Transcript: Weekly Wrap 23 June

Thank you for joining me this Friday the 23rd June, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update.

While lithium was the word of 2022 and the green commodity has recovered from lows experienced over the first 5-months of 2023, we are seeing the big miners and even smaller names exploring further into alternative battery metals especially over the last week as decarbonisation ramps up across not only the mining sector, but as a central theme in global economies too. Understanding the EV movement includes knowing that lithium-ion batteries are made up of graphite, aluminium, nickel, manganese, cobalt, steel, copper, iron and lithium, notably, graphite makes up 28.1% of the overall battery. Given the EV battery makeup comprises many metals, the appetite for explorers and producers of such metals has increased in 2023 from both an investor, and mining giants’ point of view.

This week, Rio Tinto (ASX:RIO) announced is it spending another US$498m in its Kennecott copper mine near Salt Lake City, Utah, to strengthen its supply of copper in the US by commencing underground mining at scale and improving the health of key assets. Rio Tinto Copper Chief Operating Officer Clayton Walker said ‘We are investing to build a world class underground mine at Kennecott to meet the growing demand for copper in the US, a key material for domestic manufacturing and energy transition’. On the same day Rio announced further spend in the copper space, BHP Group (ASX:BHP) released an ‘Operational Decarbonisation Investor Presentation’ to the market outlining the mining giant’s progress to reducing operational emissions by at least 30% by 2030 and a goal to achieve net zero operational emissions by 2050. The investor decarbonisation update includes an update on BHP’s ambition to power operations through 100% renewable energy, displace diesel used for cathode production through thermos-solar solution execution, and desalination or conveyance systems powered by renewable energy. BHP provided a CAPEX guidance of US$4bn to FY30, with majority of this being spent at the end of the decade to allow newer technologies to mature, while also illustrating the significant cost savings from future investments to FY30.

While BHP focuses on net zero by 2050, the company is also delving into the battery metals space through the completion of its acquisition of Oz Minerals, a copper miner with assets based in South Australia.

On the smaller more concentrated scale, we know the mergers and acquisitions market is red-hot in the battery metals segment, with Delta Lithium (ASX:DLI) catching the eye and funds of mining magnates Gina Rinehart and Mineral Resources Managing Director, Chris Ellison as they each snapped up some shares in the junior lithium miner with assets in Western Australia.

With graphite making up a major part of the EV battery composition, Talga Resources (ASX:TLG) is on the radar of Bell Potter analysts’ for its mining operations and associated downstream anode processing facilities in Northern Sweden offering a vertical integration solution to EV manufacturers in Europe. Just this week, shares in Talga rose over 2% after the graphite miner announced the European Investment Bank has provided 150 million euros in debt funding to support TLG’s Vittangi natural graphite anode business. The debt funding has come at a crucial time as Talga is set to receive an update on the status of the Nunnasvara South natural graphite mine permit soon and the permit for the Lulea Refinery is also pending. When it comes to investing in the battery metals industry, there are a few things to keep in mind. Timeline to production, CAPEX and cost allocations, and progression among competitors in green energy.

