Transcript: Weekly Wrap 1 December

As we head into the final month of 2023, it’s time to look back at how the sectors on the ASX performed throughout the year and look ahead to the outlook for 2024. Where are the buy ratings? Are some companies overvalued in the current market environment? Inflation, interest rates, China’s economic recovery and geopolitical events have really weighed on the sectors this year, some for the better and others for worse. Let’s dive into how some of the key ASX sectors have performed in 2023.

The technology sector has captured the attention of investors both locally and globally in 2023 after sharp sell-offs in 2022. The volatility since the COVID-19 rally for the high growth sector has been a rollercoaster of highs and lows that saw investors pile back into the tech sector this year, mostly driven by the hype around Artificial Intelligence. AI has been the term of 2023 given its hyper efficiency nature of delivering operational excellence, however investors need to be aware before backing a company based on saying they are investing in AI vs companies actually making material investments in AI. The sector is up 21.5% in 2023 on the ASX to lead the gains among the 11 sectors with key names making waves this calendar year. While companies like Life360 (ASX:360) have prevailed through the tech rally with shares in the location tracking technology company up 58% in CY23 as the company continues to prove cash flow positivity, others are facing slowing earnings outlook for FY24 including Wisetech Global (ASX:WTC). Investor appetite for high growth stocks has rebounded given the certainty around interest rate peaks, however when investing in the sector it is important to analyse the fundamentals behind the company and whether they have profit on the horizon, a strategic growth outlook and material investment in AI.

Consumer staples stocks have faced some headwinds in 2023 despite higher interest rates traditionally favouring companies in this sector as higher costs can be passed on without impacting demand. Tailwinds we saw in 2022 have turned to headwinds in 2023 for some key names which is what sparked investors to sell out in 2023, with the sector down 6.5% year-to-date. The supermarket giants have remained resilient as they have successfully passed on rising costs and managed debt well while also rewarding investors with consistent dividends, but for other companies like Ingham’s Group (ASX:ING), feed cost inflation is hurting margins in the current macro environment which has led to lower earnings outlook and the expectation of consumer demand for chicken to slide as alternative protein prices like beef and lamb decline. While this sector is down in 2023, staple names like Woolworths (ASX:WOW) and Costa Group (ASX:CGC) remain key staple investments within portfolios as shares in these companies are up 5.5% and 13.50% respectively year-to-date.

Discretionary stocks have surprised the market this year as investors and economists’ alike expected consumer spend in the discretionary space to ease given the 13 interest rate hikes in Australia placing increased pressure on all Aussie hip pockets. However, this certainly hasn’t been the case as until October, retail spend in Australia continued to grow, indicating Aussies kept spending despite the increased cost-of-living pressures. The discretionary sector is the second-best performer year-to-date, up 11.66% over the 11-months to December 1. JB Hi-Fi (ASX:JBH) is up 13.63% since January 1, 2023 as investors responded to key strategic moves made by the company including a key focus on reducing inventory levels, restructuring the group’s capital structure to maximise shareholder returns and bolstering the company’s cash position to weather the economic uncertainty. As retail spend has began to slow as per October’s retail sales data from the ABS, we may expect a slight pullback in this sector heading into the new year.

The financials sector has dipped into the red later this year as investors assess increased competition as customer switching between the big banks to get the best rate on offer for both deposits and loans is on the rise, and net interest margins peaking during FY23 for the big four.

Energy stocks have also been the worst performing sector in 2023 primarily due to fluctuations in the price of oil and geopolitical tensions weighing on key commodity outlooks. The price of oil has been heavily impacted this year by China’s weaker-than-expected recovery post pandemic and key oil producing nations announcing output cuts to boost the price of the commodity amid escalating geopolitical tensions especially in the Middle East. Over the last year, the price of oil is down 3.4% which has weighed on companies including Woodside Energy (ASX:WDS), Santos (ASX:STO) and Beach Energy (ASX:BPT) as each of the oil producers’ share prices are down in 2023.

