Transcript: Weekly Wrap 14 February

So far this reporting season we have seen 33 companies report with 17 beating expectations, 9 meeting expectations and 7 missing expectations.

Australia’s biggest bank, CBA (ASX:CBA), rallied this week, surprising analysts and defying the consensus sell rating. The bank’s strong performance justifies the hefty valuation it’s had over the past year. For the first half, CBA beat profit expectations, reporting $5.13 billion in NPAT, up 8% on the previous year. Revenue from regular activities rose 4% to $14.1 billion, and they declared a 225 cent per share dividend.

Some analysts raised concerns about a 6% rise in operating expenses, bringing the cost-to-income ratio to 45.2%. As for net interest margin, it saw a slight increase, with the bank citing competitive pressure on deposits and lending pricing being offset by higher earnings from capital hedges.

CBA also reported a $95 million drop in loan impairment, mainly due to lower consumer provisions, thanks to rising house prices. On the day the results were released, CBA’s share price hit a record $165 per share.

It’s been a great time for investors in insurers, with premiums skyrocketing for many Aussies over the past year. On Wednesday, Suncorp’s (ASX:SUN) results reflected this, with first-half cash earnings rising 30%, beating expectations. The main driver of the earnings boost was lower natural hazards and favourable weather conditions, leading to strong margins and fewer payouts.

NPAT surged 89% to $1.1 billion, and general insurance gross written premiums grew 8.9% to $7.5 billion. Suncorp announced it would return $4.1 billion from the sale of its banking arm to ANZ to shareholders, offering a capital return of $3 per share, plus an interim dividend of 41 cents per share and a special dividend of 22 cents. Investors responded with a 1.3% rally in Suncorp’s share price.

Suncorp also saw growth in home and motor insurance, with both sectors up over 10%, and expects gross written premiums to continue growing in the mid to high single digits.

And of course, in the gold mining space, Evolution Mining (ASX:EVN) has been on a tare over the last year as investors fight for a piece of gold in their portfolios amid uncertainty on many fronts globally.

Evolution’s share price rose just over 1% on Wednesday after the gold producer released its first-half results. The company produced 388,000 ounces of gold and 38,000 tonnes of copper, which is great news, especially with copper prices on the rebound. Underlying NPAT shot up 144%, and the company paid an interim dividend of 7 cents per share, up 250%, while also reducing net debt by $345 million.

EVN has been a strong performer for investors – shares are already up 30% in 2025 and 108% over the last year. While the results are solid, there are a few things to keep an eye on, including some uncertainty around the timing of CAPEX and potential project delays. Also, while the dividend reinvestment plan was reinstated based on shareholder feedback, its impact on funding organic growth is limited.

For gold miners, a key metric is all-in sustaining costs (AISC) and the sales price per ounce. For Evolution, AISC came in at $1638 per ounce, with the gold price at $3875 per ounce, which is strong.

AGL’s (ASX:AGL) profits took a hit, mainly due to rising costs and fierce competition in the energy space. Net debt also went up, partly due to higher investments and energy bill relief timing. Underlying profits dropped 7%, with costs climbing because of higher income taxes and capital spending. The increased competition is squeezing margins, which is hurting earnings.

Looking ahead, costs are expected to keep rising, especially with higher depreciation, amortization, and finance costs. But there’s some good news – AGL’s been successfully attracting EV drivers. Even though EV sales slowed last year, they’re still adding accounts at the same rate, thanks to their EV Night Saver Plan, which offers cheap overnight charging. This helps them grow their customer base without tapping into peak power reserves, boosting earnings by selling that power at higher prices.

After the results, AGL’s shares were up 0.17% after a bit of a rollercoaster ride during the session.

Later in this week we had results out of Seven Group that beat expectations driven by Boral’s (ASX:BLD) strength in H1, Nick Scali (ASX:NCK) also beat expectations for the first half as gross margin in the ANZ region rose to 64.4%. News Corp also beat expectations driven by strength from the company’s REA Group (ASX:REA), Bravura Solutions (ASX:BVS) and Breville (ASX:BRG) also beat expectations and Beach Energy (ASX:BPT) came in with a miss this first half reporting season.

