Transcript: Weekly Wrap 10 May

As we near the end of FY24 it is an important time to review your portfolio and investment strategies heading into the new financial year. Understanding the macro-outlook and data moving the markets is a strategic way to start your journey for FY25.

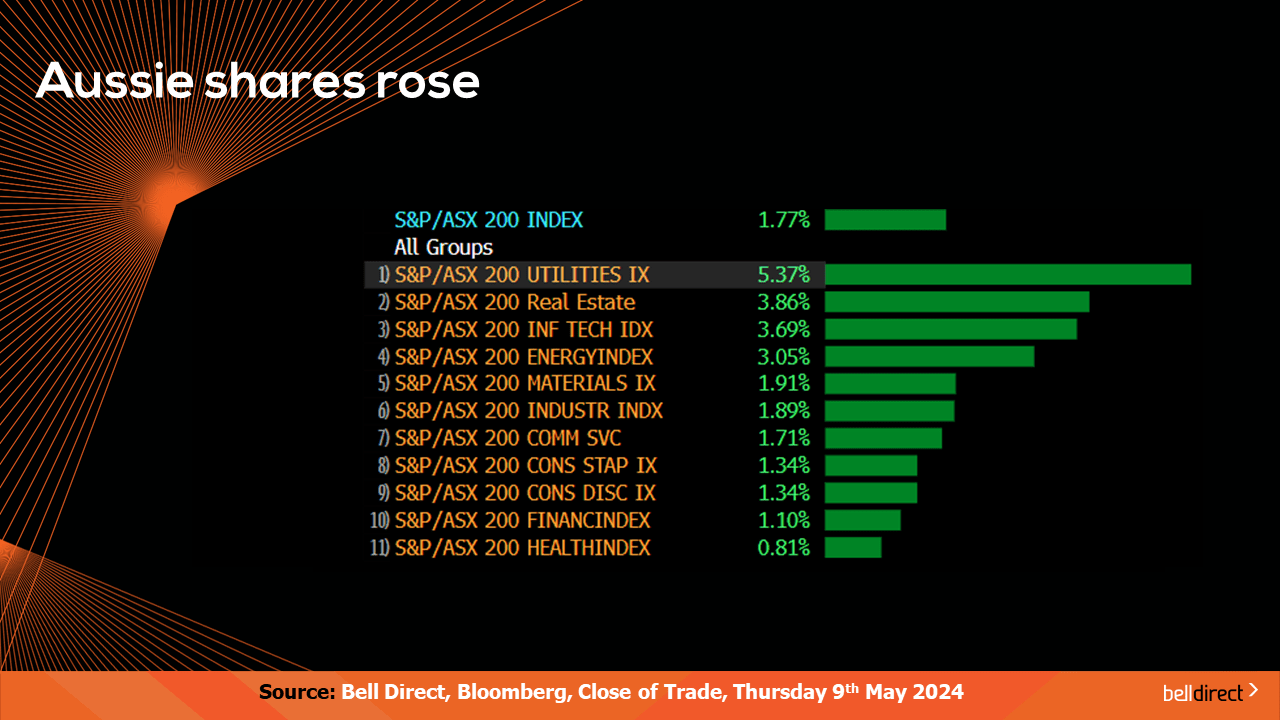

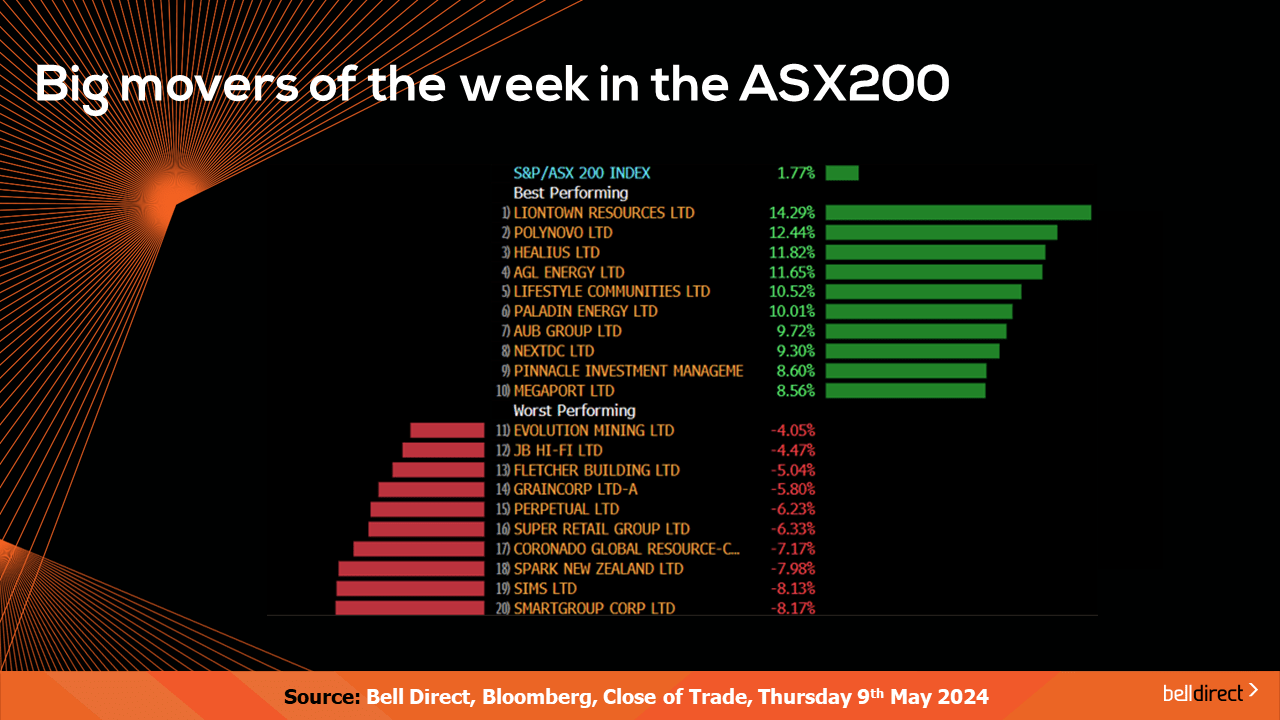

Locally from Monday to Thursday, the ASX200 rose 1.77% as investor sentiment was boosted by the RBA holding the nation’s cash rate at the current level of 4.35% for the next period. Utilities stocks led the charge rising 5.37%, while every other sector also closed the week higher.

