Transcript: Weekly Wrap 15 November

We are now at the end of receiving quarterly updates from ASX listed companies so let’s dive into how FY25 is shaping up so far at the end of Q1 and which companies stood out this week.

This week, we saw Australia’s biggest bank, Commonwealth Bank of Australia (ASX:CBA), soar to a fresh record high after the big bank released a quarterly trading update. For the 1Q FY25, CBA reported unaudited statutory NPAT of approximately $2.5bn which is flat on the PCP. Business lending volumes rose 9.9% in quarter, home lending rose 4.5%, and household deposits rose 6.5%. Operating income increased 3.5% while troublesome and impaired assets increased to $8.8bn or 0.63% of total committed exposures. The outlook from the big bank is that while inflation is showing signs of easing, growth in the Australian economy remains slow, but the bank remains optimistic on the overall outlook for the Australian economy’s strength. Shares in CBA rose 2.06% over the trading week to end Thursday’s session at a fresh record $152.84.

Building materials producer James Hardie Industries (ASX:JHX) bucked the market weakness this week to gain over 13% on the release of the company’s second quarter trading update. Despite outlining profit dropped 23% in Q2FY25 results out yesterday due to weakness in Europe and China, while its North American division, the key driver of revenue, is expected to continue growing into FY26. With tailwinds in the US from hurricanes, increased wear-and-tear of homes requiring siding replacement, and an uptick in new home builds in the region, we see James Hardie’s earnings growth runway expanding well into the new year.

Xero (ASX:XRO) shares popped on Thursday after the cloud accounting software released a first half trading update demonstrating the company’s strength in delivering growth despite a challenging market environment. For the first half of FY25, Xero reported revenue rose 25% to NZ$996m, a 6% rise in subscribers overall, average revenue per user rose 15%, free cash flow rose 96%, gross margin rose 1.4pp (%points) and NPAT increased an impressive 76% to $95m. Xero also launched the first Tap and Pay product to the market during the period which is allows Aussie and UK small businesses to accept instant payments from their smartphone. And the strength doesn’t stop there for Xero as the cloud accounting giant launched several Beta products in the AI space including Xero’s GenAI-powered smart business companion, ‘Just Ask Xero’.

Crop protection and seed technology solutions company Nufarm (ASX:NUF) rallied 6% on Thursday after releasing full year results. Underlying EBITDA for FY24 came in at $313m which was in the middle of the guidance range, while revenue across the group fell 4% and the company posted a statutory net loss of $6m. While the results appear disappointing for FY24, the outlook may have been the driver of Nufarm’s rally today with cost cutting measures, scaling growth plans and stable prices heading into FY25.

The outlook for FY25 is very mixed based on the results we have seen across the ASX so far, but some key themes include:

- Weakened demand in the first half has impacted earnings across most sectors.

- Elevated input costs have eaten into margins across every sector.

- The outlook for commodities remains volatile and has seen an increase in hedging through forward contracts for companies like Woodside to reduce exposure to downside spot price risk.

- Single digit earnings growth has been the common earnings result across the board, which was expected heading into FY25.

- With the likelihood of higher interest rates for longer in Australia, demand is expected to remain subdued through the remainder of FY25.

- Black Friday sales are starting early as retailers push to move inventory through increased promotional activity – which is good for cutting down stock but selling at a discount eats into earnings. The supermarkets have even had to increase promotional activity to prompt consumers back in store.

- Investors are welcoming forecasted strength in H2 of FY25, even if the first quarter results were disappointing.

- And technology companies expanding into AI continue to boost investor sentiment within the high growth sector.

Let’s now take a look at what else happened on the market this week.