We have a big week on the reporting season calendar next week with the likes of BHP (ASX:BHP) , a2 Milk Company (ASX:A2M), BFG (ASX:BFG), Mineral Resources (ASX:MIN), FMG (ASX:FMG), James Hardie Industries (ASX:JHX), Rio Tinto (ASX:RIO), Transurban (ASX:TCL), Telstra (ASX:TLS), QBE Insurance (ASX:QBE), Wesfarmers (ASX:WES), Whitehaven Coal (ASX:WHC) and many more releasing results so stay tuned for our coverage every Wednesday and Friday.

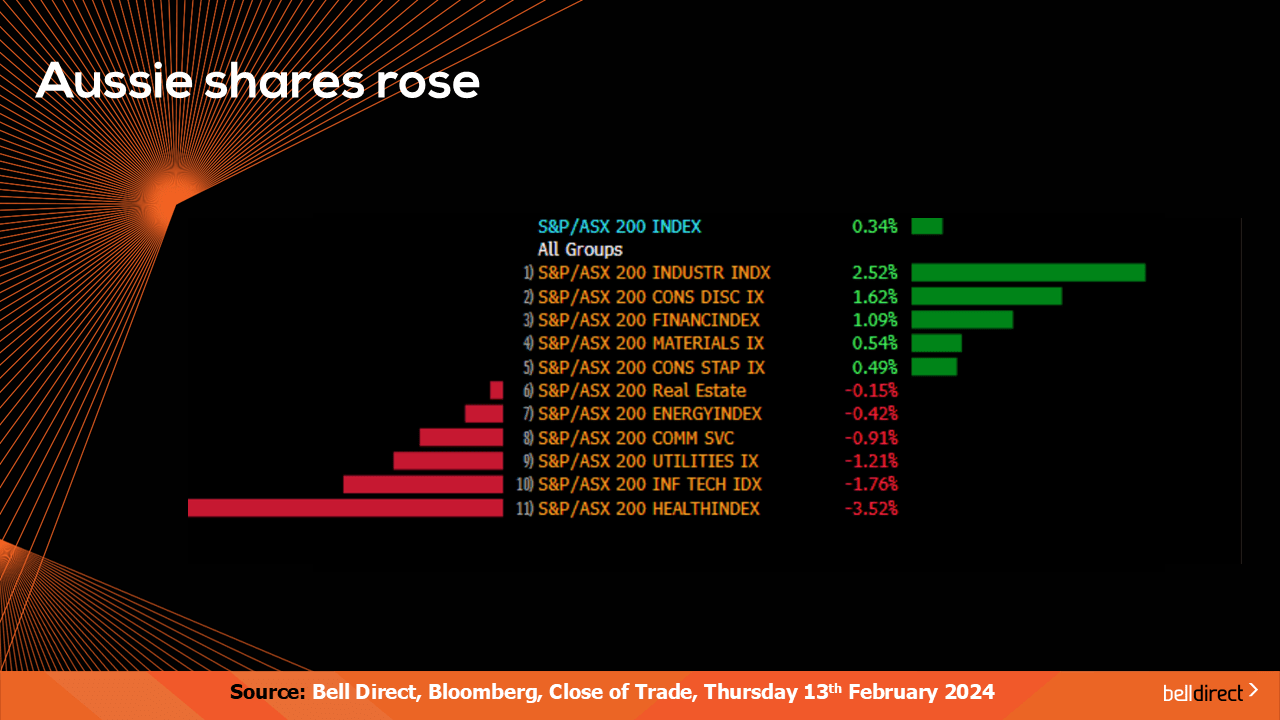

Locally from Monday to Thursday the ASX200 rose 0.34% as investors reacted to a strong slew of earnings results so far this season.

