Transcript: Weekly Wrap 24 November

Australian retailers will be eagerly awaiting the commencement of Black Friday and Cyber Monday sales for a number of reasons as we close out 2023.

Firstly, it gives retailers an opportunity to move stock and reduce inventory levels through heavily discounted promotions. A key metric investors look for when choosing whether to invest in a retailer is the level of inventory the company holds. Fashion and retail businesses are cyclical in nature, therefore a company that holds a high level of inventory may find it difficult to sell down levels possibly leading to stock being written off or sold at a loss.

Secondly, some retailers will use this sale period as a way of gaining insight into consumer sentiment toward discretionary spend in the current high-cost-of-living environment, as well as what areas retail consumers are still spending in, and which are falling out of favour with Aussie consumers.

This period also allows retailers to gauge outlook toward consumer spend in the December holiday period. If consumers spend big in the Black Friday and Cyber Monday sales, we may see a dip in spend over the traditionally high-spend busy holiday and Christmas period as consumers are likely to snap up bargains to reduce the hip pocket damage come Christmas.

An increase in retail sales is one contributor to increased inflation and while spend has remained resilient in 2023, clothing, footwear and personal accessory retailing rose just 0.3% in September from August, against food retailing rising 1% and department store retail rising 1.7%. Clothing, footwear and personal accessory retailing has experienced very marginal, if not stagnated growth, since January 2023. Household goods retailing has come down from the recent peak in November 2022, which may prove a challenging headwind for the likes of Harvey Norman (ASX:HVN), Nick Scali (ASX:NCK) and Temple & Webster (ASX:TPW) this holiday season. Temple & Webster has made key strategic moves during the period of slowing demand though, by investing in AI to enhance the customer experience, and increased marketing spend to gain further market share in the furniture market.

While we are seeing some retailers struggle through the high cost-of-living environment, others continue to remain resilient including fashion jewellery retailer Lovisa (ASX:LOV) which rallied 2% this week after releasing a trading update at its AGM outlining overall sales up strongly, driven by the company’s strong global rollout strategy with the first store in China on the horizon soon.

Investors this sale season will be keeping a close eye on just how heavily some stock is discounted and what the implications are for the respective retailers in terms of revenue over the sale period compared to the Christmas season.

