Transcript: Weekly Wrap 12 April

Well, from June 2023, investor sentiment was boosted by the idea of rate cuts on the horizon in the US as the pace of inflation slowed. This week however, it became a tale of too good to be true when the latest US inflation reading was released indicating the nation’s inflation rate rose for a second straight month to an annual rate of 3.5% in March. Not only was this above the 3.2% economists were expecting. The market got the jitters as investor hopes of rate cuts in June 2024 were quickly pushed back.

So, what are the key drivers of inflation in the US, why is it proving harder for the Fed to tame inflation in the world’s largest economy, and what impact does this have on you as an investor?

The Personal Consumption Expenditures index is the Fed’s preferred measure of inflation and came in at a 0.3% increase in the latest reading for February 2024. Despite this easing from the 0.5% rise reported in January, it remains elevated and signals that overall prices of consumer goods are not easing evenly nor fast enough.

Retail spend is another indicator and driver of inflation. In the US, retail spend rose 1.5% YoY in February to US$700.7bn following a flat reading in January. While the rise in February appears to be a large jump, it came in below economists’ expectations and provided one piece of supportive evidence for the Fed to consider cutting rates sooner.

But other drivers of inflation dampened the rate cut outlook. Strong jobs data is one key factor giving the Fed a headache when it comes to rate outlook. The most recent jobs report out of the US indicated US employers hired far more employees than expected in March whilst increasing wages at the same time. In March, 303,000 jobs were added to US payrolls which was 100,000 more than economists had anticipated. This data indicates a strong economy, and while the economy remains strong, there is minimal case for the Fed to consider interest rate cuts. The country’s unemployment rate also fell to 3.8% in March from 3.9% in February and industry specific growth has been particularly strong for hospitality businesses with the industry’s employment back above pre-pandemic levels.

Services inflation is another sticky point for not just the Fed in the US, but most major economies around the world. In the latest US inflation reading, services inflation continued to outpace overall inflation by 0.5% MoM and 5.3% annually in March. Supply chain issues resulting from rising geopolitical tensions is the key factor behind rising services inflation.

Wages growth has also been outpacing inflation in the US with the latest data for March 2024 indicating average hourly wages rose by 0.3% which matched inflation growth for March, but prior to this month, US inflation rose 0.1% between January and February while wages rose by 0.2% over the same period, and inflation fell 0.3% between December and January, while wages rose 0.5% over that same period. The higher the wages grow, the higher the cost for businesses in the US to wear or pass onto customers through elevated prices of goods and services, thus rising wages in the US contribute significantly to the stickiness of inflation in the world’s largest economy.

Energy prices are a final stubborn driver of inflation in the US. In the latest CPI reading, energy prices excluding electricity, gas, fuel and other power-related goods and services, jumped 1.1% in March.

With all of this in mind, what are markets now predicting about the Fed’s rate outlook? Markets are now factoring in the first rate cut out of the Fed in September 2024 pending inflation drivers ease over the next few months. Higher for longer is generally the consensus across all Fed officials until inflation shows consistent signs of easing to the 2% target.

For you as an investor, this is likely to mean higher costs for companies to wear that will likely impact Q1 results which are starting to be released from US companies late this week and into the coming weeks. Company forecasts might also be dampened by the idea of higher rates for longer for businesses with higher levels of debt.