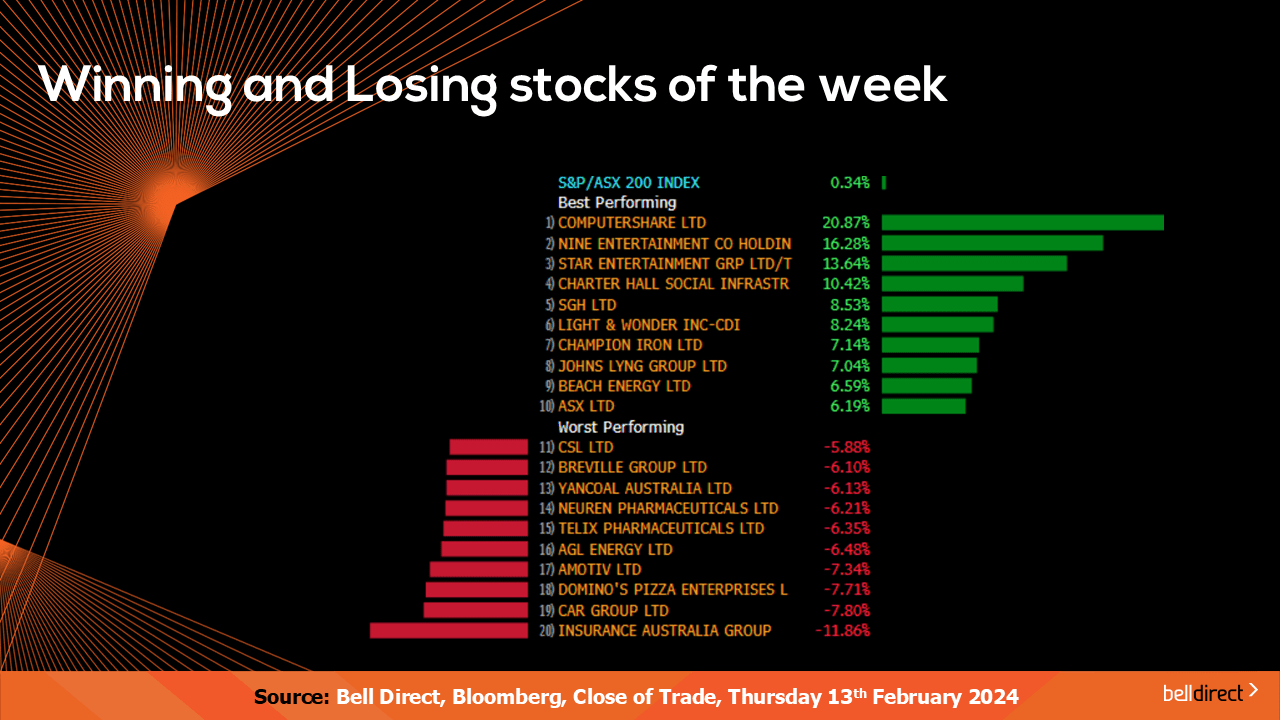

The winning stocks on the ASX 200 were led by Computershare (ASX:CPU) soaring 21% on strong first half results, while Nine Entertainment (ASX:NEC) rose 16% and Star Entertainment Group (ASX:SGR) added 14%.

And on the losing end Insurance Australia Group (ASX:IAG) fell 11.86%, Car Group (ASX:CAR) lost 7.8% and Domino’s Pizza (ASX:DMP) fell 7.71%.

