Transcript: Weekly Wrap Video 1 September 2023

Thank you for joining me this Friday the 1st September, happy Spring! I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update.

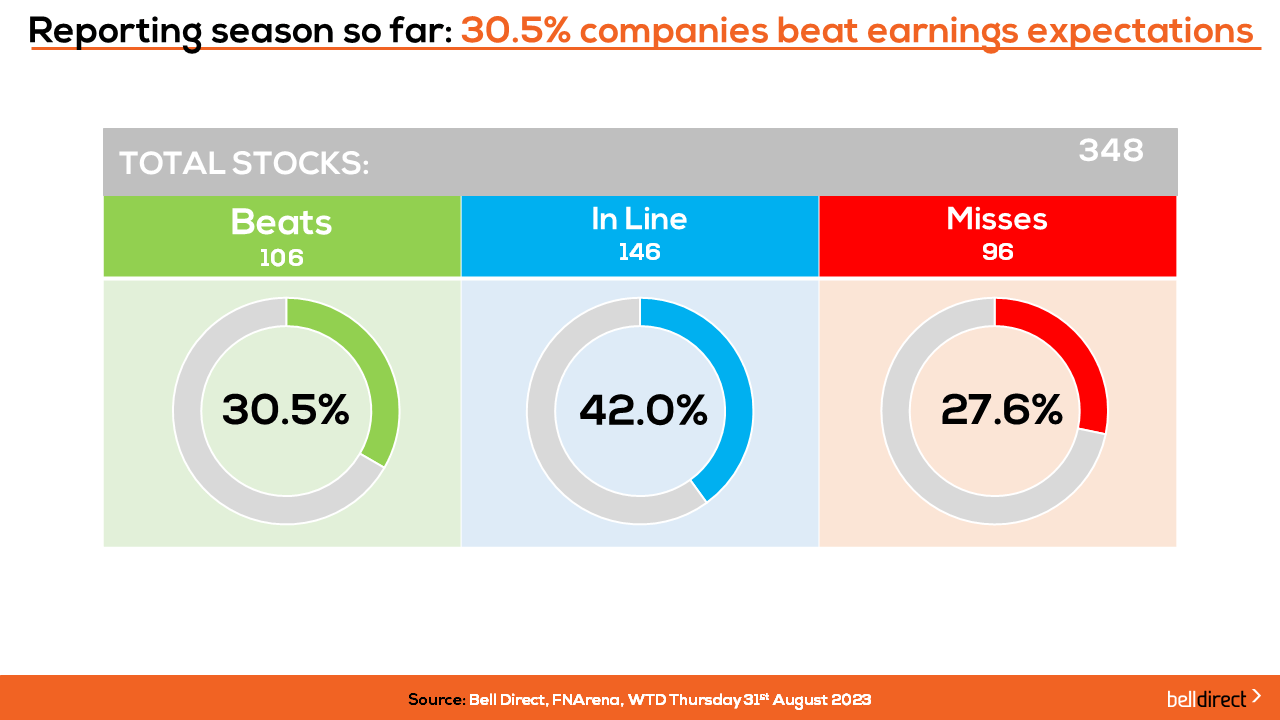

We are very close to the end of reporting season for August 2023. As of the 31st August, 348 companies have reported, with 106 beating expectations, 146 meeting expectations and 96 missing expectations.

There have been 47 companies upgraded by brokers while 41 have been downgraded. Some of the big names who have sparked rating changes include Star Entertainment (ASX:SGR), which has been upgraded to a buy, Flight Centre (ASX:FLT) to a buy and Brambles (ASX:BXB) to a downgrade.

Let’s dive into some of the big names that reported this week that prompted sharp investor and broker reactions.

