Transcript: Weekly Wrap 13 September

Economic data has been a key driver of market movements in recent times as investors shift portfolios in response to the outlook for inflation and subsequently interest rate cuts. Expectations of rate cuts are not likely in Australia until 2025, driven by factors including: sticky inflationary pressures including wages, input costs, housing and services inflation.

This week some key economic data painted vastly different pictures about the health and stability of major economies around the world and we saw starkly different investor reactions to the key data.

The week started the key inflation and trade balance data out of China. Markets in the Asia region were sold off early in the week due to China’s latest inflation data with inflation rising 0.6% in August which is a slight rise from the 0.5% rise in July, but the August reading fell short of economists’ expectations. Lower transport and oil prices weighed on inflationary growth, while clothing, health and education also fell on the prior reading. China’s struggling inflation indicates the world’s second largest economy continues to struggle in its recovery post pandemic.

China’s trade balance data out on Tuesday eased investor concerns slightly with a rebound in exports boosting the region’s trade surplus. In August China reported an increase in trade surplus to the equivalent of US$91.02bn, up from US$67.81 in the same period a year earlier and higher than the US$84.65bn reported in July. Economists were expecting a decline in trade surplus to US$83.90 for August which the reading easily exceeded. Exports for August in China rose 8.7% YoY to a 23-month high, while imports rose just 0.5% slowing sharply from the 7.2% jump in imports for July. This indicates increased activity in China and sales are being realised and leading to higher exports, while imports remain subdued.

The expectation for China’s GDP rate in 2024 has now been revised to growth of 4.5% amid the ongoing slowdown in the region’s property market and subdued demand across most industries, which falls short of the 5% growth experienced in this year. While the government continues to promise a stimulus package to reignite economic recovery and stability of the region, until a material amount is announced and handed down to assist with recovery across all industries, we are likely to see subdued economic activity out of China for a little while to come.

Over in the US, markets rallied midweek after key US inflation data released indicated the Fed’s aggressive rate strategy continues to work toward taming inflation to the target 2% level and provided further evidence that the Fed’s consideration and likelihood of a rate cut later this month can go ahead. Core inflation, which strips out volatile factors including energy and food costs, in the world’s largest economy rose 0.3% in August while the core inflation rate YoY remained at 3.2%, and the overall inflation rate remained at 2.5% YoY, edging even closer to the Fed’s target rate of 2%.

The resilience of the US economy has investor confidence boosted in the Fed’s ability to tame inflation while avoiding a recession. Retail sales remain resilient with a 1.1% rise posted in August. Wage price inflation continues to ease with an increase of 4.39% down from 4.62% reported in June. The employment market remains resilient with the unemployment rate falling to 4.2% in August, down from 4.3% in July, and the US GDP growth rate increase to 3% in Q2 of 2024 which was a welcome rise from 1.4% reported in Q1.

The Fed is widely expected to announce the first rate cut of the current interest rate cycle at the next FOMC meeting starting next week on September 17th.

Australia’s consumer confidence and business confidence data moved the local market earlier this week. Westpac consumer confidence data for September out on Tuesday came in at a fall of 0.5% which was less than economists were expecting (1.2%), but still indicated a slide from August as consumer confidence was hit by the sluggish GDP growth in Q2 for Australia and the overall stability of the Australian economy.

NAB Business confidence data for August, also out yesterday, indicated business confidence fell 3 points in August to -4 index points, compared to market expectations of a rise to 3 points. The slide in business confidence was driven by declining employment and cost inputs eating away at margins.

Economic data is likely to still move markets until the easing interest rate environment creates economic stability in the future and investor sentiment is boosted by the lower-cost environment.

