Transcript: Weekly Wrap 16 February

Thank you for joining us this Friday the 16th of February. I’m Sophia Mavridis with Bell Direct and this is the weekly market update.

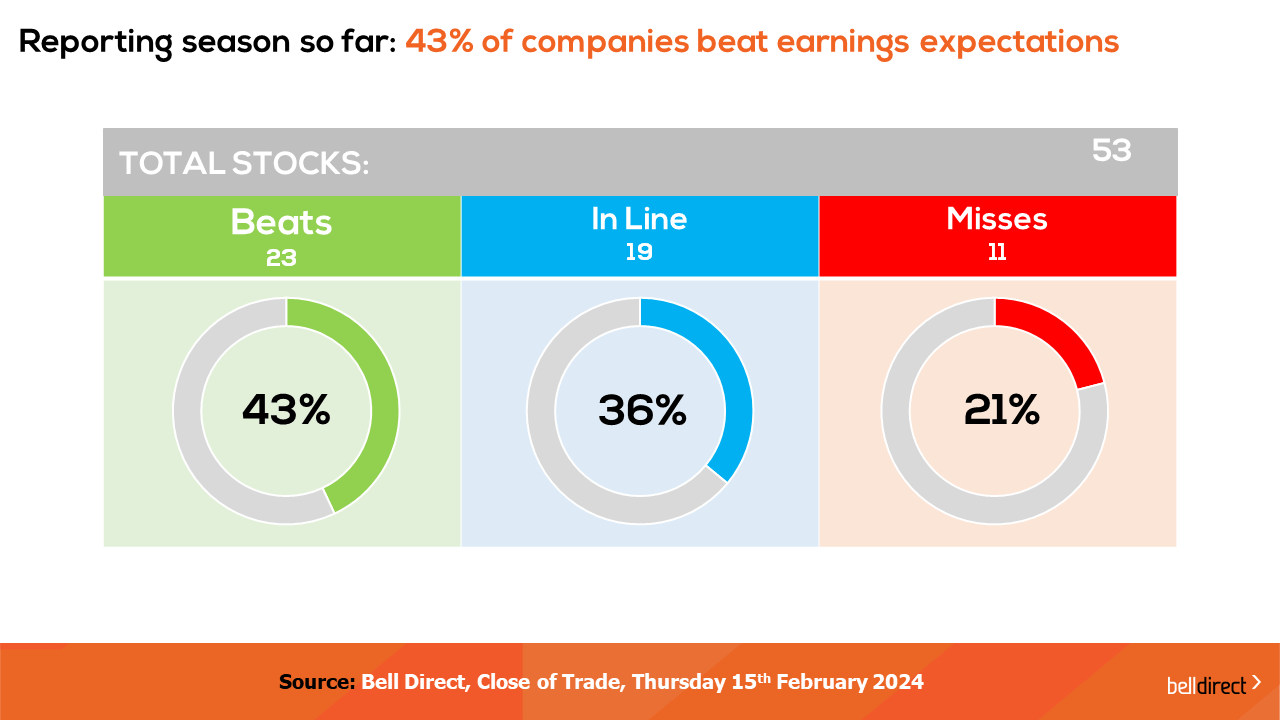

We’re halfway through reporting season now, a time when the majority of ASX-listed companies are releasing their financial results, provoking much share price movement across the market. So far this reporting season, 53 companies have reported earnings, with 23 beating market expectations, 19 in line with what analysts anticipated, while 11 missed expectations.

Let’s jump into some of the big names that reported this week.

One to note was Commonwealth Bank (ASX:CBA) after reporting that their results for the six months to December saw the net interest margin fall 6 basis points to 1.99%, as the bank saw increased competition for deposits as well as a battle for mortgage market share. However, CBA’s results were largely in line with expectations, and currently 6 brokers say it’s a sell, however it’s evident that long term holders and those chasing dividend would find it hard to see a reason to sell. UBS sees the stock’s valuation as stretched, given it’s share price has rallied 13% in the last three months, underpinning their recent downgrade. CBA will pay a $2.15 per share interim dividend, fully franked. That’s a 5-cent increase, driven by a 4% increase in the payout ratio, balanced against lower earnings.