While some retailers have surprised this reporting season, City Chic (ASX:CCX) fell out of favour with investors on Wednesday after releasing FY23 results. Over the last financial year, City Chic reported global sales fell 17% on FY22 to $268.4m, active customers dropped 12% to 0.97m, global traffic fell 16%, and the company reported a loss of $45m. There were some positives in the report though including inventory falling 73% on FY22 to $53.8m which was a factor the company had to address amid criticism of its unhealthy inventory level over FY22, and net cash rose 273% to $10.9m. FY24 may see a turn around for City Chic though as the company has completed its strategic review which has identified a significant market opportunity in the ANZ region and in the USA.

Travel stocks have had an excellent run over the last financial year, so the selloffs experienced this week were most likely due to investors taking profits as travel demand outlook eases heading into FY24.

Flight Centre’s (ASX:FLT) results for FY23 were impressive given the full-impact felt by the company from the start of the COVID-pandemic. Conditions improved in FY23 as travel demand accelerated, which saw Flight Centre report underlying EBITDA of $302m, profit before tax around 4% ahead of consensus expectations at $106m, total transaction value up 112% to $22bn which is the second strongest result achieved, and tightening cost controls maintained at 75% of FY19 cost base. Flight Centre also reinstated its dividend, announcing an 18cps final dividend for FY23. While travel demand remains strong, the outlook across the industry is easing over FY24 as unprecedented demand fuelled tailwinds for strong results in FY23, which may be the reason Flight Centre failed to provide any outlook for FY24.

Brambles (ASX:BXB) knocked FY23 out of the park and investors responded accordingly on Wednesday with the company’s share price rising 7% at the closing bell. Inflationary pressures have seen margins contract across a number of industries in FY23 results, however, for Brambles, price increases and operational efficiency have offset inflationary pressures and lower volume impacts. Volume declined 2% on FY22 due to a pallet shortage felt in the first half, however the company still posted revenue increased 10% to US$6.0768bn, underlying profit up 19% to US$1bn and declared a final dividend of US$0.14/share, taking full year dividends to US$0.2625/share. FY24 outlook was also provided by Brambles including the expectation of sales growth between 6-8% at constant currency, underlying profit growth between 9-12%, positive free cash flow before dividends of between US$450-US$550m and dividend pay-out ratio to be consistent with the pay-out policy of 45-60% of underlying profit after finance costs and tax.

The key takeaways from reporting season this week and themes that have been reiterated through investor reactions include:

- FY24 outlook is crucial to provide some certainty for investors. As we saw for airlines and travel companies that failed to provide any guidance, investors sold out.

- Staples stocks that were able to pass on rising costs from inflation were favoured by investors.

- Investors were quick to sell out of retailers who had soft results in FY23 and maintained higher inventory levels.

