Transcript: Weekly Wrap 20 September

This week we saw the first rate cut out of the US Fed this rate cycle in the form of a 50bps rate cut taking the new range to 4.75% to 5% for the next period, which was widely expected. In the past the market would respond positively to rate cuts of any kind, however Wall St fell on Wednesday after the Fed announced the rate cut as investors took hints of a potential recessionary environment to come out of the Fed’s commentary.

Fed Chair Jerome Powell signalled a second half a percentage point rate cut later this year which investors took as a sign of economic weakness requiring eased monetary policy. The latest economic data out of the world’s largest economy shows worrying signs of a sharp economic slowdown with ISM manufacturing PMI for August rising less than expected, JOLTs Job Openings for July falling to 7.677m when economists were expecting a rise to over 8m new job openings, and retail sales fell to a rise of just 0.1% in August from a 1.1% rise in July.

While there are some concerning signs in the latest economic data, there were also key data in recent weeks that signal economic stability in the US including the unemployment rate falling to 4.2% in August, ISM Services PMI rising to 51.5 points, the core inflation rate remaining at 3.2% while the overall inflation rate fell to 2.5%, and monthly PPI index rose 0.2% in August from a flat reading in July. Economic data and strength in the US economy will continue to pave the way for the Fed’s rate outlook moving forward, but markets will likely respond with a rally over the near future as earnings appreciation is on the horizon in a lower interest rate environment.

The Fed’s rate cut was welcomed by Aussie investors who pushed the local index to a record high at the open on Thursday. But why is the US rate cut a positive for our local market? Firstly, a decrease in the US interest rate generally leads to the weakening of the greenback compared to the Aussie, making the cost of imports cheaper and the cost of purchasing Aussie goods more expensive for the US. Secondly, a US rate cut boosts investor sentiment through increasing appetite for equities over safer-haven investments like bonds as equities offer higher returns in a lower interest rate environment due to the growth potential in the lower-cost market. Lower interest rates in the US also increases local hopes of rate cuts out of the RBA in the near future to align with the Fed’s rate movements.

Elsewhere this week, the price of oil is again at the forefront of headlines and impacting our local oil producer share prices. Escalating tensions in the Middle East and news of reduced oil demand out of China created a push-pull scenario for the oil price, signalling further volatility to come in the price of the commodity.

China is the world’s second largest importer of oil and demand from the region has been declining for the last 4-months, only by ranges of 0.5% to 3%. Headlines of China moving away from oil and into renewable energy sources this week led to a sharp decline in the price of oil on fears of decreased demand moving forward, which is good news for Aussie drivers at the petrol pump, but bad news for our local oil producers who’s share prices declined over the 4-trading days this week including Beach Energy falling over 2% and Woodside falling 0.9%.

The depreciation in the price of oil is unlikely to last though for two key reasons. Escalating tensions in the Middle East, the world’s largest producing region of oil, are not likely to subside any time soon thus placing further supply pressure on the price of oil. OPEC plus is also likely to step in with further production cuts to stabilise the price of oil amid escalated volatility in 2024.

