As we enter the new month let’s look back at how the ASX200 performed over the last month, the latest economic drivers of market movements this week, and what quarterly earning results both locally and abroad are suggesting about the broader market outlook from an earnings and economic conditions perspective.

For the month of October, the local key index fell 1.33% as a steep 7.23% decline in the utilities sector, and a near 7% fall in consumer staples stocks weighed on the key index over the month of October. While October is traditionally a positive month on the ASX based on historical trends, this year a lot more has been at play that has impacted market sentiment including geopolitical tensions, the inflation and rate cut story, valuations, earnings growth easing and overall economic stability.

The themes of the month included extreme volatility in the price of oil which saw the price of the commodity fall 2% over the period. This is a good thing for drivers at the petrol pump but not so good for our listed energy stocks as this hurts earnings potential for those companies selling to the spot market. The high volatility in the price of oil has driven many oil producers like Woodside to increase their hedging position to ensure earnings can be forecasted and loss potential is capped.

Elsewhere, quarterly earning results have been released over the last few weeks depicting some key themes for the outlook of FY25. Retailers, as expected, have increased promotional activity across the board and this has even been required by the supermarket giants as outlined by Woolworths this week. This isn’t a favourable strategy for earnings as margins decrease but it is important to pass inventory levels through to ensure stock doesn’t build up so much that it is required to be sold at a loss to the business. Retail spend has remained resilient, but we are finally feeling the full brunt of the high cost of living environment eat into discretionary spend and as a result retailers are experiencing low single-digit earnings growth in the latest quarter as opposed to the higher double-digit earnings we saw in FY24.

The gold miners have been on a run recently and that isn’t looking to ease anytime soon with the price of the precious commodity up just shy of 5% over the last month to record territory above US$2700/ounce. The tailwinds remain for this sector, and we have seen this flow through to strong earnings for the likes of Capricorn Metals (ASX:CMM) and Ramelius Resources (ASX:RMS) which both released results over the last week.

In the US, the Nasdaq reported a fresh record high this week as investors anticipated strong earnings growth from the mega cap magnificent 7 this week. Alphabet shares jumped 3% on the day results were released as the Google parent company reported AI boosted strong advertising revenue and growth in the company’s cloud business.

Meta, Facebook’s parent company, also rode the AI boom as results also came in strong. For Q3, Meta reported sales of US$40.6bn which was a jump of 19% on the PCP and a slight beat of Wall St expectations, while spend in AI is the driver of the company’s expenses expecting to be between US$96 to US$98bn for the year.

Microsoft on the hand disappointed investors with shares slipping in after-hours trade following the release of the tech giant’s results despite the company reporting a 16% growth in revenue over the quarter. The company’s revenue from its Azure and other cloud services was up 33% which beat estimates, but the full year revenue guidance issued by Microsoft fell short of expectations.

So far this earnings season in the US, markets have been mildly disappointed as 76% of companies have posted profits above expectations, which is lower than the 80% reported as beats in Q2, signalling a slowdown in profit growth across the board.

Australia’s core inflation rate data also moved markets this week. For the September quarter, headline inflation fell to an annual rate of 2.8% which is a positive sign for the rate outlook, however, core inflation, which is the RBA’s preferred inflation reading, rose 0.8% in the September quarter which topped forecasts of 0.7%.

