Transcript: Weekly Wrap 18 August

Thank you for joining me this Friday the 18th August, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update.

As the theme goes, reporting season continued to gain momentum this week so let’s dive into how those companies that released results fared in FY23.

Endeavour Group (ASX:EDV) is one major name that investors sold out of despite the company beating expectations across key metrics including group sales up 2.5% to $11.9bn, EBIT up 10.7% to $1.023bn, NPAT up 6.9% at $529m and a full year dividend announced of 21.8cps which is a rise of 7.9%. Of particular note, was the company’s Hotels business which is thriving in the current environment despite macro headwinds as cost-of-living pressures rise, with the Hotels business EBIT rising 35.98% in FY23 to $428m.

Healthcare has been the sector investors have fallen out of love with this reporting season and in 2023 as earnings outlook slows and companies in the sector have been trading at higher valuations over the past year. During the COVID era, healthcare stocks had high earnings growth outlooks especially those companies producing vaccines and complementary products. Fast forward to 2023 and the growth outlook for these companies is easing and they are trading at higher valuations from the growth over COVID thus the pullback in valuations this year is for a few reasons.

The sell-off in healthcare locally has partially stemmed from the US over 2023 amid Medicare’s new ability to negotiate pricing of some drugs in the industry like diabetes drugs.

Margin contraction is another area investors have been disappointed with healthcare companies this reporting season, with the prime example being ResMed (ASX:RMD) reporting its margins contracted 80bps to 55.8%.

And lastly, in a time where investors are taking a more defensive, safe-haven, income-investing stance rebalancing portfolios, companies in the healthcare sector that have weakened earnings outlook, higher costs and volatile revenue streams have been on investor sell lists both this month and year.

Switching to the technology market and Life360 (ASX:360) was a tech name that surprised this week with strong results as the location tracking hardware and software company edges closer to profitability. 360 reports on a calendar year, so for the first half, the company reported a 39% rise in total revenue to $138.9m and issued guidance expectation for revenue between $300-$310m. Annualised monthly revenue excluding hardware also rose 43% to $248.7m and the company’s net loss decreased significantly from $58.2m in H1 FY22 to $18.5m in H1 FY23. Subscriber numbers also gained momentum with the company tipping over 54 million monthly active users. Bell Potter has a buy rating on Life360 with a price target of $10.50.

On the financials front, NAB (ASX:NAB) released third-quarter results on Tuesday which were taken as a sound result with little share price movement post release of the report. As expected, post a peak late in 2022 across all banks, NAB’s net interest margin fell 5-basis points to 1.72%, reflecting higher home lending competition alongside higher deposit costs. NAB also reported statutory net profit of $1.75bn, $1.9bn unaudited cash earnings, and the announcement of a $1.5bn share buyback.

The key takeaways from this week of reporting season were that investors are very quick to sell out of company’s that do not report outlook for FY24 and rising costs impacting margins is also cause for concern from an investor’s perspective.

Looking to the week ahead we will be keeping a close eye on results out of BHP Group (ASX:BHP), Coles (ASX:COL), Woolworths (ASX:WOW) , Woodside (ASX:WDS), Ampol (ASX:ALD), the a2 Milk Company (ASX:A2M), Wesfarmers (ASX:WES), Medibank Private (ASX:MPL), Scentre Group (ASX:SCG), Wisetech Global (ASX:WTC), Pilbara Minerals (ASX:PLS) and Qantas (ASX:QAN) among many others.