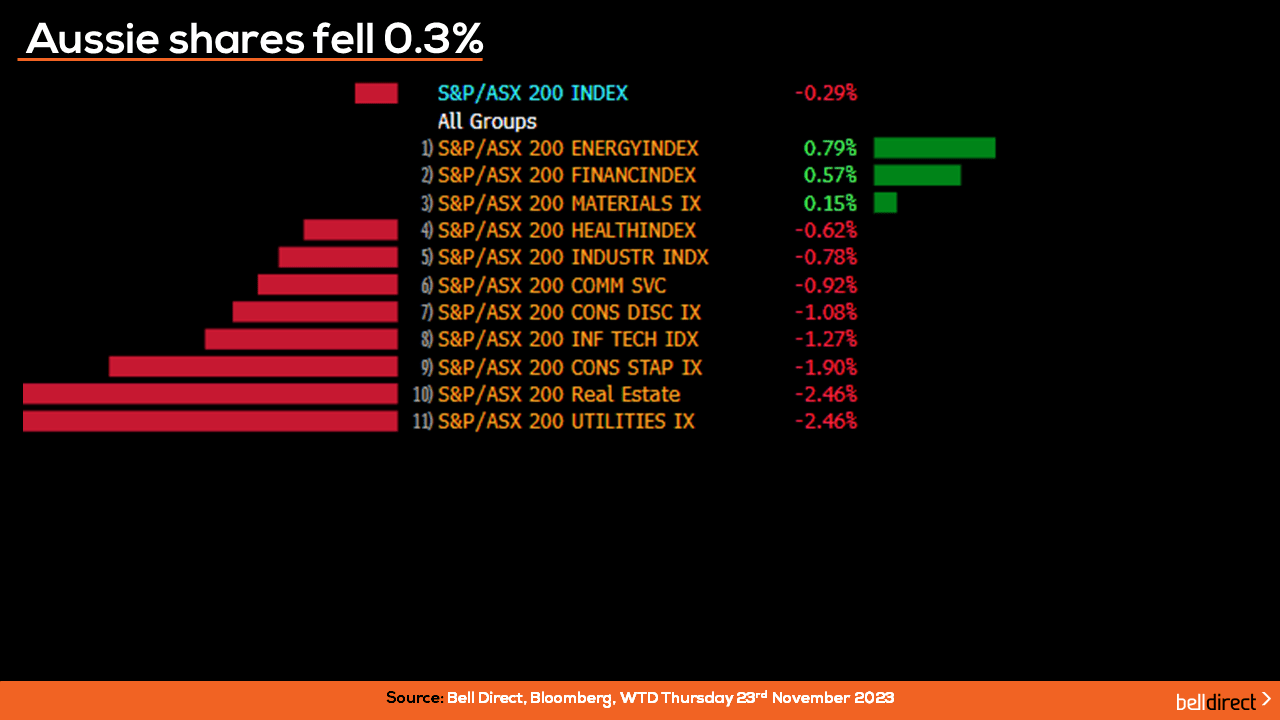

Locally from Monday to Thursday, the ASX200 fell 0.3% weighed down by the utilities and real estate sectors sliding 2.46% each. Materials and energy stocks managed to post respective gains however later in the week came under pressure amid the declining price of oil as OPEC+ delayed their next meeting aimed at adjusting oil output cuts to stabilise oil prices, while the price of iron ore dipped which dragged down the materials sector.

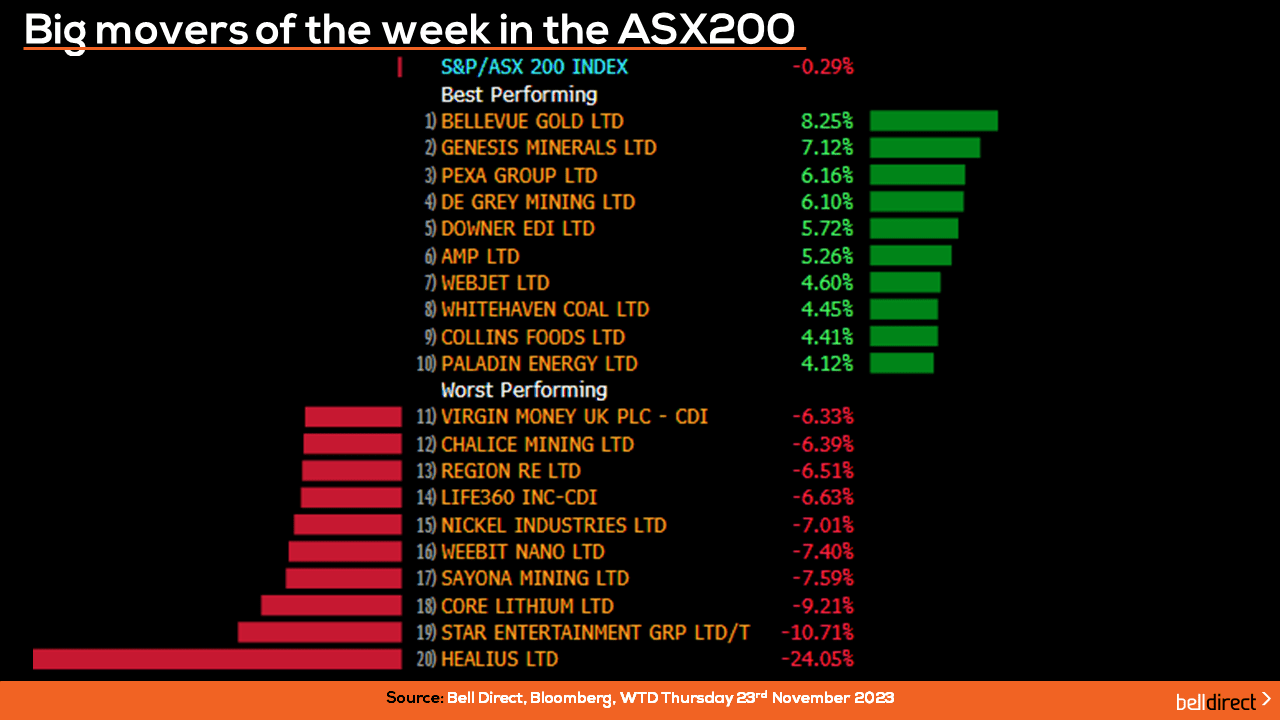

The winning stocks on the ASX200 over the four trading days were led by Bellevue Gold (ASX:BGL) rising 8.25%, Genesis Minerals (ASX:GMD) rising 7.12% and Pexa Group (ASX:PXA) adding 6.16%.

On the losing end, Healius (ASX:HLS) tanked over 24% after the company completed the institutional component of a heavily discounted entitlement offer. Star Entertainment Group (ASX:SGR) fell 10.71% over the week and Core Lithium (ASX:CXO) shed 9.21%.

