Transcript: Weekly Wrap 2 August

Reporting season kicked off this week and is set to reveal a complex earnings landscape shaped by a confluence of economic headwinds. Higher interest rates, intensified competition, rising costs and softening commodity prices have collectively dampened corporate profitability in FY24.

While overall expectations for the ASX200 are not overly negative for this reporting period, with a slight decline in earnings predicted, the broader financial outlook remains cautious.

The market’s attention is increasingly shifting towards FY25, where earnings are projected to rebound. However, when we look at the earnings of smaller companies rather than just the biggest ones, we see a very different picture, with much stronger growth expected. Given the market’s historical tendency to overestimate future earnings, this reporting season will be crucial in shaping expectations for FY25.

Despite flat aggregate earnings estimates over the past six months, the market has rallied, resulting in an elevated price-to-earnings ratio, suggesting greater investor optimism. Therefore, the market could react strongly to companies reporting worse-than-expected earnings, especially if these results cast doubt on the idea that the next financial year will be strong.

Also, sector performance is expected to diverge significantly. Travel, insurance and healthcare are poised for growth, while resources are likely to face challenges. So, the ability to withstand economic pressures and maintain pricing power will be key determinants of success.

Overall, this reporting season will highlight the challenges companies are facing in today’s economy. Investors should focus on companies demonstrating resilience and pricing power, particularly within sectors such as healthcare and technology. Conversely, domestic cyclicals, including banks and retailers, may face increased headwinds.

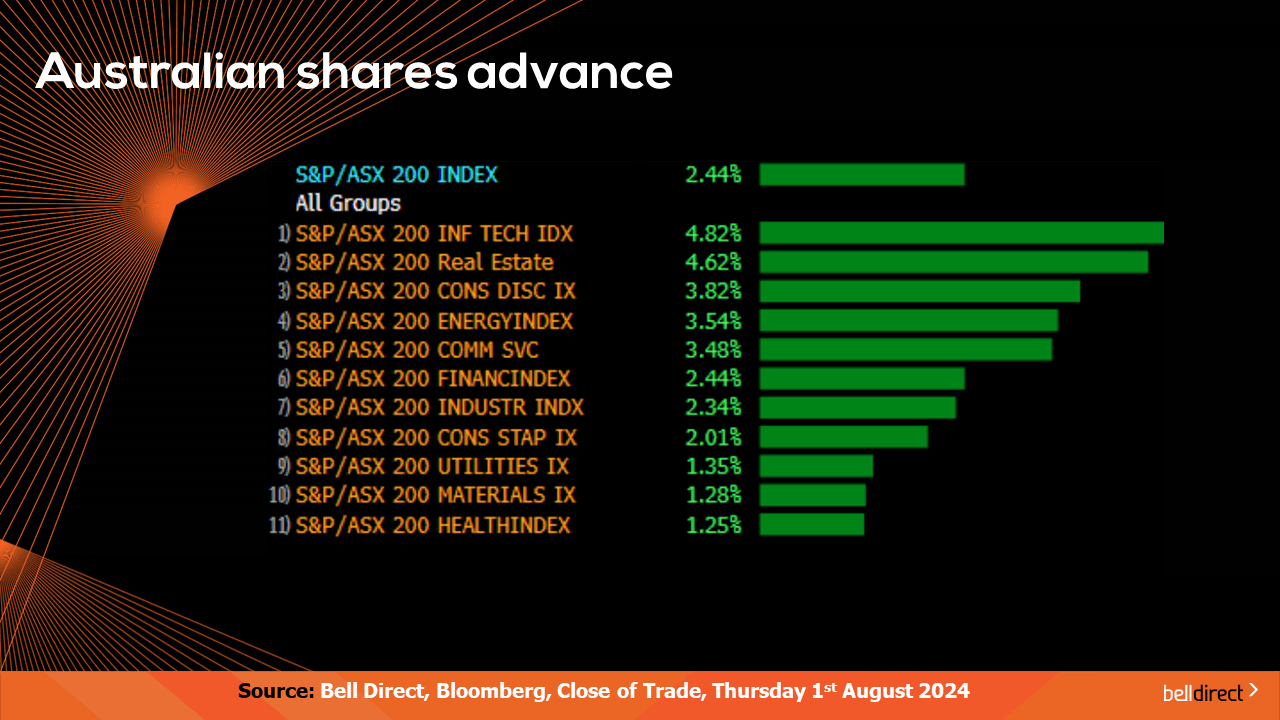

Now looking at the market’s performance this week so far.

