Transcript: Weekly Wrap 16 August

As week 2 of reporting season comes to an end, we have seen 51 companies report with 17 beating expectations, 18 meeting expectations and 16 missing expectations.

This week has seen the emergence of key trends driving investor reactions to FY24 results including high-cost pressures depleting margins across the board, retailers have surprised to the upside, and the outlook for FY25 is the most important metric for investors assessing results this reporting season.

So, who stood out this week?

Global industrial REIT powerhouse Goodman Group (ASX:GMG) delivered strong results that exceeded expectations on Thursday as the company pivots its focus to provide the essential infrastructure for servicing the global AI revolution. FY24 results out of Goodman Group included Goodman reporting EPS growth of 14% to 107.5cps, topping the 13% growth the company revised to back in May. Operating profit rose 15% to $2.049bn, group occupancy remains at a high of 97.7% and the company’s global power bank increased to 5GW in FY24 across 13 major international cities. But why did investors sell out of GMG yesterday? Likely for a few reasons. Firstly, the share price has been on a run, up 74% over the last year and up 136% over the last 5-years, so possibly some profit taking. Secondly, the company reported a statutory loss for FY24 of $98.9m but this was due to total portfolio value falling due to revaluation and capitalisation rate expansion which has been widely felt across the REIT sector in FY24. Thirdly, GMG guided to EPS expected growth of 9% in FY25, down from the 14% achieved in FY24 which investors may be concerned about, however, keep in mind that Goodman Group is known for under promising and over delivering so we may see some upwards EPS guidance revisions throughout FY25 like we did in FY24. Overall, GMG reported a solid year in FY24 and growth is expected to continue in FY25 as the company’s focus on data centre expansion is a first mover advantage in the REIT space for providing essential infrastructure to facilitate the AI revolution.

Australia’s leading energy providers, Origin Energy (ASX:ORG) and AGL Energy (ASX:AGL), reported results this week with starkly similar outlooks for FY25, while investors had mixed reactions to the energy providers’ results. On Wednesday AGL had investors fighting to buy shares in the company after reporting A statutory profit of $711m, up from a loss of $1.3bn in FY23, underlying NPAT up 189% to $812m, underlying EBITDA of $2.22bn up 63% on FY23 and a final dividend up 52% on FY23 to 35cps. A day later, Origin Energy released results that saw shares in the company tank 10% during trade, but this may have been an oversell as the results weren’t that bad. For FY24, Origin Energy reported statutory profit rose 32% on FY23 to $1.4bn, underlying profit up 58% to $1.18bn, underlying EBITDA rose 13.6% to $3.53bn and the energy provider also raised its final dividend to 27.5cps, up 37.5% on FY23. The common theme from both AGL and Origin though on the outlook front is the expectation for FY25 to deliver earnings depreciation reflecting lower wholesale costs and lower retail margins in addition to higher coal procurement costs.

Hearing implant device specialist Cochlear (ASX:COH) disappointed investors on Thursday with FY24 results that fell short of expectations and profits that came in at the bottom end of the company’s issued guidance range for FY24. For the last financial year, Cochlear reported sales revenue increased 12% in constant currency to $2.258bn, statutory NPAT rose 8% in constant currency to $357m, full year dividends rose 24% to $4.10/share, and the company issued underlying net profit guidance for FY25 to be in the range of $410-$430m, a 6%-11% increase on FY24. These results look very strong on paper, so why did investors sell out yesterday? The underlying profit guidance range Cochlear issued for FY24 was for between $385m – $400m, so Cochlear reporting $387m in underlying net profit for FY24 was at the bottom end of this range and fell short of market expectations. Investors may also be concerned about the FY25 outlook for gross margin expected to fall by around half a percentage point due to lower overhead recoveries at the new facility in Chengdu, China, and services growth is also expected to slow following 18 months of strong demand for upgrades.