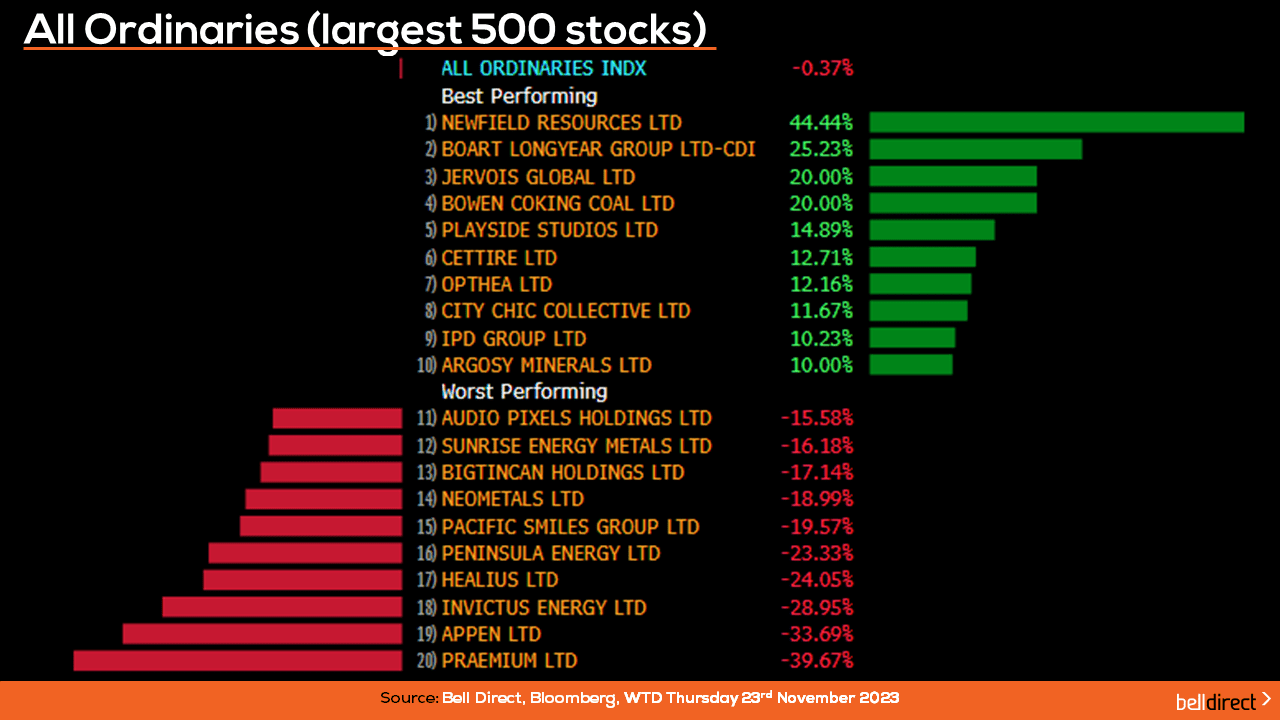

On the broader market, the All Ords fell 0.37% from Monday to Thursday, as Praemium tumbled almost 40% after the investment platform released a disappointing trading update including the expectation of a 20% decline in EBITDA for the first half of FY24. Appen (ASX:APN) tanked 34% and Invictus Energy (ASX:IVZ) lost 29% over the four trading days.

Newfield Resources (ASX:NWF) offset some of the heavy losses among the All Ords by soaring 44.44% this week, while Boart Longyear Group (ASX:BLY) rose over 25% and Jervois Global (ASX:JRV) added 20%.