Overall, the outlook for healthcare stocks is positive heading into 2024 as valuations of key companies have fallen throughout 2023 despite strong earnings growth potential, key catalysts heading into the new year for some big names including Telix Pharmaceuticals (ASX:TLX) and the prospect of rate cuts on the horizon proving favourable for margin expansion.

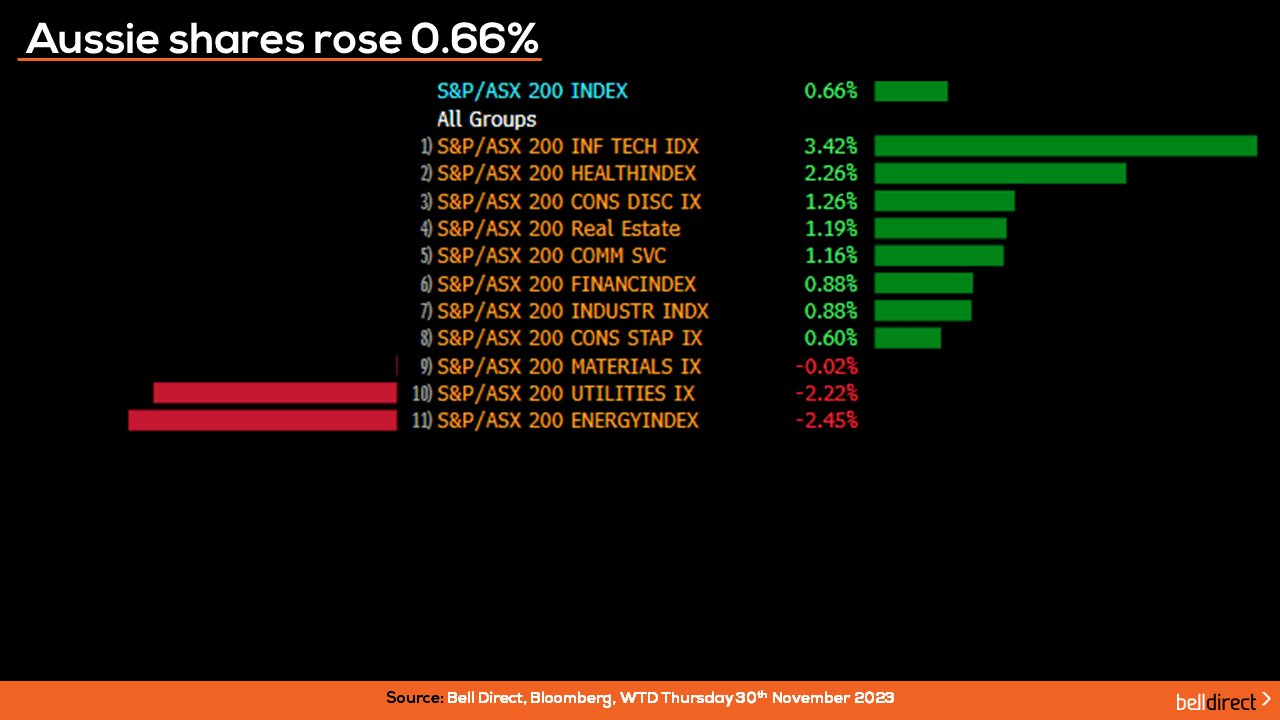

Locally from Monday to Thursday the ASX200 rose 0.66% boosted by favourable inflation data in Australia which fuelled a rally for the tech sector locally as it rose 3.42% over the four trading days.