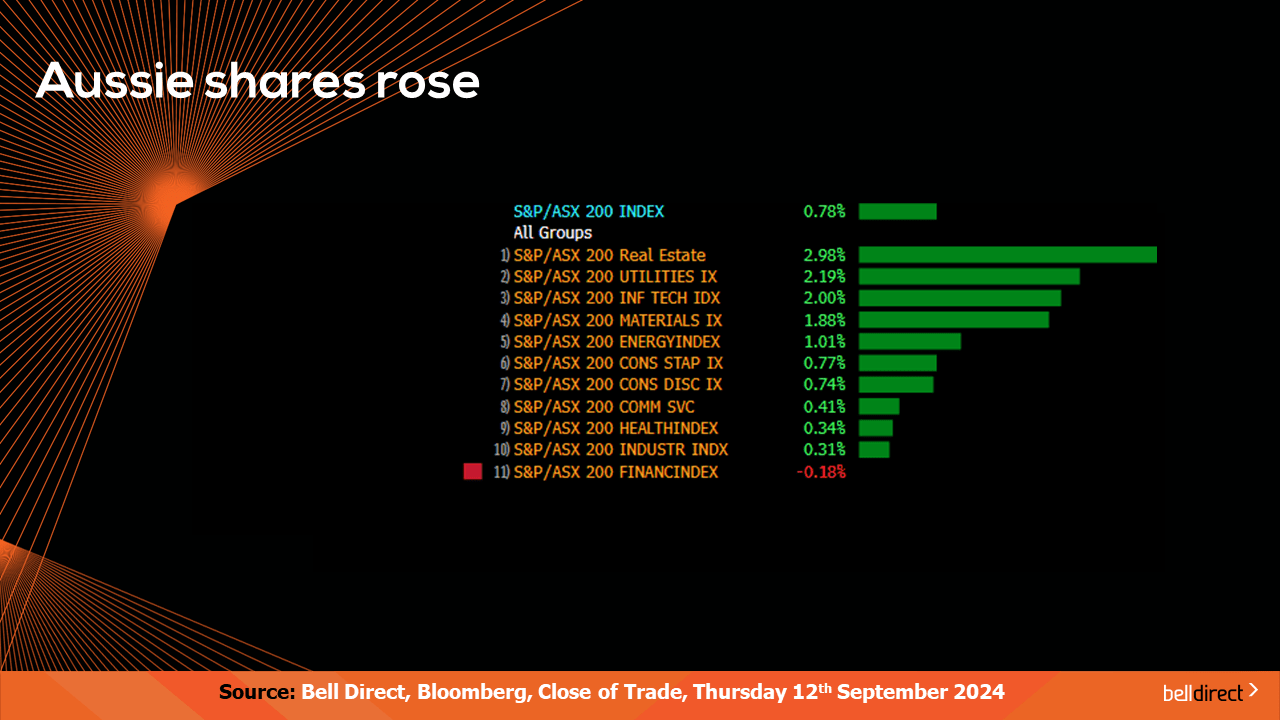

Locally from Monday to Thursday the ASX200 posted a 0.78% gain led by real estate stocks soaring almost 3% while financial stocks were the only sector to end the week lower.

