Weekly Wrap Transcript 23 February

As we end week 3 of the local reporting season calendar, 159 companies have reported with 57 beating expectations, 60 meeting expectations and 42 missing expectations. 22 companies have been upgraded by brokers while 26 have been downgraded, mostly due to slowing earnings growth and cost management inefficiencies across the first half. Charter Hall (ASX:CHC) and Beach Energy (ASX:BPT) are two names that missed expectations while Alliance Aviation Services (ASX:AQZ) posted a beat.

2021 market darling Pilbara Minerals (ASX:PLS) reported first half results that largely reflect the turbulent market conditions for all lithium miners and producers currently as the price of the commodity continues to decline, with lithium now down 76% over the last year. For the first half of FY24, Pilbara Minerals reported production rose 4% on the PCP and sales rose 7%, however, the realised price in USD/tonne fell 67% which impacted the bottom-line financial performance as PLS also reported revenue fell 65%, EBITDA fell 77%, Statutory profit after tax fell 82% and the cash margin from operations fell 71%. To the lithium giants’ credit though, it has a strong cash balance of $2.144bn and strategies in place to greatly reduce costs of operations moving forward including the Pilgangoora Operation Power Strategy. Shares in PLS fell 1% following the release of the results.

Shares in Australia’s leading supermarket giant Woolworths (ASX:WOW) also had a turbulent week this week after the company’s chief executive and managing director Brad Banducci is standing down on September 1 after 8.5 years in the role, and the release of the company’s first half results spooked investors. The supermarket giant reported revenue rose 4.4% to $34.64bn, and an interim dividend of 47cps, however, investors were more focused on the loss after significant items which soared 192.4% to $781m for the half. Poor performances from the company’s New Zealand business and Big W businesses weighed on the company’s first half performance. Following the release of the results shares fell and brokers had mixed reactions with Macquarie retaining a hold rating amid amid Woolies’ market power, while Citi has a buy rating on Woolies.

NAB (ASX:NAB) was the next big bank off the rank to report December quarter earnings which saw the share price rally 0.4% despite a lacklustre result with some key warnings of headwinds to come. NAB reported cash earnings fell 16.9% in the December quarter to $1.8bn, which as the theme goes with the big banks this reporting season, was not surprising as the big four increase provisions on rising defaults and a high level of home loan switching by customers seeking to find the most affordable interest rates. Higher expenses than forecast and the outlook for rate cuts in Australia has 3 brokers maintaining a hold rating on the leading business bank of Australia.

The flying kangaroo released first half results at the latter end of this week and investors disembarked their investment in the airline with shares plunging over 6% on Thursday. For the half, Qantas (ASX:QAN) reported a 13% drop in underlying profits as the airline unveiled a new QantasLink fleet and plans to offer free wifi on long-haul flights. Despite this, Qantas still reported a $1.25bn underlying profit before tax which was down 12.8% from the PCP, which the airline attributed to $600m in lower fares cutting into profit margins, but this was mostly offset by increased demand for travel. No interim dividend was announced but a $400m on-market share buyback was declared, and the airline finished the half with net debt of $4bn.

Over on Wall Street there was much to love about Nvidia’s earnings results which not only shot the lights out in terms of exceeding all expectations, but eased investor concerns of overvaluation of the world’s largest semiconductor producer. While many in the market question how far Nvidia can grow, their results speak for themselves in showing US$22bn in revenue for Q4 which beat expectations and the company also outlined the expectation of US$24bn in revenue for Q1… indicating the growth runway is yet to slow down.

So what have we learnt so far?

China is hurting some results while surprising others with resilience – take BHP (ASX:BHP) as the former and A2 Milk (ASX:A2M) as the latter.

The big banks may be boring and past their peak, but investors, and some brokers, see opportunity in the stability.

Cost management is key to weathering the current high interest rate, slowing economic growth environment across every sector as margin pressure and even contraction is a noticeable trend this reporting season so far.

And Dividends are the key to winning over investors or prompting a mass exodus of shareholders.

