Transcript: Weekly Wrap 24 January

Trump 2.0 kicked off with a bang this week on an economic and global market front with a rally boosting tech stocks while markets in the APAC region came under pressure over mounting fears of tariffs imposed on China. Let’s dive into what announcements moved markets this week and key corporate results that had investors fighting for to buy shares.

This week, the 47th President of the United States announced 25% tariffs on goods from Mexico and Canada twill come into effect from February 1, which will see around 30% of the value of goods imported into the US last year, increase in cost to US citizens as the tax on the goods will most likely be passed onto US customers through price hikes. Cars and car parts will be a key area that is hit by the tariffs as the US imported over US$140bn worth of motor vehicles and parts from Mexico last year. And from Canada, the US imported US$97bn worth of oil and gas from Canada last year. So while Trump’s tariffs intend to increase the cost to providers in Mexico and Canada, the tariffs will most likely be passed onto US customers through increased pricing for the imported goods.

On the China tariff front, it appears Trump’s bark was bigger than his bite when it came to implementing heavy tariffs on the world’s second largest economy. Prior to his inauguration, Trump had warned of tariffs on China up to 60%, but since taking office, the new President has said a 10% tariff is TBC. Mr Trump has now said that if China doesn’t sell a 50% stake in TikTok to the US through a joint venture, the China tariffs will go ahead and TikTok will be banned in the US. This move comes just days after the President stopped the TikTok ban in the US after just 10 hours of the app being blocked.

The tariffs were the big talk of Trump’s first few days back in office, but, over the coming months markets will closely watch how the President proposes to increase mining, restrict immigration, and tax cuts and other policies unfold.

So how have we seen investors react to Trump’s inauguration locally this week? The financials and gold stocks were popular this week as investors sought out safe-haven assets to bolster their portfolios in a time where uncertainty is riding high. The tech sector locally also rallied as investors took confidence in the high growth sectors’ earnings potential after Netflix posted its biggest quarterly subscription gain in Q4, signalling consumer demand remains strong.

Elsewhere in the market this week we had the release of some key trading updates from Aussie listed companies that impressed investors despite the tough operating conditions of a sticky inflation and elevated interest rate environment.

Bub’s Australia (ASX:BUB) soared 22.5% on Wednesday after the infant formula producer reported a sharp turnaround in 1H earnings with the company achieving EBITDA of $2.9m following a $6.8m loss in the PCP.

Liontown Resources (ASX:LTR) led the ASX200 gains on Tuesday with a rise of almost 12% after the lithium miner released a second quarter update including a 215% rise in spodumene concentrate QoQ, a 651% increase in spodumene concentrate shipments and a 674% rise in total revenue to $89.8m.

And Netwealth (ASX:NWL) shares rallied over 2% after the investment platform released a quarterly update revealing record quarterly FUA net inflows of $4.5bn, representing an increase of almost 70% on the PCP and is the second consecutive quarter of record quarterly inflows.