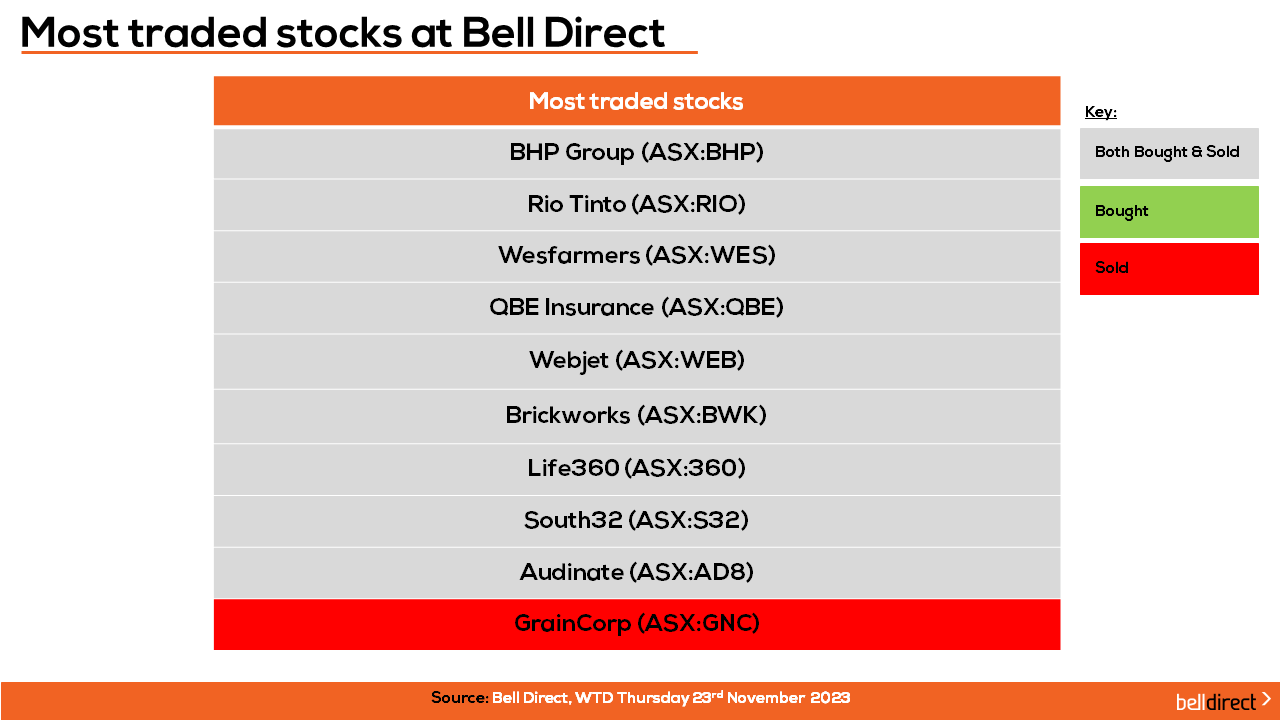

The most traded stocks by Bell Direct clients over the week were BHP (ASX:BHP), Rio Tinto (ASX:RIO), Wesfarmers (ASX:WES), QBE Insurance (ASX:QBE), Webjet (ASX:WEB), Brickworks (ASX:BKW), Life360 (ASX:360), South32 (ASX:S32), and Audinate (ASX:AD8).

Clients also sold out of GrainCorp (ASX:GNC) over the four trading days.