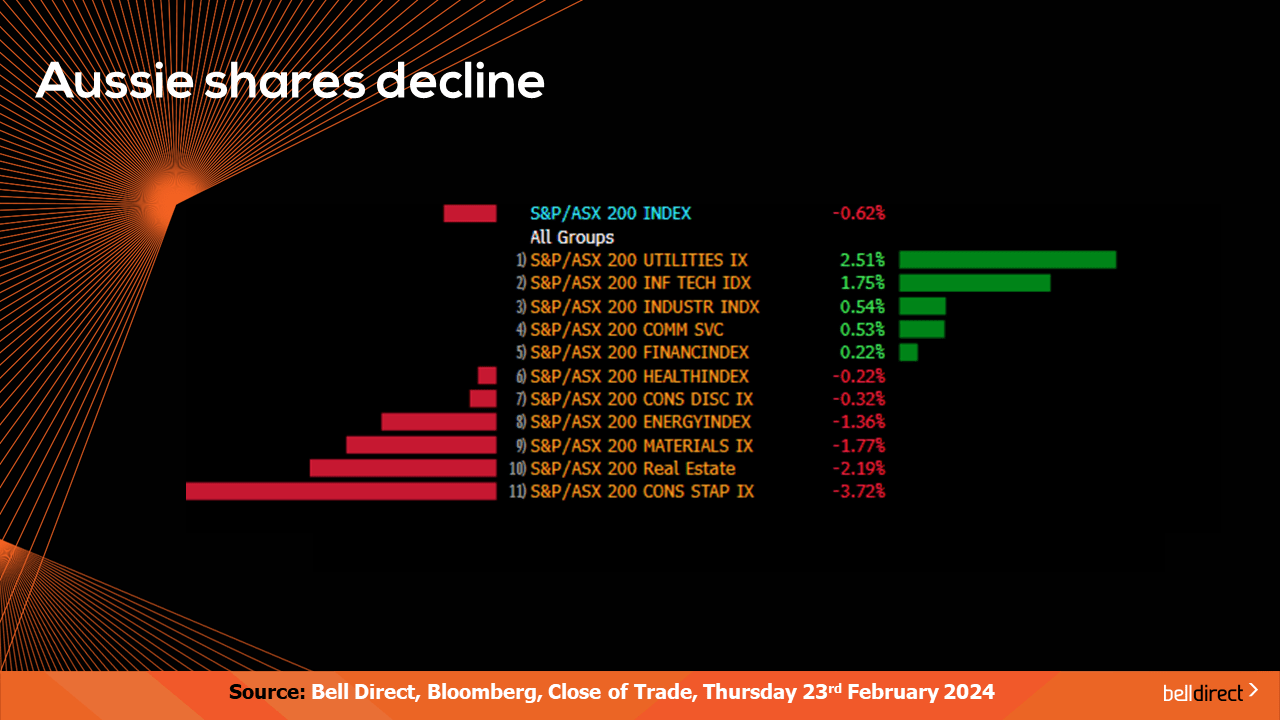

Locally from Monday to Thursday, the ASX200 fell 0.62% as investors sold out of consumer staples and real estate stocks both on corporate earnings results and wavering economic uncertainty. The utilities and info tech sectors offset some of the heavy losses over the four trading days with gains of 2.51% and 1.75% respectively.