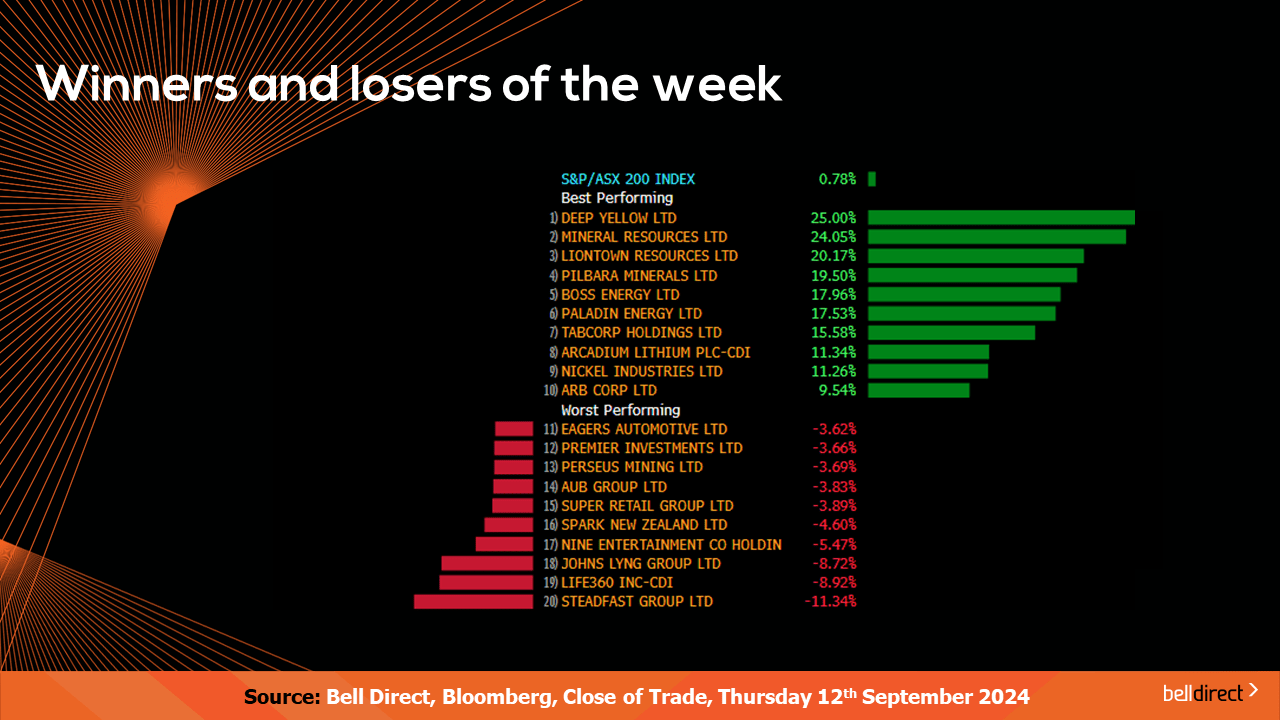

The winning stocks were led by Deep Yellow (ASX:DYL) soaring 25%, while Mineral Resources (ASX:MIN) recovered some recent losses with a 24.05% gain and Liontown Resources (ASX:LTR) also recovered some ground with a 20% rally. Steadfast Group (ASX:SDF) on the losing end posted an 11.34% decline over the 4-trading days.

