Weekly Wrap Transcript 17 November

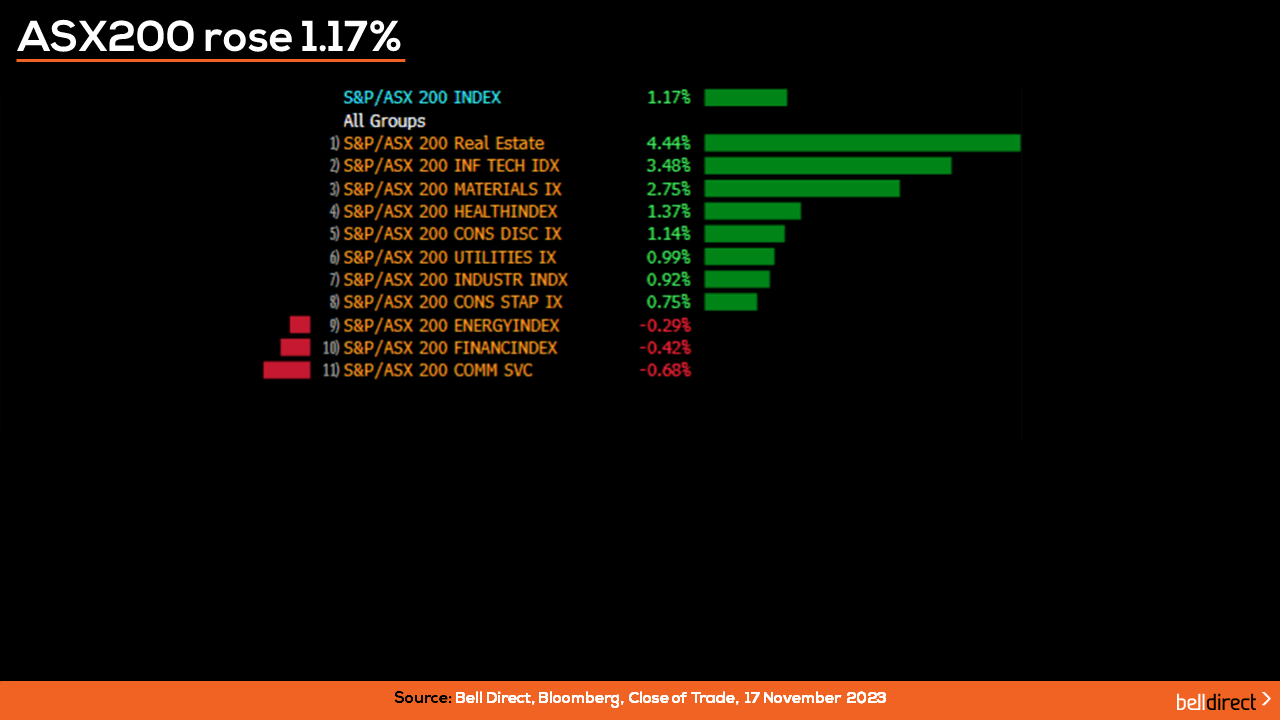

It was a green finish to the local market this week from Monday to Thursday, with the ASX200 rising 1.17% buoyed by interest-rate sensitive sectors rallying on the idea that Australia’s cash rate may have peaked at 4.35%.

The rise in investor hopes of no further rate hikes was on the back of favourable economic data released and the RBA delivering a key economic outlook speech. The key takeaway from Marion Kohler’s (Acting Assistant Governor – Economic) speech was that GDP has slowed, labour market conditions have eased a little and headline inflation has fallen from its peak of close to 8% in late 2022 to just under 5.5% in the most recent reading. As for outlook, GDP growth is expected to be below trend over 2024 due to eased growth in household consumption in the high cost-of-living, higher interest rate and higher tax payable environment. This outlook of slowing economic growth eased investor fears of further rate hikes and thus sparked the rally for rate-sensitive tech and real estate stocks this week.

One thing to keep in mind though that may be a challenge for the RBA over the coming months is Wage Price inflation (a key driver of inflation) which saw Australia record the strongest ever quarterly wages growth in Q3, rising by 1.3% in the quarter and an annual increase of 4%.

Over in the US, Wall Street’s four-day rally lost steam on Thursday on the back of US oil inventories rising to the highest level since August following renewed concerns around global demand and expectations of Saudi Arabia and Russia to extend output cuts into 2024. Bond yields falling and softer-than-expected US inflation data were the drivers of the US rally over the four trading days before Thursday.