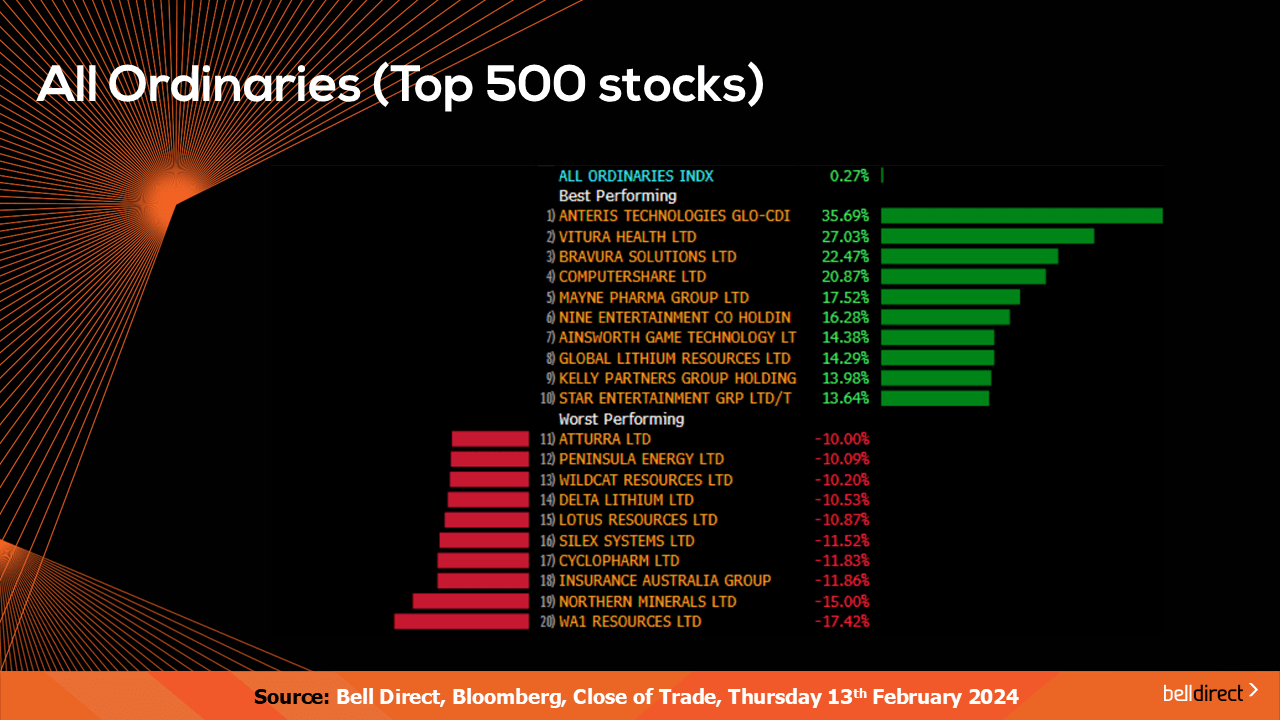

On the broader market front the All Ords, Anteris Technologies (ASX:AVR) soared 36%, Vitura Health (ASX:VIT) added 27% and Bravura Solutions (ASX:BVS) gained 22.47% while WA1 Resources (ASX:WA1) tanked 17%.

