Transcript: Weekly Wrap 12 July 2024

Thank you for joining me this Friday the 12th July, I’m Grady Wulff, Market Analyst with Bell Direct and this is the weekly market update.

Well, there is one clear way to describe the US market this week and that is RECORD RUN! The S&P500 notched 7 straight record highs, topping 5600 points for the first time and posting the 37th record close year-to-date, while the tech-heavy Nasdaq also jumped.

Stock specifically, Apple shares topped US$232.98/share for the first time ever and the iPhone giant stole the most-valuable listed company status from Nvidia. The driver of Apple’s rise to the top this week was rising investor optimism of the tech giant’s introduction of AI into the iPhone product line which was announced late in June. There really is no denying that markets and consumers alike are all about the AI revolution in 2024.

So, valuations really stay this high and what is driving Wall Street to record territory?

The short answer is yes, valuations can continue to grow as long as earnings continue growing, unless of course the stock is deemed overvalued, which may lead to a pullback. To determine if a stock is fair value, undervalued or overvalued there are a lot of formulas and technical practices involved, however, a simple way to gauge the value of a company is to compare the company’s price to earnings ratio (aka PE ratio) against the average PE of the sector it is listed in. If for example, we take Apple shares which are at US$232/share and currently trading on a PE around 35x. Given Apple is part of the tech-sector, which is known for high growth, the average PE in this sector is around 32x so Apple trading slightly above could suggest it is overvalued, however, with the expansion into AI and growing earnings, the valuation has some analysts’ saying it is fairly valued at the current level.

All markets are economic data and rate outlook driven right now and the US rally of the week just gone, cements this point following both Fed Chair Jerome Powell’s latest comments and recent economic data including non-farm payrolls and the unemployment rate coming in favourably compared to economists’ expectations. Overnight we saw the release of US inflation data which paves a solid pathway for the Fed to consider rate cuts as early as September. The core inflation rate MoM for June fell 0.1% from May while the US inflation rate YoY for June fell to 3% from 3.3% in May. Both key readings came in cooler than economists’ were expecting and indicate the Fed’s aggressive interest rate stance to date is working to cool inflation to the target of 2%.

Investors are bolstering their equities positions and adapting portfolio constructions to optimise returns ahead of the anticipated rate cuts, so we are seeing investors move into sectors that perform well in a lower interest rate environment.

Fed Chair Jerome Powell boosted investor confidence of the rate cut outlook this week after he outlined that keeping interest rates elevated for too long risks economic downside through weakened economic activity and employment.

Inflation drivers remain stickier in Australia than the US, so the rate outlook here remains more uncertain with the RBA not ruling out raising rates or holding for longer due to wages price inflation, housing inflation, retail sales and services inflation all remaining stubbornly elevated.

So, with all of this in mind, where are the opportunities for you to consider in the current market environment and what should you look out for in the coming months?

Financials stocks continue to outperform the market in 2024 with the sector up 15.33% YTD as investors see the banks will benefit from the higher-rates-for-longer thematic.

The tech sector is still running and has legs to continue its recent rally for some time as companies expand into AI and enhance earnings potential.

And Earnings season in August will be the key catalyst for you to keep an eye out for, as this will determine exactly how listed companies are faring in the high interest rate environment and whether the recent equity rally and growing valuations are fair or overpriced. When assessing each company’s reports be sure to look for outlook into FY25, earnings growth or lack of over the past few financial years, levels of debt and profits. Each sector has key metrics we look for to determine performance, for example in retail, be sure to check the company’s inventory levels as this will indicate whether the company must run sales or write-off stock at a loss, or, whether they are successful in managing stock levels.

