Transcript: Weekly Wrap 21 March

On again, off again, on again, off again. The Trump tariff rollercoaster reached new heights this week and global markets responded accordingly. While Trump’s tariffs and policy volatility is causing a headache for investors, the Fed worked to calm the storm this week by maintaining the current cash rate in the US at 4.25% to 4.5% and signalling 2 rate cuts are still on the cards for 2025, which led to a rally on Wall Street midweek.

Hong Kong has been running hot lately as fresh stimulus and solid economic data boosted investor sentiment in the region, especially for high growth tech stocks. Later this week though, the Hang Seng gains eased as China held interest rates steady for a fifth month.

Favourable economic data out of China this week and further stimulus into the world’s second largest economy signalled post-pandemic recovery in the region is well and truly underway which propelled our local mining stocks early in the week. China’s industrial production for January to February came in at a rise of 5.9% which is slightly down from the 6.2% reported in the prior period, but well above economists’ expectations of a 5% rise signalling recovery remains on track for China’s industrial output.

China’s retail sales for January to February were also released this week with consumers in the region spending more over the Chinese New Year period as the data revealed a 4% rise for the month, up from a 3.7% rise in December. The latest economic data out in China paves the solid foundations for sustained recovery in the region, which is good news for all companies with exposure to the region as demand ramps up again after being subdued for over 2 years.

Locally this week, we experienced rising investor jitters from Trump tariff implications seeping through into Aussie investor sentiment, sparking a sell-off early in the week before the key index recovered some ground later in the week.

Key Australian jobs data was released yesterday with the unemployment rate remaining at 4.1% in February, while almost 53,000 people lost their jobs during the period, decreasing the employment total to 14,513,200. This reading was well below the 30,000 increase in jobs that the market was expecting in a sign the labour market is showing signs of cooling, however, the RBA won’t be swayed by favourable labour data as RBA governor Michele Bullock said the RBA board remains alert to the possibility that the labour market is signalling a bit more strength in the economy which could delay or stall the disinflation process.

With so much uncertainty in the markets on a global scale, one area of the market is thriving. The spot price of gold soared to a fresh record high this week of US$3049.70 on Thursday, fuelling markets to call plenty of headroom for the commodity to continue running as investors flock to safe-haven investments in times of high risk and volatility. The key drivers of gold at the moment include central banks continuing to buy gold to diversify reserves to reduce reliance on the USD and hedge against inflation, escalating geopolitical tensions, fears of inflation rebounding especially in the US, Trump tariff implications on a global scale, interest rate cuts, and increased demand for the precious commodity as investors flock to safe haven assets. Bell Potter’s stock picks in the gold space include Evolution Mining, Northern Star Resources and Capricorn Metals.

Next week we may see continued volatility in equities as the ongoing Trump tariff tale continues to unfold and new threats emerge weekly from the new US president.