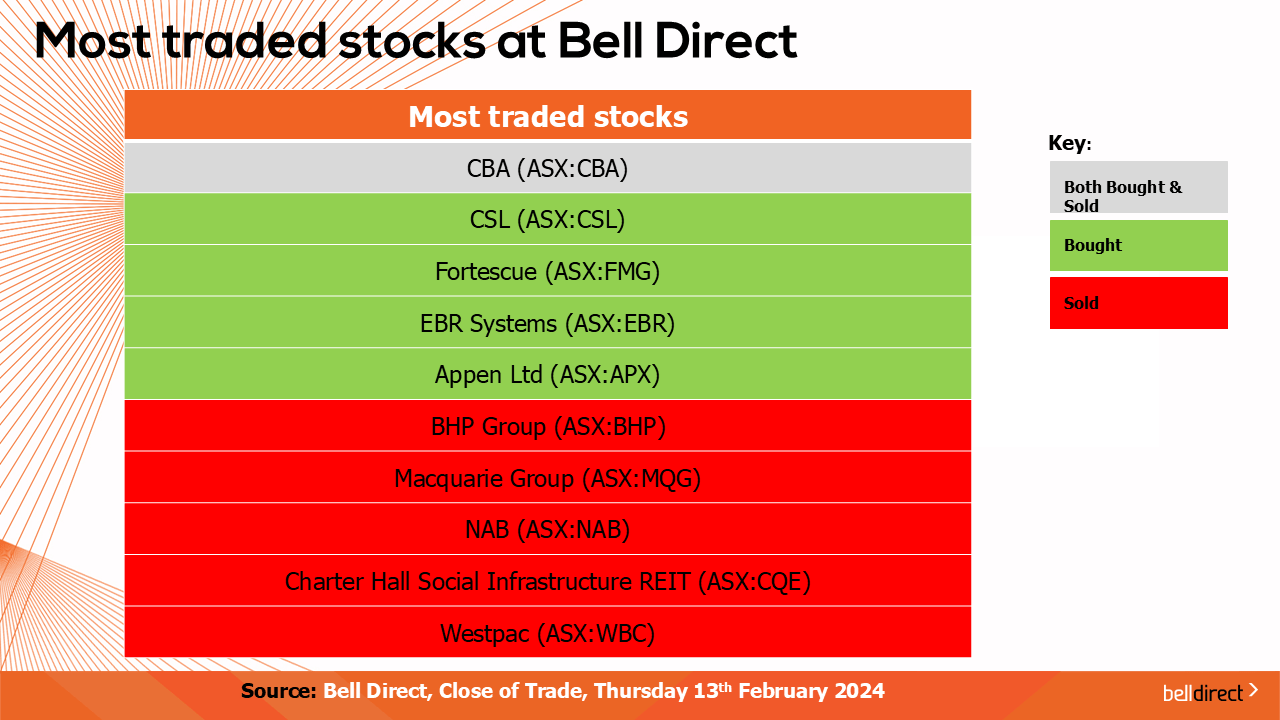

The most traded stocks by Bell Direct clients this week was CBA (ASX:CBA). Clients also bought into CSL (ASX:CSL), Fortescue (ASX:FMG), EBR Systems Inc (ASX:EBR), and Appen (ASX:APX), while taking profits from BHP (ASX:BHP), Macquarie (ASX:MQG), NAB (ASX:NAB), Charter Hall Social Infrastructure REIT (ASX:CQE) and Westpac (ASX:WBC).