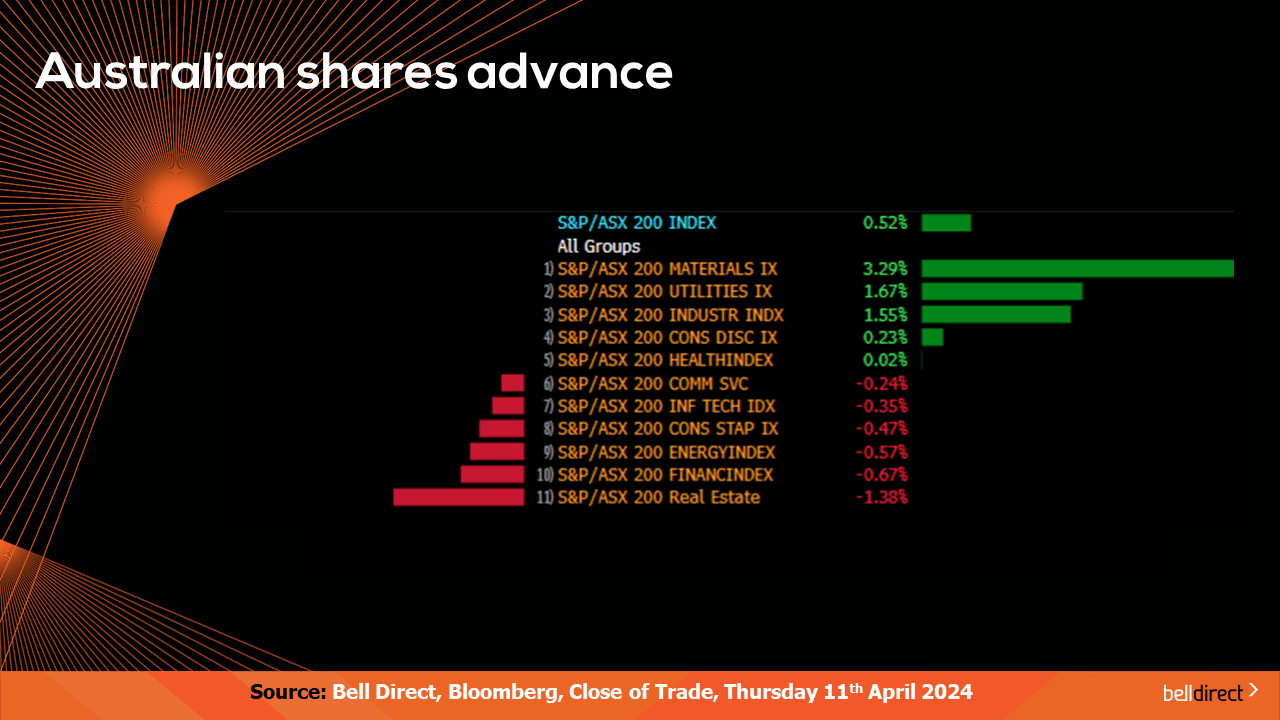

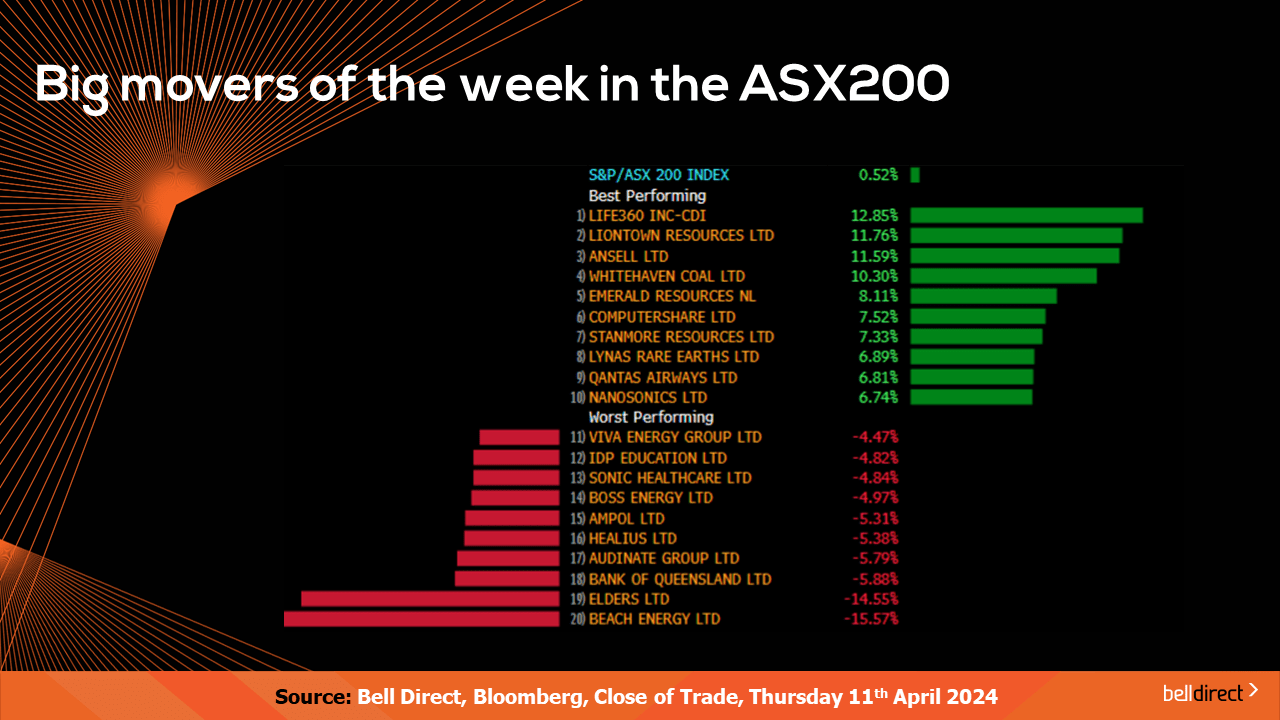

Locally from Monday to Thursday the ASX200 rose 0.52% driven by a rally for the materials sector jumping 3.3% on the rising price of iron ore on boosted outlook for recovery in demand out of China in recent days. The rate sensitive sectors like tech and real estate stocks came under pressure this week amid renewed speculation around prolonged time before rate cuts out of the Fed.

