Across global markets this week it was a very macro driven outcome that saw mixed reactions from investors across respective regional indices. From record highs in the US, to election-driven pullbacks in Europe and Australia having a lacklustre week as mixed Chinese economic data painted a murky picture about the world’s second largest economy’s economic recovery, let’s digest what news and data moved markets this week, with particular focus on China.

The week started with a slew of economic data released from China indicating strength in recovery across some key metrics, while key areas that impact Australia’s exports fell short of expectations.

ASX-listed iron ore miners received a long-awaited boost on Monday from a rise in the price of the commodity on the back of China’s crude steel demand jumping 8.1% in May from April indicating recovering demand in the world’s second largest economy.

Industrial production in China for May came in at an annual rate of 5.6% which was down from the 6.7% reported in April and well below economists’ forecasts of a 6% reading. Consumers appear to still be spending in China though with retail sales in the region showing significant recovery in May with a jump to 3.7% from 2.3% in April which beat economists’ expectations.

The dire property market in China showed further signals of weakness in May with the house price index data out on Monday outlining an annual rate decline of 3.9%, down from the 3.1% decline in April and greater than economists’ expectations of a decline to an annual rate of 3.5%. China’s house price index has been declining since May 2023.

And finally, China’s unemployment rate remained at 5% in May for a second month with is a positive sign of recovery in the nation’s labour market following a peak of 5.3% in February.

Until we see material recovery across the board in China, post-pandemic recovery remains the focus in the region and will continue to drive the outlook for the region and is why we are seeing a shift by many global economies away from reliance on trade partnering with China in search of alternative, more secure trade with more stable economies in the post-pandemic era.

Elsewhere in the Asia region, India’s stock market and economy are painting a very attractive and resilience outlook for the remainder of 2024. The Indian stock market, or the Bombay Stock Exchange is up 7.01% and up 22% over the last year. The key drivers of India’s resilience have been the government’s targets for boosting the defence sector exports, strong corporate earnings especially for IT, banking and healthcare companies in the region, and positive outlook for initiatives to be introduced around economic reforms, and infrastructure development and to attract foreign investment post the recent Indian election. India’s IT-hub nature has seen key tech stocks in the region rally in 2024 as global providers look to the region for IT services in the AI-driven digital transformation era.

On Tuesday this week, Australia’s central bank maintained the nation’s cash rate at 4.35% for another period as was widely expected by economists’ however investors reacted cautiously to the hawkish comments out of RBA governor Michele Bullock where she did not rule anything out and said the future of rates remains uncertain as inflation key drivers remain sticky.