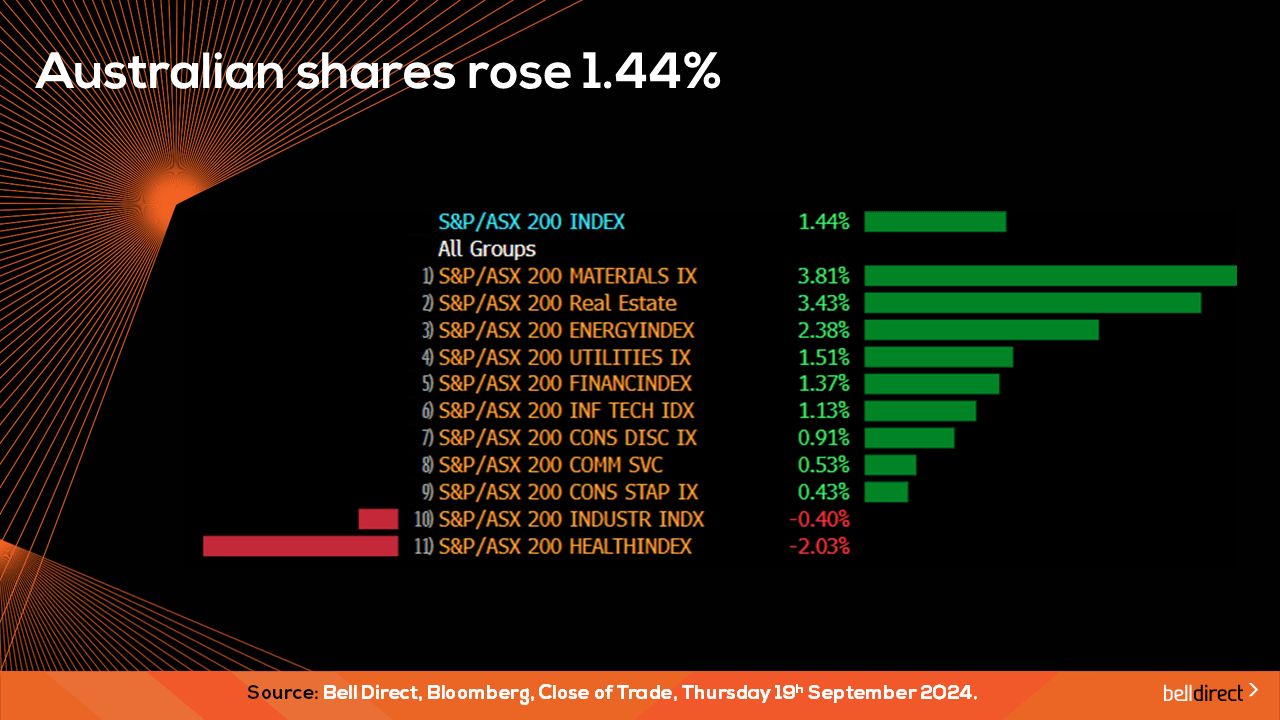

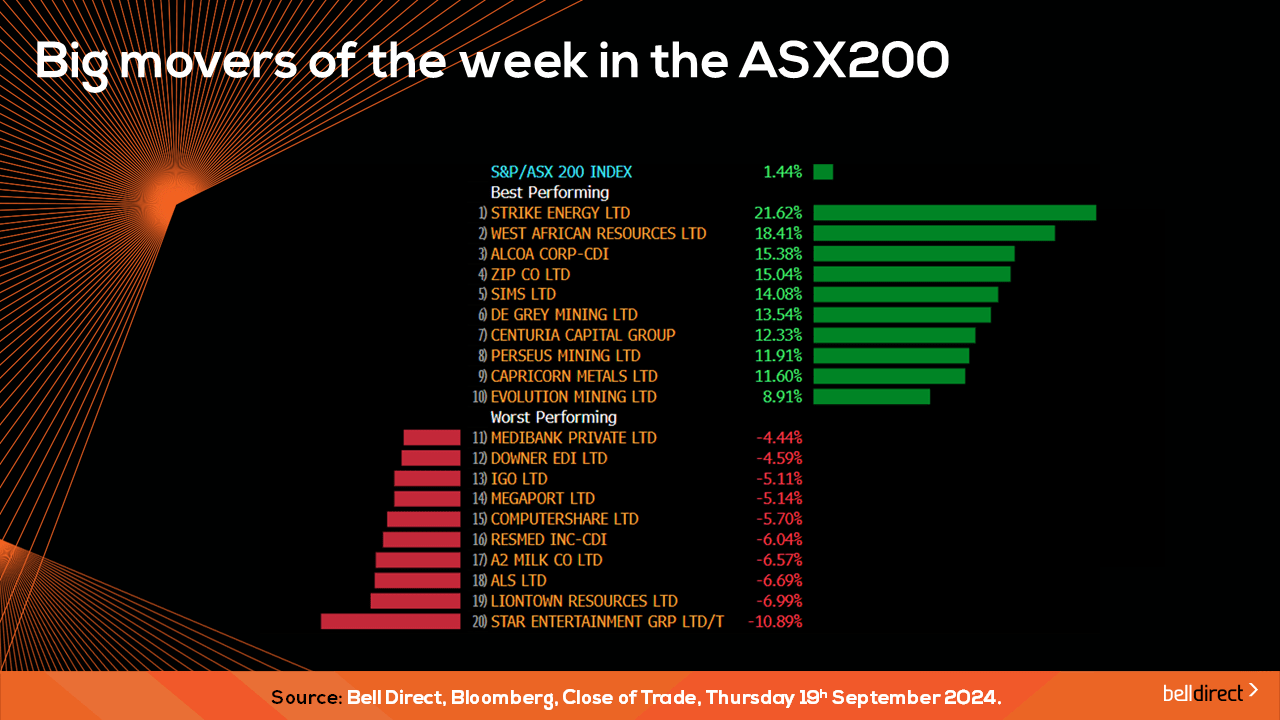

Locally from Monday to Thursday the ASX200 rose to record territory boosted by the Fed’s rate cut and positive economic data released locally.

