic calendar next week, investors may respond to the RBA’s latest meeting minutes out on Tuesday, which will give some insight into the rate cut outlook, while Australia’s key trade balance data is out on Thursday for January, which will give a key insight into Australia’s trade activity in the first month of 2025.

Overseas, US unemployment rate data is out later in the week which will give an indication of the strength of the US labour market against inflationary and rate pressures.

And that’s the markets for this week. I’m Sophia Mavridis with Bell Direct. Have a great Friday and happy trading!