Transcript: Weekly Wrap 17 January

It was a mixed bag across markets early in the week before the latest US inflation reading boosted global investor sentiment as inflation in the world’s largest economy continues to ease, paving the way for the Fed to continue its rate cut journey.

The Fed’s aggressive rate strategy during the post-pandemic economy cycle is working to supress inflation to the Fed’s target 2% with core inflation in the world’s largest economy now at 3.2% as of December. Despite headline inflation rising to 2.9% in December, the fall in core inflation which strips out volatile items like fuel and food, provides great support for the Fed to be pleased with inflation cooling and to be able to consider another rate cut soon.

Locally, the rate pathway isn’t as certain here as in the US following the release of a mixed jobs report this week. Australia’s latest jobs data for December showed unemployment ticked up to 4% which is supportive for the RBA to consider rate cuts near-term as the tight labour market shows signs of loosening. However, the way in which 56,300 more jobs were added to the economy in the month adds further headache for the RBA given the figure was significantly higher than the 15,000 new jobs economists were expecting. With a tight labour market remaining stubbornly strong, the RBA’s chances of considering a rate cut in February are slim given more income is generated which means greater capital for Australians to filter back into the economy thus driving inflation tailwinds for greater spend over the coming months.

We are also preparing for the release of highly anticipated earnings season which kicks off in February. Investors will be eager to see how Aussie listed companies performed in the high interest rate, elevated inflation, and subdued demand environment of 1HFY25, and on a global scale, how US companies performed during FY24 against headwinds of Trump being re-elected, the Fed’s first rate cut, and global geopolitical tensions weighing on earnings growth over the US financial year.

While valuations are running hot for some equities like CBA, we have seen continued momentum on the earnings growth front that justifies the high forward PE valuations some companies are trading on like Life360, while others have investors hitting the sell button amid subdued earnings growth outlook.

This week we saw Pro Medicus (ASX:PME) announce yet another long-term contract signed for the rollout and use of its leading cloud-based imaging platform, Visage 7. The deal worth $33m is with the University of Kentucky College of Medicine and includes the rollout of Visage 7 to the college’s UK affiliates including two hospitals, for a period of 9-years. Bell Potter currently has a hold rating on Pro Medicus as it is another example of a company trading on a sky-high PE ratio over 300x.

And some retailers released updates this week sparking mixed reactions from investors.

Department store giant Myer tumbled over 23% to start the week lower after the retailer released an ‘in-line’ trading update with flat growth amid challenging trading conditions during the high interest rate environment. The update dragged down shares in Premier Investments too by 16% as Premier is the largest shareholder in Myer.

Meanwhile, City Chic shares rose over 11% on Tuesday as investors welcomed the plus size fashion retailer’s first half trading update including strong sales over the holiday period, reduced inventory and a return to profitability.

And Baby Bunting shares also rose over 11% after the baby retailer released a first half update outlining comparable store sales growth of 2.2%, and the expectation to report a first half gross profit margin of 39.8% which is up 260bps on the PCP.

Locally from Monday to Thursday the ASX200 rose 0.4% as a choppy start to the week offset the positive inflation and economic data driven gains later in the week.

The winning stocks were led by Star Entertainment Group (ASX:SGR) rallying 22.73% after a businessman in Macau bought up a significant amount of the embattled casino operator’s stock. Ingenia Communities (ASX:INA) also rose over 15% this week while Corporate Travel Management (ASX:CTD) added 10.63% over the 4-trading days.

And on the losing end Premier Investments (ASX:PMV) lost 15.31%, Netwealth (ASX:NWL) fell 10.83% and Hub24 (ASX:HUB) ended the week down 9.19%.