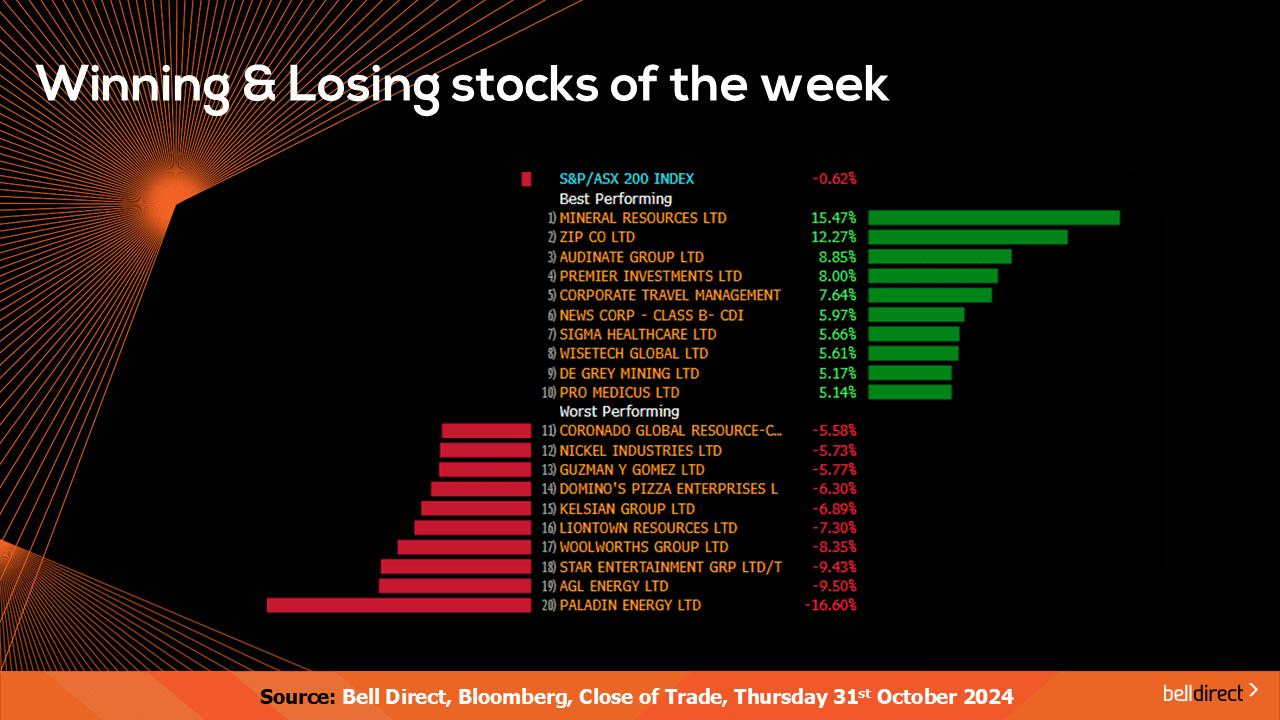

Locally this week, the ASX200 posted a 0.62% loss as the consumer staples sector posted a 5% decline while tech stocks soared on the back of the Nasdaq’s record highs earlier in the week.

The winning stocks on the ASX200 this week were led by Mineral Resources (ASX:MIN) soaring 15.47% after Gina Rinehart splashed $1.1bn to buy Mineral Resources’ two oil and gas exploration permits in the Perth Basin. Zip Co (ASX:ZIP) also rallied 12.27% this week while at the losing end, Paladin Energy (ASX:PDN) tanked 16.6%.