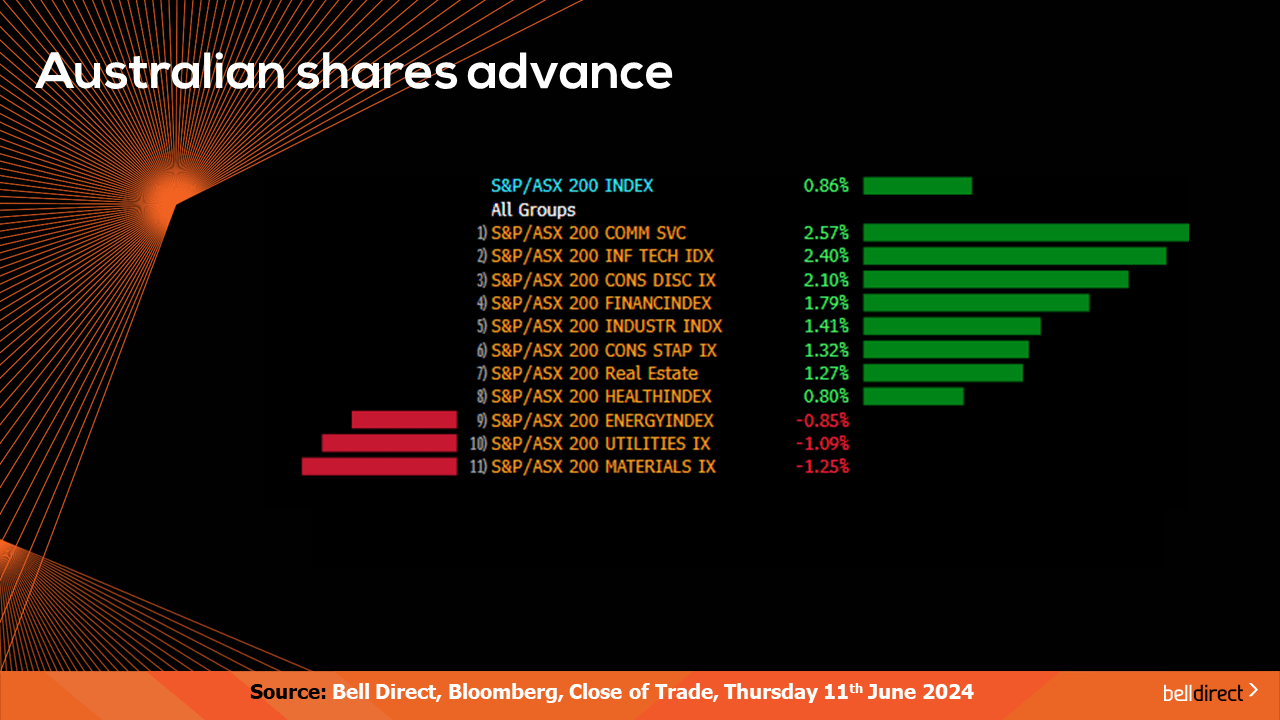

Locally from Monday to Thursday the ASX200 rose 0.86% which was weighted to the tail end of the week after an early sell-off to start the week. Communication services and tech stocks led the market gains with the sectors posting increases of 2.57% and 2.40% respectively. At the other end of the market materials and utilities stocks came under pressure this week.