And over on the big bank front, Australia’s biggest bank, CBA (ASX:CBA) released results on Wednesday including Statutory NPAT of $9.481m, down 6% on FY23, a 3% rise in the company’s total dividends for FY24 to a record $4.65/share, Net interest margin fell 8 basis points to 1.99%, operating expenses rose 3% on FY23 due to inflationary pressures, and consumer arrears increased reflecting the impact of higher interest rates and high cost of living pressures on customers. Following the release of yesterday’s results, every broker who covers the big bank maintained a sell rating, with price targets well below the current share price of $134/share, so the question arises, how high can CBA’s valuation really go?

And that wraps our week 2 coverage of reporting season, now let’s look at what happened on the local market this week.

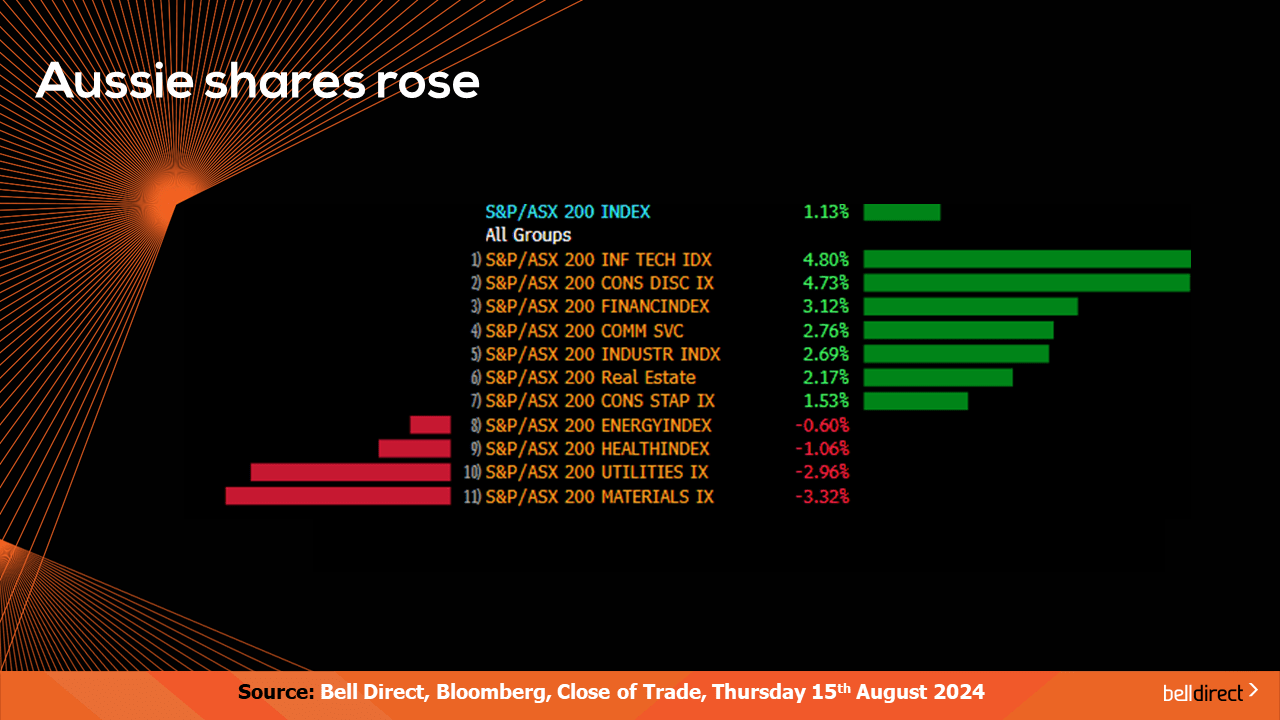

Locally from Monday to Thursday the ASX200 had a much more positive week with a gain of 1.13% over the 4-trading days as investors welcomed strong FY24 results out of key names.

