Transcript: Weekly Wrap 20 October

Thank you for joining me this Friday the 20th October, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update.

All eyes were on key economic data out of China this week to determine the recovery outlook for the world’s second largest economy, and the flow on impacts of such a recovery into global economies, especially Australia. If the data had indicated the weak recovery continues, the outlook for Aussie commodities and general exports would have been dampened further into FY24. However, thankfully for the land down under, the data came in above economists’ expectations and boosted sentiment around China’s recovery gaining some ground.

China’s GDP growth rate expanded by 4.9% YoY in Q3 2023 which is cooler than the 6.3% growth in Q2 but above market expectations of a 4.4% rise, indicating the Chinese economy is finally expanding post the end of pandemic lockdowns earlier this year.

China’s retail sales data YoY in September also rose by 5.5%, which is a significant jump from the 4.9% recorded in August and also supports the idea that consumers in China are back to spending again post pandemic.

And Chinese industrial production YoY also remained at 4.5% in September, however this was above market expectations of a 4.3% rise.

What this data means locally is that the outlook for Aussie commodities, especially iron ore, is brighter as China is Australia’s largest trading partner. This drives the price outlook for iron ore and therefore revenue growth for our big Aussie iron ore miners as industrial production and building in China regains momentum. The Chinese government also made a rare mid-year revision to its national budget just last week in another bid to stimulate economic recovery. This move combined with interest rate cuts are also assisting in the growth and recovery in the region. While companies with exposure to the region were hurt during the August reporting season, we may see some revised outlook announcements in the near-term as companies expect a ramp up of demand in the region which is a positive for locally listed stocks that operate in China.

Elsewhere, we have started seeing first quarter trading updates released both locally and third quarter results released in the US over the last week which sparked mixed reactions from investors based on company performance over the last quarter, especially on the guidance front.

Luxury online fashion retailer Cettire (ASX:CTT) fell 3.4% on Wednesday despite the company doubling its revenue to $167.4m and active customers rising 69% on the PCP in the latest trading update released yesterday against tough economic conditions. The market reaction extended to a further sell-off in Cettire shares on Thursday as investors may fear the ‘higher for longer’ interest rate outlook may hurt demand for luxury fashion items.

Bapcor (ASX:BAP) fell over 12% on Tuesday after the auto parts retailer posted a trading update outlining first quarter performance is below expectations due to slowing sales growth and current margin pressures faced in the high interest rate, rising cost environment.

Nick Scali (ASX:NCK) shares also rose on Thursday after the furniture retailer provided first-half profit guidance that topped market expectations despite trading still trending downward but slowly improving.

And Netwealth (ASX:NWL) fell over 7% on Thursday after the financial services provider released a first-quarter update including a sudden rise in fund outflows from high-net-worth clients.

Over in the US, quarterlies have seen some stocks experience sharp declines including United Airlines which announced softer-than-expected guidance, while some banks including Bank of America rallied after posting better-than-expected results in the high interest rate environment.

The key takeaway from the reporting period so far is that outlook is the key to providing investors with some certainty in the tougher economic conditions expected over the coming months.