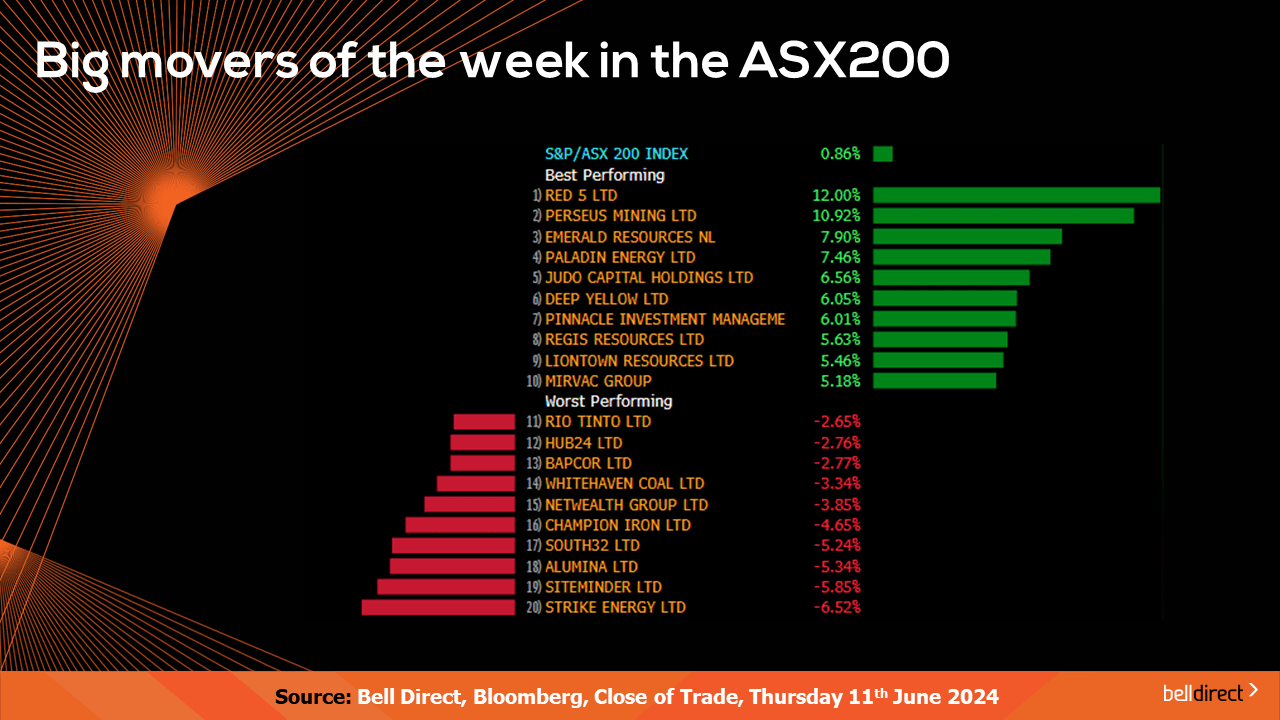

The winning stocks were led by Red 5 jumping 12% on a trading update and restructured hedge facility and security package. Perseus Mining rose 10.92% this week and Emerald Resources added 7.9% over the four trading days.

And on the losing end Strike Energy fell 6.52%, Siteminder lost 5.85% and Alumina posted a 5.34% loss.