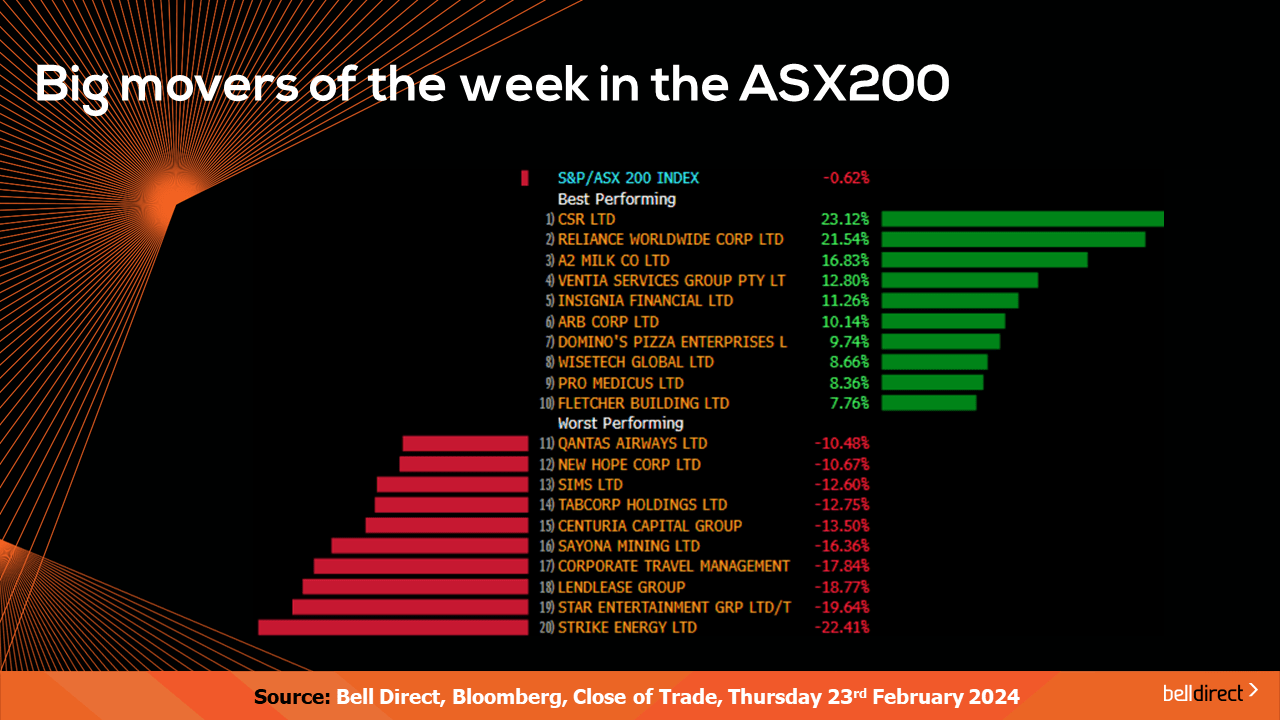

The winning stocks on the ASX200 this week were led by CSR (ASX:CSR) jumping 23%, Reliance Worldwide Corp (ASX:RWC) rallying 21.54% and A2 Milk Co (ASX:A2M) rising 16.83% on strength in its Chinese market products.

On the losing end, Strike Energy (ASX:STX) tanked a further 22% on its latest trading update while Star Entertainment Group (ASX:SGR) lost 20% on a second legal inquiry update.