Our local market rallied this week; the ASX200 advanced 2.44% Monday to Thursday with all sectors in the green. Technology and real estate are in the lead, gaining 4.82% and 4.62% respectively. Today however, our local market is set for a sharp decline, with the SPI futures suggesting a 1.78% decline this morning, at the time of recording. This follows data on in the US overnight which pointed to slower growth and concerns that he Fed has waited too long to start cutting interest rates.

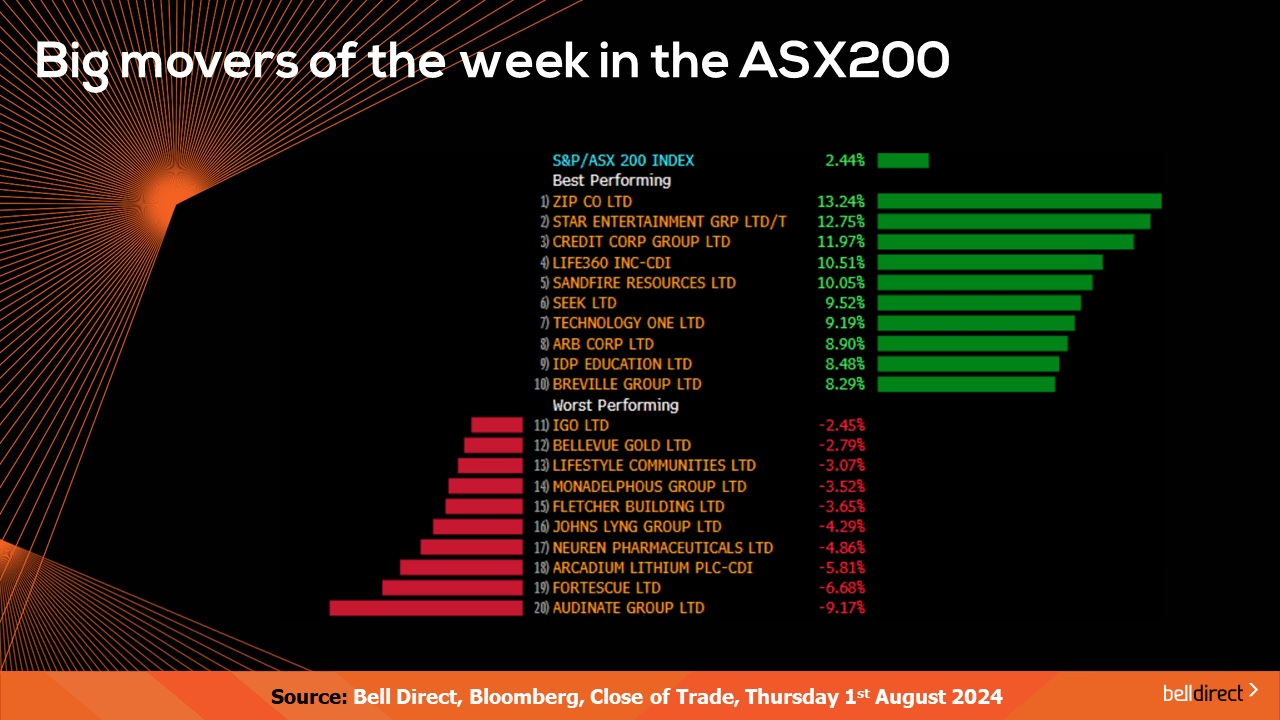

On the ASX200 leaderboard, buy-now-pay-later company Zip (ASX:ZIP) advanced the most, up more than 13% this week so far, after the company posted its quarterly cash flow numbers on Tuesday. ZIP is up 216% so far this year. Star Entertainment (ASX:SGR), Credit Corp Group (ASX:CCP) and Life360 (ASX:360) were also in the lead. While investors took profits from Audinate Group (ASX:AD8), Fortescue (ASX:FMG) and Arcadium Lithium (ASX:LTM).