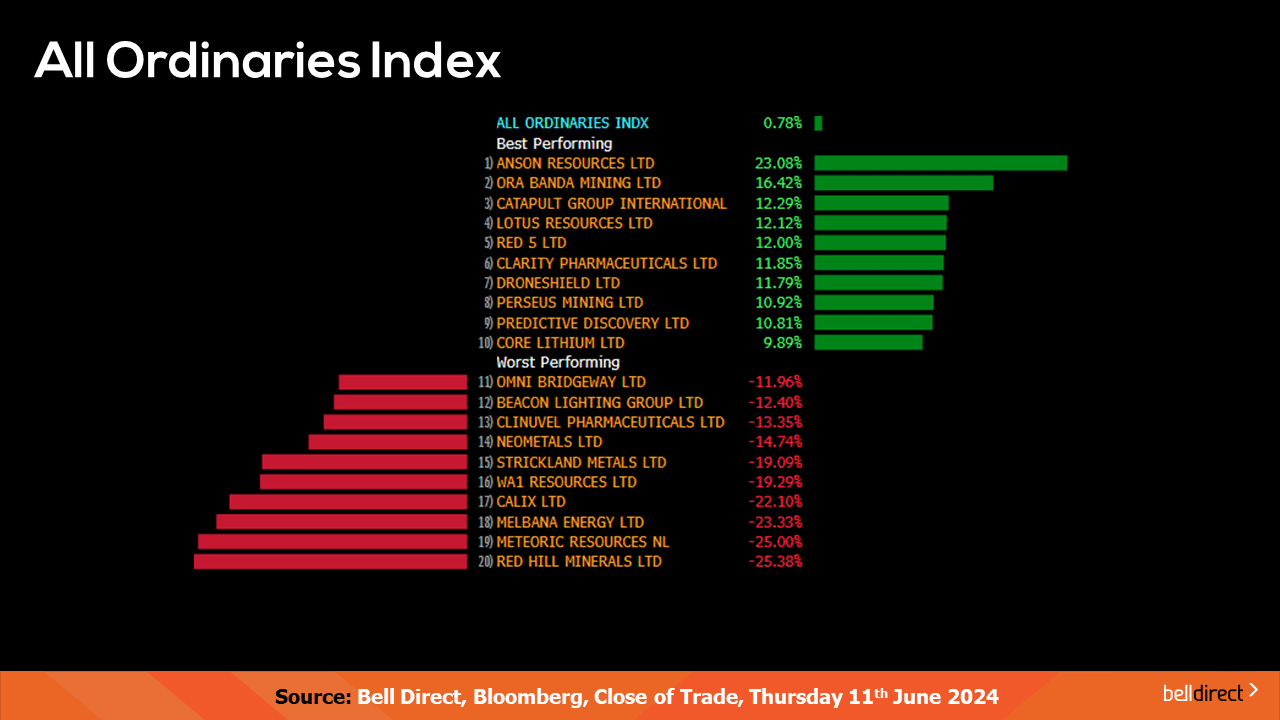

The broader market, or the All Ords also rose 0.78% over the four trading days as Anson Resources soared 23.08%, Ora Banda Mining rose 16.42% and Catapult Group International jumped 12.29%.

Red Hill Minerals tumbled 25.38% over the four trading days while Meteoric Resources lost 25%.