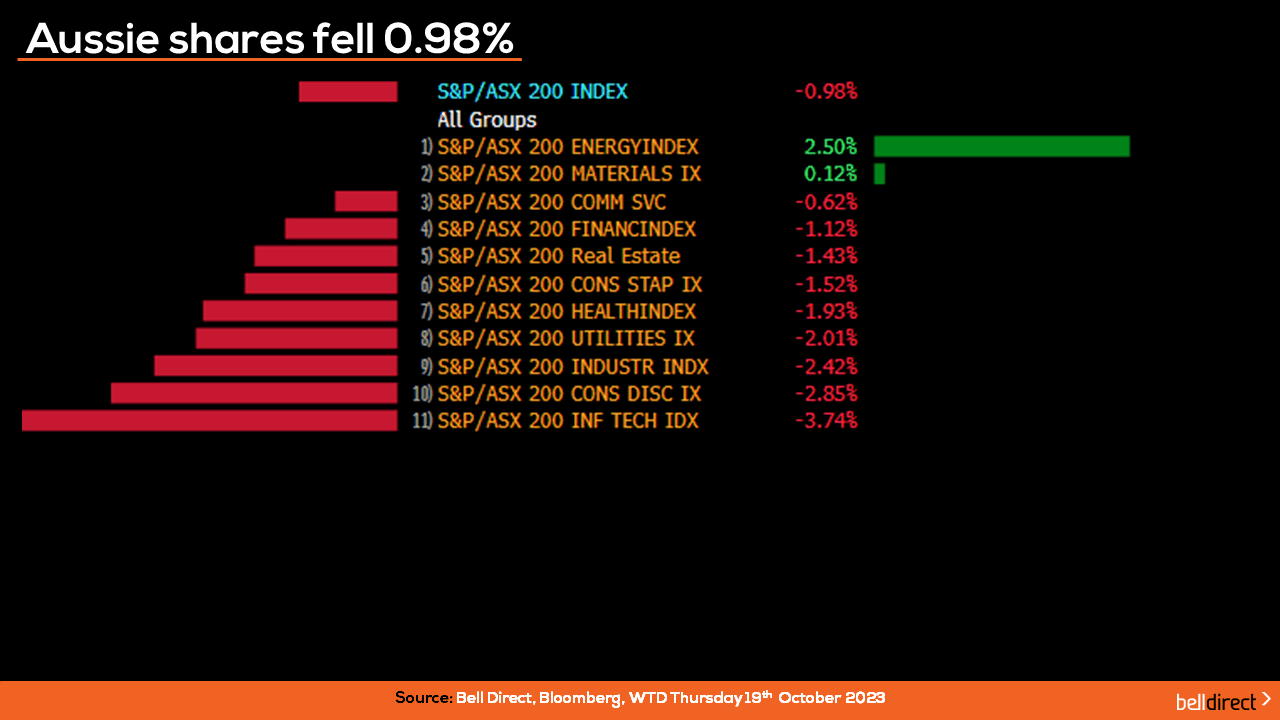

Locally from Monday to Thursday the ASX200 fell just shy of 1%, weighed down by the technology sector tumbling 3.74% while energy stocks offset some of the heavy losses, gaining 2.5% as a sector over the 4 trading days.