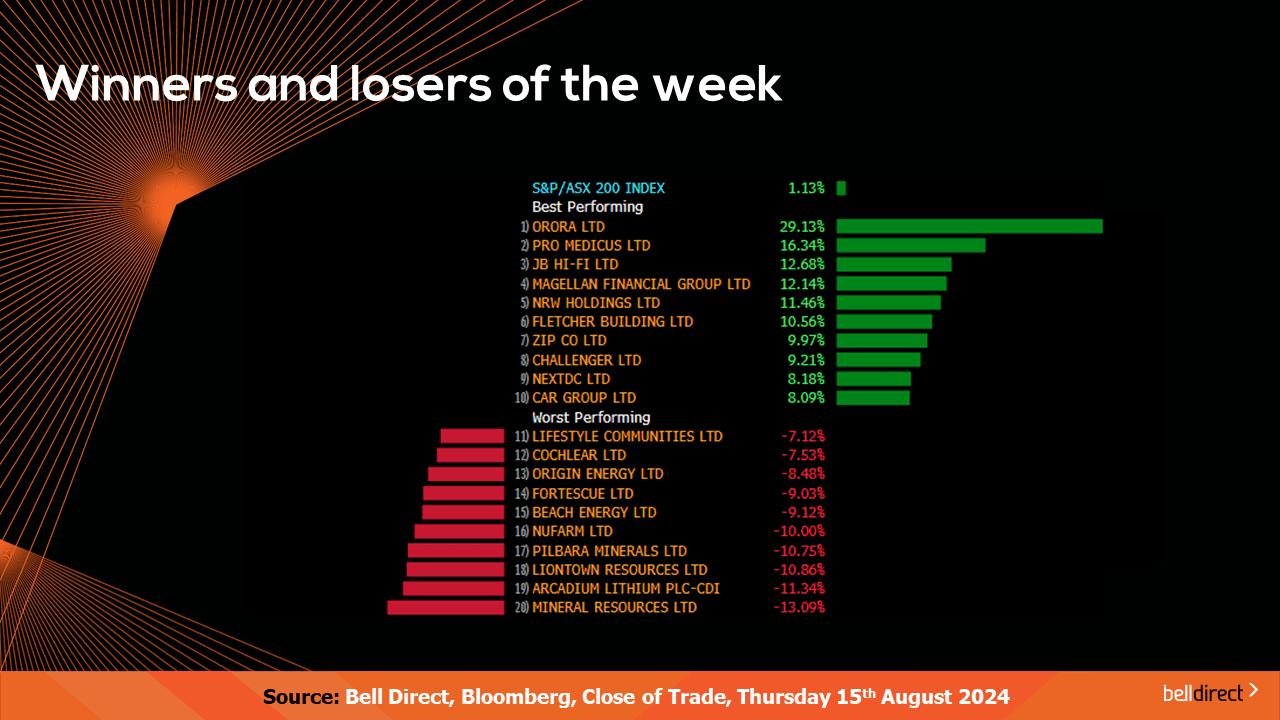

The winning stocks on the ASX200 this week were led by Orora (ASX:ORA) soaring 29% on FY24 results, while Pro Medicus (ASX:PME) added 16%, and JB Hi-Fi (ASX:JBH) ended the week up 12.68%.

And on the losing end Mineral Resources (ASX:MIN) lost 13% and Arcadium Lithium (ASX:LTM) ended the week down 11.3%.