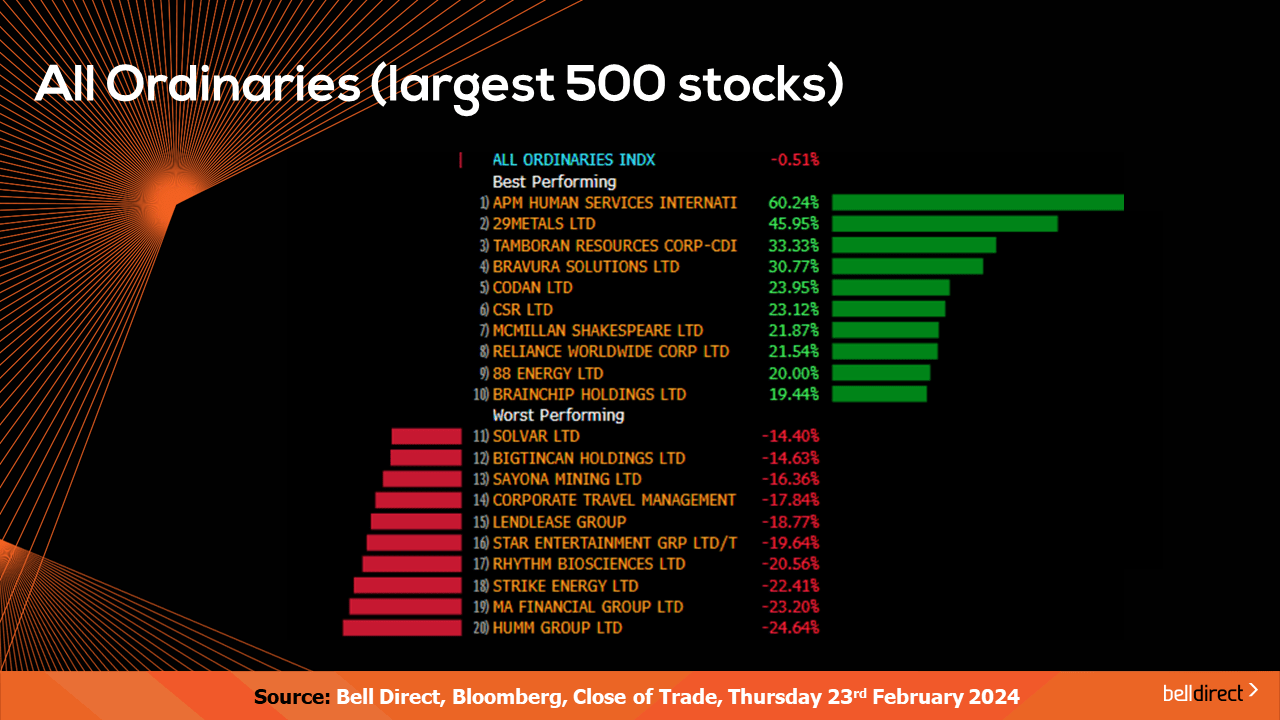

The All Ords fell 0.51% over the trading week as Humm Group (ASX:HUM) and MA Financial Group (ASX:MFG) fell 24% and 23% respectively, while APM Human Services International (ASX:APM) soared over 60% on receipt and rejection of a takeover bid.