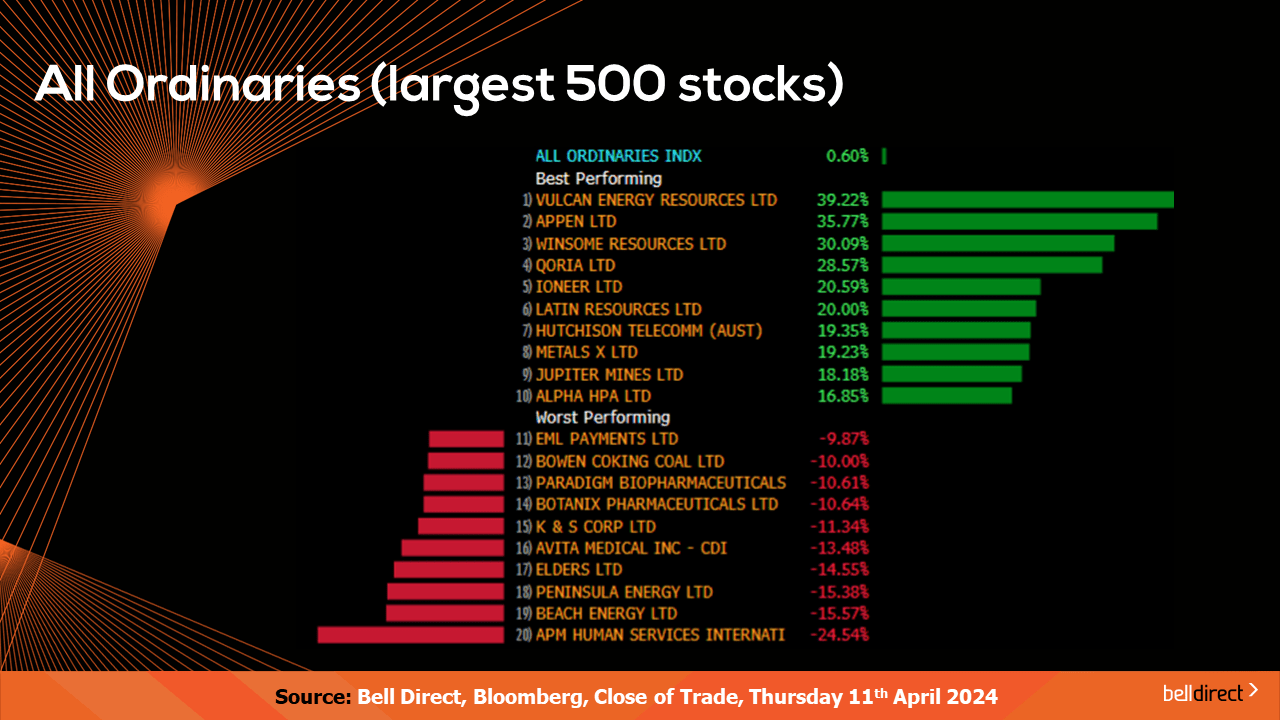

On the broader market, the All Ords rose 0.6% led by Vulcan Energy Resources (ASX:VUL) which soared 39.2%, Appen (ASX:APX) rose 35.77% and Winsome Resources (ASX:WR1) added just over 30%.

On the losing end of the All Ords, APM Human Services International (ASX:APM) fell 24.54%.