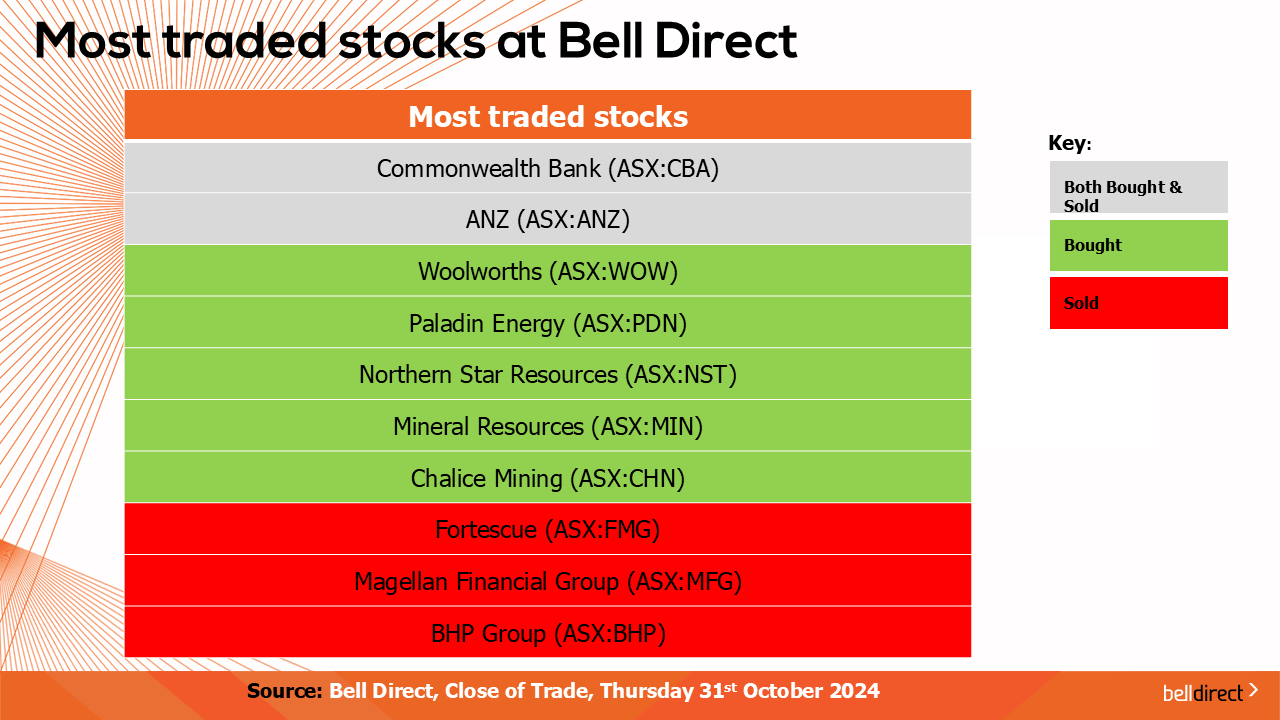

The most traded stocks by Bell Direct clients this week were CBA (ASX:CBA) and ANZ (ASX:ANZ) while clients also bought into Woolworths (ASX:WOW), Paladin Energy (ASX:PDN), Northern Star Resources (ASX:NST), Mineral Resources (ASX:MIN), and Chalice Mining (ASX:CHN). Clients also took profits from Fortescue (ASX:FMG), Magellan Financial Group (ASX:MFG), and BHP (ASX:BHP) over the 4 trading days.

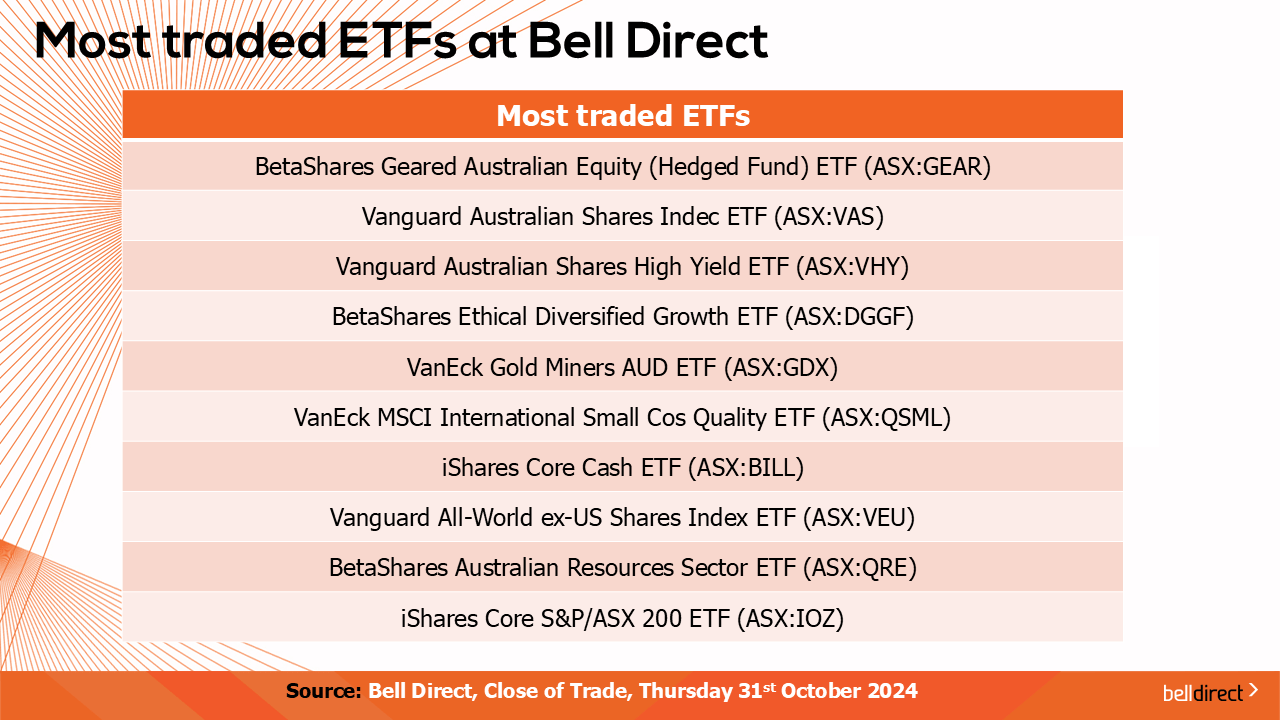

And the most traded ETFs by our clients this week were led by BetaShares Geared Australian Equity (Hedge Fund) ETF, Vanguard Australian Shares Index ETF, and Vanguard Australian Shares High Yield ETF.

