Transcript: Friday 18 October 2024

Thank you for joining me this Friday the 18th October, I’m Grady Wulff, Market Analyst with Bell Direct and this is the weekly market update.

This week we had a mix of economic data, US earnings results and commodity price volatility that were the key drivers of market moves over the trading week.

In the US, we had Wall St start the week in record territory across the Dow and S&P 500 on the back of mostly stronger-than-expected results out early this Q3 results period.

JP Morgan Chase rose 4.4% last Friday after topping profit and revenue expectations for Q3 while Wells Fargo rose 5.6% on stronger-than-expected profits.

Morgan Stanley gained 7% on Wednesday after beating Wall Steet expectations for Q3 earnings and revenue.

United Airlines also beat estimates in Q3 and forecast strong results for Q4 which boosted shares in the leading airline up 12.4% on Wednesday.

Walgreens shares have been on a tare this week with a gain over 17%, putting US pharmacy stores giant on track for its biggest one-week gain since December 1987. The move comes after the company announced it will close 1200 stores by 2027 to cost cut, in addition to the release of the company’s Q4 results beating estimates.

Around 50 S&P 500 companies have posted results so far with 79% of those beating expectations. The strength of equities in the high interest rate period of Q3 is welcomed by investors who have been increasingly concerned of a potential recession over a soft landing in the rate cut cycle as economic data has been equally weighted in favour of both scenarios. The Fed has a tough job over the coming months to monitor economic data and the stability of the economy to avoid a recession in the world’s largest economy. The strength in the Q3 results so far has driven markets to record territory across the major averages this trading week.

Elsewhere, we started the week with key economic data out of China that reaffirmed the sluggish economic recovery in the region and halted the stimulus-related global equities rally this week as there is still much to be done to materially reignite growth in the region.

China’s inflation rate rose just 0.4% in September annually, where the market was forecasting a 0.6% rise. MoM the inflation rate was flat while the market was expecting a 0.4% rise. Producer price index in the region fell 2.8% which was worse than the 1.8% decline reported in August and worse than economists’ were expecting. Vehicle sales in the region also fell just 1.7% which was much better than economists were expecting at a 5.6% fall. All of this data paints a weak economic picture out of the world’s second largest economy indicating desperate need to the stimulus to be injected into the economy ASAP.

The latest stimulus announced later this week came in the form of an expansion to the original stimulus to 4 trillion yuan to support ‘white list’ projects in housing that are eligible for financing and increase bank lending for such developments. The stimulus expansion underwhelmed the market and the economic data weighed on iron ore prices this week.

The stimulus addition this week though failed to impress investors with ongoing fears that the amount is not enough and led to the price of iron ore tumbling to a 3-week low. Whether the stimulus is enough will tell over the coming months as investors assess key economic data and demand for iron ore and other commodities out of the world’s second largest economy.