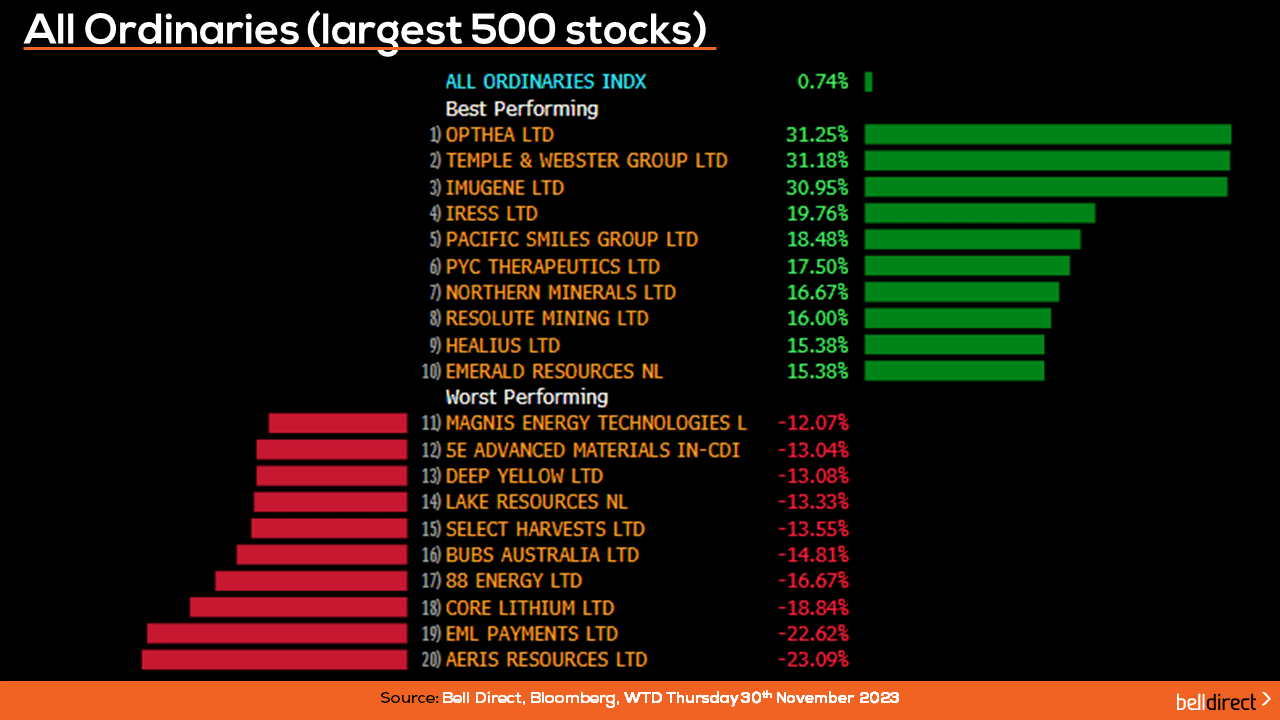

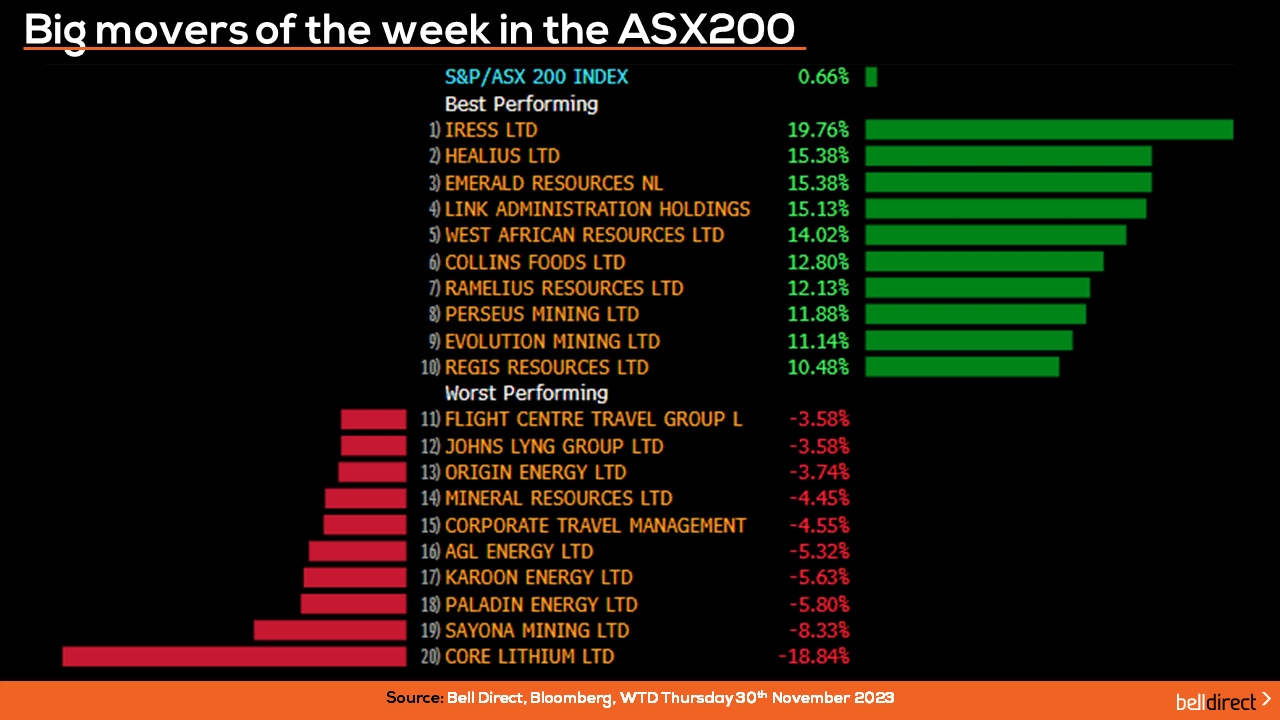

On the broader index, the All Ords rose 0.74% over the trading week led by Opthea rocketing over 31% while Temple and Webster rose 31.18% after the online furniture retailer released a strong trading update at its AGM. Aeris Resources (ASX:AIS), EML Payments (ASX:EML) and Core Lithium (ASX:CXO) weighed on the All Ords this week.