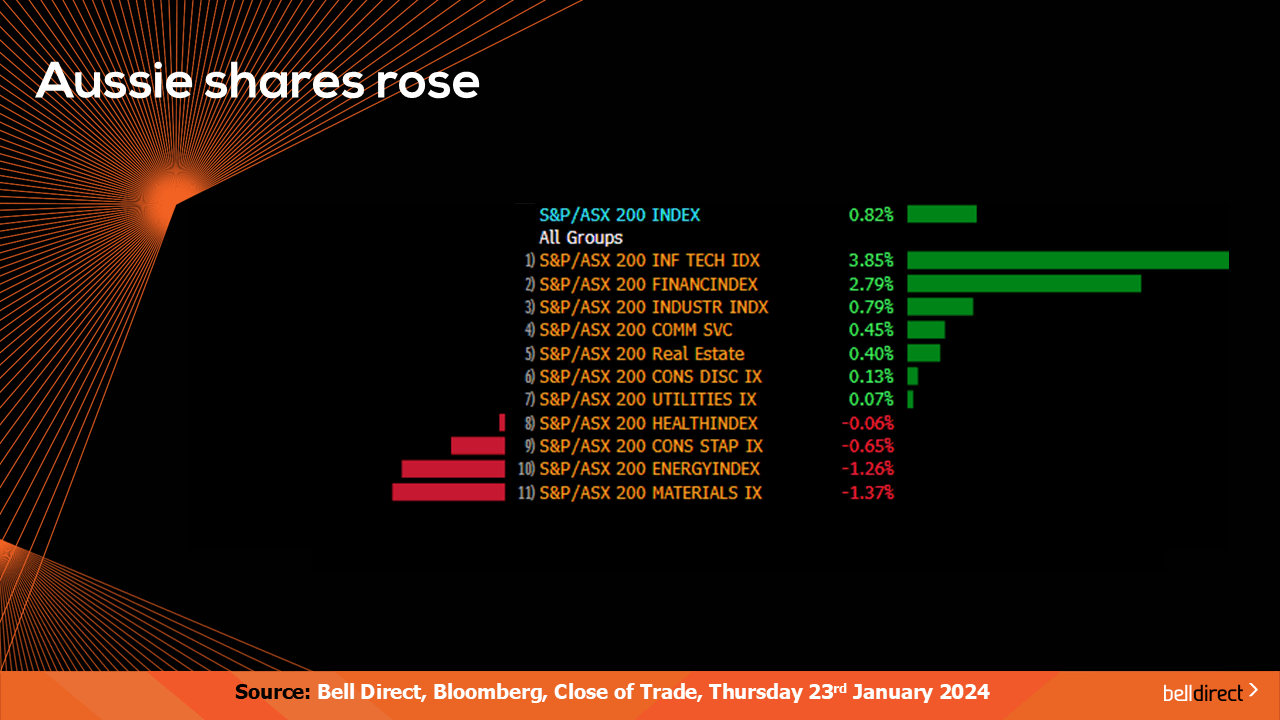

Locally from Monday to Thursday the ASX200 posted a gain of 0.82% led by strength for tech, financials and industrials stocks. The local market also took strong lead from Wall Street’s Trump rally that saw the S&P500 hit a fresh record this week.