AMP (ASX:AMP) also reported this week, beating profit forecasts, which was a surprise to the market given the companies recent track record. Morgan Stanley has a Hold rating, noting that the company is begging to deliver on revenue margins, costs and capital management, and the broker anticipates further share price upside, should management continue to deliver on its cost and revenue targets. However, AMP shares rallied this week on the $295 million capital return promise, through future dividends or buying back shares on-market. AMP’s net profit for 2023 was down 32% to $265 million on annual revenue of $2.98 billion, which is a 27% increase on a year ago.

A stock on Bell Potter’s radar is IDP Education (ASX:IEL), one of the largest educational services providers globally, facilitating the placement of international students into education institutions. The company posted a strong result that beat market expectations and left brokers optimistic on its outlook. Bell Potter has upgraded revenue forecasts on strength in student placement volumes and recent pricing increases, however, this was more than offset by an increase in overhead assumptions and interest expenses. On valuation, Bell Potter downgraded IEL from a Buy to a Hold.

Also this week, Telstra (ASX:TLS)’s share price declined on disappointing half year results. For six months ending December 31st, Telstra reported an increase in total income and underlying EBITA, reflecting growth across mobile services, international, Amplitel and Teltra InfroCo Fixed, which offset weakness in mobile hardware and other business divisions. However, shares were under pressure as management revised its earnings guidance range for FY24. The telco company was previously targeting EBITDA of between $8.2 – 8.4 billion, now revised down in response to weaker than expected performance from its Network Applications and Services business.

Next week will be the biggest week in this reporting season, with over 200 ASX-listed companies, set to release their financial results. Some big names to look out for include BHP, Rio Tinto, Santos, Woolworths, WiseTech, APA, Fortescue Metals and Pilbara Minerals, just to name a few.