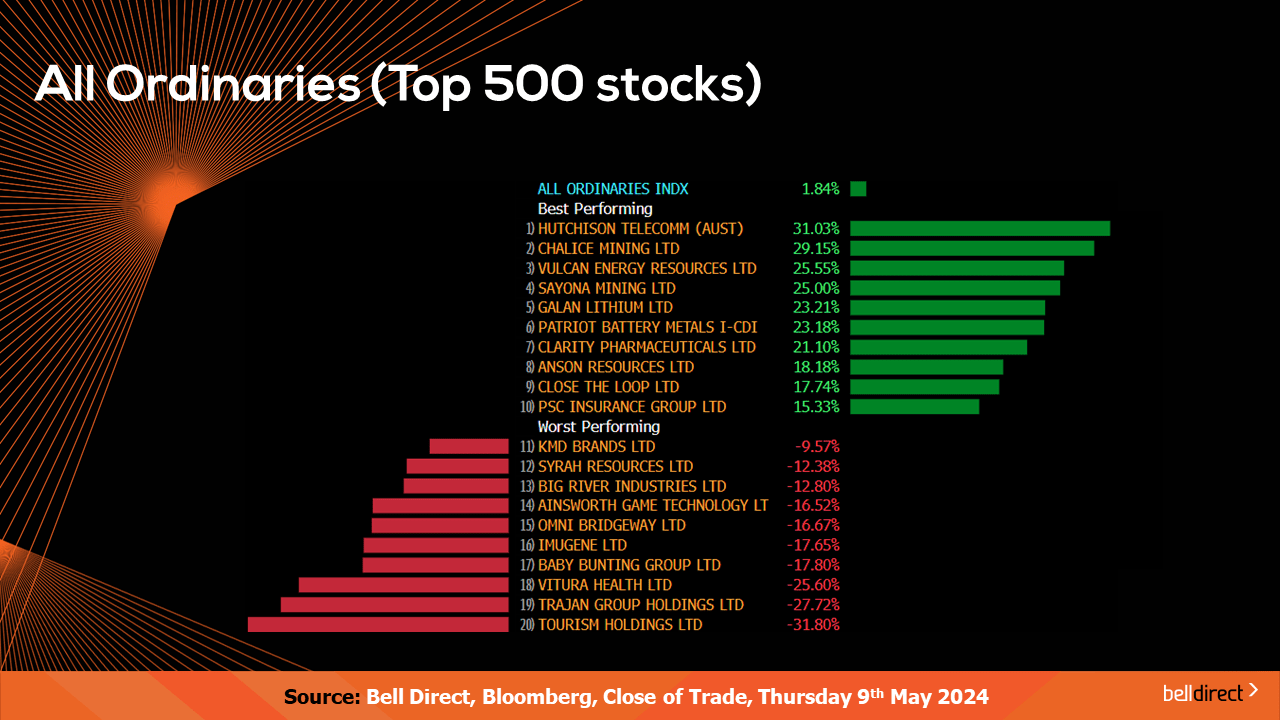

The All Ords posted a 1.84% gain over the 4-trading days this week led by Hutchison Telecomm (ASX:HTA) soaring 31% while Tourism Holdings (ASX:THL) posted a 31.8% loss.