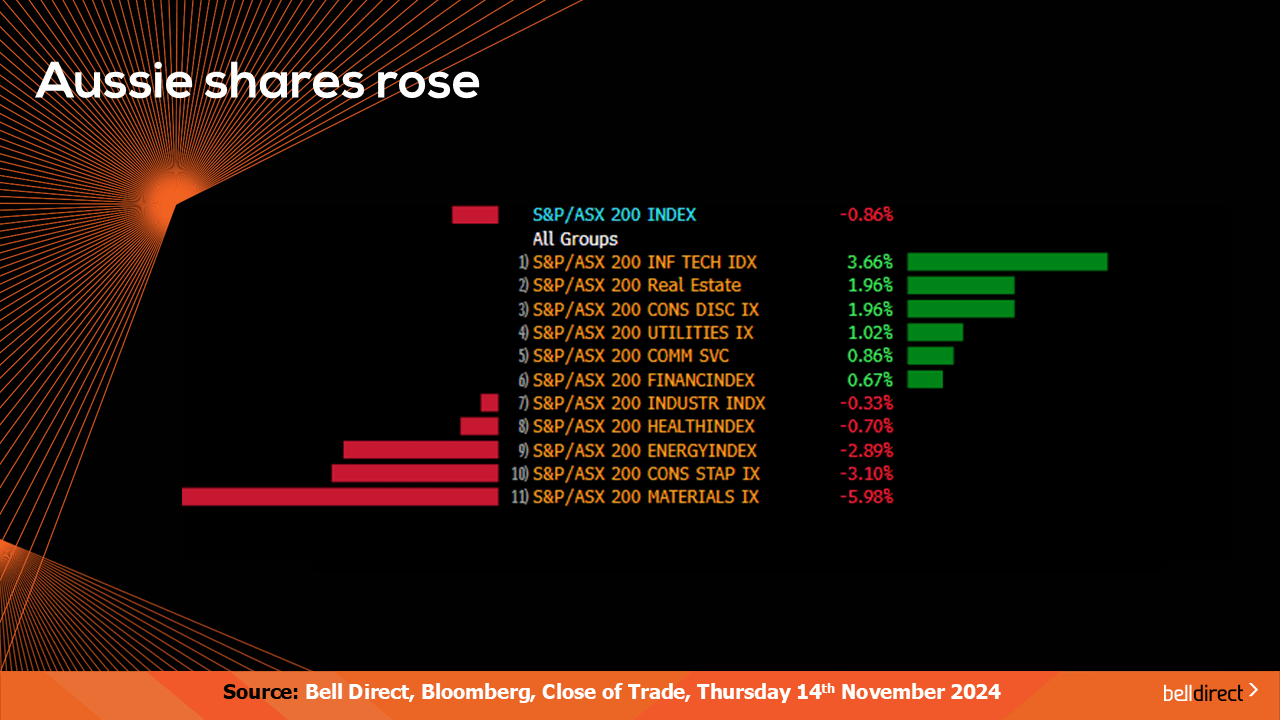

Locally from Monday to Thursday the ASX200 fell 0.86% as the global post-election rally took a breather across all global markets. Tech stocks managed to post a 3.66% rise this week driven both by strength for the Nasdaq on Wall St and from local tech company earnings results. Materials stocks lost 6% over the week tracking the declining price of iron ore.