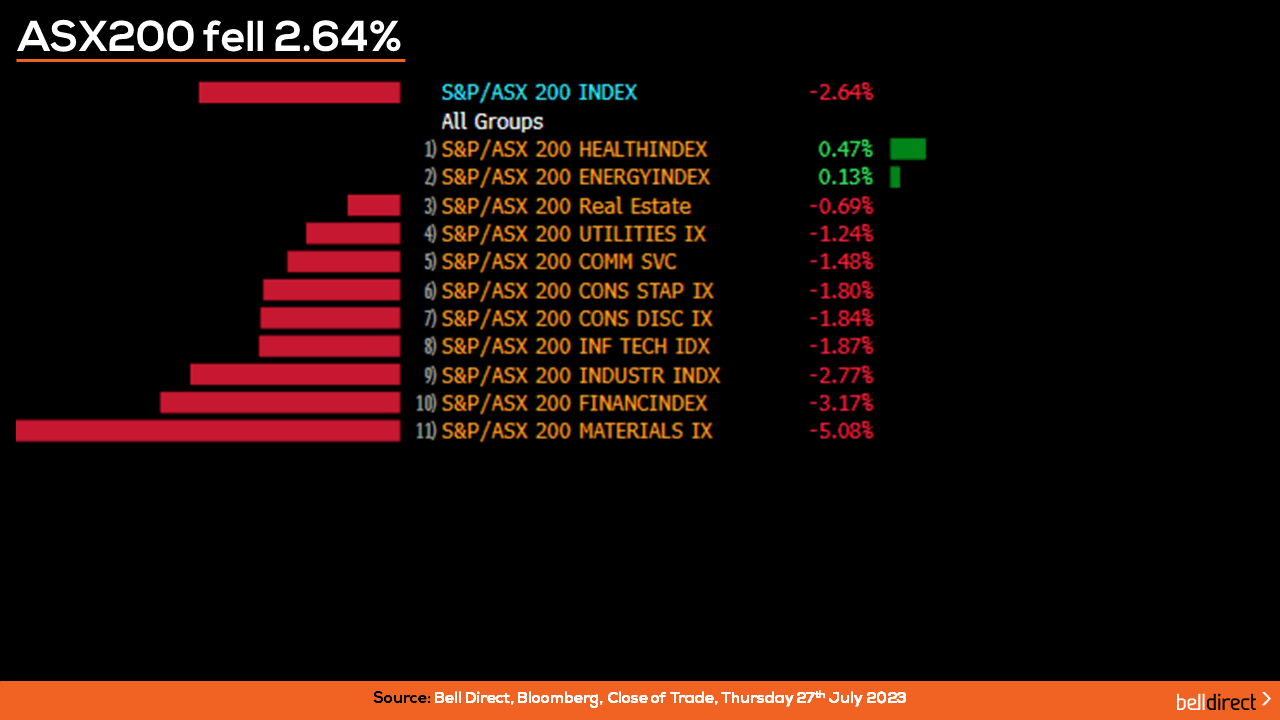

Locally from Monday to Thursday the ASX200 tumbled 2.64% as Chinese economic data, US banking downgrade warnings, and local data weighed on investor sentiment. In China, weak retail sales and manufacturing output data provided further indication that the world’s second largest economy is struggling to regain momentum post pandemic.

Australia’s unemployment rate increased from 3.5% to 3.7% in July, in a strong sign the RBA’s rapid interest rate rises since May 2022 are starting to cool the tight labour market.

Materials stocks took the biggest hit this week, with the sector shedding 5.08% over the four trading days. Financials and industrials were also sold off by investors with those sectors losing 3.17% and 2.77% respectively.