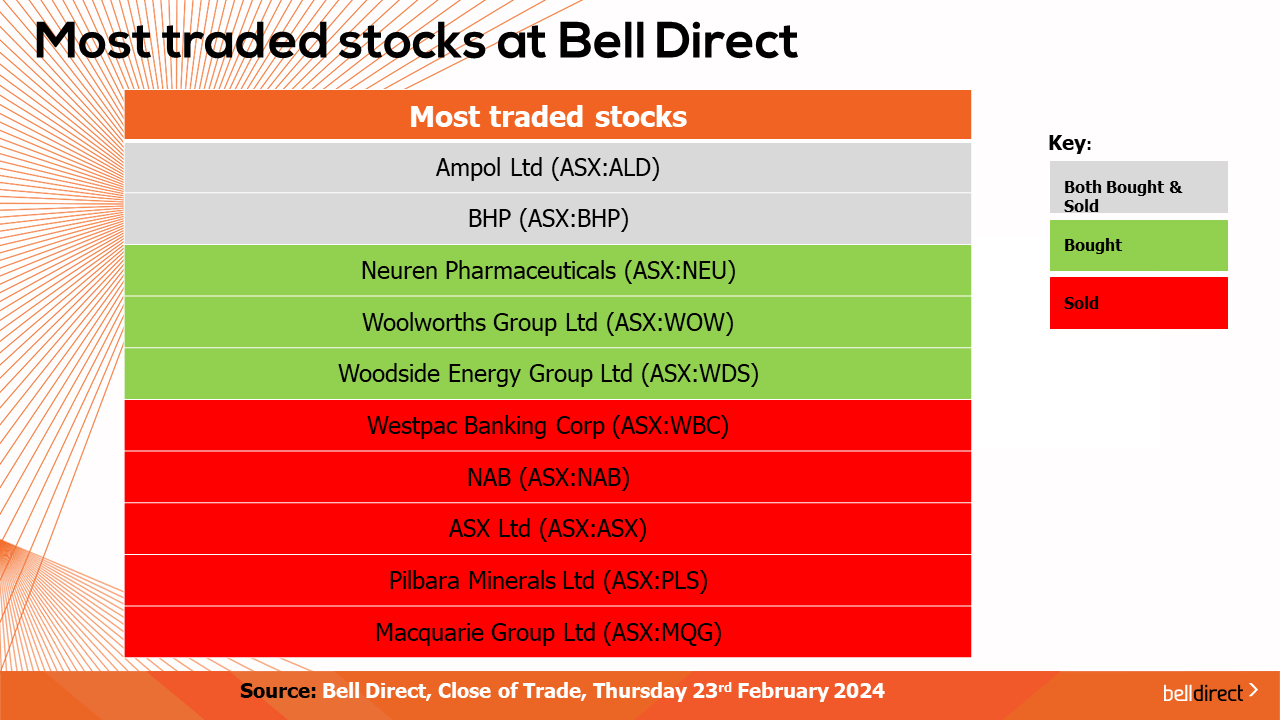

The most traded stocks by Bell Direct clients from Monday to Thursday this week were Ampol (ASX:ALD) and BHP (ASX:BHP). Clients also bought into Neuren (ASX:NEU), Woolworths (ASX:WOW), and Woodside (ASX:WDS). Clients also took profits from Westpac (ASX:WBC), NAB (ASX:NAB), ASX (ASX:ASX), Pilbara Minerals (ASX:PLS) and Macquarie Group (ASX:MQG).

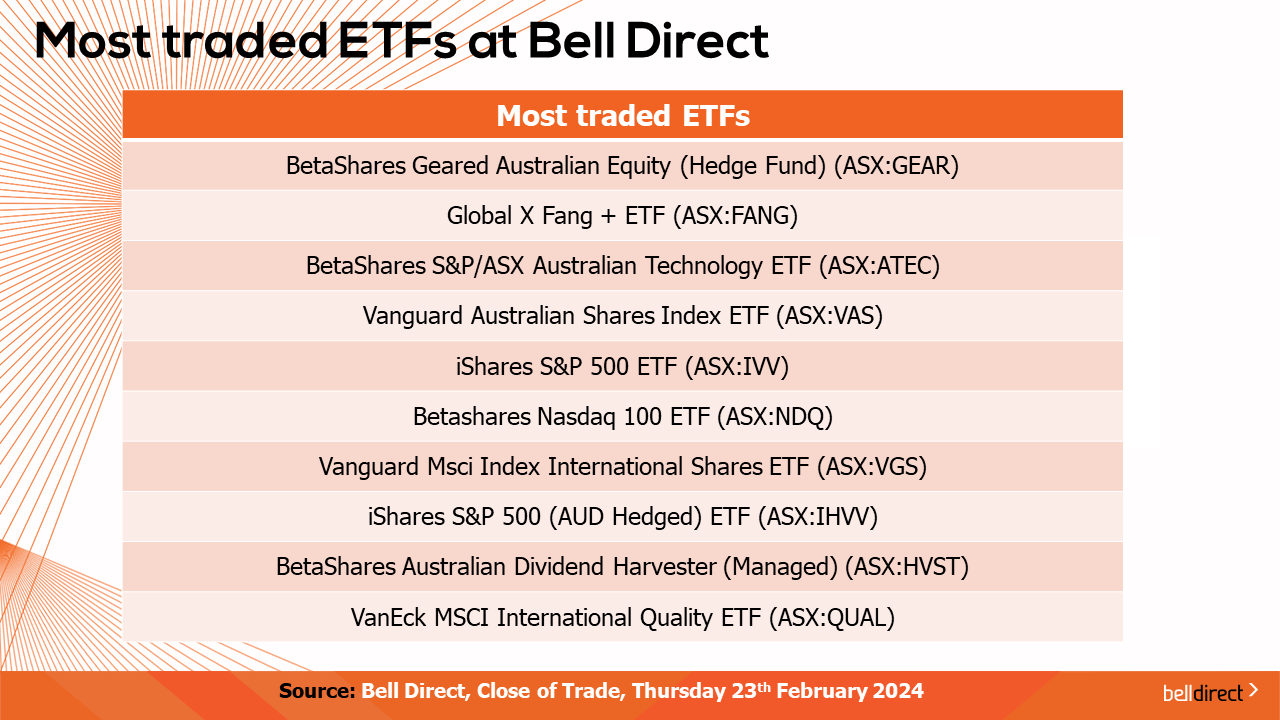

The most traded ETFs this week were led by BetaShares Geared Australian Equity (Hedge Fund), Global X FANG+ ETF, and BetaShares S&P/ASX Australian Technology ETF.