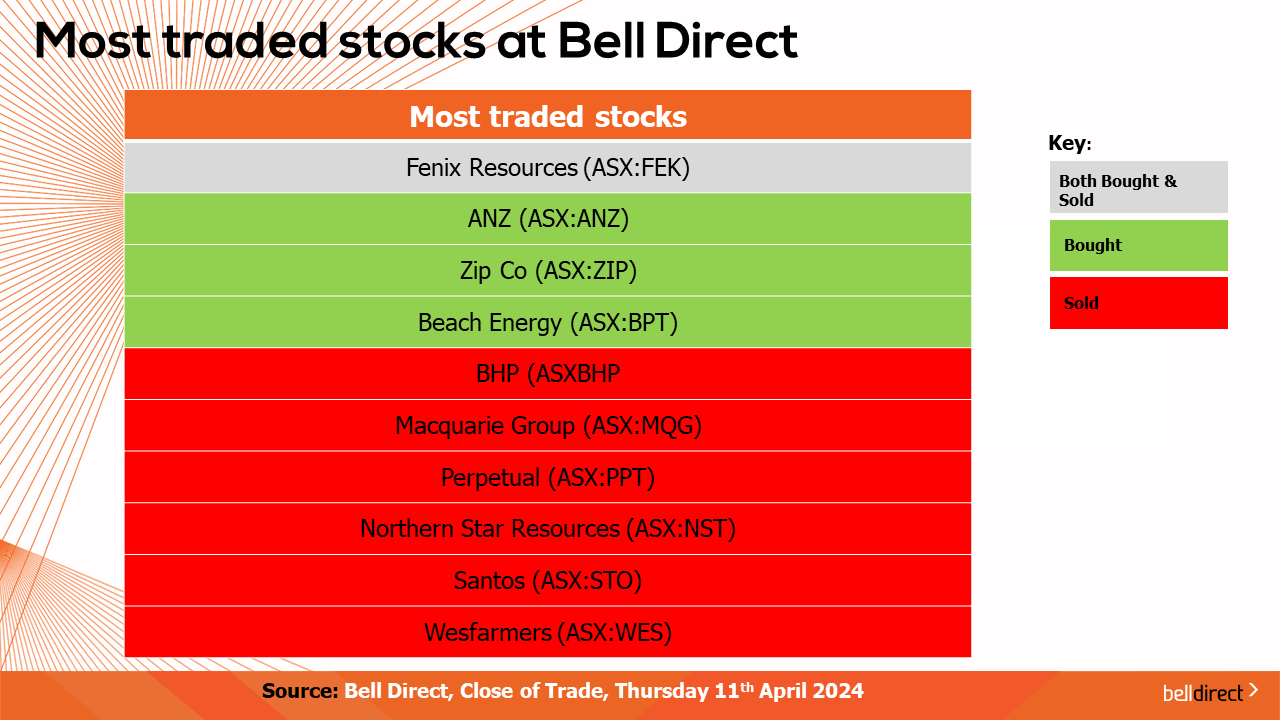

The most traded stocks by Bell Direct clients this trading week were Fenix Resources (ASX:FEX). Clients also bought into ANZ (ASX:ANZ), Zip Co (ASX:ZIP), and Beach Energy.

And clients took profit from BHP (ASX:BHP), Macquarie Group (ASX:MQG), Perpetual (ASX:PPT), Northern Star Resources (ASX:NST), Santos (ASX:STO) and Wesfarmers (ASX:WES).