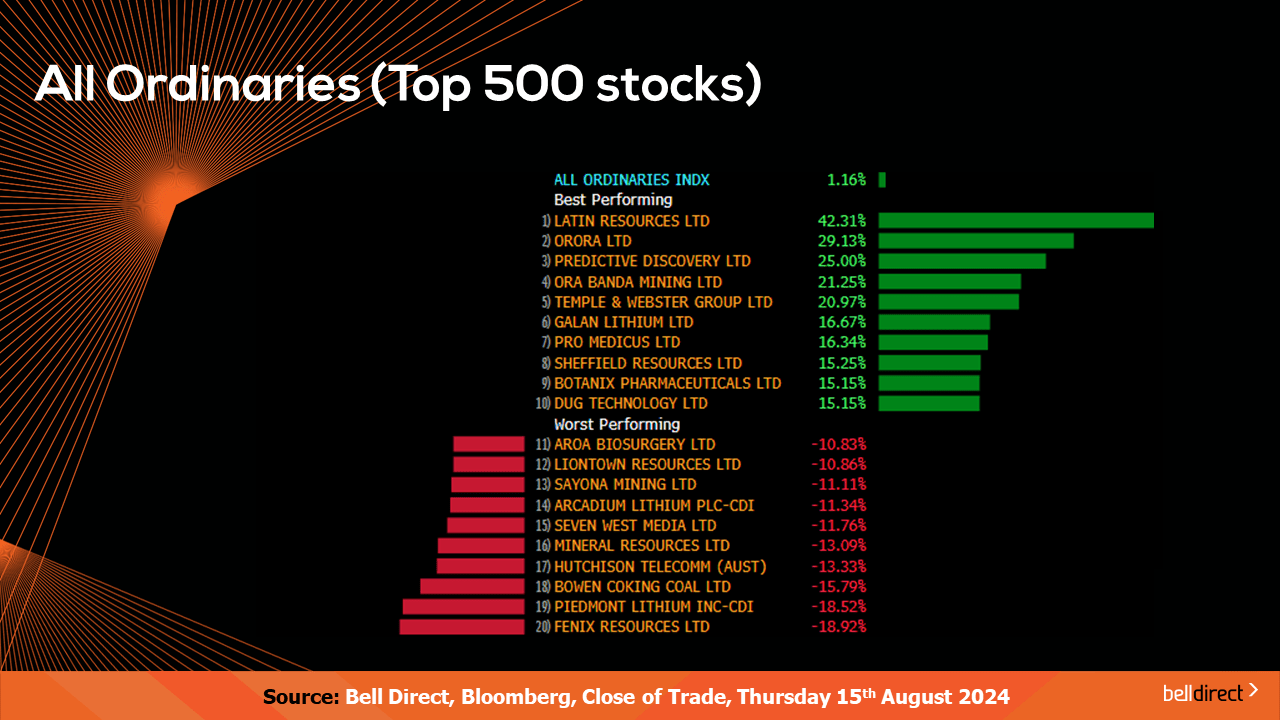

On the broader market front, the All Ords rose 1.16% led by Latin Resources (ASX:LRS) soaring 42% while Fenix Resources (ASX:FEX) lost 18.92%.

