Transcript: Weekly Wrap 27 September

Locally this week the ASX started with a red run before investors regained optimism to rally the ASX over 8200 later in the week, all based on rate outlook both in Australia and the US.

This week, the RBA maintained the nation’s cash rate at 4.35% for the next period which investors and the market were expecting, but investors sent the ASX lower on Tuesday after the rate decision was handed down due to commentary out of Australia’s central bank signalling the most recent projections for inflation in Australia indicate that it will be some time yet before inflation substantially hits the target 2-3% range. Without inflation taming to the target 2-3%, the RBA’s elevated rate of 4.35% will continue to hurt earnings for companies with higher input costs and subdued demand due to a high cost of living environment for all Australians.

While headline inflation in Australia fell to an annual rate of 2.7% in August, key inflation drivers remain sticky which is prolonging the RBA’s rate cut outlook. Underlying inflation for the same period was 3.4% which is a step in the right direction but still too high for the RBA’s liking.

Key inflation drivers including house price inflation, input cost inflation, rental price inflation, insurance inflation, food, alcohol and tobacco inflation and retail sales. With each of these key drivers continuing to grow every month, the RBA’s job is far from done in combatting inflation in Australia. The impact of the higher interest rate environment is also hitting Australia’s economic growth with GDP easing to a mere increase of 0.2% for the June quarter, and 1% for the year to June. Higher for longer may be the view in Australia but in the US another issue is being faced, in the form of a possible recession.

The Fed’s aggressive rate hike strategy post-pandemic worked to cool inflation in the world’s largest economy, but it came at the cost of now verging on recession. With economic data in the US equal in favour of a recession and a soft landing, the Fed will need to monitor economic activity closely and possibly cut by a further 50bps at the next meeting to ensure a recession is avoided.

Elsewhere this week we saw some key corporate updates locally that saw major share price moves.