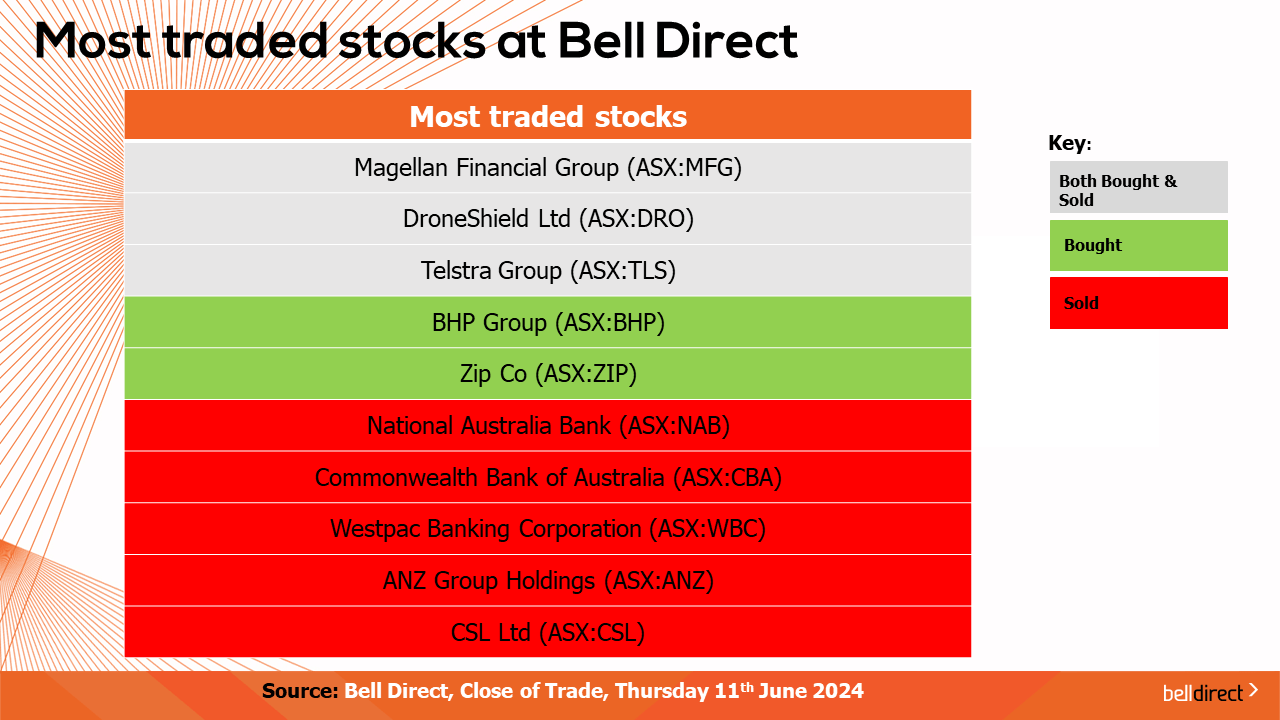

The most traded stocks by Bell Direct clients this week were Magellan Financial, DroneShield, and Telstra Group. Clients also bought into BHP, and Zip, while taking profits from all four big banks being NAB, CBA, Westpac and ANZ, and CSL.

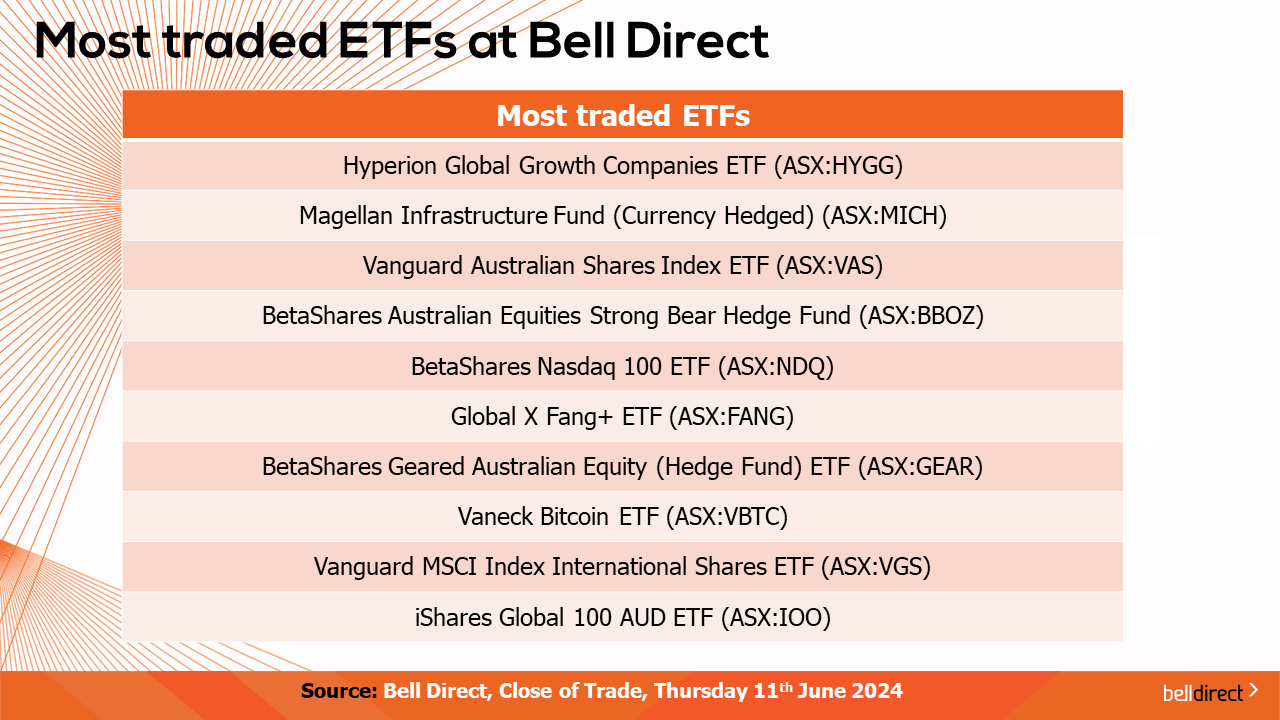

And the most traded ETFs by our clients this week were led by Hyperion Global Growth companies fund, Magellan Infrastructure Fund, and Vanguard Australian Shares Index ETF.