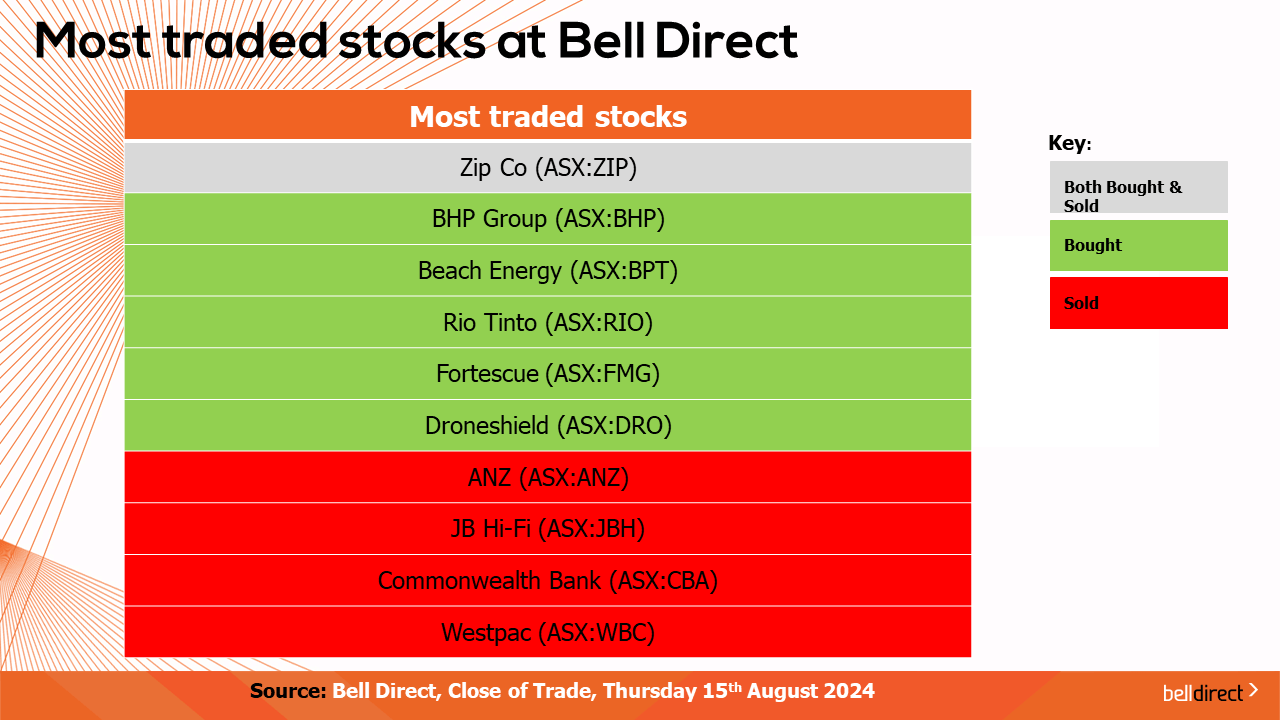

The most traded stocks by Bell Direct clients this week were ZIP (ASX:ZIP), clients also bought into BHP (ASX:BHP), Beach Energy (ASX:BPT), Rio Tinto (ASX:RIO), FMG (ASX:FMG), and DroneShield (ASX:DRO).

Clients also took profits from ANZ (ASX:ANZ), JB Hi-Fi (ASX:JBH), CBA (ASX:CBA), and Westpac (ASX:WBC).

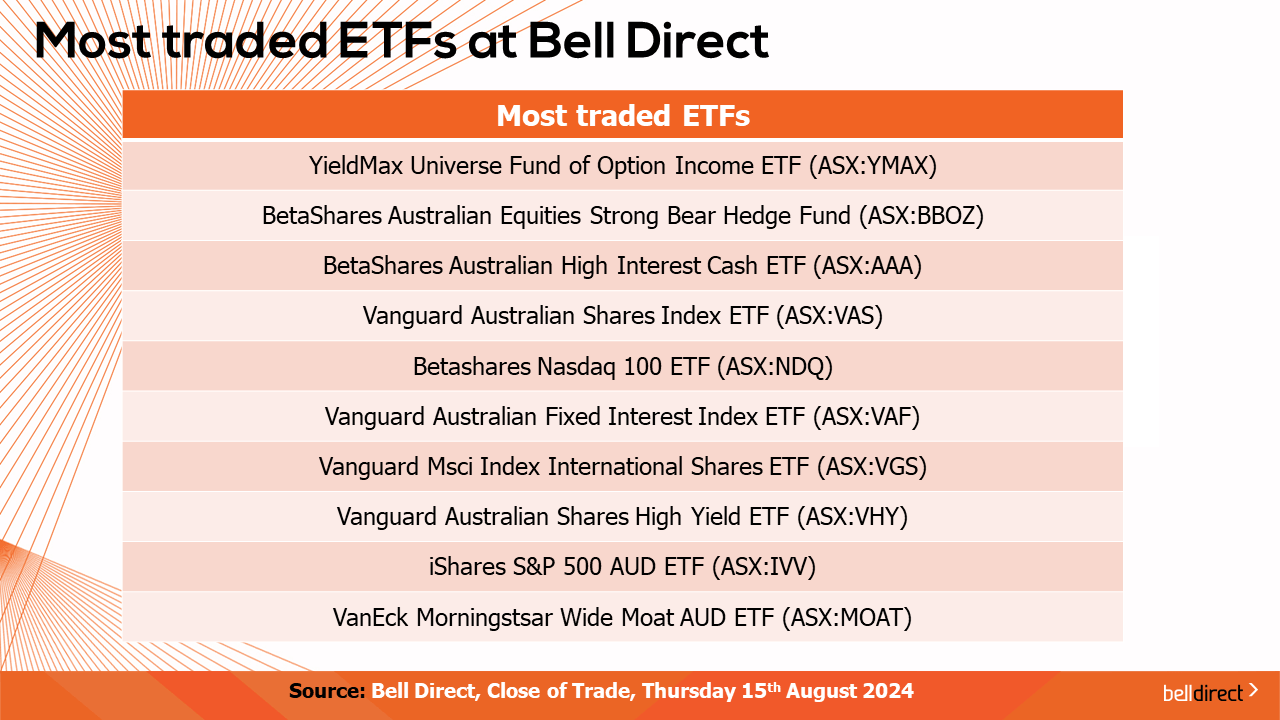

And the most traded ETFs by our clients over the 4-trading days were led by YieldMax Universe Fund of Option Income ETFs, Australian Equities Strong Bear Hedge Fund, and Betashares Australian High Interest Cash ETF.