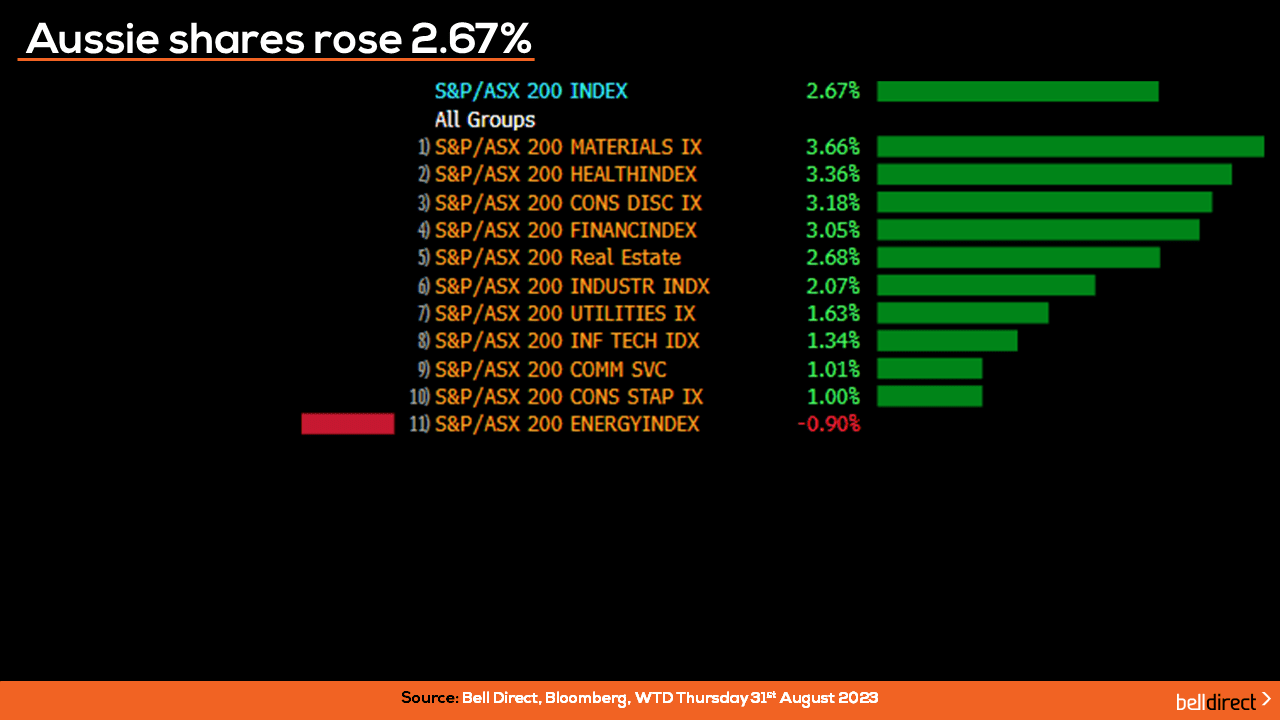

Locally from Monday to Thursday it was a very strong week on our local market with the ASX200 rising 2.67% as all except the energy sector posted a notable gain. The materials stocks had the biggest rally with the sector rising 3.66%, followed by the health care sector adding 3.36% and consumer discretionary rose 3.18%.