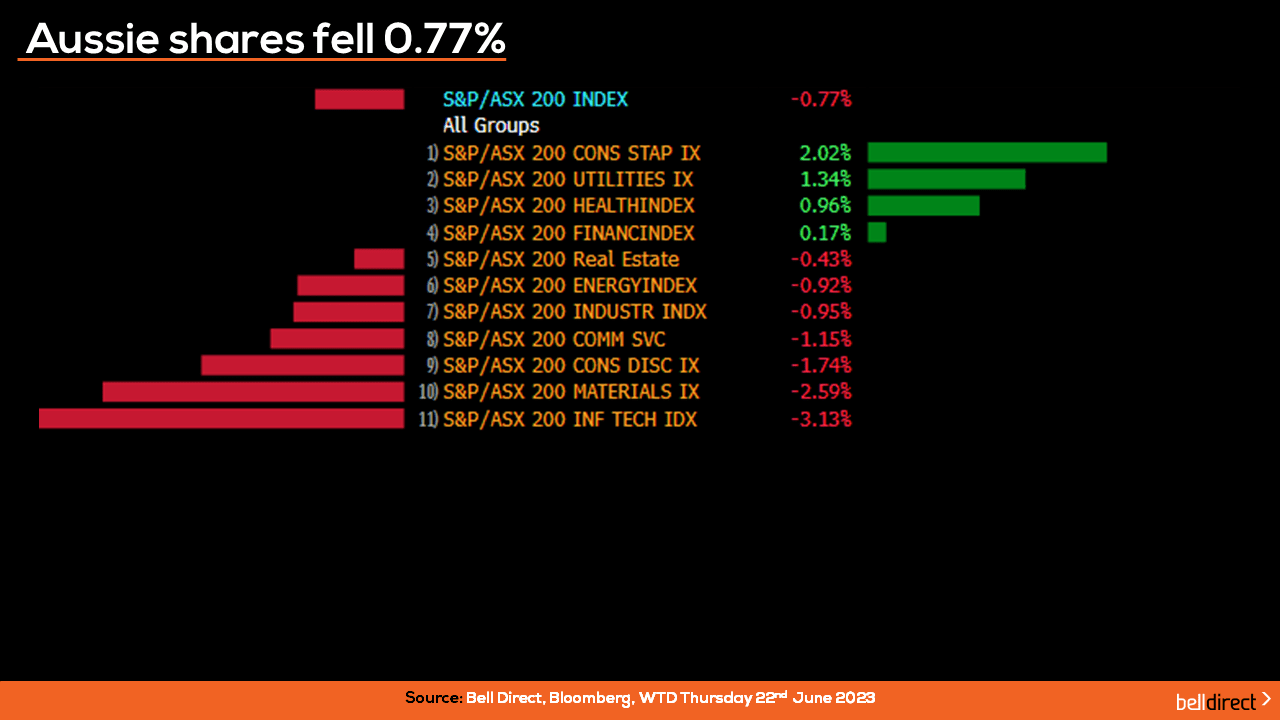

Locally from Monday to Thursday, the ASX200 fell 0.77% as the recent rally for information technology stocks lost steam with the sector closing 3.13% lower over the four days, while investors bought into consumer staples stocks which are generally more likely to hold their value in a high interest rate, high inflation environment.

