As we enter the new financial year markets are sitting at all time highs, macro-economic data is driving rate outlook, and investors are cautiously searching for investment opportunities in the current market landscape.

Themes to look for heading into FY25 include diversified AI exposure, gold exposure, healthcare, REIT and copper. These are the key themes and areas showing attractive returns and outlook in the new financial year.

Three stocks that look attractive in the current market conditions are:

Lycopodium (ASX:LYL) provides engineering and project delivery services in the resources, infrastructure, and industrial processes sectors. While companies operating in the mining space are generally tied to fluctuations in the commodity cycle, Lycopodium reduces downside risk exposure to downturns in cycles by not owning the assets it provides engineering services for. Boasting names including Woodside, BHP, Newcrest Mining, Rio Tinto, and Newmont mining as some of its many clients, Lycopodium has built a global presence with credible mining giants.

In conjunction with its core engineering services business, Lycopodium also operates a Process Industries division focused on the Australian manufacturing industry which is experiencing market traction in its Rail offering.

From a financials standpoint, the company has experienced ongoing strength over time. Since 2019, LYL has more than doubled its revenue to over $327.57m in FY23, doubled its return on equity to 42.83% in FY23, more than doubled its profit after income tax to $45.58m in FY23, more than doubled its EPS to 117.72cps in FY23 and almost tripled its dividend to 81cps fully franked in FY23. With record results in FY23, Lycopodium’s dividend yield of 6.03% places it in the top 25% of Australian dividend paying companies.

This company was covered by Bell Potter’s analyst until 2021 and a buy rating was retained for majority of the coverage period.

A rise in the number of miners around the world requiring engineering services, growing profits and earnings, and solid dividend payments places Lycopodium on the radar for investors in FY25.

Accent Group (ASX:AX1) is a footwear and sports clothing retailer and wholesaler which owns/operates a number of footwear businesses in the performance, comfort and active lifestyle sectors.

Many investors are avoiding the retail and consumer discretionary space in the current high-interest rate, easing retail spend environment, however, there are some companies that can withstand downturns in economic activity like Accent Group has proven.

AX1 owns leading footwear companies including The Athlete’s Foot Australia, Platypus, and Hype, while also owning a number of mono-branded retail stores for Hoka, Timberland, Stylerunner and more. Accent Group also holds the exclusive distribution rights for a number of leading international brands across ANZ including Sketchers, Reebok, Vans, CAT, and Dr Martins. One thing you may notices about Accent Group is the younger demographic target through many of its brands, this is one key factor that boosts the company’s viability to withstand economic downturns as younger consumers are less impacted by cost-of-living pressures; think first retail job, no rent, no food to pay for, no insurances etc = any money earned is spent on the latest retail fashion trends for this consumer group.

AX1 came out this week to advise the exit of 17 Glue Stores due to underperformance, which investors welcomed with a 8% rise in the company’s share price on the date of announcement. Accent is known for its strength in assessing store returns and exiting underperforming outlets in a timely manner.

From a financials standpoint, AX1 is a leap above most retailers in the current market landscape. In the first half of FY24 the company reported total sales rose 2.7% on the PCP to $810.9m, the opening of 72 new stores, and a reduction in inventory. The company also pays a dividend with a historical yield of 6.57% (IRESS).

While some retailers are winding up operations in the US like City Chic, Accent Group is preparing to launch their Nude Lucy brand into the states for the first overseas expansion of the brand as global demand for affordable athleisure wear ramps up.

And management plays a huge part in the success of AX1 as Brett Blundy, one of Australia’s best known and most successful retail entrepreneurs, stands as non-executive director of the company.

Bell Potter’s analyst is bullish on Accent Group with a buy rating and 12-month price target of $2.50/share.

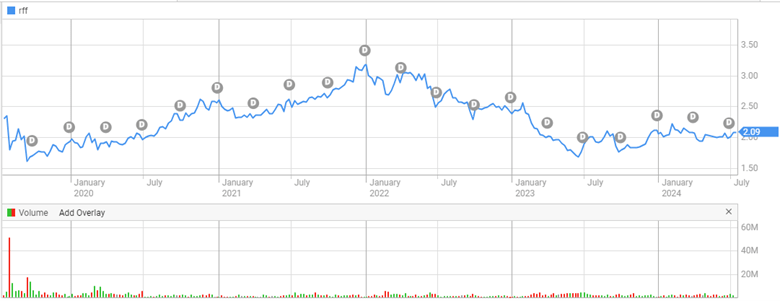

Rural Funds Group (ASX:RFF) is a listed agricultural REIT with a portfolio focused on almond orchards, vineyards, cattle, cotton and macadamias.

Over the last few years investors have been cautious of the REIT sector amid work-from-home policies and declining retail spend impacting the performance and tenancy rates of physical real estate assets. The sector has comeback from 2020 lows to trade 25% higher over the last year, driven by opportunities in the datacentre and industrial warehousing REIT space.

Rural Funds Group offers an alternative, yet still attractive, investment in the REIT sector through owning and managing the agricultural properties a number of listed companies including Select Harvests (ASX:SHV) and Treasury Wine Estates (ASX:TWE) tenant.

The A-REIT boasts a solid dividend yield of 5.9% with dividends sitting consistently at 11.7cps and are expected to rise over the coming financial years.

A key strength of RFF is their Weighted Average Lease Expiry which stands at 12.8 years. This provides secured revenue for RFF over a longer period than the average REIT, with most of the RFF tenancy contracts having incremental 2.5% increases over the duration of the lease.

Diversification is key for a REIT stock and RFF is one company does this well through its farms covering cattle, vineyards, macadamias, almonds, and cropping. RFF has also recently shifted focus to developing more macadamia farms to capitalise on the rising macadamia prices which reduces farming losses and improves the prospects of securing either a counterparty or sale of unleased orchards.

As higher debt hurts any company in times of higher interest rates, RFF is considering the sale of some farms it currently owns and operates to reduce gearing in the current higher-for-longer economic landscape.

Over H1FY24 RRF property revenue rose 12.4% primarily due to rental income earned on first tranche of macadamia developments and lease indexation. Earnings also jumped 19.5% or $11.6m driven by property revaluations, and the company made a profit after tax of $43.754m.

Given Rural Funds operates in the agricultural space, the outlook for crop performance is a key metric any investor needs to assess when considering an investment in the ag-sector. The outlook for the winter and summer crops this year according to the most recent ABARES report indicates a solid year ahead for the farmers which bodes well for Rural Funds and their tenants.

With Australia’s growing population and higher migration down under, increased demand for the produce of Rural Funds Group’s tenants also adds to stronger outlook for the company over coming years.