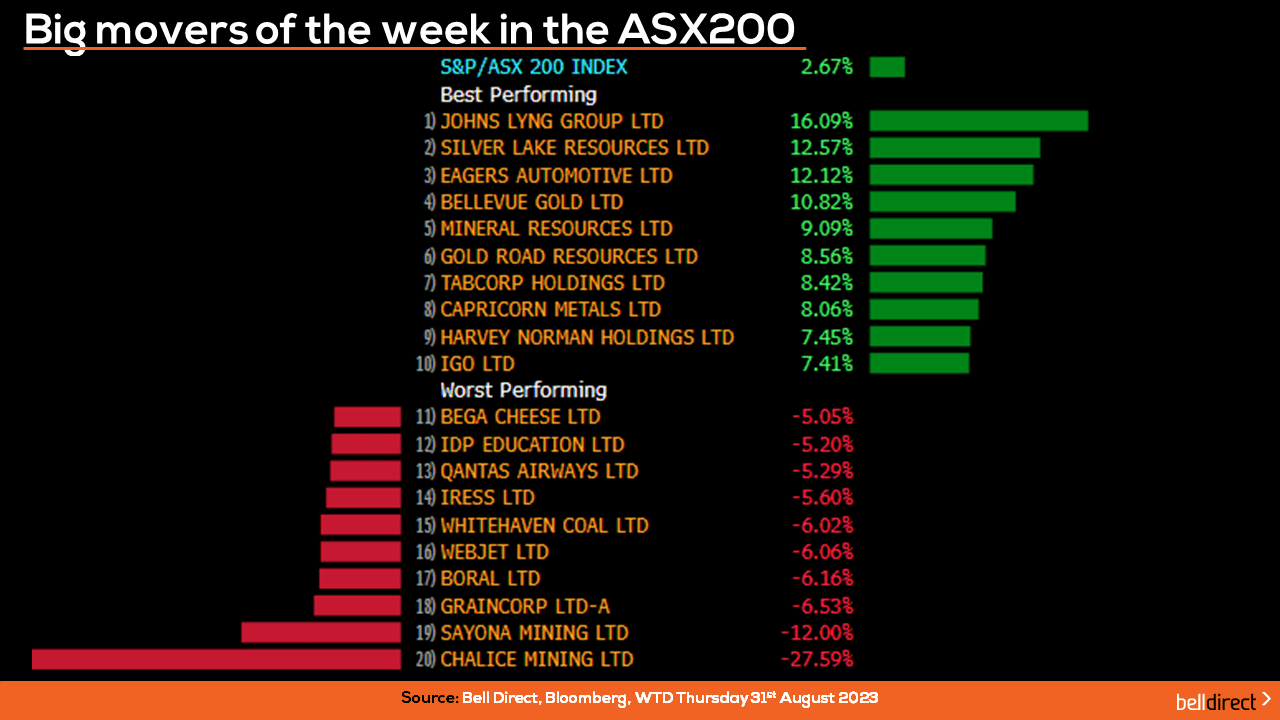

The winning stocks on the ASX200 were led by Johns Lyng Group (ASX:JLG) jumping 16.09% on the company reporting a 64% rise in profit for FY23. Silver Lake Resources (ASX:SLR) rose 12.6% from Monday to Thursday and Eagers Automotive (ASX:APE) rallied 12.12% over the four trading days.

And on the losing end Chalice Mining (ASX:CHN) tumbled 28% after updating the market on a scoping study, while Sayona Mining (ASX:SYA) fell 12% and Graincorp (ASX:GNC) fell 6.5% over the week.

