In times of uncertainty, the protection of capital and downside risk reduction are key goals. For Australian investors, who are heavily invested into equities, many may not appreciate the benefits of fixed income, otherwise known as bonds, in pursuit of these goals.

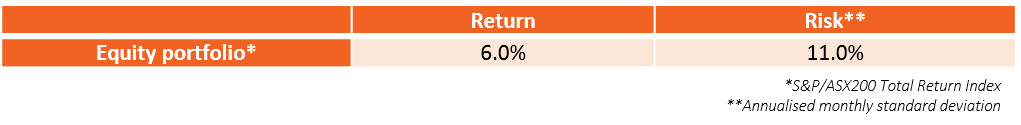

For an investor who has fully allocated their funds into equities, the returns may be high but so too is the potential volatility.

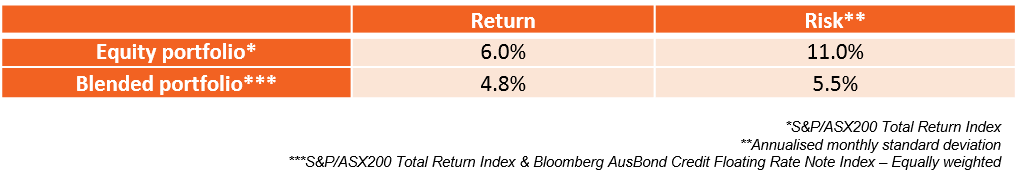

For example, an investor who has invested over five years into an Australia equity portfolio would have typically generated an annualised return of around 6%. Overshadowing this return, however, is the annualised monthly variability of returns, which was around 11%. In other words, the risk of the portfolio is nearly double the compensation!

Alternatively, if the investor split their investment equally into a portfolio of both equities and fixed income via floating rate notes, a small reduction in returns was made for a major reduction in volatility. The blended portfolio has reduced the variability in returns by 50%.

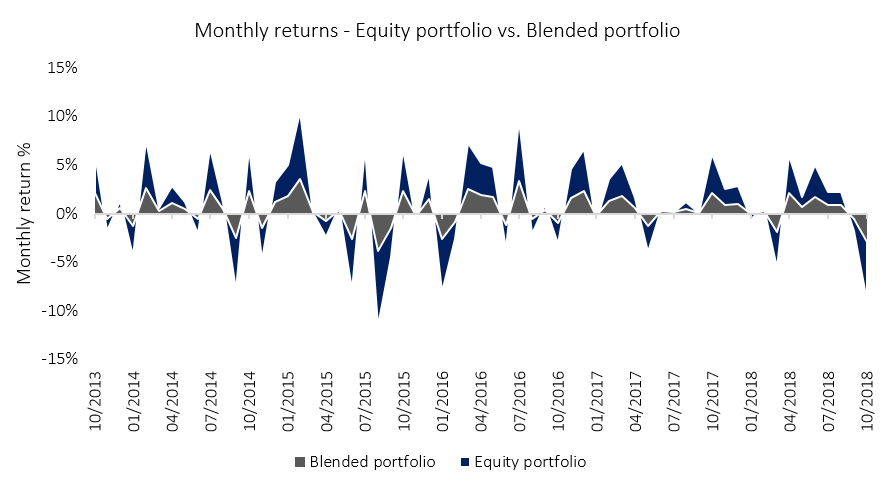

The reduction in monthly variability is shown in the graph below comparing the equity only with the blended portfolio. The rises in the portfolio are slightly lower, but the reduced returns are offset by the reduction in the sharp falls.

Which bonds – Fixed or Floating?

While diversifying into fixed income can reduce risk, the question around what type of bonds to invest into is just as important.

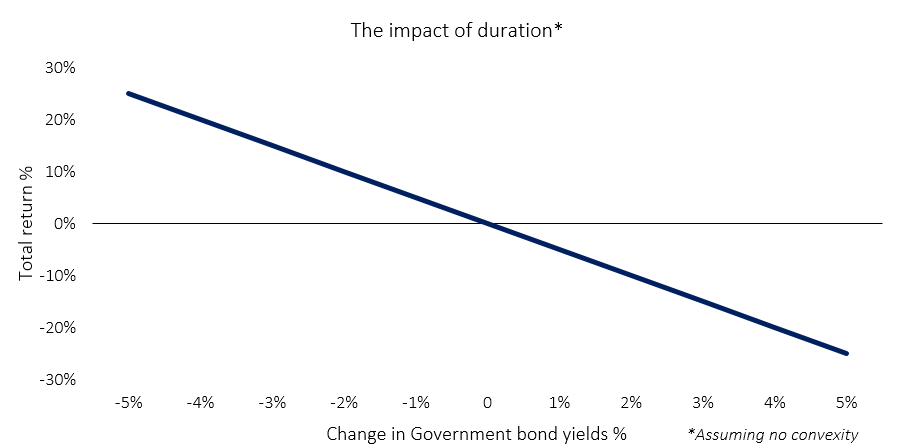

Fixed rate bonds are the most common. Fixed rate bonds, however, are susceptible to interest rate risk. Interest rate risk, expressed as duration, is a measure of how sensitive bond prices are to changes in bond yields. As bond yields rise, bond prices will fall and vice versa. For example, a fixed rate bond with a duration of 5 years, a 2% increase in its yield can cause a price fall in the region of 10%.

Floating rate notes provide an alternative option for an exposure to fixed income. The main benefit of floating rate notes is the limited interest rate risk. As the bond ‘floats’ with the market, the income is adjusted to reflect the changes in the market interest rate periodically. This allows the investor to achieve the risk reduction benefits by diversifying away from equities, whilst also, eliminating the majority of the interest rate risk.

Floating rate notes provide an alternative option for an exposure to fixed income. The main benefit of floating rate notes is the limited interest rate risk. As the bond ‘floats’ with the market, the income is adjusted to reflect the changes in the market interest rate periodically. This allows the investor to achieve the risk reduction benefits by diversifying away from equities, whilst also, eliminating the majority of the interest rate risk.

Credit risk

On top of interest rate risk, the other key risk for bonds is credit risk. That is, the bond issuer may not make interest payments or repay the principal on time. Credit risk is often measured by credit ratings. The highest being “AAA”, which is the rating of the Australian government and the lowest rating before default is “CCC”.

The two indices which are typically reflective of fixed and floating bonds in Australia are the Bloomberg Ausbond Composite Index and Bloomberg Ausbond Credit Floating Rate Note Index, which have credit ratings of “AA+“ and “AA-” respectively.

You can get exposure to Fixed Income by investing in the Spectrum Strategic Income Fund.

Find out more here.