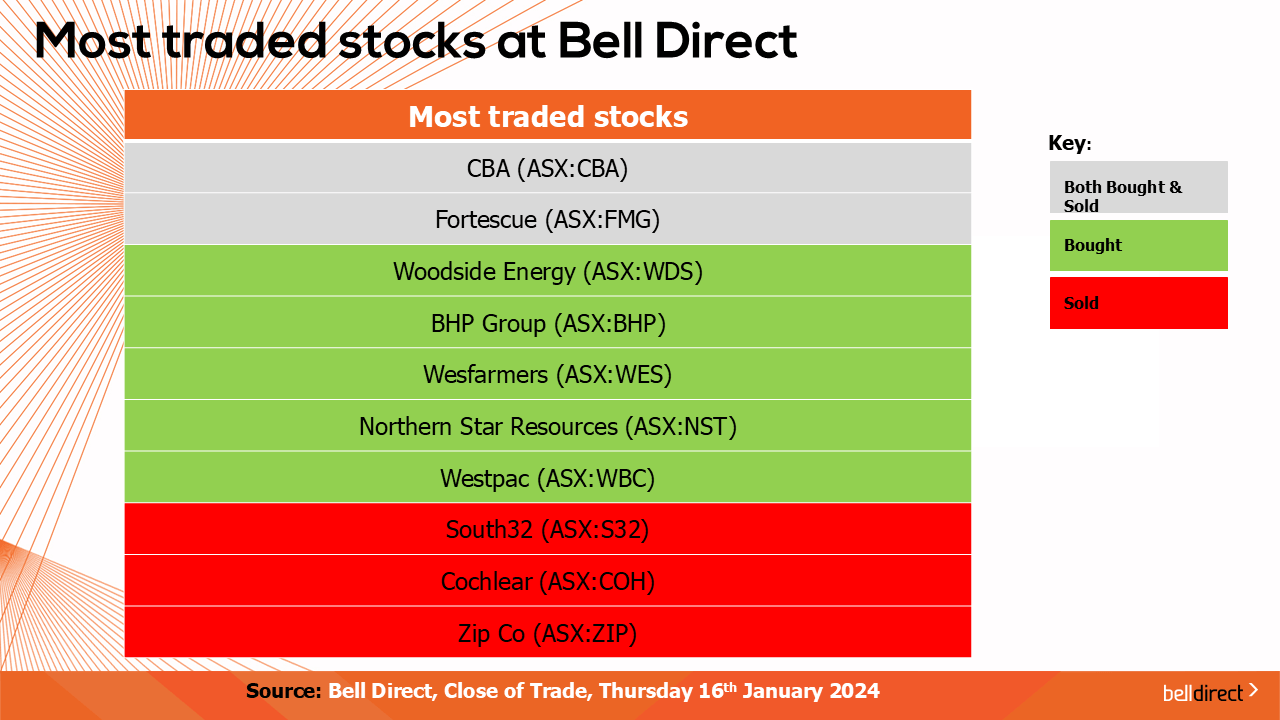

The most traded stocks by Bell Direct clients this week were Commonwealth Bank (ASX:CBA), and Fortescue (ASX:FMG). Clients also bought into Woodside (ASX:WDS), BHP (ASX:BHP), Wesfarmers (ASX:WES), Northern Star Resources (ASX:NST) and Westpac (ASX:WBC), while taking profits from South32 (ASX:S32), Cochlear (ASX:COH) and Zip (ASX:ZIP).