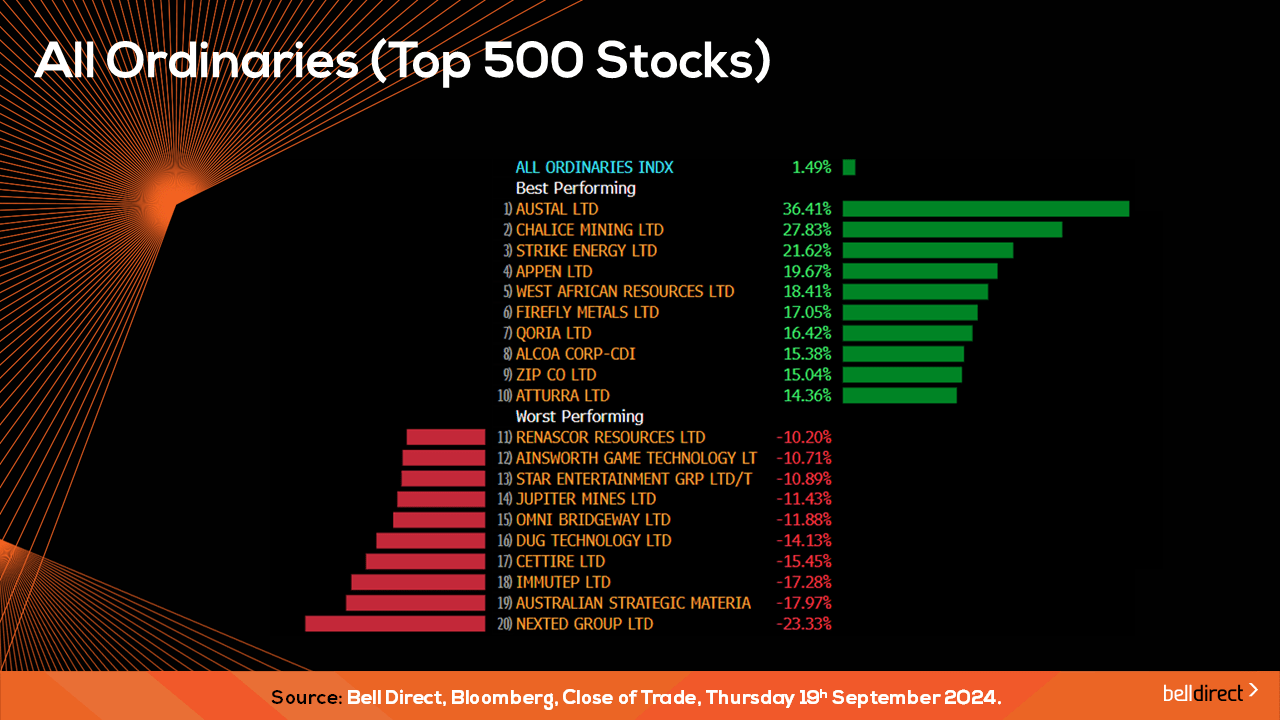

On the broader market, the All Ords, rose just under 1.5% this week as Austal (ASX:ASB) soared 36% on new contract wins while NextEd Group (ASX:NXD) fell 23%.