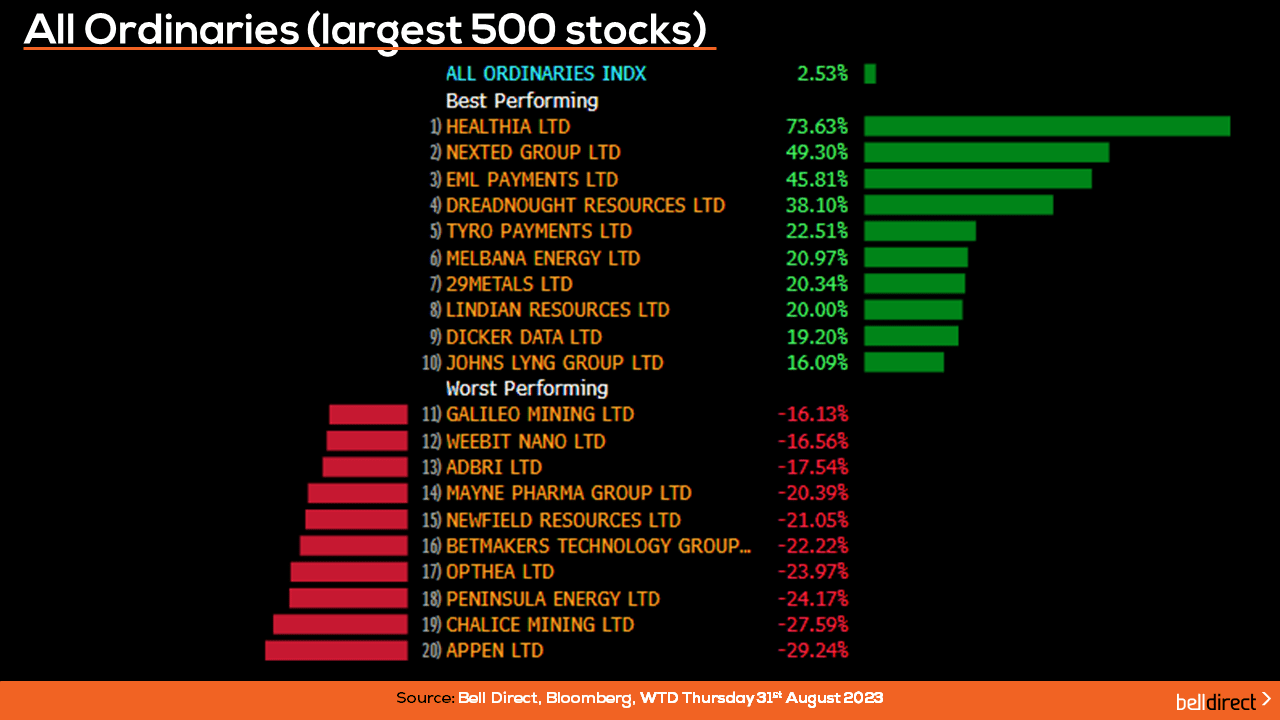

On the broader market, the All Ords rose 2.53% led by Healthia (ASX:HlA) soaring 74% after the company received a takeover bid, while NextEd Group (ASX:NXD) rose 49% and EML Payments (ASX:EML) jumped 46%.

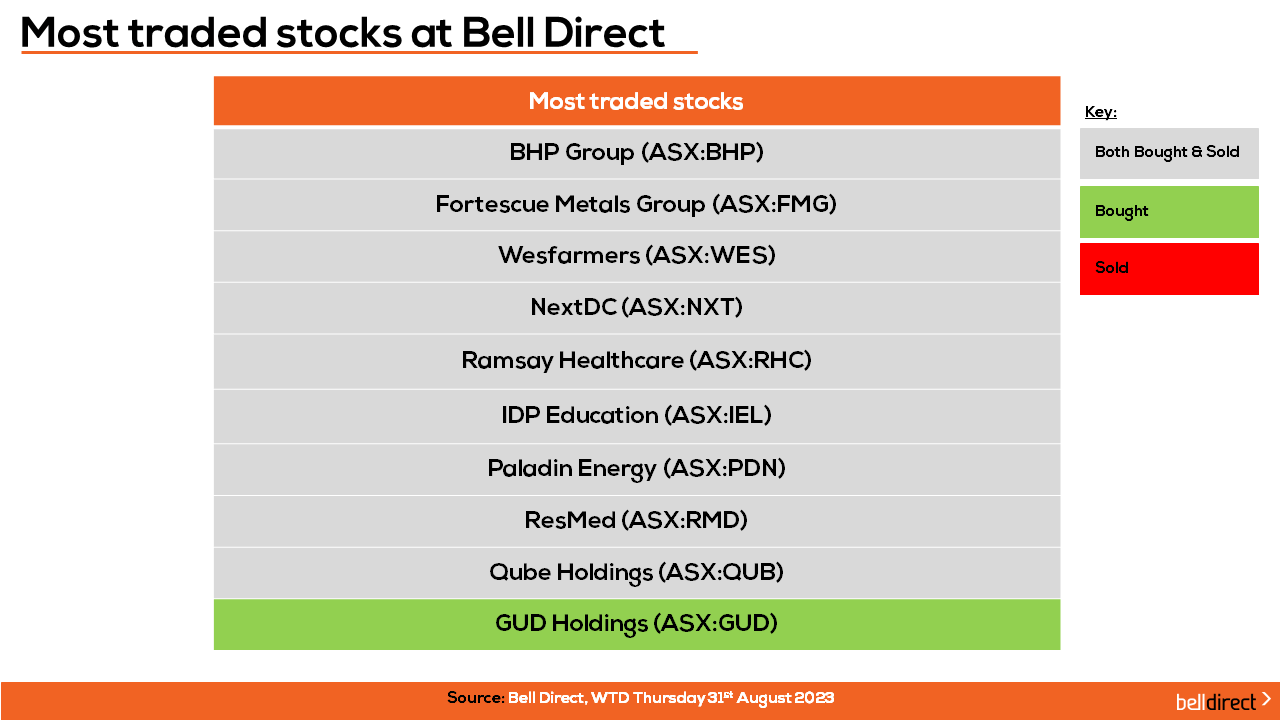

The most traded stocks by Bell Direct clients from Monday to Thursday were BHP Group (ASX:BHP), Fortescue Metals Group (ASX:FMG), Wesfarmers (ASX:WES), NextDC (ASX:NXT), Ramsay Healthcare (ASX:RHC), IDP Education (ASX:IEL), Paladin Energy (ASX:PDN), ResMed (ASX:RMD) and Qube Holdings (ASX:QUB). Clients also bought into GUD Holdings (ASX:QUD).