And for the week ahead, we will see some key names including Endeavour Group (ASX:EDV), Nanosonics (ASX:NAN), Suncorp Group (ASX:SUN), City Chic (ASX:CCX), Coles Group (ASX:COL), Karoon Energy (ASX:KAR), Zip Co (ASX:ZIP) and more releasing results.

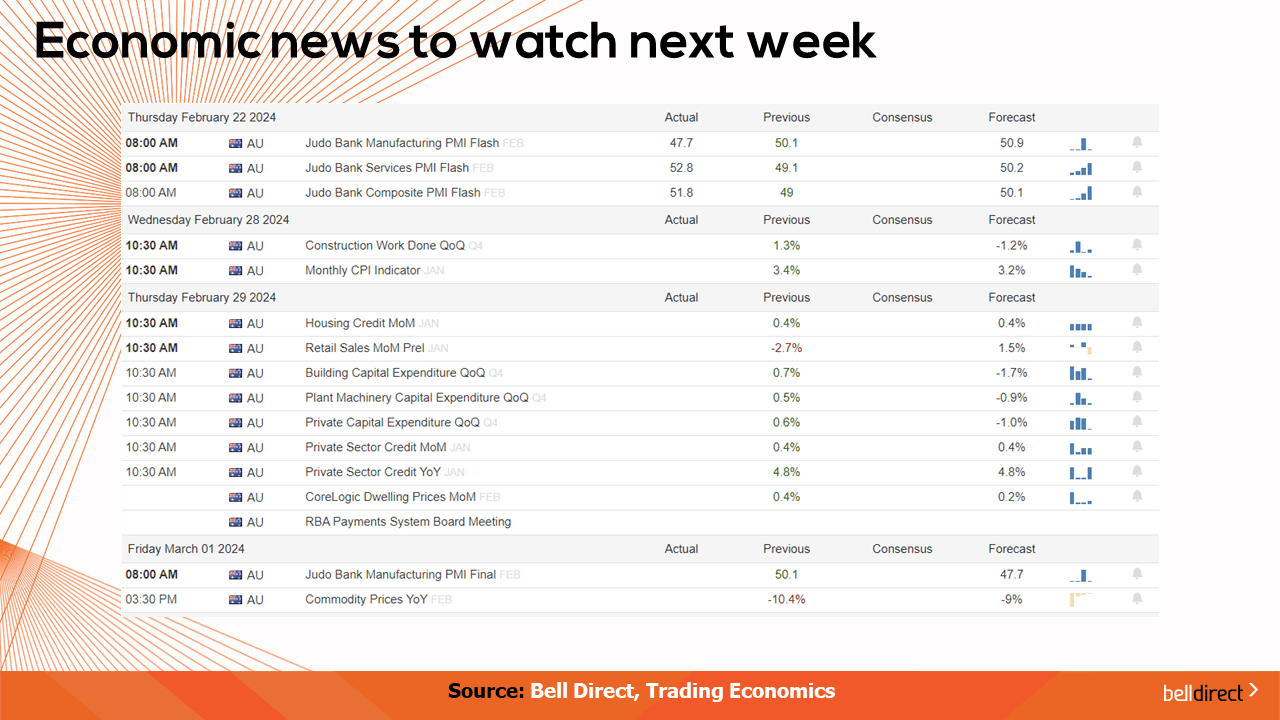

Overseas, estimated US GDP growth rate data for Q2 is out on Wednesday, Personal spending data MoM for January is out on Thursday and US ISM Manufacturing PMI is out on Saturday, with the expectation of a decline in GDP and Personal spending, but an increase in manufacturing PMI.

And that’s all for this Friday, have a wonderful day and weekend, and as always, happy investing!