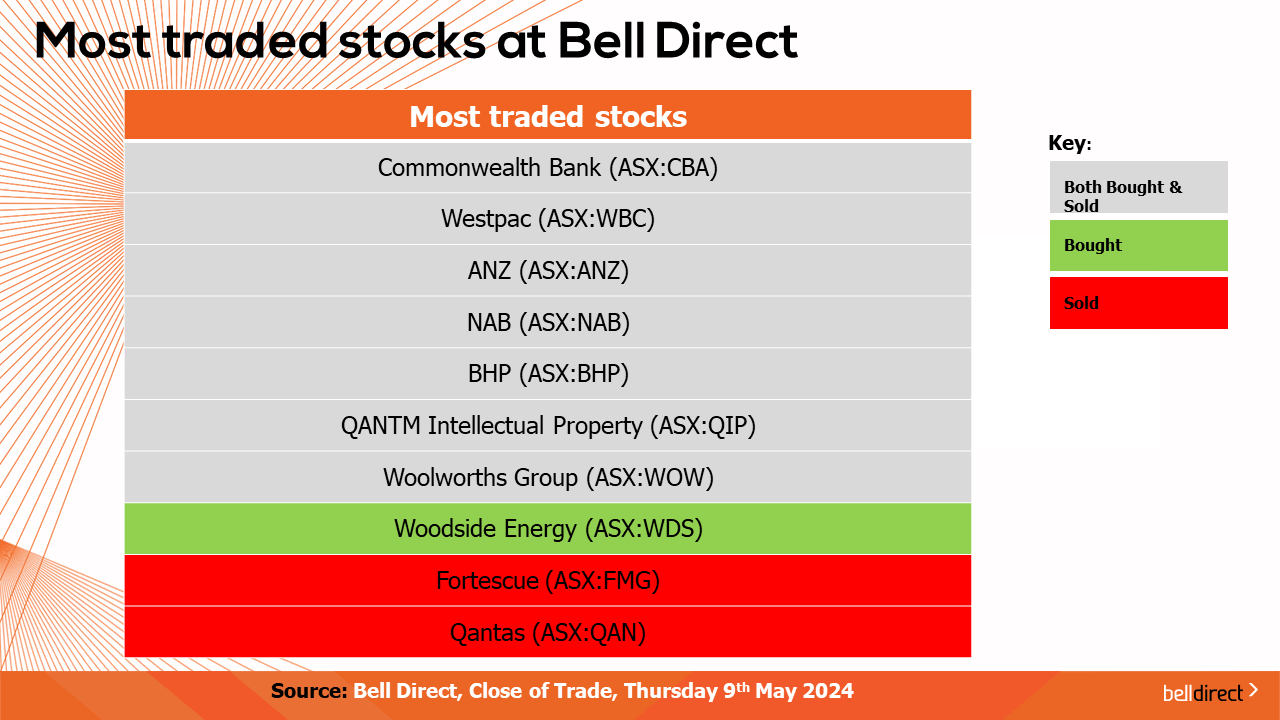

The most traded stocks by Bell Direct clients over the four trading days this week were CBA (ASX:CBA), Westpac (ASX:WBC), ANZ (ASX:ANZ), NAB (ASX:NAB), BHP (ASX:BHP), QANTM Intellectual Property (ASX:QIP) and Woolworths (ASXWOW). Clients also bought into Woodside (ASX:WDS) while