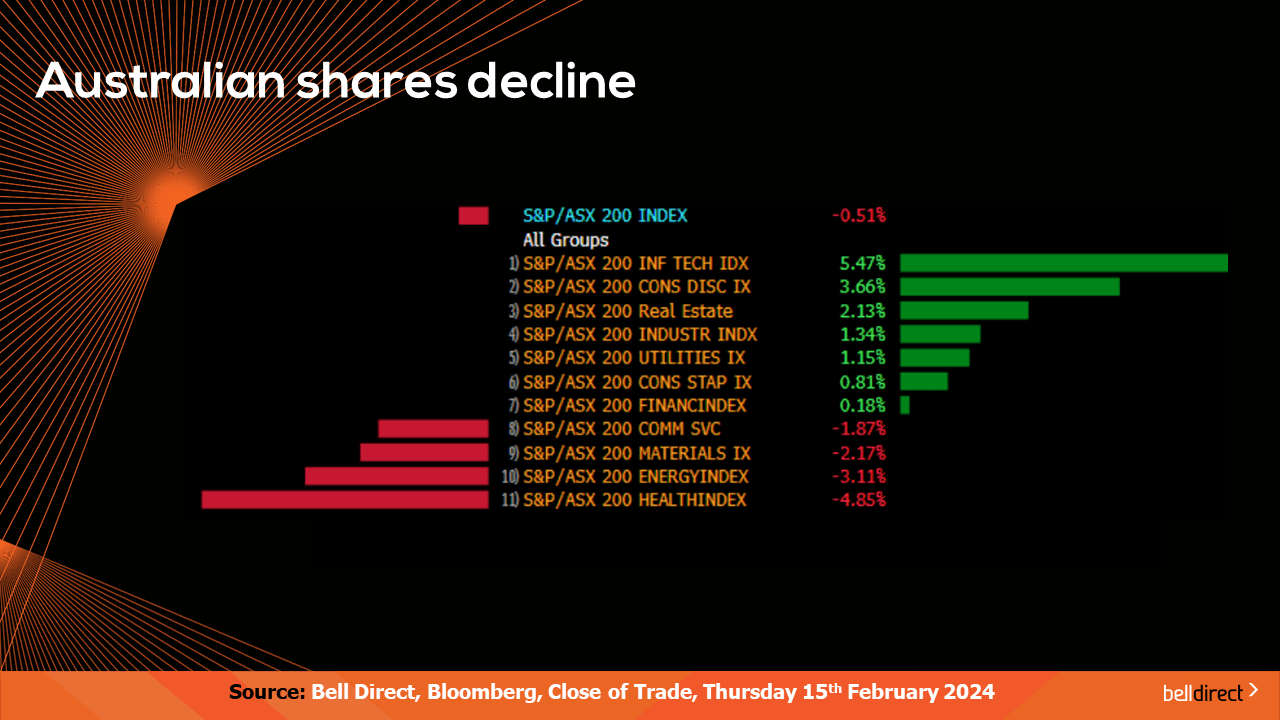

The Australian share market declined 0.5% this week so far, with the information technology sector taking the lead, rallying 5.5%, followed by consumer discretionary and real estate. Meanwhile, the healthcare sector declined the most, down 4.85%, followed by energy and materials.