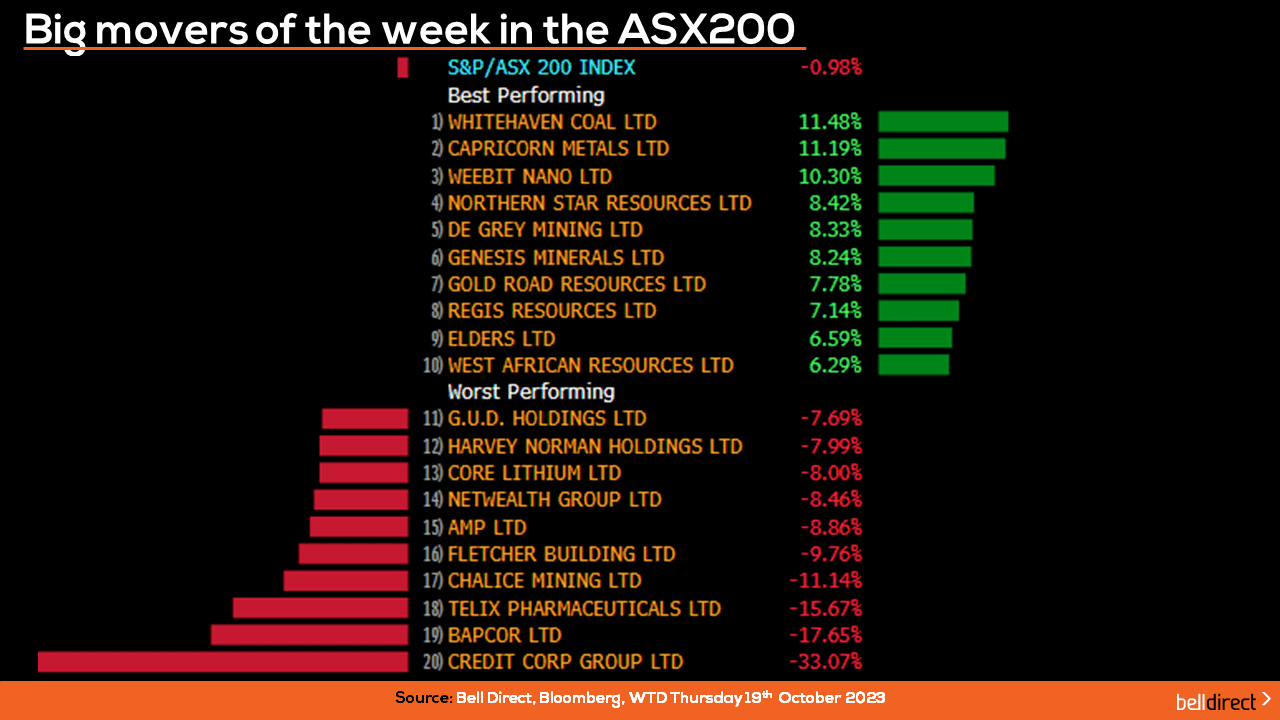

The winning stocks on the ASX200 were led by Whitehaven Coal (ASX:WHC) jumping 11.5% on a US$3.2bn acquisition of BMA’s metallurgical coal mines, while Capricorn Metals (ASX:CMM) rose 11.2% and Weebit Nano (ASX:WBT) rebounded 10.3%.

At the losing end, Credit Corp Group (ASX:CCP) tanked 33% after the company announced it expects a more than 50% reduction in FY24 profits.