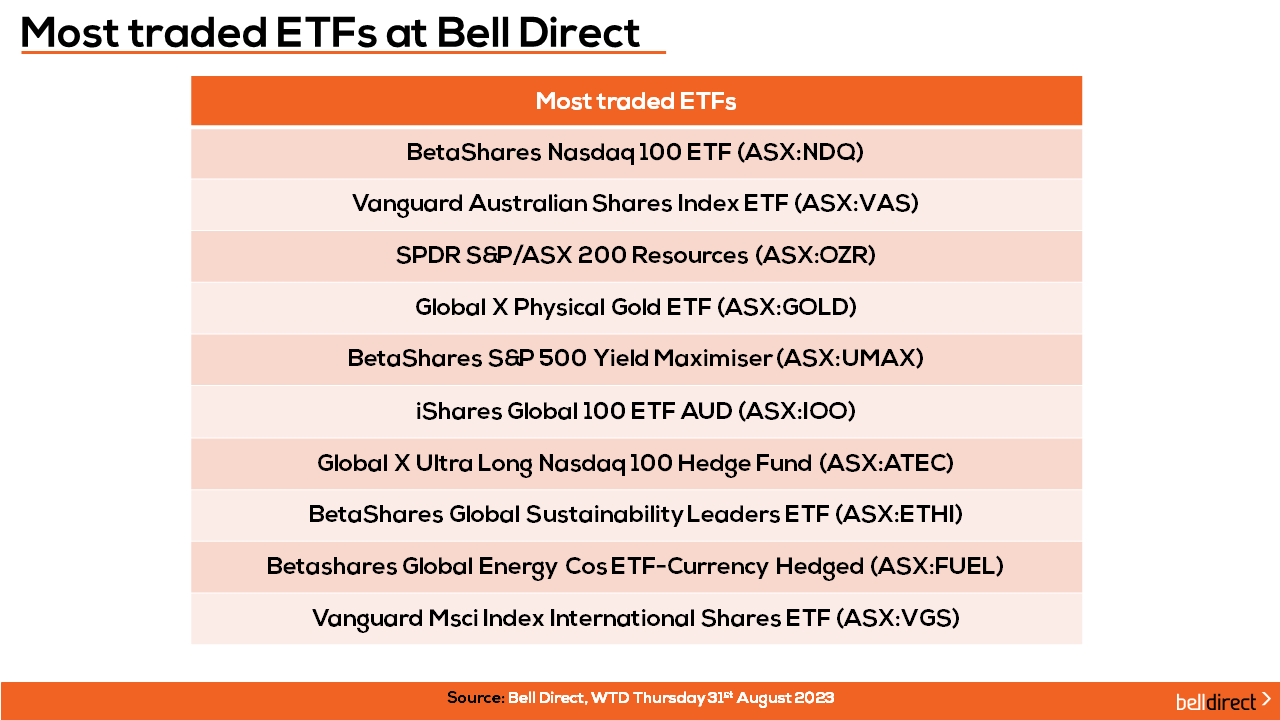

And the most traded ETFs were the BetaShares Nasdaq 100 ETF (ASX:NDQ), the Vanguard Australian Shares Index ETF (ASX:VAS) and the SPDR S&P/ASX200 Resources ETF (ASX:OZR).