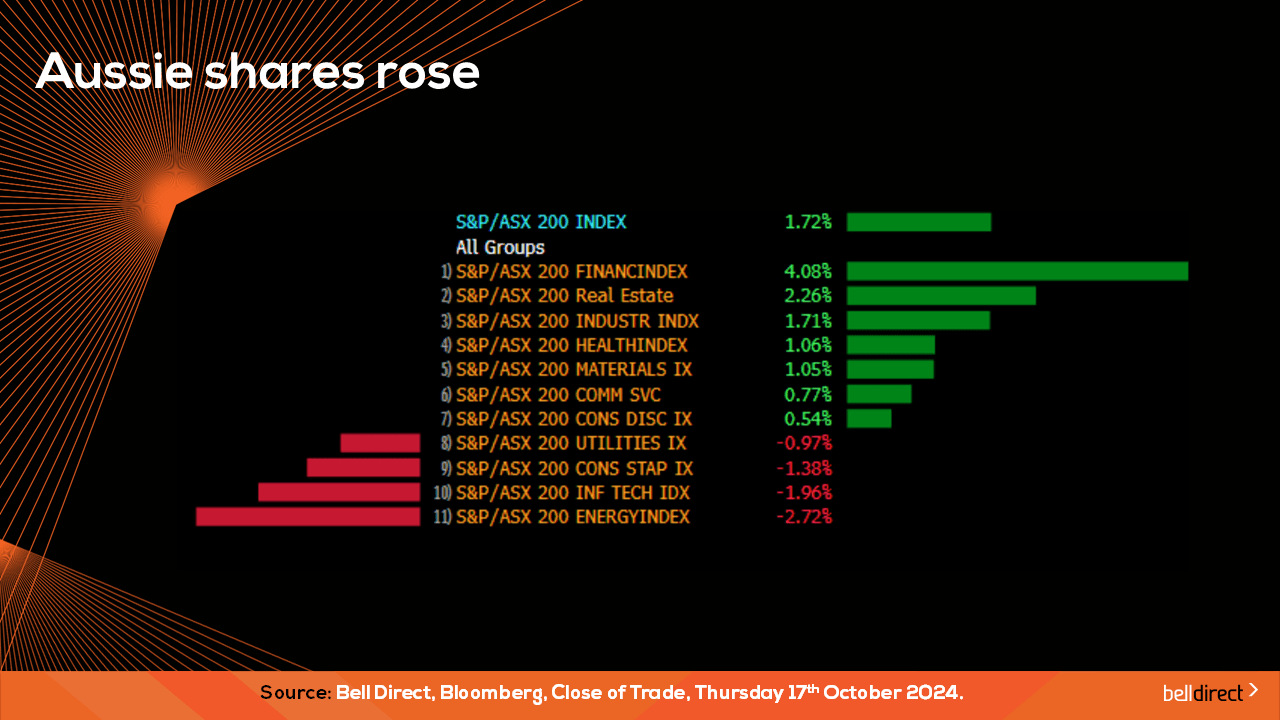

Locally from Monday to Thursday the ASX200 rose 1.72% as a 4% gain for the financial sector boosted the key index to a strong end to the week.