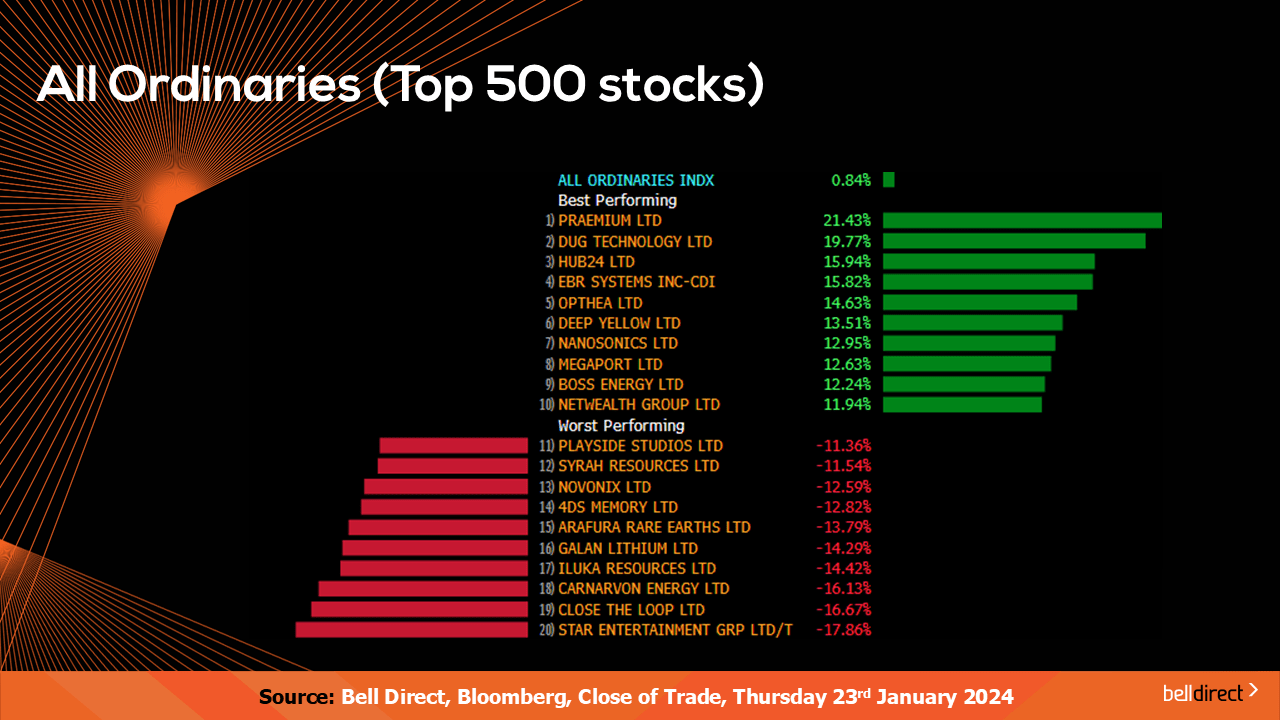

The winning stocks on the key index this week were led by HUB24 (ASX:HUB) gaining almost 16%, while Deep Yellow (ASX:DYL) rose 13.51% and Megaport (ASX:MP1) ended the week up 12.63%.

And on the losing end Star Entertainment’s (ASX:SGR) woes worsened as the embattled casino operator tumbled 17.86%, Iluka Resources (ASX:ILU) fell 14.42% and Sigma Healthcare (ASX:SIG) ended the week down 6.71%.