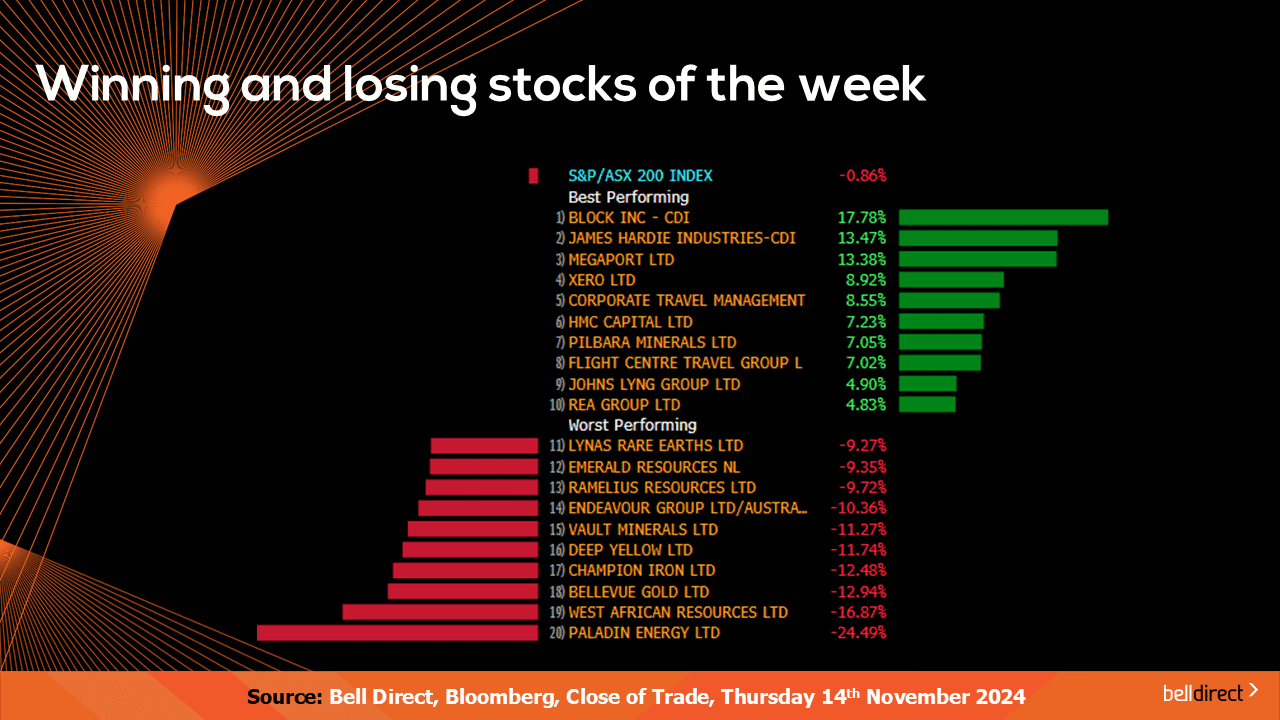

The winning stocks from Monday to Thursday were led by Block Inc. (ASX:SQ2) rising 17.8%, James Hardie (ASX:JHX) Industries adding 13.5%, and Megaport (ASX:MP1) gaining 13.4%.

On the losing end, Paladin Energy (ASX:PDN) tanked 24.5%, West African Resources (ASX:WAF) lost 16.9% and Bellevue Gold (ASX:BGL) ended the week down just under 13%.