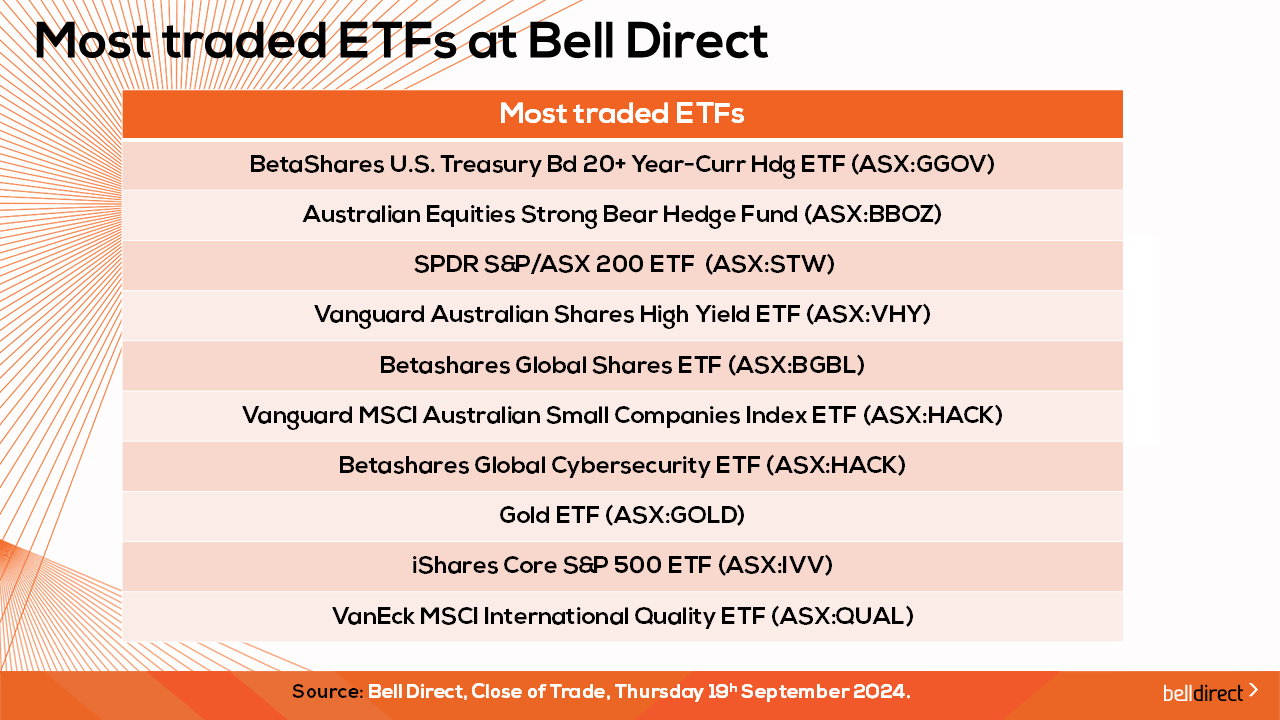

And the most traded ETFs by our clients this week were led by BetaShares US Treasury 20+ Year-Currency Hedge ETF, BetaShares Australian Strong Bear Hedge Fund and SPDR S&P/ASX200 ETF.

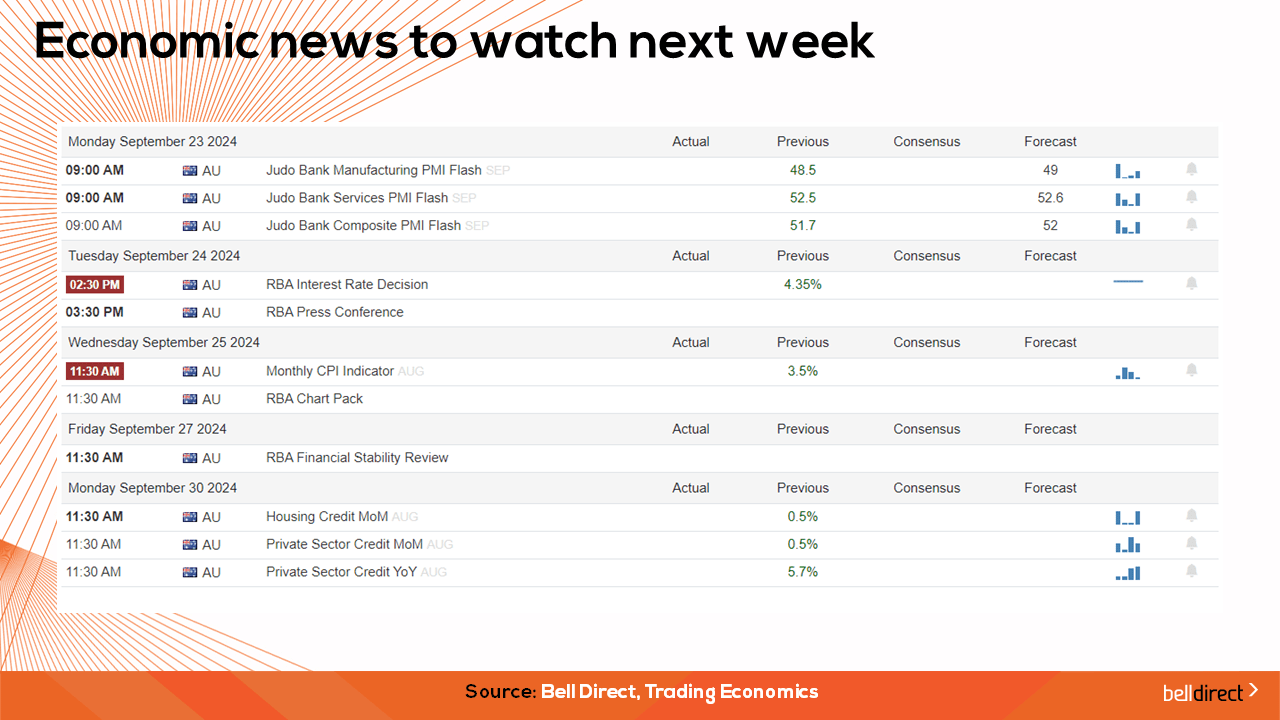

On the economic calendar next week we will likely see investor reactions to the RBA’s latest rate decision which is announced on Tuesday. Australia’s monthly inflation data is also out on Wednesday next week which will likely spur investor reaction, especially if the reading is higher than the 3.5% reported in July.

Overseas we will see key durable goods orders, GDP growth rate and personal spending data out in the US which will paint a clearer picture of the economic health of the world’s largest economy.

And in China we will see key manufacturing data out later next week which will give further insight into just how slow the economic recovery is in the world’s second largest economy post pandemic.

And that’s all for this week, have a fantastic weekend and happy investing!