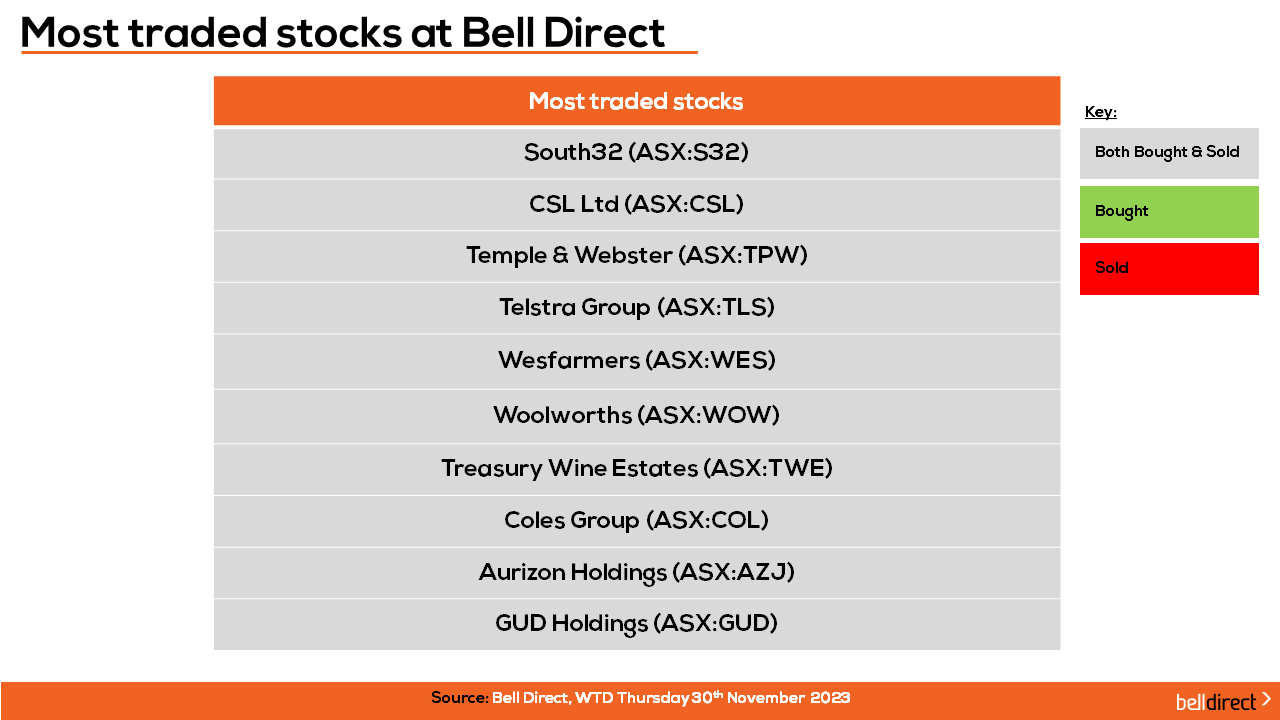

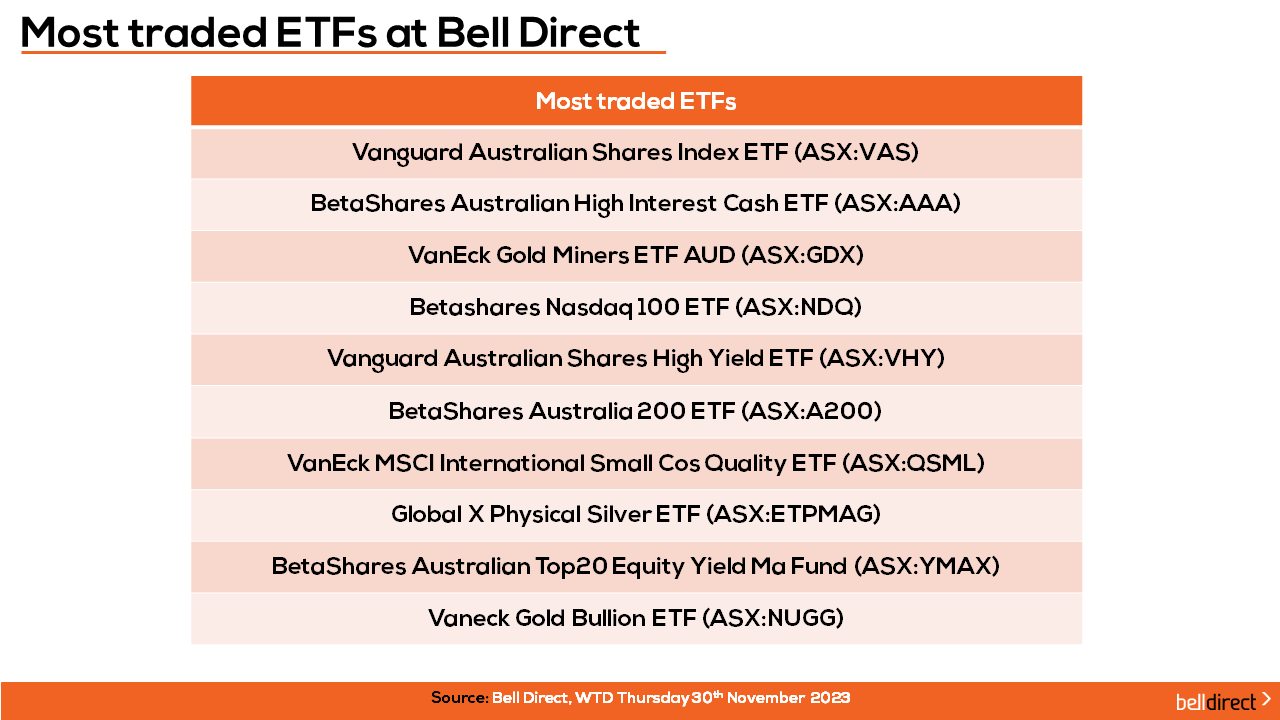

And on the diversification front, the most traded ETFs by Bell Direct clients over the four trading days were led by Vanguard Australian Shares Index ETF, Betashares Australian High Interest Cash ETF and VanEck Gold Miners ETF AUD.