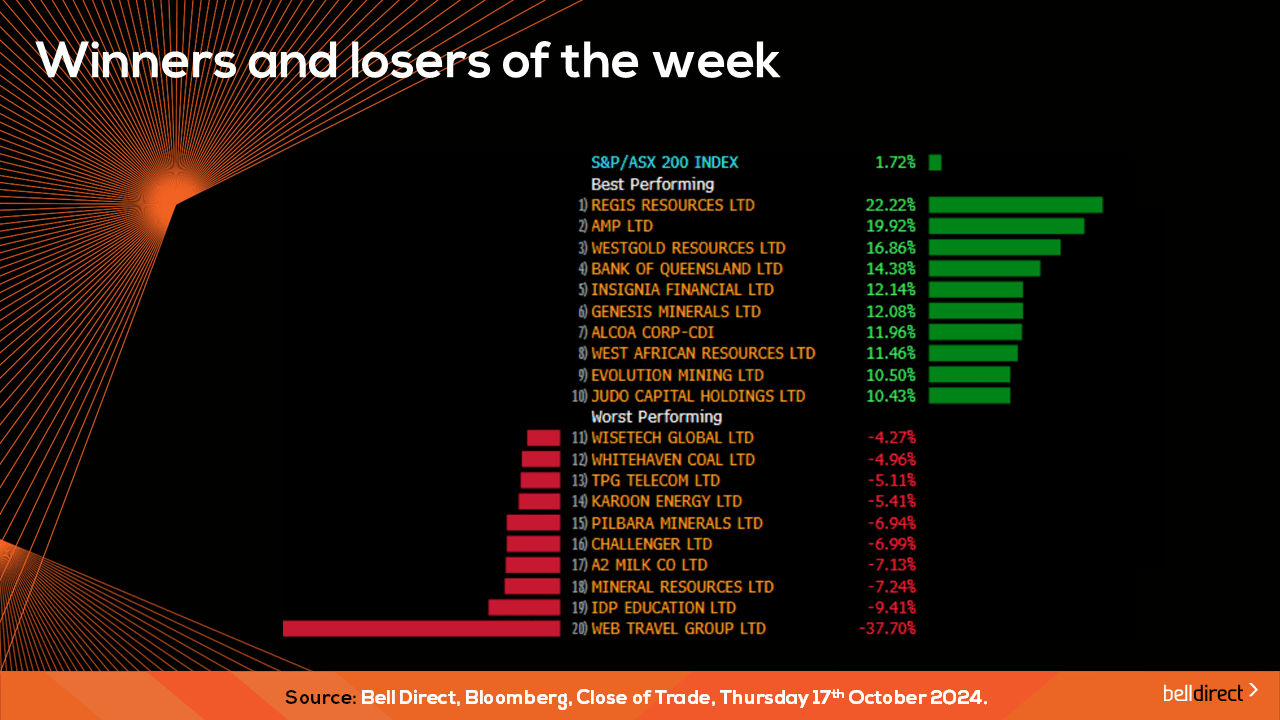

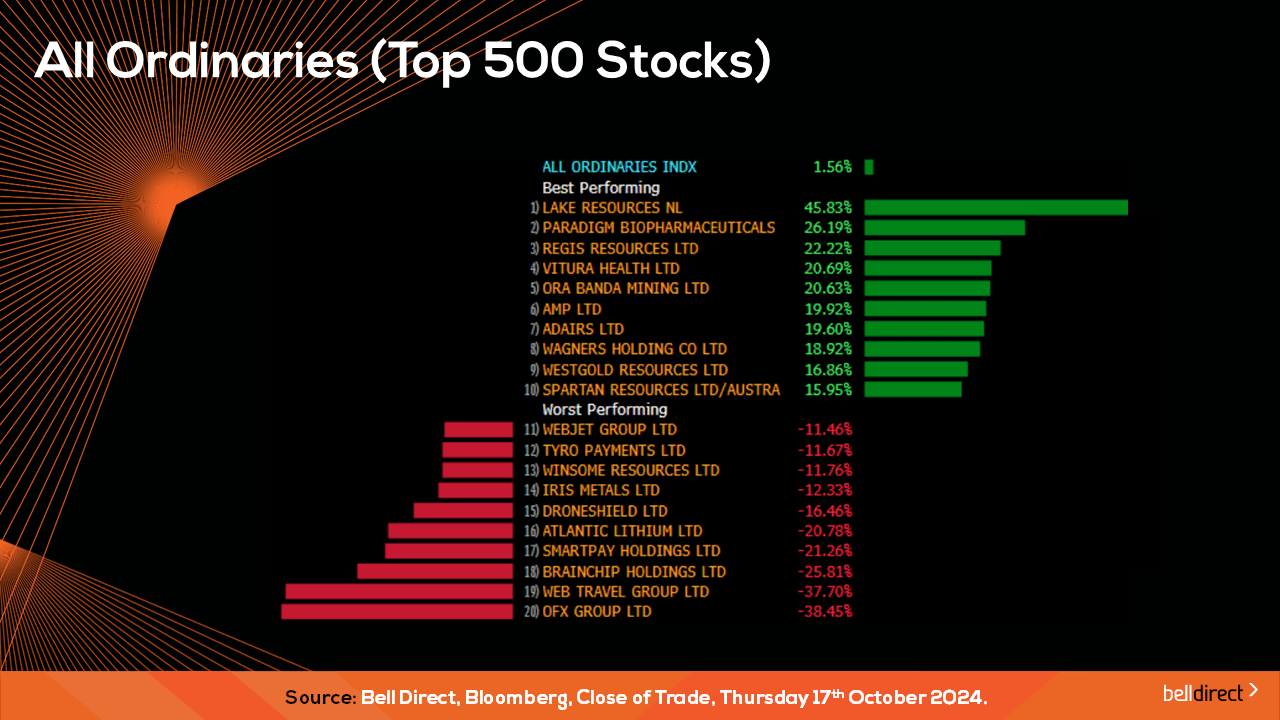

The winning stocks from Monday to Thursday on the ASX200 were led by Regis Resources (ASX:RRL) jumping 22.22%, while AMP Ltd (ASX:AMP) added 19.92% and Westgold Resources (ASX:WGX) gained 16.86%.

Web Travel Group (ASX:WEB) tanked 37.70% this week following the release of the company’s trading update. IDP Education (ASX:IEL) fell 9.41% over the four trading days and Mineral Resources (ASX:MIN) ended the week down 7.24%.