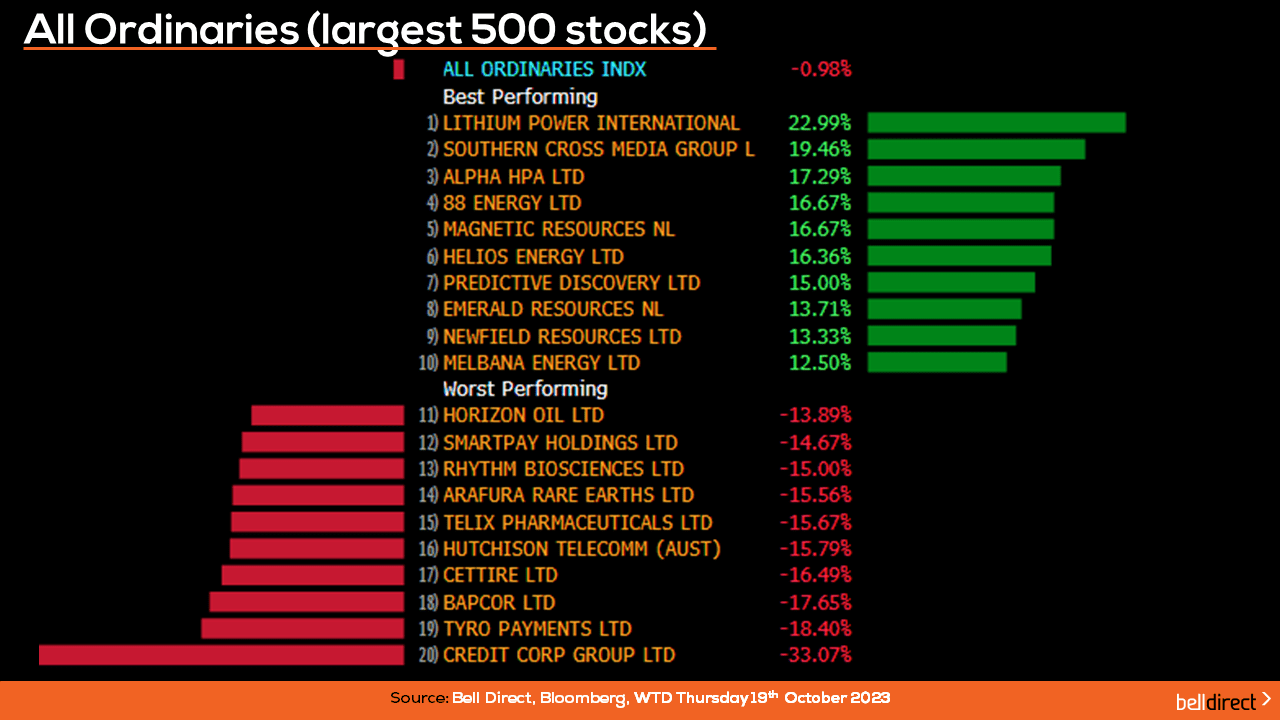

On the broader market, the All Ords also fell 0.98% this week, as Lithium Power International (ASX:LIT) soared 23% while Tyro Payments (ASX:TYO) fell 18.4%.