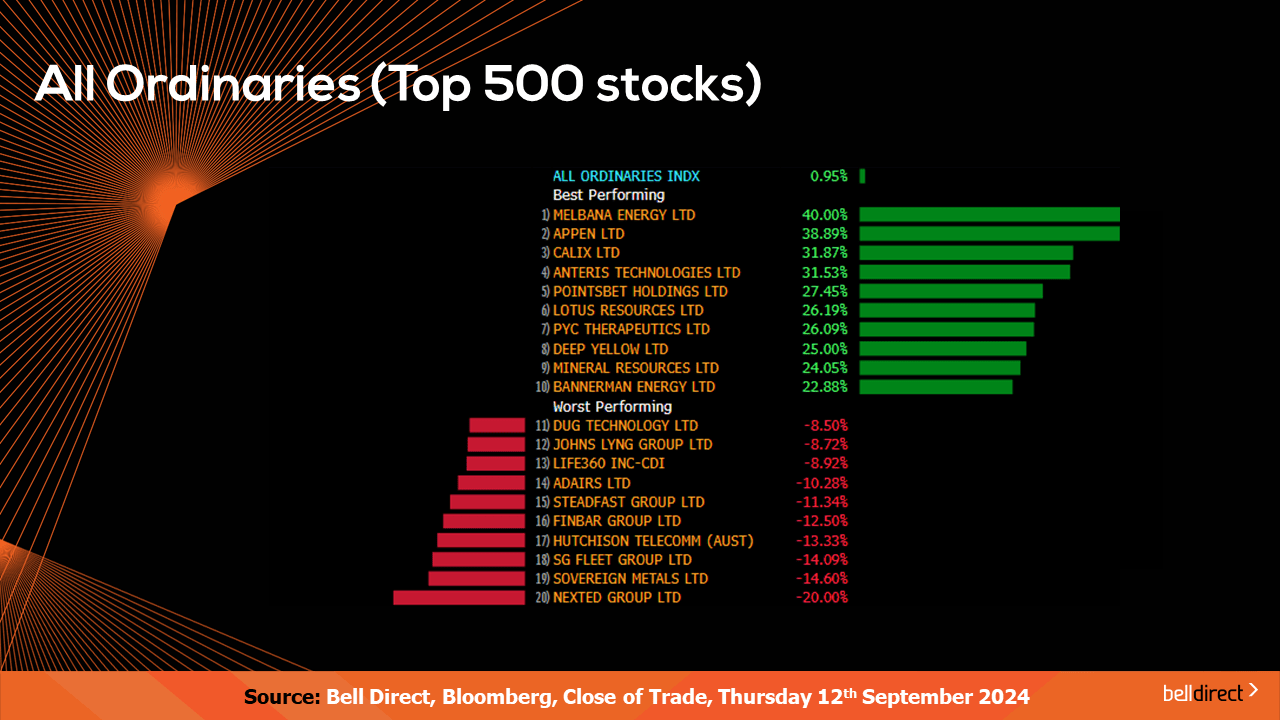

On the broader market index, the All Ords rose 0.95% this week led by Melbana Energy (ASX:MAY) soaring 40% while Appen (ASX:APX) and Calix (ASX:CXL) added 39% and 32% respectively.

