Author: Grady Wulff

This week, stubbornly sticky inflation and budget preparations presented a double blow for investor hopes of rate cuts in the near future. Australia’s latest CPI reading came in at a rise of 1% in the March quarter which was higher than the 0.6% rise in the December quarter and above the 0.8% economists were expecting. Annually, CPI rose 3.6% to the March 2024 quarter with the most significant contributors to the rise being education, health, housing and food and non-alcoholic beverages. Rents rose 2.1% and new dwellings purchased by owner-occupiers rose 1.1% indicating the housing crises continues to worsen.

While the markets are pricing in just a 4% chance of another rate hike out of the RBA, investors were still spooked by the idea of rates remaining elevated for longer as the RBA continues its efforts to tame inflation to the target 2-3% range.

The upcoming federal budget is also on the radar of investors as the RBA needs to account for above-average price growth and sticky inflation against a slowing economy when deciding monetary spend or cut decisions for the 2024-2025 budget.

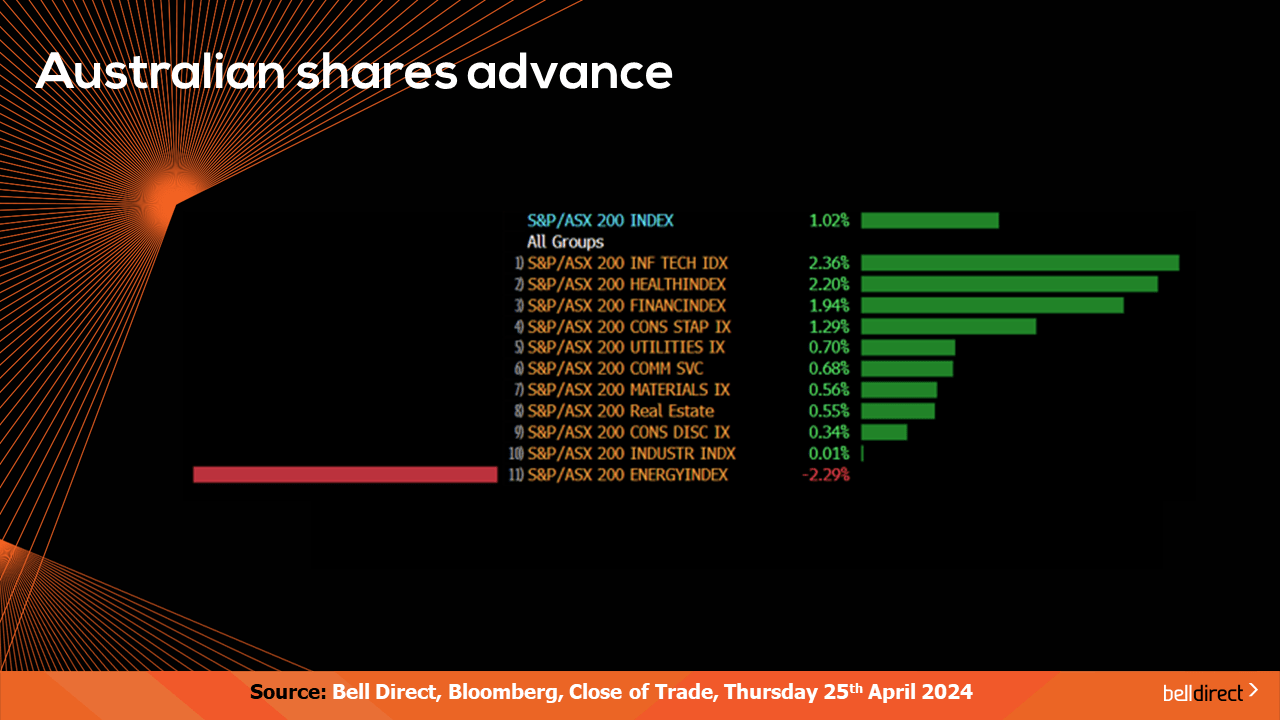

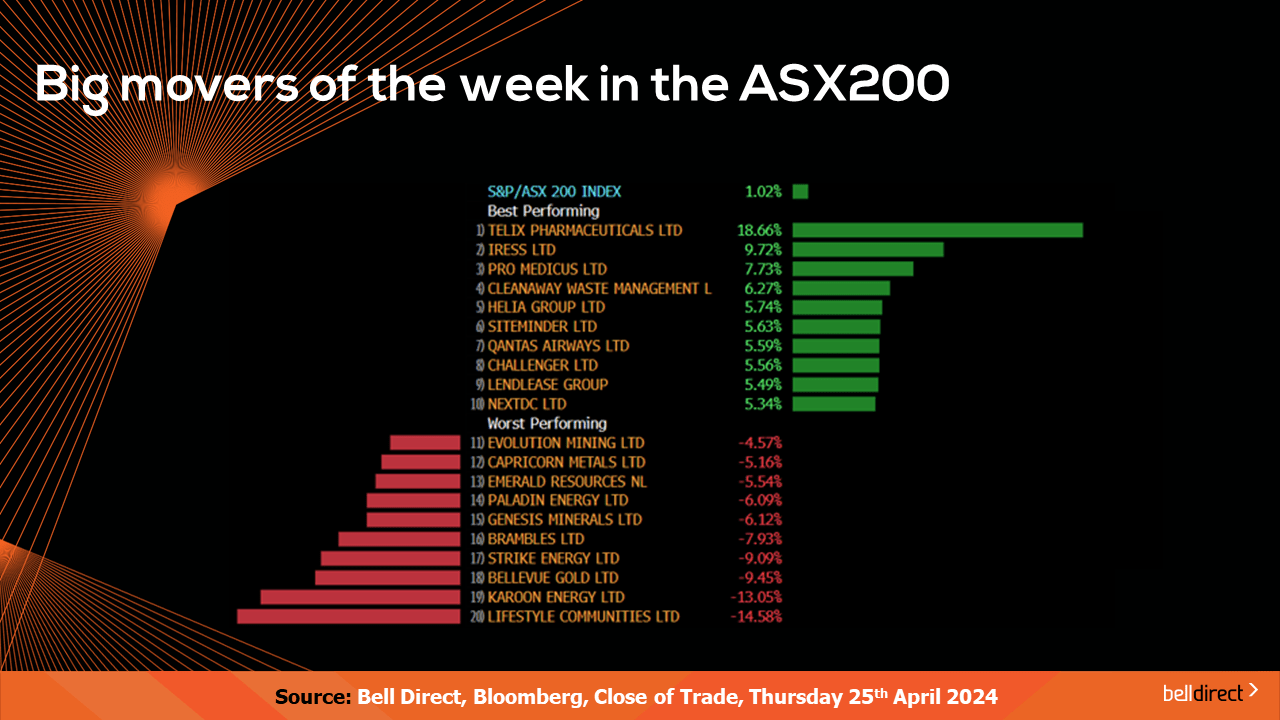

Across the trading week though, the ASX200 rose 1.02% buoyed by strong corporate earnings results and taking lead from Wall Street’s rebound rally this week. The tech-sector did most of the heavy lifting with a rise of 2.36% over the 3-trading days to Friday, while healthcare rose 2.2% boosted by the big healthcare names including Telix Pharmaceuticals (ASX:TLX) soaring 18.66% in the aftermath of the cancer imaging agent and therapy producer releasing strong Q1 results last week.

The energy sector was the only sector to end the trading week in the red with a decline of 2.29% on escalating geopolitical tensions and economic uncertainty.