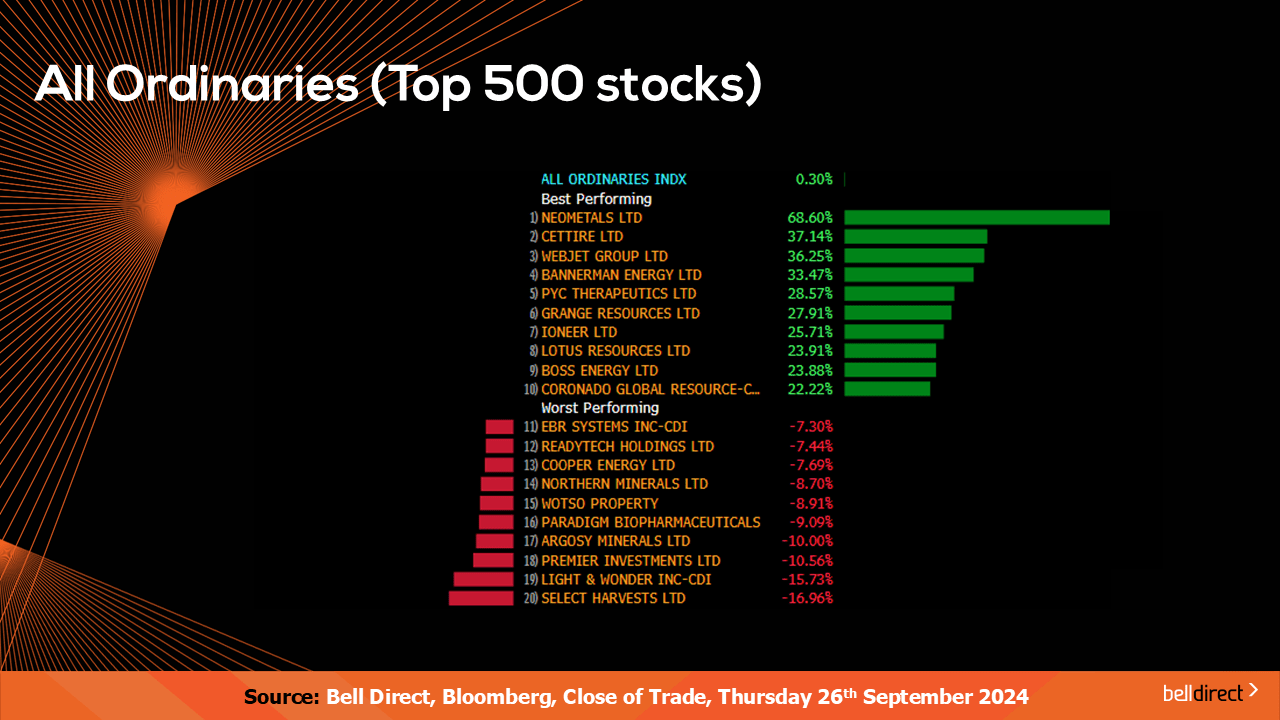

Luxury online fashion platform Cettire rocketed 75% on Tuesday after the company released its annual report for FY24 including gross revenue almost double that of FY23 to $978.3m, delivered margin of $155m, active customers hitting almost 700,000 and adjusted EBITDA of $32.5m. The results indicate despite the high cost of living environment, Australians and global consumers are still shopping in the luxury space.

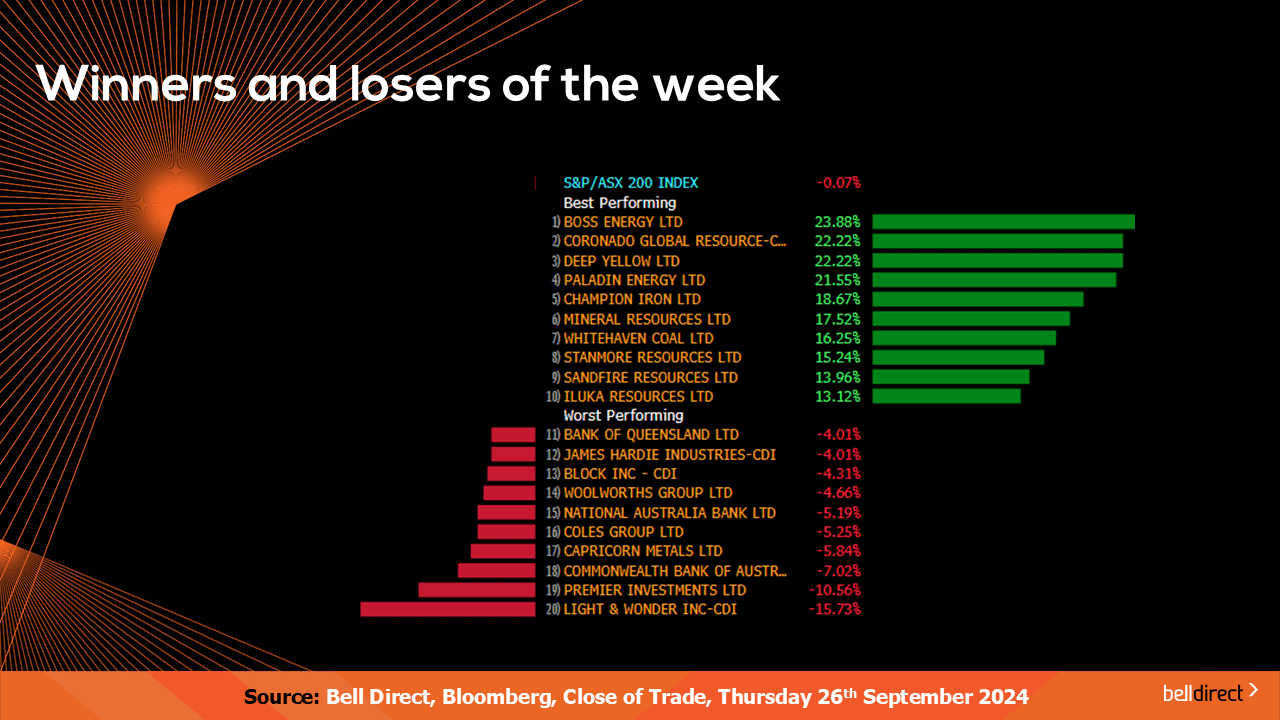

Boss Energy rallied earlier in the week with a gain of 11% in the aftermath of Microsoft announcing the signing of a deal with Constellation Energy to restore a nuclear power plant in the US of which Microsoft will purchase 100% of its power for AI ambitions for 20-years. This drives value for uranium and Boss Energy which has a 30% stake in the Alta Mesa uranium mine in South Texas.

And embattled casino giant Star Entertainment Group was in a trading halt at the time of releasing financial accounts outlining the group posted a $1.7bn loss in FY24, with shares expected to resume trading later this week.

Brickworks also released FY24 results this week that sent the share price shot up over 8% on Thursday. For the last financial year, Brickworks reported a statutory net loss of $119m which is a 130% increase on the last financial year, the company’s full year dividend rose 3.1% to 67cps, underlying EBITDA declined 80% to $157m and revenue fell 8% to $1.089bn. A slump in results that investors welcomed as the market may have been expecting much worse.