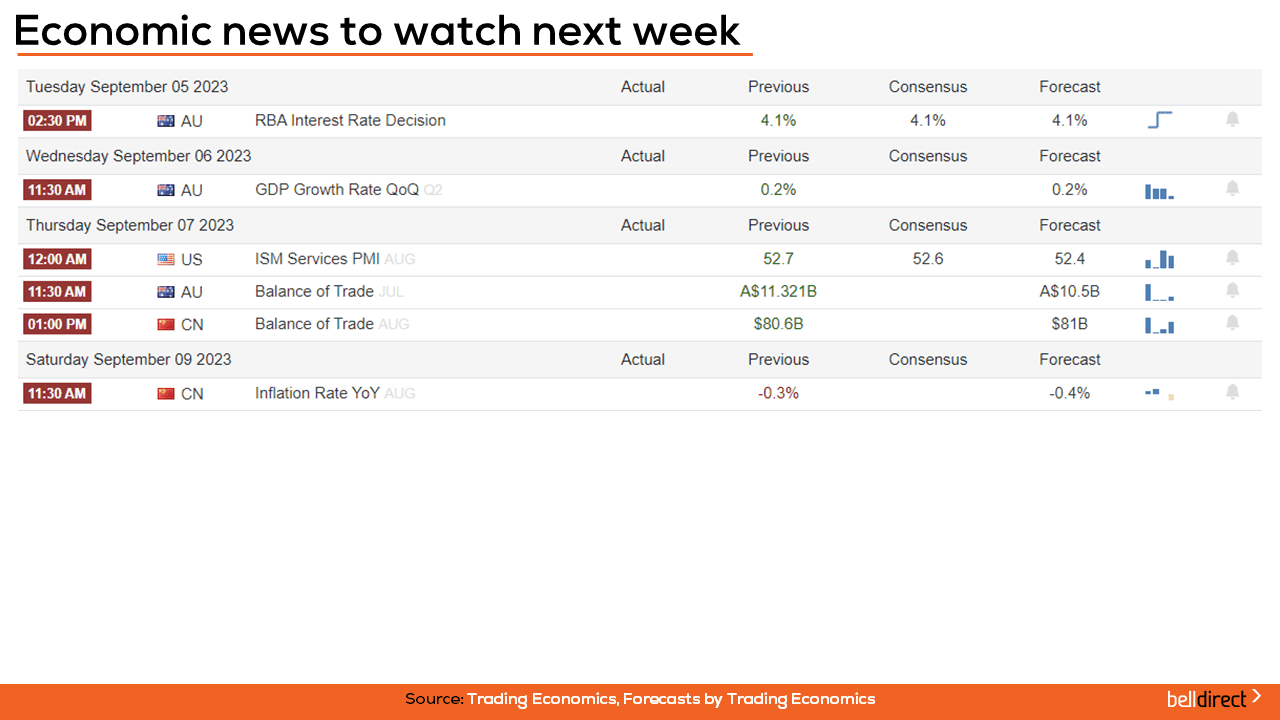

Looking to the week ahead as we wind down from reporting season the focus shifts back to macroeconomic moves and data as a guide for market movers. The RBA will hand down the latest interest rate decision for Australia on Tuesday with the expectation for rates to be held at 4.1% for the month ahead as the economy continues to show strong signs of cooling, especially through CPI easing to growth of 4.9% in data out this week.

Australia’s GDP growth rate data for Q2 will also be released next Wednesday which will provide further insight into the impact of interest rates and inflation on economic growth.

Australia’s Trade Balance data for July is also out on Thursday with the forecast of a decline in trade surplus to $10.5bn from $11.321bn in June.

Overseas, US ISM Services PMI data for August is out on Thursday with consensus expecting a slight decline to 52.6 points from 52.7 points in July.

China’s trade balance and inflation rate data is also released later next week which the market will be keeping an eye on to determine how the world’s largest economy is recovering post-pandemic.

And that’s all for this week. Have a wonderful Friday, a great weekend and happy investing.