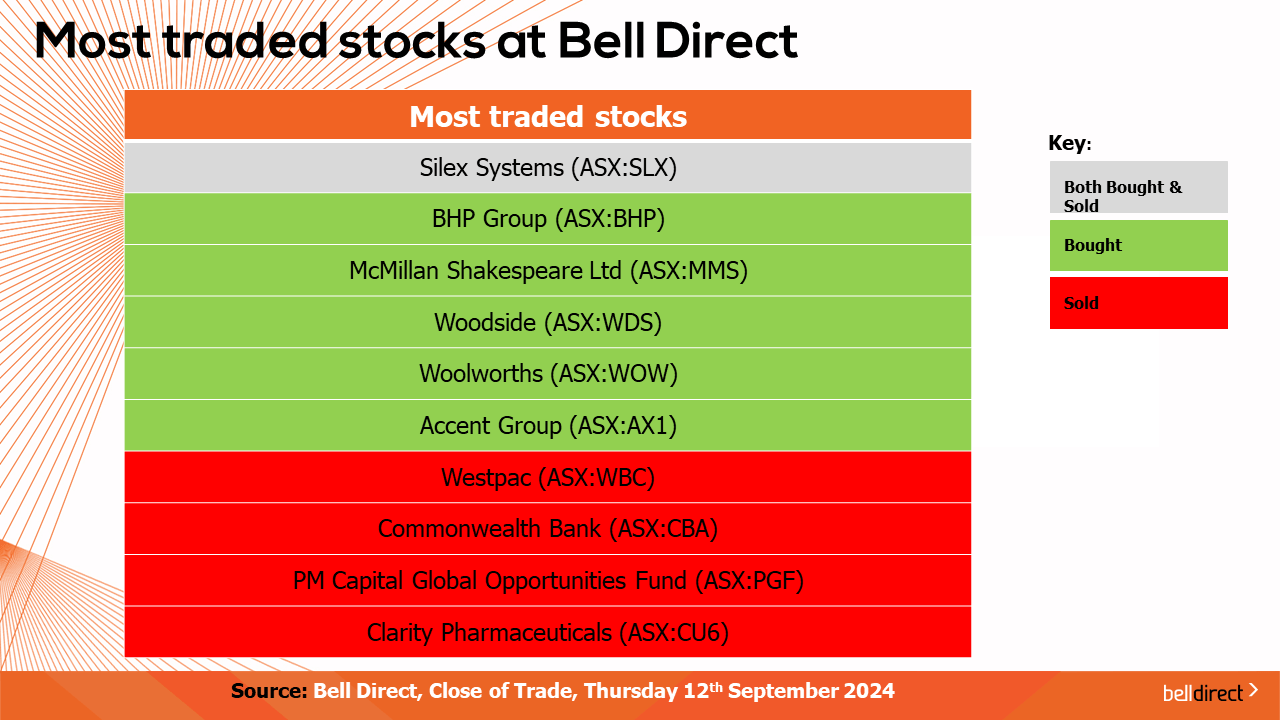

The most traded stock by Bell Direct clients this week was Silex Systems (ASX:SLX). Clients also bought into BHP (ASX:BHP), McMillan Shakespeare (ASX:MMS), Woodside (ASX:WDS), Woolworths (ASX:WOW) and Accent Group (ASX:AX1), while taking profits from Westpac (ASX:WBC), CBA (ASX:CBA), PM Capital Global Opportunities Fund (ASX:PGF), and Clarity Pharmaceuticals (ASX:CU6).

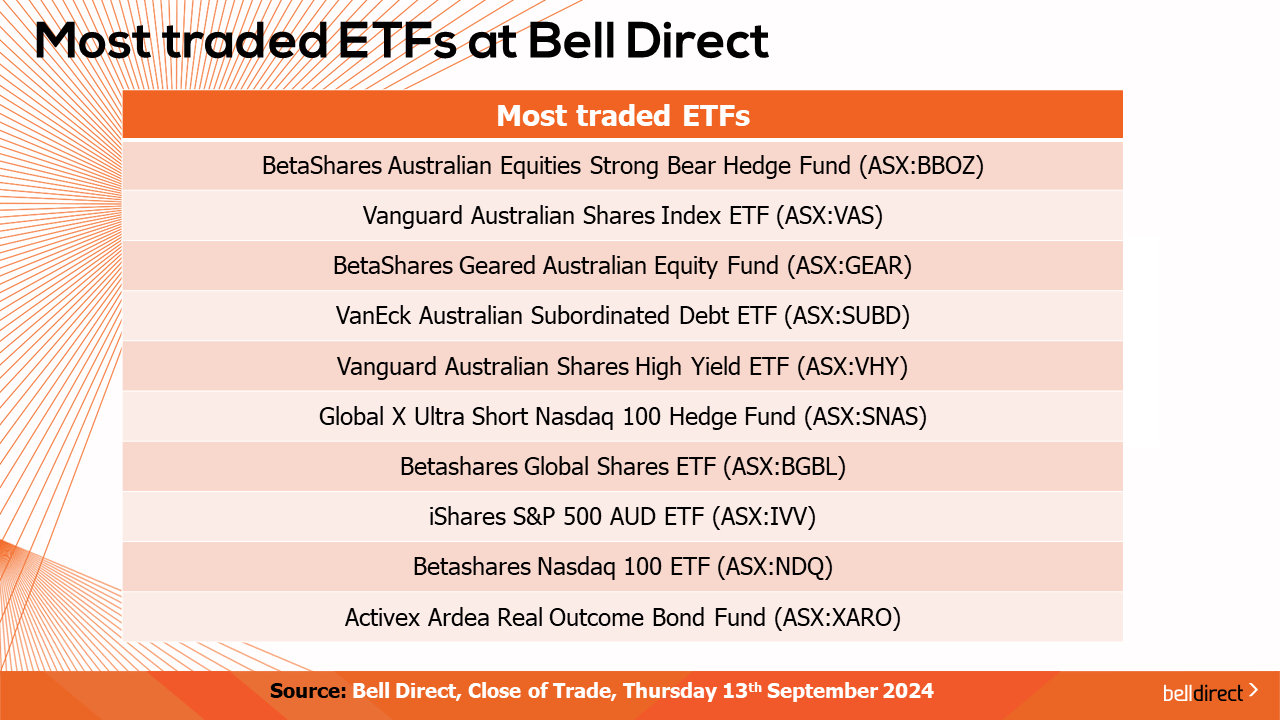

And the most traded ETFs by our clients this week were led by BetaShares Australian Equities Strong Bear Hedge Fund, Vanguard Australian Shares Index ETF and BetaShares Geared Australian Equity (Hedge Fund) ETF.