taking profits from Fortescue (ASX:FMG) and Qantas (ASX:QAN).

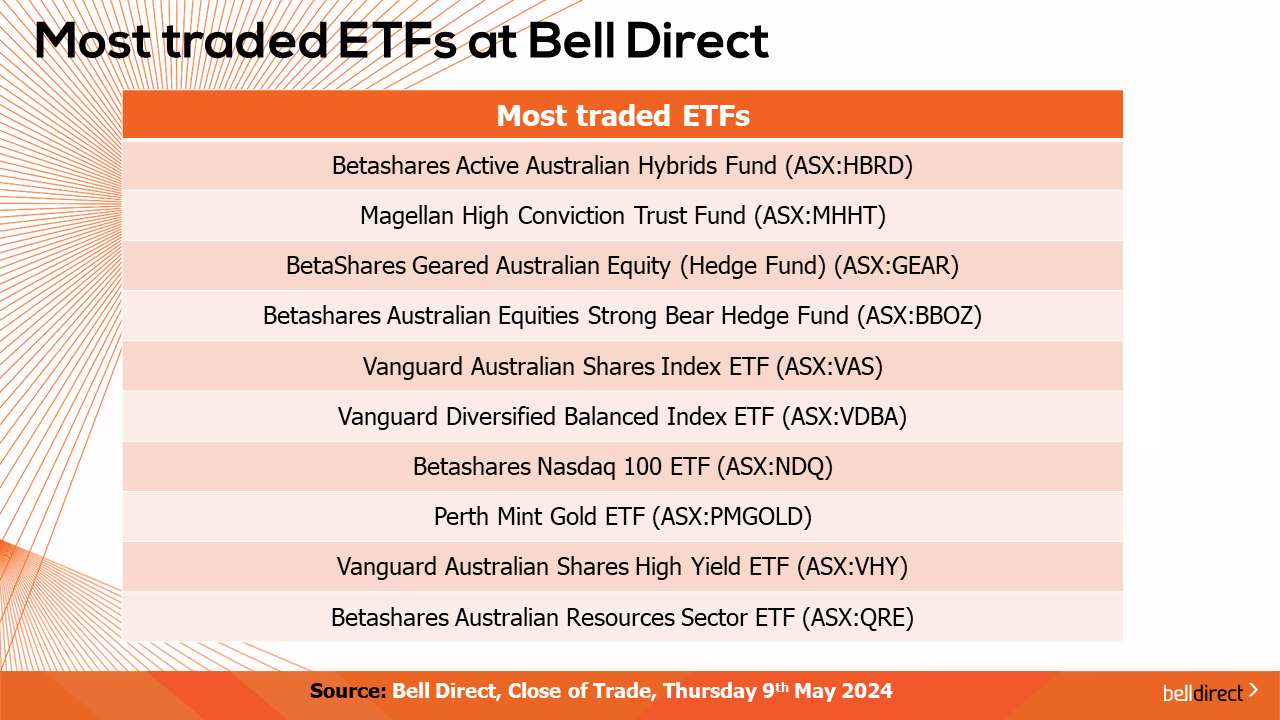

And the most traded ETFs by Bell Direct clients this week were led by BetaShares Active Australian Hybrids Fund, Magellan High Conviction Trust Fund, and BetaShares Geared Australian Equity (Hedge Fund) ETF