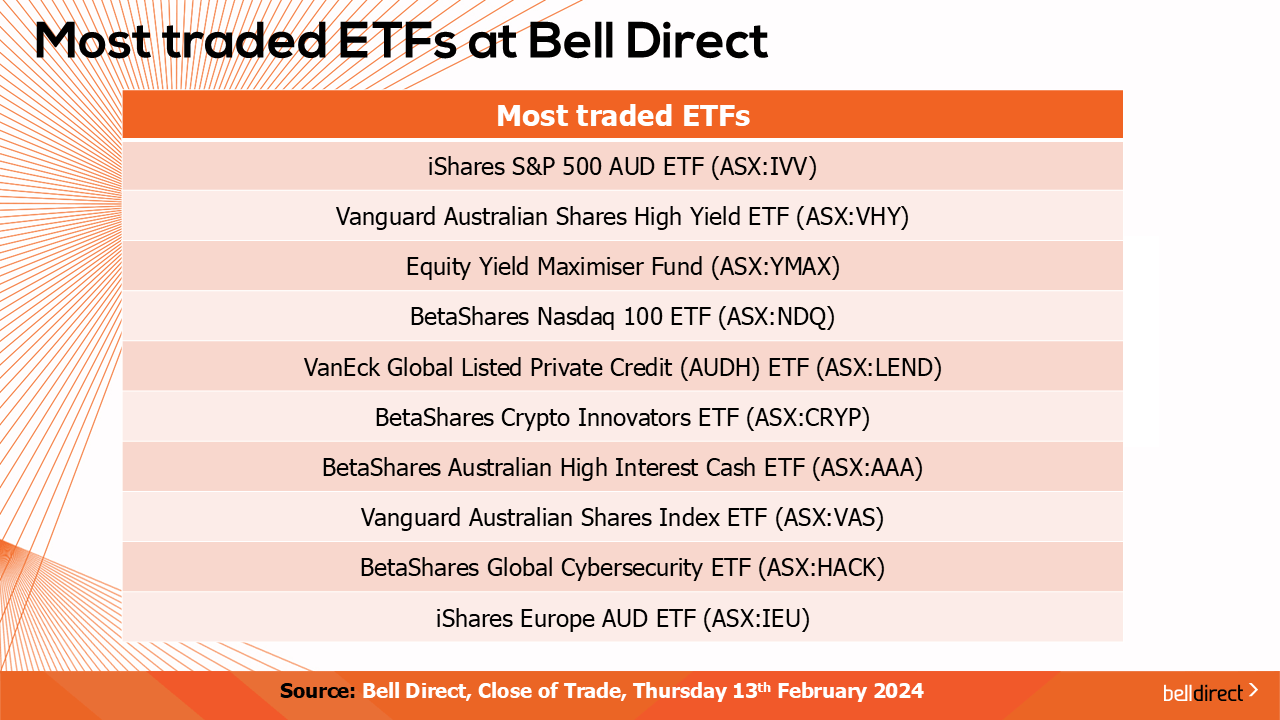

And the most traded ETFs were led by iShares S&P 500 AUD ETF, Vanguard Australian Shares High Yield ETF, and BetaShares Aus Top 20 Equity Yield Maximiser fund.

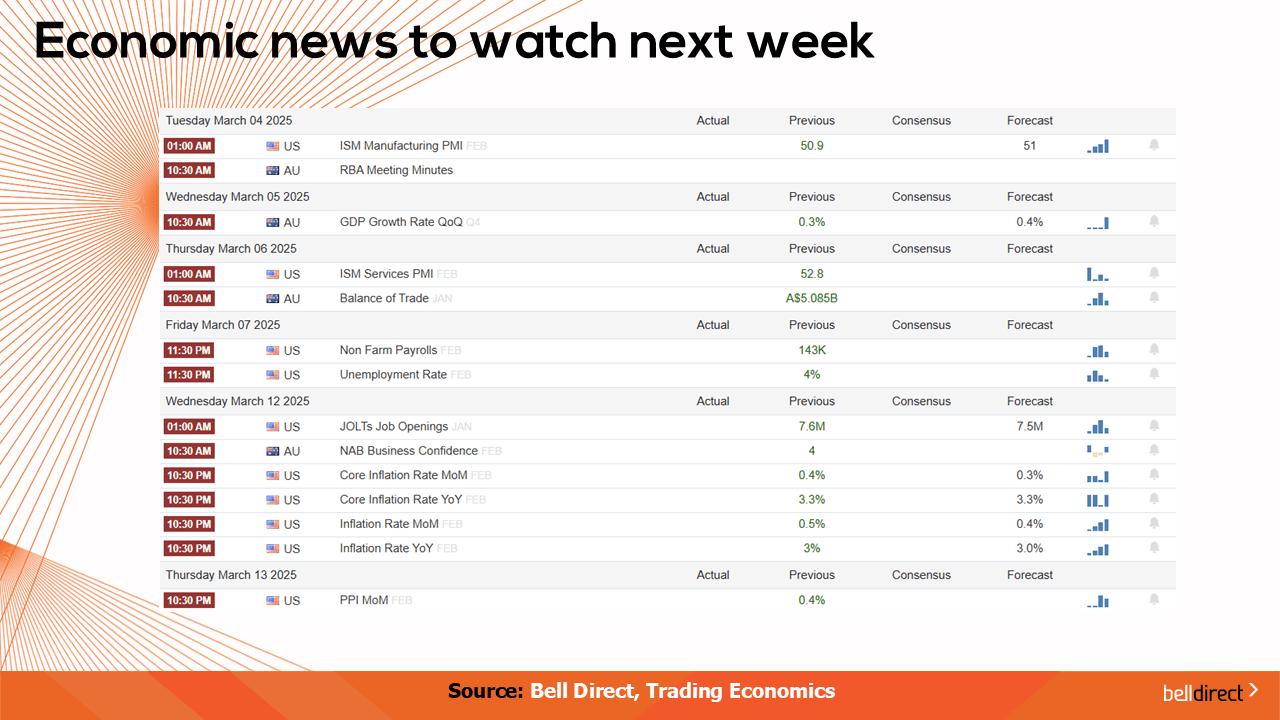

On the economic calendar front next week, we may see investors react to Australia’s RBA rate decision where it is widely expected the RBA will announce the first rate cut to 4.1% on Tuesday. We will also receive Australia’s latest unemployment rate out later next week.

Overseas, Japan’s GDP growth rate and trade balance data is out next week and, in the US, key building data and FOMC minutes are released.

And that’s all for this Friday, have a wonderful day and happy investing!