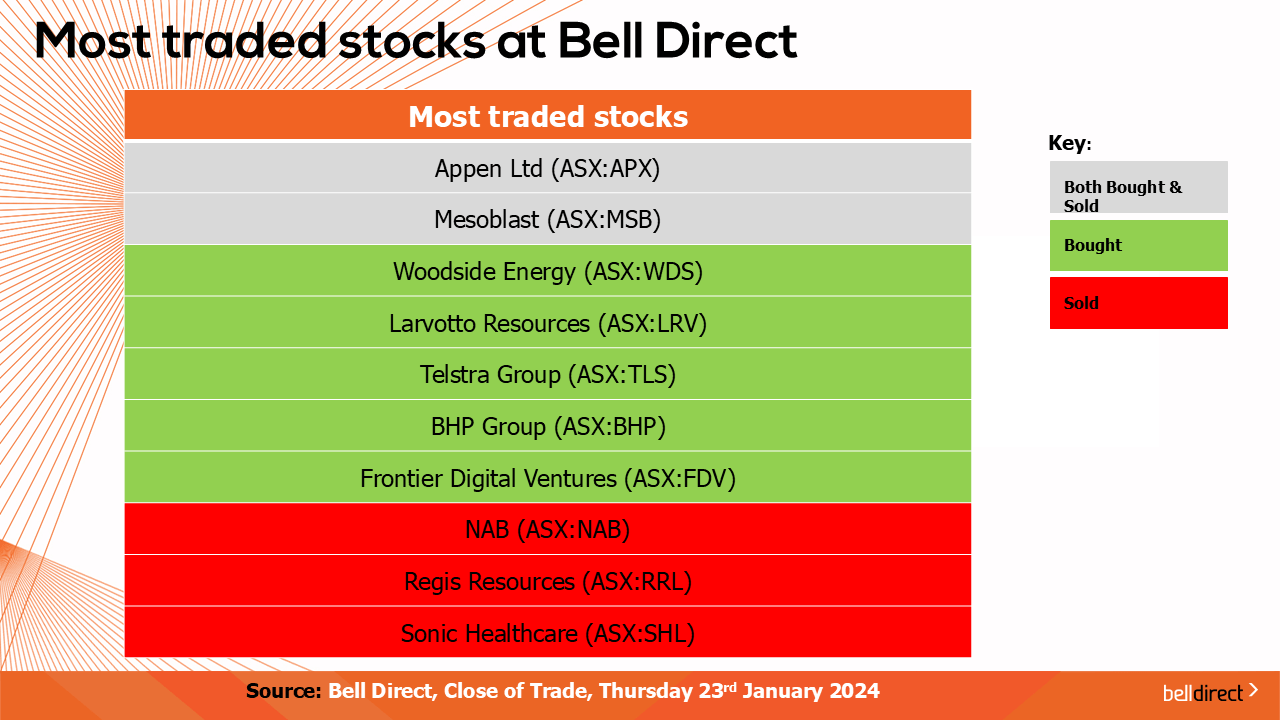

The most traded stocks by Bell Direct clients this week were Appen (ASX:APX), and Mesoblast (ASX:MSB). Clients also bought into Woodside (ASX:WDS), Larvotto Resources (ASX:LRV), Telstra Group (ASX:TLS), BHP (ASX:BHP), and Frontier Digital Ventures (ASX:FDV), while clients took profits from NAB (ASX:NAB), Regis Resources (ASX:REG), and Sonic Healthcare (ASX:SHL).

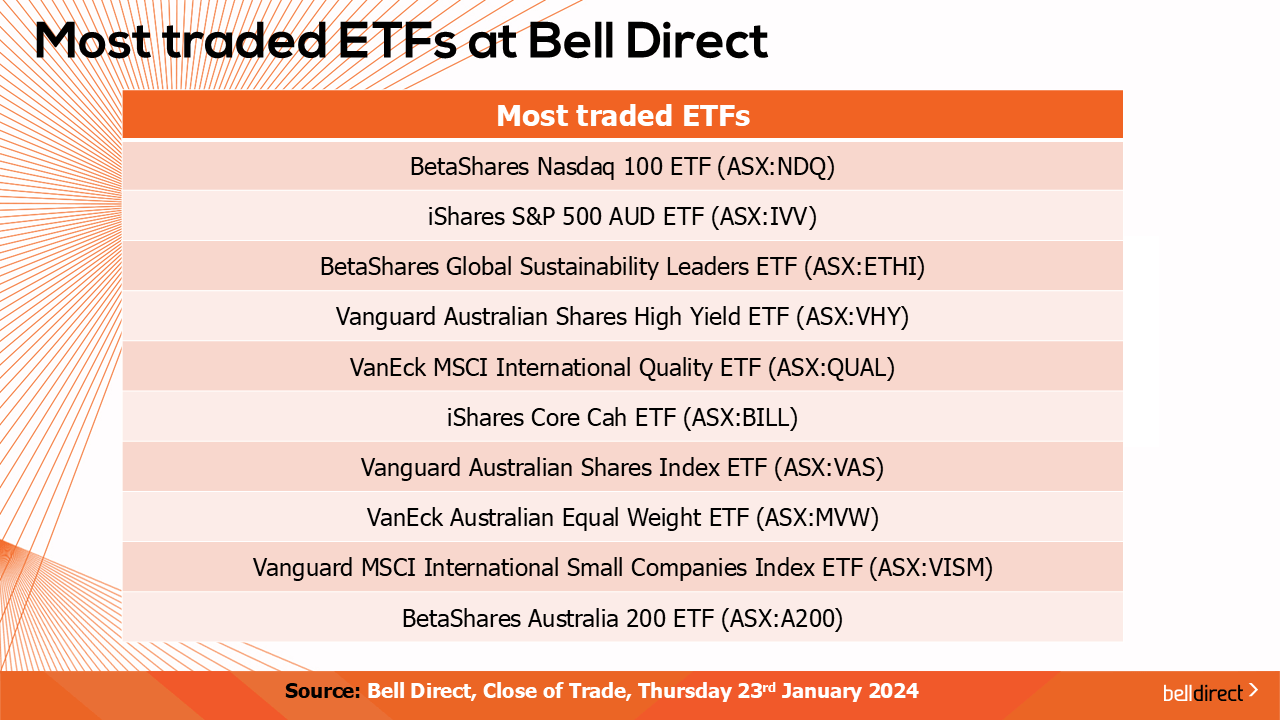

And the most traded ETFs were led by Betashares Nasdaq 100 ETF, iShares S&P 500 AUD ETF and BetaShares Global Sustainability Leaders ETF.