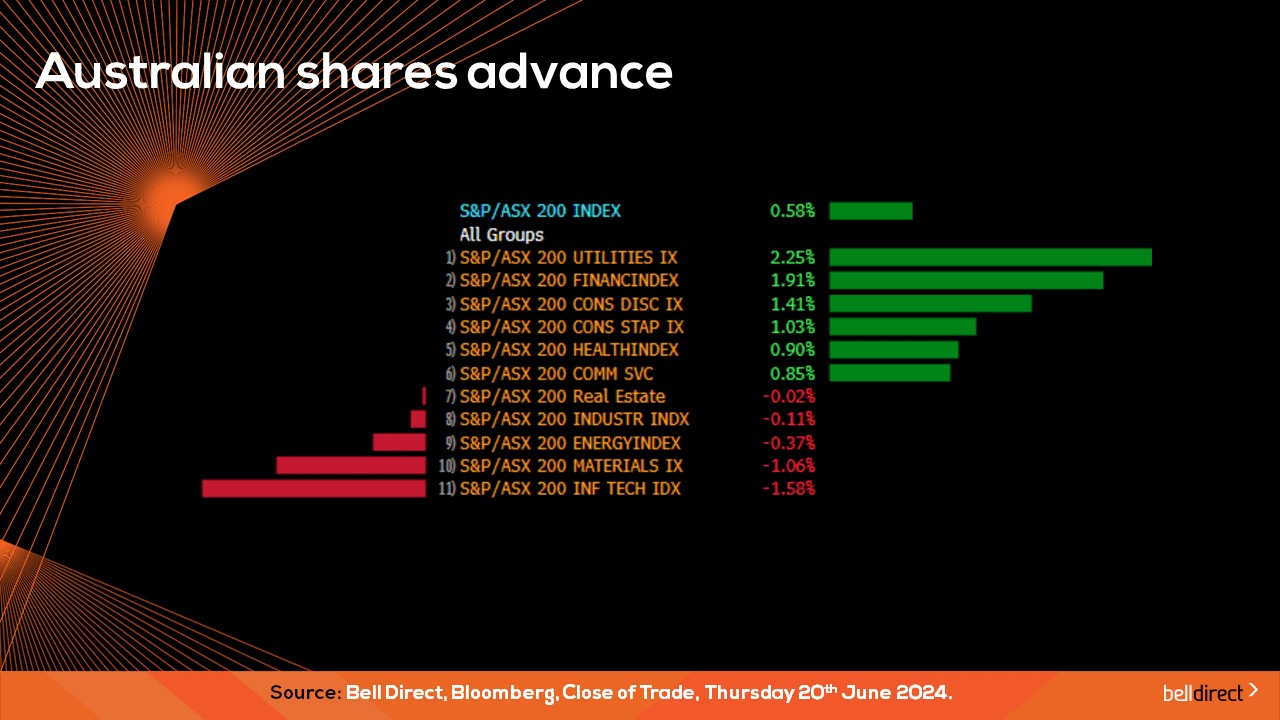

Locally from Monday to Thursday the ASX200 rose 0.58% as a rally for utilities, financial and consumer discretionary stocks offset losses in the tech and materials sectors.