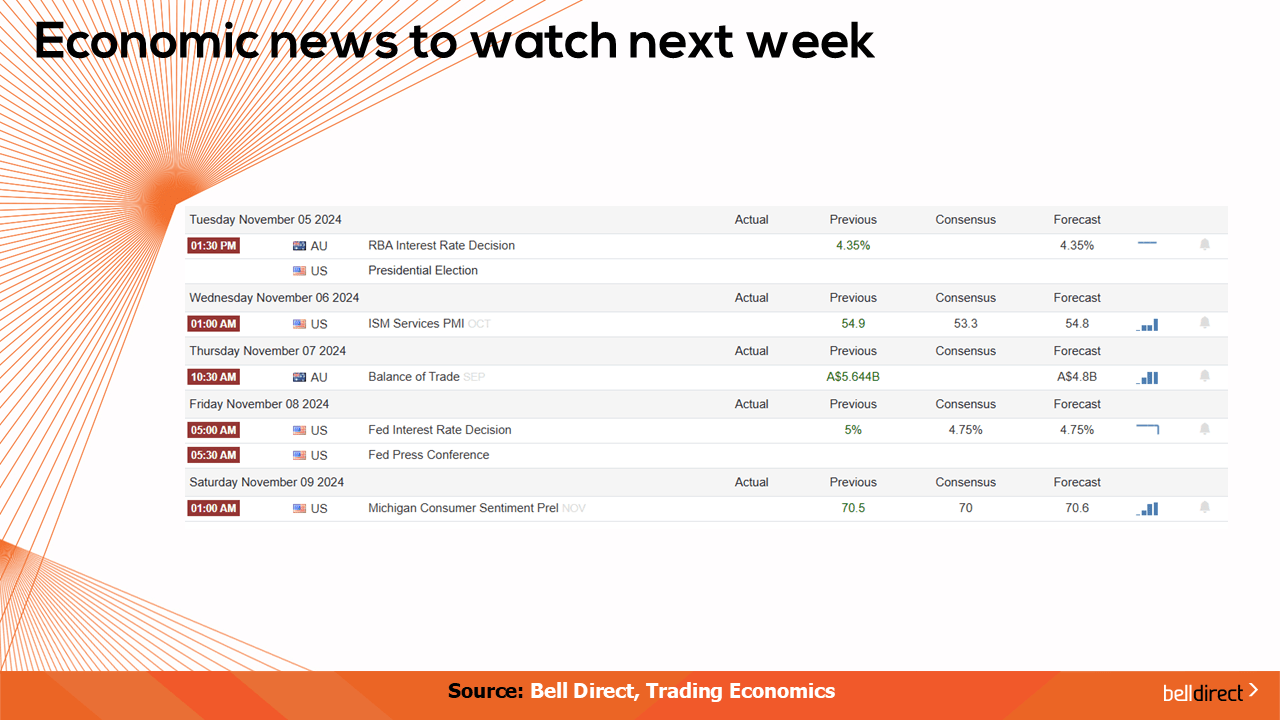

On the economic calendar front next week, we can expect to see markets react to the RBA’s interest rate decision on Tuesday where it is widely expected that Australia’s central bank will maintain the current cash rate at 4.35% for another period.

Australia’s trade balance data for September is out on Thursday with the market forecasting a rise in trade surplus to $8.2bn, from the $5.644bn reported in August.

Overseas, the US Fed will hand down the latest rate decision to the world’s largest economy on Friday where it is expected the Fed will cut rates again, this time by 25 basis points to 4.75%, while the Bank of England will also hand down its rate decision next week where it is also expected a 25 basis point rate cut will be announced to take the rate to 4.75%.

And that’s all for this Friday, have a wonderful weekend and happy investing!