Transcript: Weekly Wrap 10 January

With the ASX having a volatile week driven by rate outlook, US tech and chip stocks rallying and the all-important inflation reading, investors flocked back into safe-haven areas of the market like gold and the big banks whilst navigating the first few weeks of the new trading year. So, let’s look at the inflationary outlook and factors the RBA will consider in the lead up to the February meeting.

The latest CPI reading out on Wednesday this week revealed inflation growth in Australia is slowing. In the 12-months to November, Australia’s monthly CPI rose to 2.3% which is up from a the 2.1% reported in the year to October but indicates headline inflation remains within the RBA’s target 2-3% range. Core inflation falling to 3.2% from 3.5% in October was also a welcome step in the right direction in terms of the RBA’s rate strategy working to cool inflation.

In November, inflation was driven by a 6.7% rise in alcohol and tobacco and a 2.9% increase in food and non-alcoholic beverages. This was partially offset by a 21.5% drop in electricity prices amid the government rebates reducing electricity costs for Aussie households, and a 10.2% fall in automotive fuel. Following the release of the CPI reading, the market is now factoring in a 73% chance that the RBA will cut the nation’s cash rate at the February meeting.

Australian retail sales data for November released later this week had mixed responses with the reading coming in below market expectations for November, but still showing consumers are spending which adds to inflationary pressures in our economy. The data for November showed a rise of just 0.8% MoM for November which was below economists’ expectations of a 1% rise and only just above the 0.5% rise in October. November is traditionally a strong retail spend month given the Black Friday and Cyber-Monday promotional periods, but this data indicates the high cost of living environment for all Aussies is beginning to slow discretionary spend.

Australia’s unemployment rate on the other hand may be a preventative factor for the RBA to not cut rates in February as our labour market remains strong. In November, Australia’s jobless rate fell to 3.9% which was a starkly different outcome to the rise to 4.2% economists were expecting. Until the labour market eases and unemployment rises, the RBA is likely to take the labour strength as a driver of inflation when considering the rate outlook for 2025. The lower unemployment rate leads to more money circulating the economy and in a higher wage environment, we are likely to see retail spend remain elevated over the coming months.

Some other data that may support the RBA holding rates in February are input cost inflation rising to a 3-month high due to higher material, transport and wages costs, and the 11th monthly expansion in the services sector reported in December. These inflationary drivers are the key factors behind inflation remaining sticky and may prevent the RBA from cutting in February.

You may ask where to from here? As we saw this week, many investors are returning from holiday and buying into haven investments like the banks and gold related stocks, or those that are a staple investment offering safe returns that are relatively unaffected by economic volatility. It will be a watch and wait situation as to what the RBA is likely to announce in February at the first rate meeting of the year, however, as we have seen in the US, inflation has a strong ability to rebound in a very short period, so the RBA is likely to take the cautious approach rather than cutting rates too prematurely.

Locally from Monday to Thursday the ASX 200 rose 0.95% as a tech rally, favourable CPI data and strength in the US boosted local market sentiment.

The winning stocks were led by Insignia Financial rallying 14.12% on a fresh takeover offer, while Arcadium Lithium (ASX:LTM) rose almost 10%, and Sigma Healthcare (ASX:SIG) ended the week up 7.55%.

And on the losing end Star Entertainment Group (ASX:SGR) fell 31.58%, Westgold Resources (ASX:WGX) fell 12.76% and Lovisa (ASX:LOV) ended the week down 12.50%.