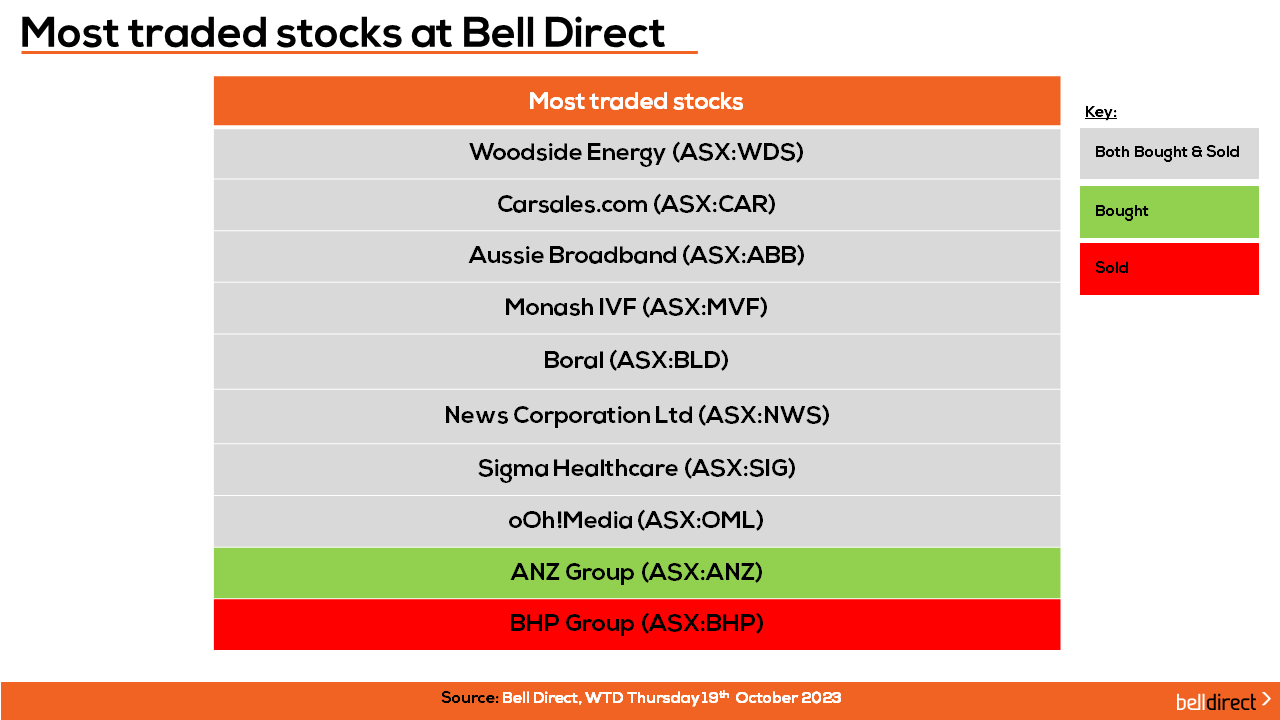

The most traded stocks by Bell Direct clients over the four trading days were Woodside Energy (ASX:WDS), Carsales.com (ASX:CAR), Monash IVF (ASX:IVF), Boral (ASX:BLD), News Corporation (ASX:NWS), Sigma Healthcare (ASX:SIG), Aussie Broadband (ASX:ABB) and oOh!Media (ASX:OML).

Clients also bought into ANZ (ASX:ANZ) while taking profits from BHP Group (ASX:BHP).

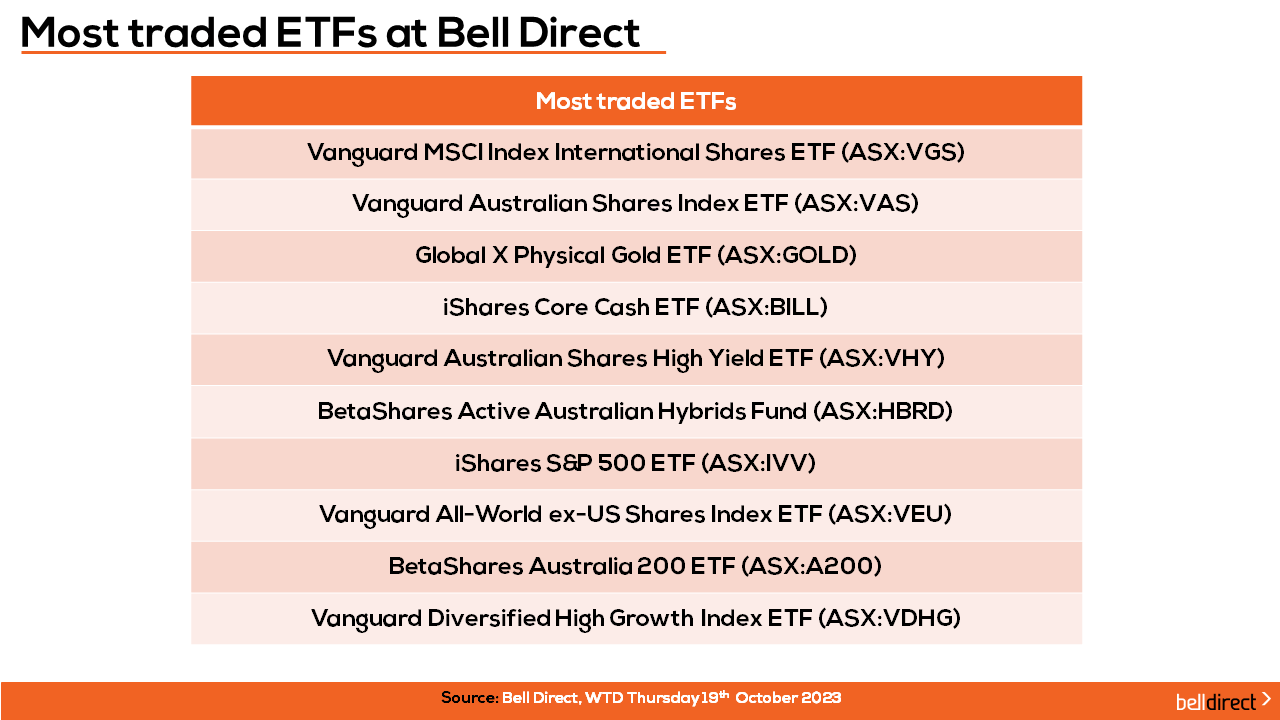

The most traded ETFs were led by Vanguard MSCI Index International Shares ETF, Vanguard Australian Shares Index ETF, and Global X Physical Gold ETF.