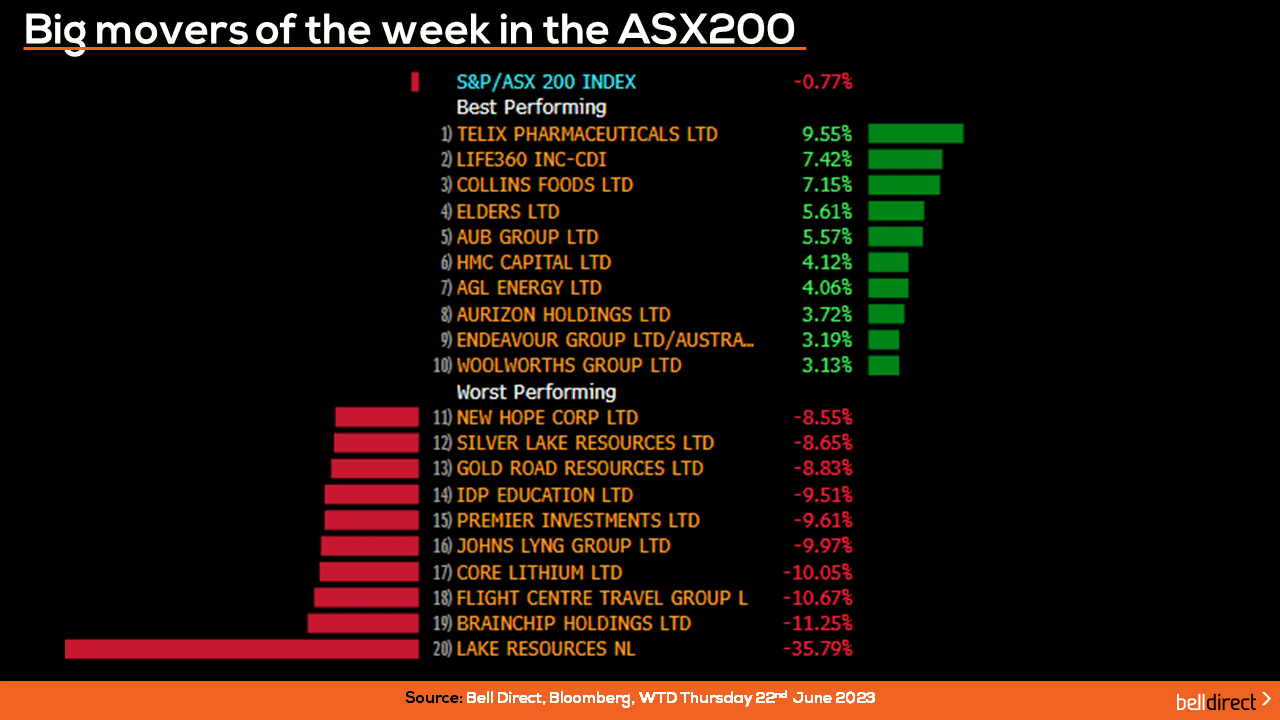

The winning stocks over the four days were led by Telix Pharmaceuticals (ASX:TLX) which hit a record high share price after announcing the acquisition of UK-based medical device firm Lightpoint Medical. Life360 (ASX:360) rallied 7.42% over the week and Collins Foods (ASX:CKF) added 7.15%.

On the losing end, Lake Resources (ASX:LKE) tanked 35.79% after the miner delayed its expected production date at the Kachi project in Argentina by 3-years through a new two-phase development plan. BrainChip Holdings (ASX:BRN) and Flight Centre (ASX:FLT) also lost 11.25% and 10.67% respectively.

On the broader market front, the All Ords fell 0.94% from Monday to Thursday weighed down by Jervois Global (ASX:JRV) losing 20% and Magnis Energy Technologies (ASX:MNS) diving 17.65%. Some of the heavy losses were offset by Vitura Health (ASX:VIT) gaining 24% and PointsBet Holdings (ASX:PNH) lifting 20.88% on takeover interest in its North American business.