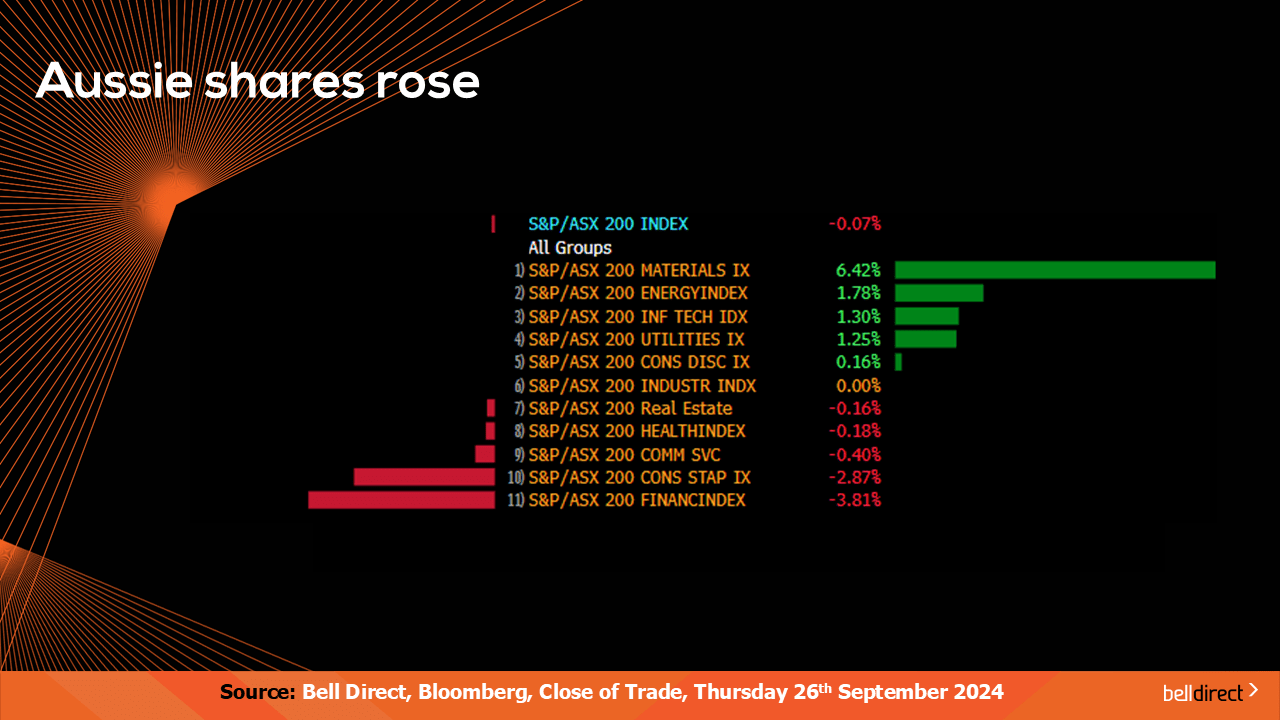

Locally from Monday to Thursday the ASX200 fell 0.07% in a very mixed trading week as investors digested key rate moves and economic data. Materials stocks soared 6.42% on a rise in the price of iron ore while financials fell 3.81%.