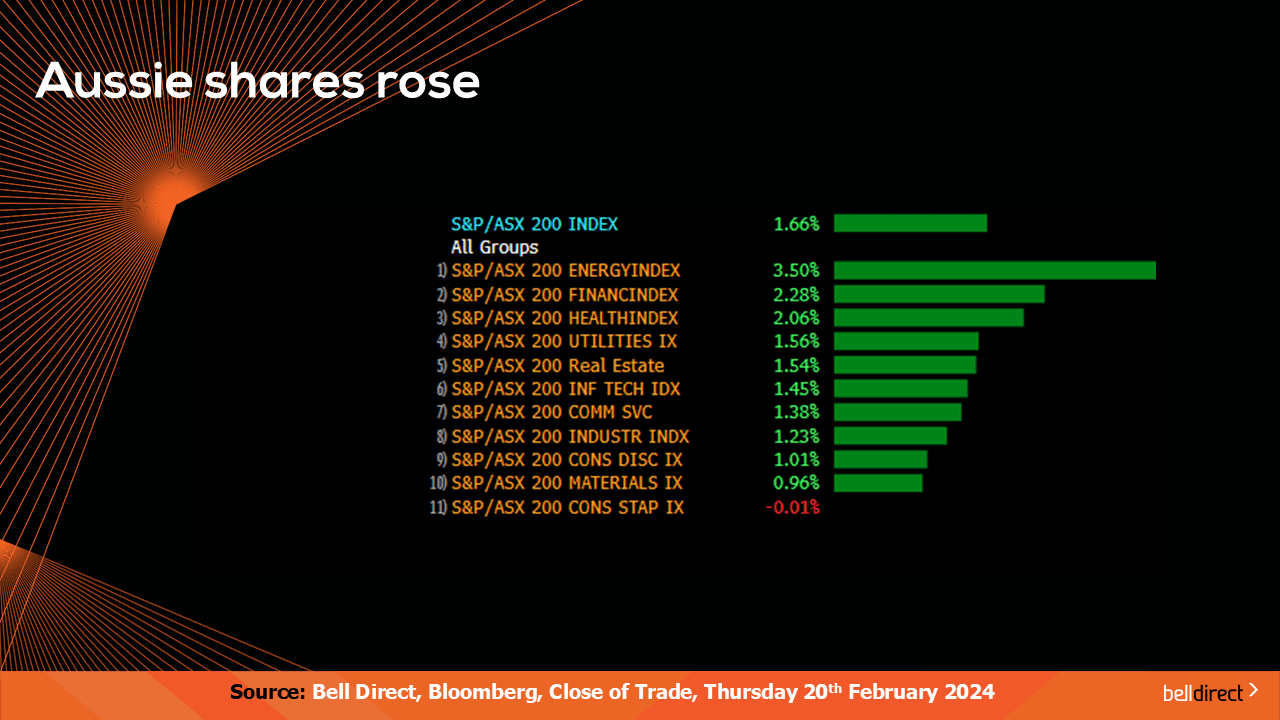

Locally this week the ASX 200 rose 1.66% with every sector ending the week in the green aside from consumer staples stocks which fell just 0.01%. Energy stocks experienced the biggest gain of the week with a 3.5% rise from Monday to Thursday.