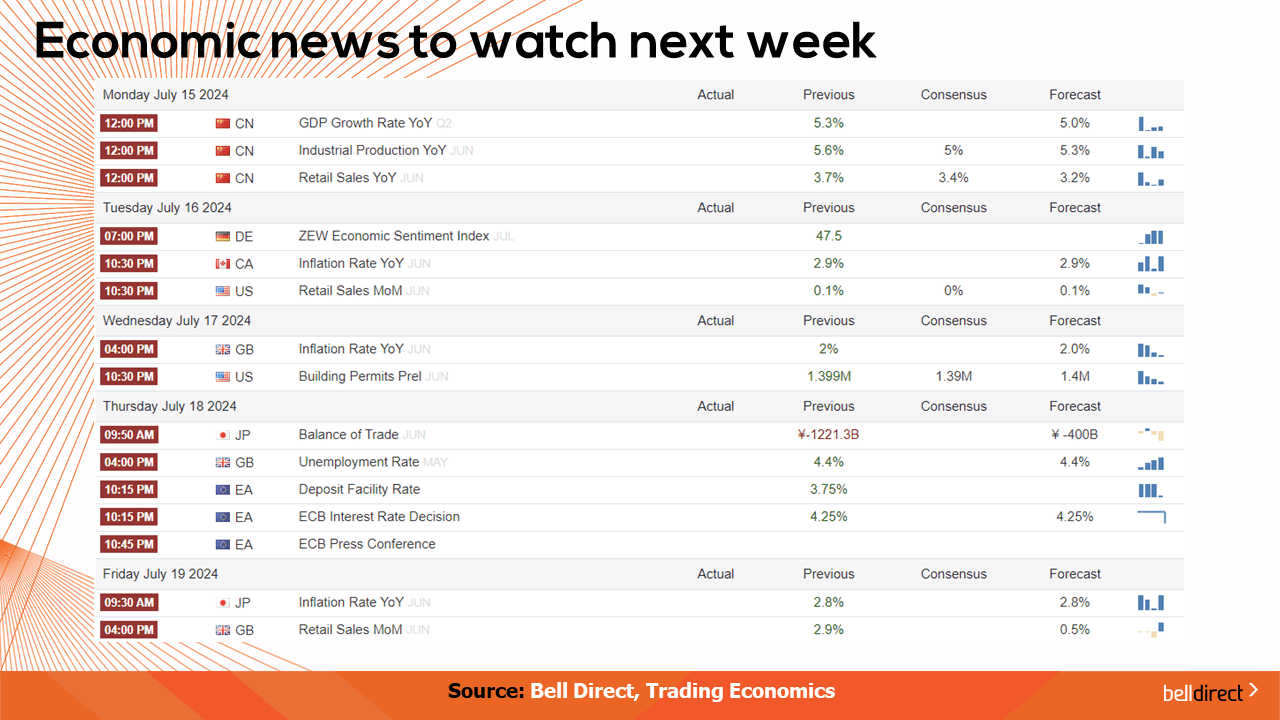

Looking at the week ahead from an economic calendar standpoint we may see markets react to China’s GDP Growth rate data for Q2 out on Monday alongside Industrial production and retail sales data as these three readings will paint a clear picture on how the world’s second largest economy fared in the second quarter and if it continues to struggle with recovery post-pandemic.

US retail sales data is out on Tuesday with the market anticipating a flat reading on May as cost-of-living pressures continue to bite.

The ECB will hand down its latest rate decision later next week where it is widely expected Europe’s central bank will maintain the current cash rate of 4.25%.

And that’s all for this week, have a wonderful weekend and happy investing!