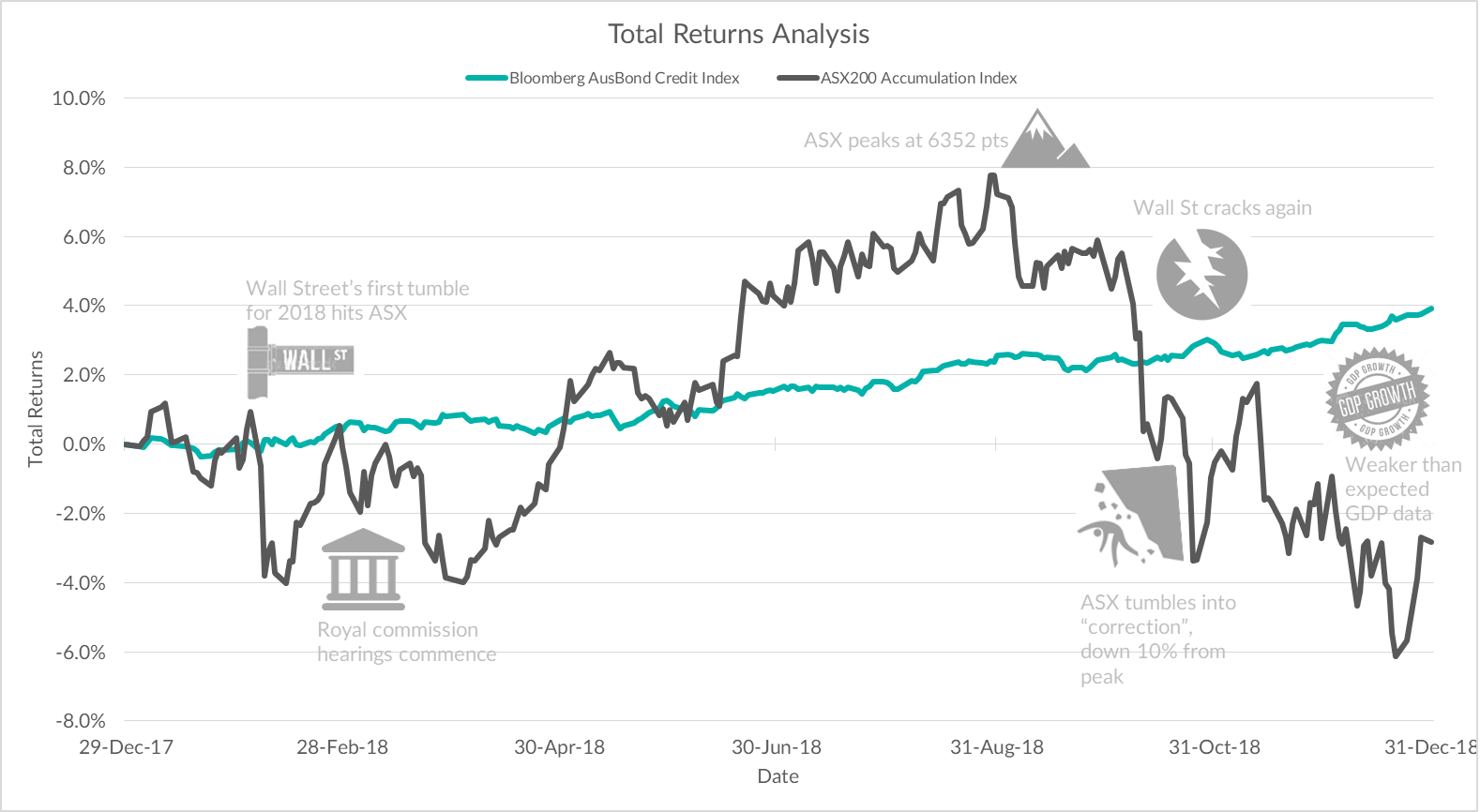

2018 was a bumpy year for shares globally. The S&P/ASX200®, the benchmark for the Australian market finished down approximately 2.8% including dividends, 6.9% excluding dividends.