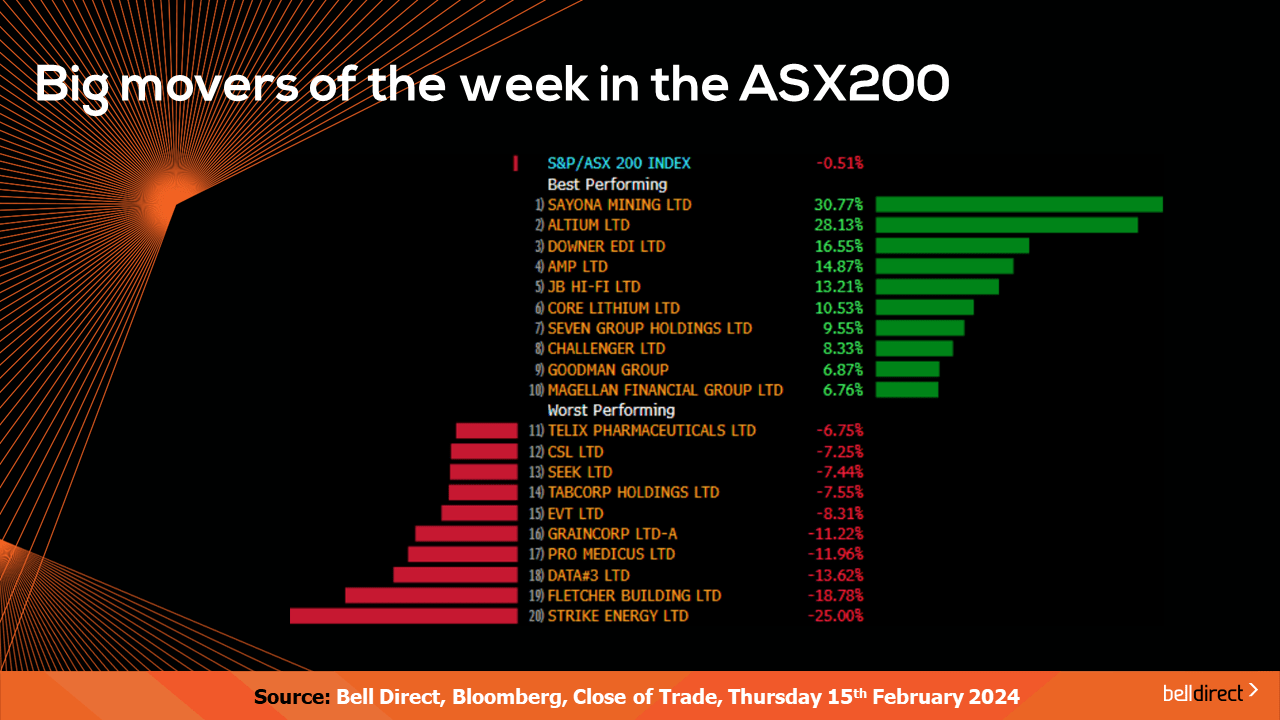

On the ASX200 leaderboard, Sayona Mining (ASX:SYA) was in the lead, advancing an impressive 30% Monday – Thursday, defying the overall volatility of the ASX200 index this week. The lithium stock took the market by surprise this week, with an undisclosed partnership agreement with a major lithium producer, that is to significantly boost SYA’s production capabilities and presence in the market.

Altium (ASX:ALU) was also ahead this week, up 28%, after accepting a takeover offer from Japanese tech company Renesas Electronics Corporation; a scheme of arrangement for a cash price of $68.50 per share, which represents a 34% premium to its close price on Thursday, valuing Altium at $9.1 billion.

On the other hand, Strike Energy (ASX:STX) declined 25% this week, following news of failed appraisal testing over its key South Erregulla gas field in the Perth Basin. The company came out of a trading halt on Tuesday, revealing that South Erregulla hadn’t produced gas from its target zone, when completed last week. Management believes they may have encountered a possible gas-water contact.