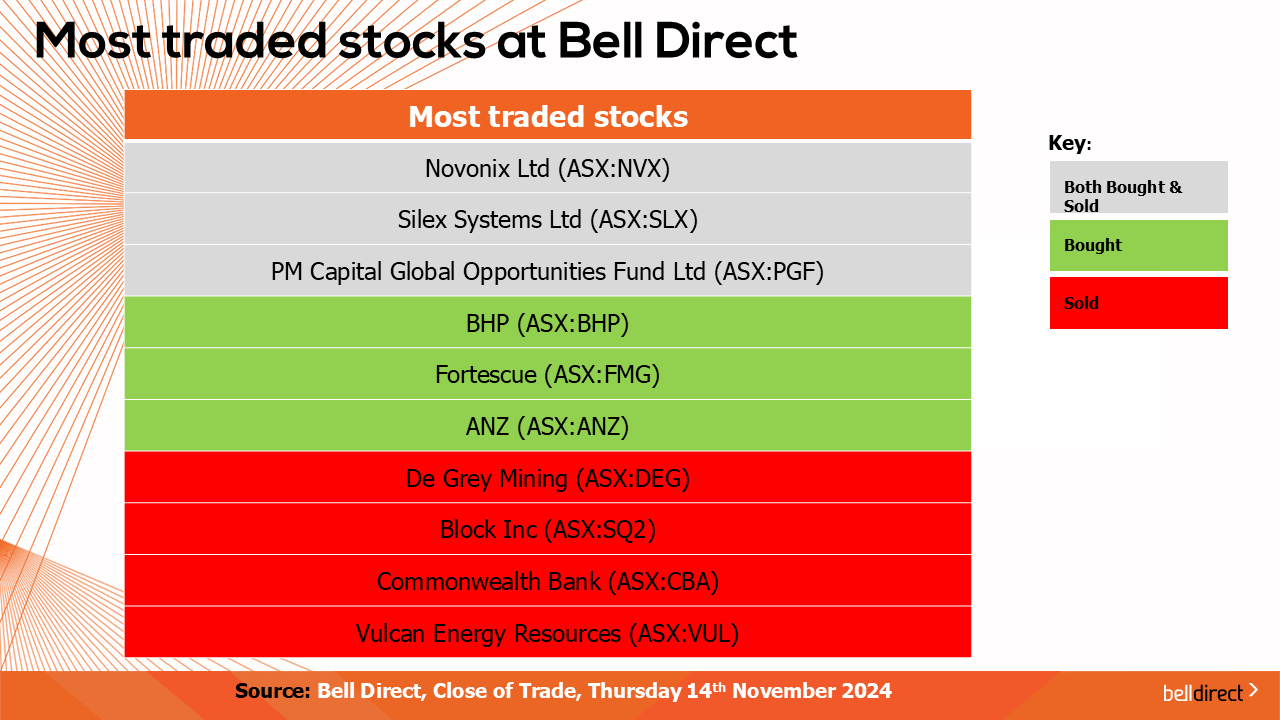

The most traded stocks by Bell Direct clients this week were Novonix (ASX:NVX), Silex Systems (ASX:SLX), and PM Capital Global Opportunities Fund Ltd (ASX:PGF). Clients also bought into BHP (ASX:BHP), Fortescue (ASX:FMG), and ANZ (ASX:ANZ) while taking profits from De Grey Mining (ASX:DEG), Block Inc (ASX:SQ2), CBA (ASX:CBA) and Vulcan Energy Resources (ASX:VUL).