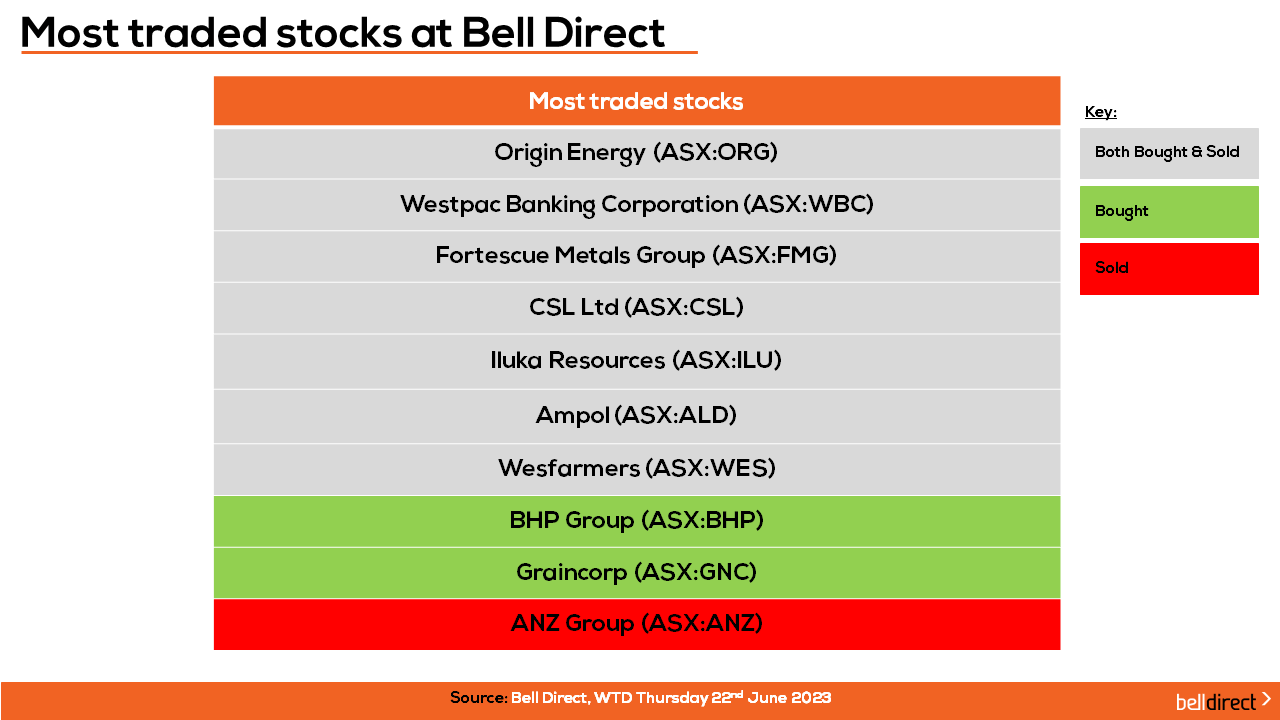

The most traded stocks by Bell Direct clients over the four days were Origin Energy (ASX:ORG), Westpac Banking Corporation (ASX:WBC), Fortescue Metals Group (ASX:FMG), CSL Limited (ASX:CSL), Iluka Resources (ASX:ILU), Ampol (ASX:ALD), and Wesfarmers (ASX:WES).

Clients also bought into BHP Group (ASX:BHP), and GrainCorp (ASX:GNC), while taking profits from ANZ Group Holdings (ASX:ANZ).

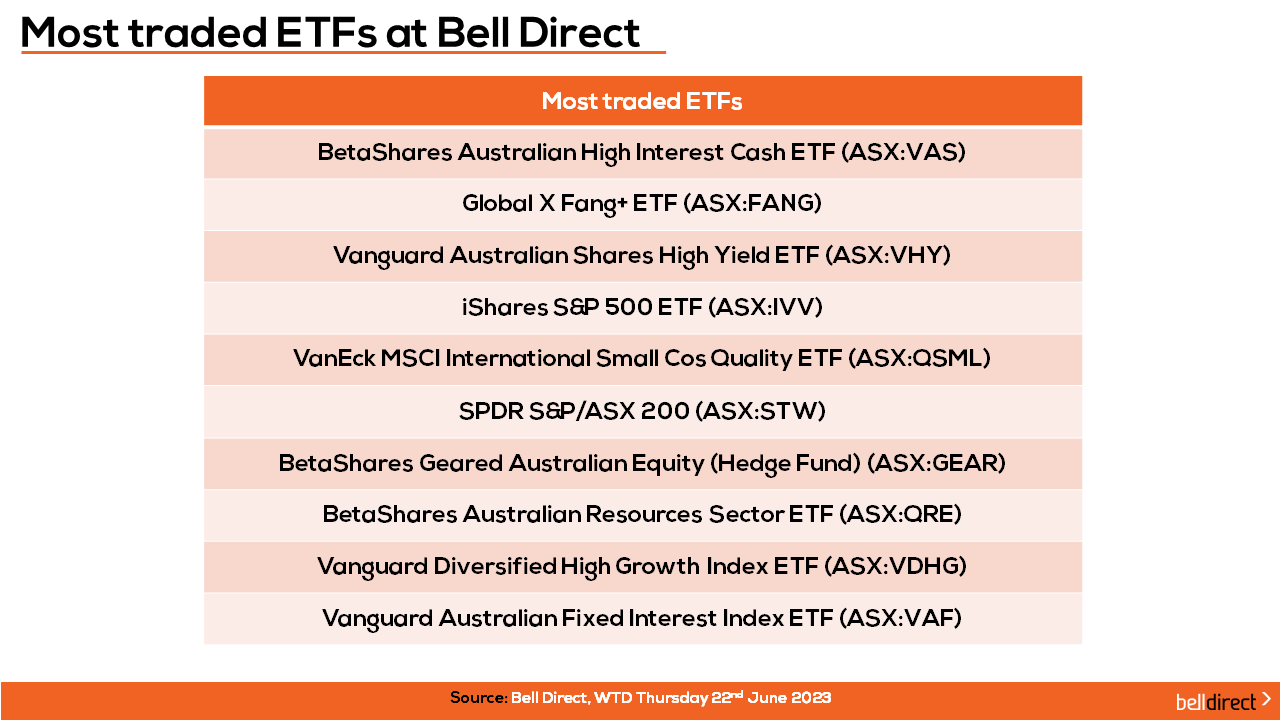

And taking a look at diversification, the most traded ETFs by Bell Direct clients this week were the Vanguard Australian Shares Index ETF (ASX:VAS), Global X Fang+ ETF (ASX:FANG), and Vanguard Australian Shares High Yield ETF (ASX:VHY).