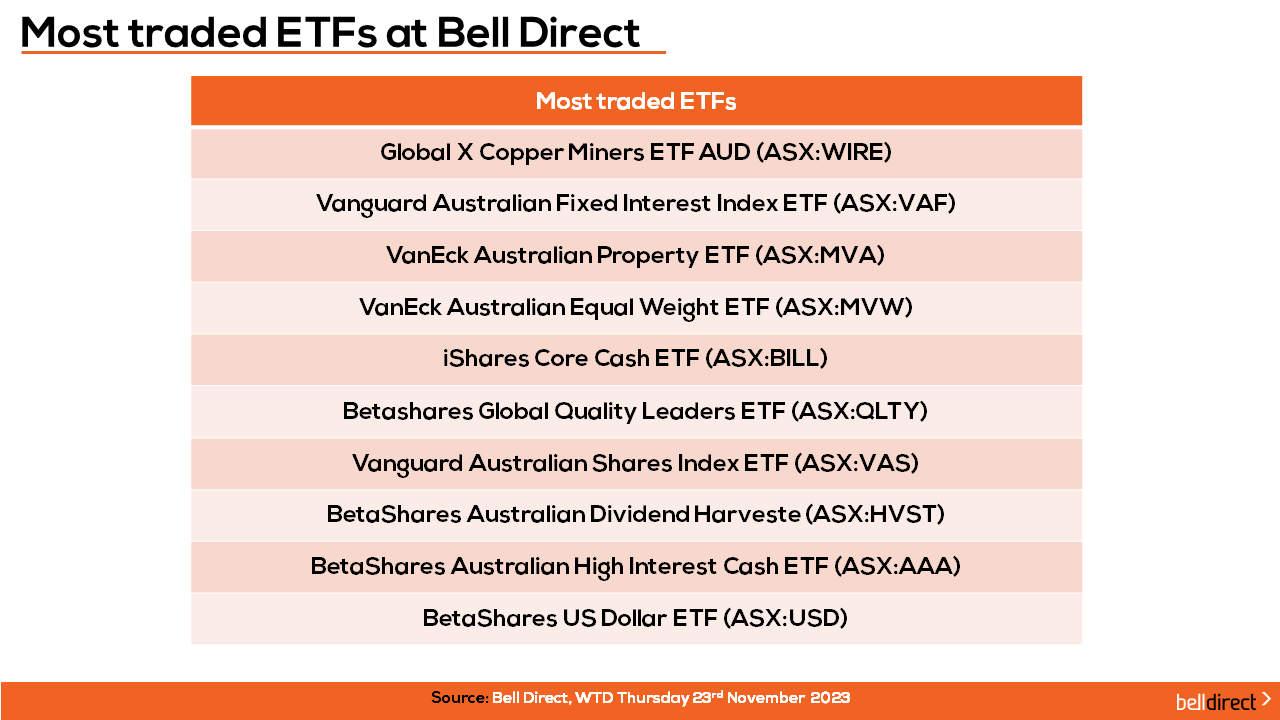

On the diversification front, the most traded ETFs by Bell Direct clients from Monday to Thursday were Global X Copper Miners ETF AUD, Vanguard Australian Fixed Interest Index ETF and VanEck Australian Property ETF.

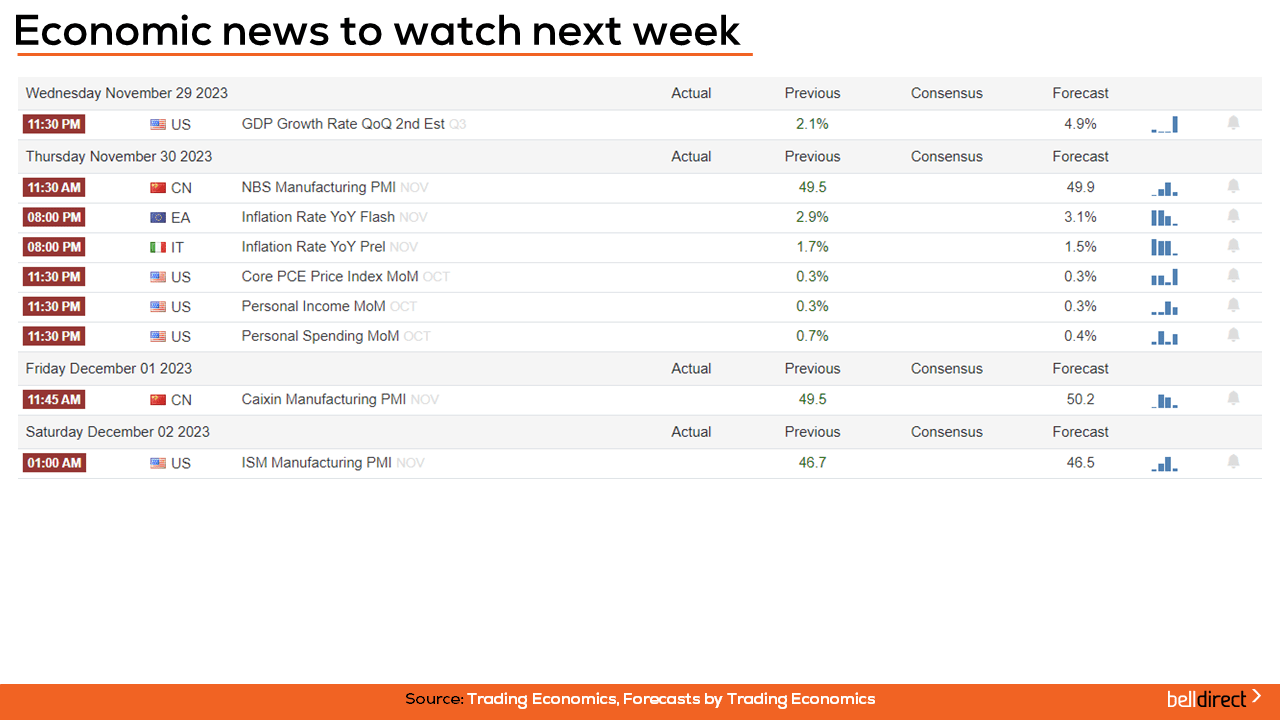

Looking to the week ahead, US GDP growth rate data for Q2 is out on Wednesday with the market forecasting economic growth of 4.9%, from the previous 2.1% expansion. US personal income and spending data is also out on Thursday which will give the market an insight into how Americans are coping financially in the high interest rate environment.

In China, key manufacturing data is out later next week which is expected to show a slight rise in the manufacturing sector, which may spark a rally for our local iron ore miners as this will provide a sign of economic recovery from Australia’s number one iron ore importer.

And that’s all we have time for today, have a wonderful weekend and as always, happy investing!