Pandemic-favourite growth stocks have faced a turbulent ride in the post-pandemic era as investors pile into asset classes with lower volatility historically. To survive post-pandemic in a market that is highly driven by investor sentiment, technology stocks need to stand out by being cash flow positive, having low levels of debt, and/or focused on diversification in service and product offerings to meet real gaps in the market and provide real value in the lives of consumers.

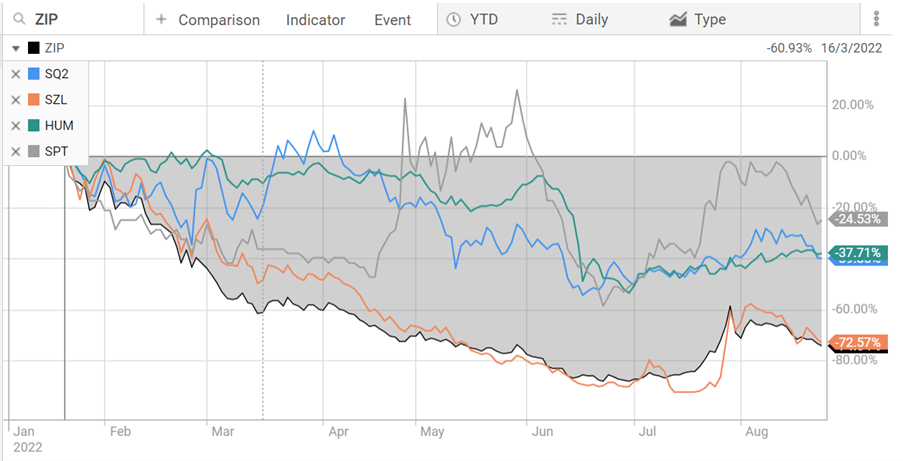

The buy now, pay later sector surged then tumbled with the likes of Block (ASX:SQ2) (formerly Afterpay) trading 40% lower YTD, just over a year after being named the best performing stock on the ASX200. With regulators following closely on the heels of BNPL players due to providers profiting from the unaffordable debt acquired by millions of customers worldwide, the need for sustainable profitability without relying on customers acquiring excessive debts is the way forward for BNPL survival in the eye of the investor. Competition in this sector also ramped up recently with the likes of the big banks and other leading financial providers including the Commonwealth Bank and PayPal coming out with their own BNPL product offerings to shake up the market.

How did Splitit (ASX:SPT) buck the investor sell-off trend of BNPL stocks? The US-based BNPL provider is cash flow positive and has been since earlier this year. The company has also diversified into offering white label BNPL solutions to challenge traditional market leaders and has expanded its use into the rental market through a partnership with letus for its Instalments-as-a-Service payment offering. For investors, Splitit has ticked several boxes to survive the tech sell-off in 2022.

On the software technology front, Altium (ASX:ALU) is a standout stock amid the tech sell-off in 2022 for its recent FY22 results and product value. For FY22, Altium reported EBITDA margin up 36.7%, 23% growth in revenue, and NPAT jumped 57% to US$55.5m which well exceeded market expectations and wasn’t boosted by positive one-offs. Altium’s share price surged 20% to its highest point since February this year, all whilst it had to facilitate one-off costs of US$1.3m to relocate staff out of Ukraine. Altium then provided FY23 guidance which beat analysts’ expectations with revenue expected between the range of US$255m -US$265m (growth of 15%-20%) and underlying EBITDA margin growth of 35%-37%.

Following the release of the results, brokers altered their ratings including Bell Potter maintaining its buy rating on the stock and upgrading its share price target to $37.50/share, RBC upgrading Altium to Outperform, Macquarie raising Altium to Neutral, and Jarden Securities also raising its rating to Neutral.

Geopolitical events have also proven beneficial for some technology companies including Silex Systems (ASX:SLX) which has had investors piling in this year with the stock currently up 140% YTD based on its innovative SILEX laser enrichment technology targeted at the nuclear fuel and quantum computing industries. The energy crisis brought on by the Russia-Ukraine war boosted Silex’s fortunes as the world accelerated the focus and shift to alternative sources of energy. The modern-day need for technology like Silex Systems makes it an appealing stock to investors to survive the tech sell-off of 2022.

For the technology sector as a whole in 2022, investors are cautious about piling into growth stocks especially given the Fed is expected to further raise interest rates by 75-basis points at the September FOMC meeting, so without product diversification, positive cash flow or high value of offering in the current market, technology stocks face a bumpy ride ahead.