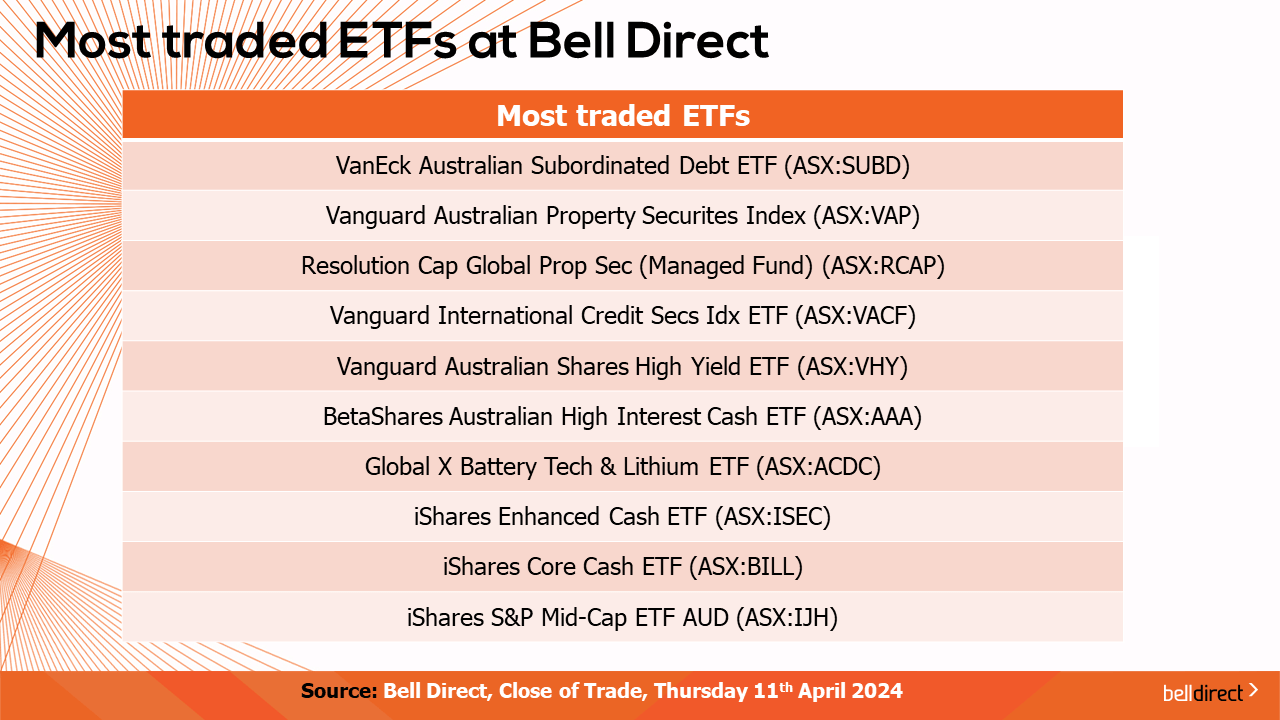

And the most traded ETFs were led by VanEck Australian Subordinated Debt ETF, Vanguard Australian Property Securities Index ETF and Resolution Capital Global Property Securities exchange traded managed fund.

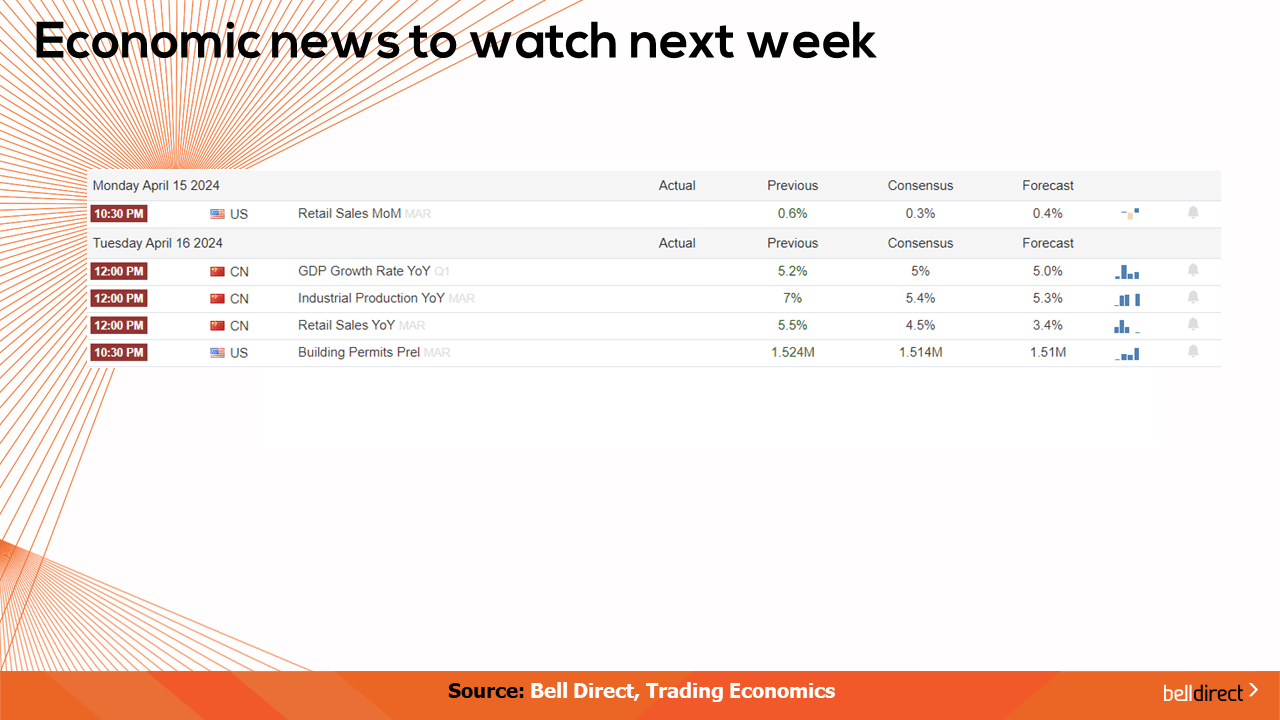

Looking at the week ahead, US retail sales data for March is released on Monday which investors will eagerly await the release of to determine just how many key inflation drivers remain sticky, and if retail is one of them.

China’s GDP growth rate data, industrial production and retail sales are also out next Tuesday which will give a key insight into how the world’s second largest economy is faring through the sluggish post-pandemic recovery era.

And that’s all for this Friday, have a wonderful weekend and happy investing!