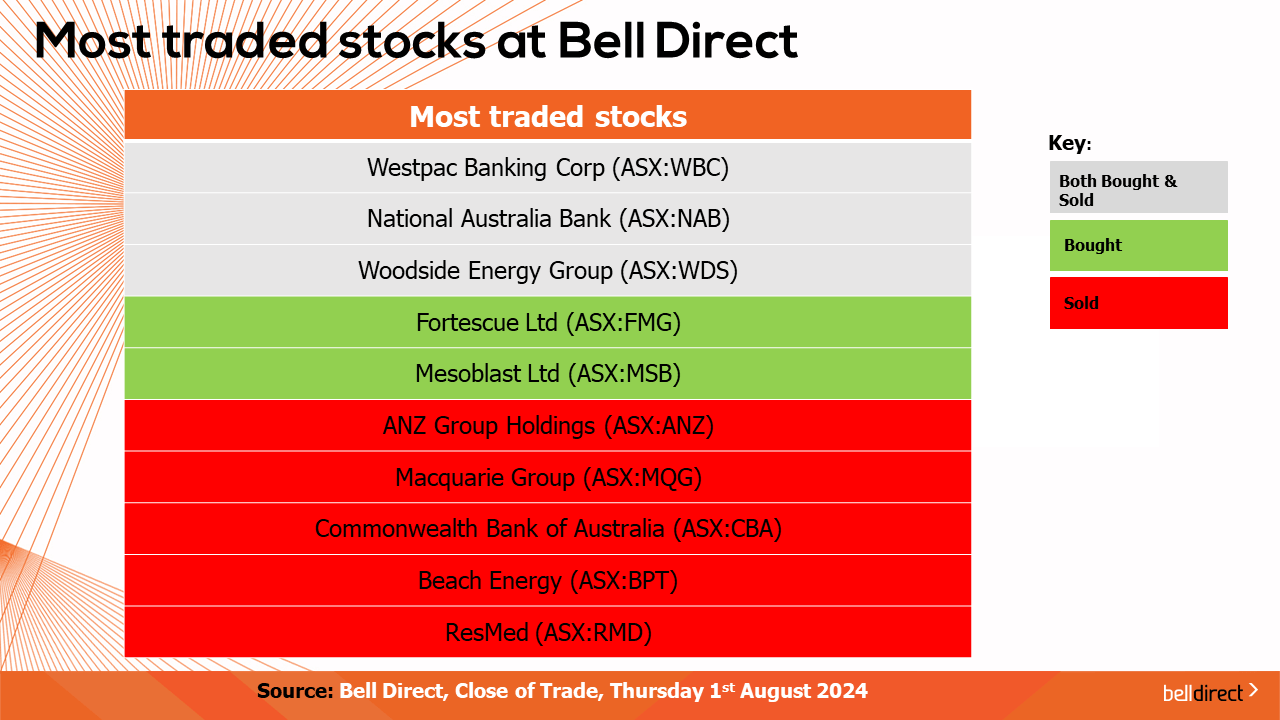

As for the most traded stocks by Bell Direct clients this week, these included Westpac (ASX:WBC), NAB and Woodside Energy (ASX:WDS). Clients bought into Fortescue (ASX:FMG) and Mesoblast (ASX:MSB), while took profits from ANZ, Macquarie (ASX:MQG), Commonwealth Bank (ASX:CBA), Beach Energy (ASX:BPT) and ResMed (ASX:RMD).