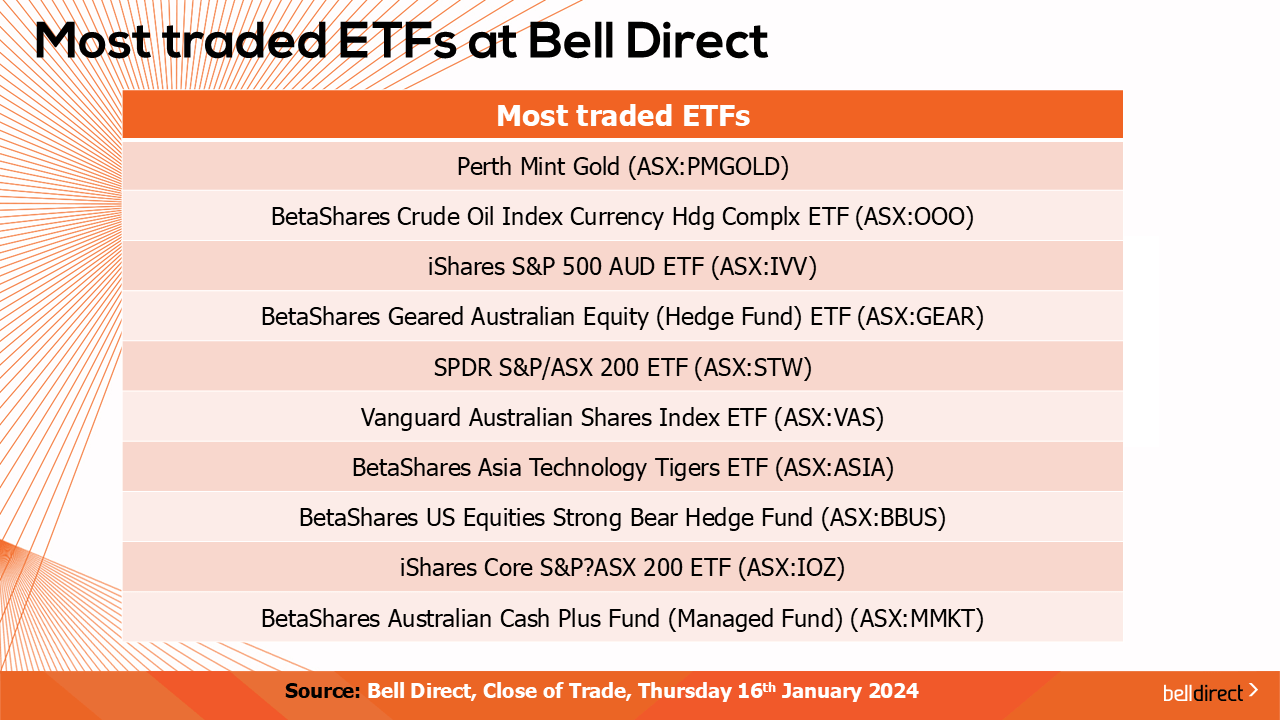

And the most traded ETFs were led by the Perth Mint Gold ETF, Betashares Crude Oil Index Currency Hdg Cmplx ETF and iShares S&P 500 AUD ETF.

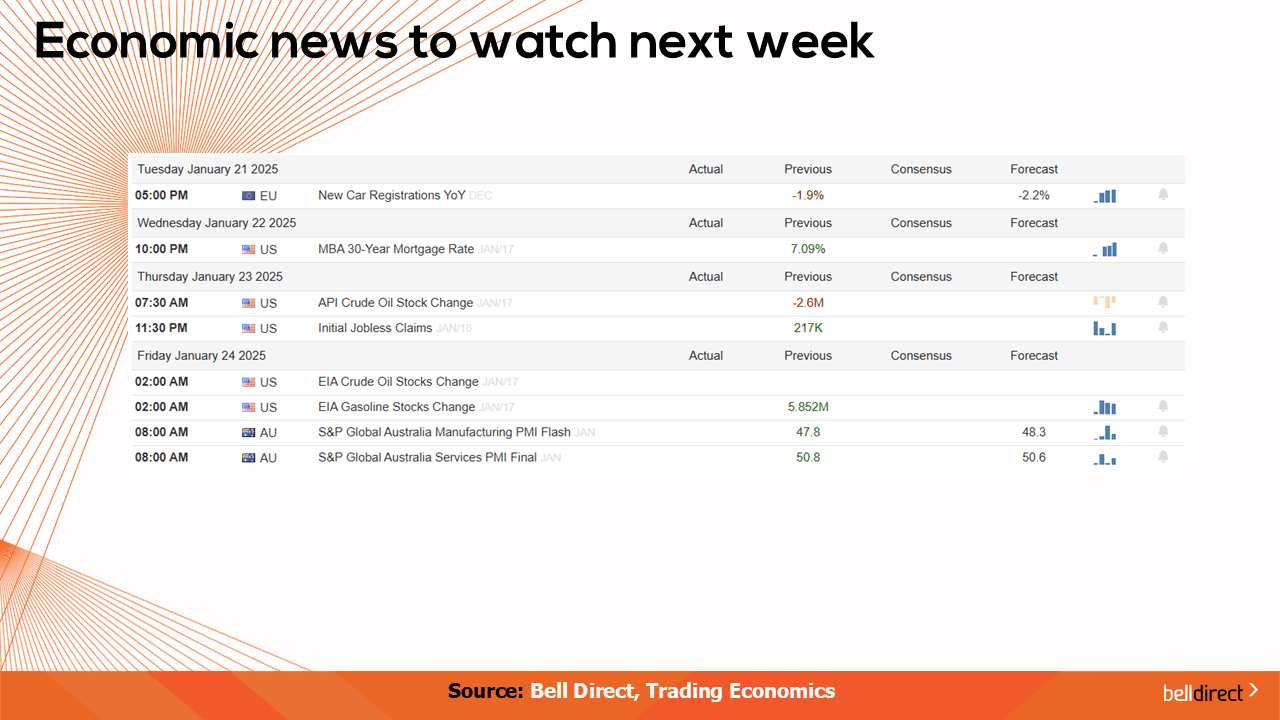

Looking ahead to next week we may see investors respond to NAB Business confidence data for December out on Thursday with the forecast of a rise to 3 index points following a decline to -3 index points in November.

Overseas, Japan’s inflation rate and trade balance data are out later next week before the Bank of Japan will hand down the latest rate decision on Friday next week where it is widely expected the BoJ will raise the cash rate by 0.25% to 0.5%.

And in the UK, we will see the latest Global Manufacturing and Services PMI data out for January on Friday next week.

And that’s all for today, have a wonderful weekend and happy investing!