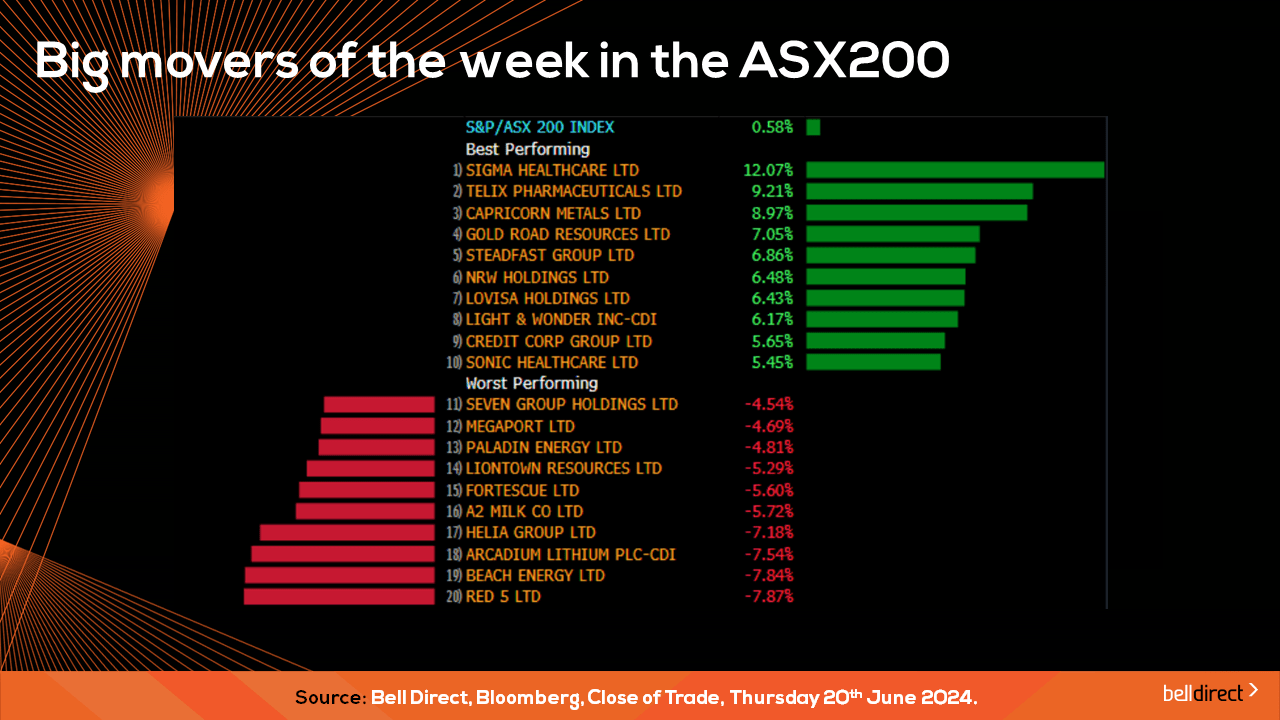

The winning stocks on the key index this week were led by Sigma Healthcare rallying 12.07%, while Telix Pharmaceuticals added 9.2% and Capricorn Metals rose just shy of 9%.

And on the losing end Red 5 dropped 7.87%, Beach Energy fell 7.84% and Arcadium Lithium fell 7.54% over the 4-trading days.