The main drivers of the September downturn were geopolitical events, in particular the threat of trade wars and rising interest rates in the US. This decline effectively wiped out the year’s gains. A portfolio weighted heavily in growth-style stocks would have likely lost money. Whilst corporate bonds did suffer some losses last year, the Bloomberg AusBond Credit Index finished up almost 4%.

The chart below illustrates the relative performance of shares and corporate bonds last year.

Bonds help you sleep, whereas shares can cause restless nights

Source: Bloomberg & Australian Corporate Bond Company

Source: Bloomberg & Australian Corporate Bond Company

It’s clear to see bonds were largely unaffected by the numerous events that impacted shares. When the share market seems to be going up and up, it’s easy to overlook the cushioning effect of a solid fixed income foundation. But, in current volatile times it’s increasingly important for investors to ensure they can protect the wealth they’ve built up.

Investors with balanced portfolios (50:50 bonds and shares), may have found their share market declines became balanced by their bond returns. A solid foundation of bonds can help protect and stabilise most portfolios through volatile times.

Investment grade bonds are a defensive asset class. The stability and diversification they can offer really shouldn’t be overlooked. With the prospect of more uncertainty ahead, defensive assets are increasingly on the radar of investors. So, now’s a good time to consider if they are right for you.

Corporate bonds – no longer just for the professionals

Corporate bonds have traditionally been popular among institutional investors. A recent report from global funds manager, Blackrock, showed 40% of surveyed institutions were planning to increase their corporate bond exposure. But, with most bonds issued in $500,000 lots, self-directed investors and SMSFs have largely been excluded from this market.

That’s no longer the case. There’s a broad range of bond ETFs and more than 50 different Exchange-Traded Bond units (XTBs), which provide access to the returns of bonds. All are available to trade via Bell Direct on the ASX.

Diversification and simplification

Bond ETFs provide investors with access to a very diverse range of bonds. They’ve helped open up an asset class that was hard to access and they are simple to buy and sell via Bell Direct. There is one key feature that XTBs have which ETFs don’t. We will use a term deposit, an investment that most investors would be familiar with, to illustrate this point. When you buy a term deposit, you know the return it will provide because the interest rate is known upfront AND because it has an end date (it matures). XTBs also have these ‘fixed’ features which provide you with comfort and predictability from day 1.

The downside of perpetuity

However, bond ETFs (and bond managed funds) are continual investments – they don’t have a date when they mature. This means they can’t provide that same level of predictability of returns. Also, they are pooled products – the fund manager adds and removes new bonds, sometimes on a daily basis and there could be hundreds of bonds included. That’s good for your diversification, but perhaps more importantly, it means you don’t know what your return will be. It also means you lose that certainty of what you’ve invested in.

Don’t forget it’s knowing your cash flows when you invest that’s at the heart of fixed income.

The predictability of individual bonds

Whilst bond ETFs provide easy access to the benefits of bonds, as we’ve seen they can’t offer predictability of returns. A different way of accessing the benefits of bonds, but still retaining those core ‘fixed’ elements, is via XTBs (Exchange Traded Bond units). XTBs have that same advantage of ETFs, in that they are easy to access on ASX. They can be bought and sold at visible prices at any time. But XTBs have one key difference – each XTB mirrors a single specific bond. This means each XTB has a clear coupon amount and a maturity date when investors get the face value back (subject to no default by the bond issuer). By retaining this one to one relationship of an XTB with its parent bond you keep all of the ‘fixed’ or predictable elements.

Just like with ETFs, you can invest as much or as little as you like with XTBs (starting from $500).

- Buy just a few units, or cherry pick specific XTBs to deliver a specific cash flow, or

- Pick an XTB which returns the face value to you at a specific time, or

- Select the companies that you know and trust.

By choosing exactly what you want you stay in control, rather than leaving the decisions to the fund or ETF manager.

Disclaimer: The information in this article is general in nature. It should not be the sole source of information. It does not take into account the investment objectives or circumstances of any particular investor. You should consider, with or without advice from a professional adviser, whether an investment is appropriate to your circumstances. Australian Corporate Bond Company Limited is the Securities Manager of XTBs and will earn fees in connection with an investment in XTBs.

For more information on XTBs, check out their website here.