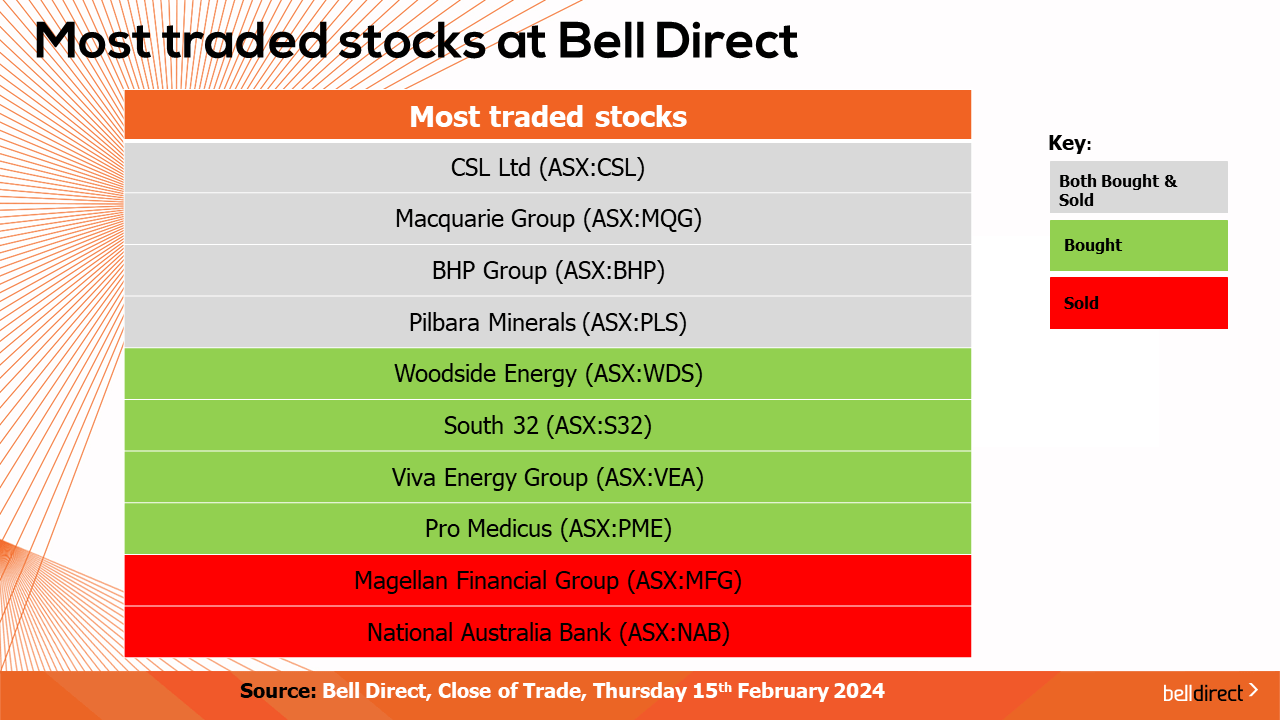

The most traded stocks by Bell Direct clients this week included CSL (ASX:CSL), Macquarie Group (ASX:MQG), BHP Group (ASX:BHP) and Pilbara Minerals (ASX:PLS).

Clients also bought into Woodside Energy (ASX:WDS), South 32 (ASX:S32), Viva Energy Group (ASX:VEA) and Pro Medicus (ASX:PME). While took profits from Magellan Financial Group (ASX:MFG) and National Australia Bank (ASX:NAB).

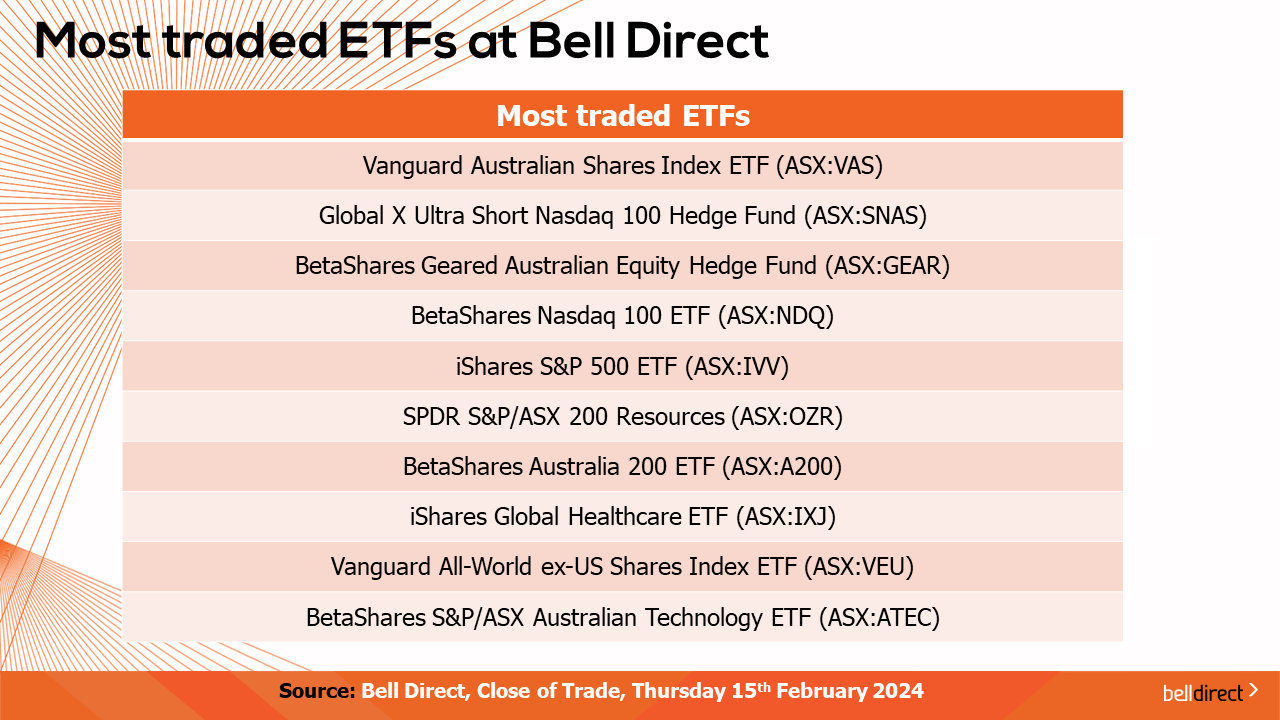

And the most traded ETFs by Bell Direct clients were the Vanguard Australian Shares ETF (ASX:VAS), the Global X Ultra Short Nasdaq 100 Hedge Fund (ASX:SNAS) and the BetaShares Geared Australian Equity Hedge Fund (GEAR).