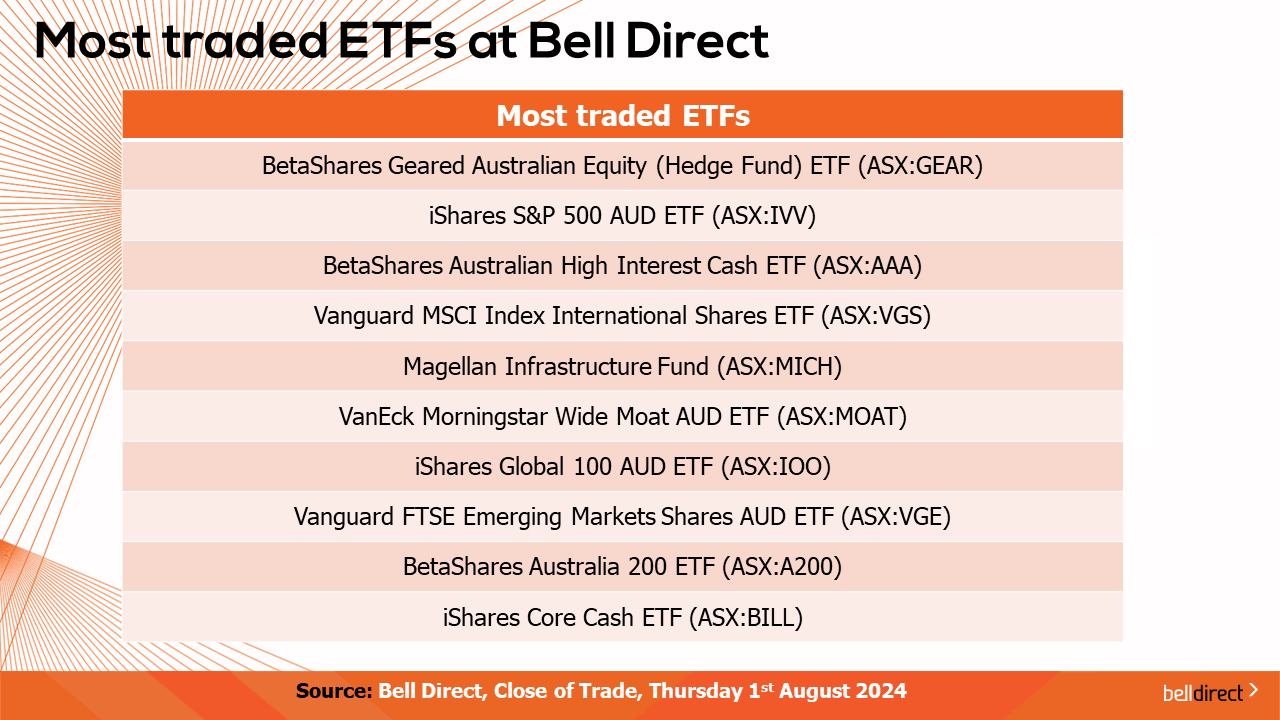

And the most traded ETFs were the BetaShares Geared Australian Equity ETF (ASX:GEAR), the iShares S&P500 ETF (ASX:IVV) and the BetaShares Australian High Interest Cash ETF (ASX:AAA).

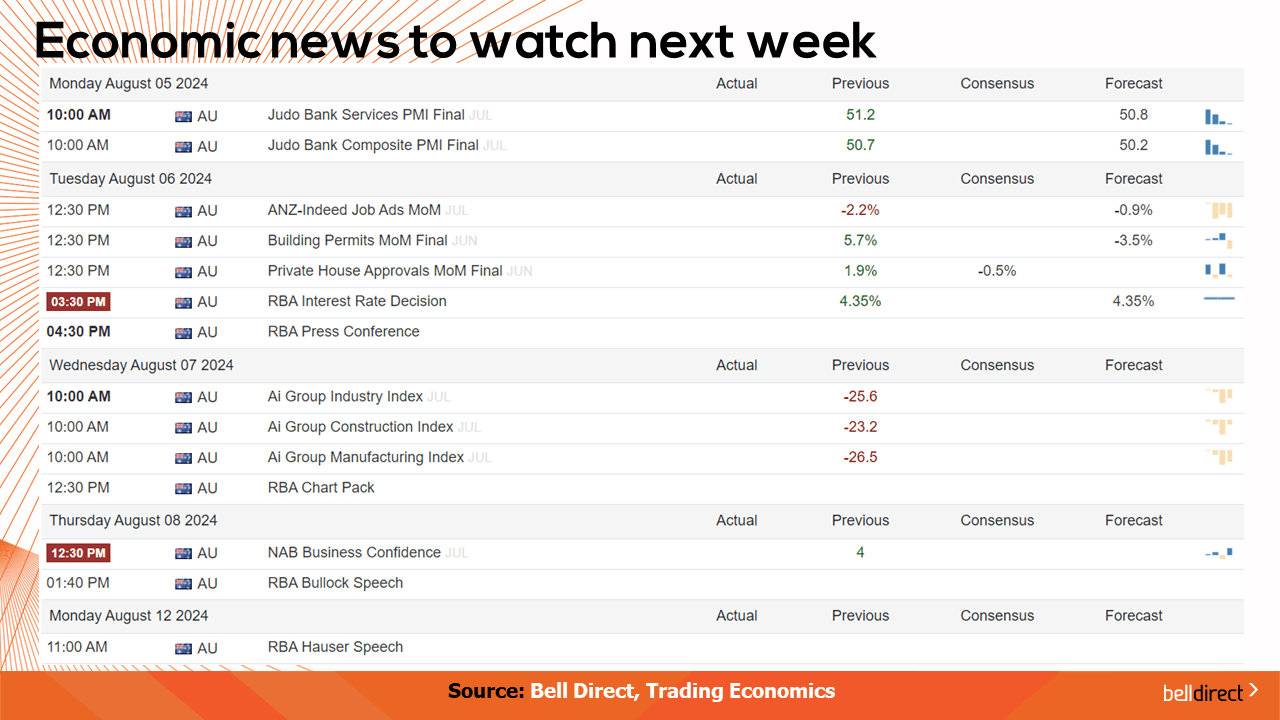

And to end, economic data to watch out for next week.

On Monday the final services PMI will be out for July. That’s the purchasing managers’ index, a indicator of economic trends in the services sector. Then on Tuesday, the next RBA Interest Rate decision will be announced, expected to remain on hold at 4.35%. Followed by business confidence data out on Thursday.

And that’s all for today. I’m Sophia Mavridis with Bell Direct. Have a great Friday, and happy investing.