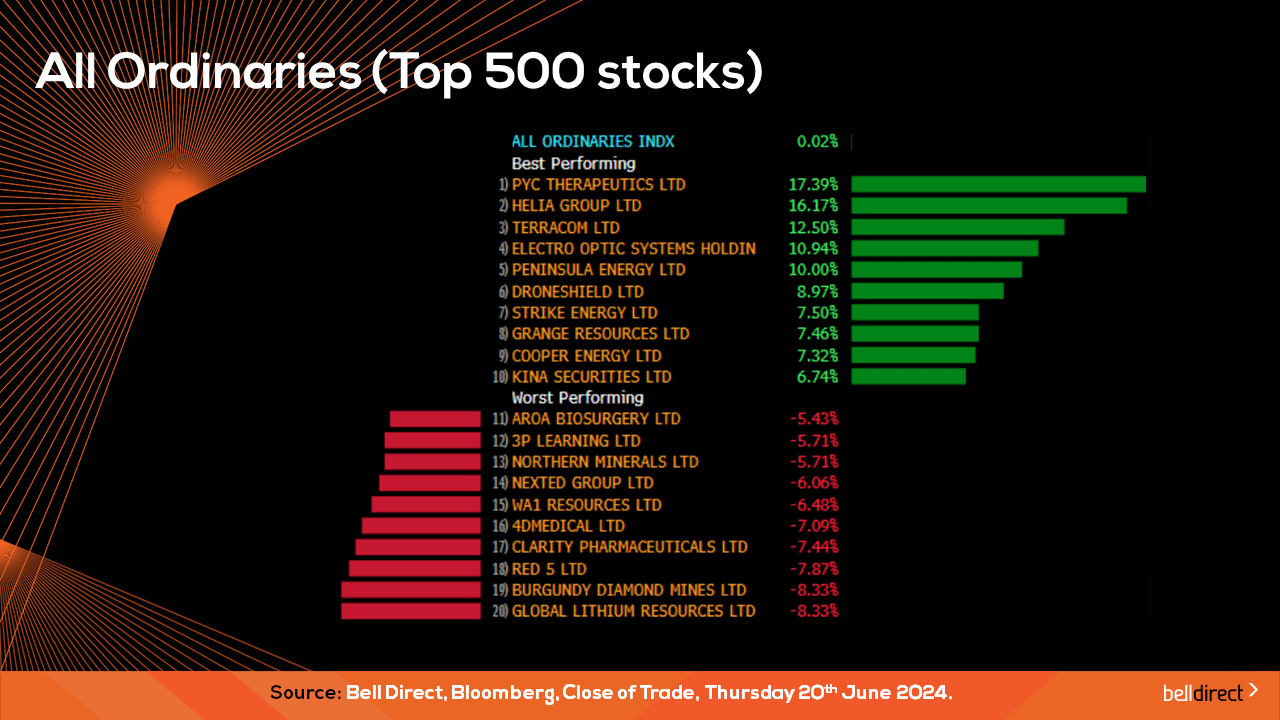

On the broader market index, the All Ords rose just under half a percent led by PYD Therapeutics soaring 28.6%, WA1 Resources rising 26.22% and Calix jumping 26.05%.

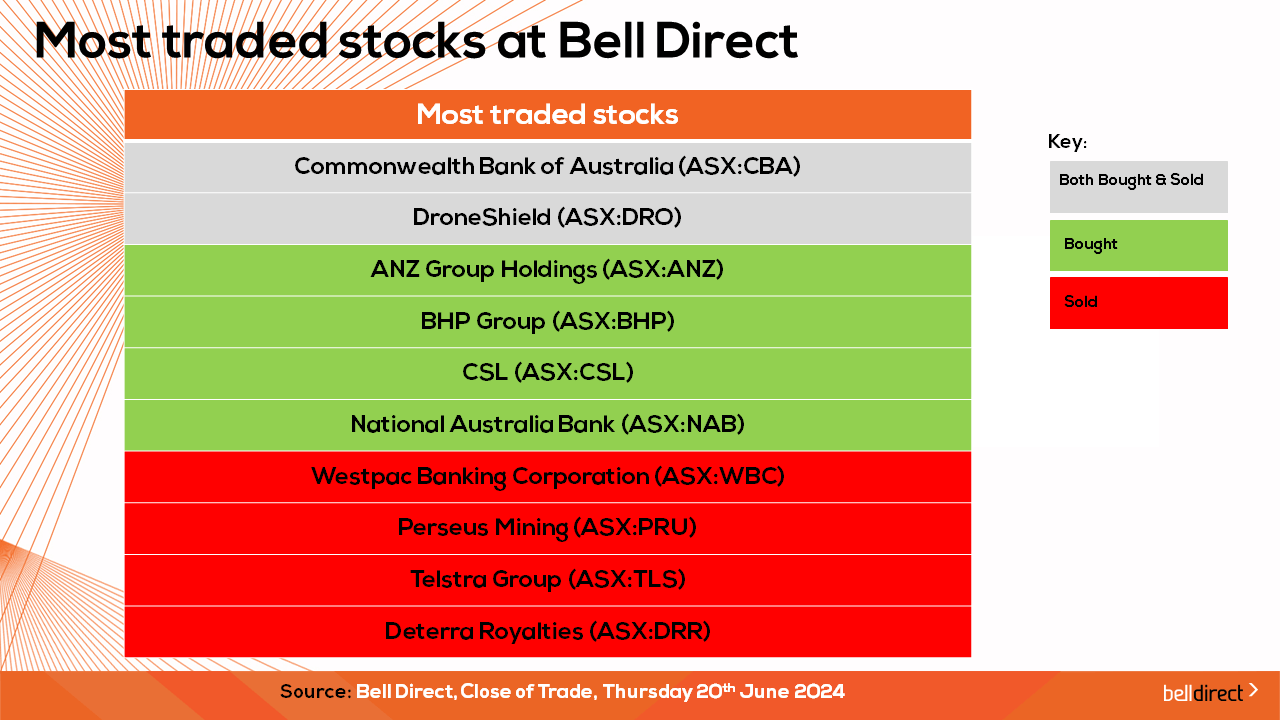

The most traded stocks by Bell Direct clients this week were CBA, and DroneShield. Clients also bought into BHP and Deterra Royalties while taking profits from ANZ, CSL, Westpac, Perseus Mining and Telstra Group.