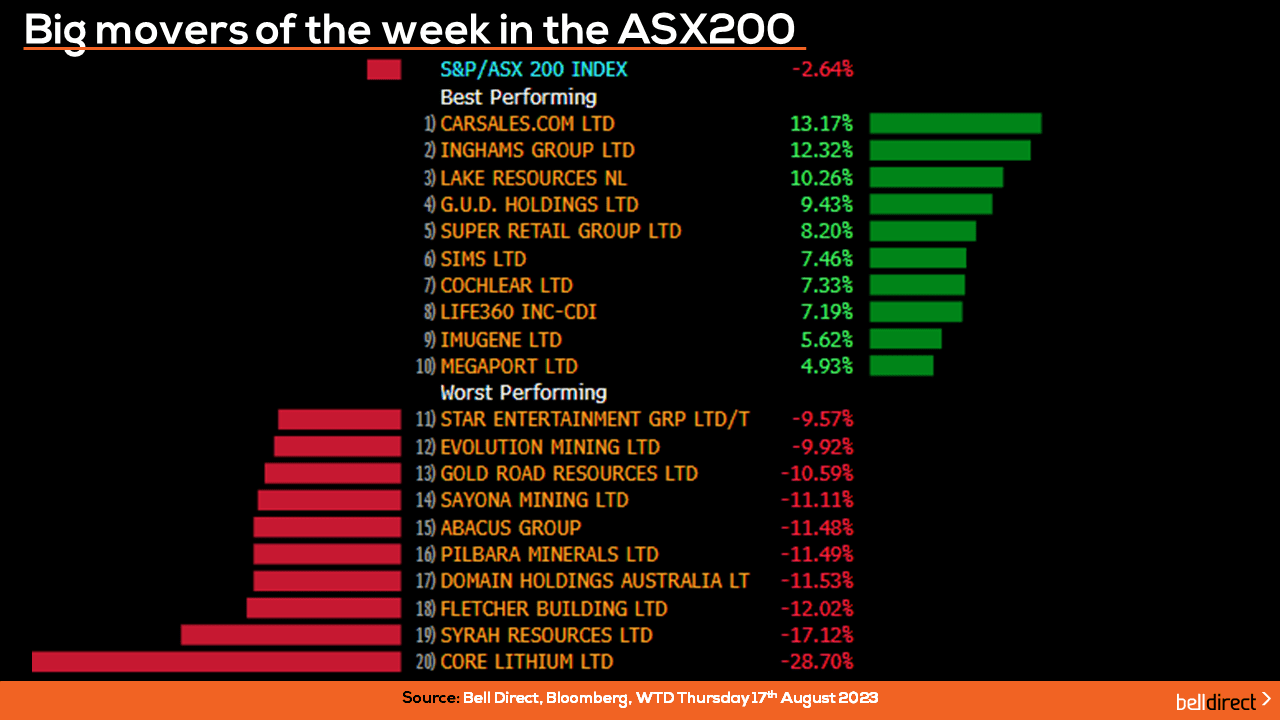

Taking a look at the winning stocks on the ASX200 this week Carsales.com (ASX:CAR) led the charge after reporting strong FY23 results, while Inghams Group (ASX:ING) and Lake Resources (ASX:LKE) also rallied 12% and 10% respectively.

Core Lithium (ASX:CXO) on the other hand tumbled 28.7% after announcing it had successfully completed a $100m institutional placement.