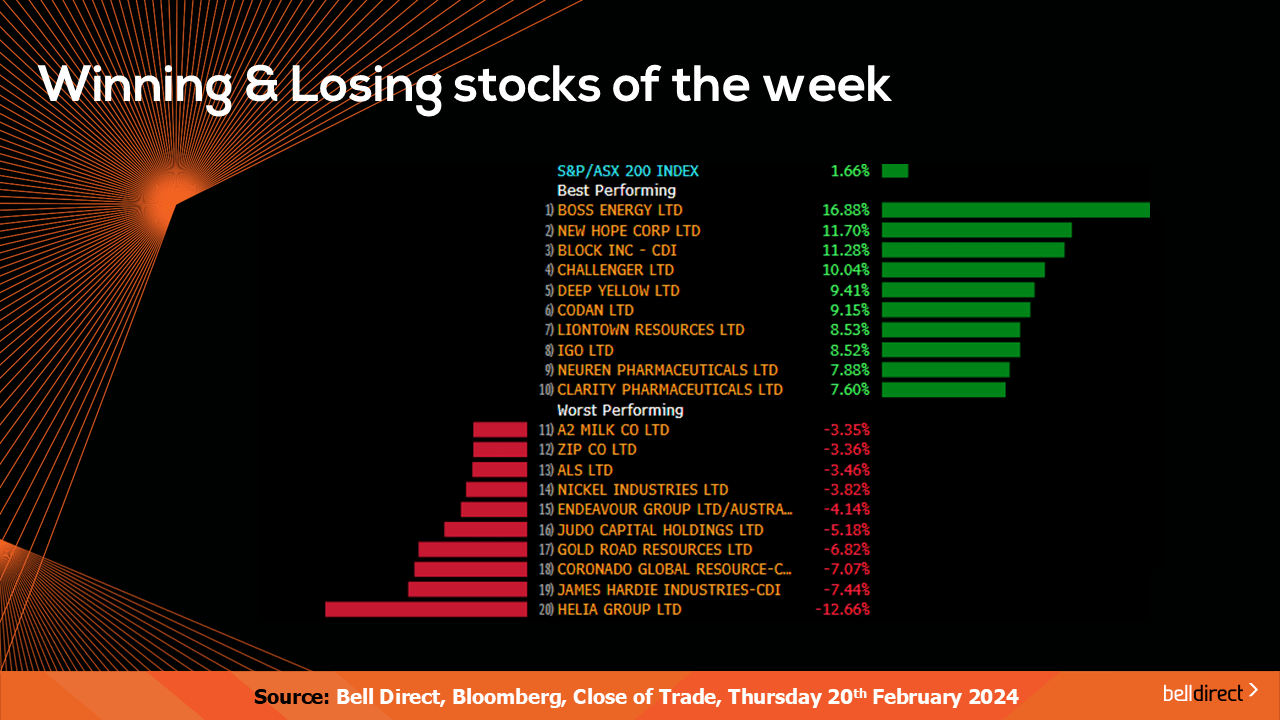

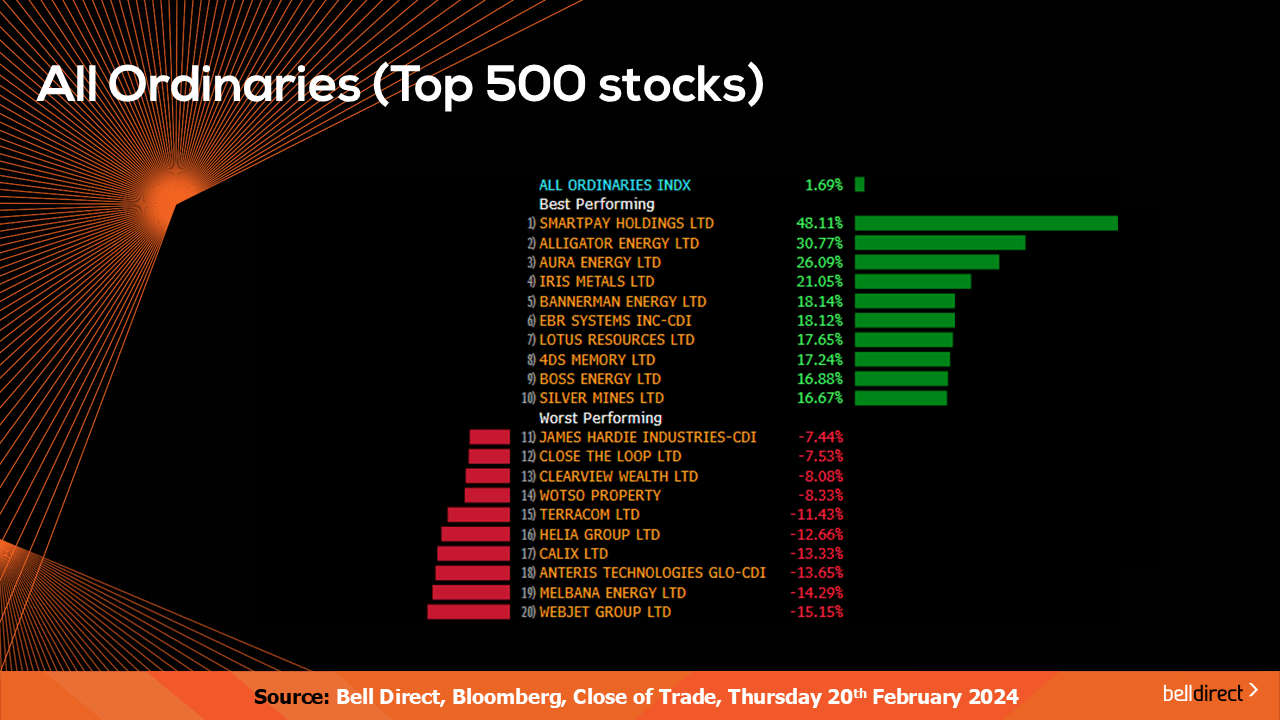

The winning stocks were led by Boss Energy (ASX:BOE) soaring 17%, New Hope Corporation (ASX:NHC) rallying 11.70% and Block Inc (ASX:XYZ) adding 11.3%.

And on the losing end Helia Group (ASX:HLI) tumbled 12.66%, James Hardie Industries (ASX:JHX) fell 7.44% and Coronado Global Resources (ASX:CRN) ended the week down 7.07%.