And the most traded ETFs by our clients this week were led by Vanguard Australian Shares High Yield ETF, Betashares Global Shares ETF and Global X Semiconductor ETF.

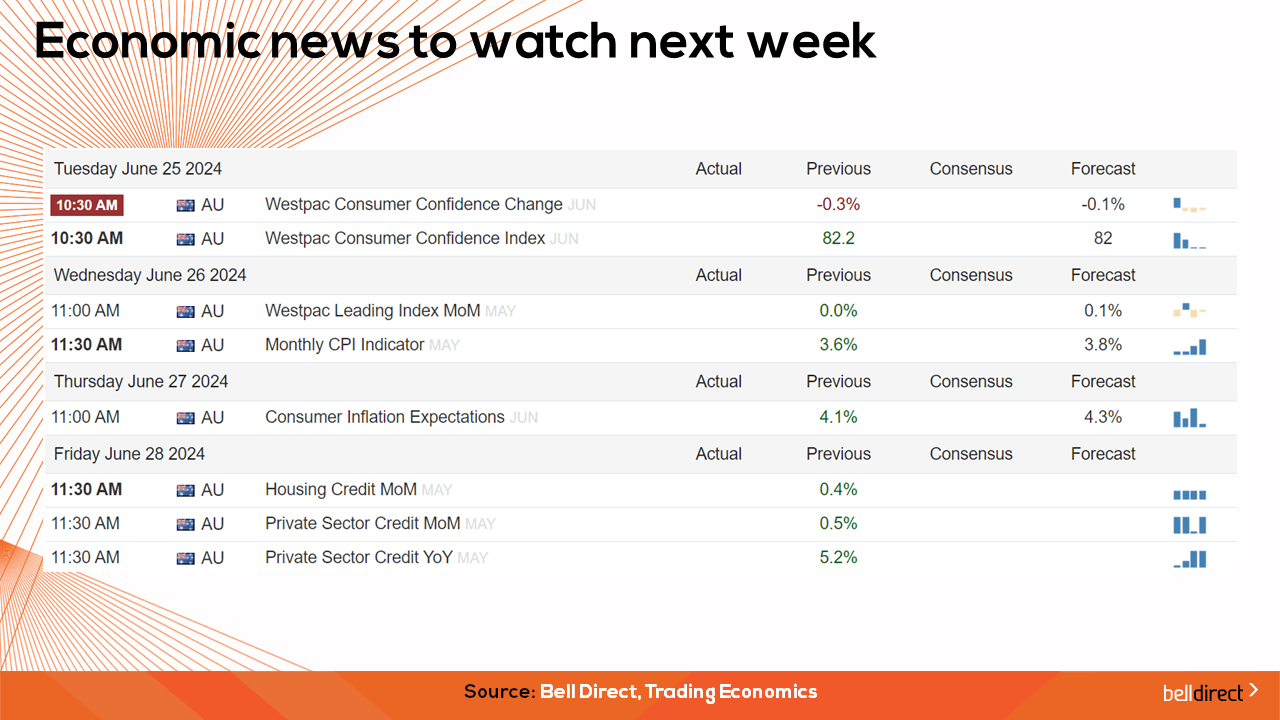

Looking to the week ahead from an economic data standpoint, Westpac consumer confidence data for June is out on Tuesday with the forecast of a slight improvement in confidence to a decline of -0.1% from the fall of 0.3% in May.

Overseas, it is a big week for the US where investors will be eagerly anticipating the release of US GDP growth rate data for Q1 where it is expected the economy grew by just 1.3% in the first quarter, down from 3.4% growth in Q4 which will indicate the high interest rate environment is taking a toll on economic growth out of the world’s largest economy.

US core PCE index for May, which is the Fed’s preferred measure of inflation, is also out Friday next week which will be used as a guide for the Fed’s rate pathway as a reading over 0.2% will indicate PCE remains elevated, and inflation remains sticky.