Is the lithium train about to take off again?

This week we saw a surprise diversification unfold in the form of mining giant Rio Tinto undergoing a 4-day process to acquire dual-listed Arcadium Lithium in an all-cash deal worth US$6.7bn. Rio’s diversification into the once loved and market darling commodity, lithium, both shocked markets and fuelled strong tailwinds for other locally listed lithium miners like Liontown Resources which rose 10% this week, and Piedmont Lithium which gained 38% this week.

With the price of lithium declining 90% from their peak in 2022, and the outlook for depressed pricing for a little while to come, we can’t help but wonder why Rio splashed some big cash to snap up Arcadium Lithium, so let’s delve into the sector, what rationale Rio has unveiled for its mega purchase and what this deal means for the sector.

Arcadium Lithium’s balance sheet has come under pressure, as have many of the lithium miners in 2024, due to depressed lithium prices, which forced Arcadium to announce in September that it plans to halt expansion at, and put its Mt Cattlin lithium mine in WA into care and maintenance mode from mid next year. Under the new Rio Tinto deal though, Rio’s ownership of Mt Cattlin places it alongside fellow mining magnates in Mineral Resources and Gina Rinehart’s stakes in lithium assets in the same region.

The true appeal of Arcadium for Rio though is its global lithium portfolio with particular focus on its North American assets which border the growing US EV industry. Arcadium also has downstream processes which is where higher margins are made for lithium producers. With interests in lithium mines across Argentina, China, Japan, the broader US, Canada, the UK, and Western Australia, Rio’s purchase of Arcadium means Rio will now control around 5% of the world’s lithium supply.

While resources analysts have been cautious of subdued demand for lithium expected to continue for the near-term, Rio Tinto’s boss Jakob Stausholm says he isn’t worried about the price of the commodity over the next 12-months, and is more focused on the long-term fundamentals of the need for lithium in the global EV and green energy transition for decades to come.

While fellow mining giant BHP goes hard in diversifying into copper, another key commodity in the green energy transition, Rio has chosen to make the leap into lithium. Rio’s reasoning for the acquisition includes the sheer global scale of Arcadium’s operations, diversification into the green energy transition, the first mover advantage of a global blue chip entering into the lithium industry, and the outlook for supply deals with big car makers now that Arcadium is under the Rio Tinto umbrella.

On the outlook front for lithium, analysts are expecting the price of lithium carbonate and hydroxide remain around US$11,000/tonne for at least the next 2 years before rising in FY26, while spodumene prices are expected to remain in the US$900/tonne until at least FY27. Rio’s deal though may be telling us that a price spike and supply resurgence may be on the cards a little sooner than expected, especially after China’s stimulus package to reignite economic growth flows through into global markets.

With this major acquisition this week sparking tailwinds for lithium miners, especially on the smaller scale, we could see an increased interest from other big miners into the lithium market in the near-term as the commodity looks set to rebound following a few years of subdued demand and price depreciation.