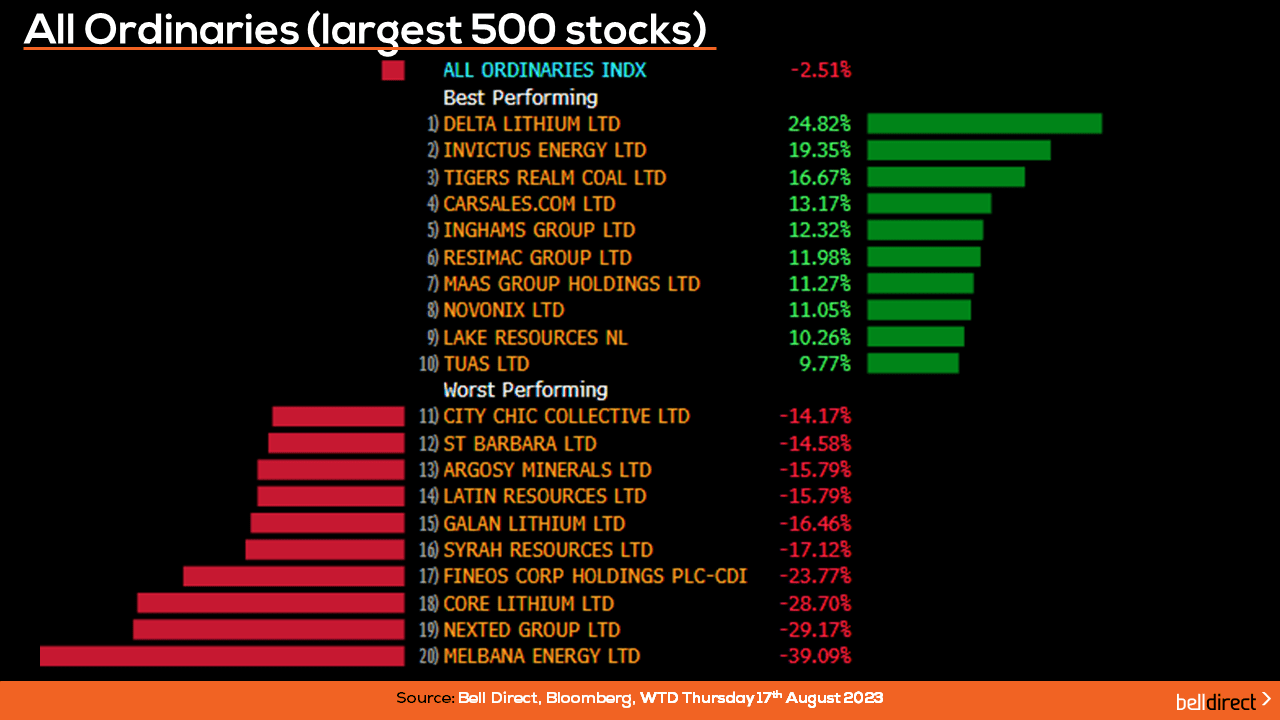

On the broader index, the All Ords fell 2.51% this week as a near 25% gain for Delta Lithium (ASX:DLI) was offset by Melbana Energy (ASX:MAY) tumbling 39%.