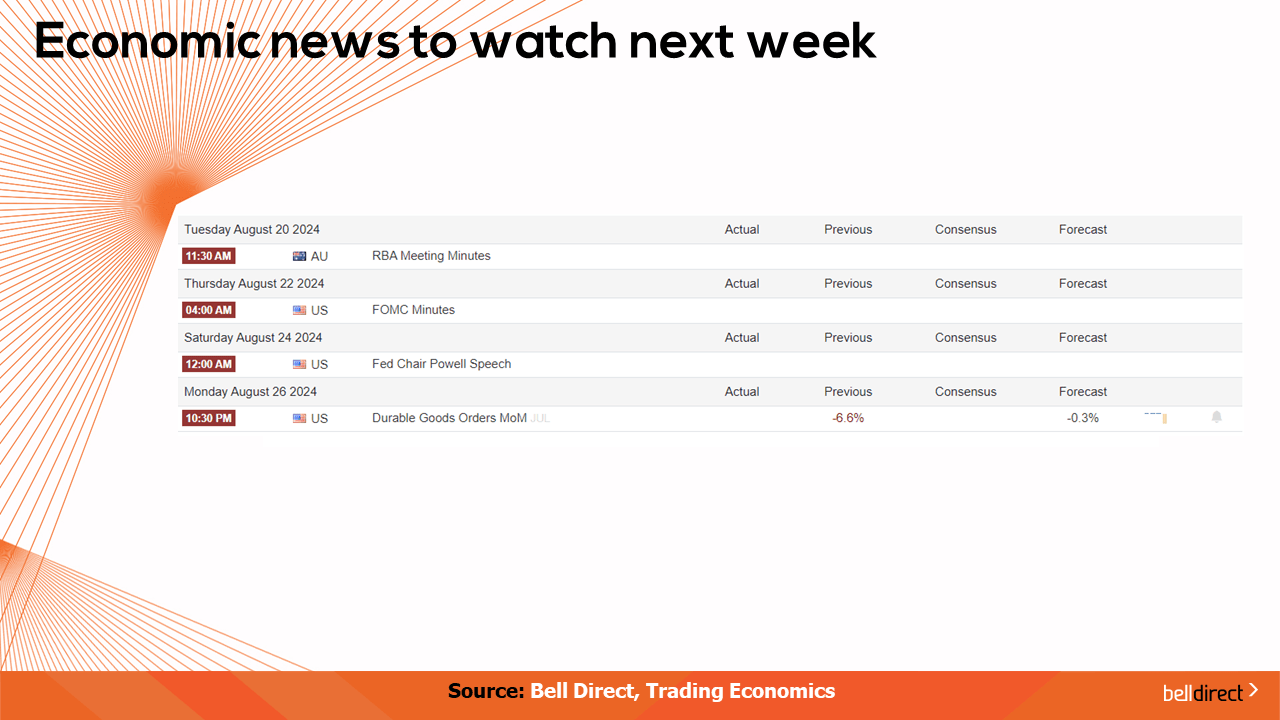

On the economic calendar next week we can expect investors to react to the release of the RBA’s latest meeting minutes out on Tuesday, while overseas the FOMC US meeting minutes are out on Thursday local time which will also likely cause US investors to react, as both minutes should incorporate an outlook on the rate front for Australia and the US.

On the reporting season calendar next week we can expect results out of Ampol (ASX:ALD), Santos (ASX:STO), Domino’s Pizza (ASX:DMP), WiseTech Global (ASX:WTC), Sonic Healthcare (ASX:SHL), Whitehaven Coal (ASX:WHC), and Insurance Australia Group (ASX:IAG) among many other names.

And that’s all for this week, have a wonderful weekend and happy investing.