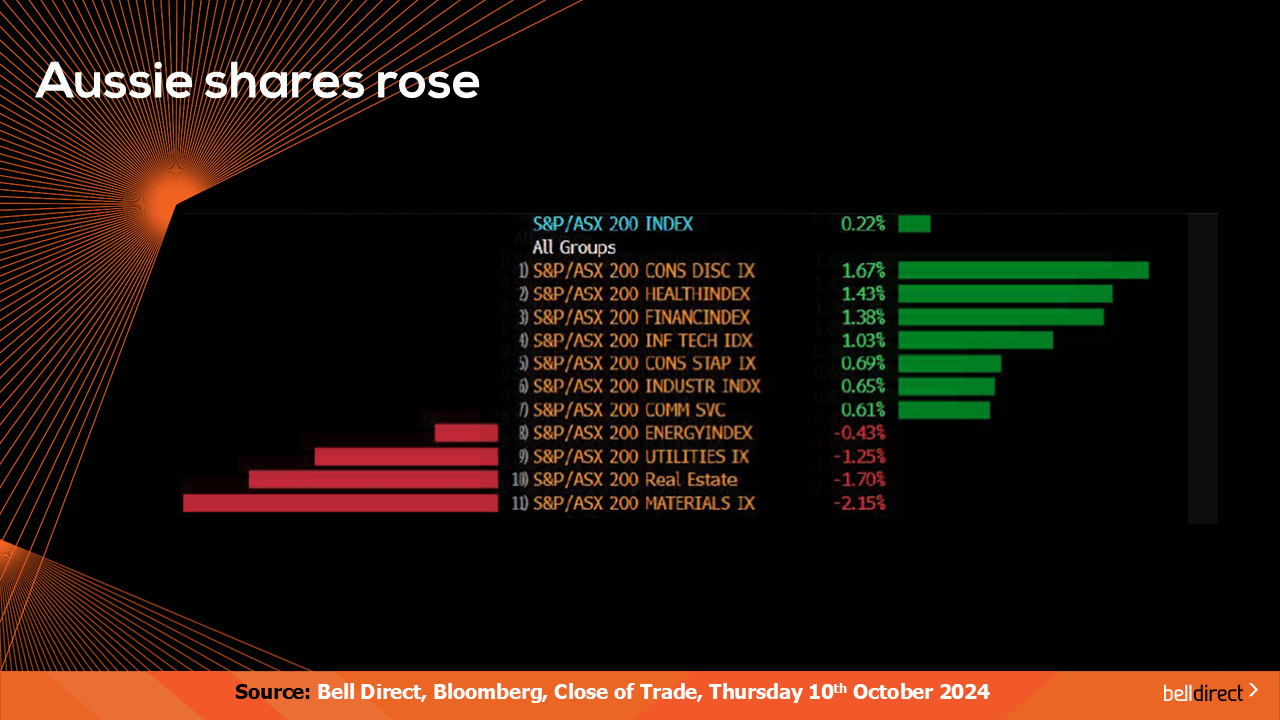

On the local market this week, the ASX200 rose 0.22% buoyed by a rally for consumer discretionary, health care and financials stocks while materials and real estate stocks came under pressure this week.