Lifestyle Communities weighed on the ASX200 this week with a loss of 14.58% after the retirement communities company downgraded its settlements guidance for FY24. Gold miners also came under pressure this week in the sliding price of the precious commodity, with Bellevue Gold (ASX:BGL) falling 9.45%, Capricorn Metals (ASX:CMM) losing 5.16% and Evolution Mining (ASX:EVN) posting a 4.57% loss over the trading week.

Overseas, Wall Street rallied this week as investors shrugged off rate cut outlook concerns in favour of responding positively to strong corporate earnings results for the first quarter. So far this reporting period, 139 of the S&P500 companies have reported and 78.4% have beat expectations indicating corporate performance remains strong even as interest rates remain elevated.

Looking at the week ahead, Australia’s trade balance data for March is released next Thursday with the expectation of a rise in trade surplus to $7.9bn from $7.28bn in February.

Overseas, China’s all important NBS Manufacturing PMI for April is out on Tuesday with the forecast of a rise to 51.2 index points from 50.8 index points in March which will provide some evidence of continued recovery in China’s manufacturing industry.

GDP growth rate data is released next week for a number of key economies including France where it is expected the French economy grew 0.2% in Q1 from a 0.1% rise in Q4. European GDP growth rate data is also out on Tuesday with the expectation of a 0.2% rise QoQ in Q1.

In the US, the Fed’s interest rate decision will be handed down on Thursday with the expectation that the Fed will hold rates steady for another month, while key employment data is also out later next week with JOLTs job openings data for March, non-Farm payrolls data for April and the unemployment rate for April being released across Thursday and Friday. Economists are expecting the unemployment rate to remain at 3.8%, non-farm payrolls to increase by 190k, down from 303k in March and 8.7m new jobs to have opened in March.

And that’s all for this week, we hope you have a wonderful weekend and happy investing.