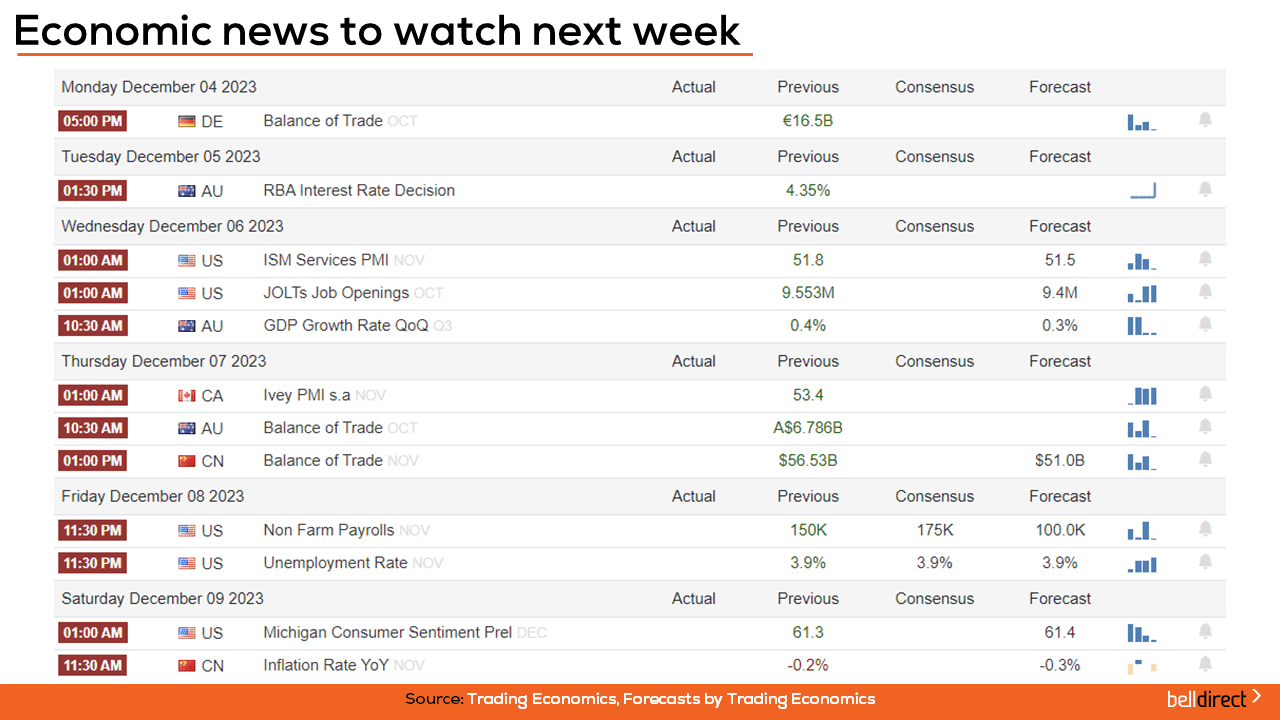

Looking to the week ahead, the all-important and highly anticipated RBA interest rate decision is announced on Tuesday with the expectation of Australia’s central bank to hold the cash rate at the current rate of 4.35% for the final month of 2023. Australia’s GDP growth rate data is also out on Wednesday for Q3 with the expectation of a slight contraction to 0.3% growth for the quarter. And Australia’s trade balance data is out on Thursday.

Overseas, key US jobs data is out from Wednesday with JOLTS Job Openings data for October, Nonfarm payrolls data and US unemployment rate data all released which will give further insight into how the tight US labour market is faring.

And that’s all for this week, we hope you have a wonderful weekend and as always, happy investing!