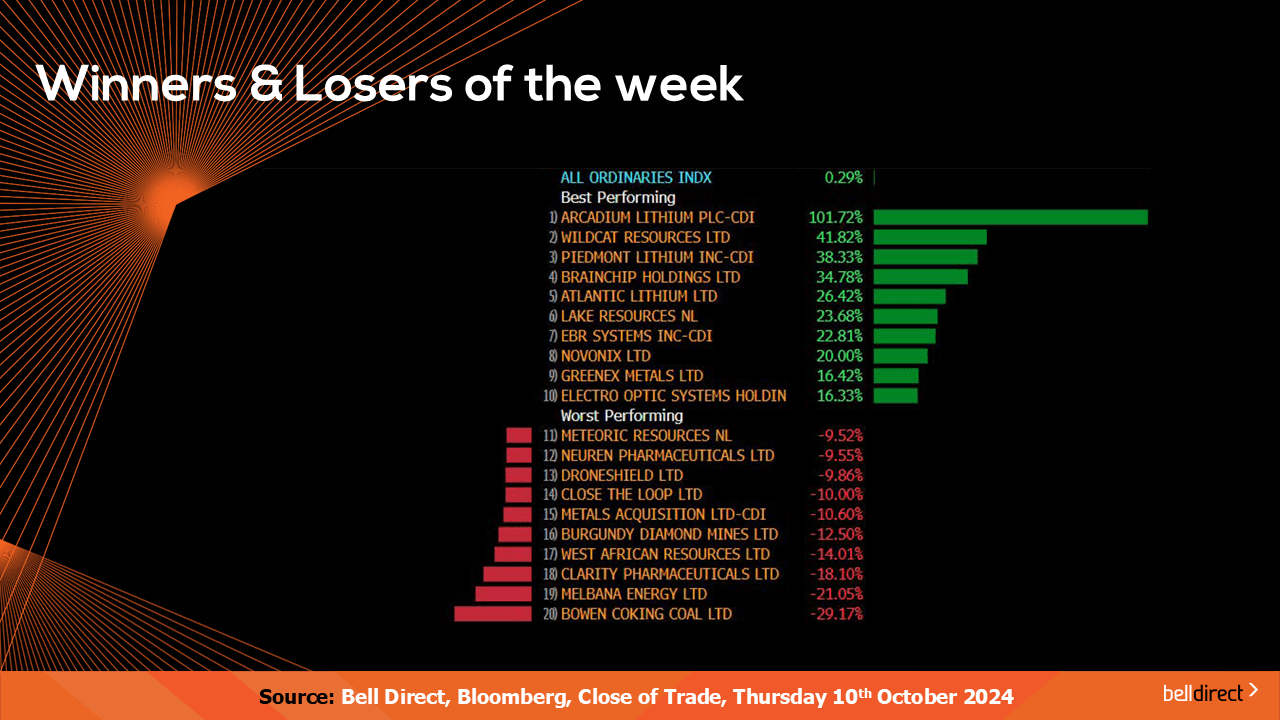

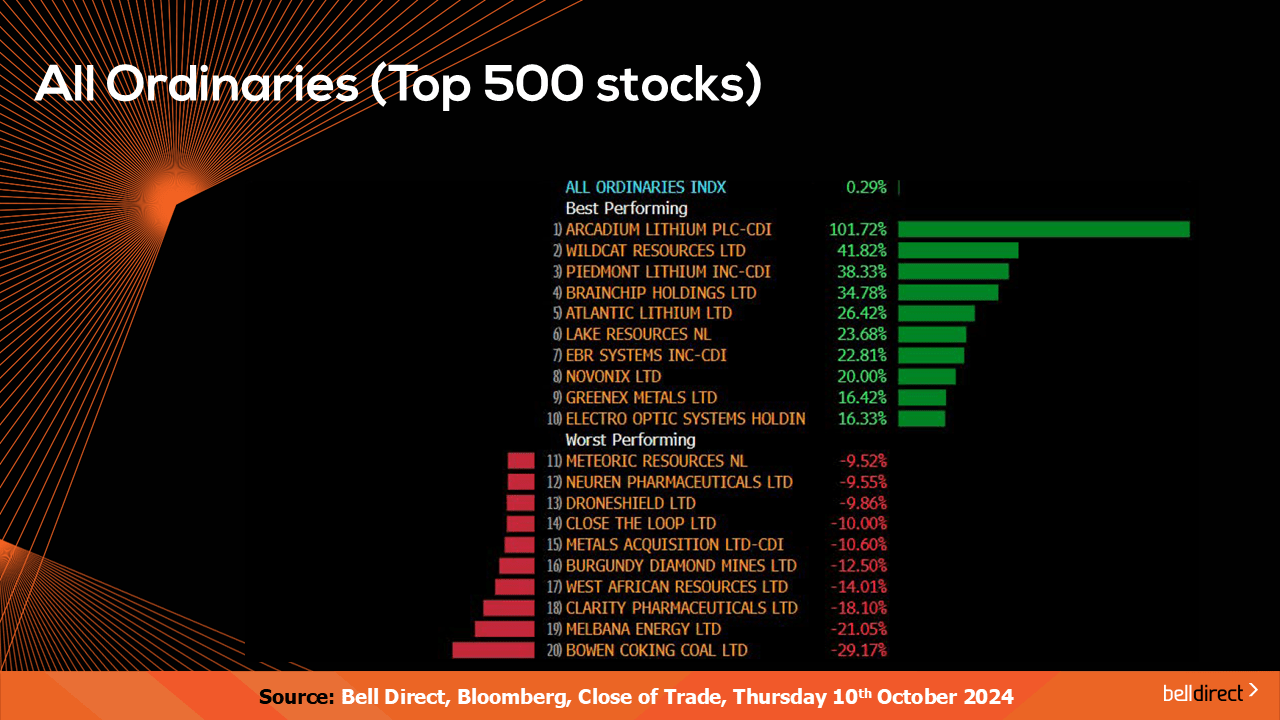

The winning stocks over the 4 trading days were led by Arcadium Lithium soaring 101.72% due to the Rio Tinto takeover news, while Zip Co and Liontown Resources also each added 14% and 10% respectively.

On the broader market, the All Ords posted a gain of 0.29% this week led by Wildcat Resources (ASX:WC8) rising 42% while Piedmont Lithium (ASX:PLL) added 38%.

Bowen Coking Coal (ASX:BCB) and Melbana Energy (ASX:MAY) led the losing end of the All Ords this week with losses of 29% and 21% respectively.