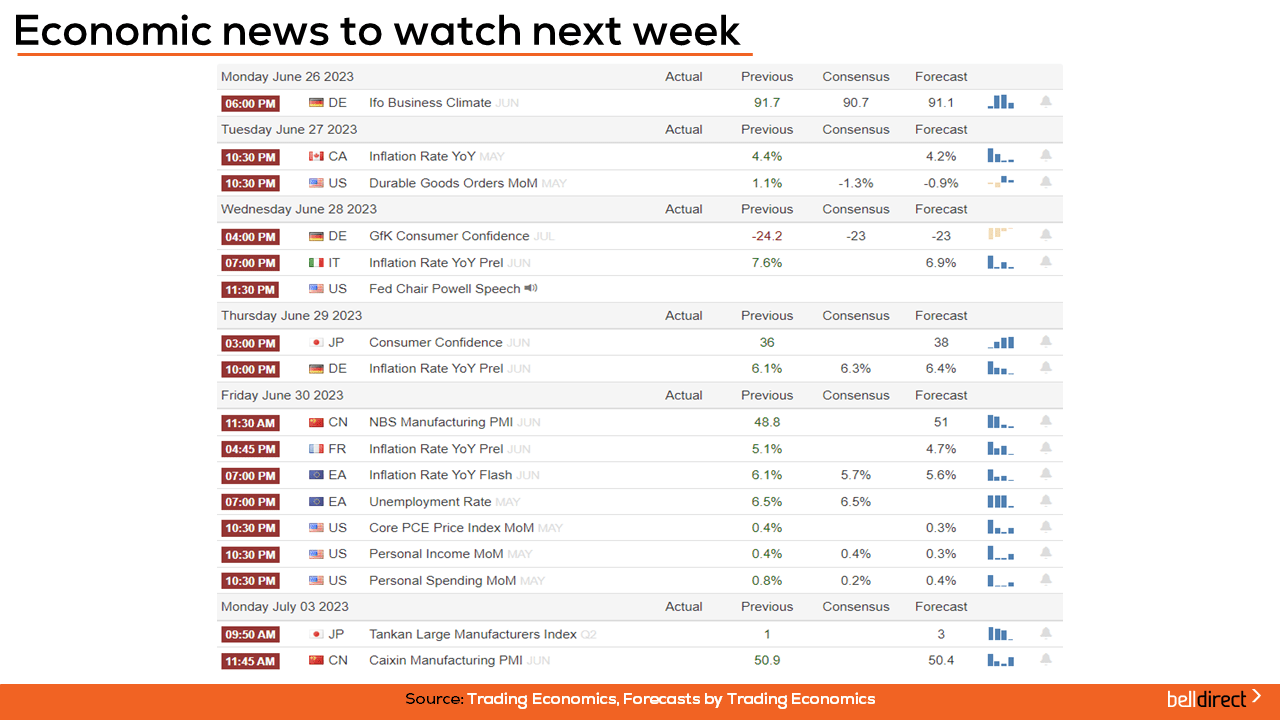

Looking ahead to next week, Australia’s monthly CPI indicator for May is out on Wednesday with consensus expecting a decline to 6.3% from 6.8% in April, which would indicate inflation is cooling in-line with rate hikes out of the RBA.

Australian retail sales preliminary data for May is also out next week on Thursday with the market expecting a rise of 0.1% from a flat reading in April.

Overseas, Canada’s annual inflation rate for May is out on Tuesday with the forecast for a decline to 4.2% from 4.4% in April, while China’s manufacturing PMI for June is out on Friday with the forecast for a rise to 51 points for the month, up from 48.8 points in April, as the Chinese government takes action to stimulate economic growth and recovery post-pandemic lockdowns being lifted just 5-months ago.

And that’s all we have time for today, have a wonderful Friday, a great weekend and happy investing!