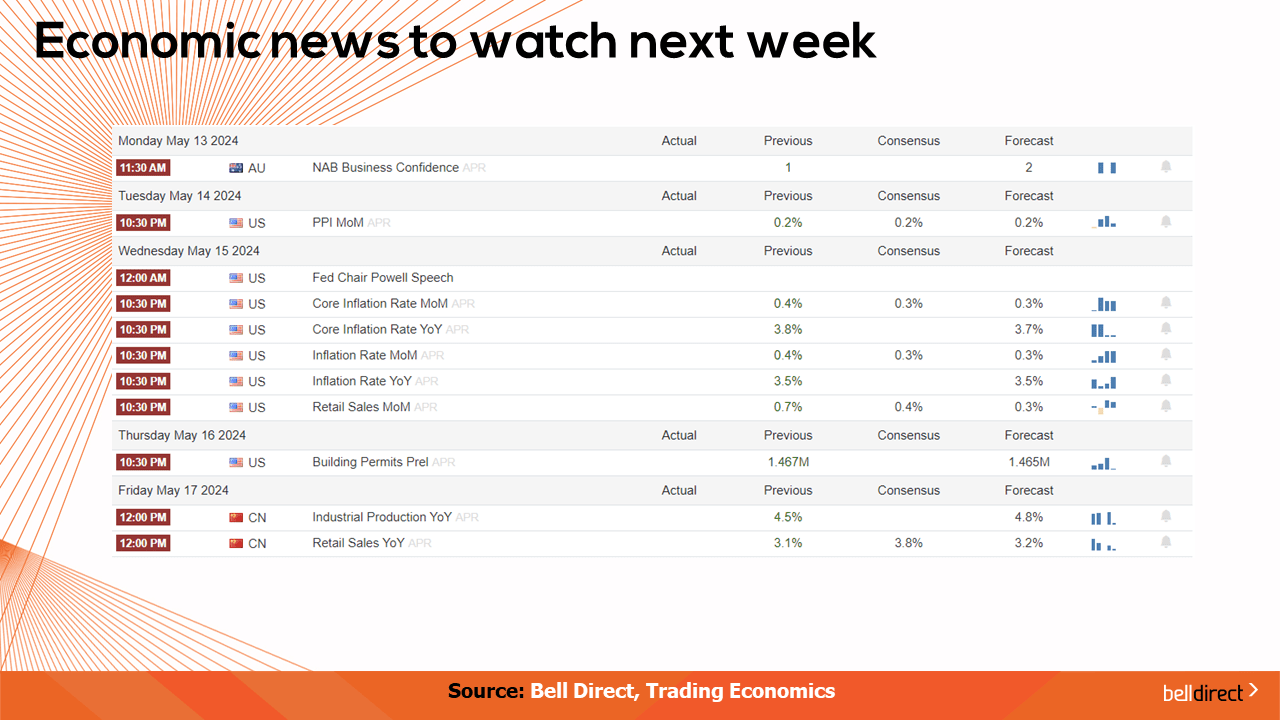

Looking at the week ahead on what may move markets from an economic data perspective, NAB business confidence data for April is out on Monday with the forecast of a slight rise to 2 points from 1 point in March, which will indicate business confidence in current conditions is rising.

Overseas, key inflation-related data is out in the US throughout next week starting with producer price index data out on Tuesday with economists’ expecting a flat reading on March. Core inflation and inflation rate data are also out next week in the US with the expectation of a slight decline in core inflation to 3.7% in April from 3.8% in March, and the inflation rate is expected to remain at an annual rate of 3.5%. US retail sales rounds out the week with the market forecasting a decline from March’s 0.7% rise to a 0.3% rise in April, indicating cost-of-living pressures are dampening consumer discretionary spend.

And that’s all for this Friday, next week we will be producing written updates to start the week as we are attending conferences but will be back to normal programming later in the week. Happy Friday and happy investing.