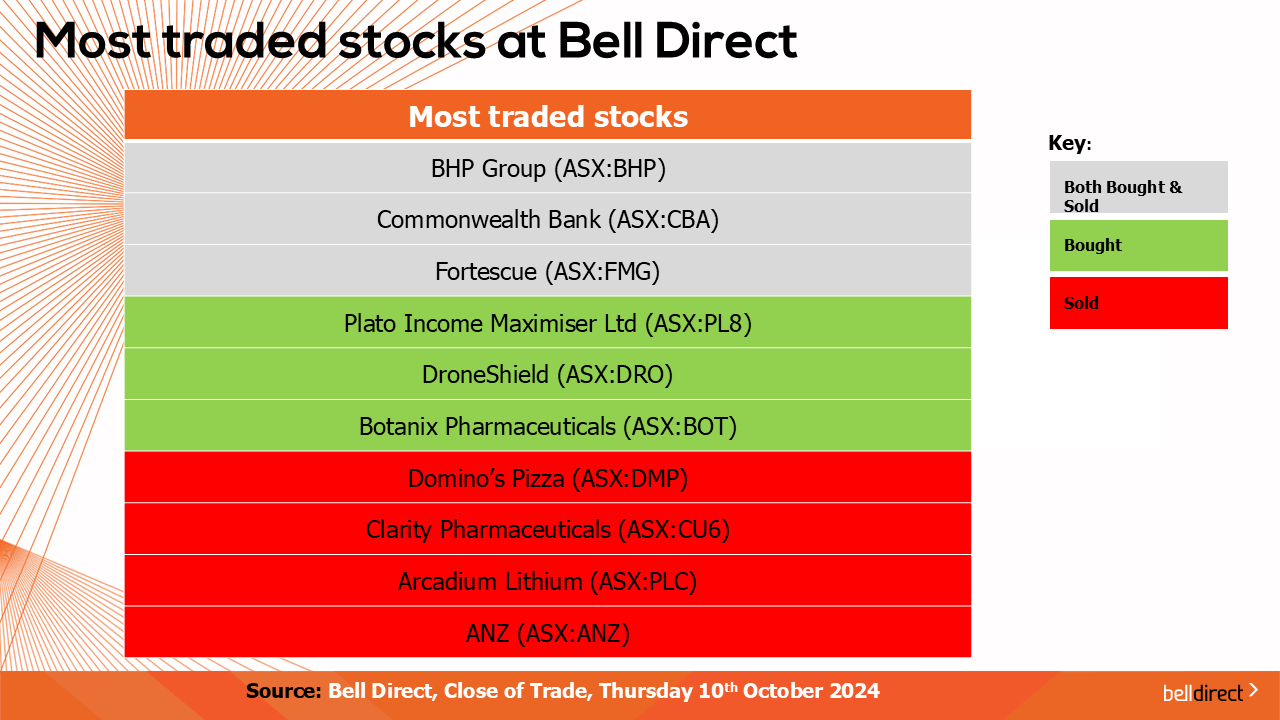

The most traded stocks by Bell Direct clients this week were BHP (ASX:BHP), CBA (ASX:CBA), and Fortescue (ASX:FMG). Clients also bought into Plato Income Maximiser Ltd (ASX:PL8), DroneShield (ASX:DRO)and Botanix Pharmaceuticals Ltd (ASX:BOT) while taking profits from Domino’s Pizza (ASX:DMP), Clarity Pharmaceuticals (ASX:CU6), Arcadium Lithium (ASX:LTM), and ANZ (ASX:ANZ).