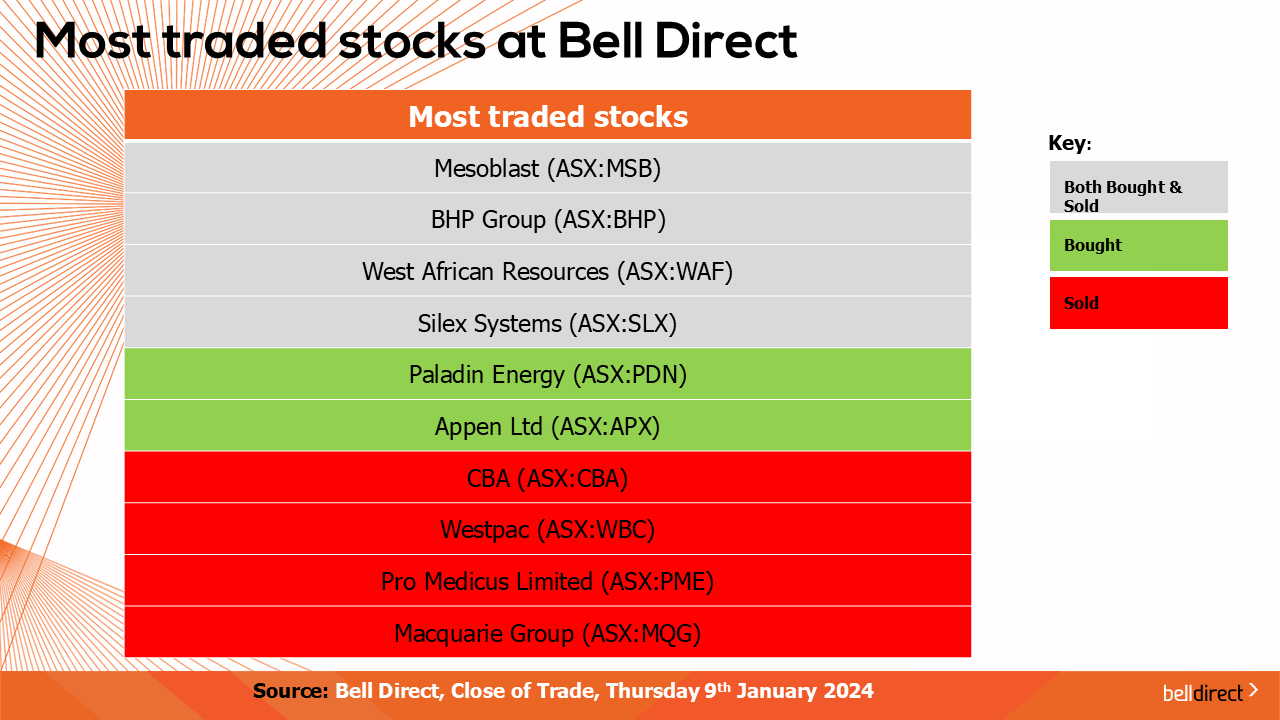

The most traded stocks by Bell Direct clients this week were Mesoblast (ASX:MSB), BHP (ASX:BHP), West African Resources (ASX:WAF), and Silex Systems (ASX:SLX). Clients also bought into Paladin Energy (ASX:PDN), and Appen (ASX:APX). While taking profits from CBA (ASX:CBA), Westpac (ASX:WBC), Pro Medicus (ASX:PME) and Macquarie Group (ASX:MQG).

And the most traded ETFs by our clients this week were led by BetaShares Australian Equities Strong Bear Hedge Fund, Global X Fang+ ETF and Global X Semiconductor ETF.

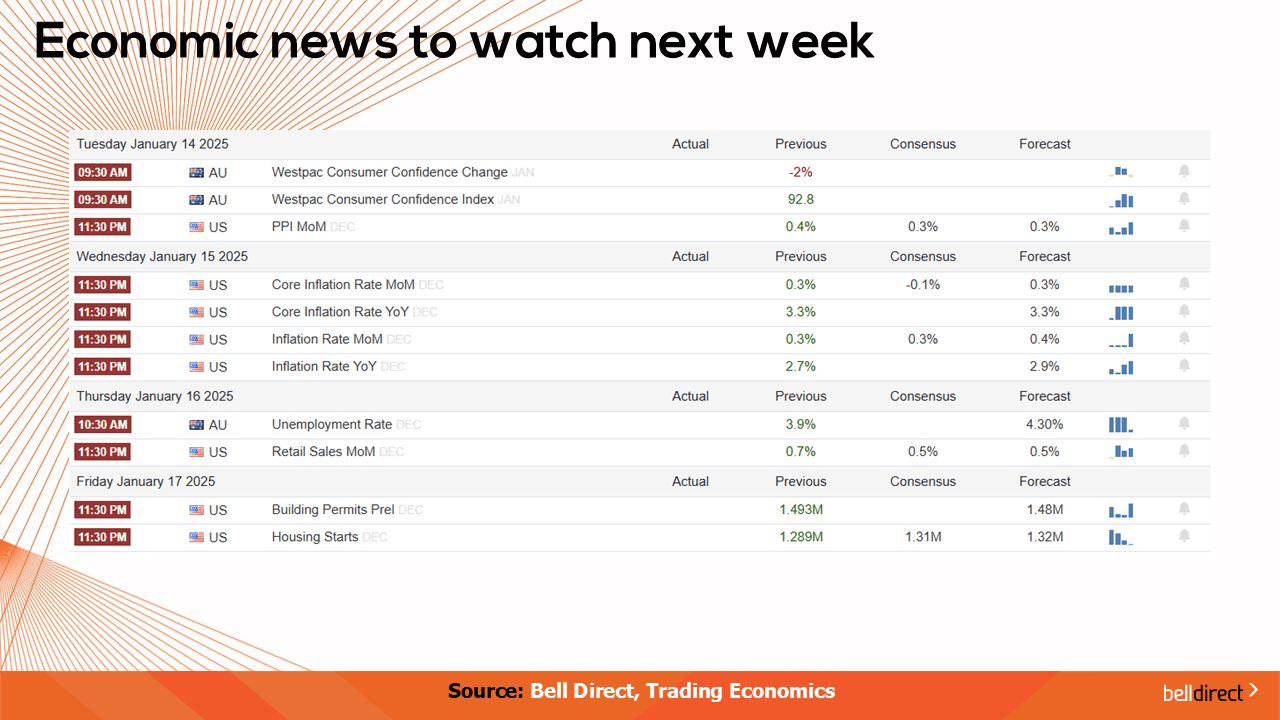

On the economic calendar front next week, we may see investors locally respond to Westpac consumer confidence data out on Tuesday and the unemployment rate for December is out on Thursday with the forecast of an uptick in unemployment.

In the US it is a big week for inflation data with the market expecting a decline in core inflation, while retail sales data for the US is out on Thursday with the forecast of a decline over the holiday period.

And that’s all for today, have a wonderful weekend and happy investing!