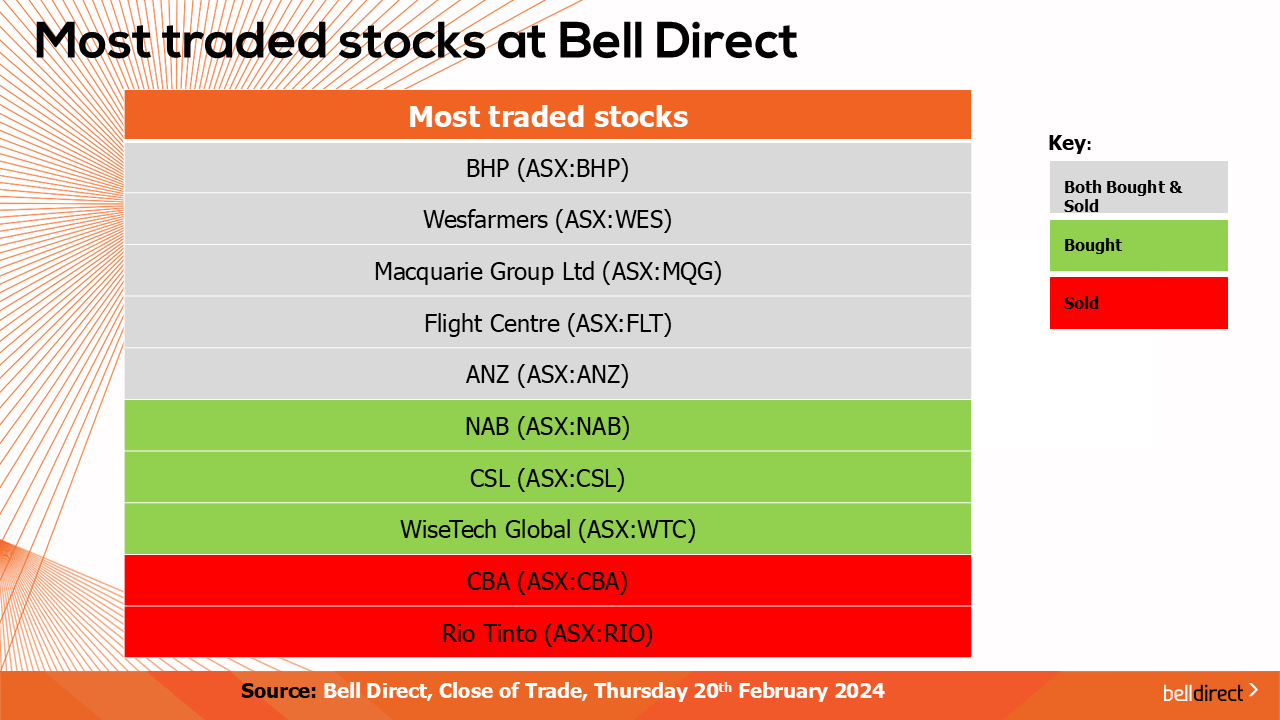

The most traded stocks by Bell Direct clients this week were BHP (ASX:BHP), Wesfarmers (ASX:WES), Macquarie (ASX:MQG), Flight Centre (ASX:FLT), and ANZ (ASX:ANZ).

Clients also bought into NAB (ASX:NAB), CSL (ASX:CSL) and Wisetech Global (ASX:WTC), while taking profits from CBA (ASX:CBA) and Rio Tinto (ASX:RIO).