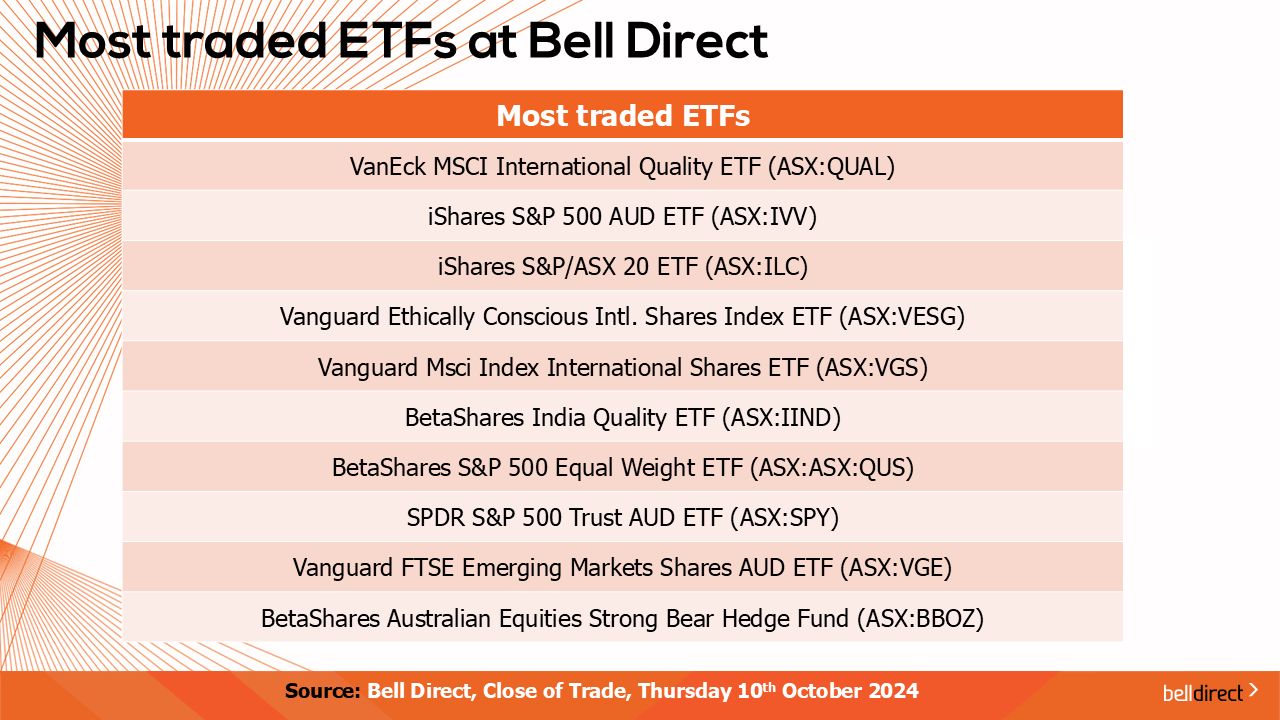

The most traded ETFs by our clients this week were led by VanEck MSCI International Quality ETF, iShares S&P 500 AUD ETF and iShares S&P/ASX 20 ETF.

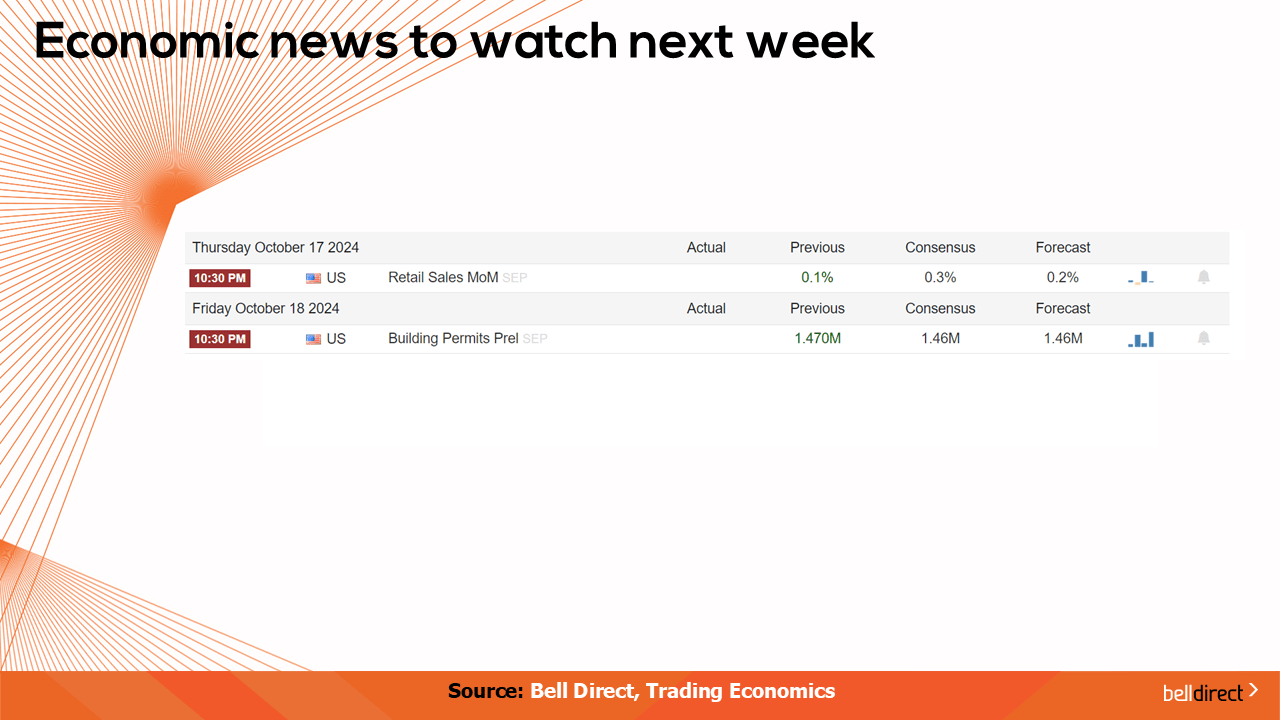

On the economic calendar front next week we may see investors react to Australia’s key employment data out on Thursday, US retail sales data also out on Thursday and China’s GDP growth rate data for Q3 and industrial production data for September out on Friday.

And that’s all for this week, have a wonderful weekend and happy investing!