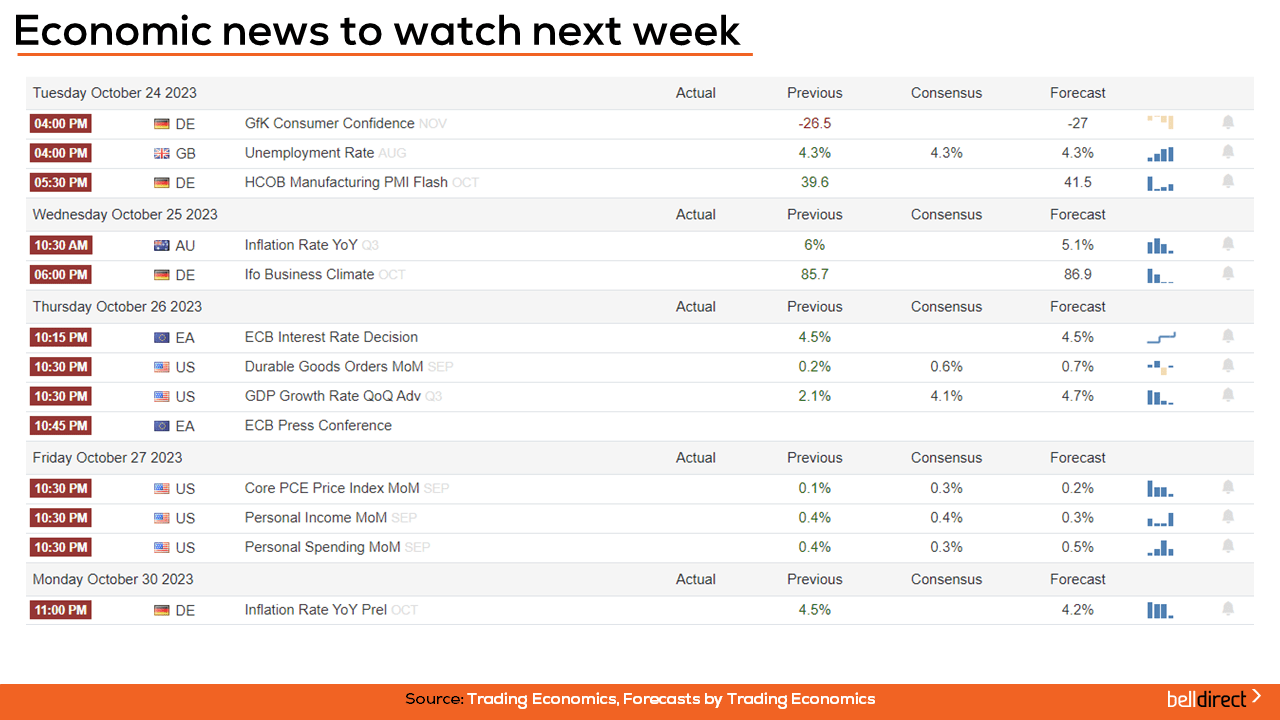

Looking at next week, Australia’s all important inflation rate data for Q3 is out on Wednesday with the forecast of a decline to 5.1% from 6% in Q2 which would provide further support for the RBA to hold and look to cutting the nation’s cash rate in the near future.

Overseas, UK unemployment data is out on Tuesday, while US GDP Growth rate data for Q3, US Core PCE Price Index and Personal income data is out later next week which will all provide an insight into how the Fed’s aggressive interest rate stance to date is playing out in tackling inflation in the region.

And that’s all we have time for today, have a wonderful Friday, a great weekend and as always, happy investing!