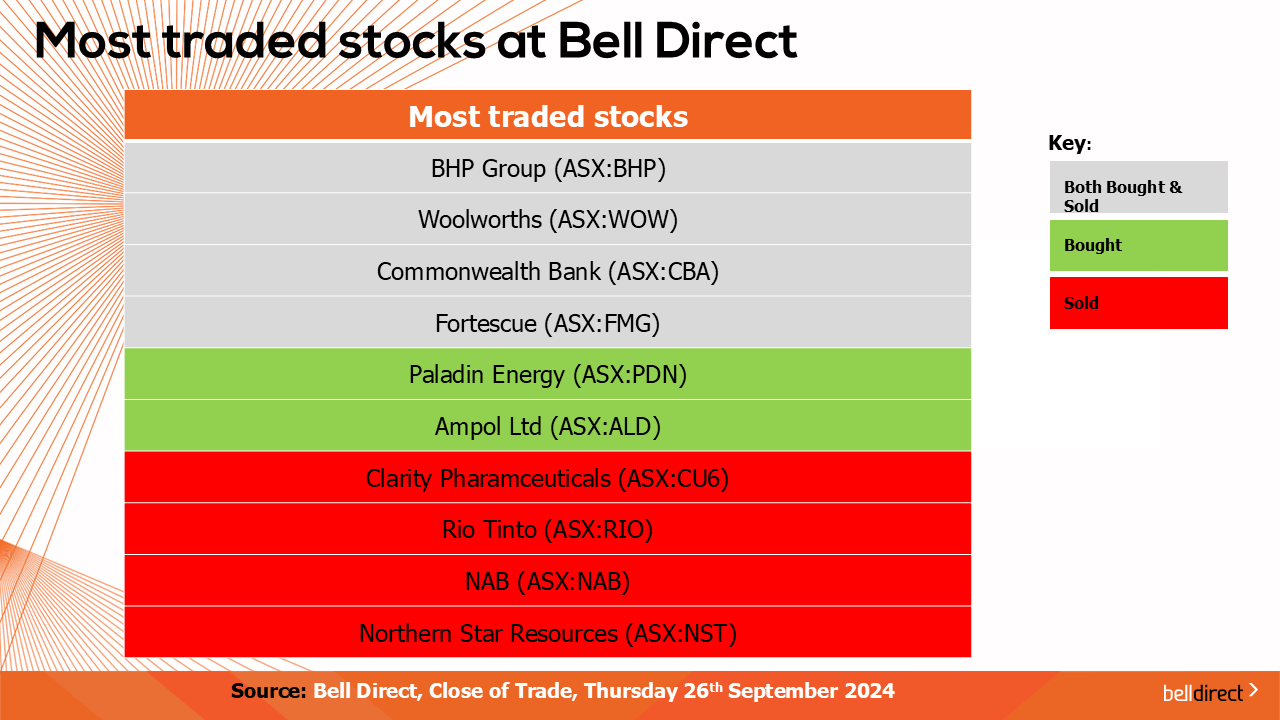

The most traded stocks by Bell Direct clients this week were BHP (ASX:BHP), Woolworths (ASX:WOW), CBA (ASX:CBA), and Fortescue (ASX:FMG). Clients also bought into Paladin Energy (ASX:PDN) and Ampol (ASX:ALD) while taking profits from Clarity Pharmaceuticals (ASX:CU6), Rio Tinto (ASX:RIO), NAB (ASX:NAB) and Northern Star Resources (ASX:NST).