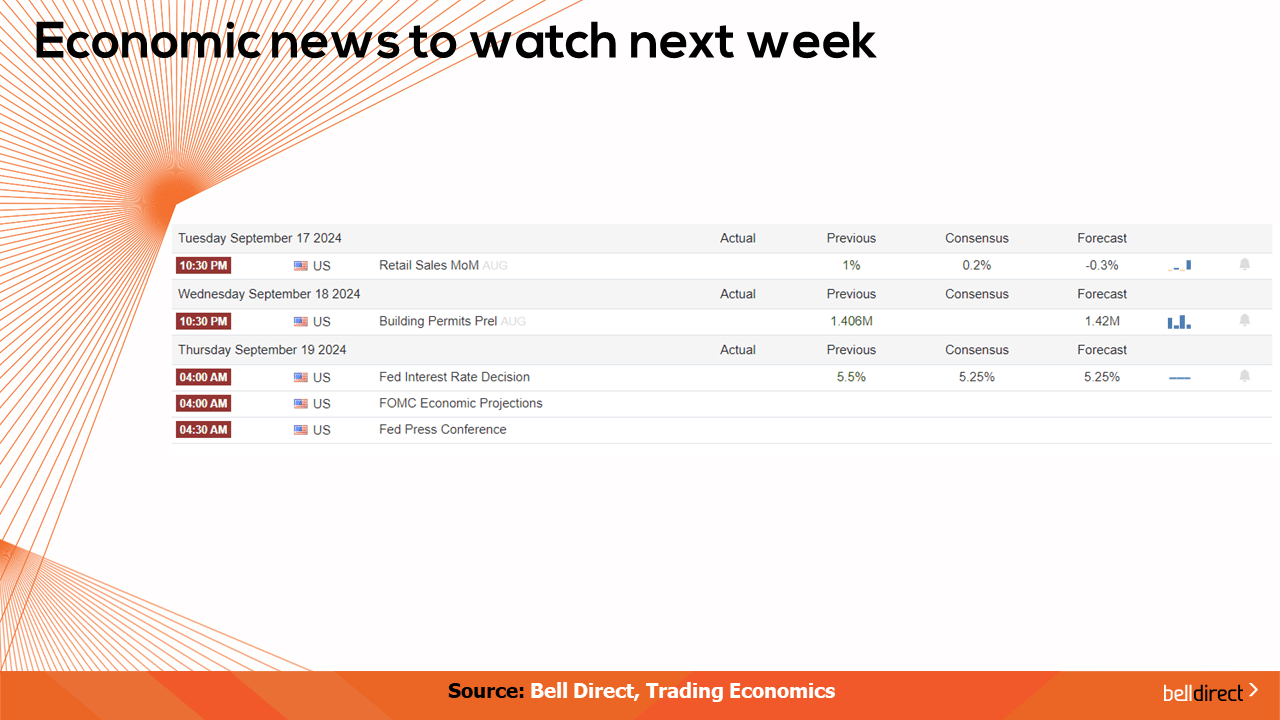

On the economic calendar next week, there is no key local economic data released so all investor eyes will be on US retail sales out on Tuesday with the expectation of a 0.3% decline in retail spend, while building permits data in the US is out on Wednesday and the highly anticipated Fed’s rate meeting kicks off on Tuesday.

The UK and Japan will also hand down their respective interest rate decisions later next week with the expectation of the BoE to maintain the current 5% rate, while the BoJ is expected to be increased to 3% from 2.8%in July.

And that’s all for this week. Have a wonderful weekend and happy investing.