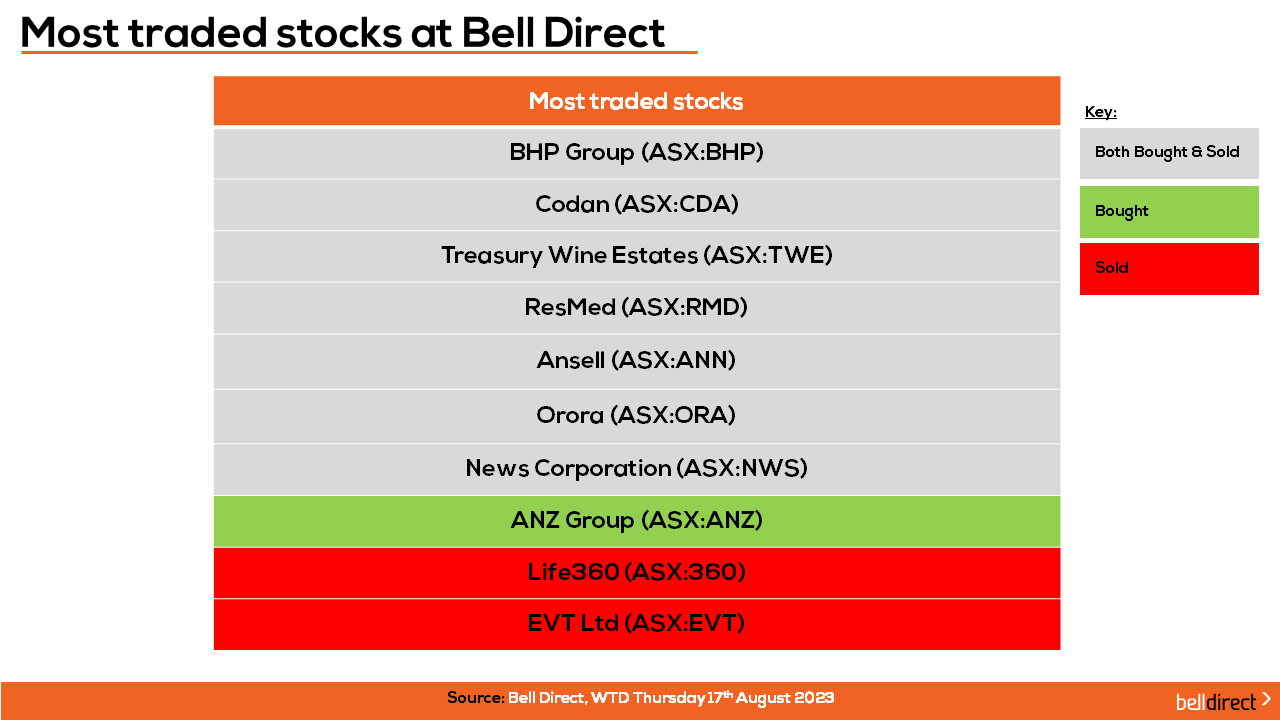

The most traded stocks by Bell Direct clients from Monday to Thursday, were BHP Group (ASX:BHP), Codan (ASX:CDA), Treasury Wine Estates (ASX:TWE), ResMed (ASX:RMD), Ansell (ASX:ANN), Orora (ASX:ORA), and News Corporation (ASX:NWS).

Clients also bought into ANZ (ASX:ANZ) while taking profits from Life360 (ASX:360) and EVT (ASX:EVT).