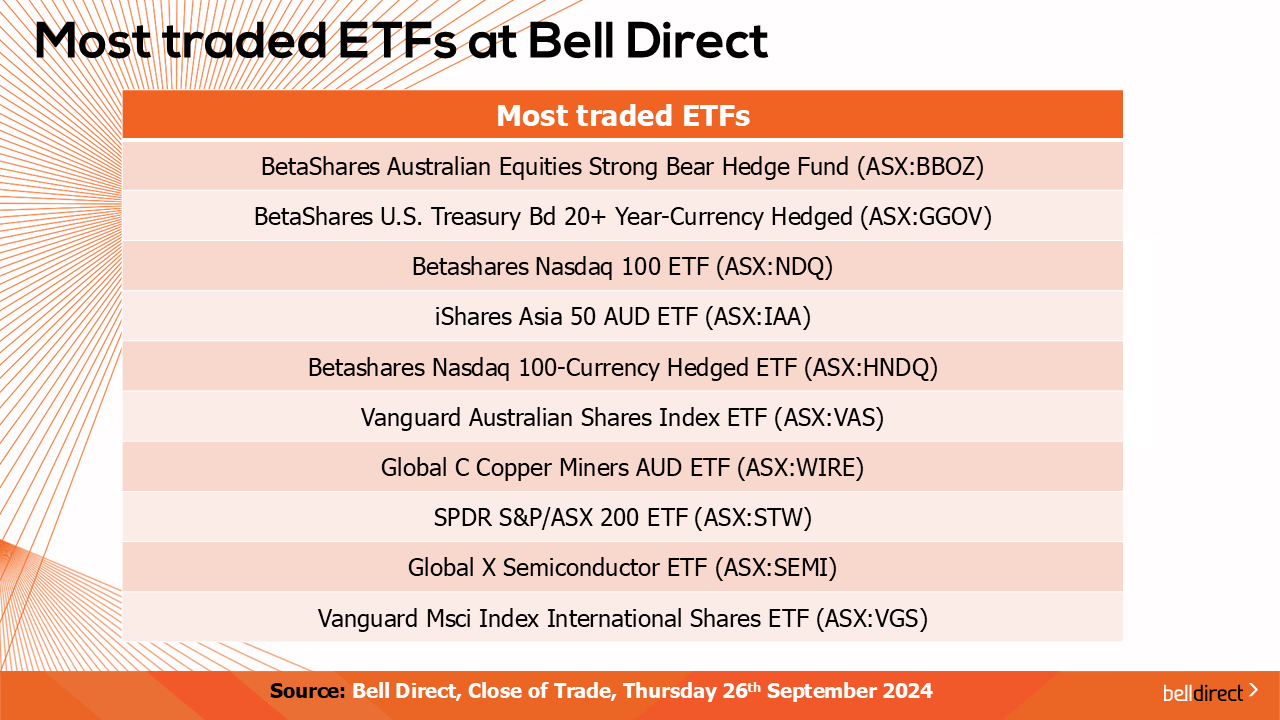

The most traded ETFs by our clients this week were led by BetaShares Australian Equities Strong Bear Hedge Fund, SPDR S&P/ASX Australian Government Bond ETF and Betashares Nasdaq 100 ETF.

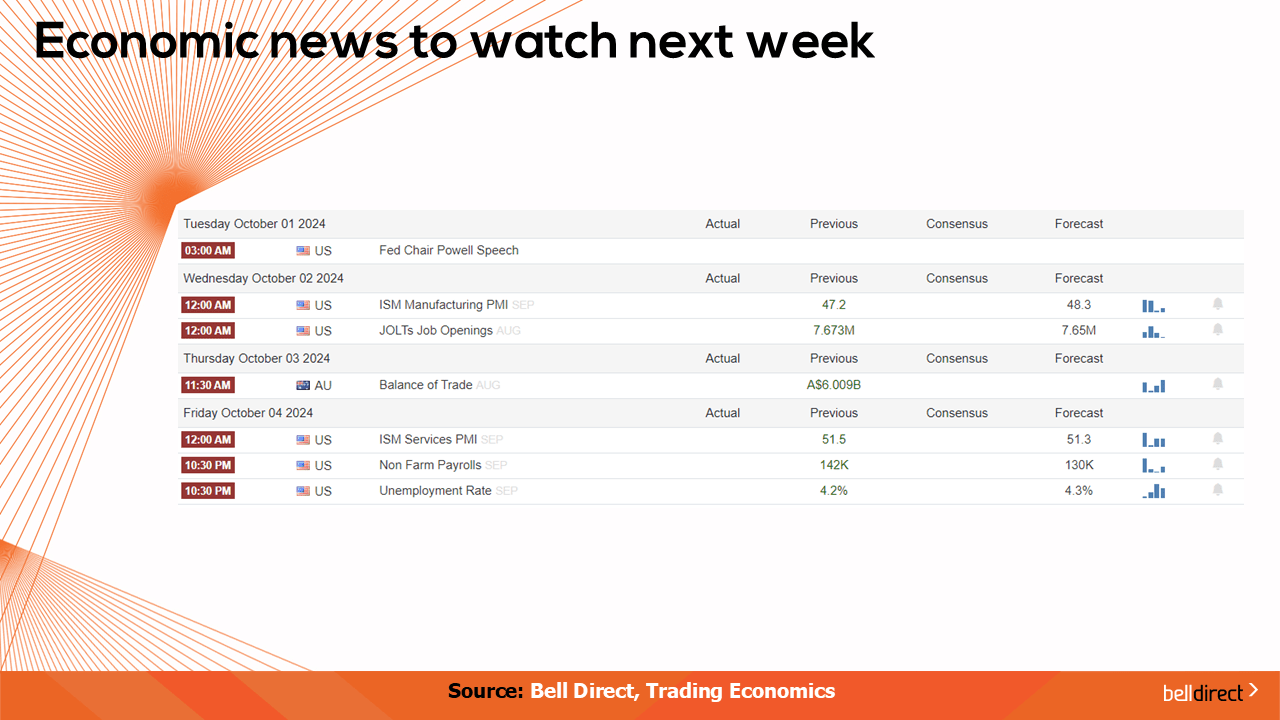

On the economic calendar front next week we can expect investors to react to Australia’s trade balance data out for August on Thursday.

Overseas, key Chinese economic data is out early in the week with manufacturing PMI out for September on Monday with the market expecting a slight increase from August.

In the US key manufacturing PMI and jobs data are out later in the week with the market expecting further easing in the labour market but an increase in manufacturing PMI.

And that’s all for this Friday, have a wonderful day and happy investing!