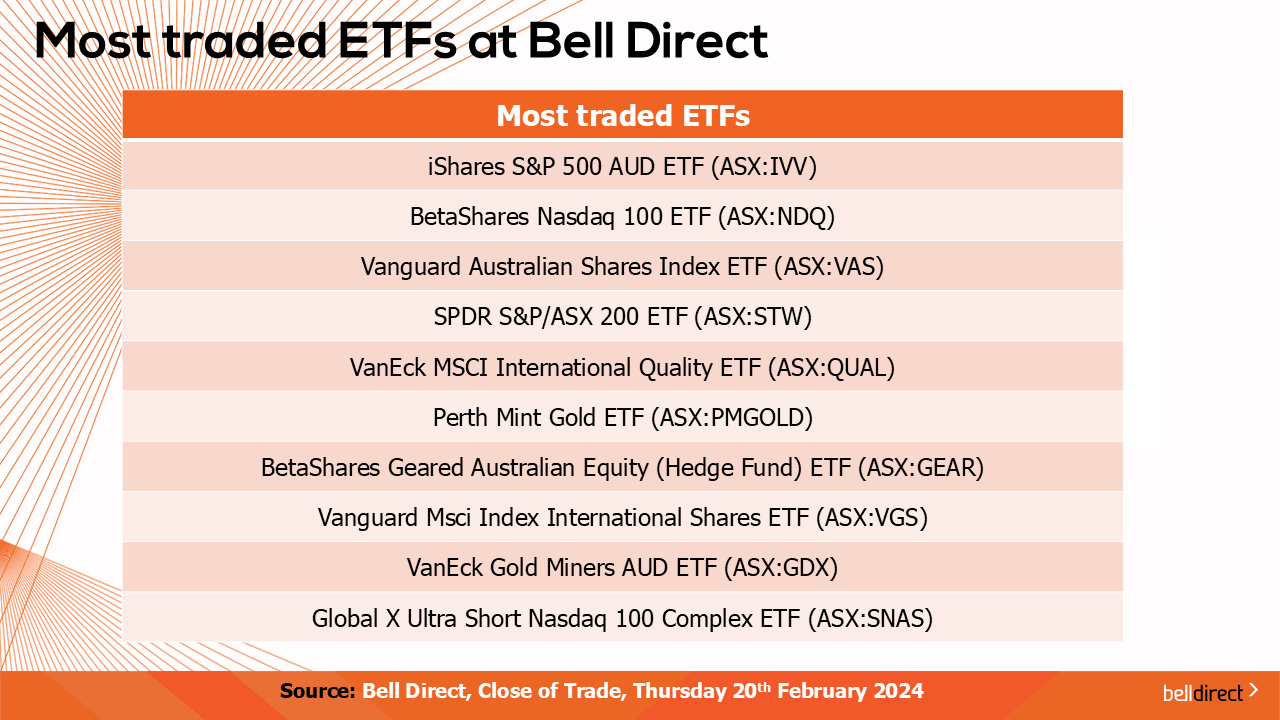

And the most traded ETFs by our clients were led by iShares S&P 500 AUD ETF,

Betashares Nasdaq 100 ETF and Vanguard Australian Shares Index ETF.

On the economic calendar next week, we may see investors locally react to the monthly CPI indicator data out on Wednesday with the expectation of a slight uptick in inflation in Australia in February.

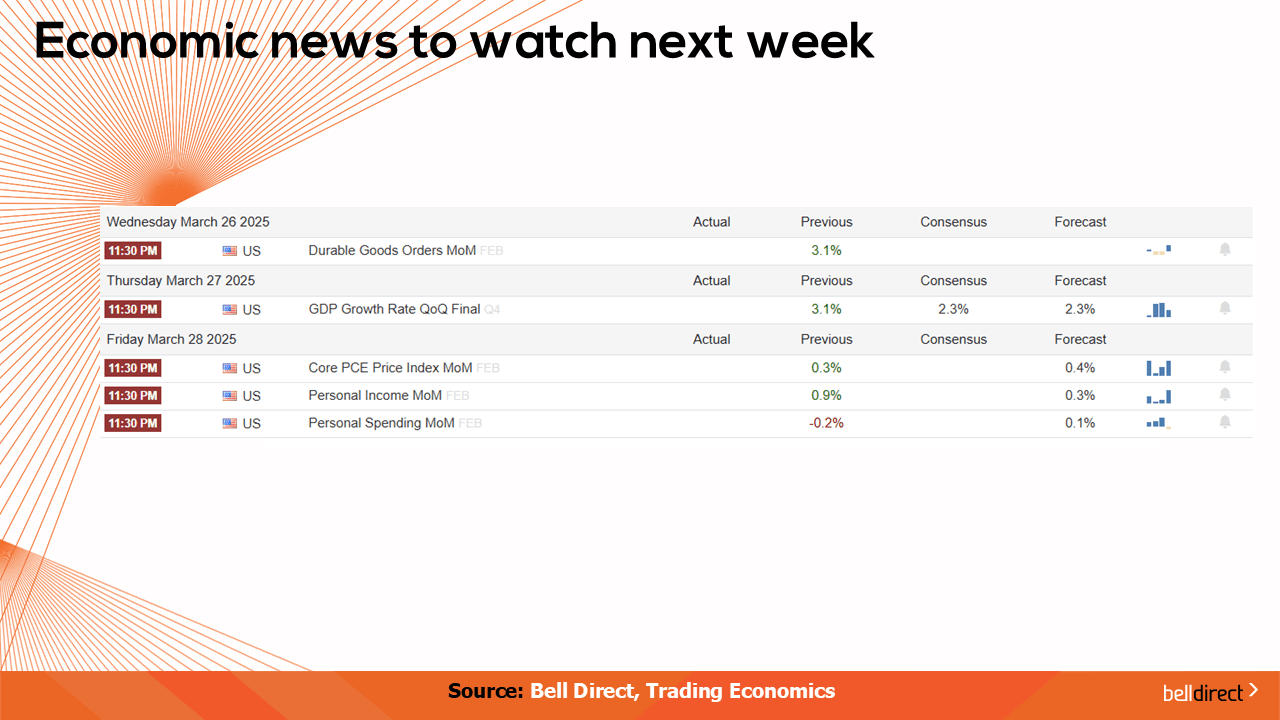

Overseas in the US, durable goods orders, GDP growth rate, core PCE, personal income and personal spending data are all out next week which will give the Fed a clearer picture of the inflation picture in the world’s largest economy.

And that’s al for this week, have a wonderful weekend and happy investing!