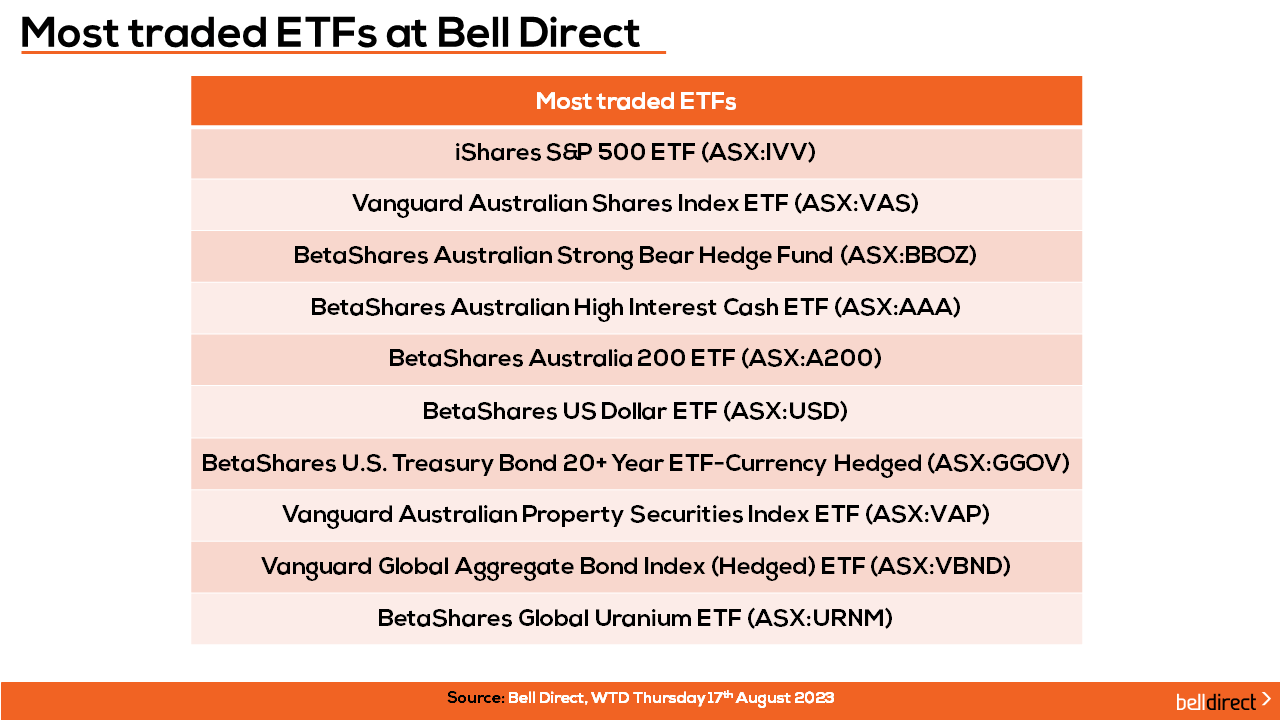

On the diversification front, the most traded ETFs by Bell Direct clients were led by iShares S&P 500 ETF, Vanguard Australian Shares Index ETF and BetaShares Australian Strong Bear Hedge Fund.

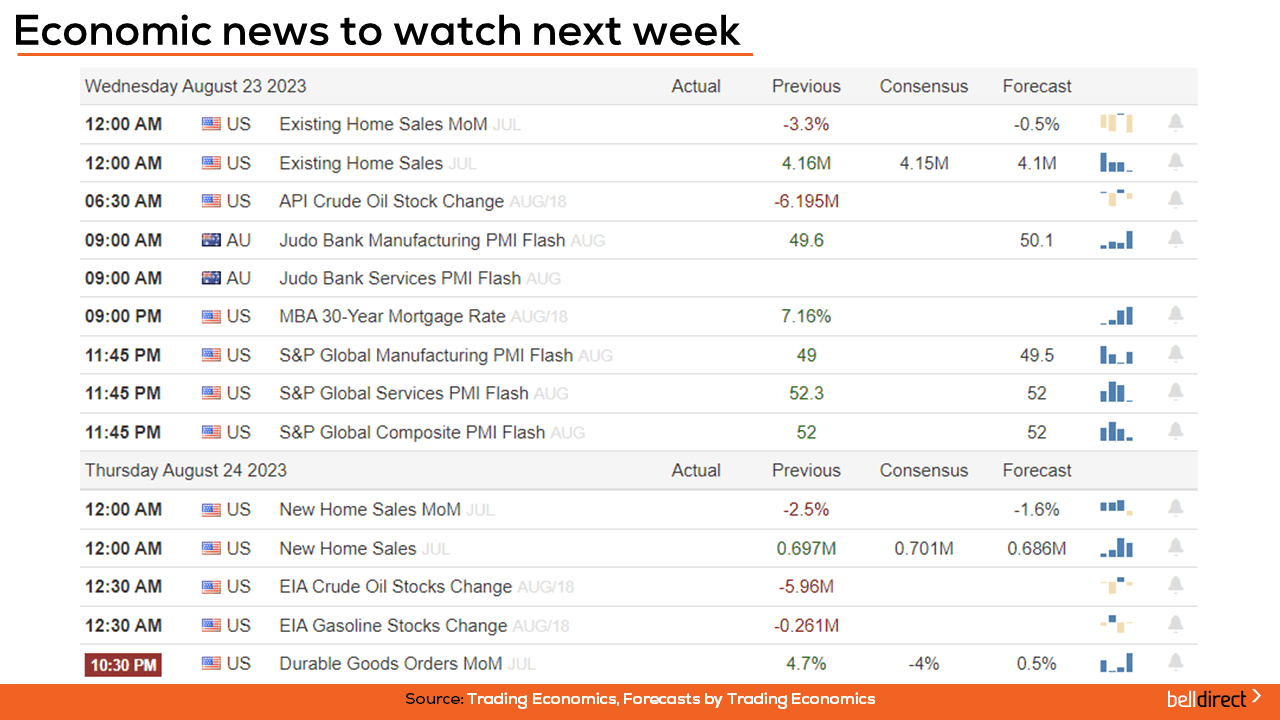

Looking ahead to next week on the economic calendar, it is a quiet week both locally and globally, however on Wednesday we will gauge an insight into the flash Judo Bank Manufacturing and Services PMI data for August in Australia and on Thursday we will see durable goods orders data out of the US.

And that’s all for this week. Have a wonderful weekend and as always, happy investing!