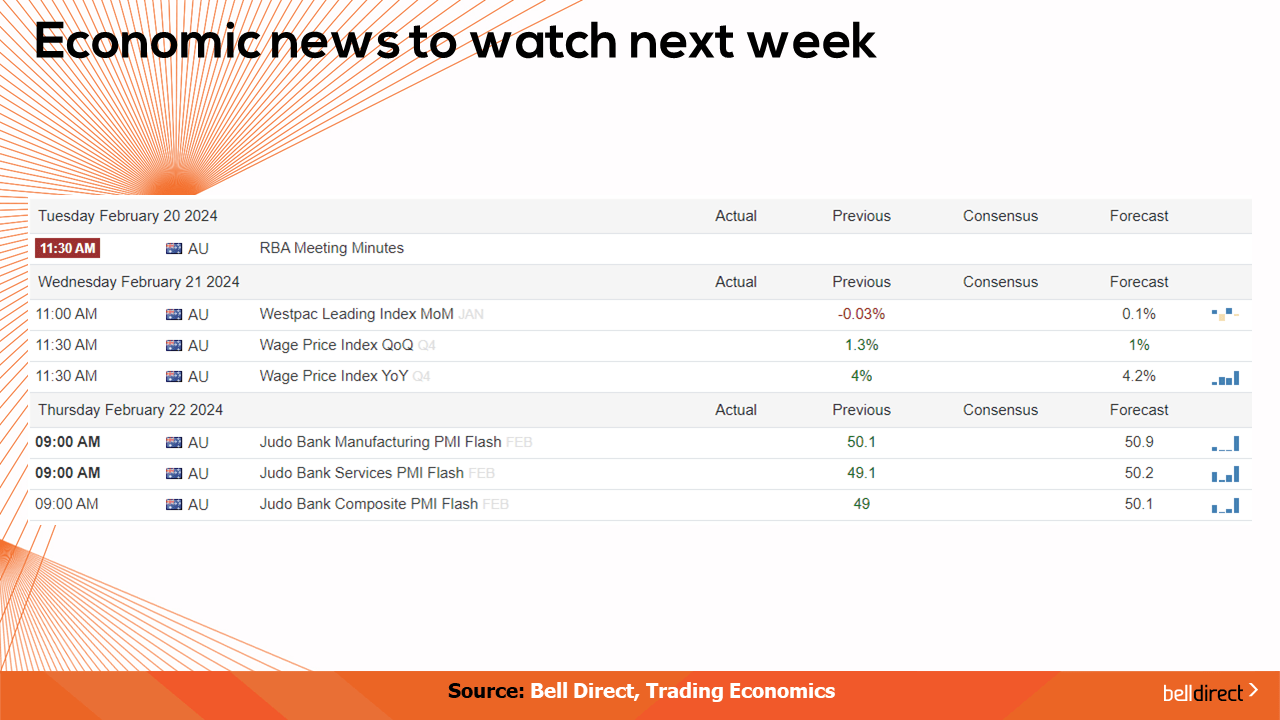

And to end, economic data to look out for next week:

On Tuesday, the latest RBA meeting minutes will be released, on Wednesday we’ll release Westpac’s lending index data and the wage price index data, and on Thursday, the manufacturing and services Flash PMI for February will be out. That’s a forward looking estimate of the final PMI out the following week. And remember, a PMI reading above 50, indicates an expansion from the month prior.

And that’s all for this week. I’m Sophia Mavridis with Bell Direct. Have a great day and happy trading!