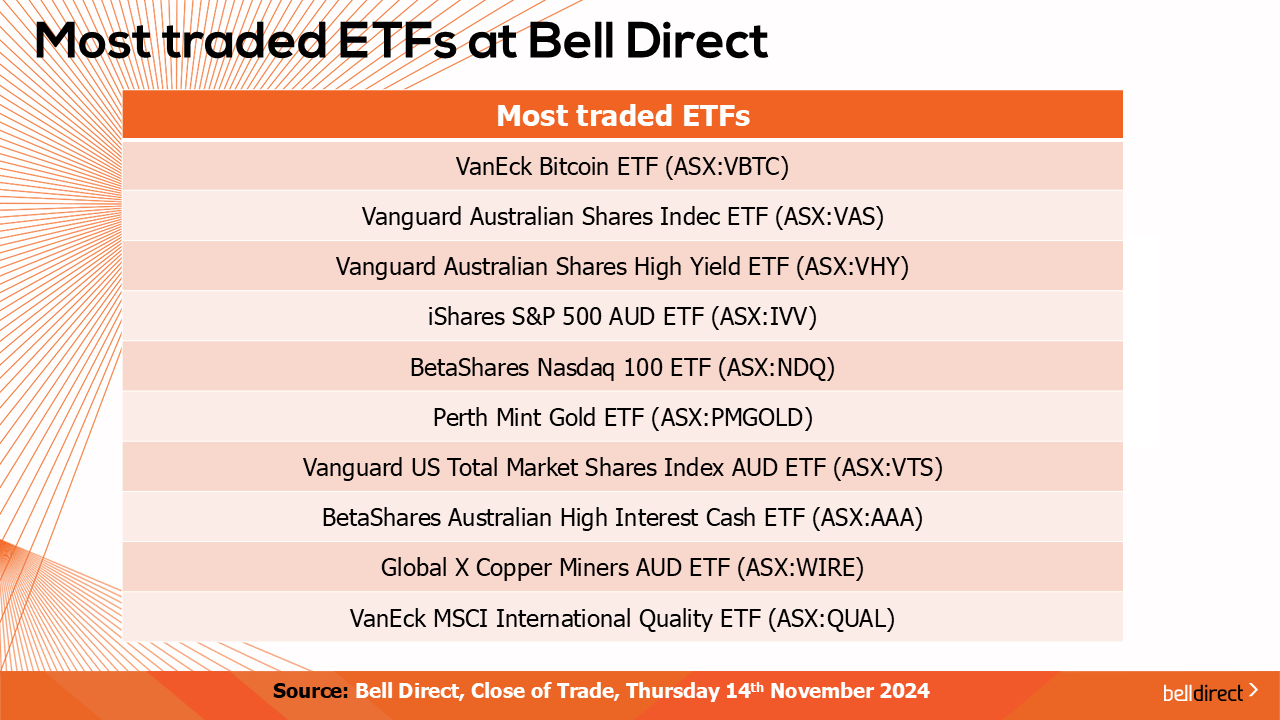

And the most traded ETFs by our clients this week were led by Vaneck Bitcoin ETF, Vanguard Australian Shares Index ETF and Vanguard Australian Shares High Yield ETF.

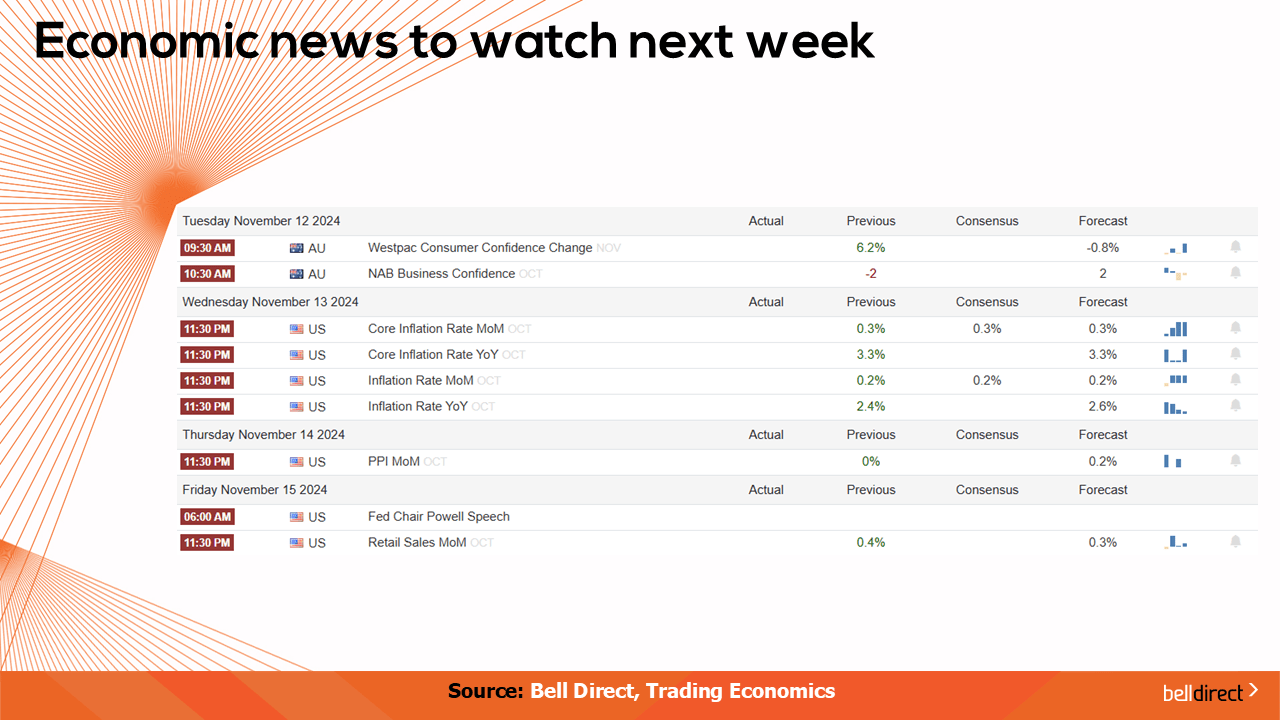

On the economic calendar next week, we may see investors react to the release of the RBA’s latest meeting minutes out on Tuesday as investors try to gauge the outlook for rate cuts from Australia’s central bank. Overseas, we have key trade balance and inflation data out in Japan, Inflation and retail sales data out of the UK, and US Building Permits data out in the US, which will paint a greater picture of the overall inflation journey across key economies around the world.

And that’s all for this Friday, have a wonderful weekend and happy investing!