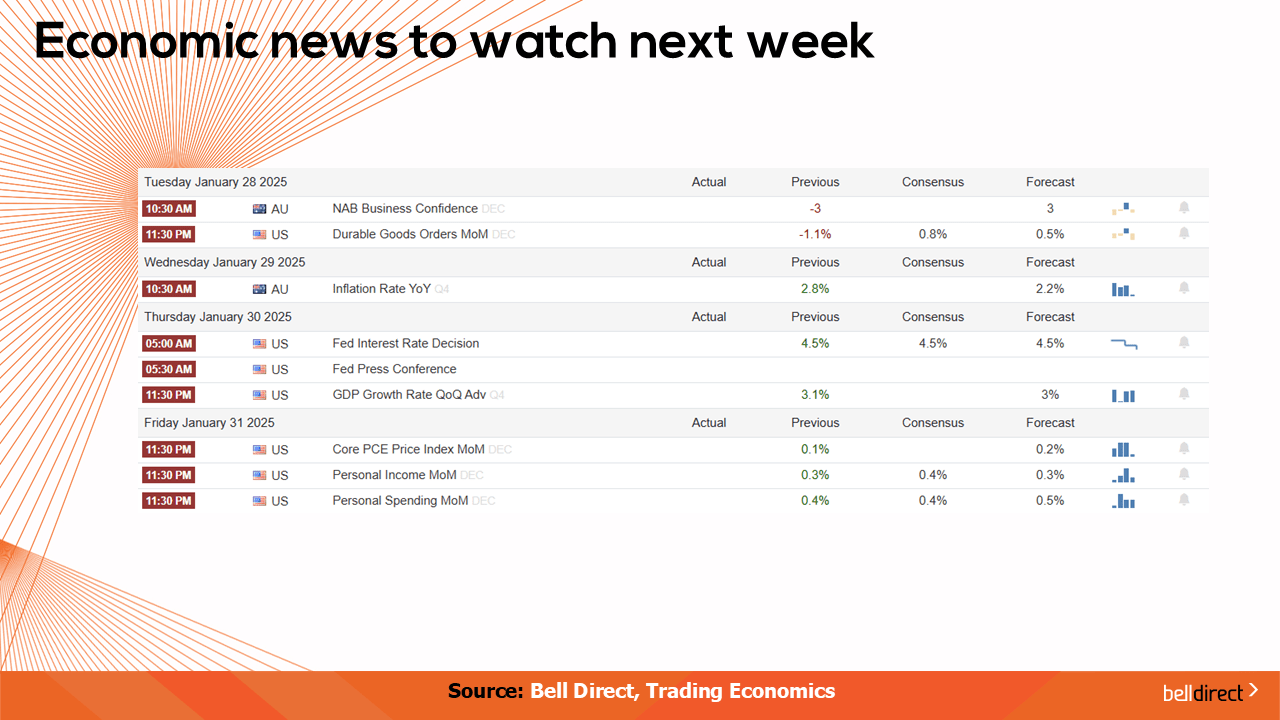

On the economic calendar front next week, we may see investors locally react to Australia’s inflation Rate data for Q4 is out on Tuesday with the forecast of a decline in inflation to an annual rate of 2.2% from the 2.8% reported in Q3.

Overseas, China’s Manufacturing PMI is out on Monday with the forecast of a rise in factory activity. In the US on Thursday the Fed’s latest rate decision will be handed down with the market expecting the Fed to maintain the current cash rate as inflation shows signs of rebounding.

And that’s all for this Friday and week, have a wonderful weekend and happy investing!