The most traded stocks by Bell Direct clients this week were Commonwealth Bank (ASX:CBA), Westpac (ASX:WBC), and Insignia Financial (ASX:IFL). Clients also bought into New Hope Corporation (ASX:NHC) and GrainCorp (ASX:GNC), while taking profits from Macquarie (ASX:MQG), Arcadium Lithium (ASX:LTM), Fortescue (ASX:FMG), ANZ (ASX:AMZ), and MA Financial Group (ASX:MAF).

And the most traded ETF by our clients this week were led by BetaShares Geared Australian Equity (Hedge Fund) ETF (ASX:GEAR), Vanguard Australian Shares Index ETF (ASX:VAS), and Vanguard MSCI Index International Shares ETF (ASX:VGS).

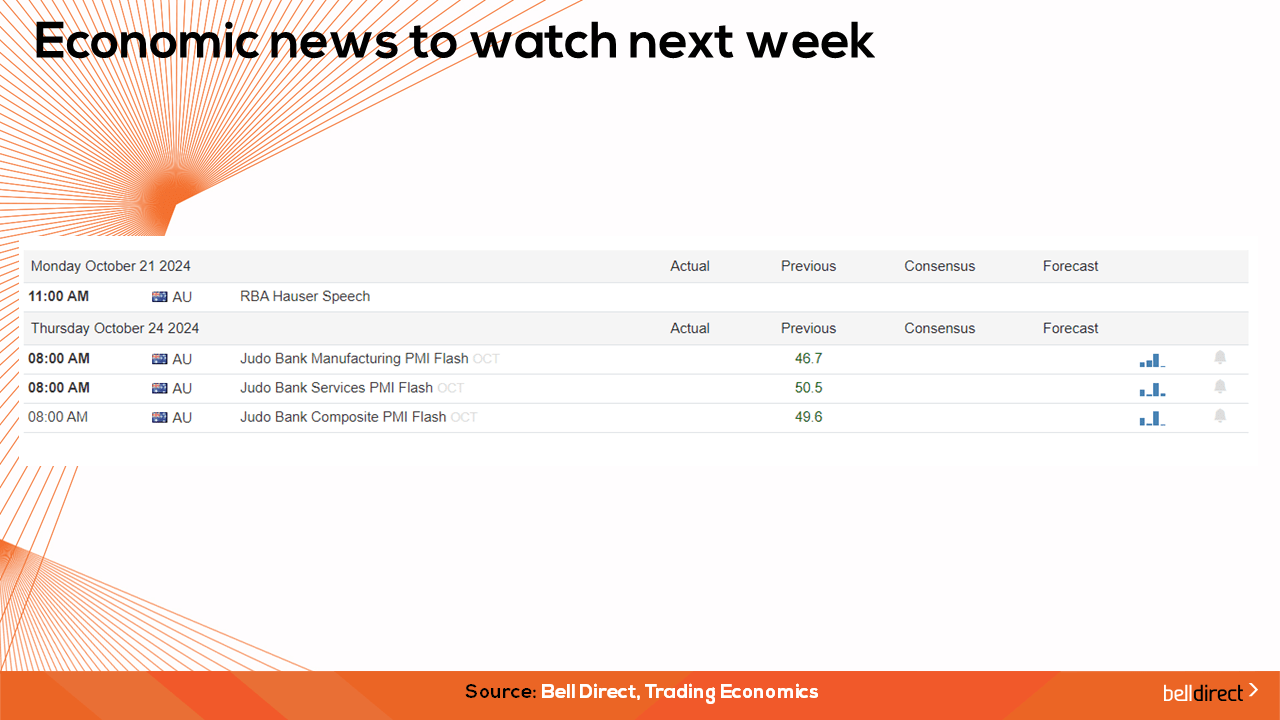

On the economic calendar front next week, we may see investors react to Australia’s Judo bank Manufacturing PMI flash indicator out on Thursday, while overseas in the US we can expect markets to react to US new home sales, durable goods orders, manufacturing PMI initial jobless claims, and existing home sales out throughout the week to further gauge the health of the US economy.

And that’s all for this Friday, have a wonderful weekend and happy investing!